There were 26 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

27 November, 2022

US Stocks Watchlist – 27 November 2022

26 November, 2022

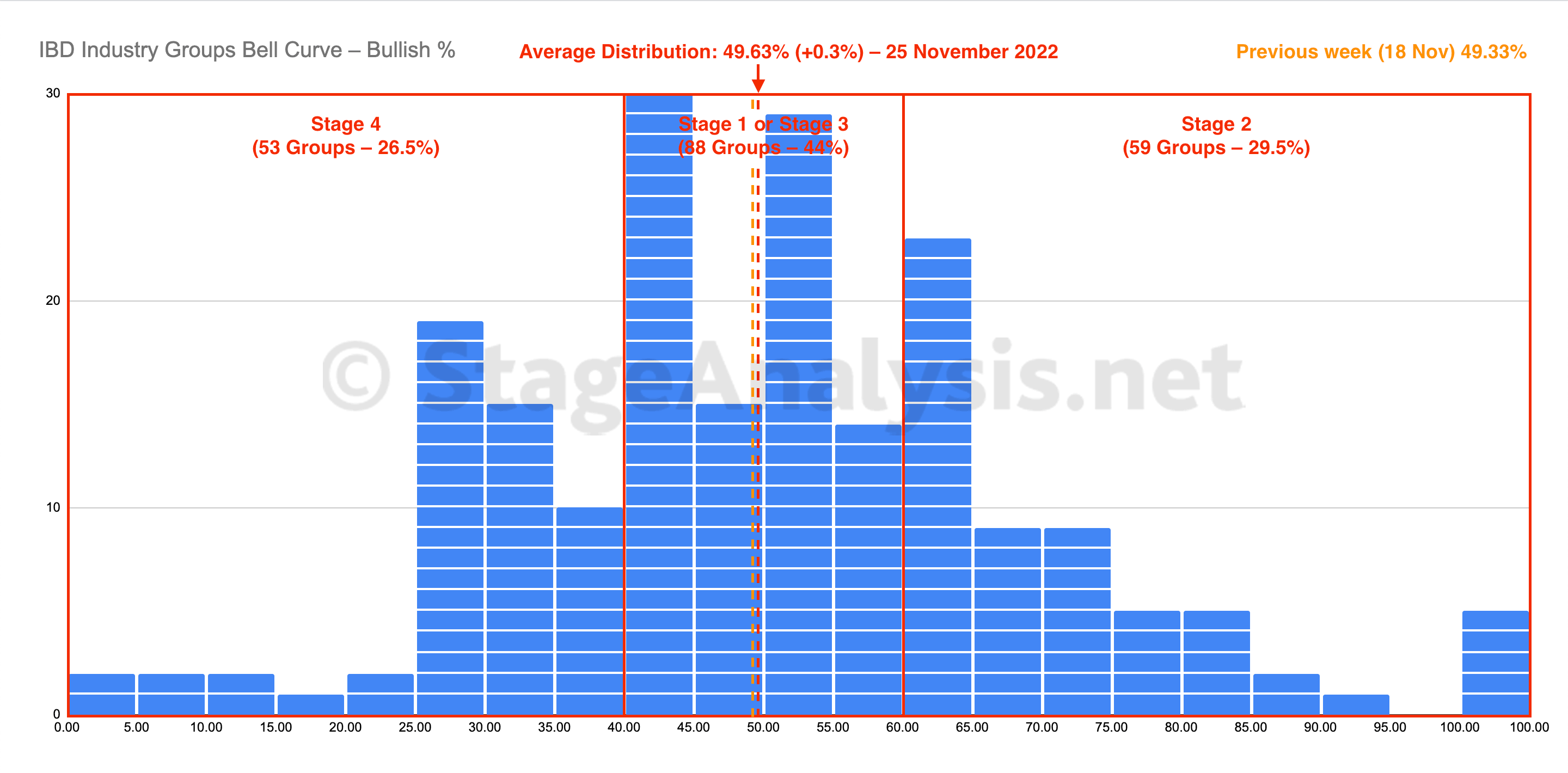

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve continued to consolidate for another week, with only a small gain of +0.30% to end the week at 49.63% over. So little change with it firmly in the middle of the range, and the majority of groups in the Stage 1 zone.

Read More

26 November, 2022

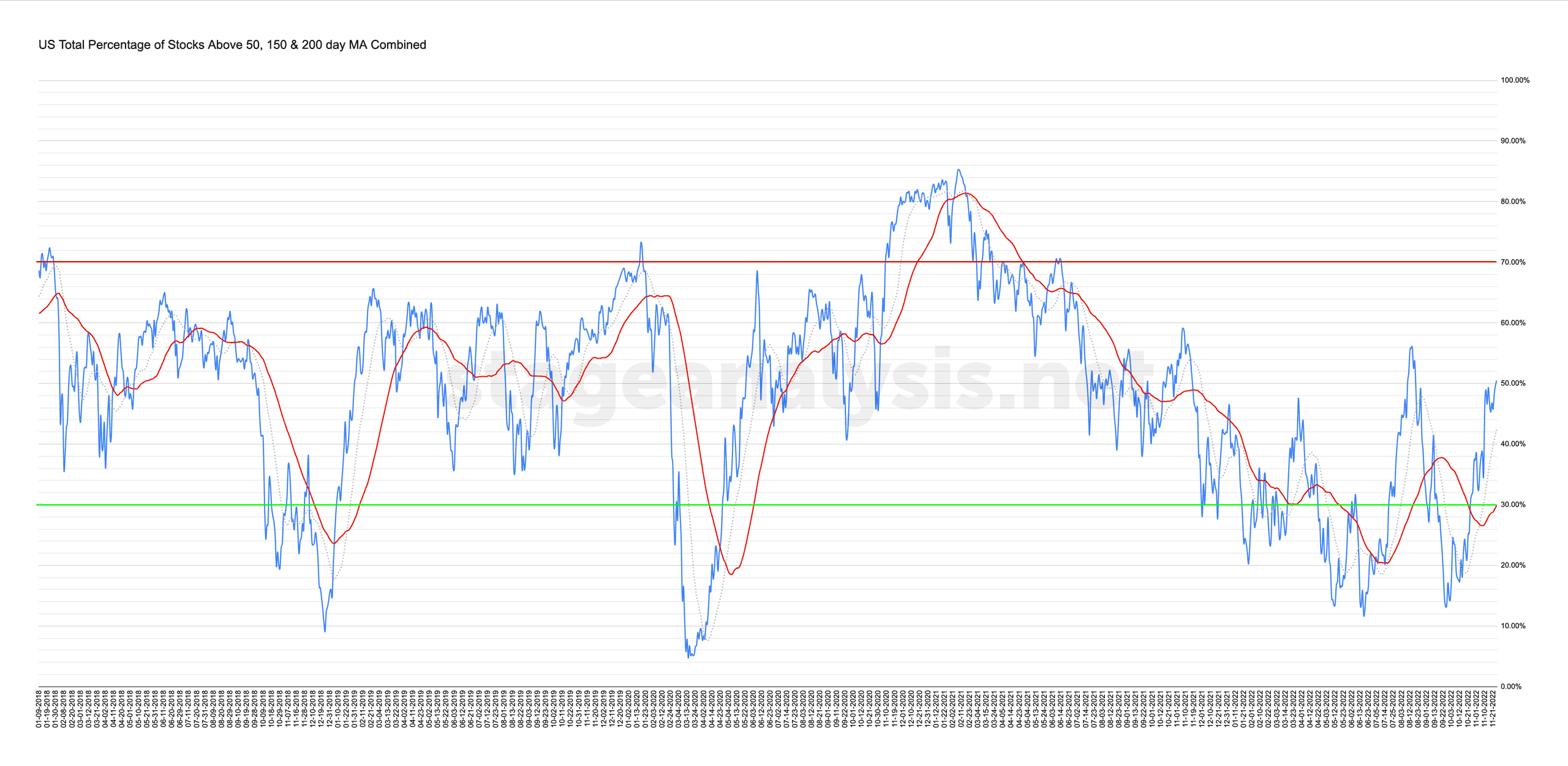

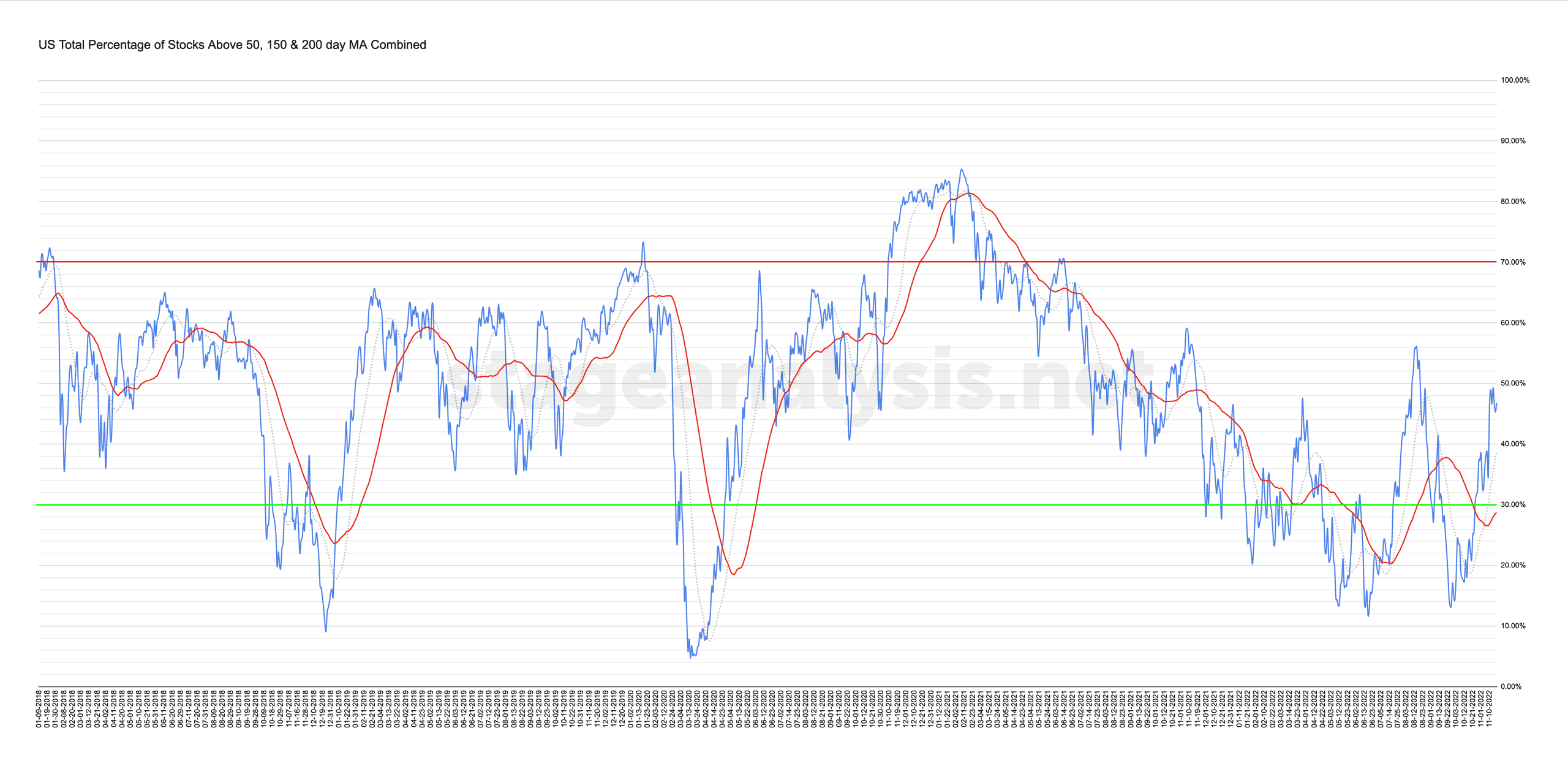

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

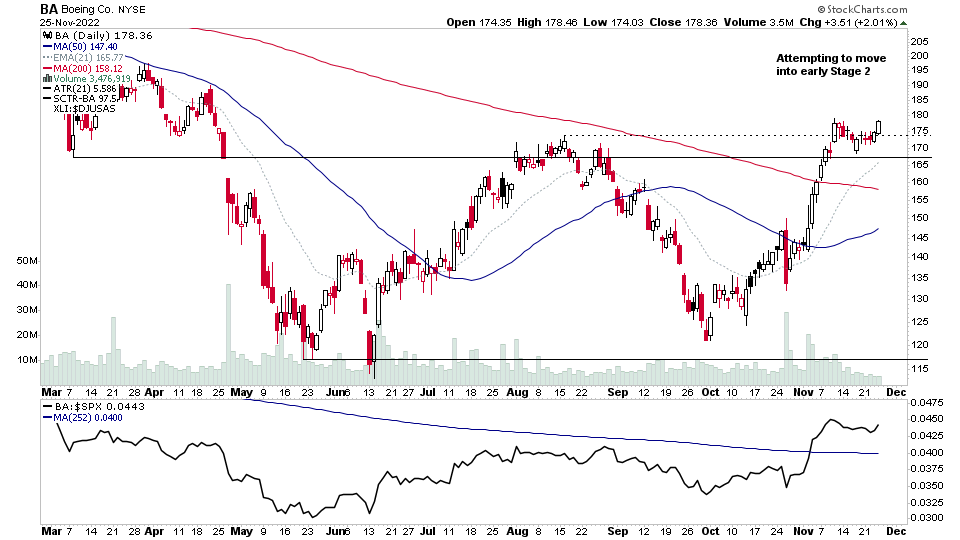

25 November, 2022

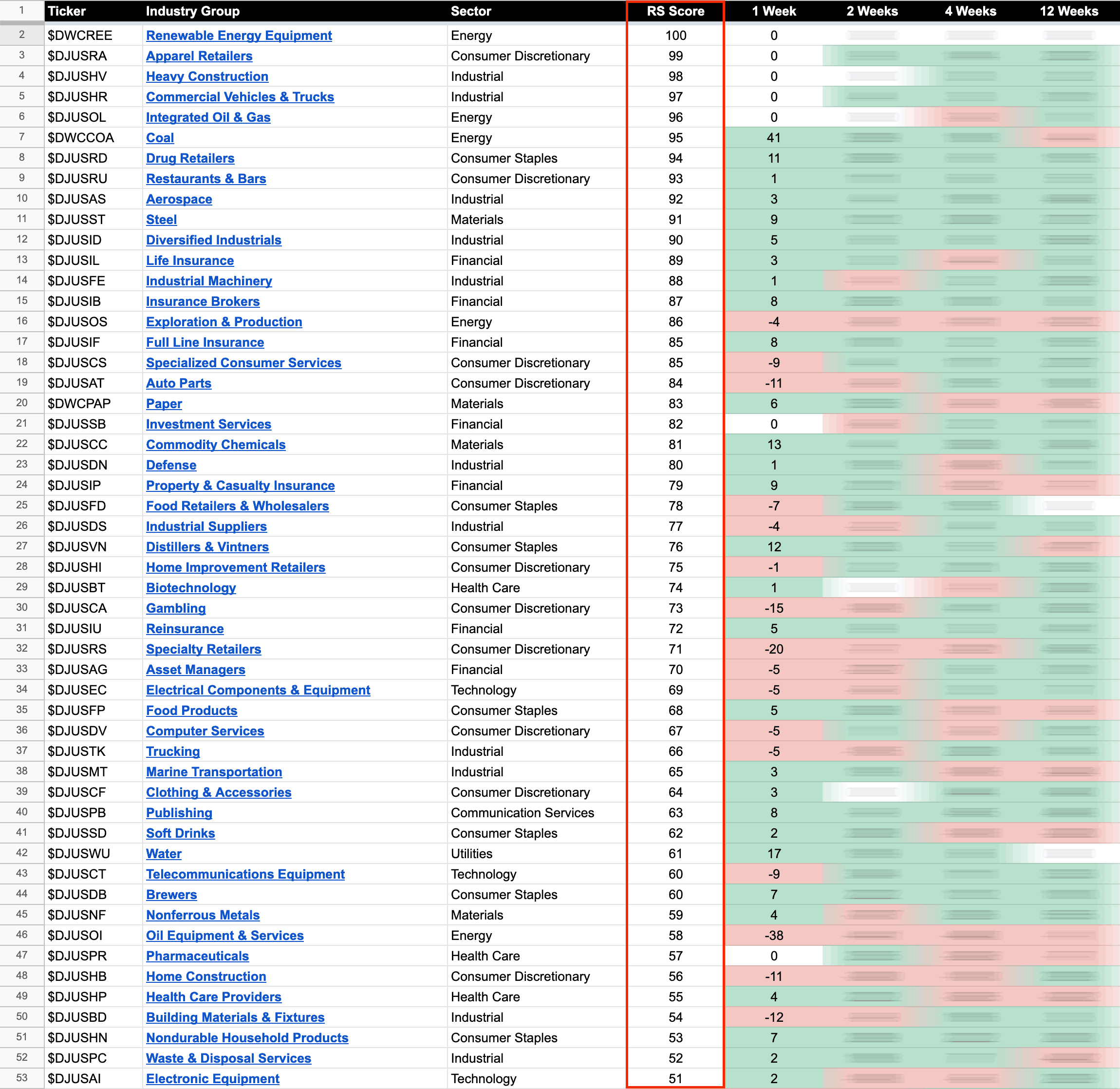

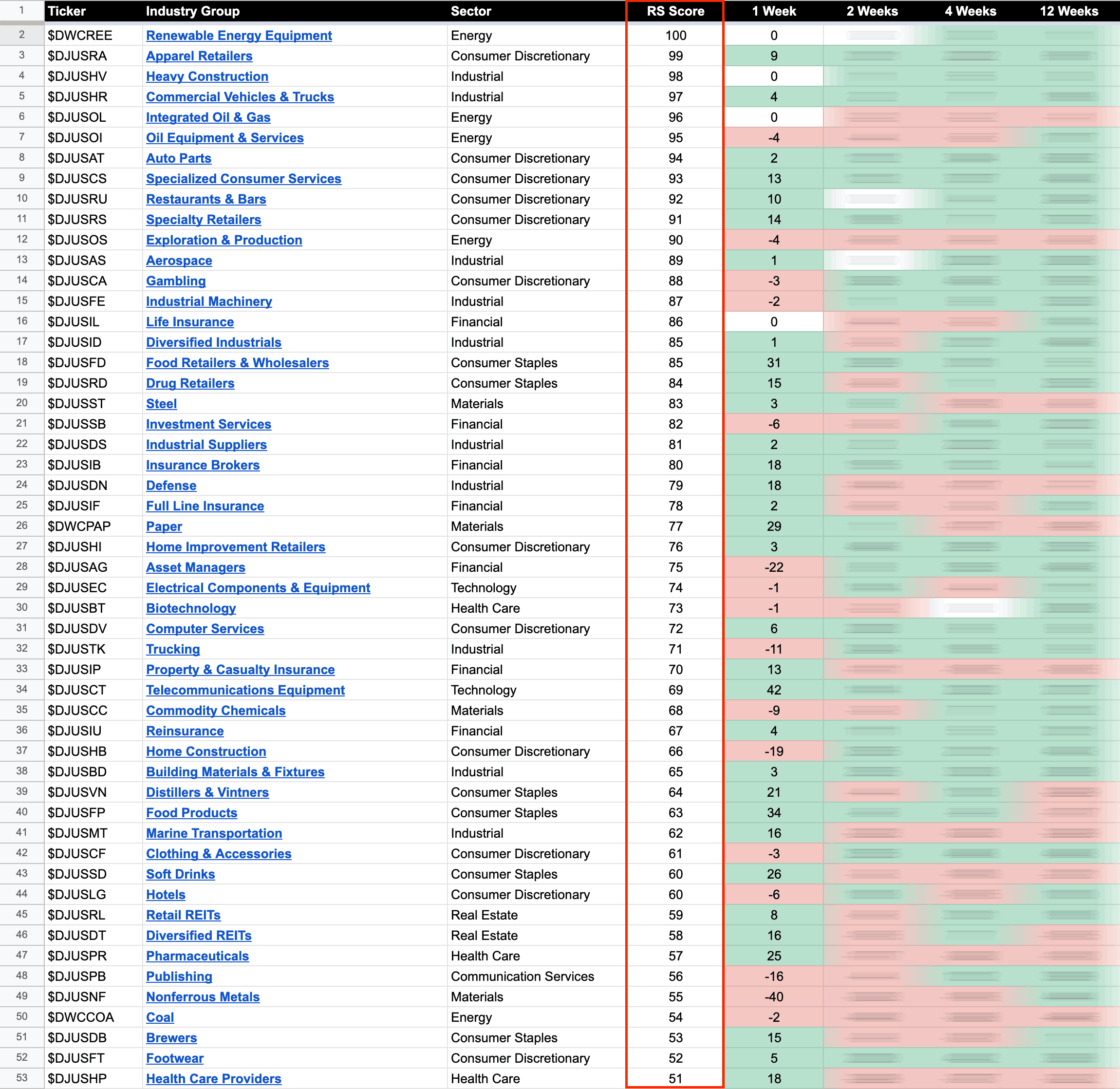

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

22 November, 2022

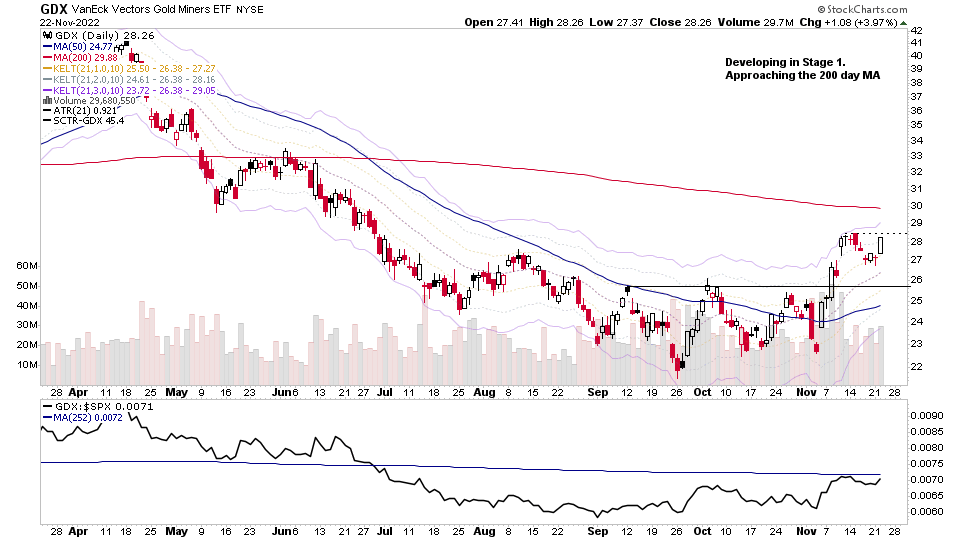

Gold & Silver Miners Developing in Stage 1 and the US Stocks Watchlist – 22 November 2022

The Gold and Silver Miners continue to improve in potential Stage 1 base structures as the US Dollar Index struggles to regain its 30 week MA, after the dramatic collapse into early Stage 3 three weeks ago, which boosted the precious metals, that the majority of the time move inversely to the Dollar Index...

Read More

20 November, 2022

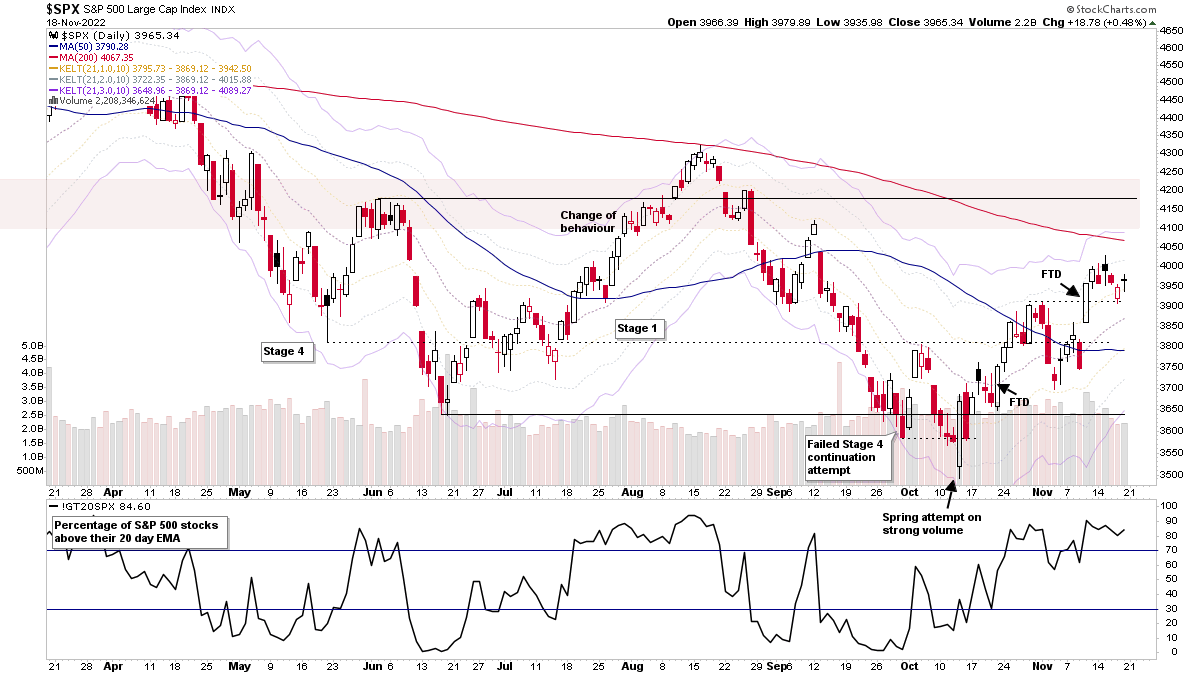

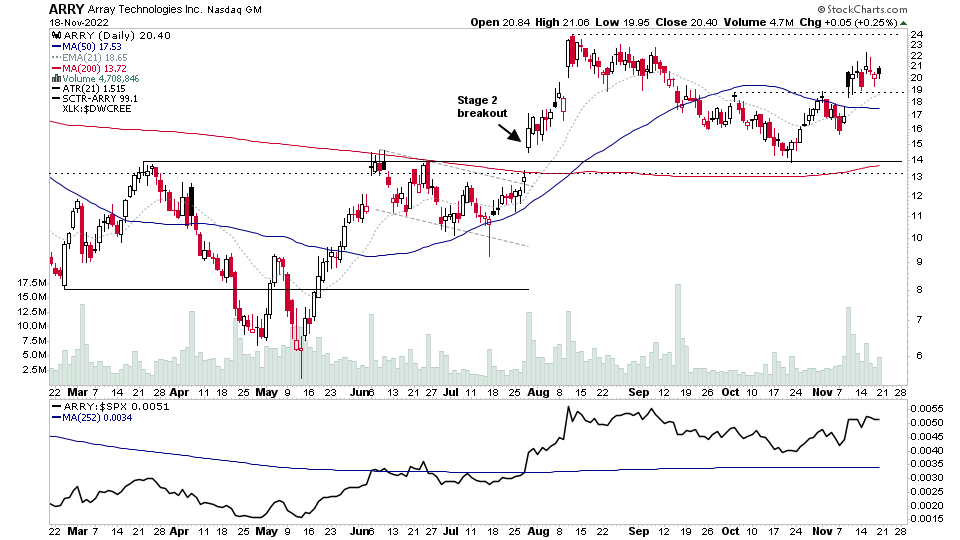

Stage Analysis Members Video – 20 November 2022 (1hr 32mins)

The members weekend video discussing the market indexes, industry groups relative strength, IBD industry group bell curve – bullish percent, market breadth charts to determine the weight of evidence, Stage 2 breakout attempts in multiple stocks and the US watchlist stocks in more detail.

Read More

20 November, 2022

US Stocks Watchlist – 20 November 2022

For the watchlist from the weekend scans...

Read More

19 November, 2022

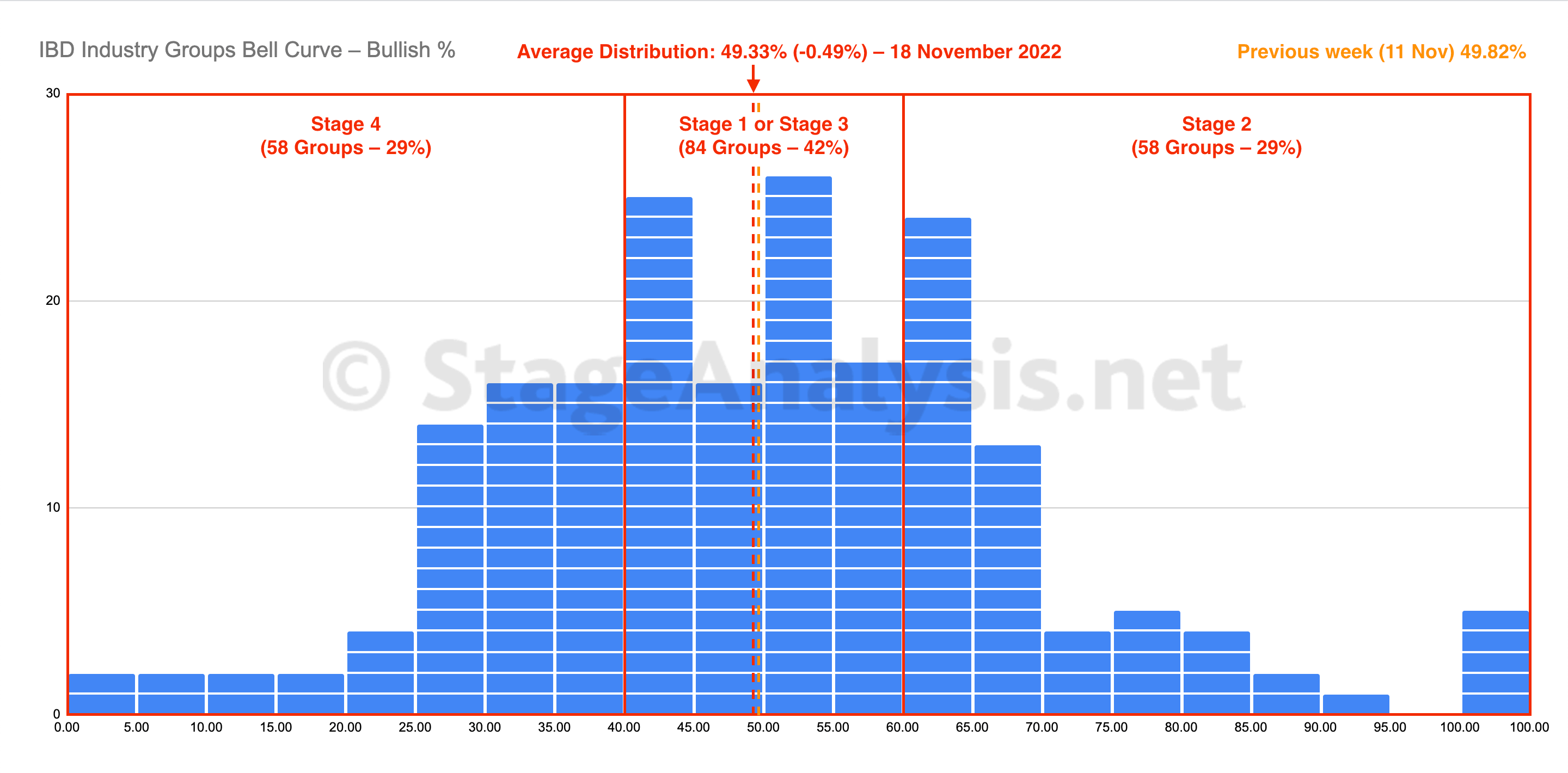

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve consolidated this week, with a slight decline of -0.49%, to end the week at 49.33%. So it remains firmly in the middle of the range, with the majority of groups in the Stage 1 zone.

Read More

19 November, 2022

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

18 November, 2022

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More