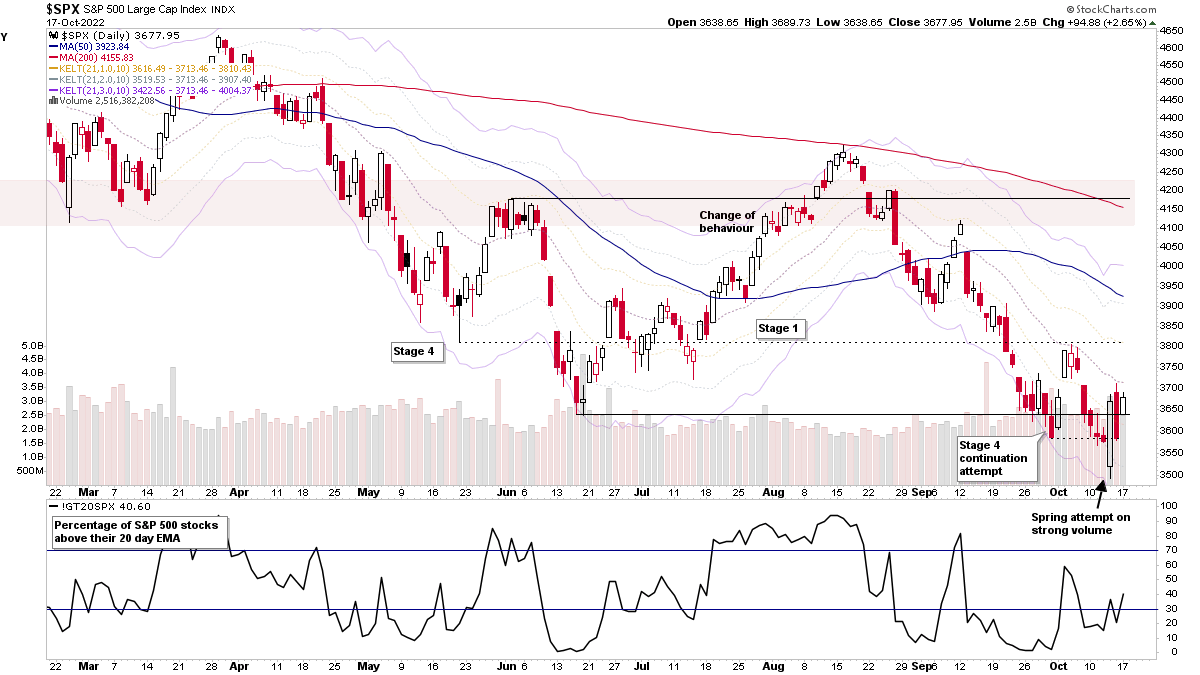

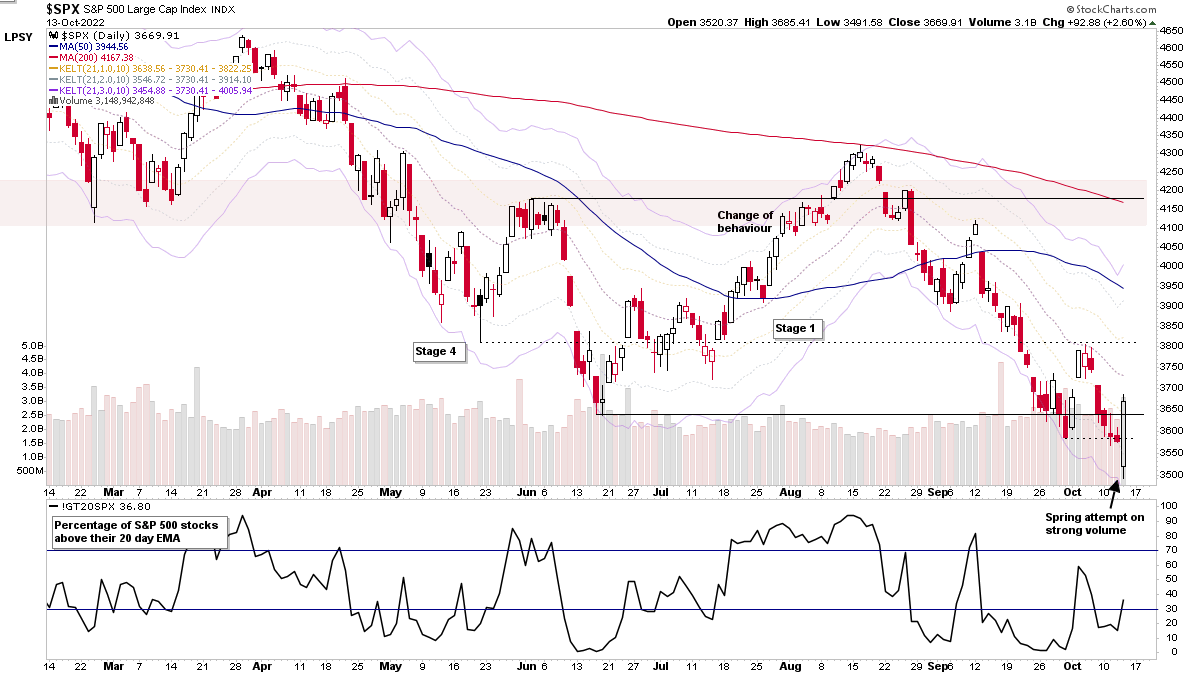

The heavy volume Spring attempt from last Thursday remains in play as a potential swing low, with a further reclaiming of the 5-day MA in the S&P 500 today – which marks Day 3 of a rally attempt from the swing low. So the S&P 500 and Nasdaq are both potentially in position for another CAN SLIM method Follow Through Day (FTD) attempt on Day 4 or later...

Read More

Blog

17 October, 2022

Stock Market Update and the US Stocks Watchlist – 17 October 2022

16 October, 2022

Stage Analysis Members Weekend Video – 16 October 2022 (1hr 14mins)

The regular members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail.

Read More

16 October, 2022

Earnings Watchlist – 17-21 October 2022

Earnings season begins to ramp up this coming week with hundreds of stocks reporting earnings, the bulk of which are in the Bank group and Financials sector. In todays post I've cut the list down to 48 of the stocks reporting to give a reasonably broad overview...

Read More

15 October, 2022

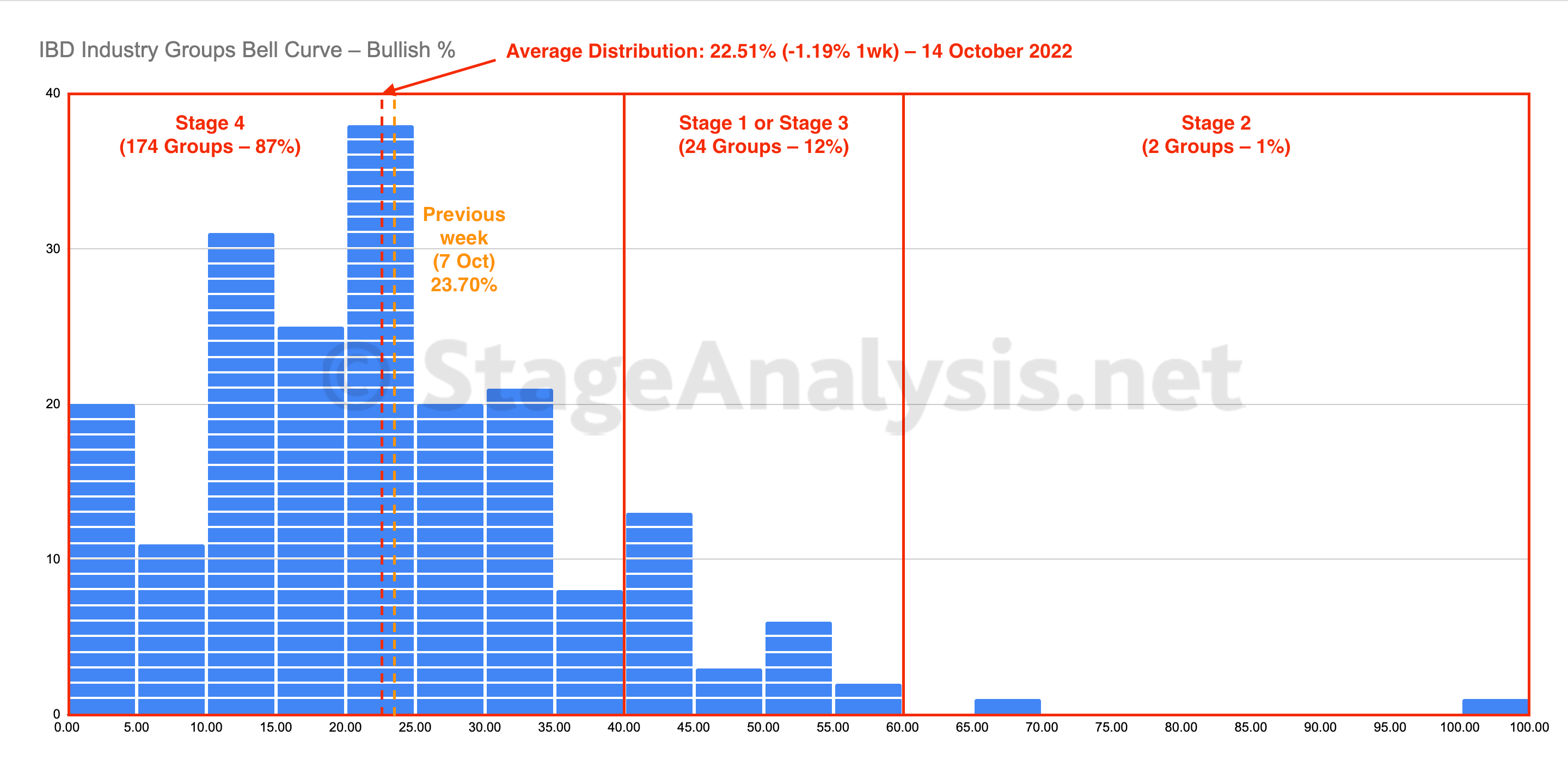

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent declined by -1.19% this week to close the week at 22.51% overall, which is deep in the Stage 4 zone (below 40%) still. However, even though the overall average dropped and remains near to the lowest levels of the year. There was some minor positive shifts with slightly more groups moving from Stage 4 into the Stage 1 zone...

Read More

15 October, 2022

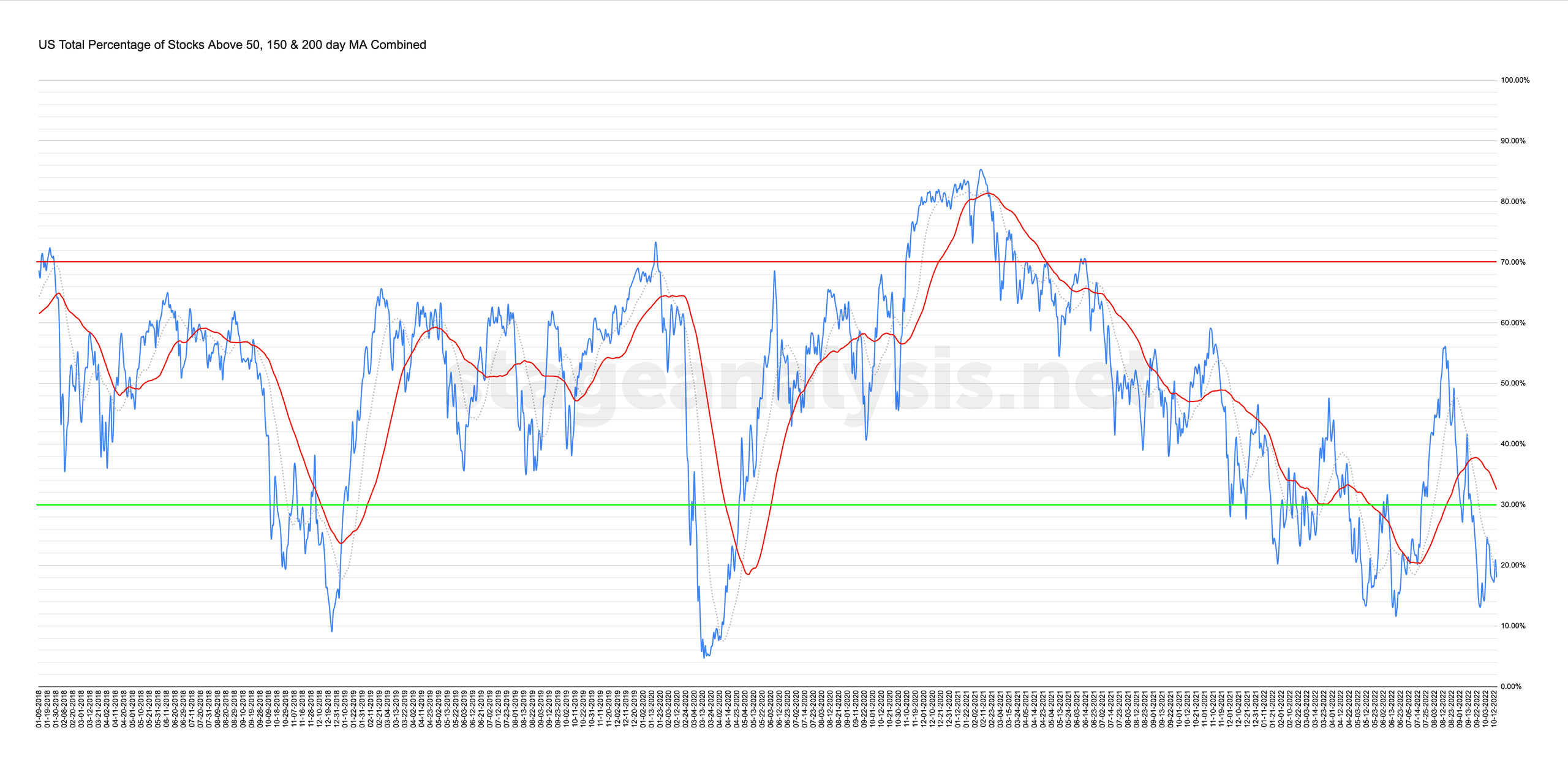

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

14 October, 2022

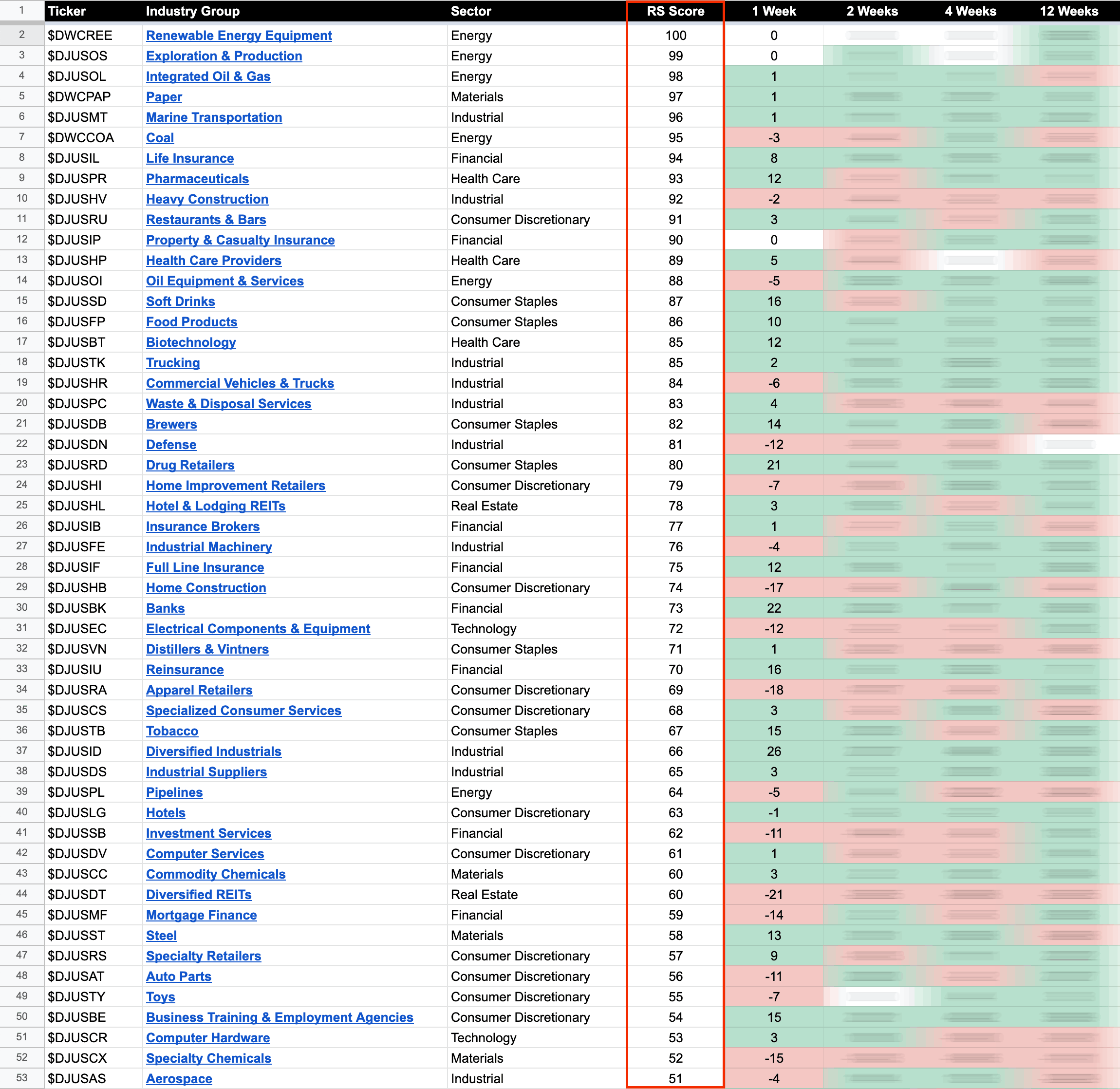

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

13 October, 2022

Financials Emerging in Developing Stage 1 Bases and the US Stocks Watchlist – 13 October 2022

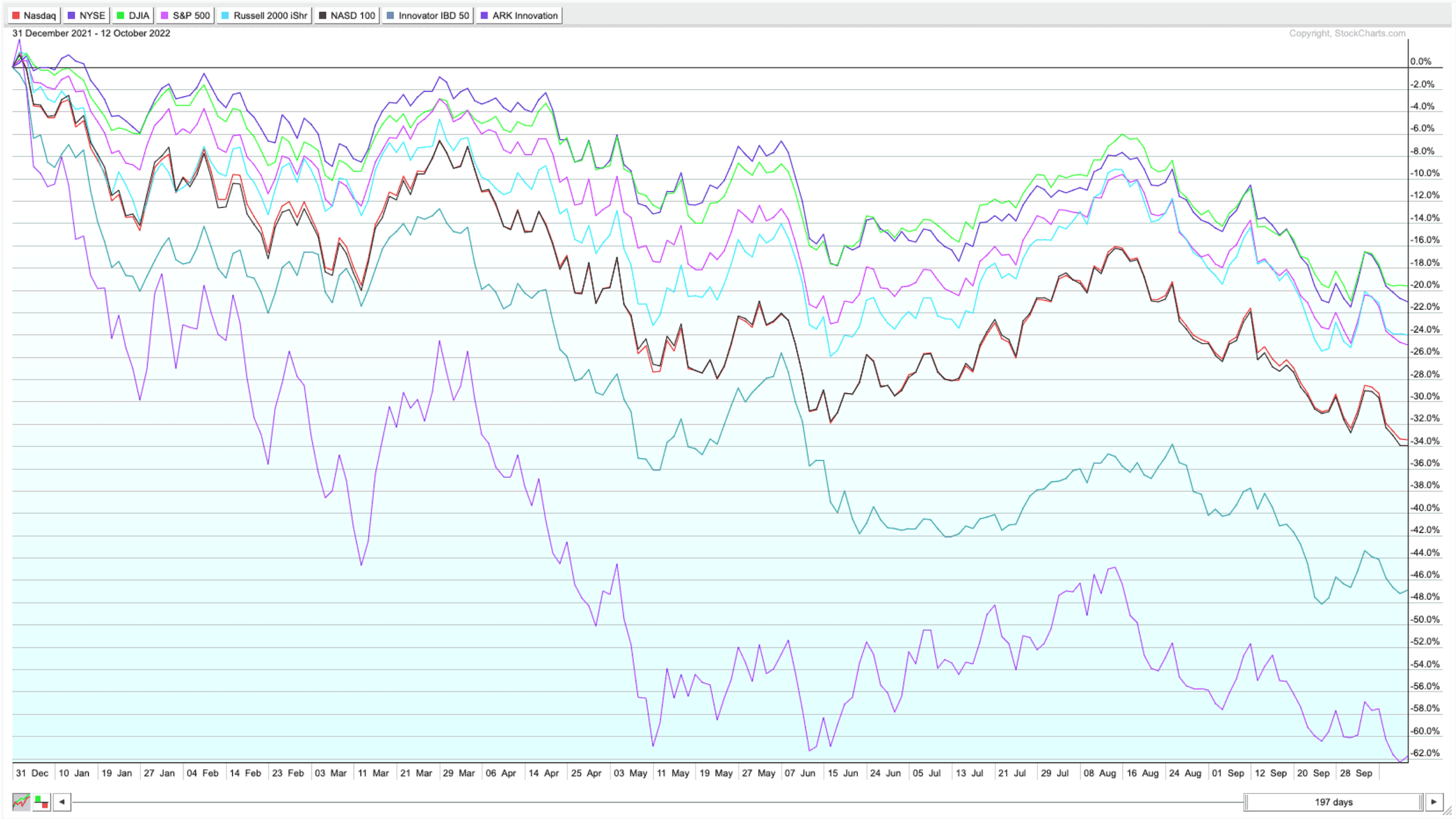

The major market indexes had a major shakeout today with a greater than 5% range on the daily bar in the S&P 500 for example, as it opened sharply lower with a Stage 4 continuation breakdown attempt in the pre-market / early European session...

Read More

12 October, 2022

Stage Analysis Members Midweek Video – 12 October 2022 (1hr 1min)

The members midweek video discussing the market, sector breadth, short-term market breadth and individual stocks from the watchlist in more detail...

Read More

11 October, 2022

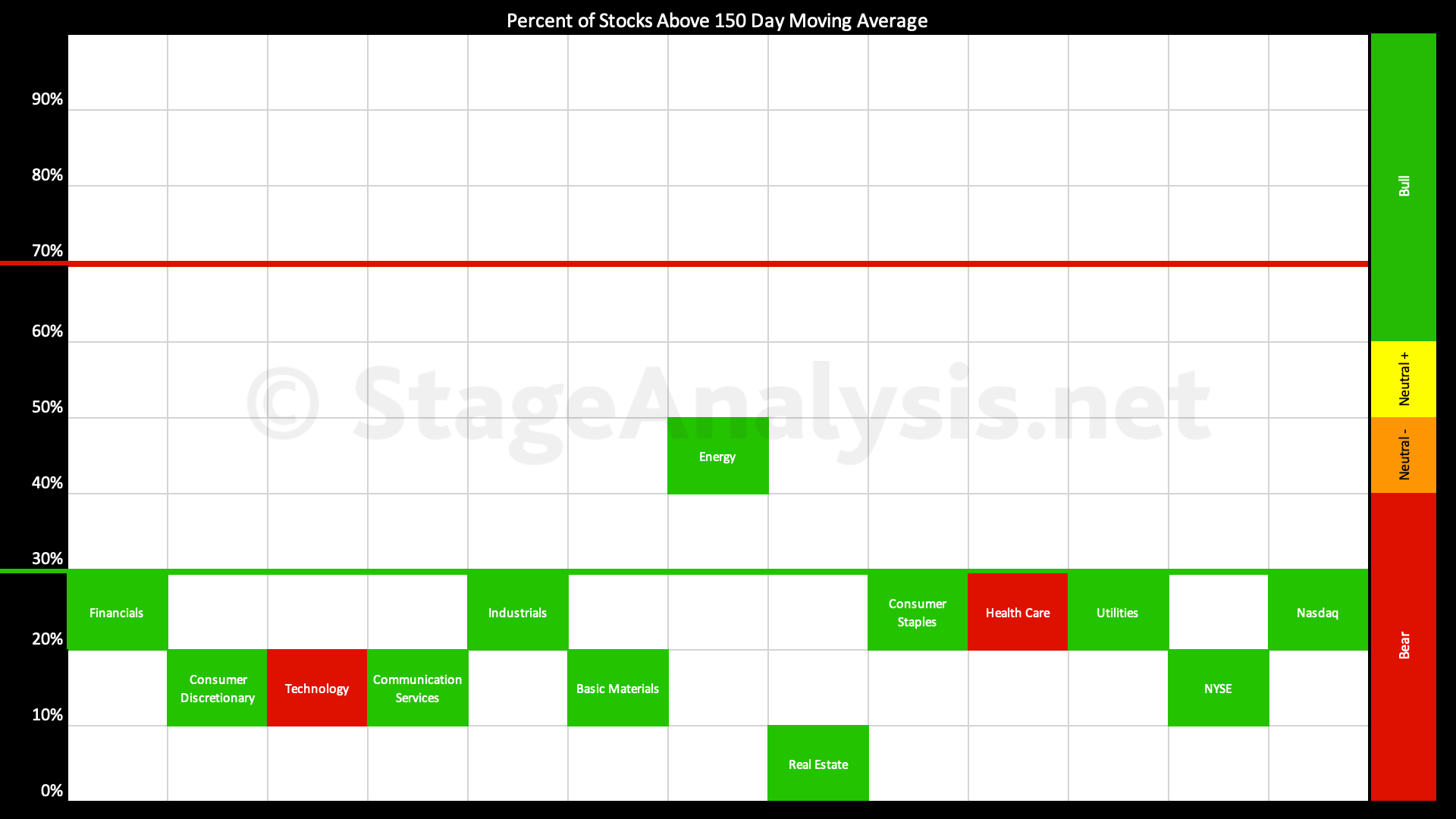

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has declined by a further -10.27% over the last three weeks since the last sector breadth post, and is currently at 18.90%, which is one of the lowest readings of the year to date...

Read More

11 October, 2022

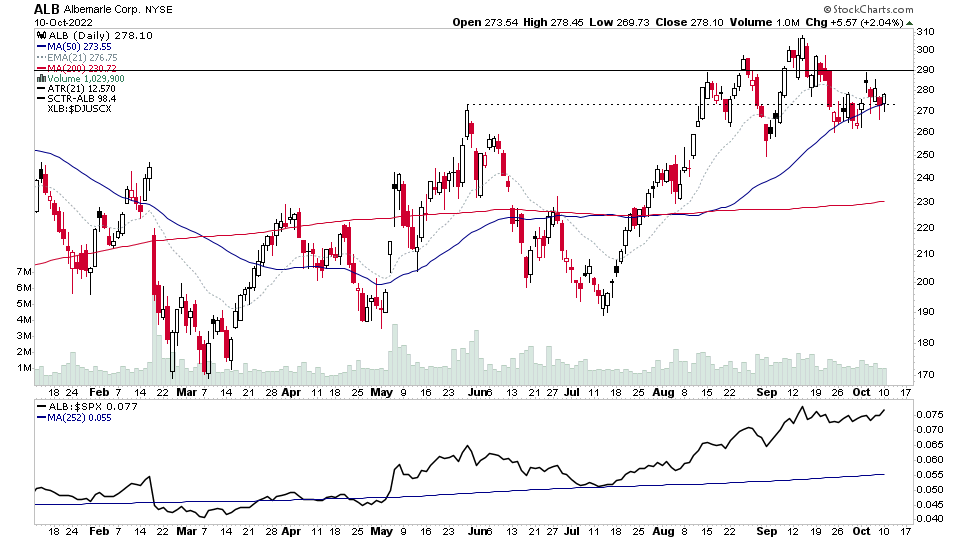

US Stocks Watchlist – 10 October 2022

The market continued lower today with less aggression than Friday and on lower volume. But is now within one standard deviation of the prior low, and so it could be tested tomorrow, and if supply remains dominant...

Read More