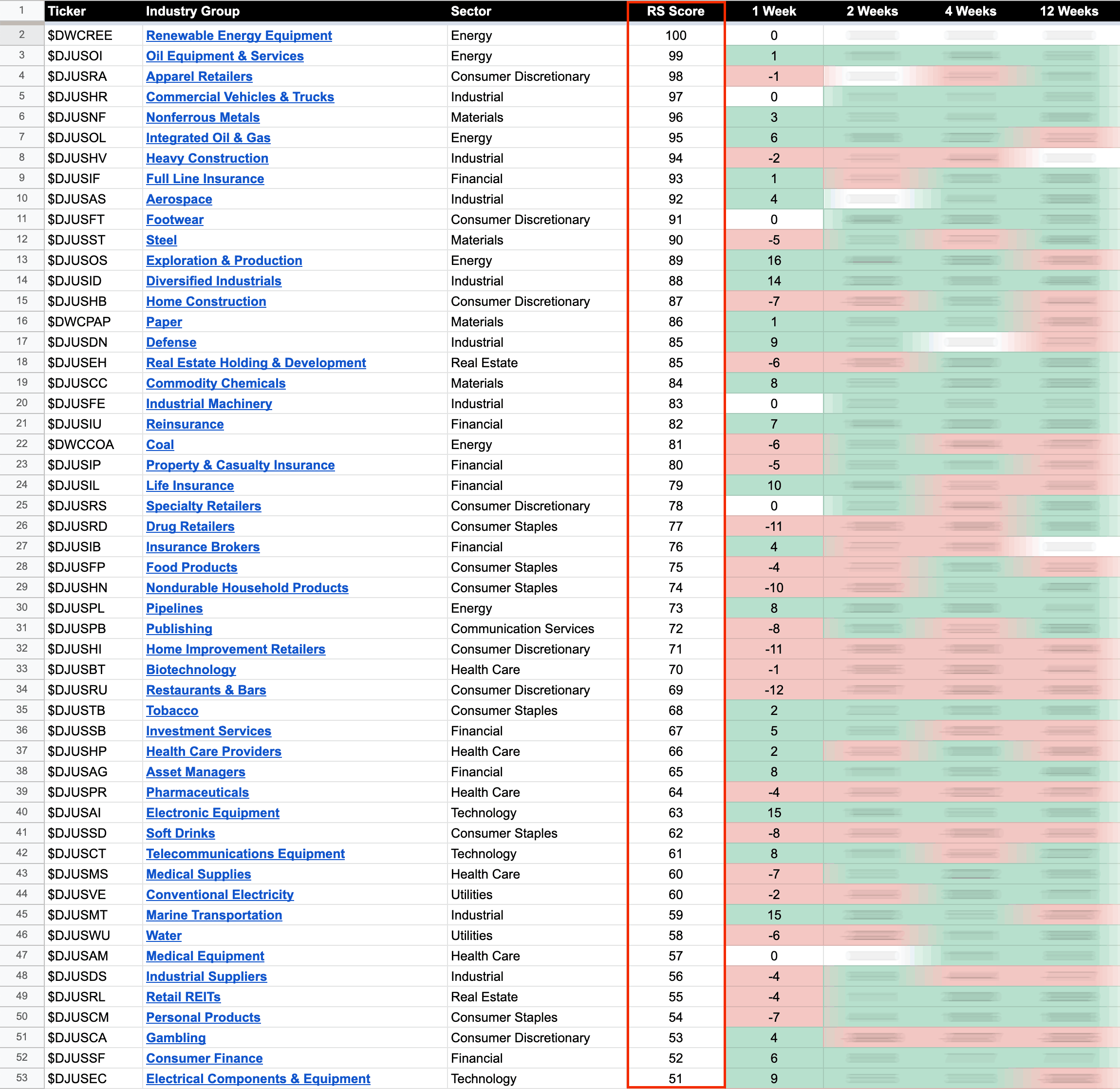

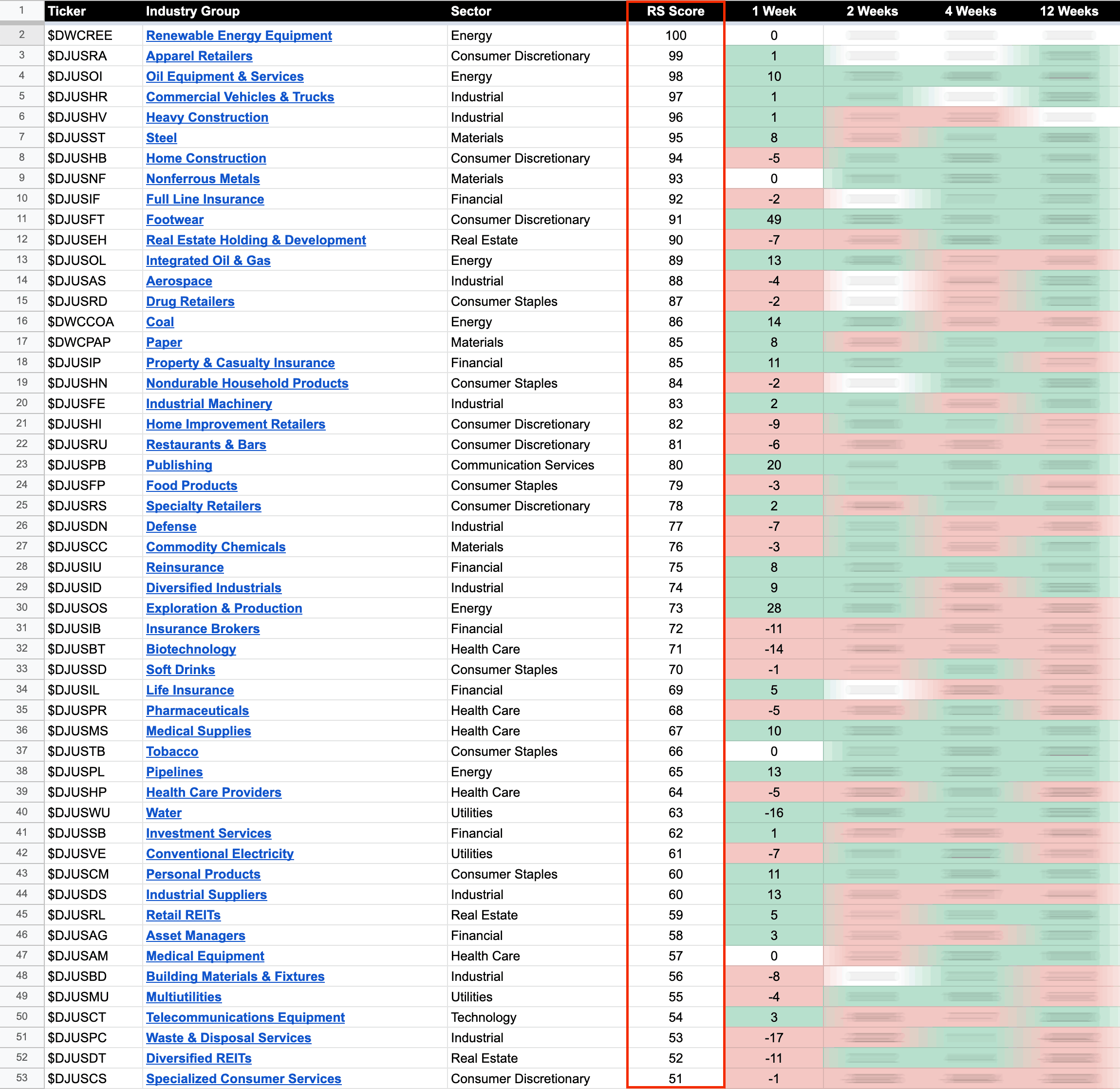

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

Blog

30 December, 2022

US Stocks Industry Groups Relative Strength Rankings

29 December, 2022

US Stocks Watchlist – 29 December 2022

The Software group is the dominant theme in todays watchlist scans with multiple stocks in the group approaching their respective Stage 2 breakout levels...

Read More

28 December, 2022

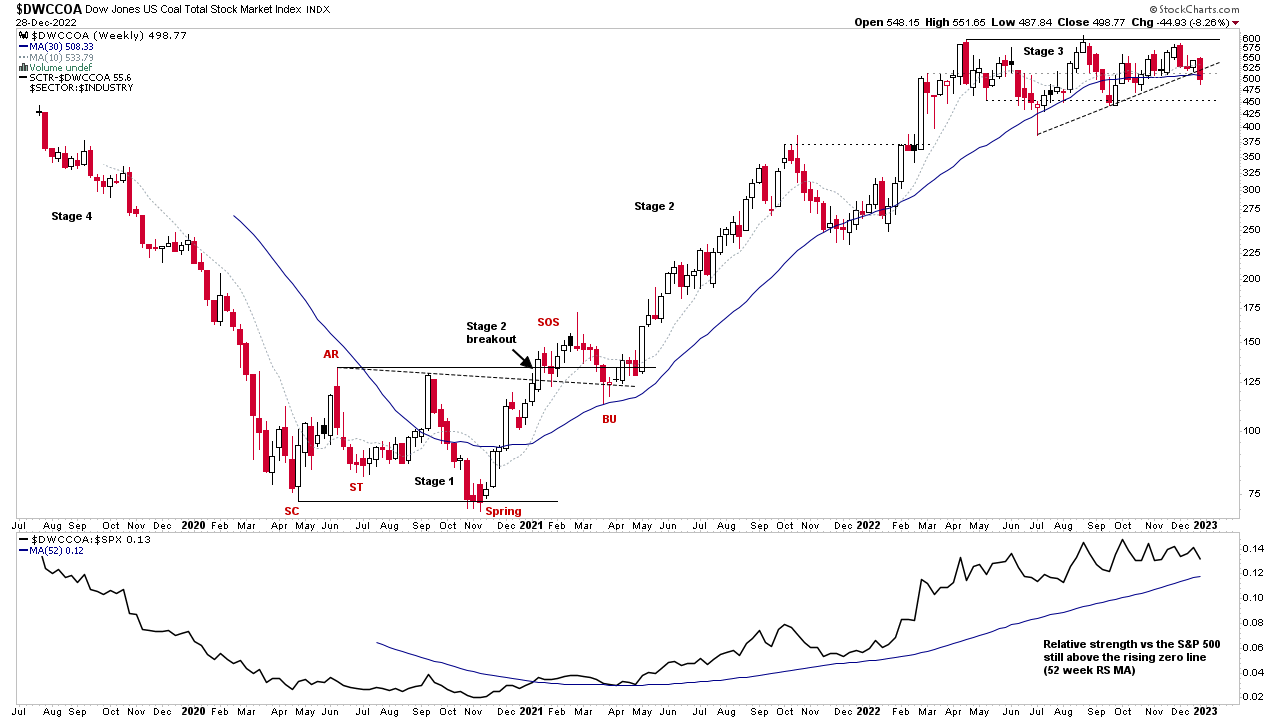

Group Focus: Coal Stocks in Late Stage 3 – 28 December 2022 (34mins)

The midweek video is a group focus on the Coal group and stocks, which led the market through the majority of 2021 and early 2022, and has multiple stocks closing the year above a +100% gain and three quarters of the stocks with more than a +20% gain year to date. However, the group and its stocks have weakened in late Stage 3 type structures over the last 8 months or so, and hence it is vulnerable to a potential Stage 4 breakdown attempt...

Read More

28 December, 2022

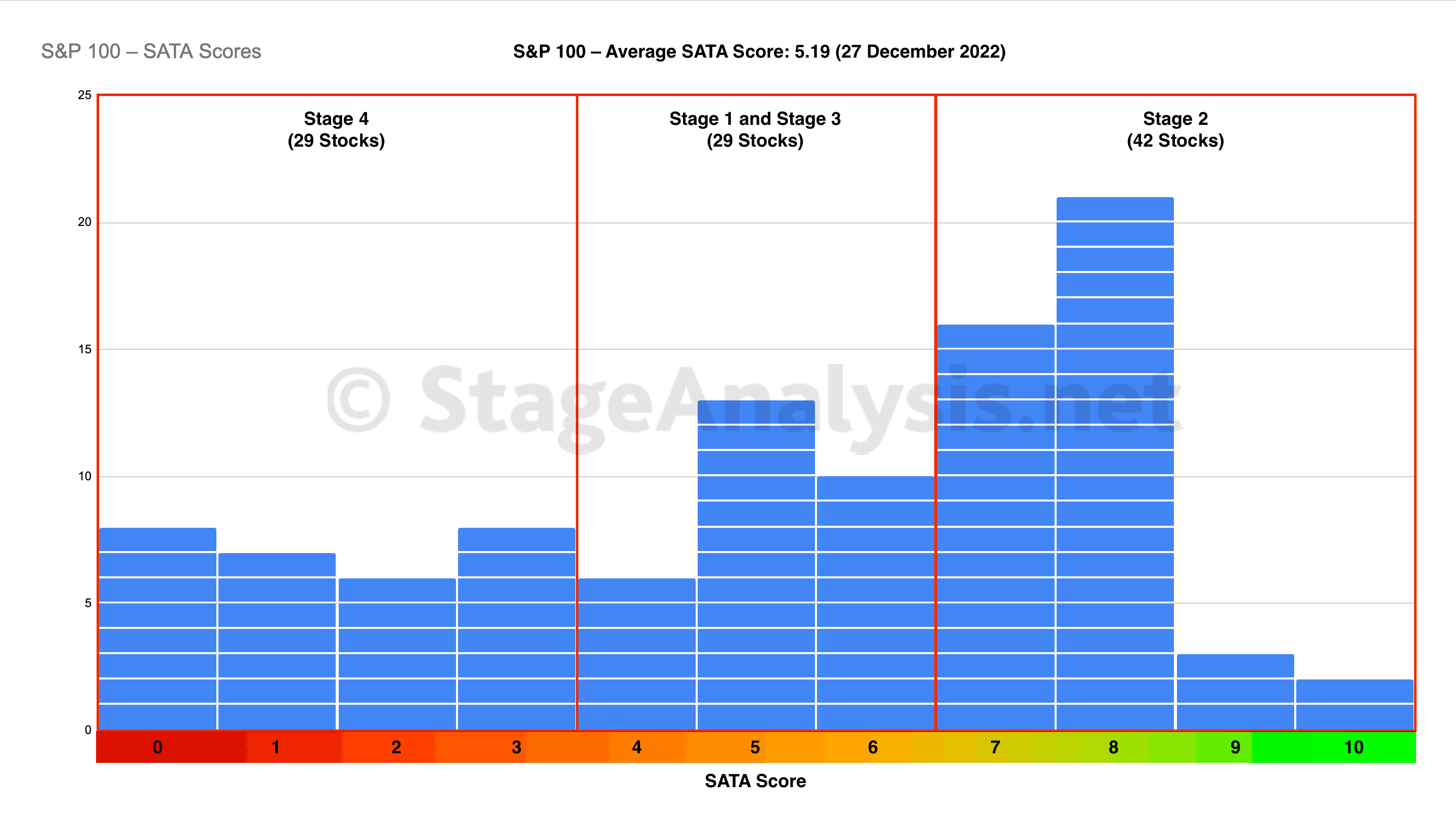

Stage Analysis Technical Attributes Scores – S&P 100 (OEX)

The S&P 100 comprises 100 major blue chip companies and is a sub-set of the popular S&P 500 index. So I thought it would be useful to look at the Stage Analysis Technical Attributes (SATA) weekly scores for all of the stocks in the S&P 100 as we come to the end of 2022, as it will give a picture of the current health of these 100 key stocks. for the US market...

Read More

26 December, 2022

US Stocks Watchlist – 26 December 2022

There were 28 stocks highlighted from the US stocks watchlist scans today...

Read More

25 December, 2022

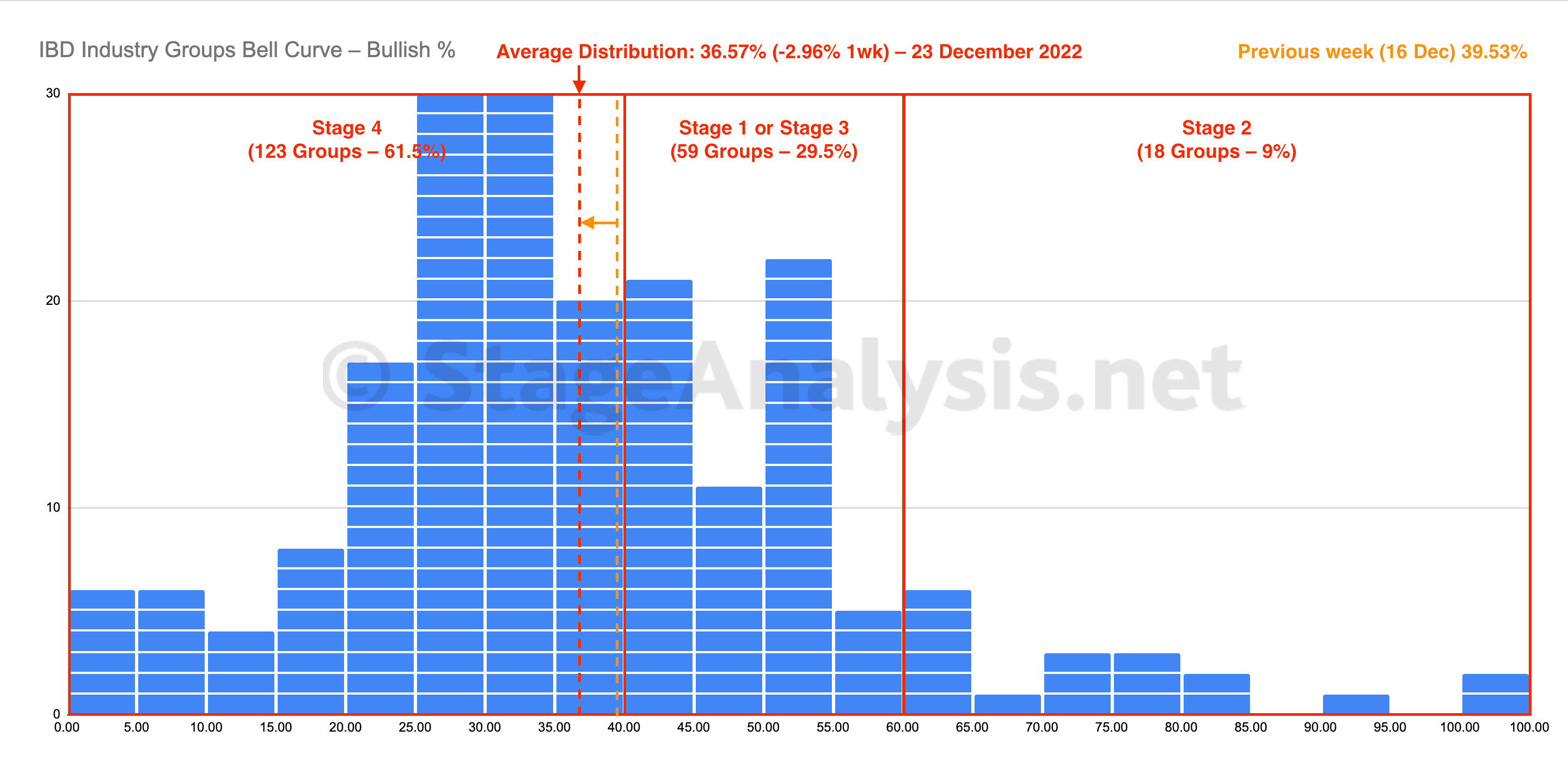

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve declined by a further -2.96% this week, edging it slightly further into the Stage 4 territory...

Read More

24 December, 2022

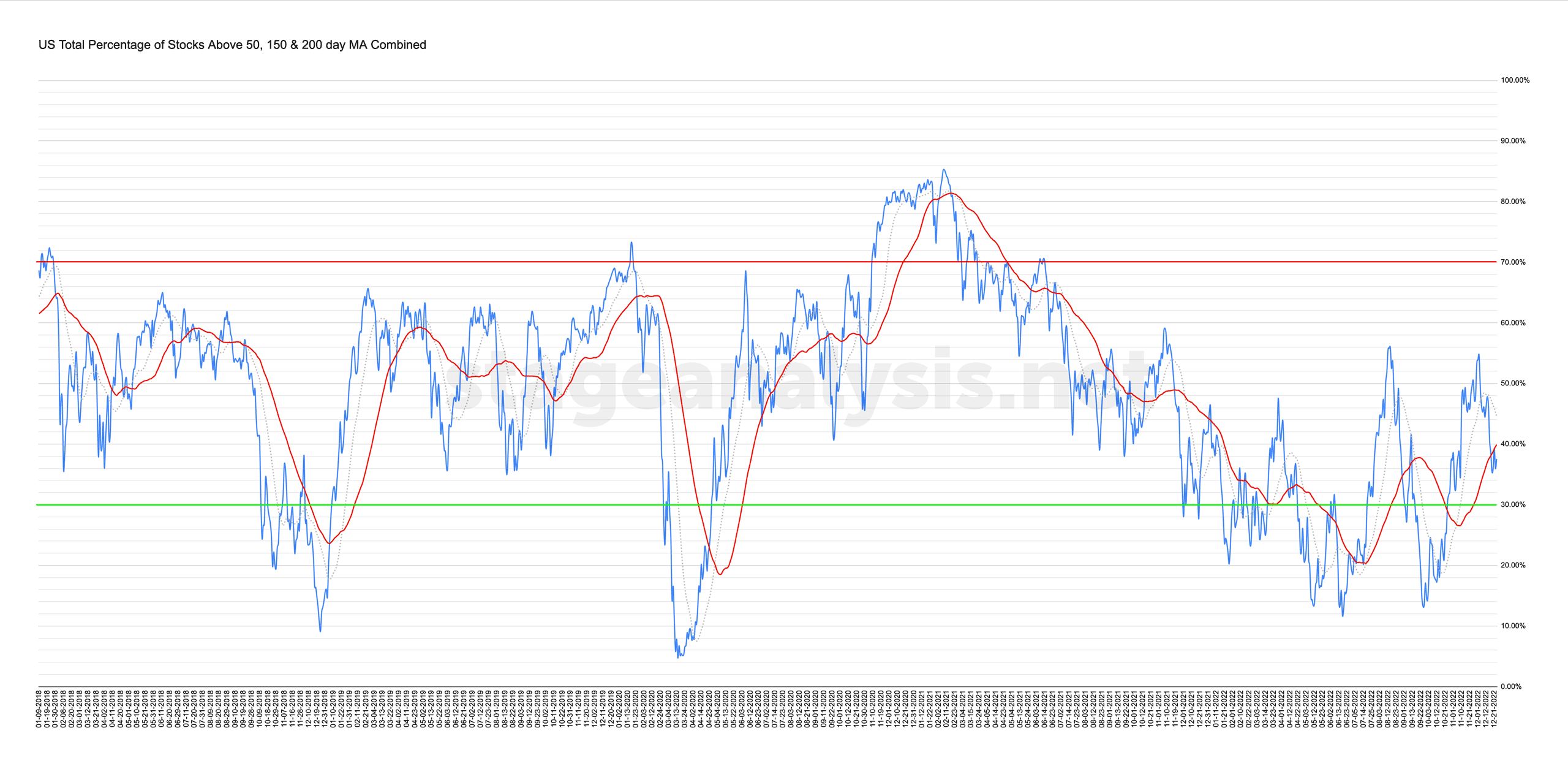

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

23 December, 2022

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

22 December, 2022

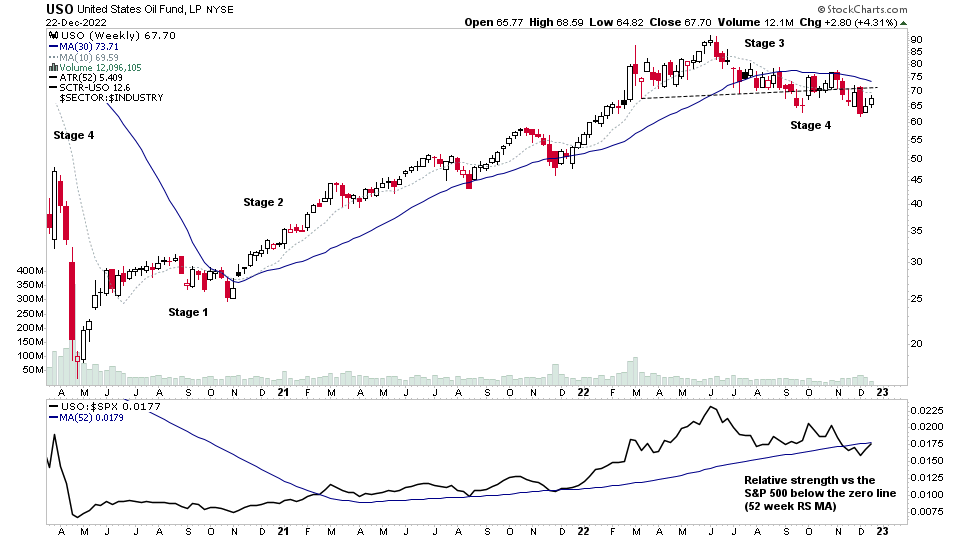

Technically Weak US Stocks / ETFs & Industry Groups – 22 December 2022

A major theme showing up in the scans of the technically weak stocks and etfs was the large amount of Oil stocks in late Stage 3, and hence vulnerable to potential Stage 4 breakdowns in the near future...

Read More

21 December, 2022

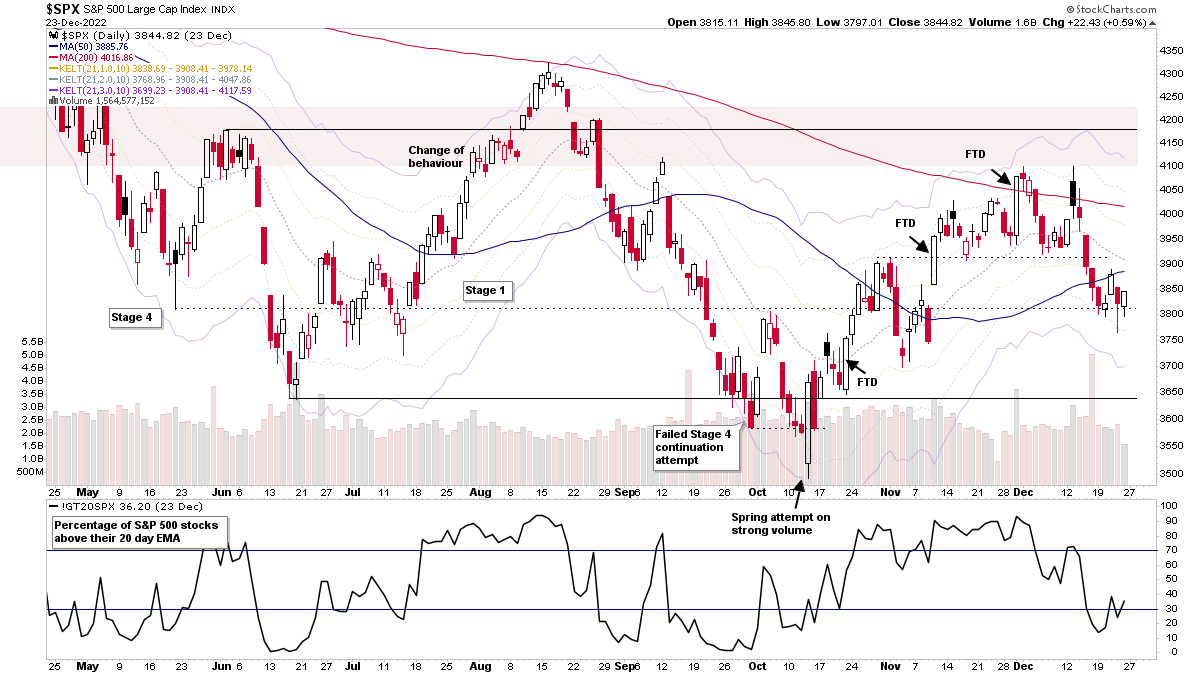

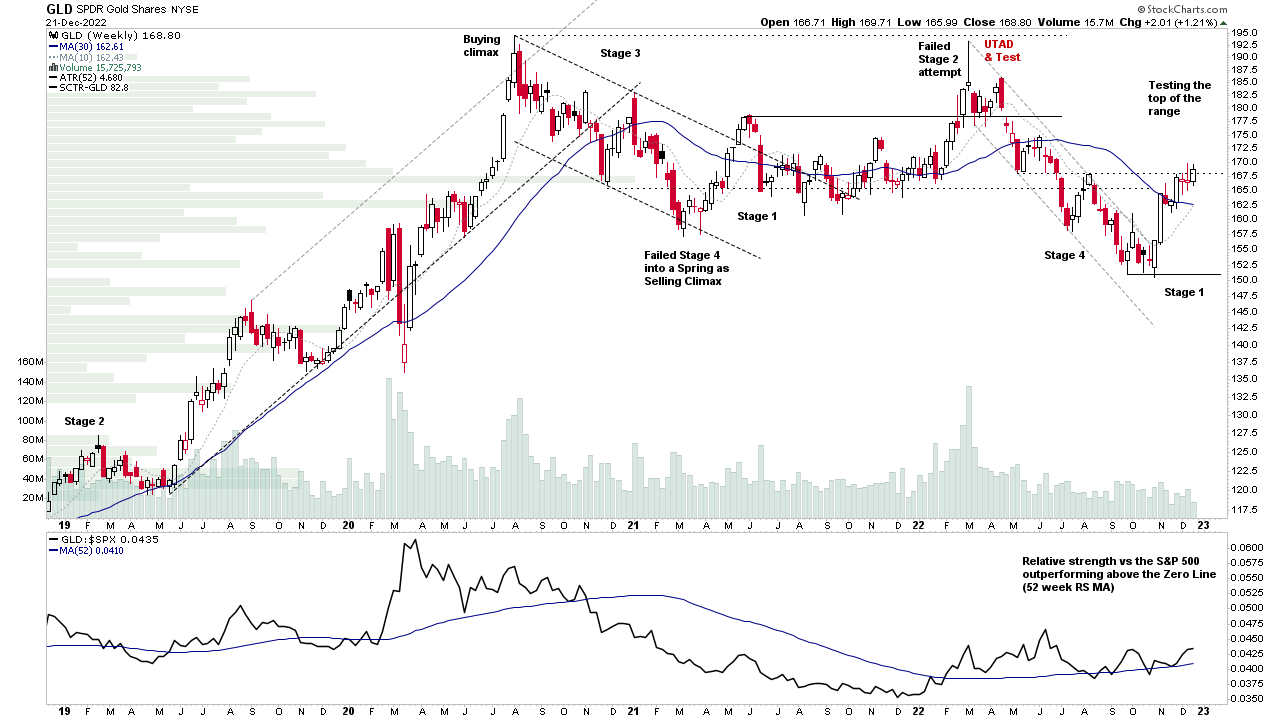

Stage Analysis Members Video – 21 December 2022 (56mins)

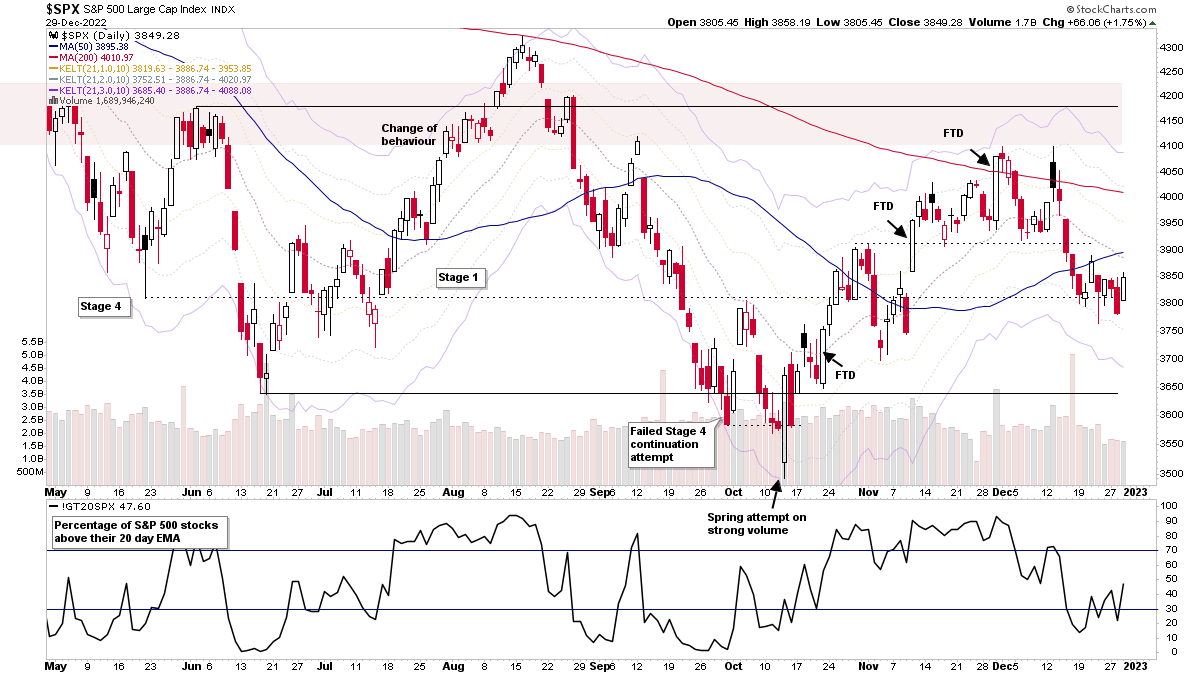

The Stage Analysis members midweek video discussing Gold, Silver & The US Dollar, the S&P 500 & Nasdaq 100 Equal Weight Comparisons, short-term market breadth indicators and the US watchlist stocks in more detail with live markups of the individual stocks and group themes.

Read More