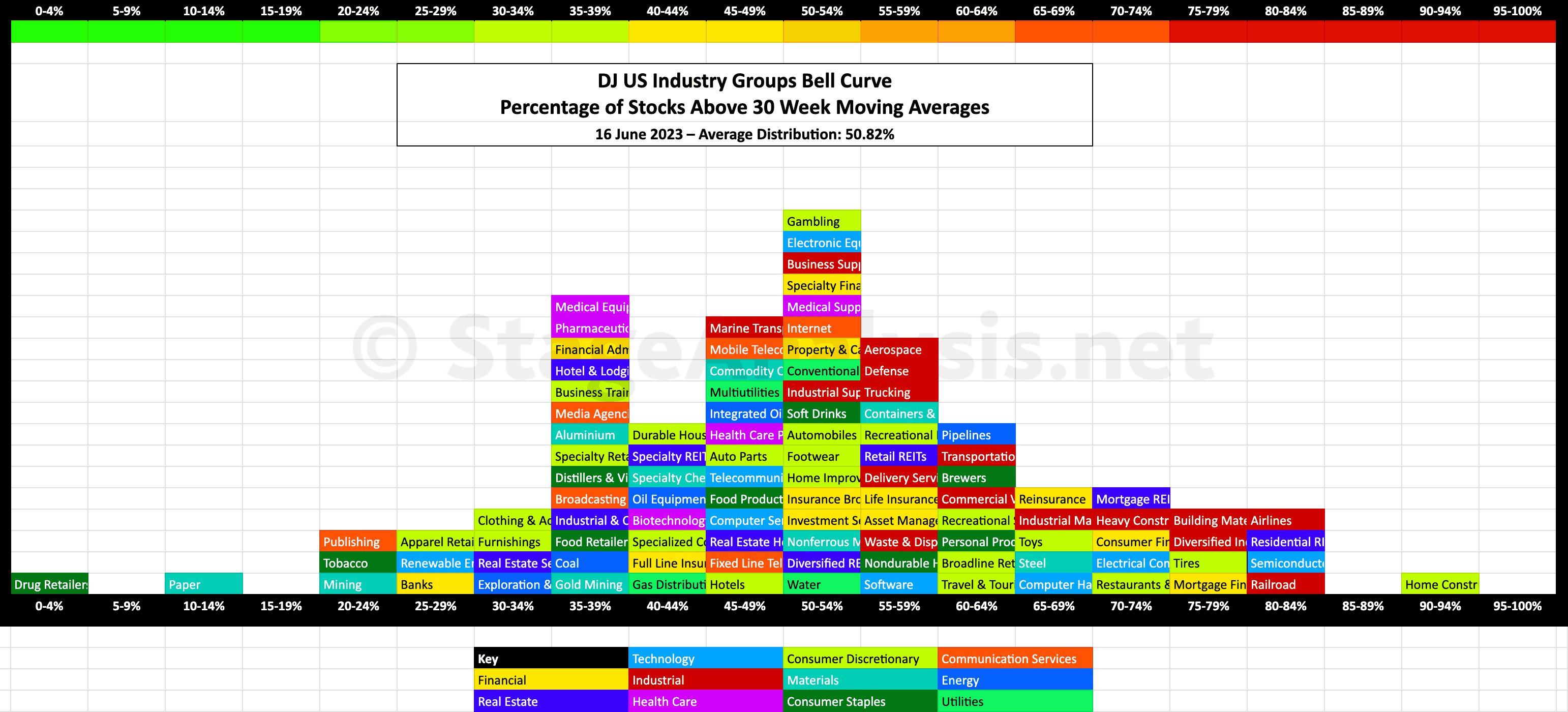

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More

Blog

18 June, 2023

Stage Analysis Members Video – 18 June 2023 (1hr 29mins)

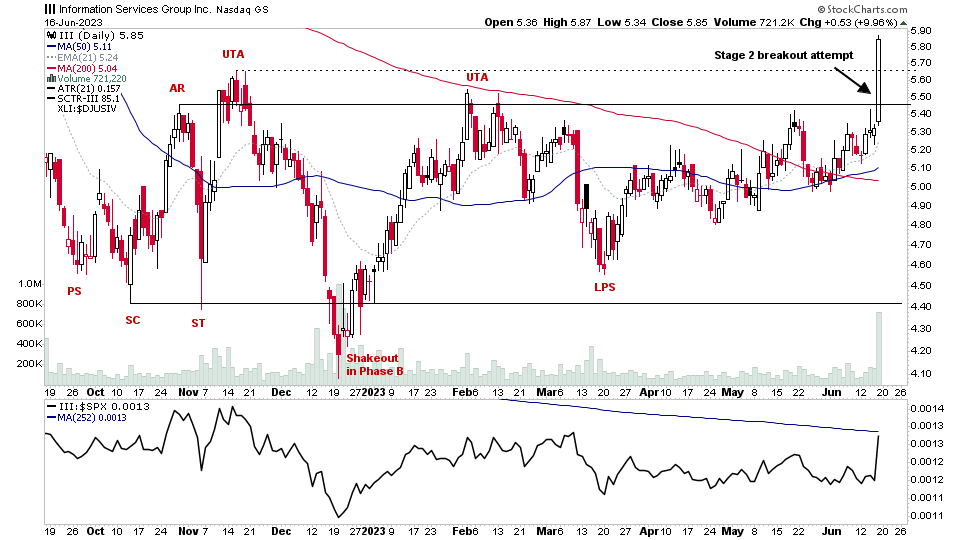

This weeks Stage Analysis weekend video features the regular members content of the the Major US Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update to help to determine the weight of evidence, Stage 2 breakout attempts on volume and finally the US Watchlist Stocks from the recent posts with detailed live markups on multiple timeframes.

Read More

18 June, 2023

US Stocks Watchlist – 18 June 2023

There were 20 stocks highlighted from the US stocks watchlist scans today...

Read More

17 June, 2023

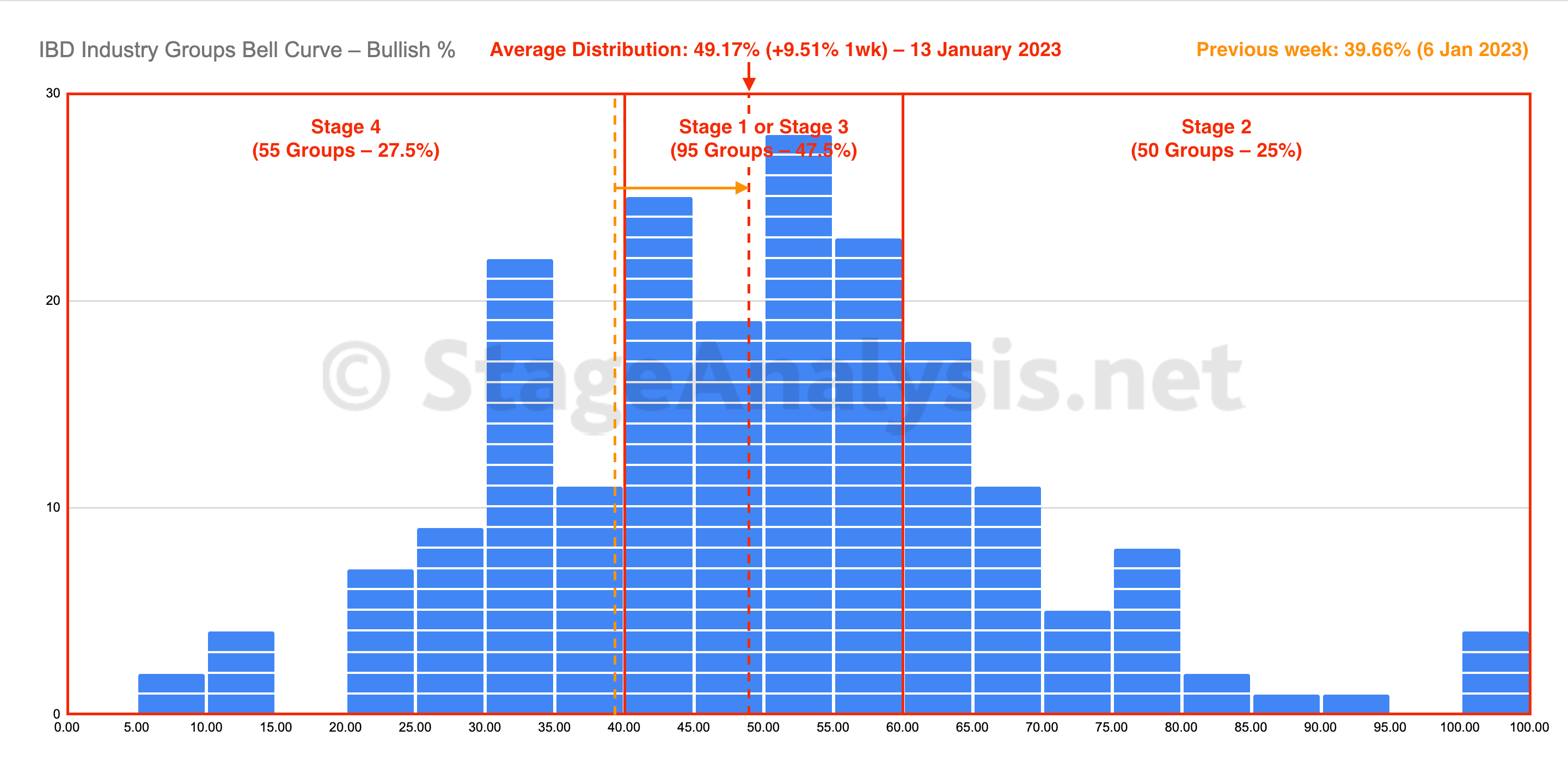

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent shows the few hundred industry groups plotted as a histogram chart and represents the percentage of stocks in each group that are on a point & figure (P&F) buy signal. This information provides a snapshot of the overall market health in a unique way, and is particularly useful for both market timing strategies and as a tool in aiding with the Stage Analysis methods "Forest to the Trees" approach, where we look for developing group themes...

Read More

17 June, 2023

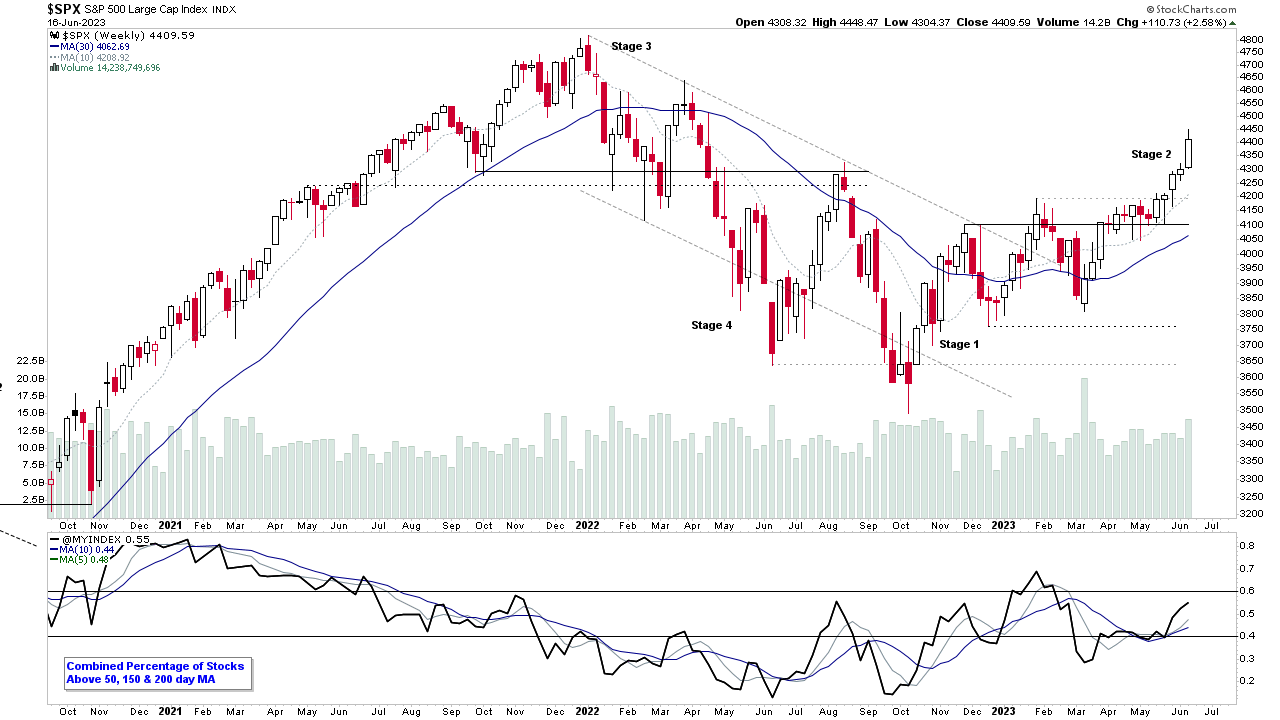

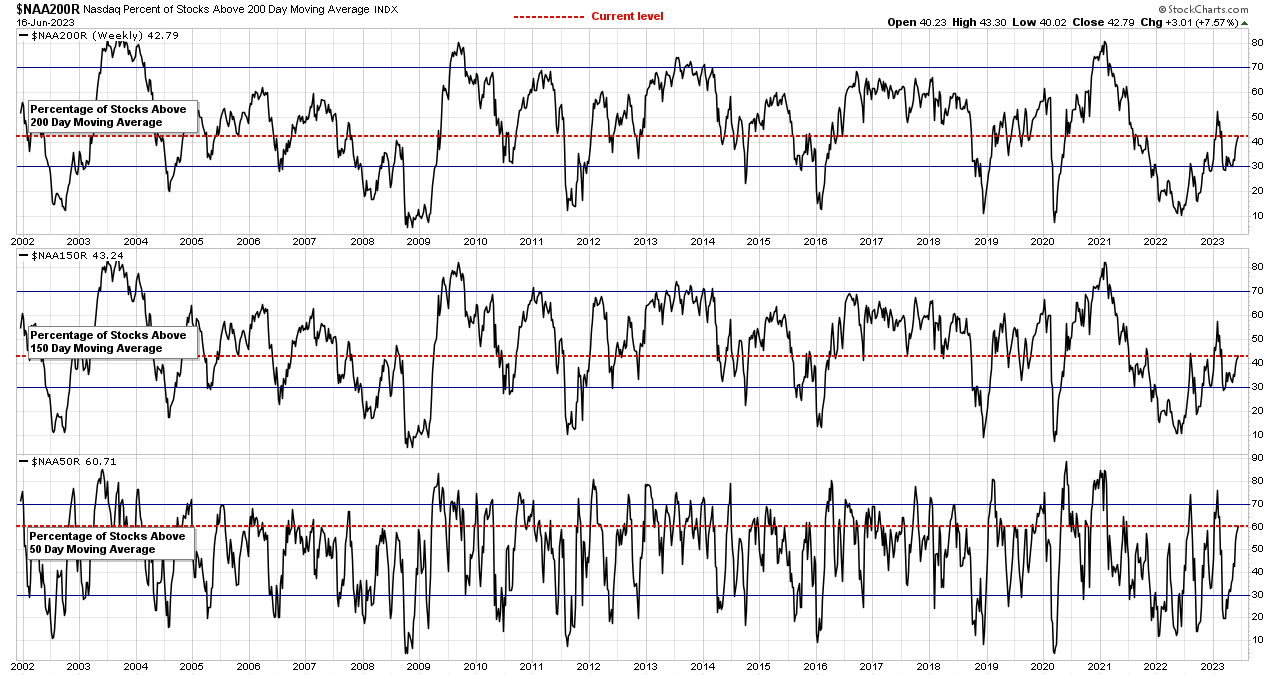

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

16 June, 2023

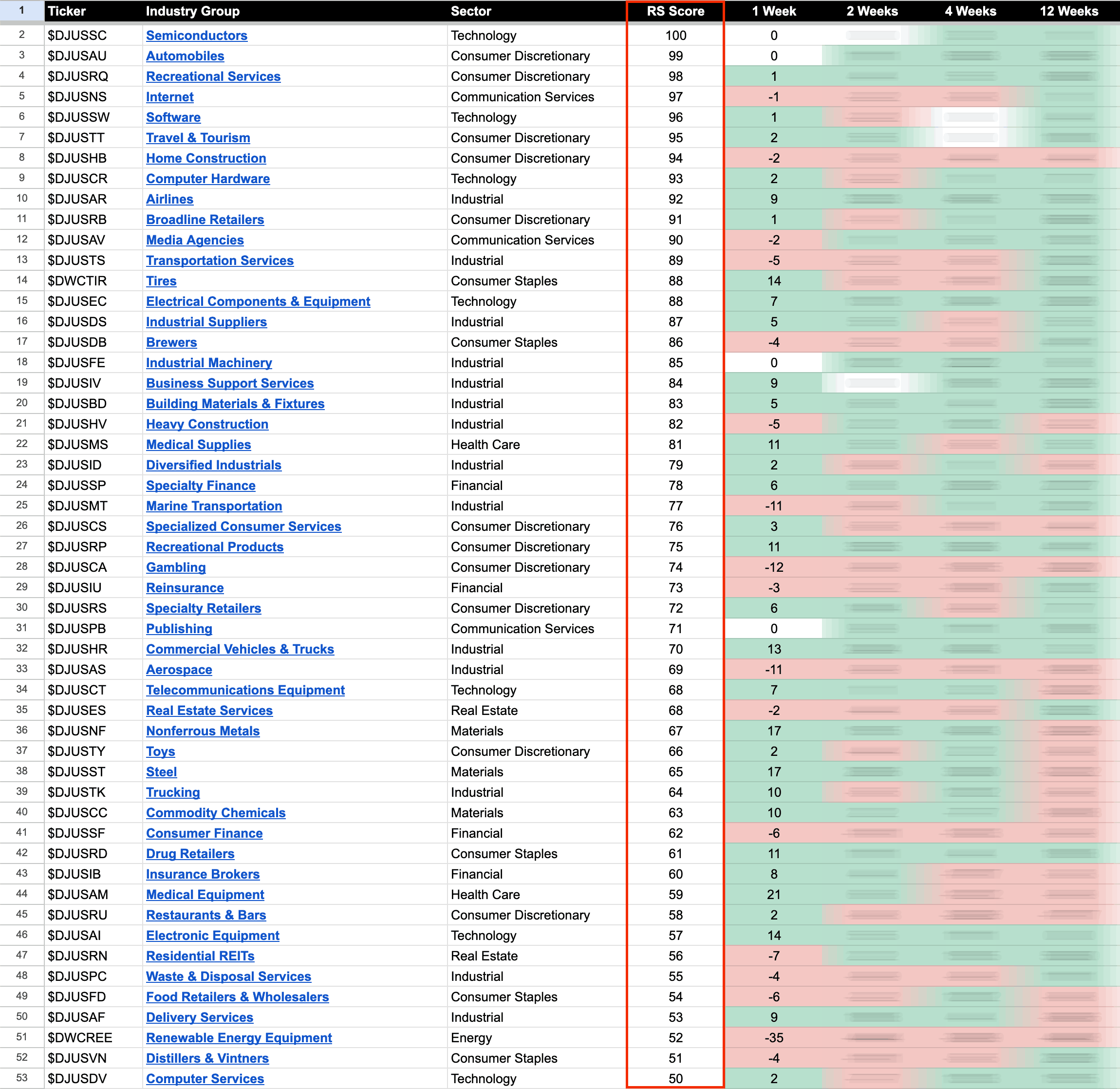

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

15 June, 2023

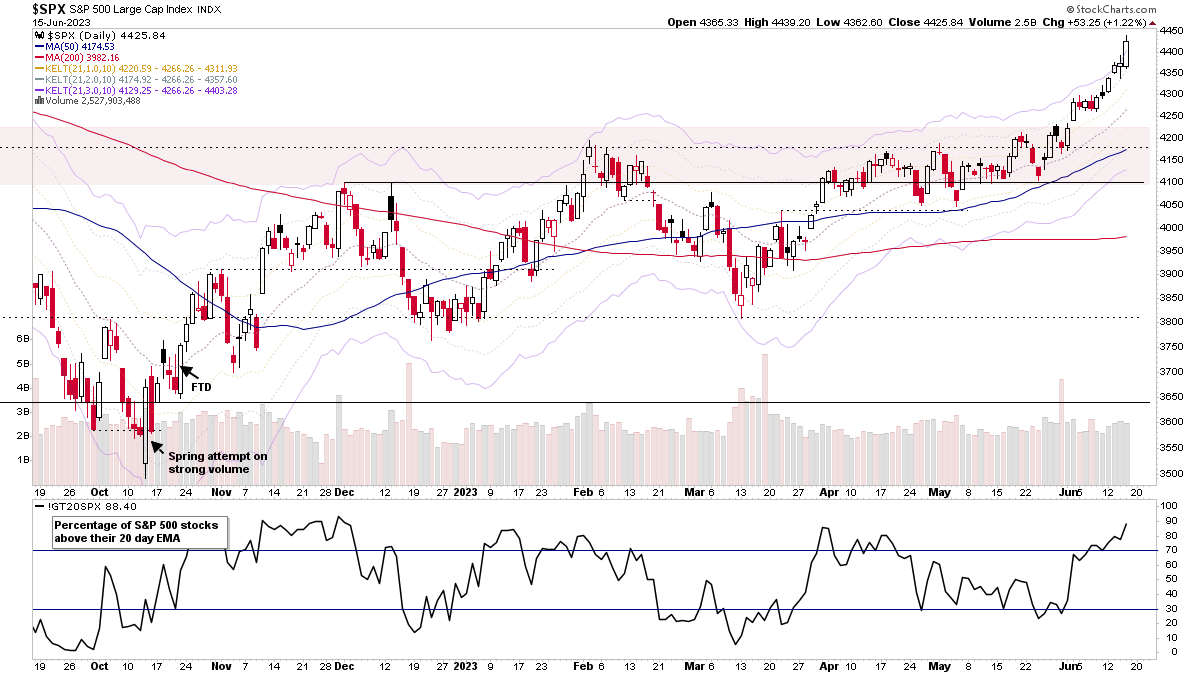

S&P 500 52 Week Highs & the US Stocks Watchlist – 15 June 2023

A bigger watchlist again as the amount of groups making new 52 week highs continues to expand, as the market rally broadens into the NYSE stocks. So there continues to be more stocks from Industrials, Materials, Consumer Discretionary etc...

Read More

14 June, 2023

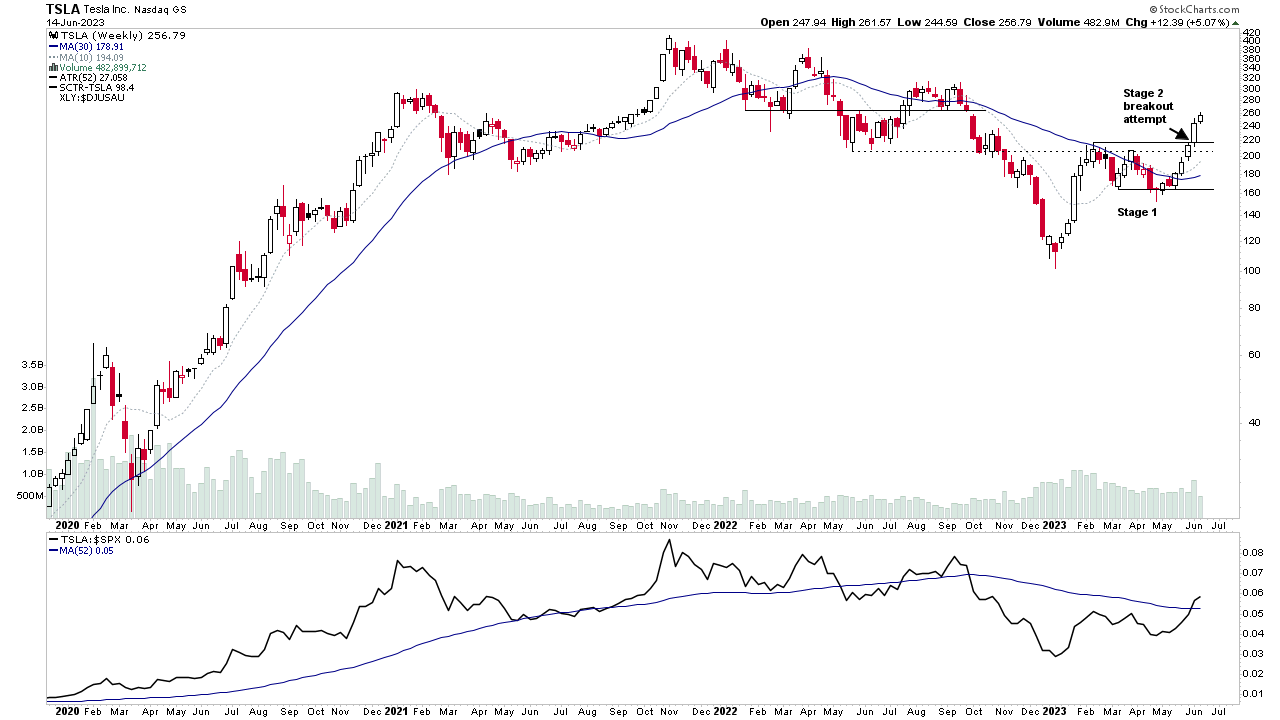

Group Focus Video: Automobiles Moving into Stage 2 – 14 June 2023 (1hr)

This weeks members midweek video is a special group focus on the Automobiles Group, which has moving strongly up the relative strength rankings over the last 3 months, and is currently in 2nd place overall, with multiple stocks in the group starting to breakout into early Stage 2...

Read More

13 June, 2023

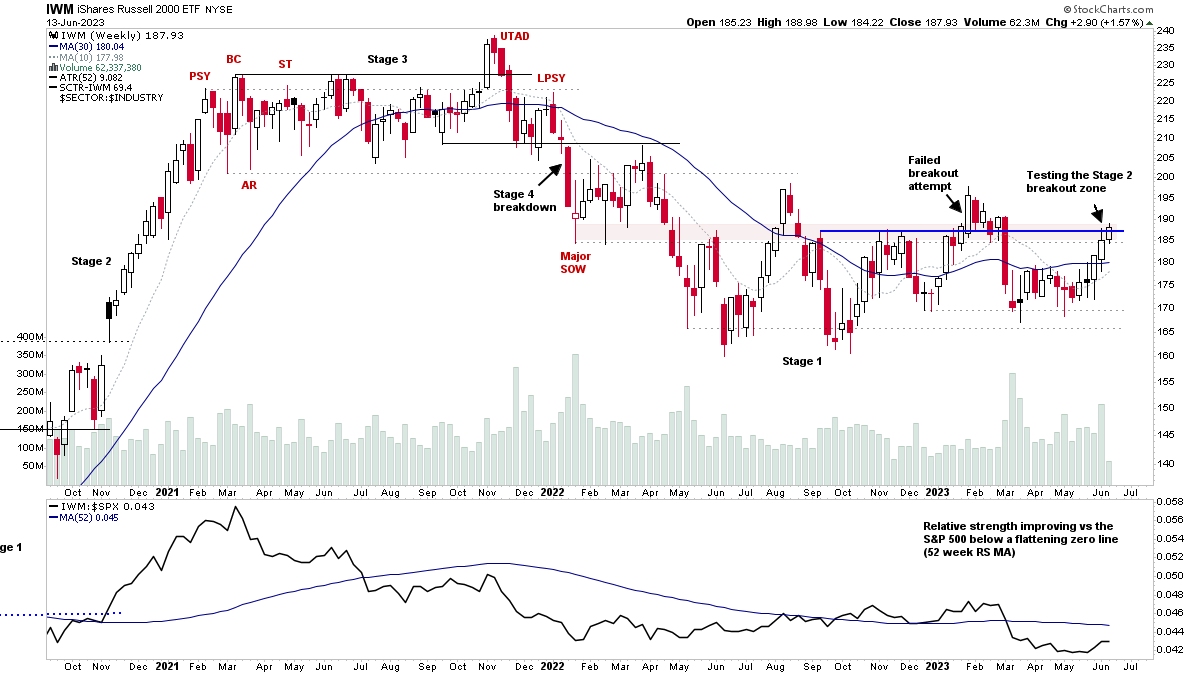

NYSE Breadth Expansion and the US Stocks Watchlist – 13 June 2023

The Russell 2000 Small Caps is once again testing resistance, and attempting to breakout into Stage 2. But as yet hasn't been able to push through and overcome the resistance from the March significant bar, from when the banking crisis erupted, and so remains in late Stage 1 currently.

Read More

12 June, 2023

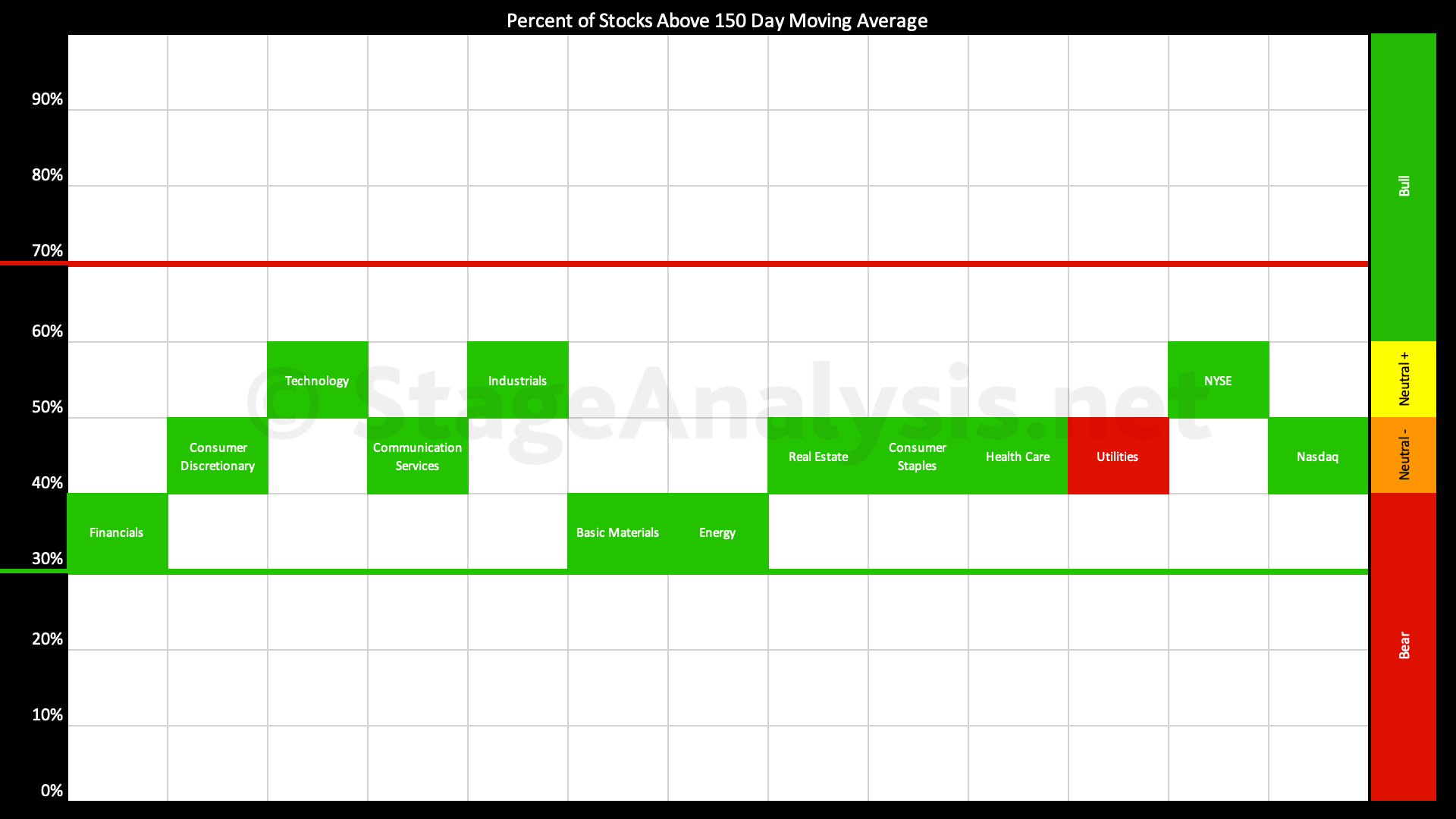

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More