Todays Stage Analysis Members Midweek Video covers the midweek update of the major US market indexes – S&P 500, Nasdaq Composite, Russell 2000 & the VIX. Plus the short term Market Breadth Update: Percentage of Stocks Above 20 Day MAs, Bullish Percent Index and New Highs - New Lows charts...

Read More

Blog

31 May, 2022

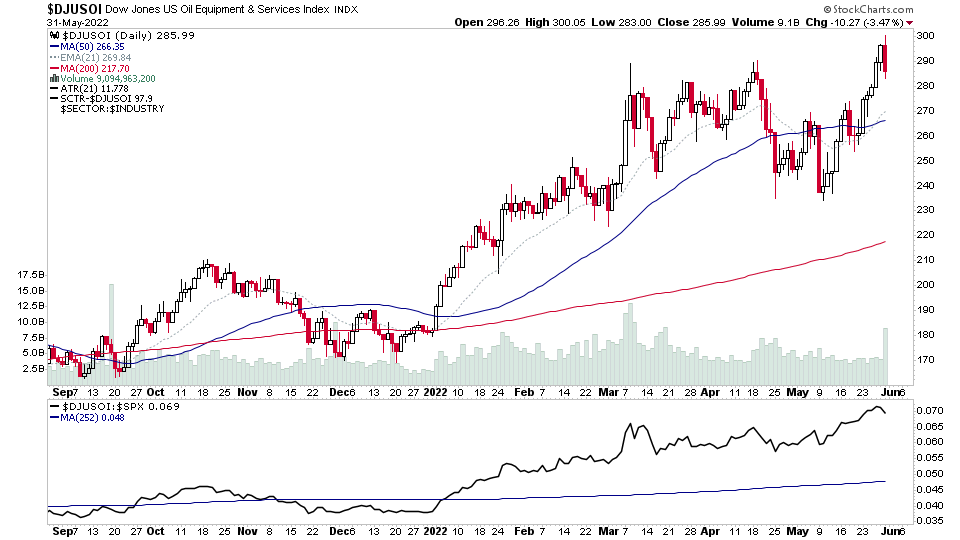

Buying Climaxes and Reversals on Volume in Leading Oil Groups Closes Out May 2022

Stocks pulled back today, as we reached the end of May 2022, after a three day rally off of the recent tests of the lows in the broad market Stage 4 decline. But all the major indexes made higher lows from the previous day though...

Read More

29 May, 2022

Stage Analysis Members Weekend Video – 29 May 2022 (1hr 43mins)

This weekends Stage Analysis Members Video features analysis of some attempted Stage 2 breakouts on strong relative volume and some strong volume springs. Followed by the Major Indexes Review on Multiple Timeframes, and the IBD Industry Group Bell Curve - Bullish %, as well as the Industry Groups Relative Strength Rankings and groups on the move. I also cover the Market Breadth Charts in detail to help to determine the Weight of Evidence and then I finish with detailed coverage of the weekends watchlist stocks from the US stock market and IPO stocks update from the midweek video.

Read More

29 May, 2022

US Stocks Watchlist – 29 May 2022

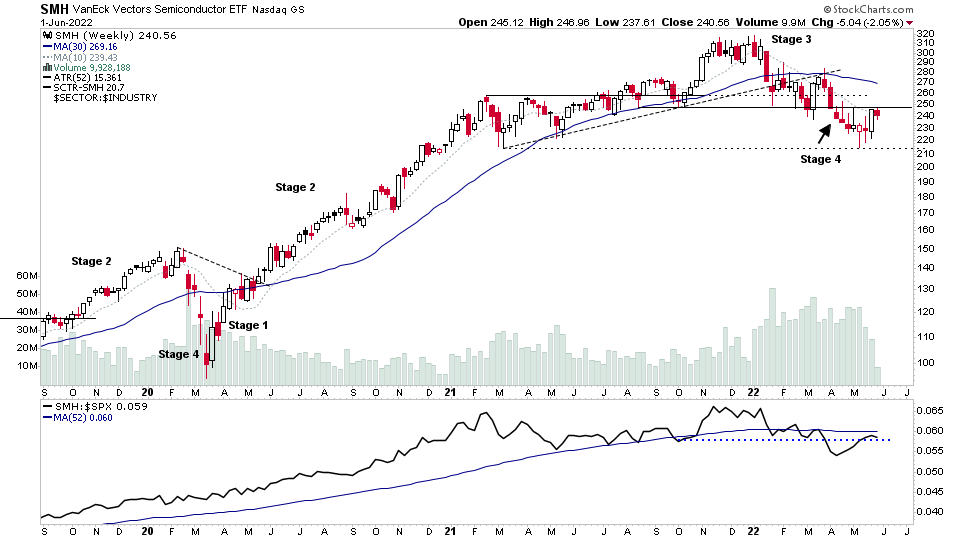

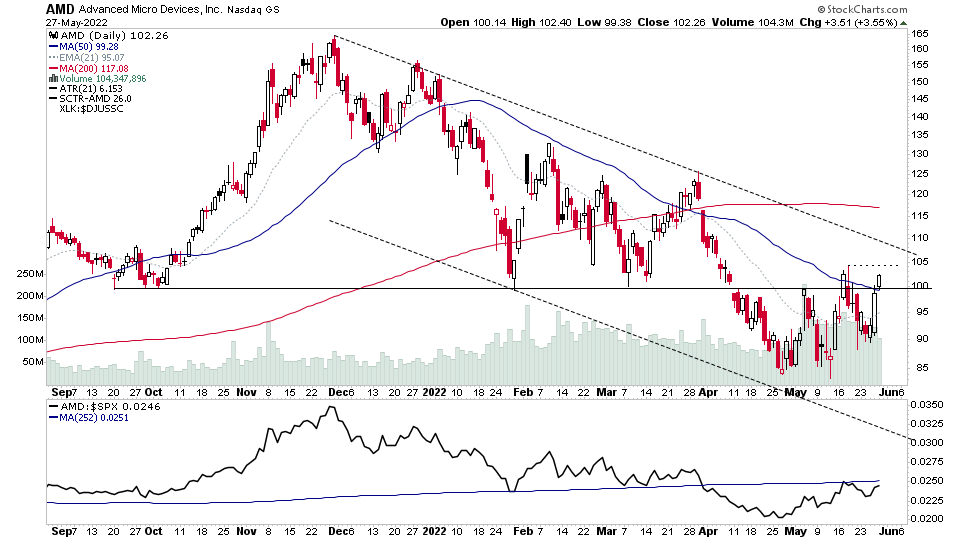

Software and Semiconductors dominated the weekend scans with strong rebounds in many in the groups over the last week or so, which have mainly formed as spring and test patterns within short term base structures in Stage 4...

Read More

28 May, 2022

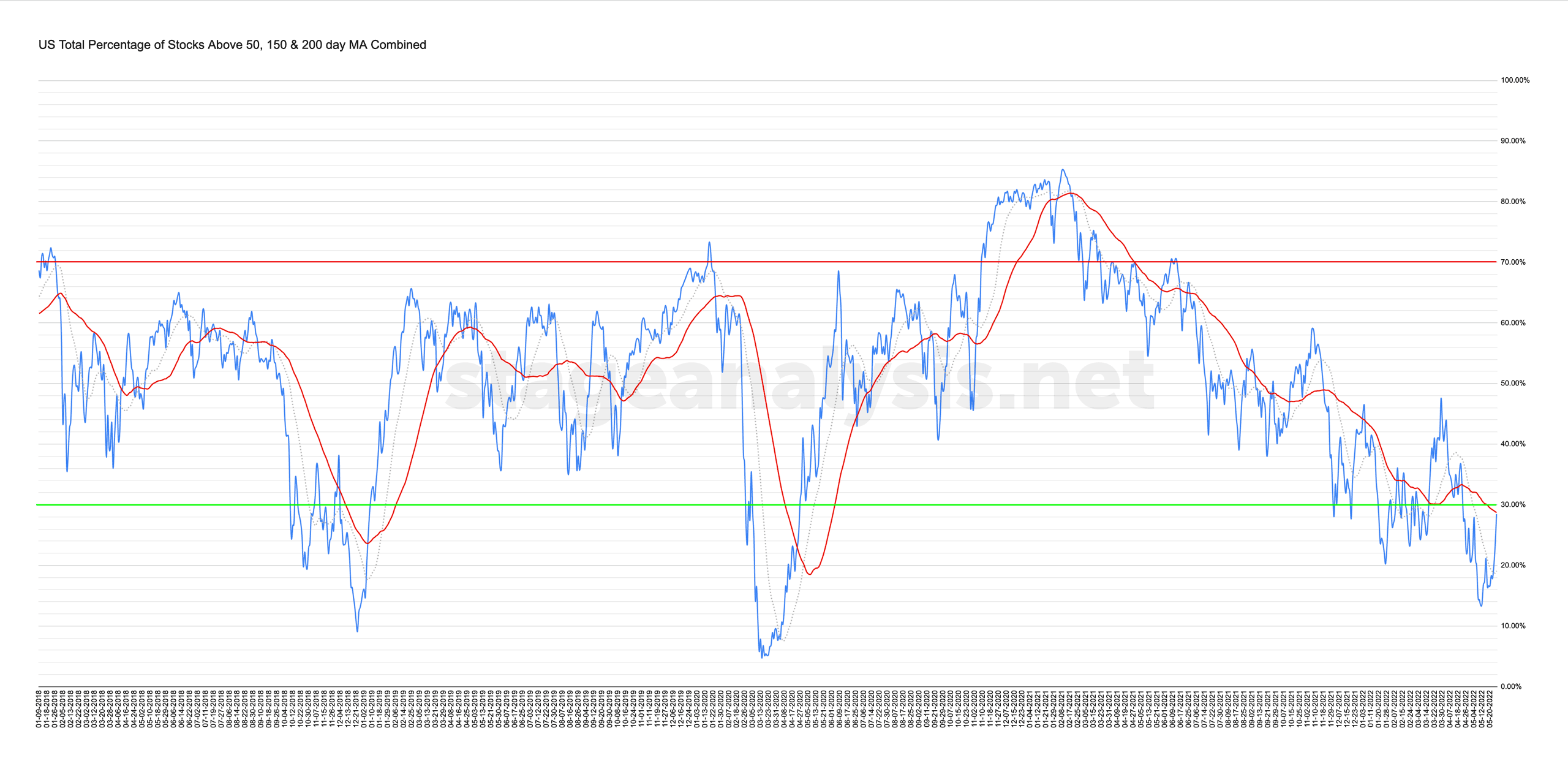

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

28 May, 2022

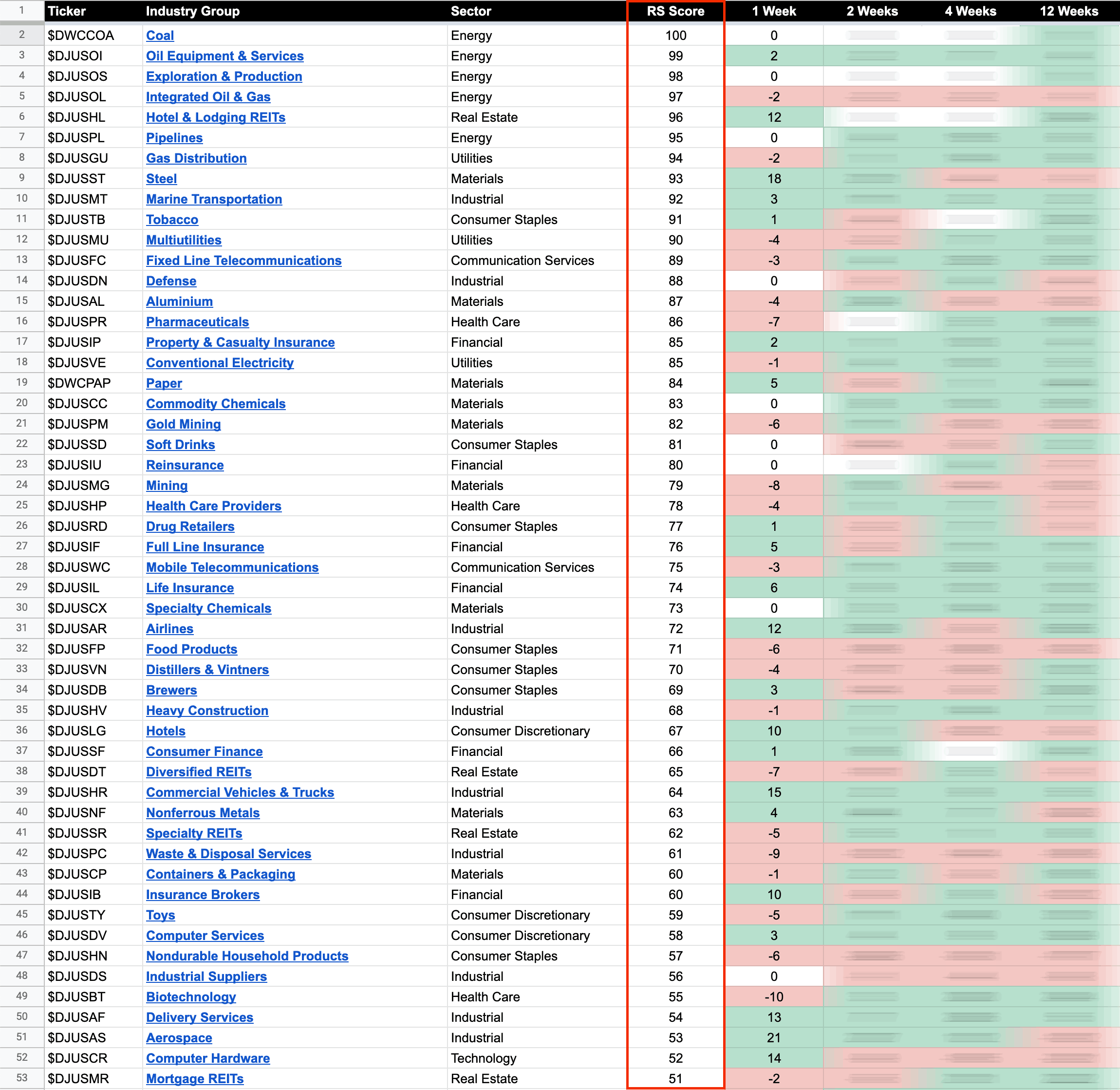

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

26 May, 2022

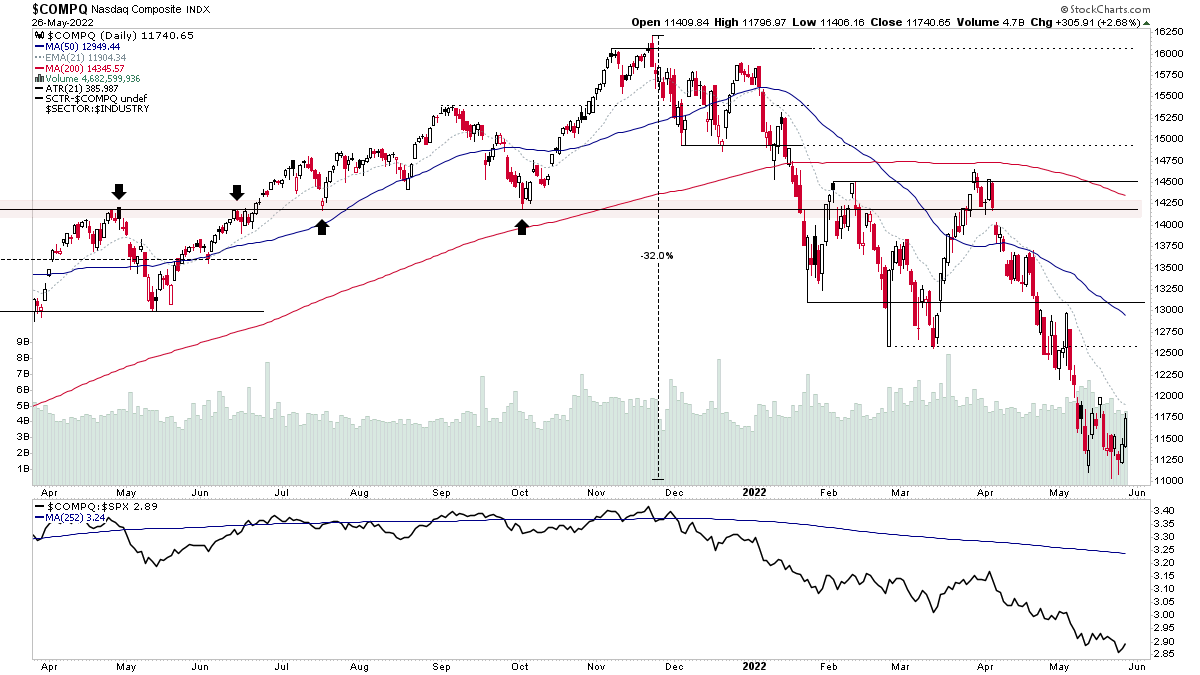

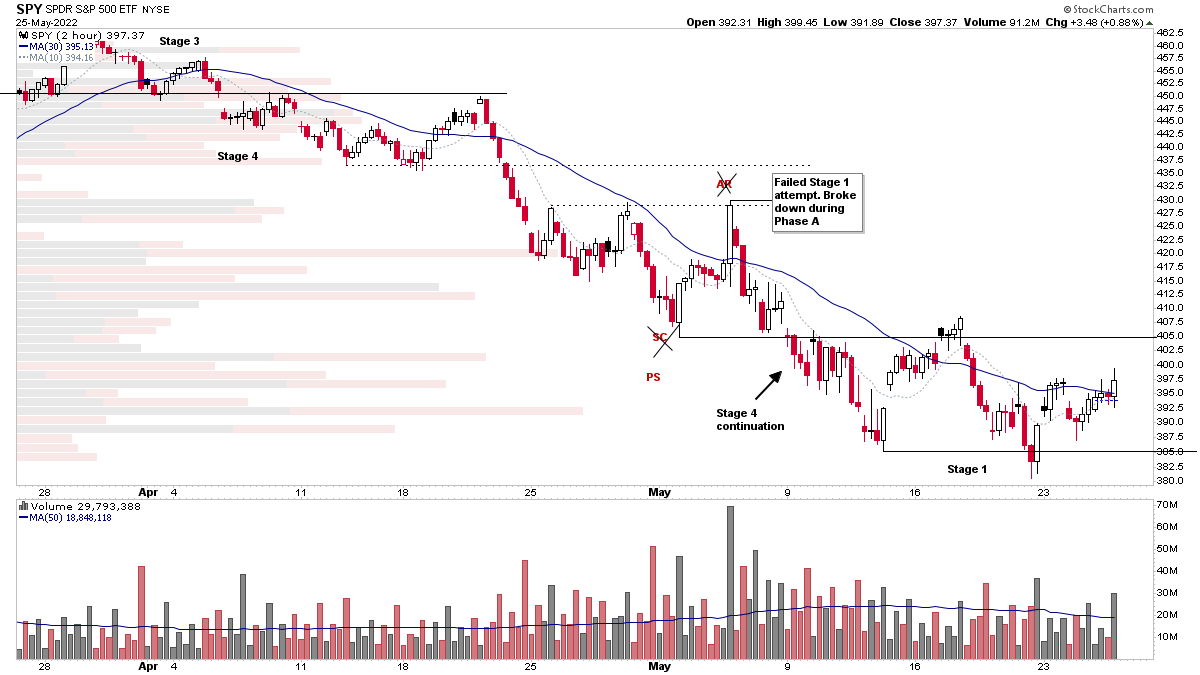

Follow Through Day – Part Four: Oversold Stage 4 Stocks Attempt to Rebound

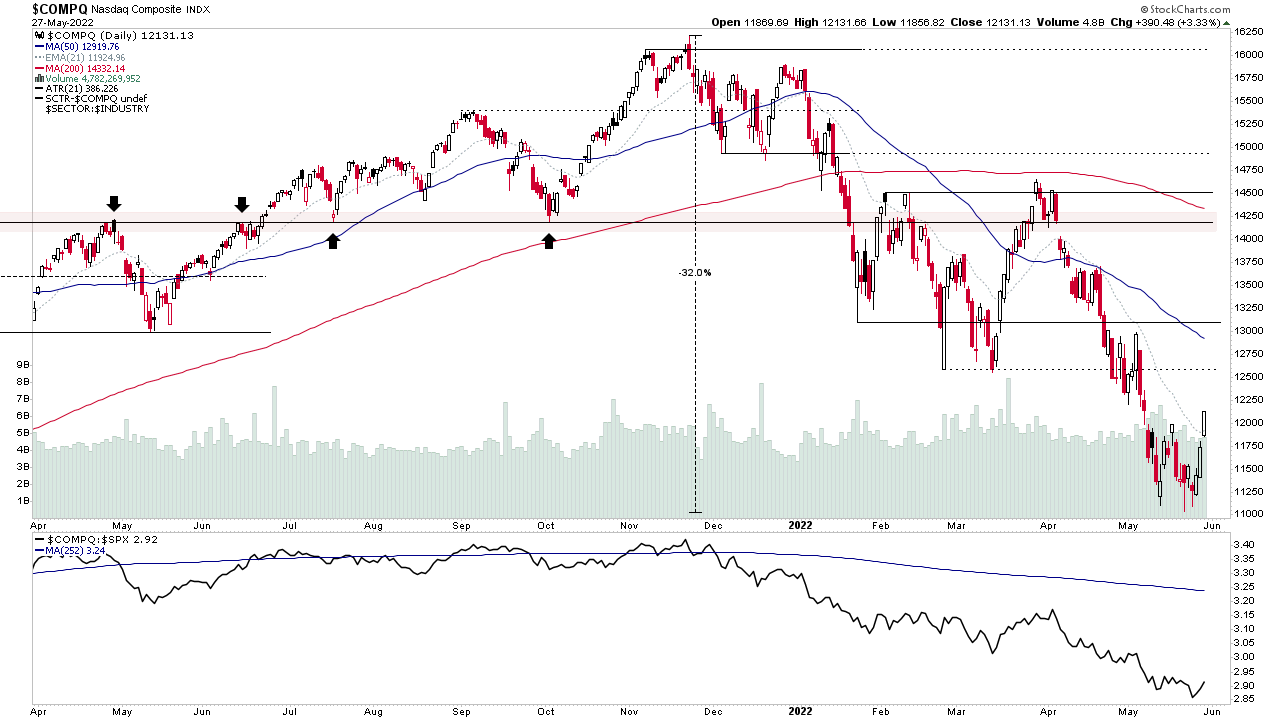

Today saw strong moves in the more depressed areas of the market with leadership from beaten down areas such as Growth, Consumer Discretionary, Communication Services, Technology, Software, Semiconductors and IPOs and more. Which triggered yet another Follow Through Day (FTD) attempt – the fourth this year – and IBD declaring a Confirmed Uptrend again. However...

Read More

26 May, 2022

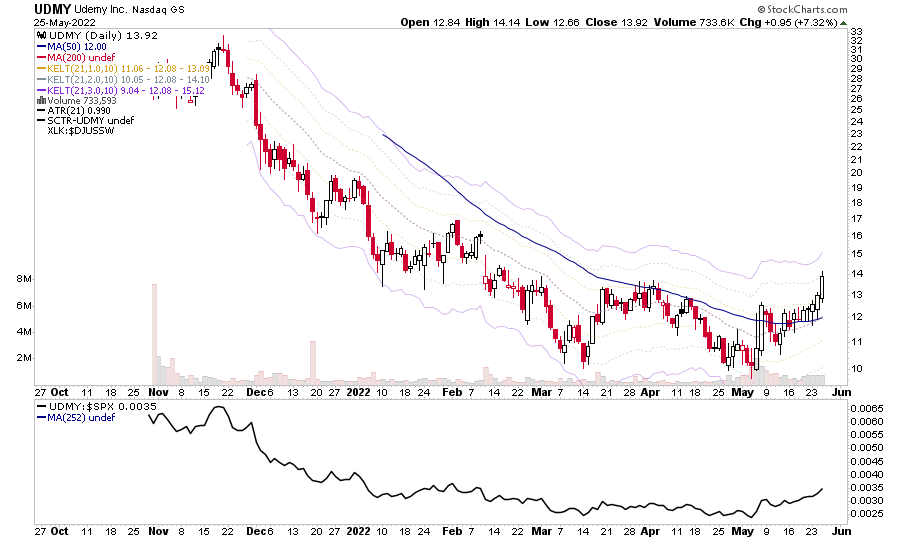

IPO Stocks Watchlist – 25th May

Stage 4 / Stage 1 stocks building base structures for the watchlist from the IPO stocks that have come public in the last year...

Read More

25 May, 2022

Stage Analysis Members Midweek Video – IPO Special –25 May 2022 (1hr 30mins)

Todays Stage Analysis members video includes a special feature focusing on the IPO stocks that listed in the last year and are attempting to build bases. The has been a huge decline in the IPO stocks since November, with a more than -60% decline in the IPO etf for example that covers the group. But some of those younger stocks that have listed could recover and become future leading stocks once the Stage 4 decline ends and starts to transition into Stage 1.

Read More

24 May, 2022

US Stocks Watchlist – 24 May 2022

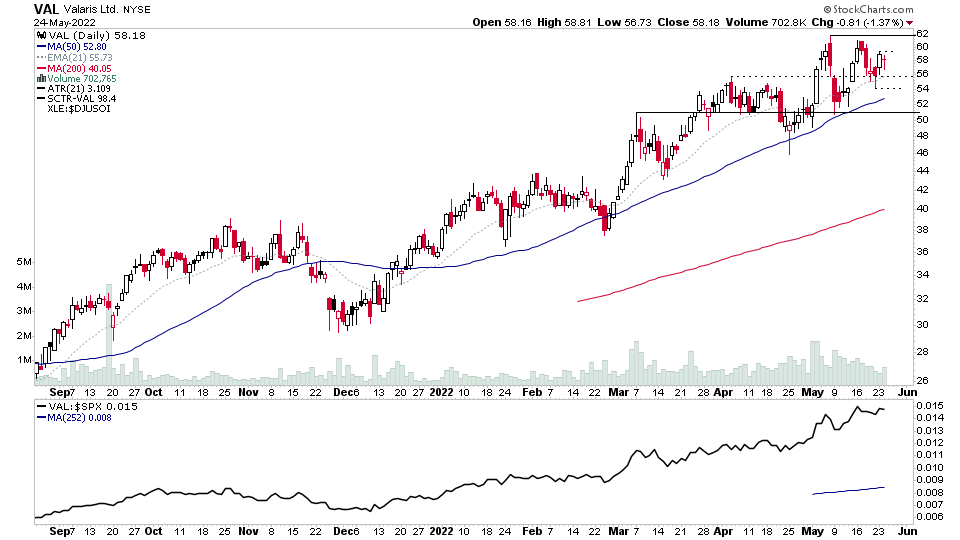

Oil stocks remain in focus with many in the sector tightening up near the highs of their current base structures...

Read More