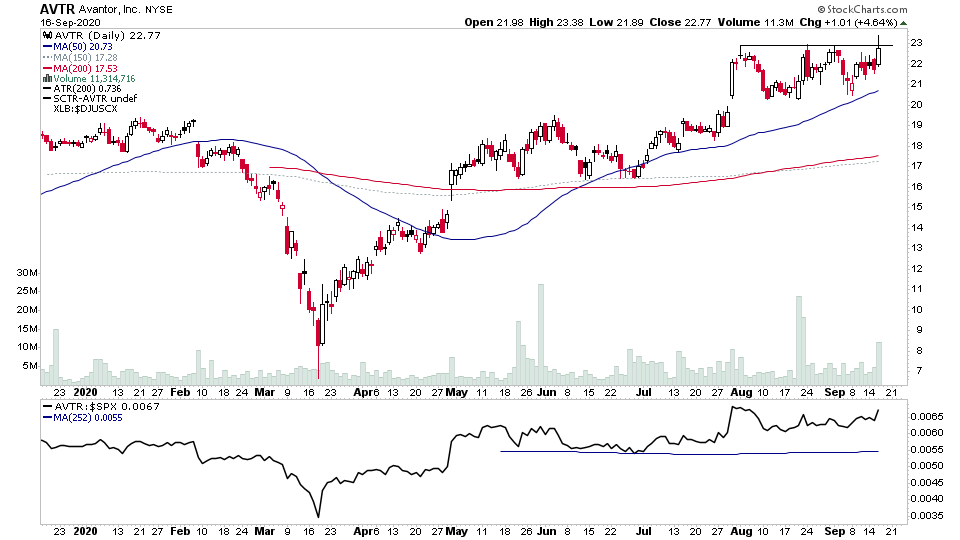

For the watchlist from Wednesdays scans - AVTR, GME, GOGO

Read More

Blog

16 September, 2020

US Breakout Stocks Watchlist - 16 September 2020

15 September, 2020

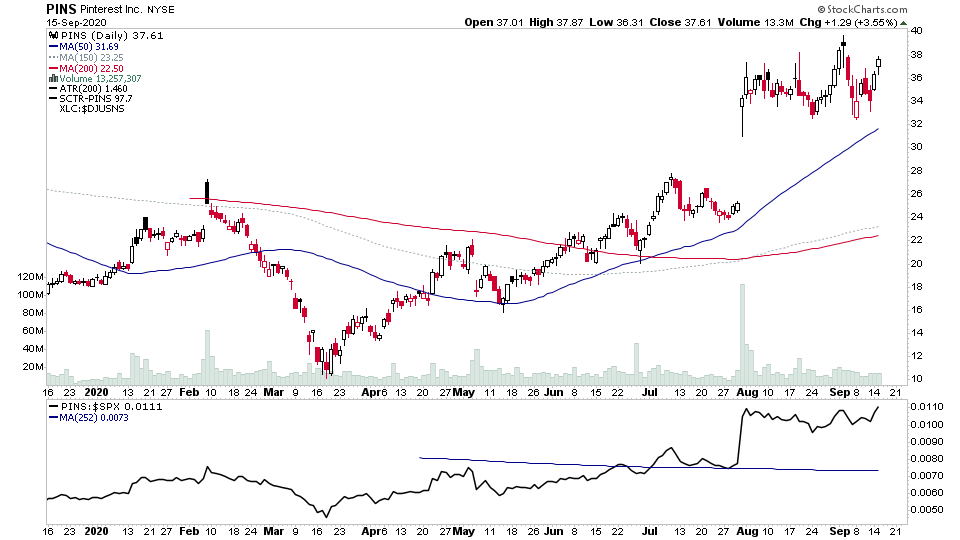

US Breakout Stocks Watchlist - 15 September 2020

A lot of leaders showing up in tonights scans, with a heavy weighting in the Software group. For the watchlist from Tuesdays scans - APPS, CRNC, CRWD, DDOG, DECK, FSLY, GRWG, GSX, NOW, NVTA, PINS, SEDG, SGMS, SQ, TSM, UPS, ZM

Read More

14 September, 2020

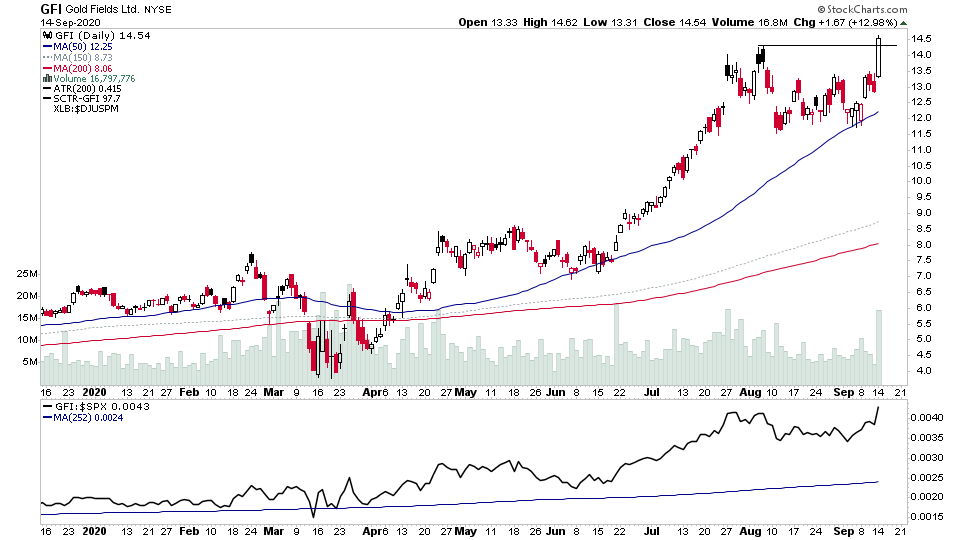

US Breakout Stocks Watchlist - 14 September 2020

There's a few sector themes continuing to appear in the watchlist, with multiple Biotech stocks, and Gold and Silver miners breaking out or near the top of bases. For the watchlist from Mondays scans - ADAP, AEM, AG, AMTI, BTG, BYND, CLDX, FSM, GFI, GH, INFY, KTOS, MAG, NIO, NSTG, SE, SGMS, SILV, SSRM, TPX, TSLA, VRT, VSLR, WMS

Read More

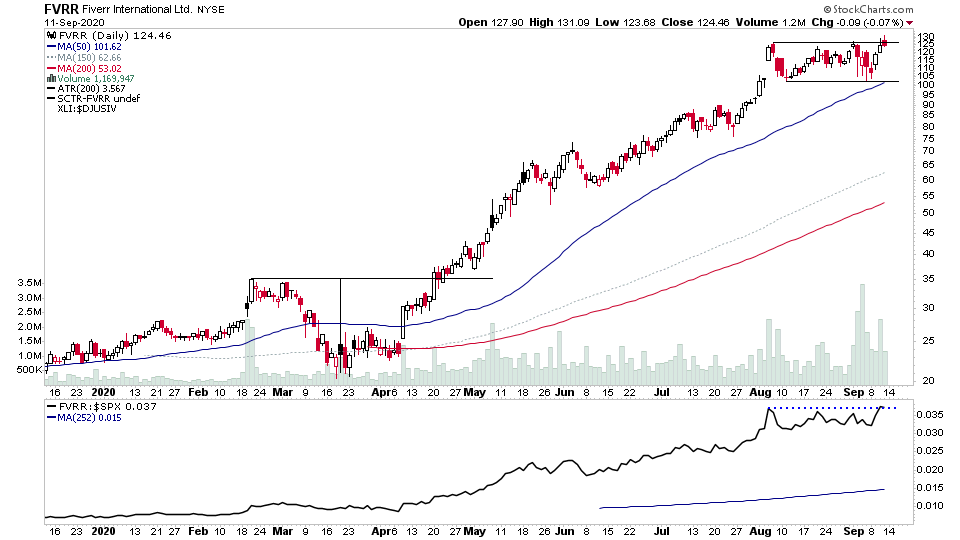

12 September, 2020

US Breakout Stocks Watchlist - 12 September 2020

For the watchlist from Fridays scans - ABB, BLDR, CMI, DLPH, ETN, FUL, FVRR, INFY, KTOS, LEN, PH, PWR, RIO, TKR, TPH, UPS

Read More

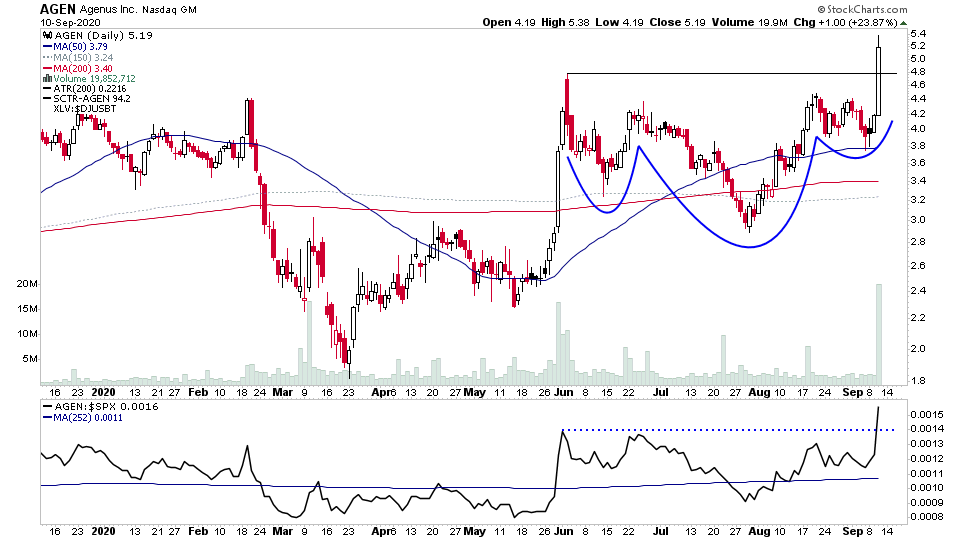

10 September, 2020

US Breakout Stocks Watchlist - 10 September 2020

For the watchlist from Thursdays scans - AGEN, NOMD

Read More

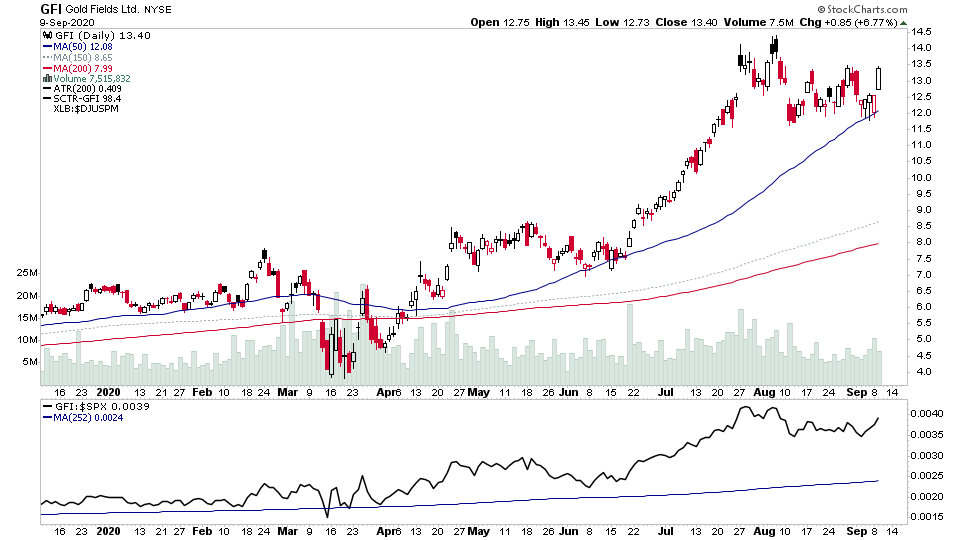

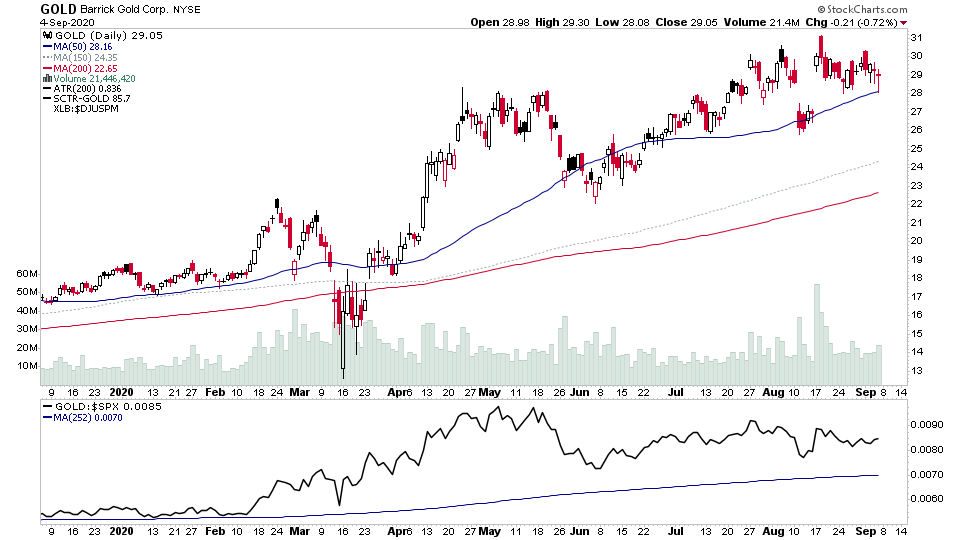

09 September, 2020

US Breakout Stocks Watchlist - 9 September 2020

For the watchlist from Wednesdays scans - DKNG, GFI, GOLD, OR, PENN, SNAP, VRT, WPM. More gold and silver miners dominating the watchlist again tonight.

Read More

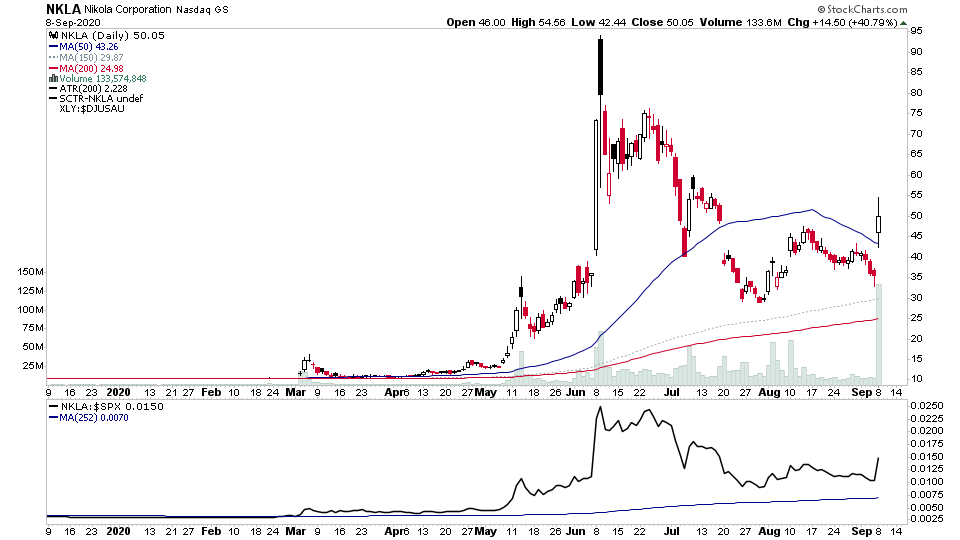

08 September, 2020

US Breakout Stocks Watchlist - 8 September 2020

For the watchlist from Tuesdays scans - AEM, NEM, NG, NKLA, RCM, SDC, UBER

Read More

06 September, 2020

US Breakout Stocks Watchlist - 6 September 2020

Slim pickings from the weekend watchlist scans after a volatile few days - DAR, GOLD, GRVY, WKHS

Read More

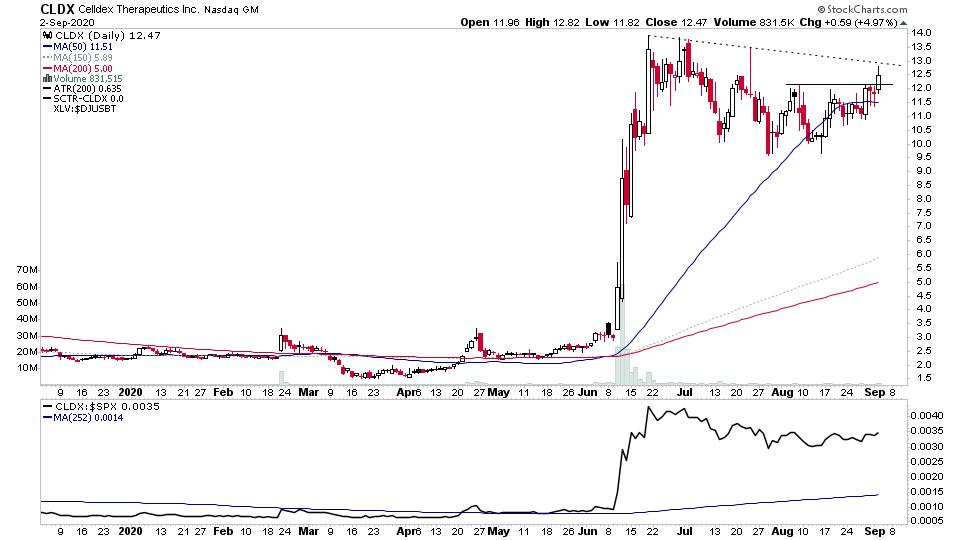

02 September, 2020

US Breakout Stocks Watchlist - 2 September 2020

For the watchlist from Tuesdays scans - CLDX, SNAP

Read More

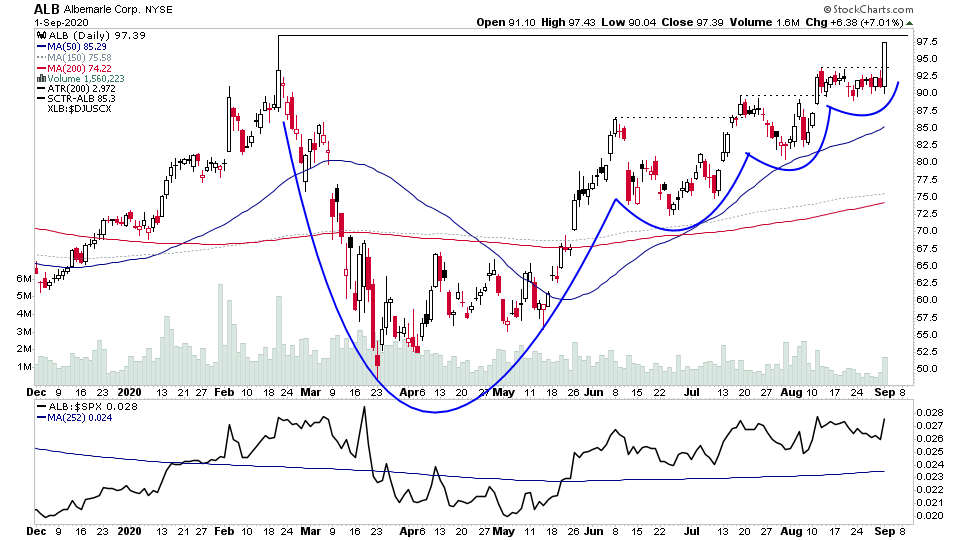

01 September, 2020

US Breakout Stocks Watchlist - 1 September 2020

For the watchlist from Tuesdays scans - ADSK, ALB, APD, BILI, CHGG, CRNC, NFLX, NVTA, OKTA, RPAY, SHOP, SVMK, TSM, TTD, WKHS, YETI

Read More