For the watchlist from Tuesdays scans - ADBE, AEYE, AJG, AMZN, BILI, CRM, CRSP, EVTC, GOOG, LPSN, NFLX, NTES, NVTA, OKTA, PDD, PTON, SPWR, ZM

Read More

Blog

18 August, 2020

US Breakout Stocks Watchlist - 18 August 2020

17 August, 2020

US Breakout Stocks Watchlist - 17 August 2020

I was cautious going into today with the lack of breakouts in the weekend scans. But the market came back to life again and we have numerous stocks for the watchlist tonight. Plus a group move with multiple homebuilders attempting to breakout.

Read More

16 August, 2020

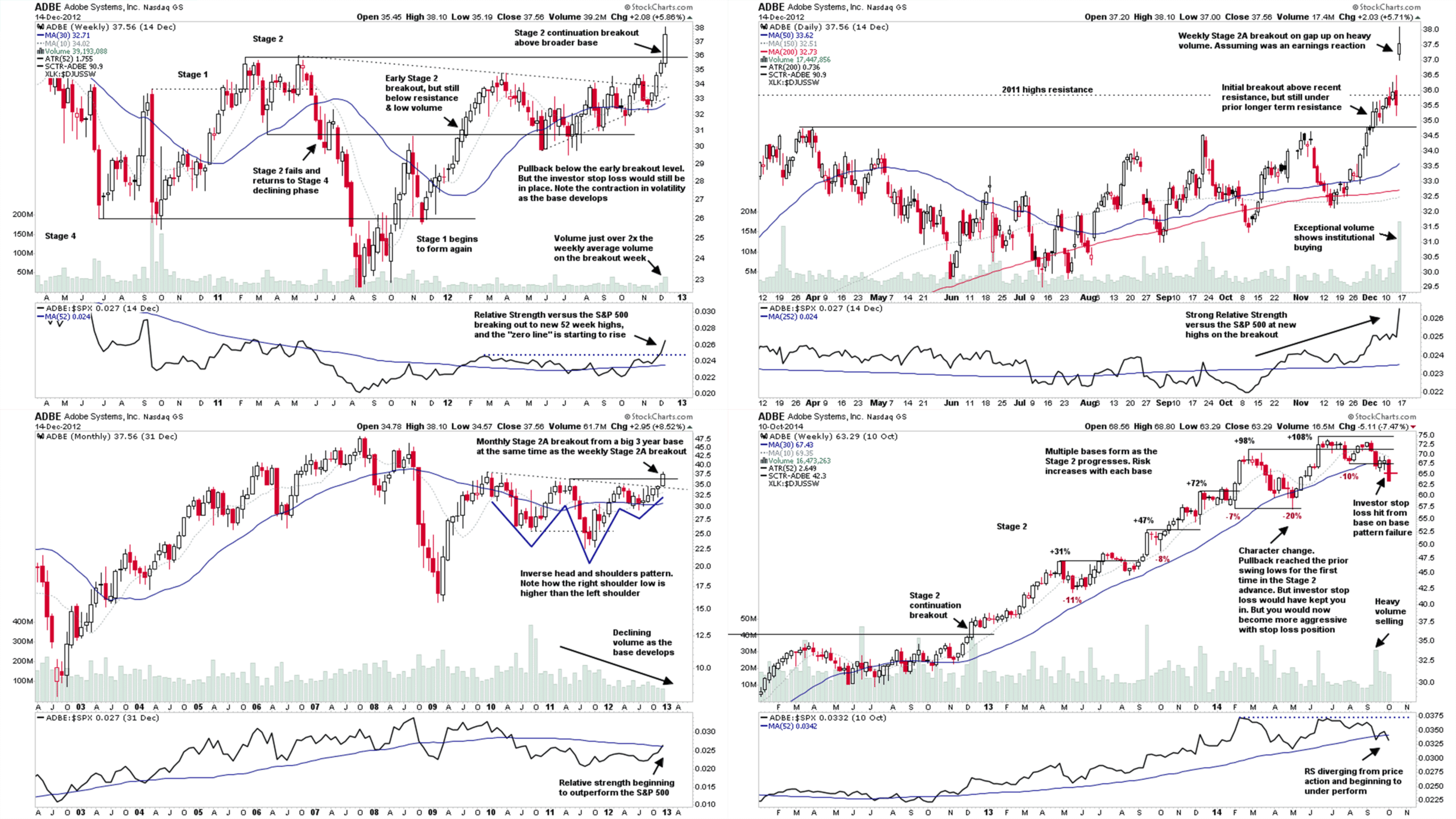

MODEL STOCKS #1 – Historical Multi-Timeframe Stage Analysis of the $ADBE 2012-2014 Stage 2 Advancing Phase

First video of a new series studying past leaders Stage 2 advances

Read More

13 August, 2020

US Breakout Stocks Watchlist - 13 August 2020

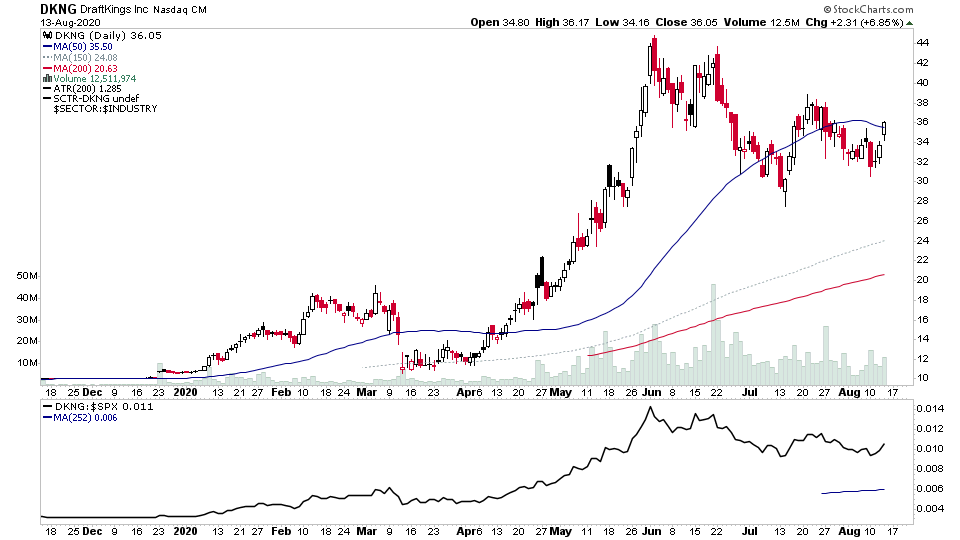

For the watchlist from Thursdays scans - APD, BE, CDLX, CGNX, CMG, CSIQ, DKNG, FND, GRMN, HALO, HUBS, KLAC, NSTG

Read More

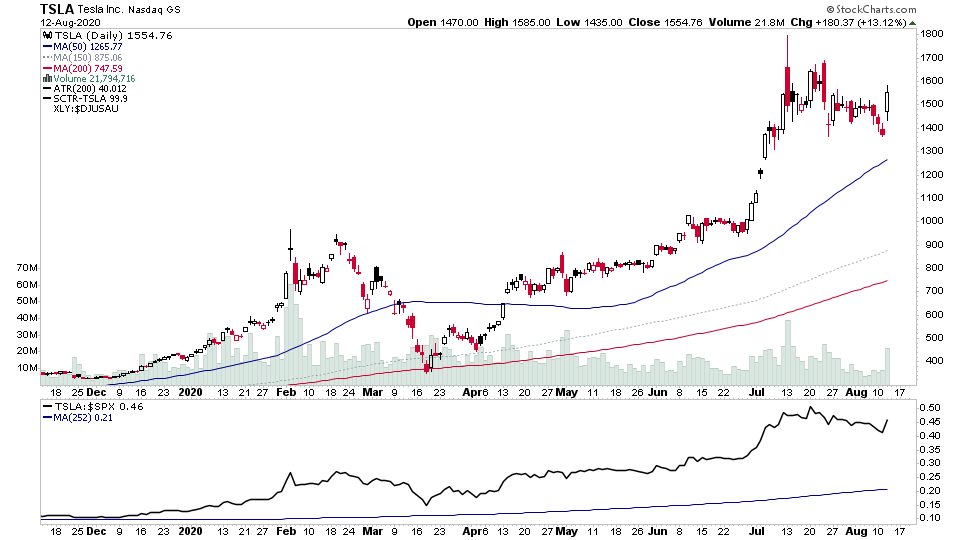

12 August, 2020

US Breakout Stocks Watchlist - 12 August 2020

An interesting mix tonight with stocks from a broad range of sectors in the watchlist...

Read More

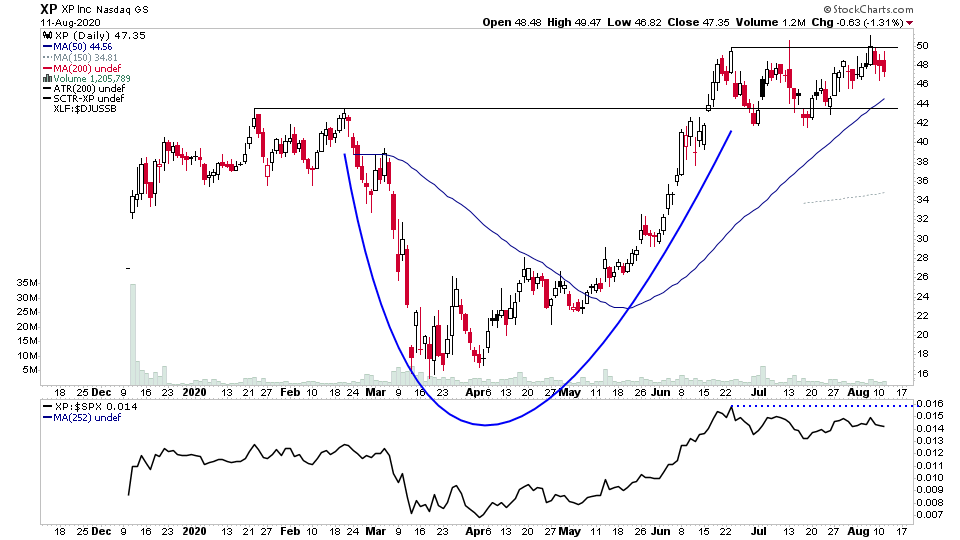

11 August, 2020

US Breakout Stocks Watchlist - 11 August 2020

For the watchlist from Tuesdays scans - ALB, APEI, AVYA, ETFC, FTV, GGG, SPOT, XP, V

Read More

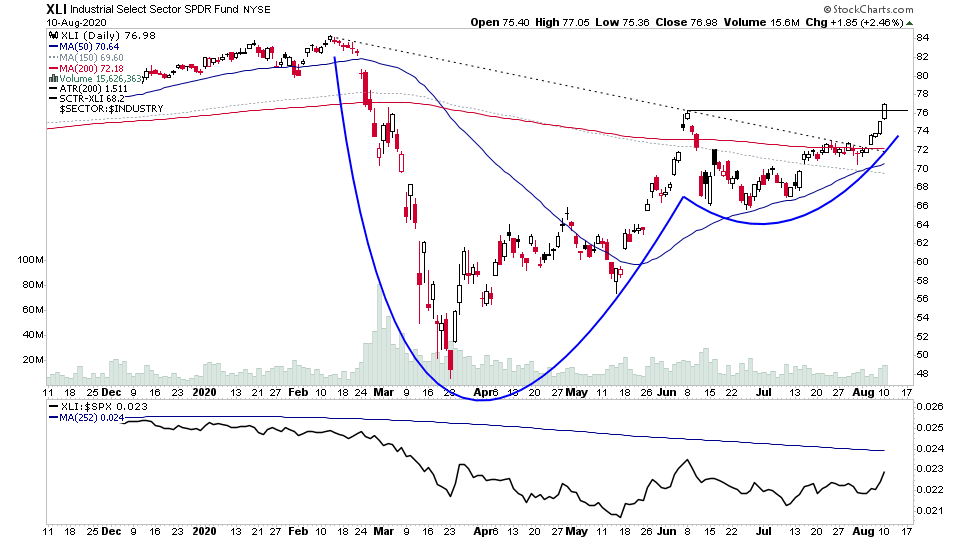

10 August, 2020

US Breakout Stocks Watchlist - 10 August 2020

The Industrials sector is attempting to move into early Stage 2A with todays breakout above the pivot, and unsurprisingly the watchlist is dominated with industrial names today...

Read More

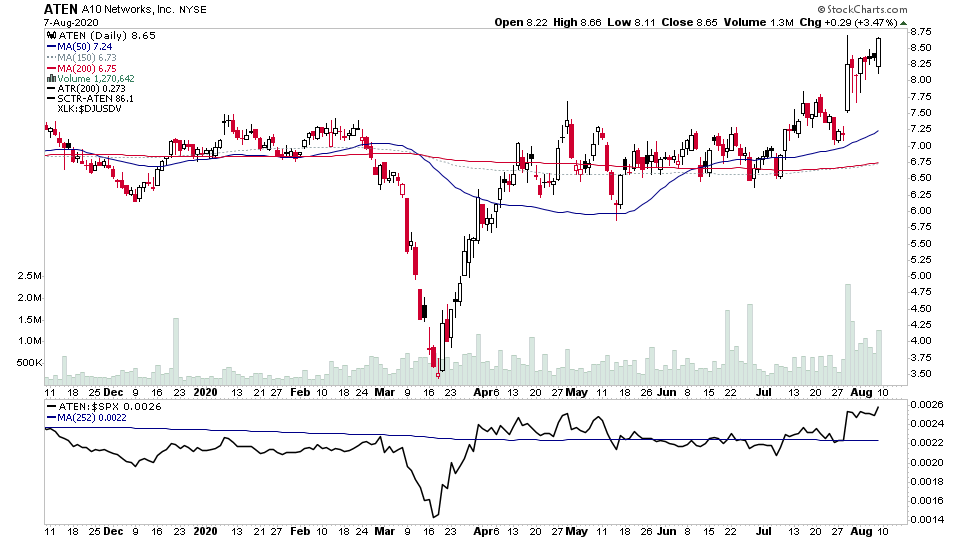

09 August, 2020

US Breakout Stocks Watchlist - 8 August 2020

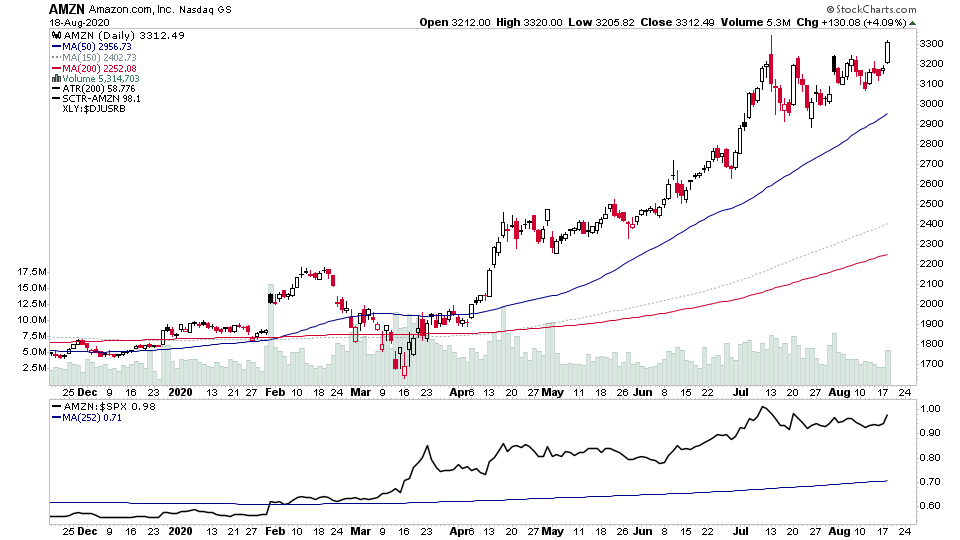

For the watchlist from the weekend scans - ALC, AMZN, ATEC, ATEN, CSIQ, FSLR, SWI, ZM

Read More

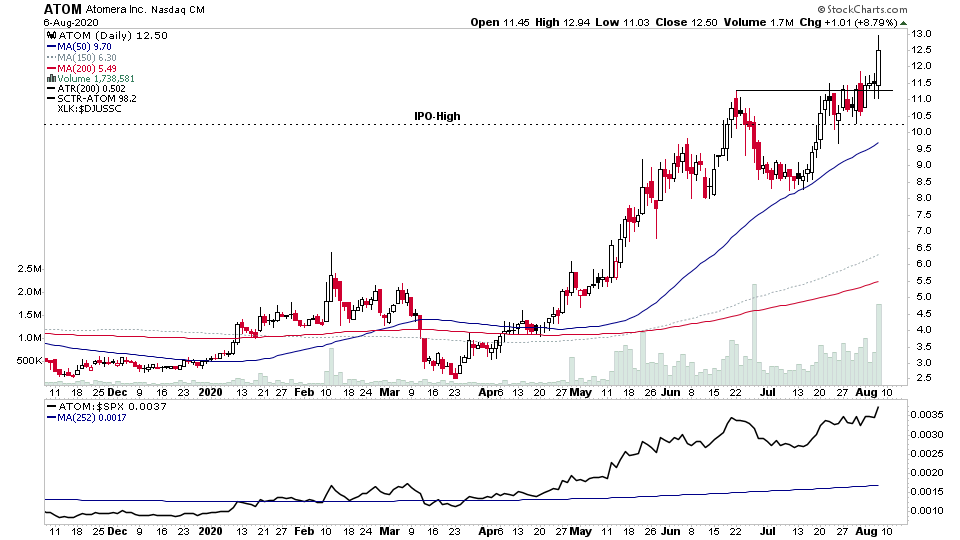

06 August, 2020

US Breakout Stocks Watchlist - 6 August 2020

For the watchlist from Thursdays scans - ADBE, APPS, ARLO, ATOM, CENX, EDIT, FB, GMED, GOOG, HUBS, LPSN, MAXR, PENN, TRI, TRMB

Read More

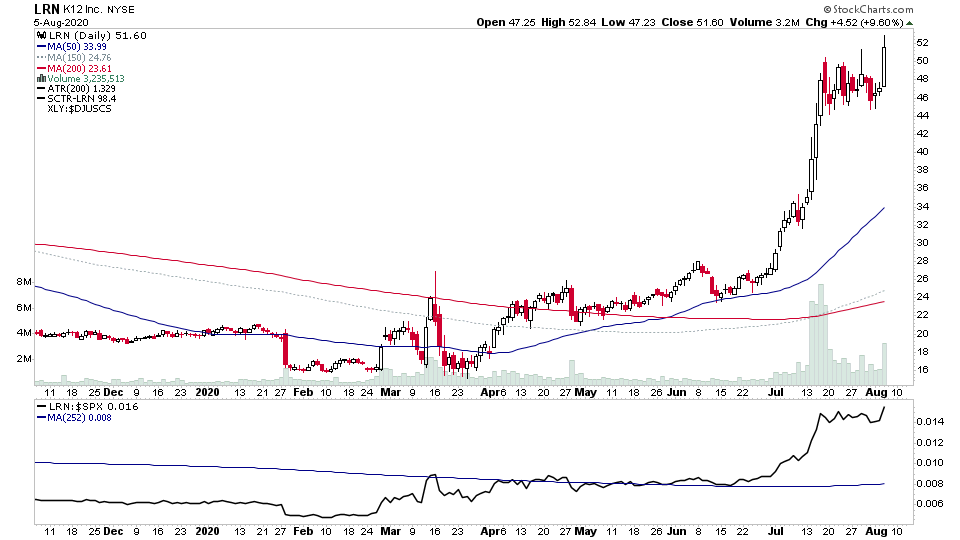

05 August, 2020

US Breakout Stocks Watchlist - 5 August 2020

For the watchlist from Wednesdays scans - ALB, ALDX, ALTR, IMXI, LRN, LULU, MA, NTRA, SGRY, SQM, SY, TER

Read More