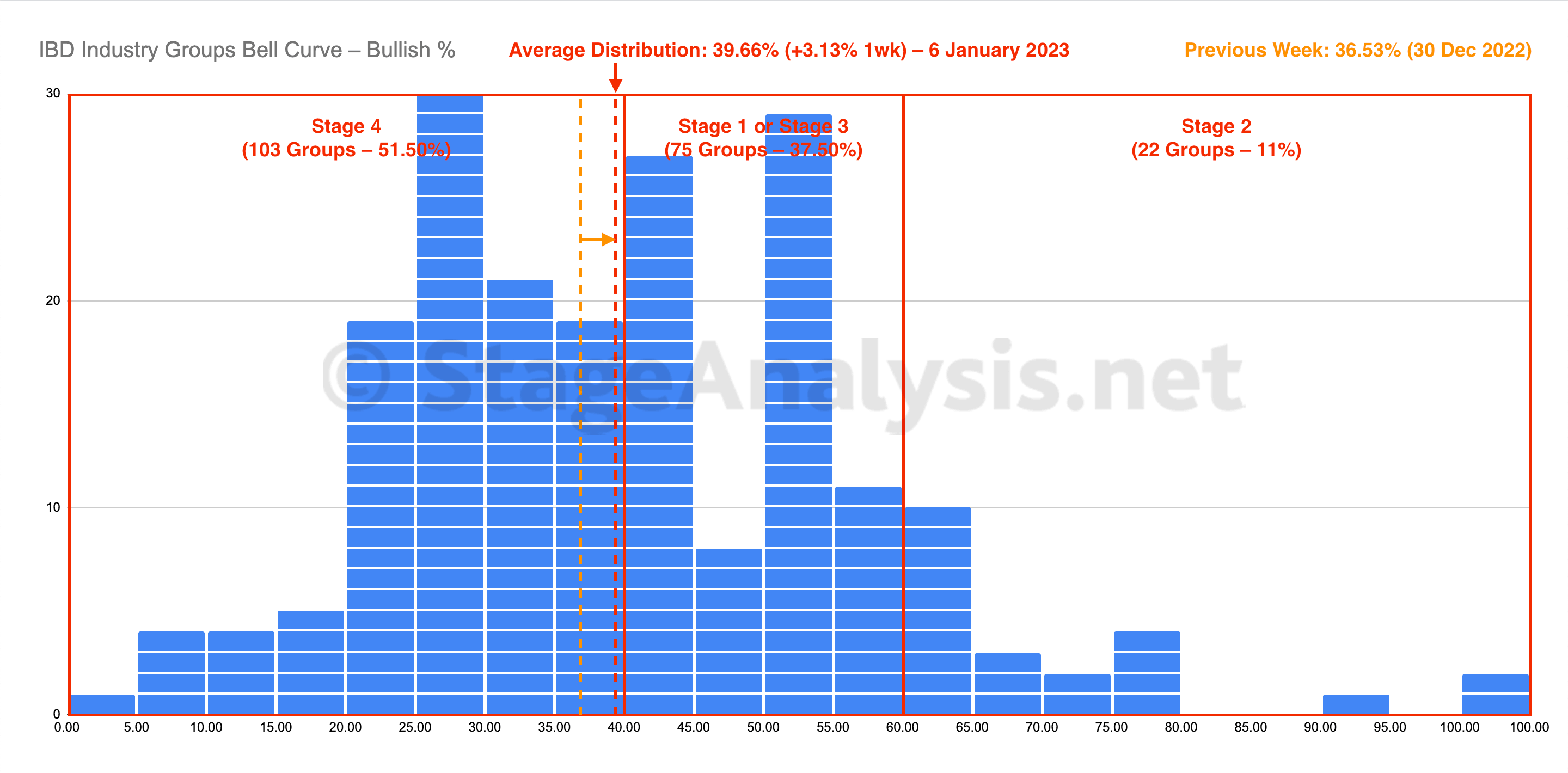

The IBD Industry Groups Bell Curve reversed slightly higher over the previous week with a +3.13% gain to close the week at 39.66%. The amount of groups in Stage 4 decreased by -19 (-9.5%), and the amount of groups in Stage 2 increased by +6 (+3%), while the amount groups in Stage 1 or Stage 3 increased by +13 (+6.5%).

Read More

Blog

07 January, 2023

IBD Industry Groups Bell Curve – Bullish Percent

07 January, 2023

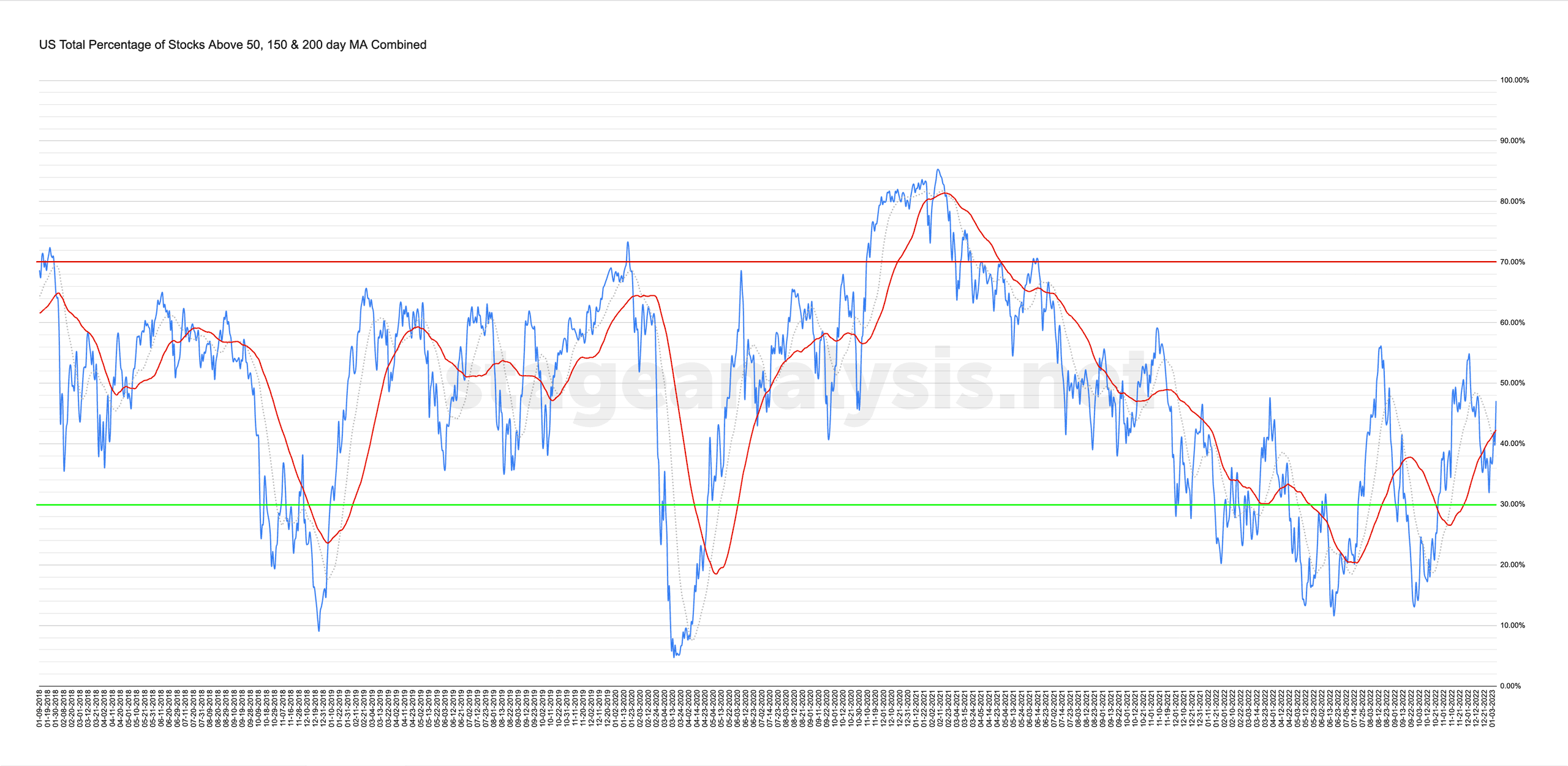

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

06 January, 2023

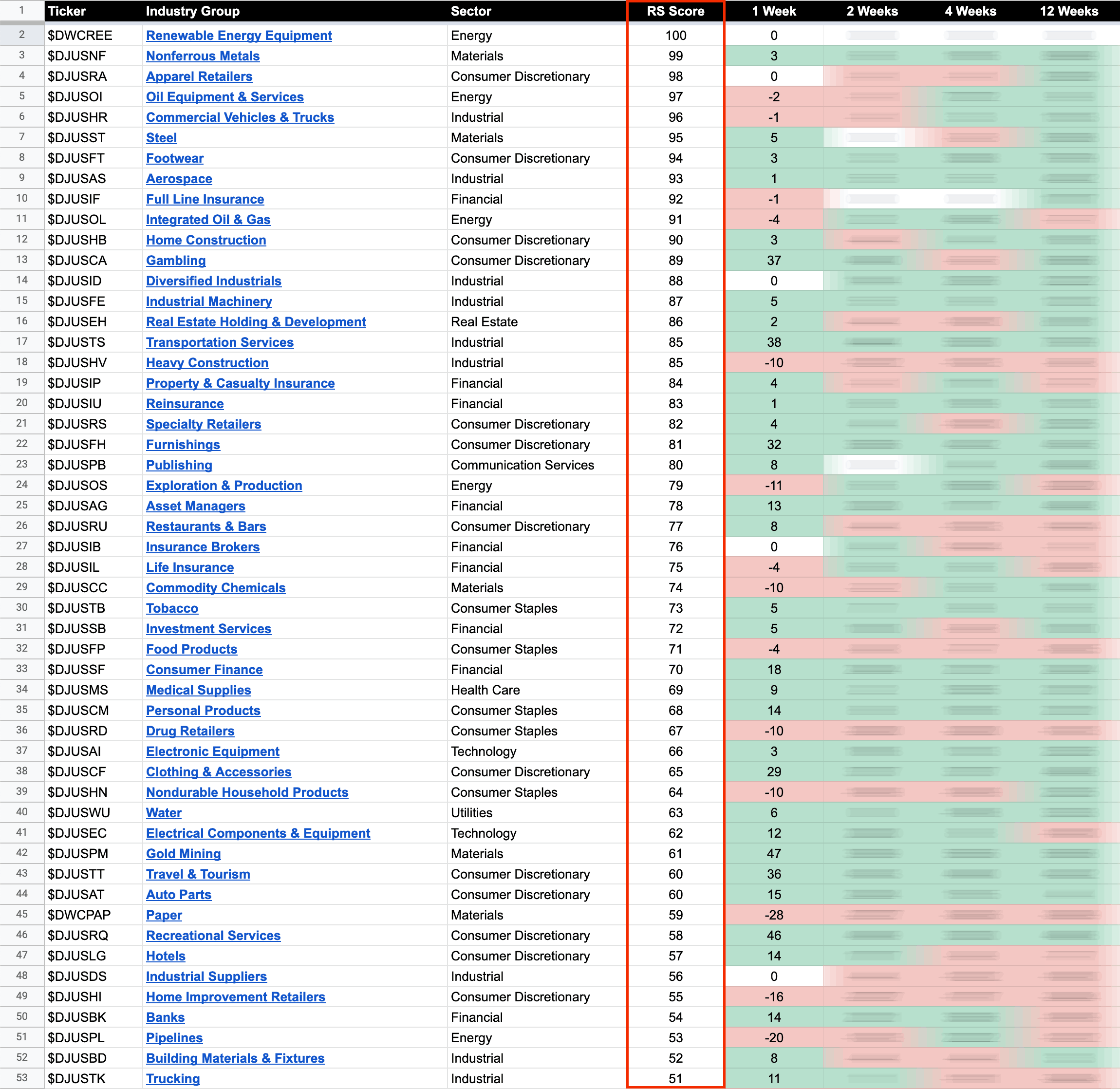

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

05 January, 2023

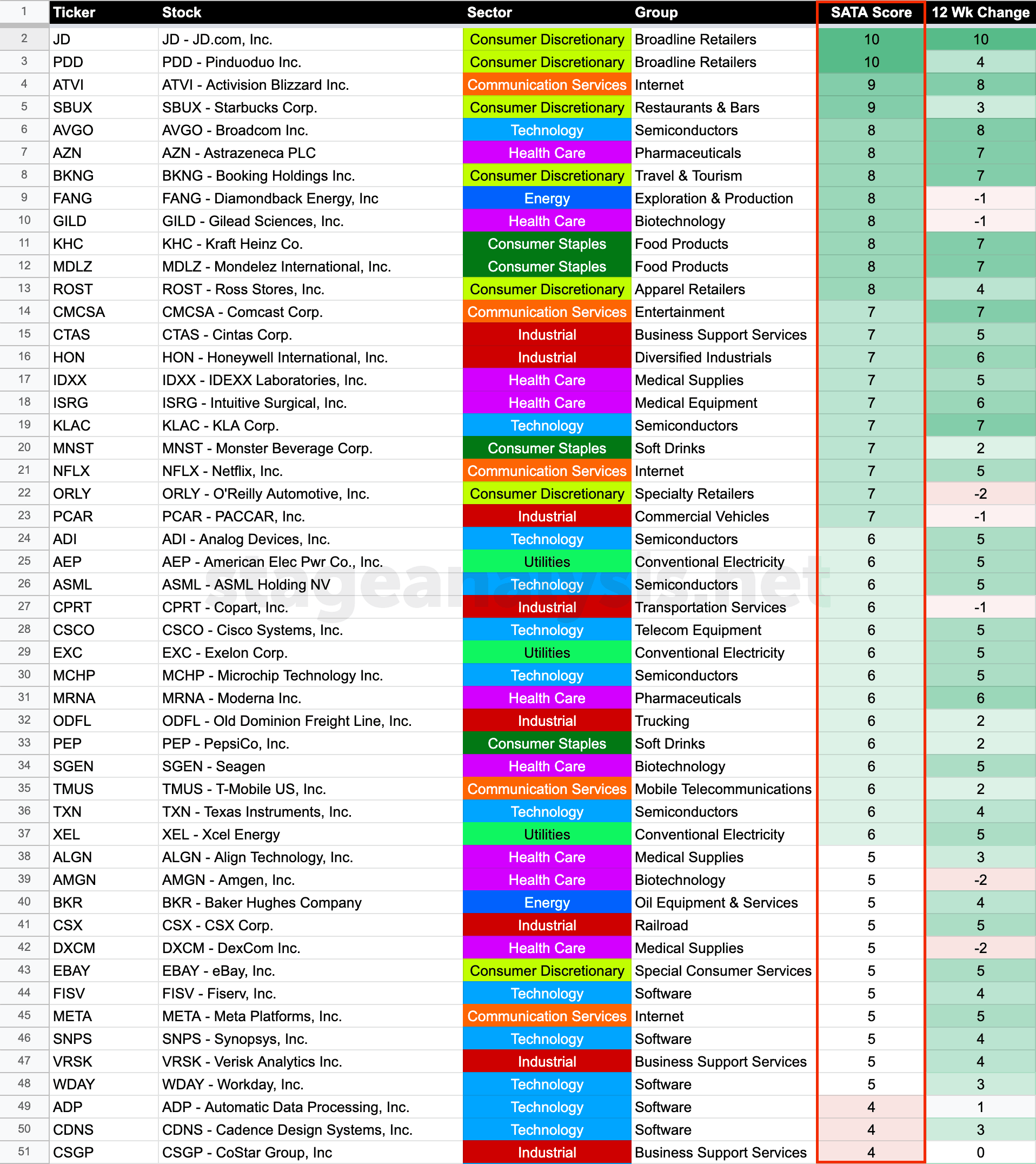

Stage Analysis Technical Attributes Scores – Nasdaq 100

We last covered the Stage Analysis Technical Attributes (SATA) weekly scores for the Nasdaq 100 back in mid November, which shows a rough guide of the Stages of the individual stocks within the Nasdaq 100. i.e. everything above a 7 would be considered in the Stage 2 zone (Positive), 4-6 in the Stage 1 or Stage 3 zone (Neutral), and 3 or below is the Stage 4 zone (Negative)...

Read More

04 January, 2023

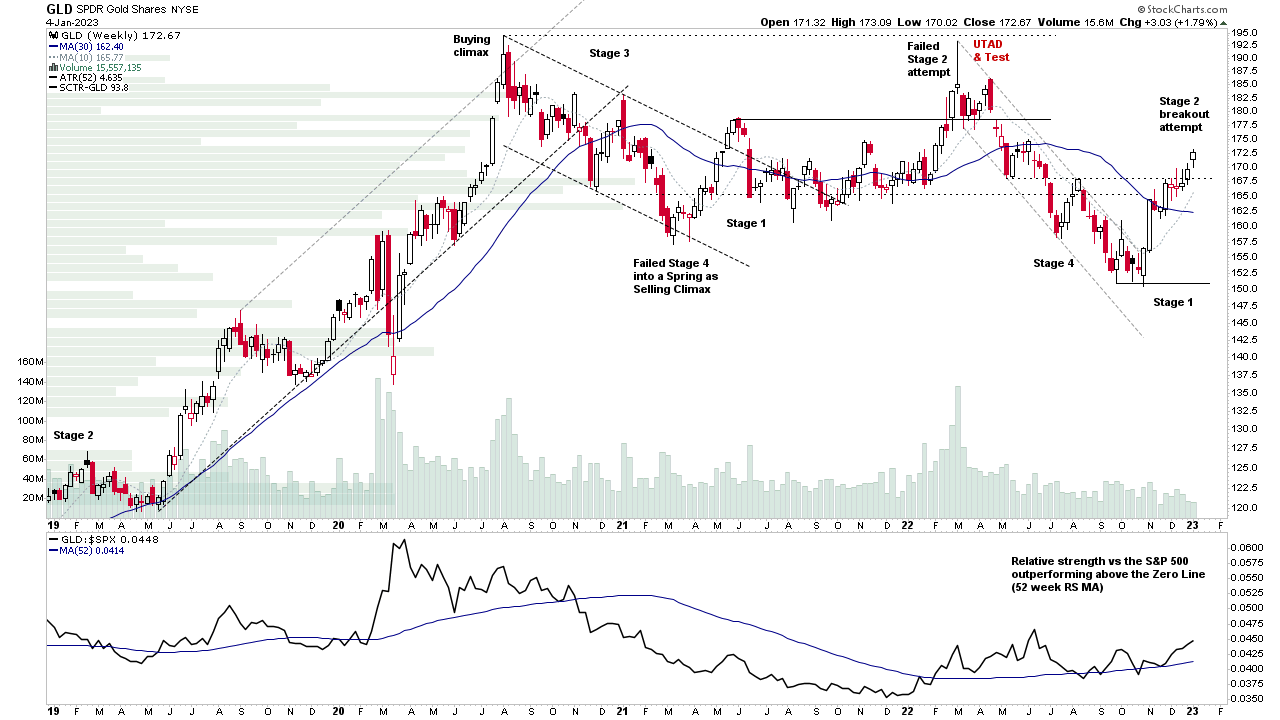

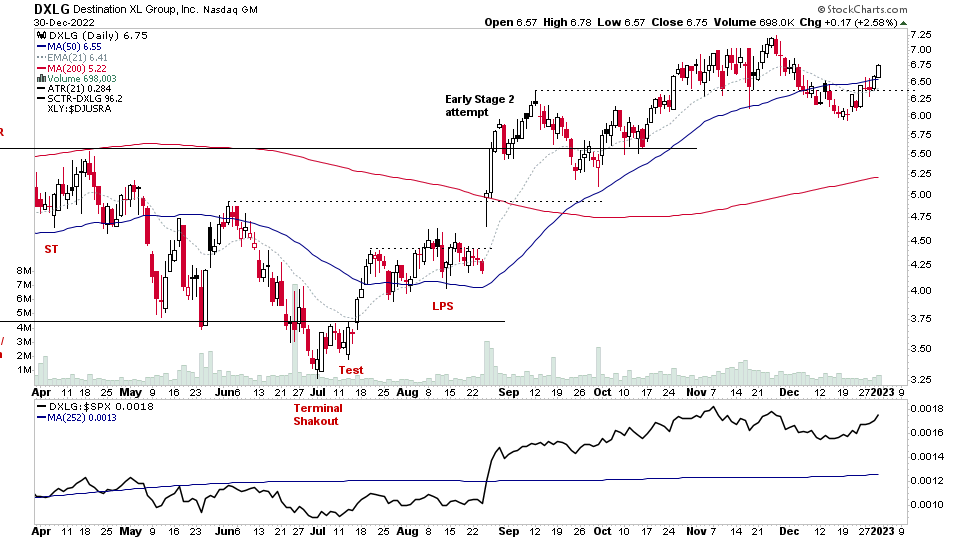

Gold Attempting To Move Into Stage 2 and the US Stocks Watchlist – 4 January 2023

A massive list today, with numerous Stage 2 breakout attempts and breakout attempts within Stage 1 bases still. Gold & Silver Mining stocks were a major theme, as physical gold futures attempts to move into Stage 2, after testing the breakout level continually for the last month...

Read More

03 January, 2023

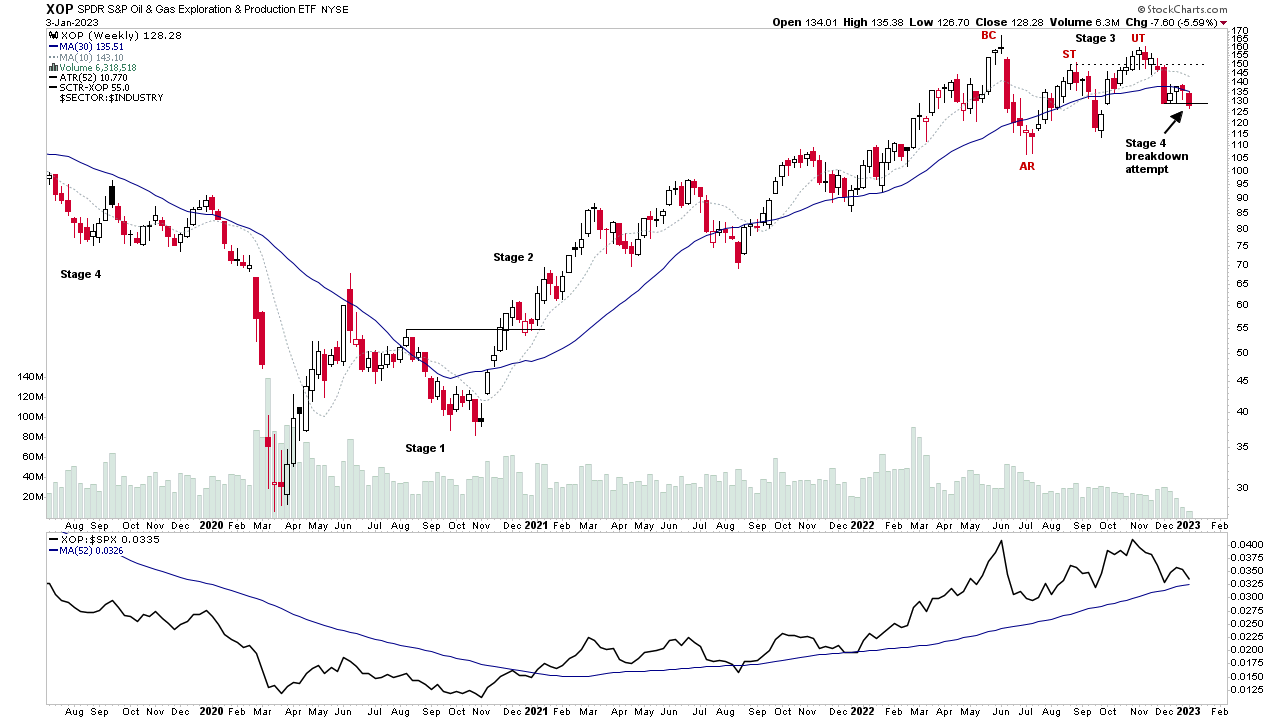

Oil & Gas Stocks – Multiple Stage 4 Breakdowns & Technical Weakness – 3 January 2023 (36mins)

The start of the new trading year in the US stock market saw multiple Stage 4 breakdown attempts in the Energy group stocks, with the Exploration and Production group stocks dominating the scans of the stocks breaking down into Stage 4 and within late Stage 3 structures...

Read More

02 January, 2023

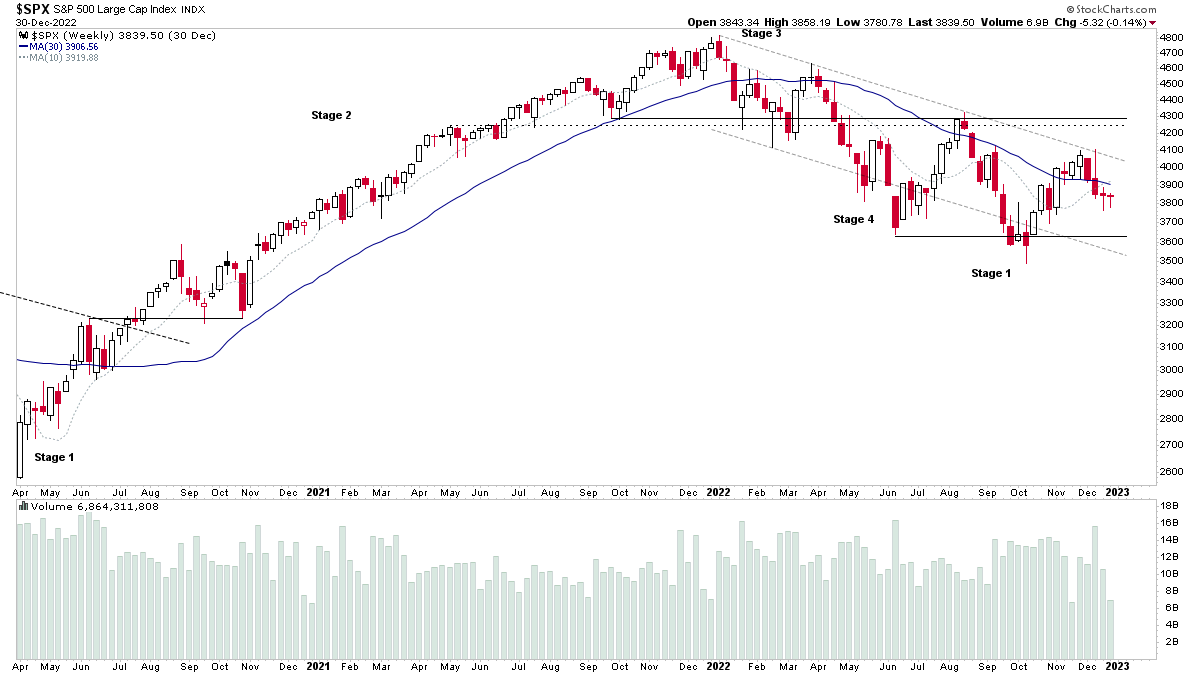

Stage Analysis Members Video – 2 January 2023 (1hr 31mins)

The Stage Analysis members weekend video with an end of year review of the markets, and special features on the US Industry Groups Relative Strength 2022 strongest groups, and the IBD Top 5 stocks of 2022. Plus the IBD industry group bell curve, and the market breadth charts to determine the weight of evidence. Followed by the US watchlist stocks in detail on multiple timeframes.

Read More

02 January, 2023

US Stocks Watchlist – 2 January 2023

There were 36 stocks highlighted from the US stocks watchlist scans today...

Read More

01 January, 2023

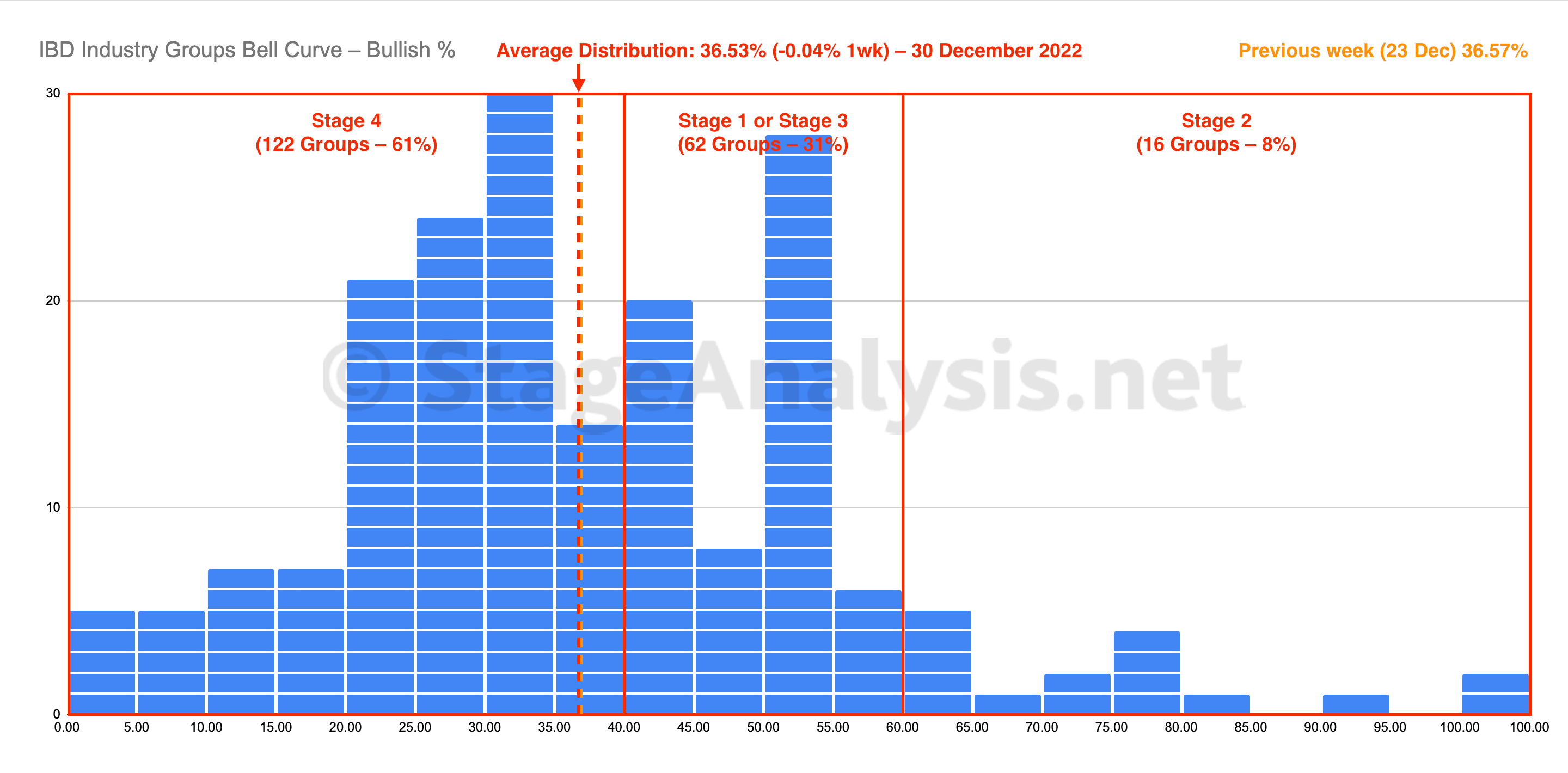

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve was mostly unchanged on the week with only a -0.04% move, closing the week at 36.53%. The amount of groups in Stage 4 decreased by -1 (-0.5%), and the amount of groups in Stage 2 decreased by -2 (-1%), while the amount groups in Stage 1 or Stage 3 increased by -3 (+1.5%)...

Read More

31 December, 2022

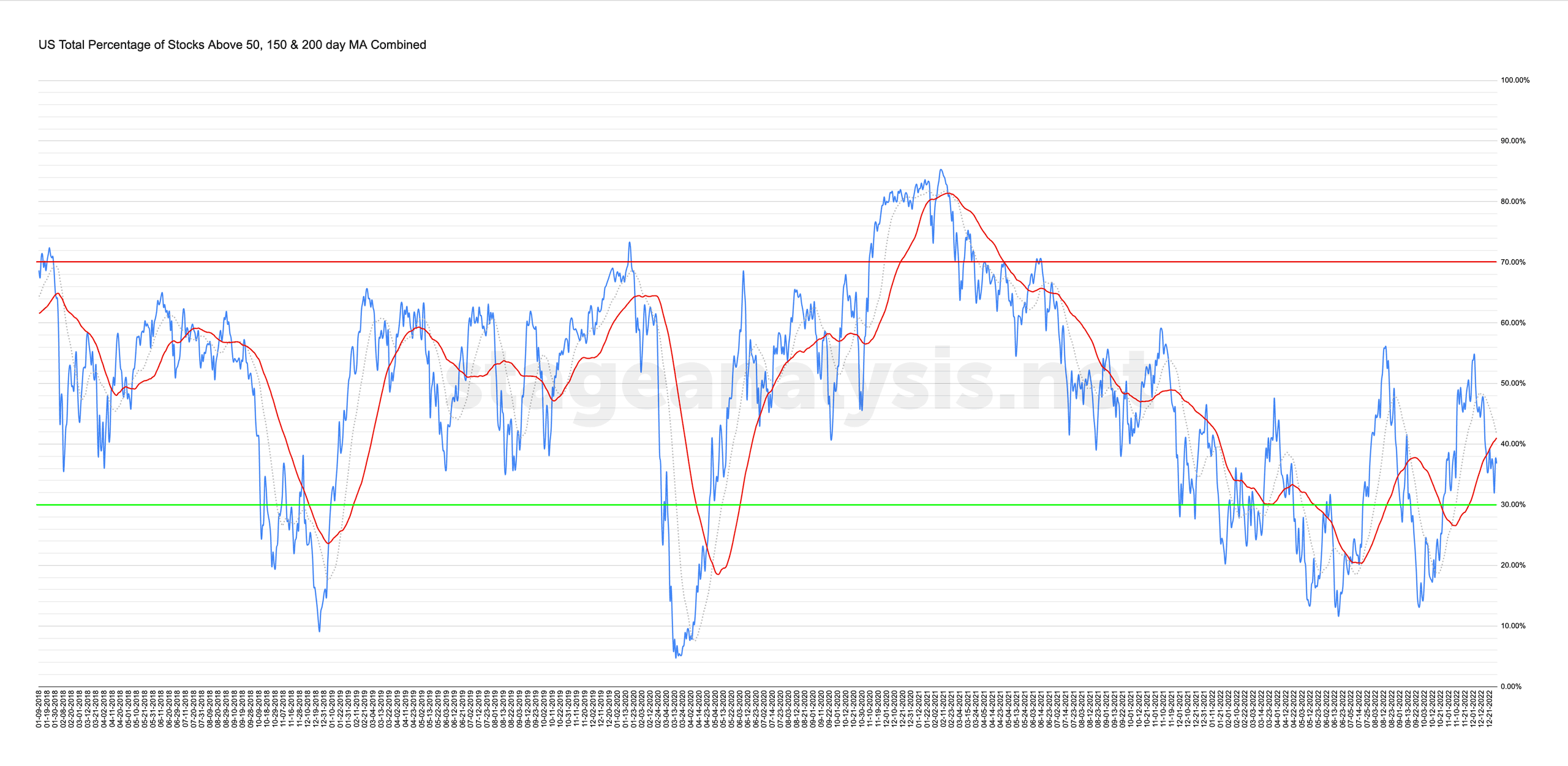

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More