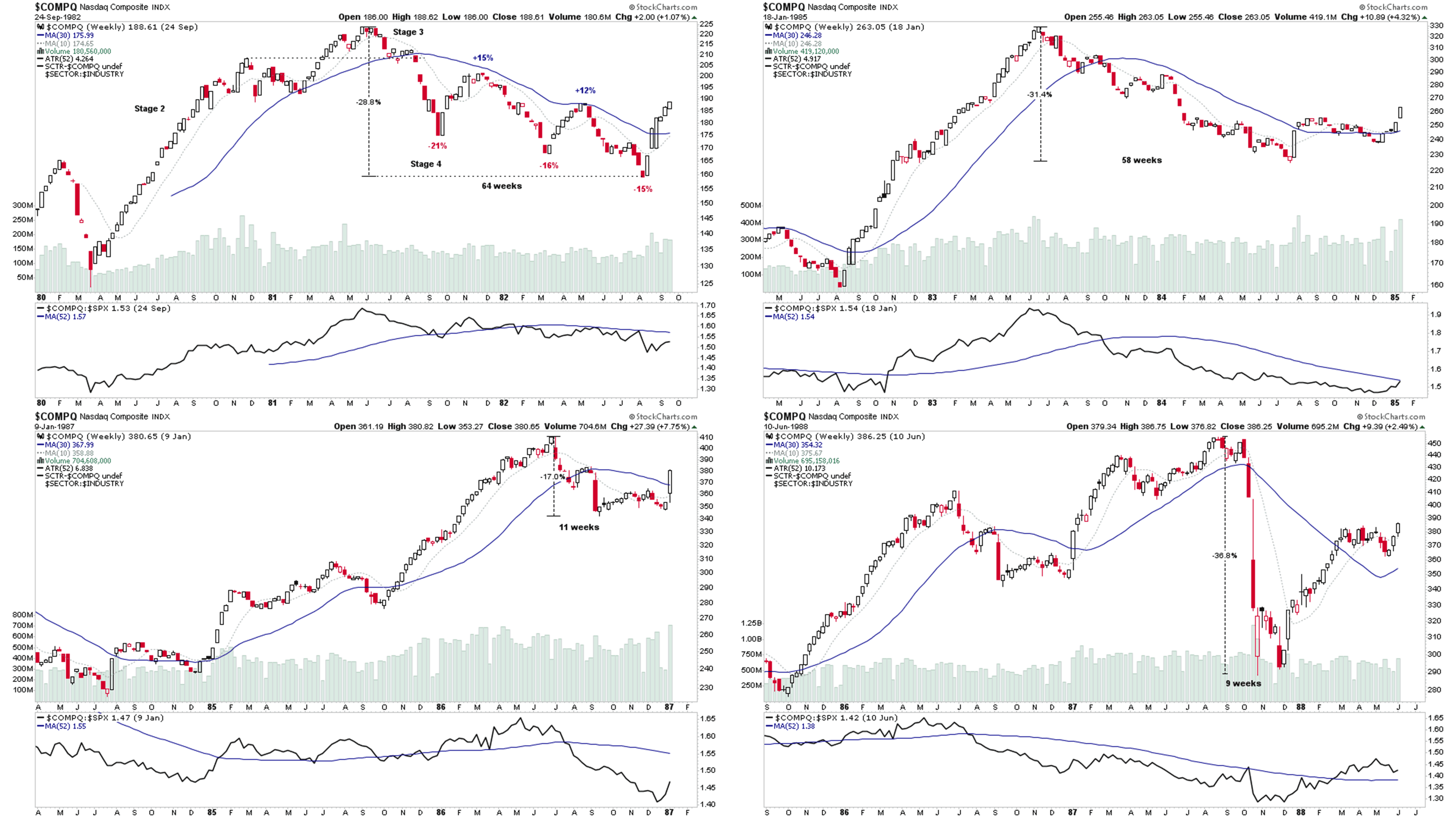

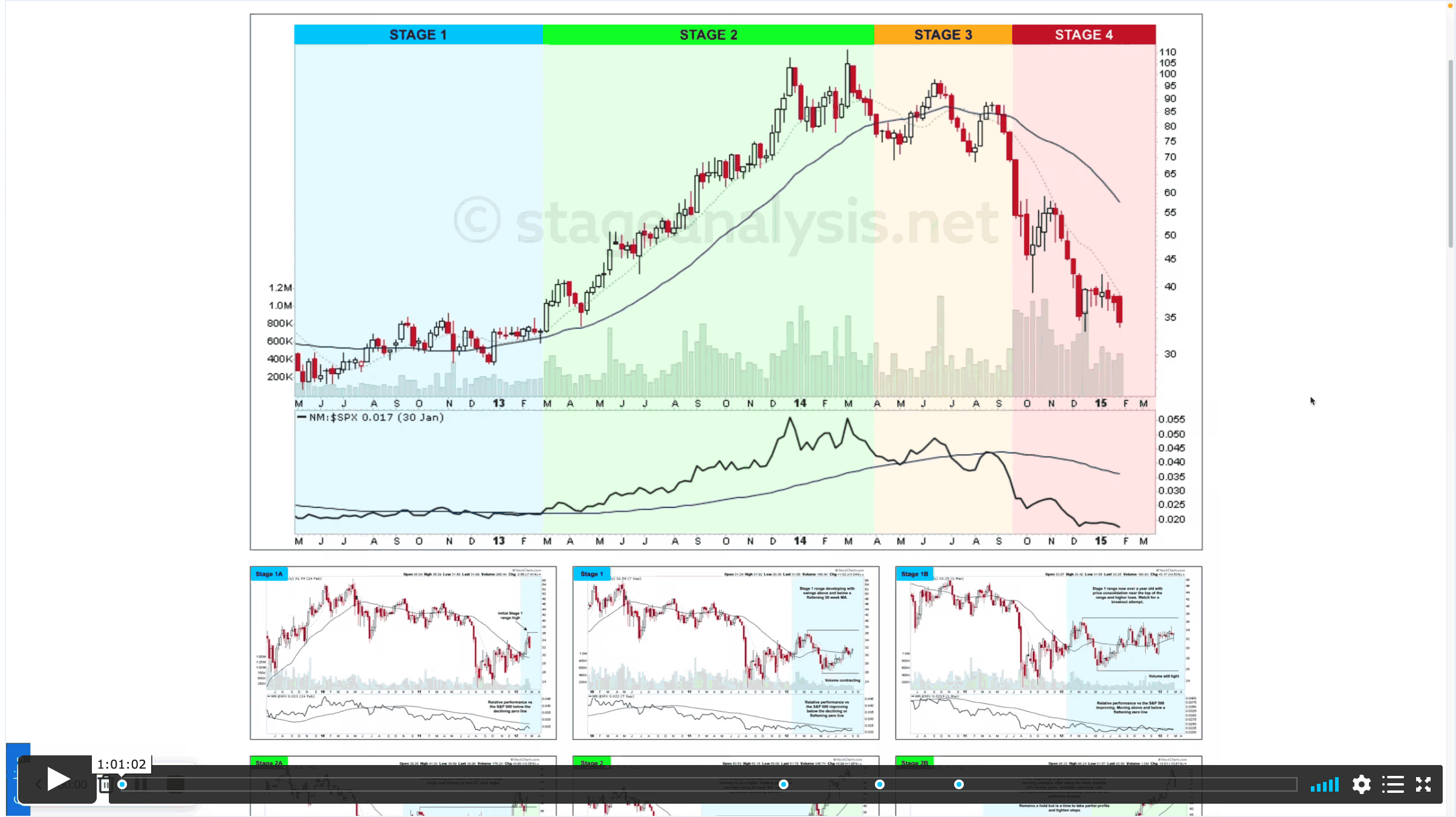

A packed schedule on todays Stage Analysis Members Midweek Video, with a brief overview of historical Stage 4 declines in the Nasdaq to start, looking at how the 15 previous significant Stage 4 declines since the early 1980s ended – capitulation or not?

Read More

Blog

14 June, 2022

Stock Market Treads Water Ahead of the Fed Decision and US Stocks Watchlist – 14 June 2022

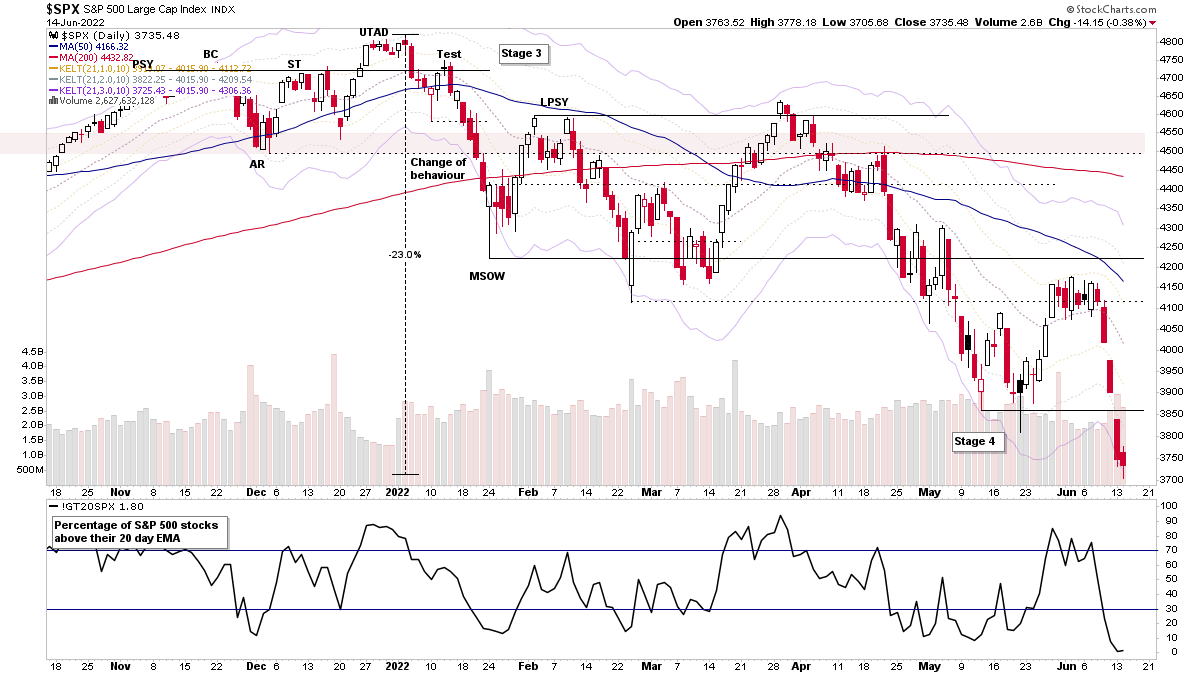

The S&P 500 made a further continuation breakdown on Monday, but failed to make much more progress today as it and other markets treaded water ahead of the Fed interest rate decision on Wednesday...

Read More

14 June, 2022

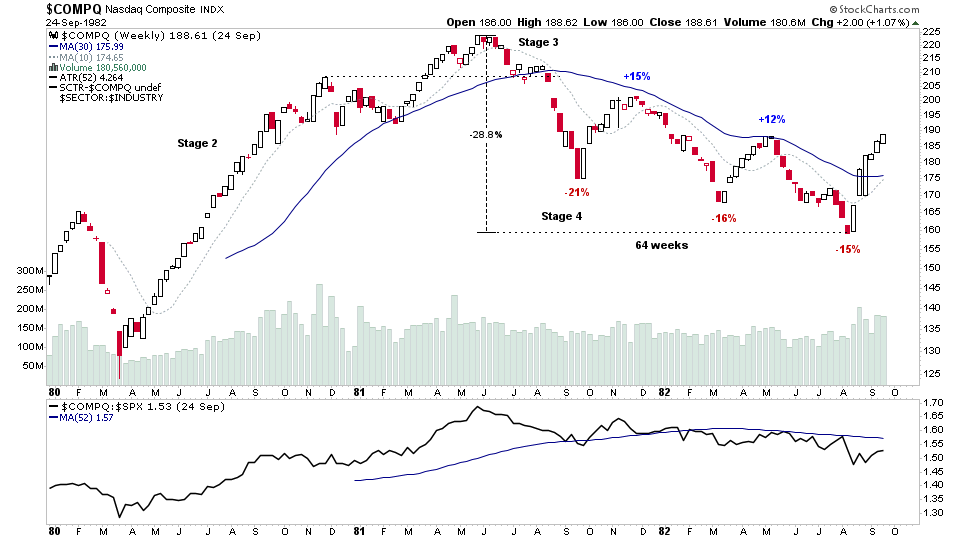

Stock Market Studies: Bear Market – Stage 4 Decline in the Nasdaq Composite – 1981-82

As the majority of the worlds stock markets are currently experiencing an ongoing Stage 4 declining phase. I thought it would be interesting and useful to have a look back at the significant Stage 4 declines since the early 1980s – of which there have been 16 including the current Stage 4 decline...

Read More

12 June, 2022

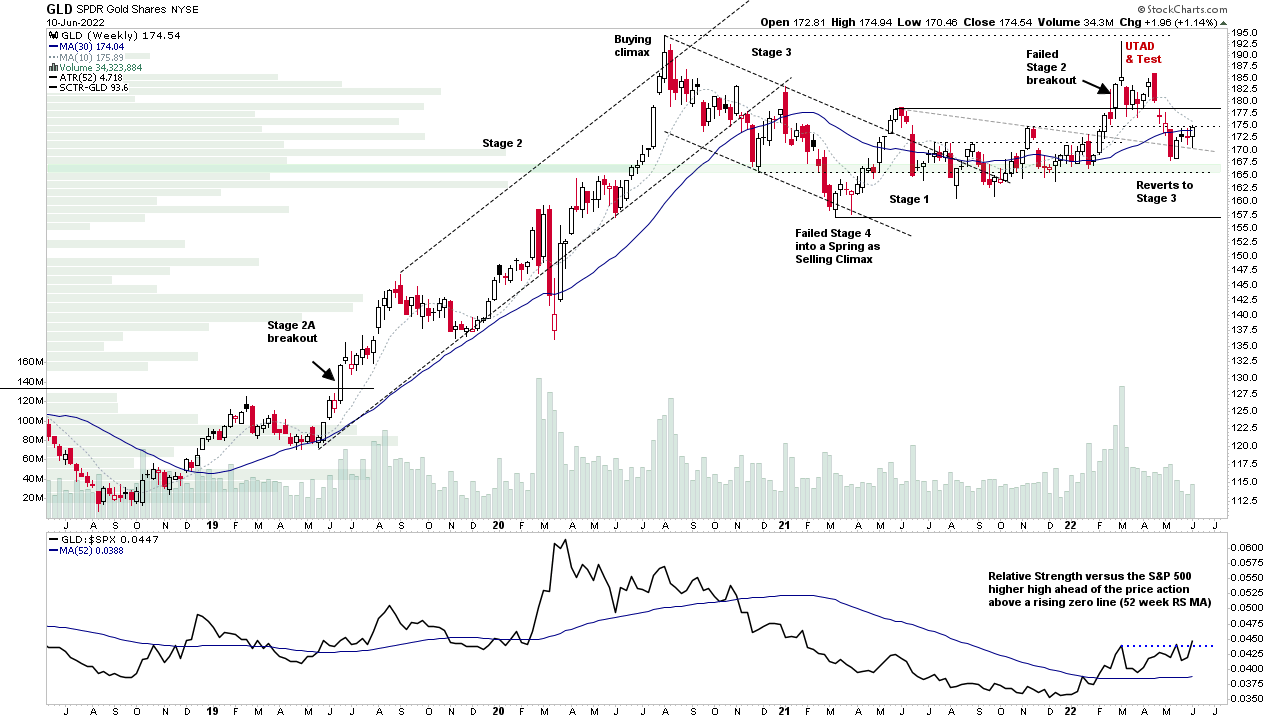

Stage Analysis Members Weekend Video – 12 June 2022 (1hr 20mins)

This weeks Stage Analysis Members Video features a special on the precious metals, with Stage Analysis of Gold and Silver on multiple timeframes as well and the most interesting Gold miners and Silver miners charts...

Read More

12 June, 2022

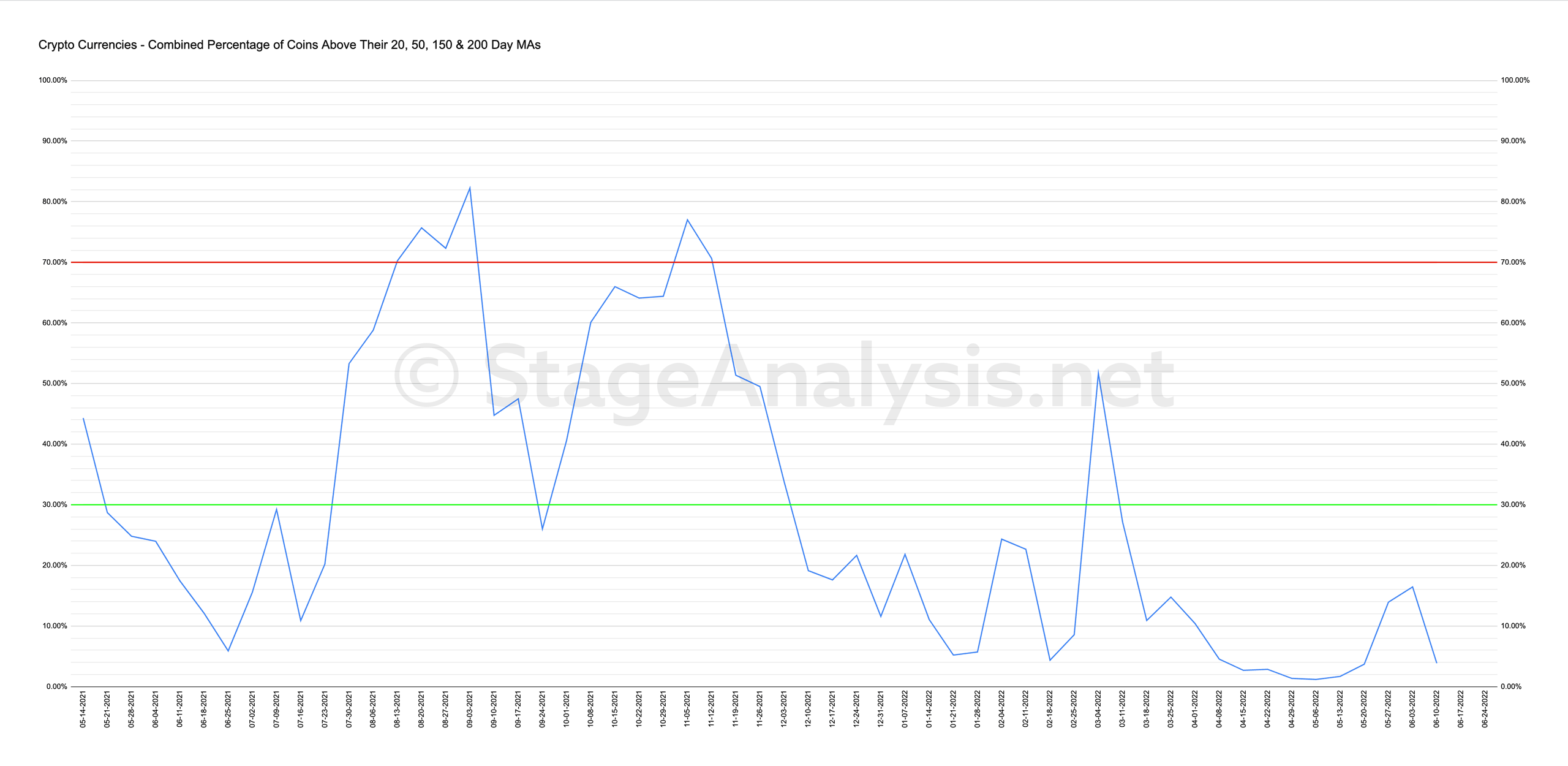

Crypto Breadth: Percentage of Crypto Coins Above Short, Medium & Long Term Moving Averages

It's been a long time since I've posted the Crypto Coin breadth charts that cover the 149 crypto coins that stockcharts shows...

Read More

11 June, 2022

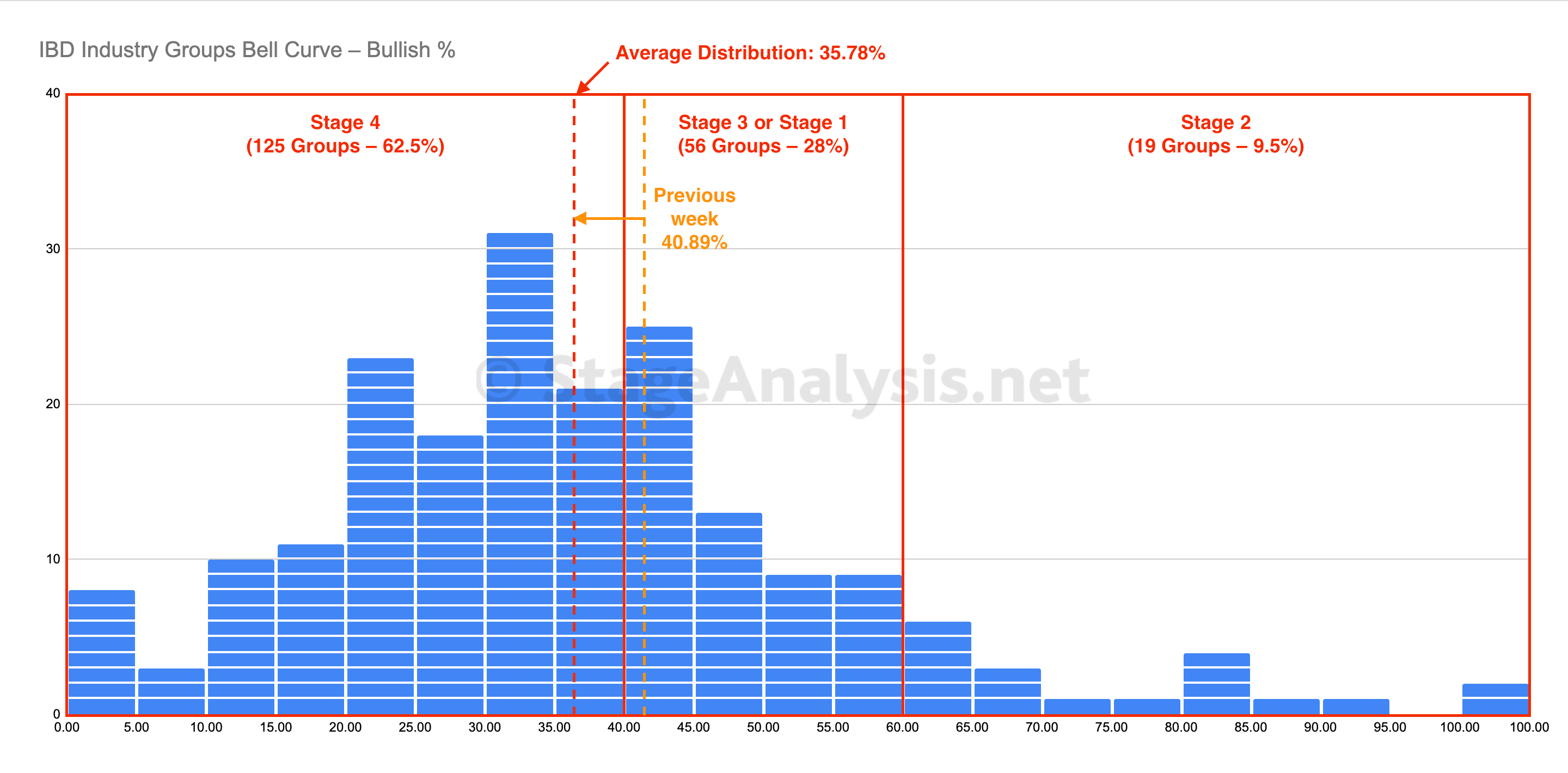

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent had a negative shift of -5.11% this week and fell back into the Stage 4 zone with an average distribution in the 200 Investors Business Daily (IBD) Industry Groups of 35.78%.

Read More

11 June, 2022

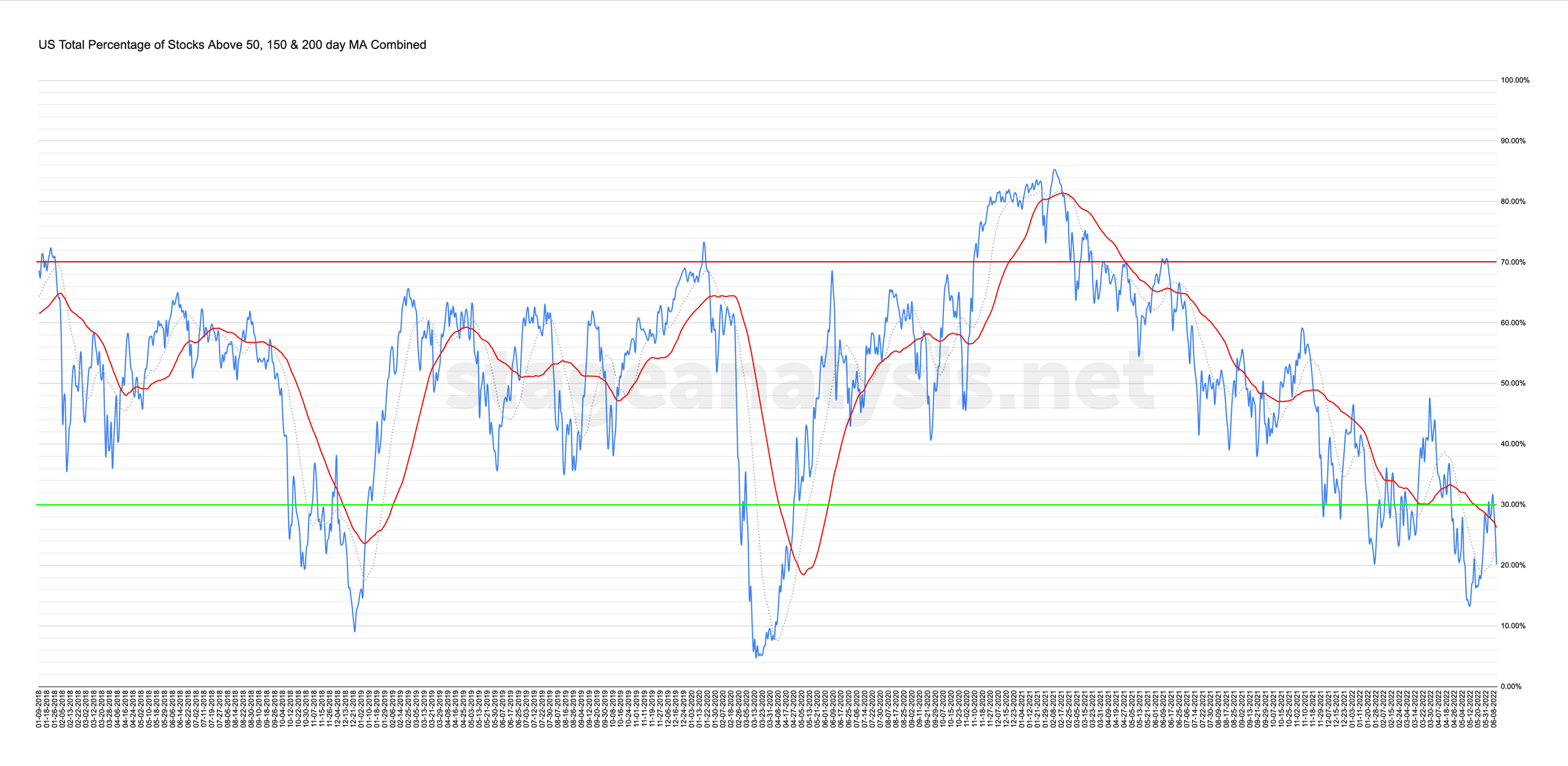

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

10 June, 2022

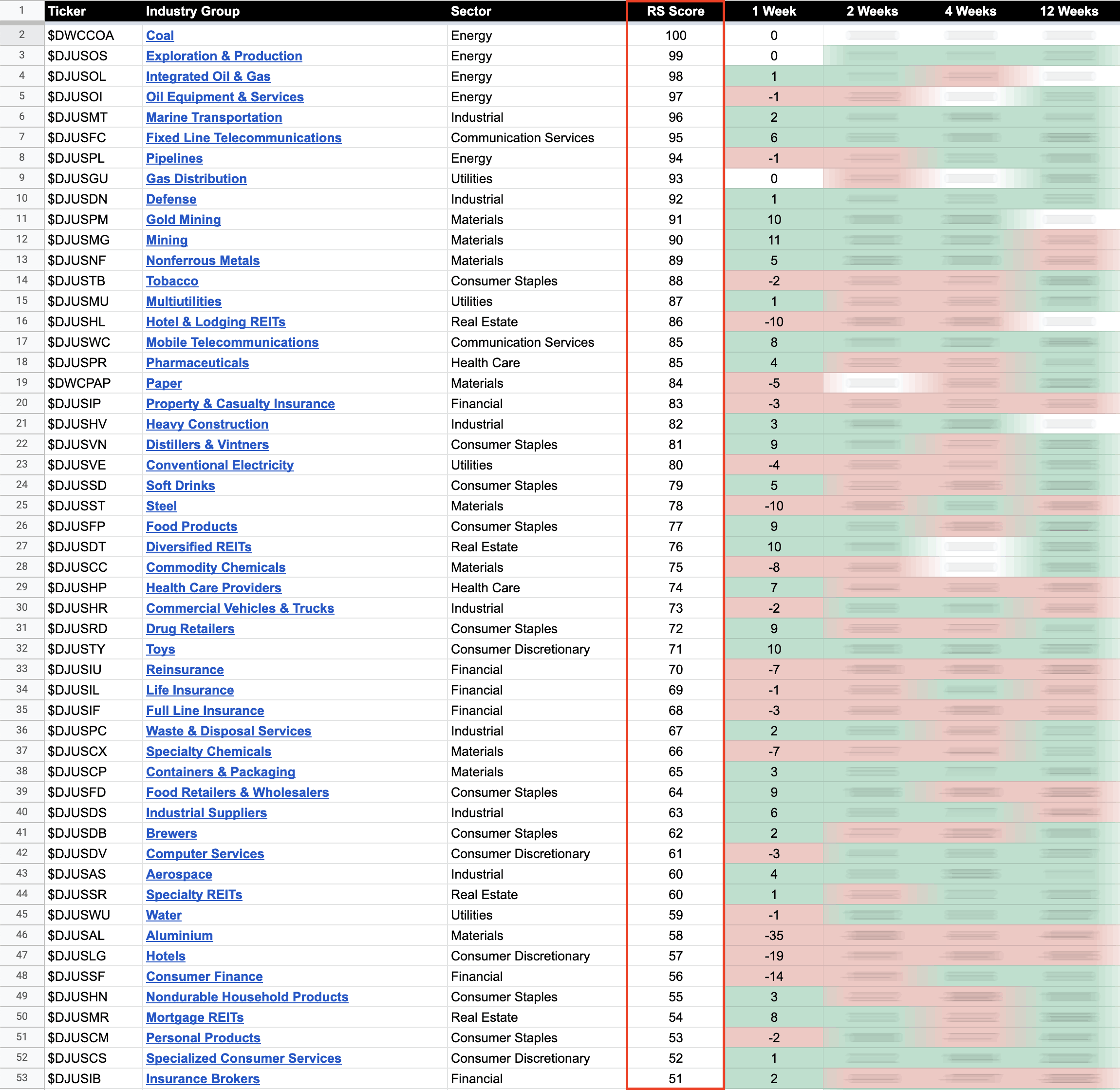

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

09 June, 2022

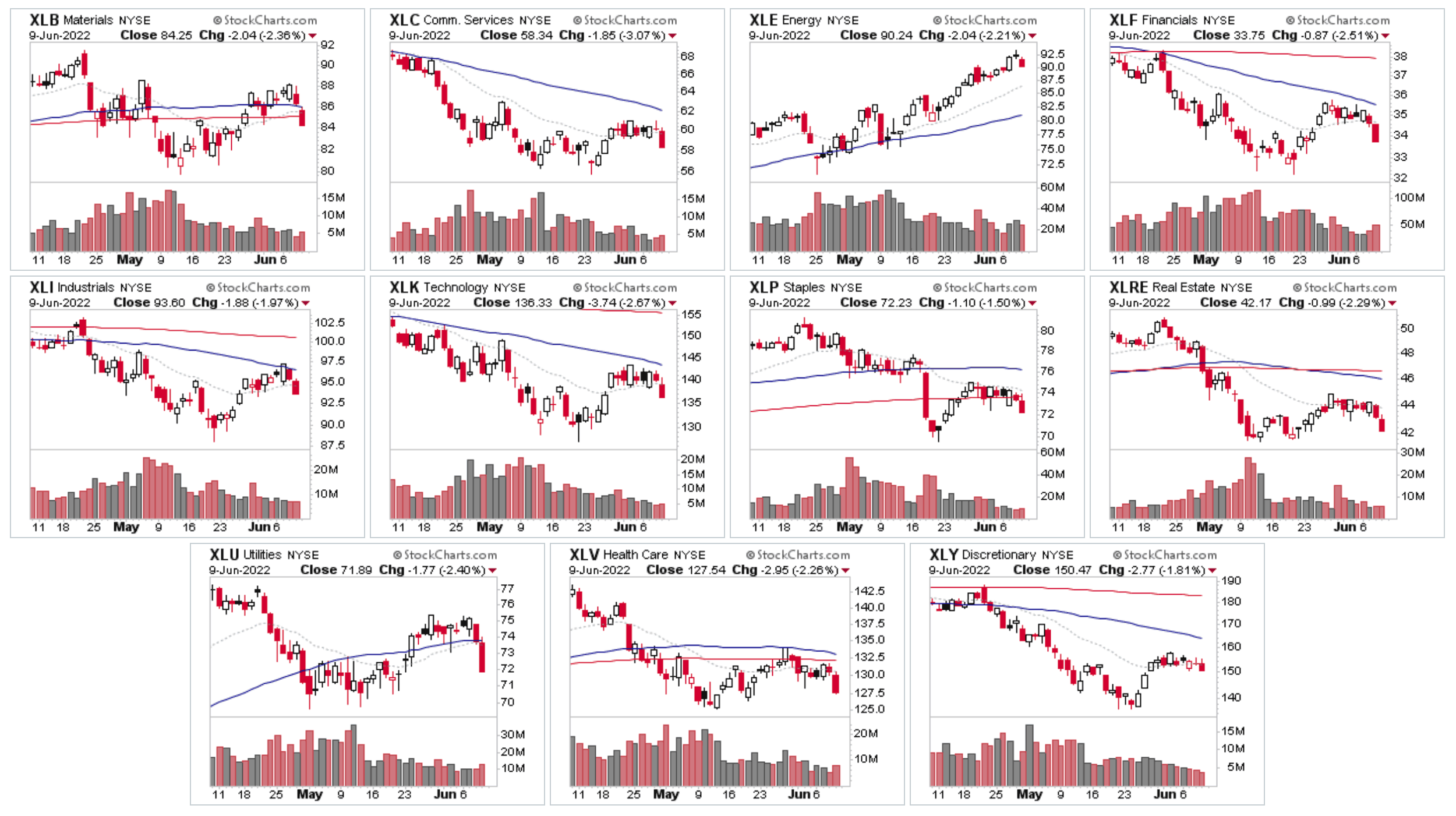

Stage 4 Trend Reasserts Itself – 10 June 2022

Broad based selling today with stocks accelerating to the downside in the afternoon session after initially attempting to hold up during the morning, and if you zoom into the intraday 2 hour chart...

Read More

08 June, 2022

Stage Analysis Members Midweek Video – Searching for Stage 1 Bases in the Software Group – 8 June 2022 (1hr)

This weeks Stage Analysis Members midweek video features a special on the searching for Stage 1 Bases in the Software Group, as numerous software stocks have been appearing in the watchlist scans over the last month or so and exhibiting a change of behaviour...

Read More