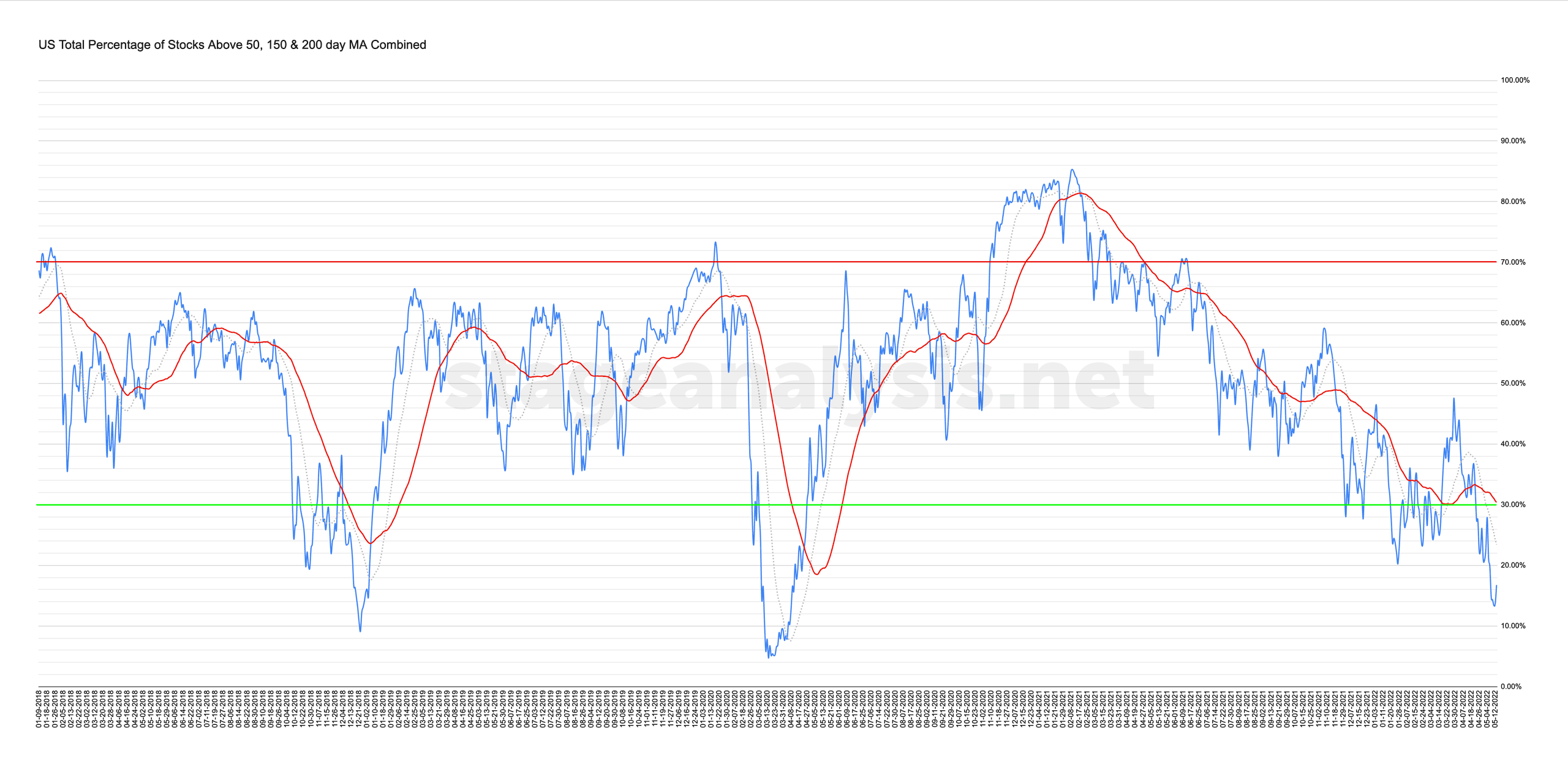

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

Blog

13 May, 2022

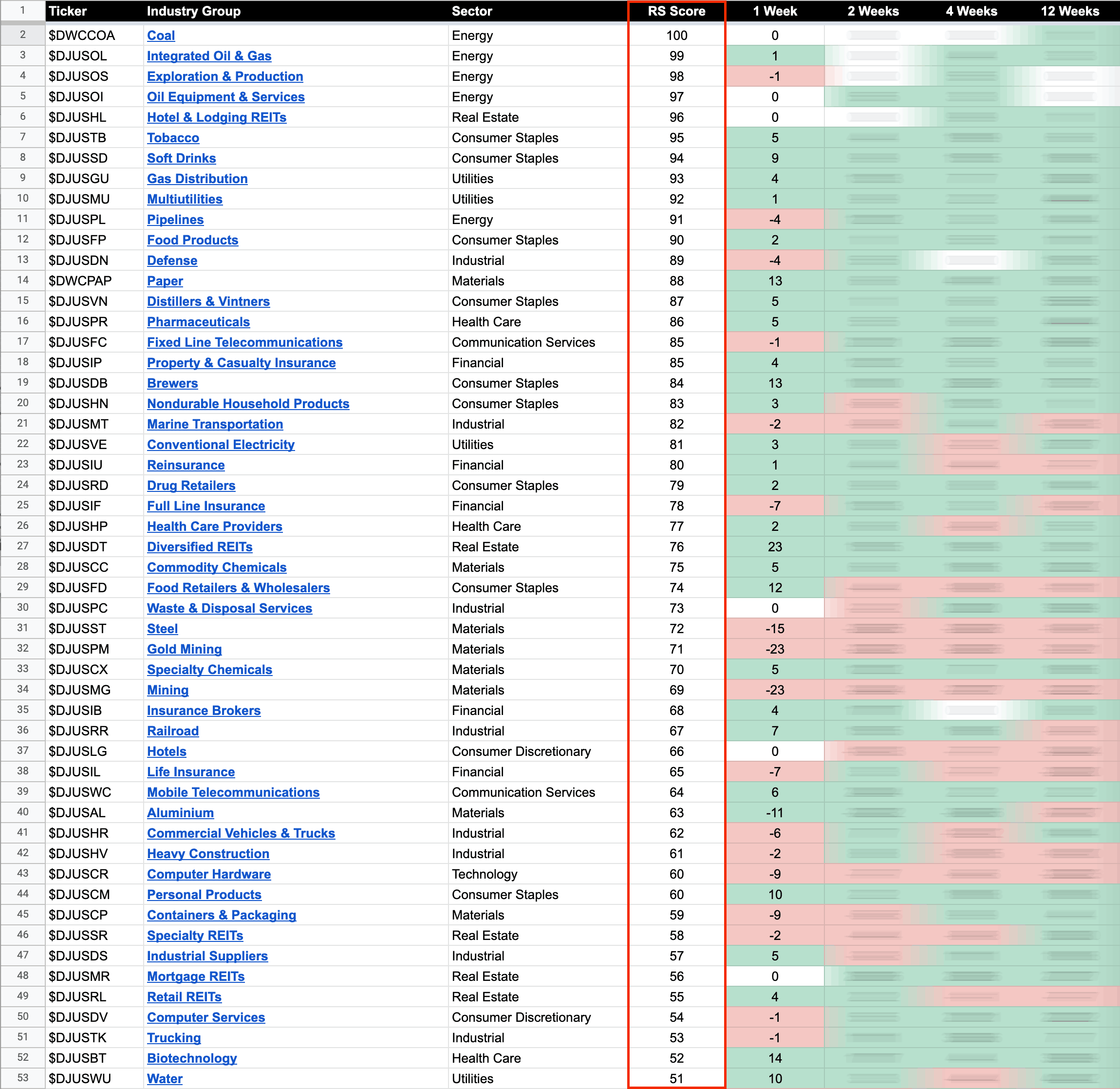

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

12 May, 2022

US Stocks Watchlist – 12 May 2022

A very small list again today as the major Stage 4 decline in the market continues. There are a few group themes today with Specialty Chemicals and Electrical Components having multiple entries.

Read More

12 May, 2022

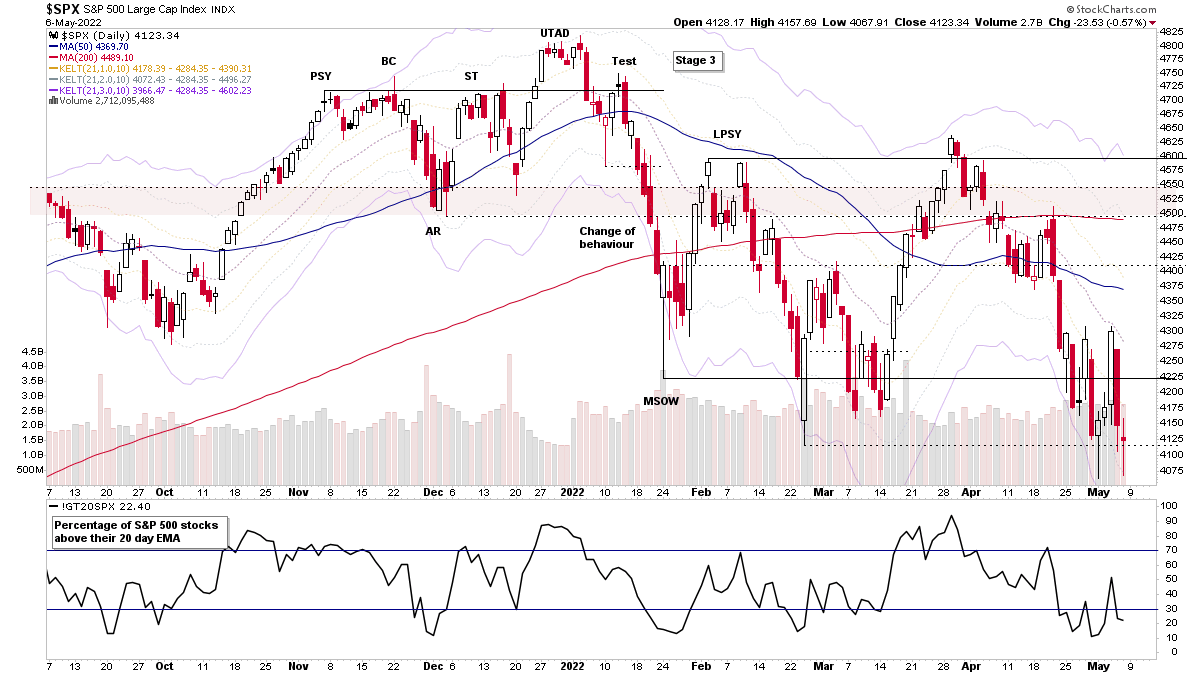

Stage Analysis Members Midweek Video – 11 May 2022 (1hr 14mins)

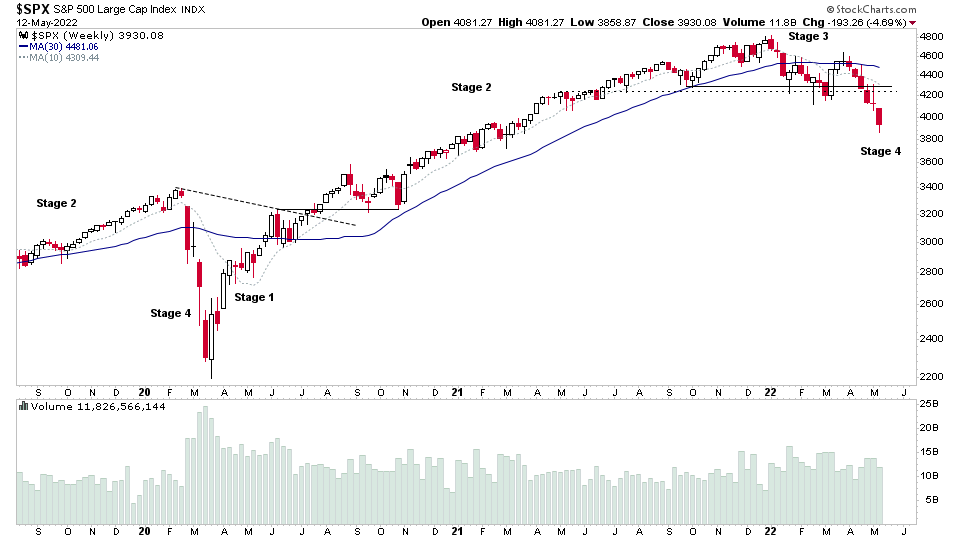

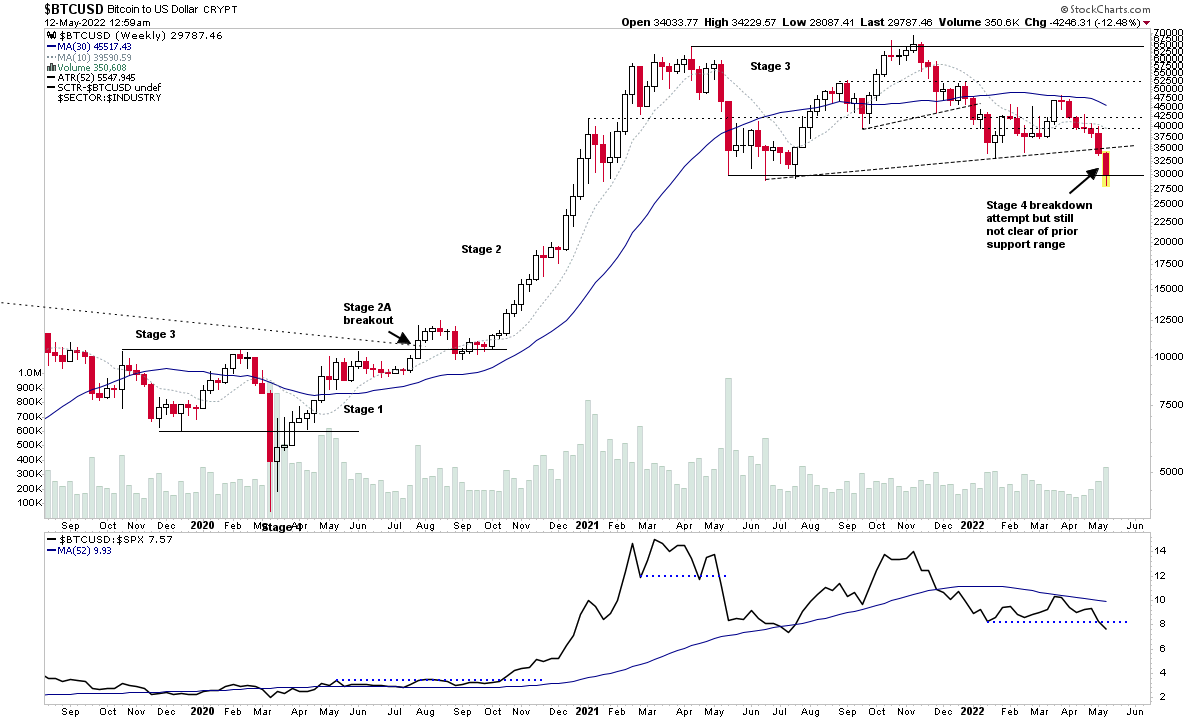

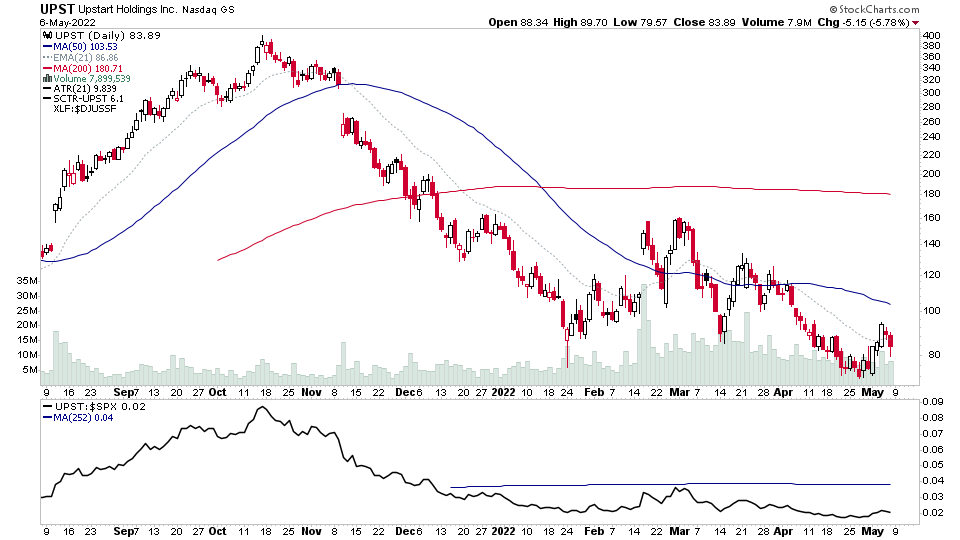

This weeks Stage Analysis Members Midweek Video features analysis of the major indexes Stage 4 declines and the VIX. Plus a detailed look at the mega caps stocks with AAPL (Apple) attempting to breakdown in Stage 4 today and join the other large cap stocks already in Stage 4...

Read More

10 May, 2022

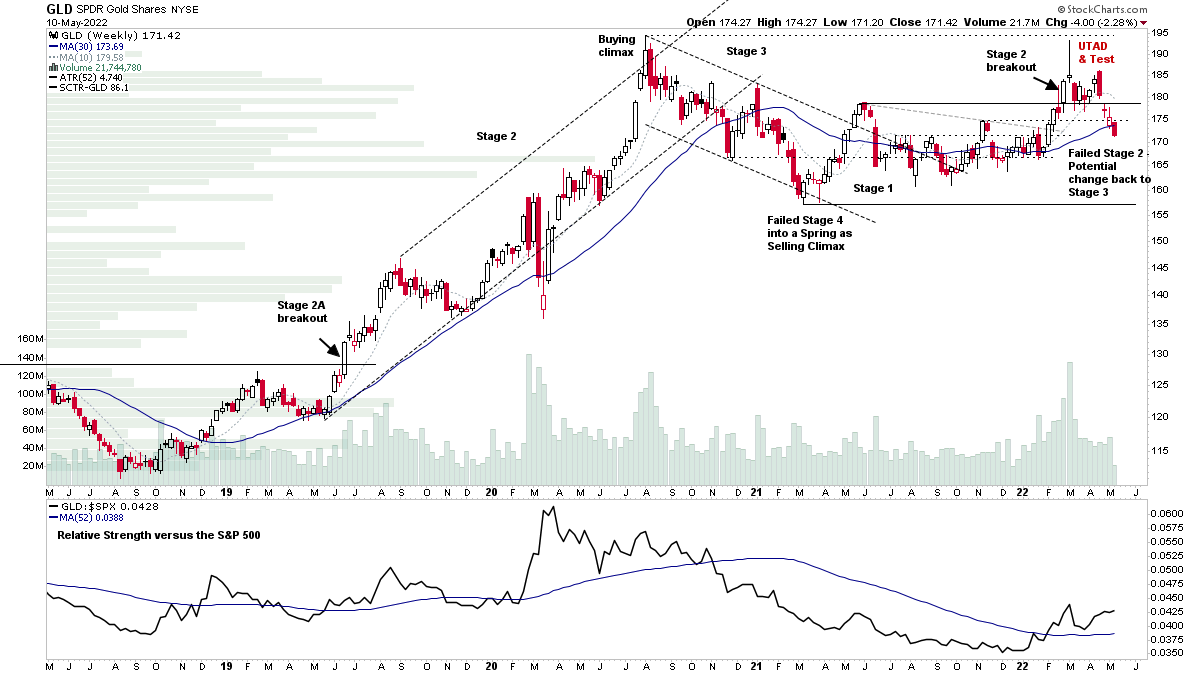

Major Commodities and Market Breadth Update

Golds brief move into Stage 2 in February and March looks to have failed with it moving strongly back into the previous Stage 1 base and through two support levels, and looks to have formed potential UTAD and Test events, which could shift the interpretation of the broader base structure from an Stage 1 accumulation structure to still being in a Stage 3 distributional structure...

Read More

09 May, 2022

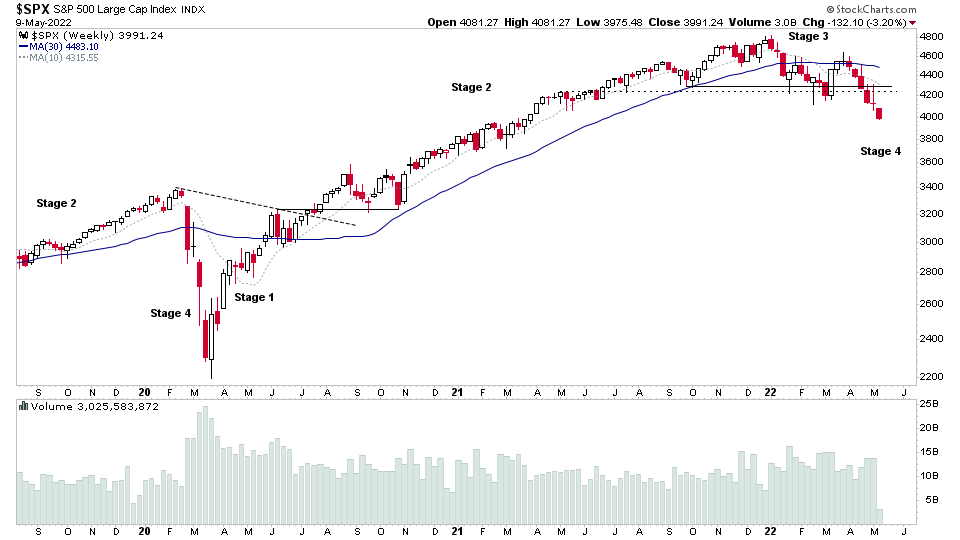

Stage 4 Decline Accelerates in the US Stock Market

It was another day of heavy declines in the US stock market from the open, which further deteriorated into the later part of the trading day, as the major large indexes, such as the S&P 500 finally broke down more convincingly below the lows that it had been clinging onto, and hence now is more clearly in Stage 4 on the chart...

Read More

08 May, 2022

Stage Analysis Members Weekend Video – 8 May 2022 (1hr 29mins)

This weekends Stage Analysis Members Video features analysis of the multiple Stage 2 breakouts and significant bars. Market analysis of the major indexes, US Industry Groups Relative Strength tables. The market breadth update to help to determine the weight of evidence. US stocks watchlist and finally a look at some of the most interesting stocks with earnings this coming week.

Read More

08 May, 2022

Earnings Watchlist – 9 to 13 May 2022

Another big week of earnings coming up with 977 stocks reporting according to Earnings Whisper. Here's a few of the stocks of interest to watch for potential reactions in both directions.

Read More

08 May, 2022

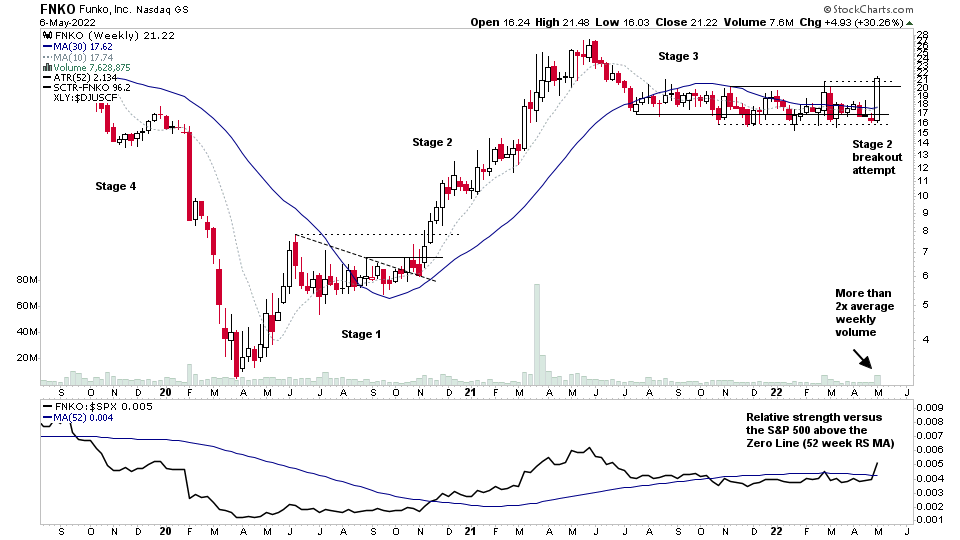

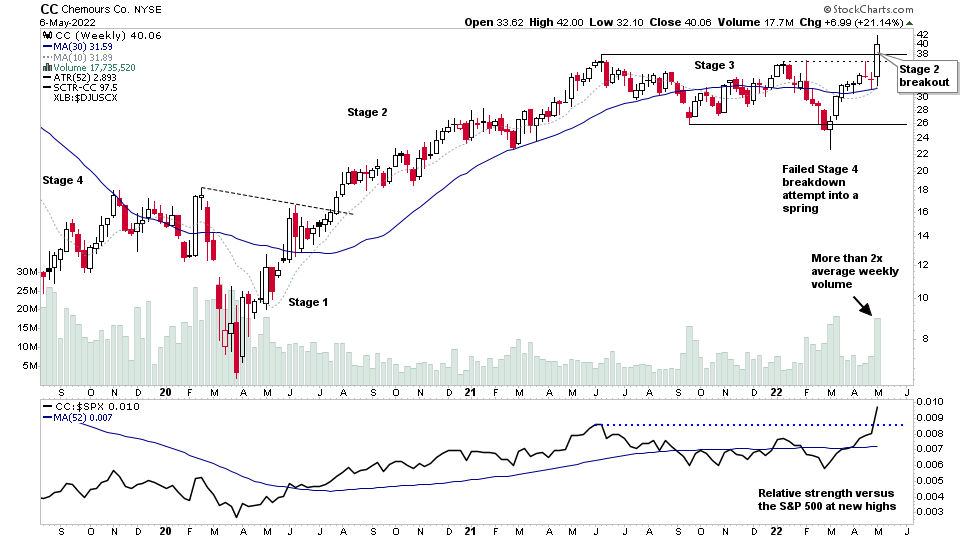

Stage 2 Breakouts and Significant Bars

Multiple stocks making Stage 2 breakouts to new highs and some in Stage 3 showing a change of behaviour following earnings with Significant Bars.

Read More

07 May, 2022

US Stocks Watchlist – 8 May 2022

For the watchlist from the weekend scans...

Read More