There were 44 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

08 February, 2023

US Stocks Watchlist – 7 February 2023

05 February, 2023

Stage Analysis Members Video – 5 February 2023 (1hr 31mins)

The Stage Analysis members weekend video featuring the regular content with the major US Indexes, the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

05 February, 2023

US Stocks Watchlist – 5 February 2023

For the watchlist from the weekend scans...

Read More

04 February, 2023

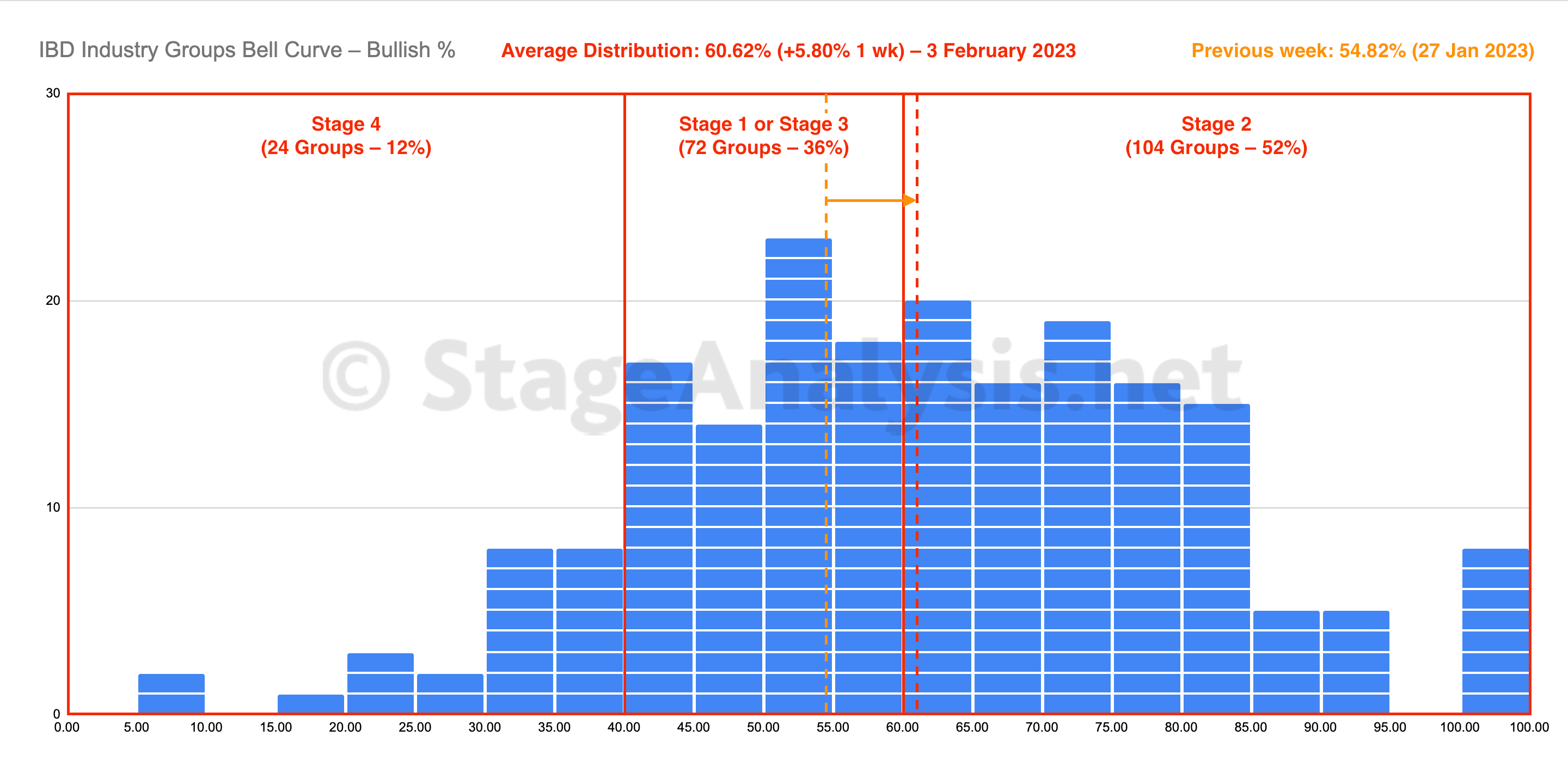

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve continued to expand past the middle over the last week by a further +5.80%, ending the week at 60.62%. The amount of groups in Stage 4 decreased by -14 (-7%), and the amount of groups in Stage 2 increased by +23 (+11.5%), while the amount groups in Stage 1 or Stage 3 decreased by -9 (-4.5%).

Read More

04 February, 2023

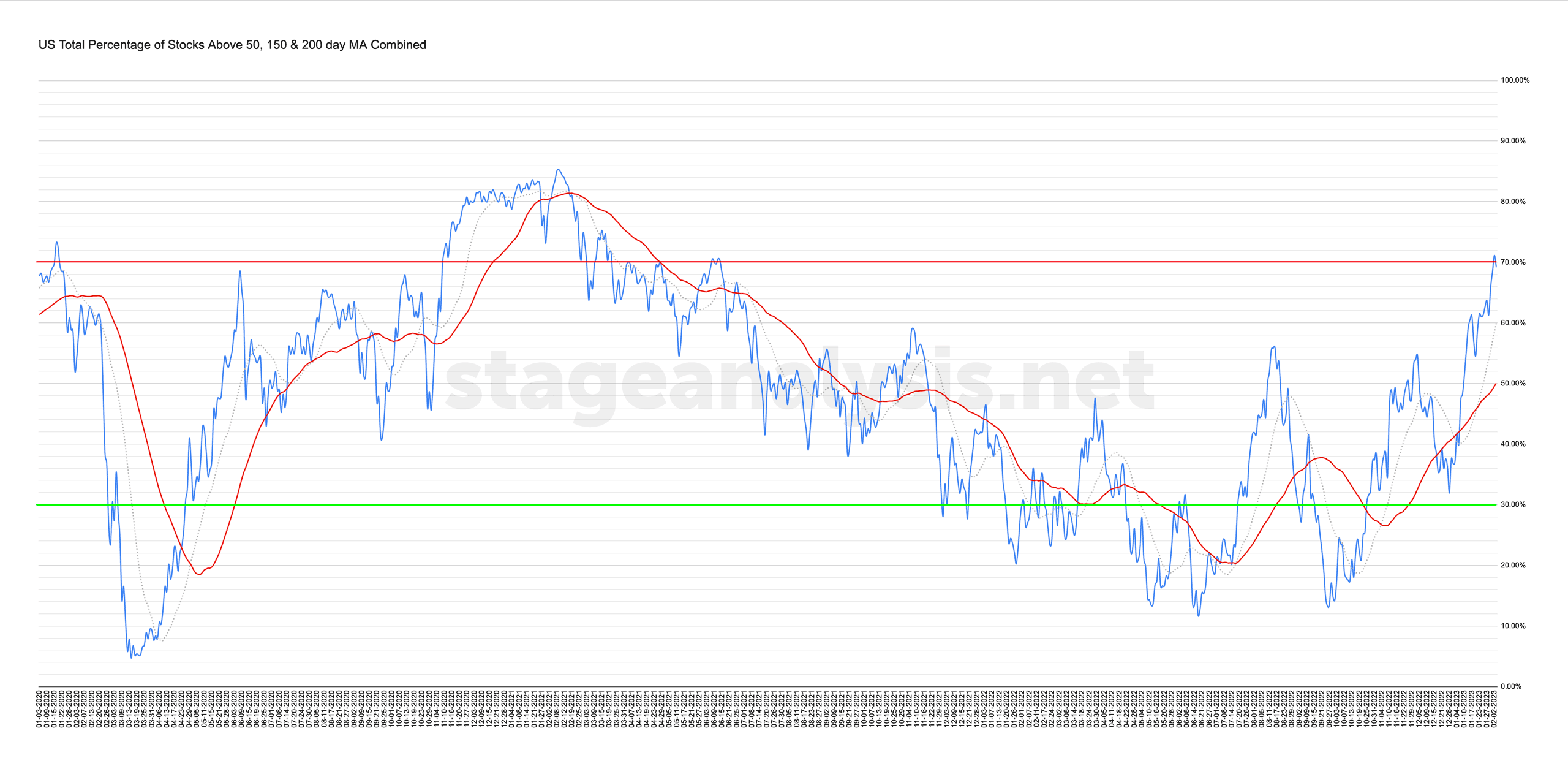

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

03 February, 2023

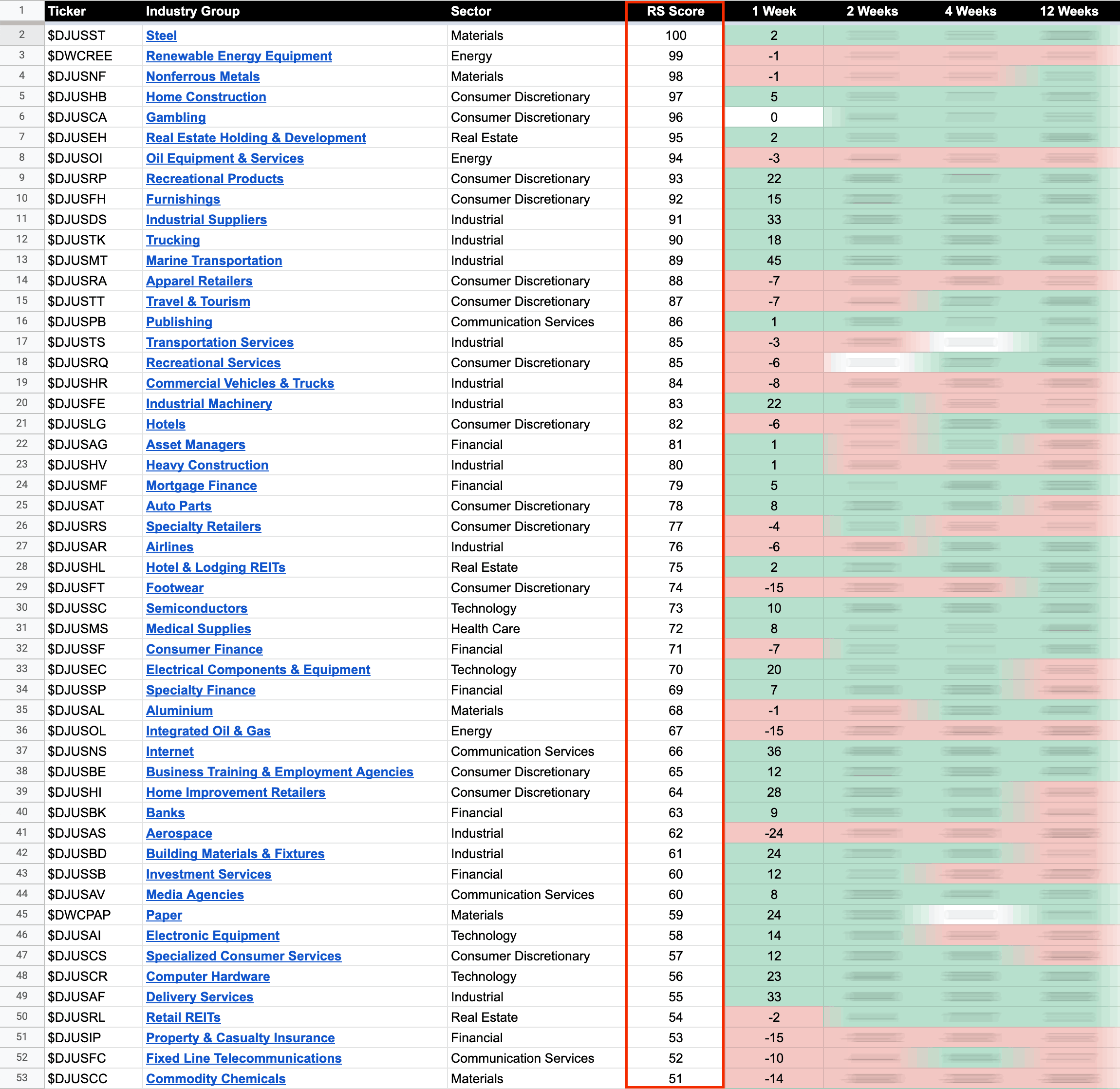

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

02 February, 2023

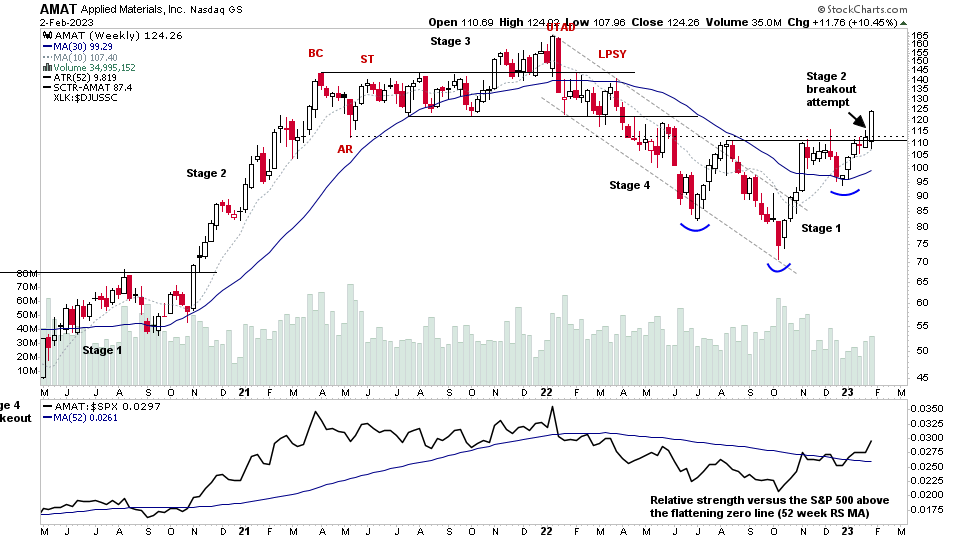

Stage 2 Breakouts Multiply in US Stocks & ETFs – 2 February 2023

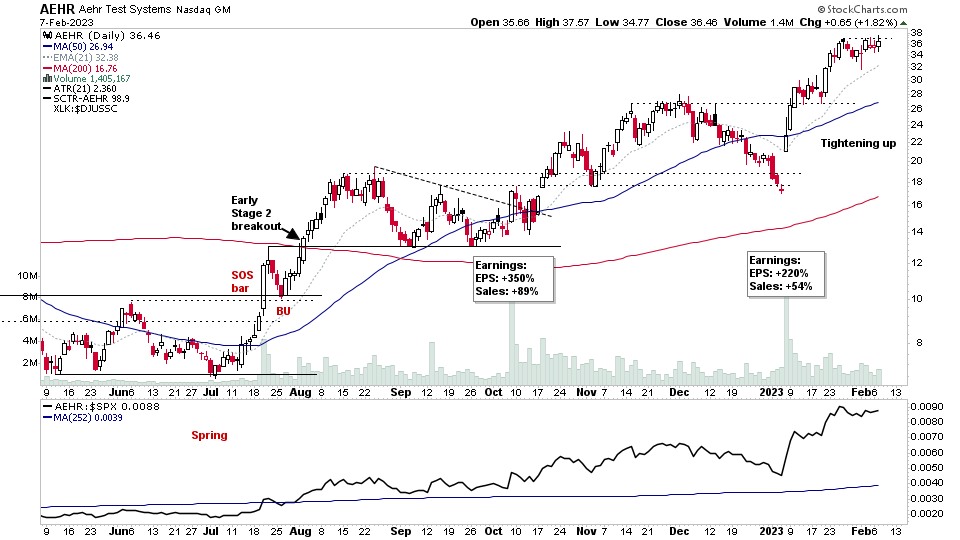

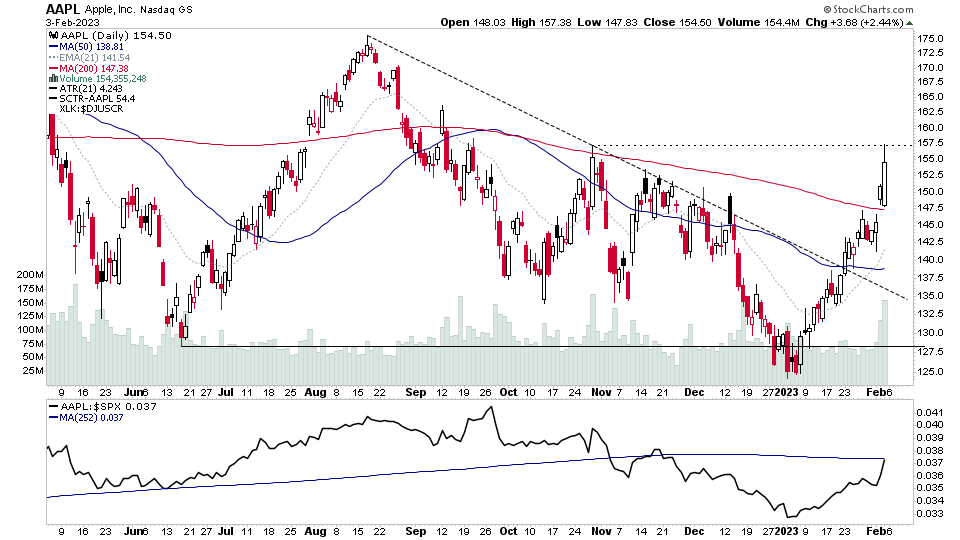

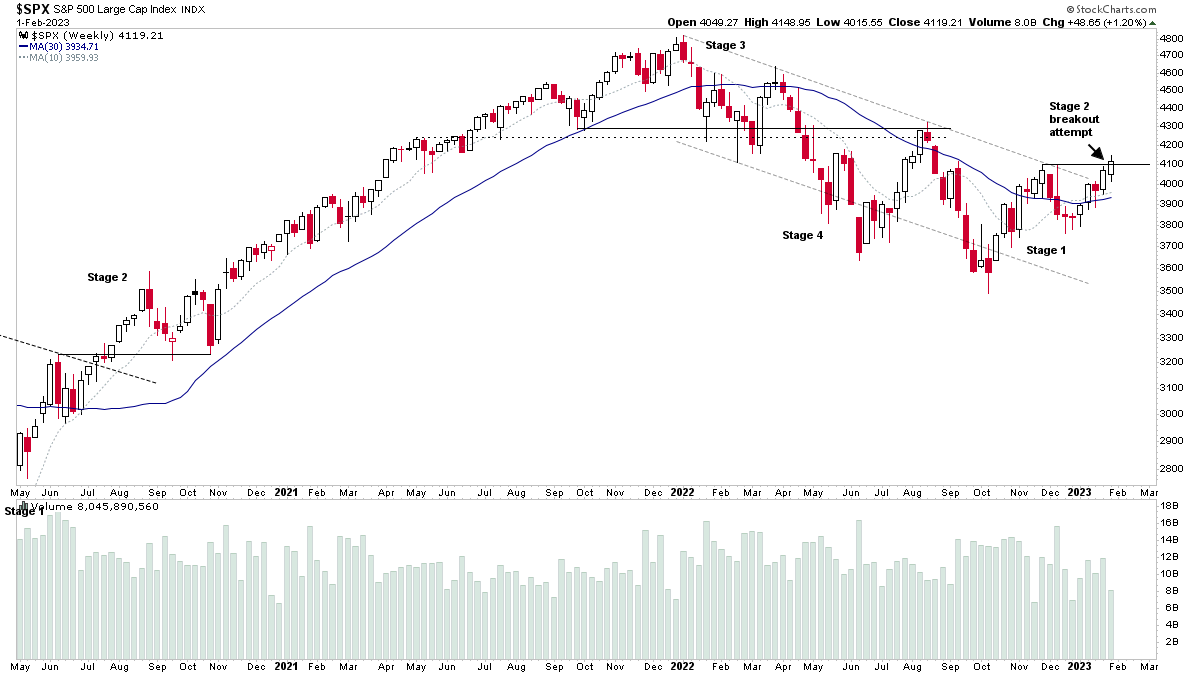

There has been a dramatic increase in the amount of Stage 2 breakout attempts over the last few weeks, with more and more areas of the market attempting to move into early Stage 2, with many showing both strength and volume, which has caused the indexes to also attempt to move into early Stage 2, as highlighted in the last few days posts.

Read More

01 February, 2023

Stage Analysis Members Video – 1 February 2023 (35 mins)

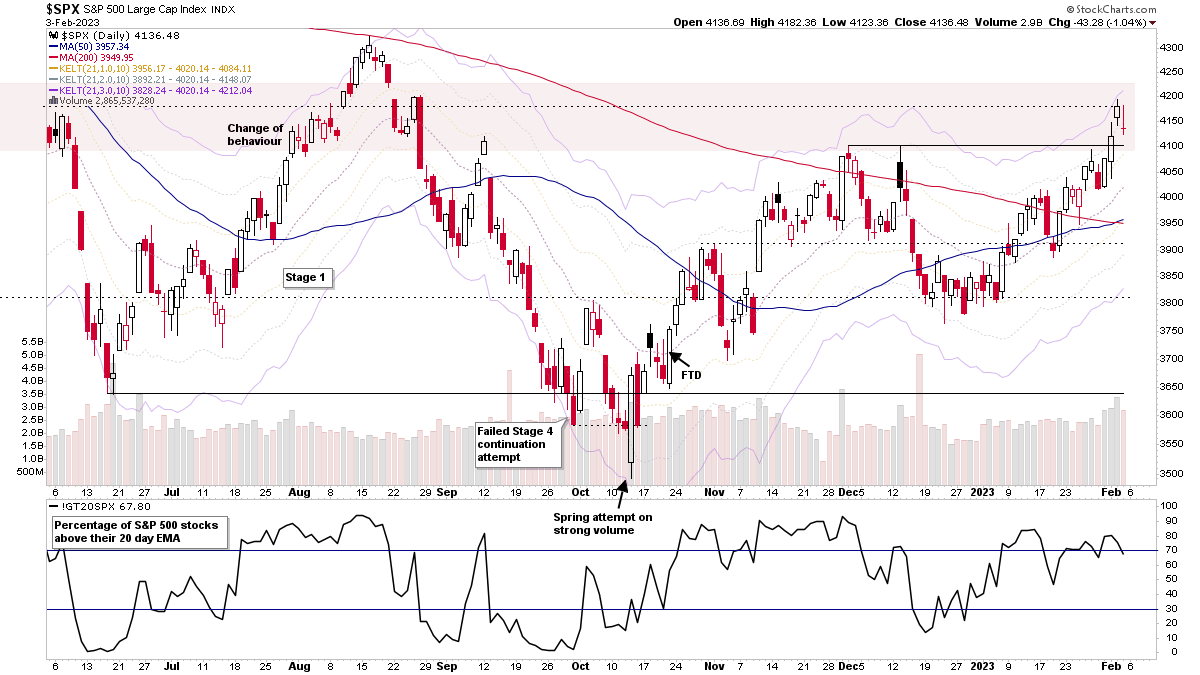

Stage Analysis Members midweek video discussing the Stage 2 breakout attempts in some of the major indexes, a look at the some of the key market breadth data, recent watchlist stocks and more on the small caps from yesterdays post.

Read More

31 January, 2023

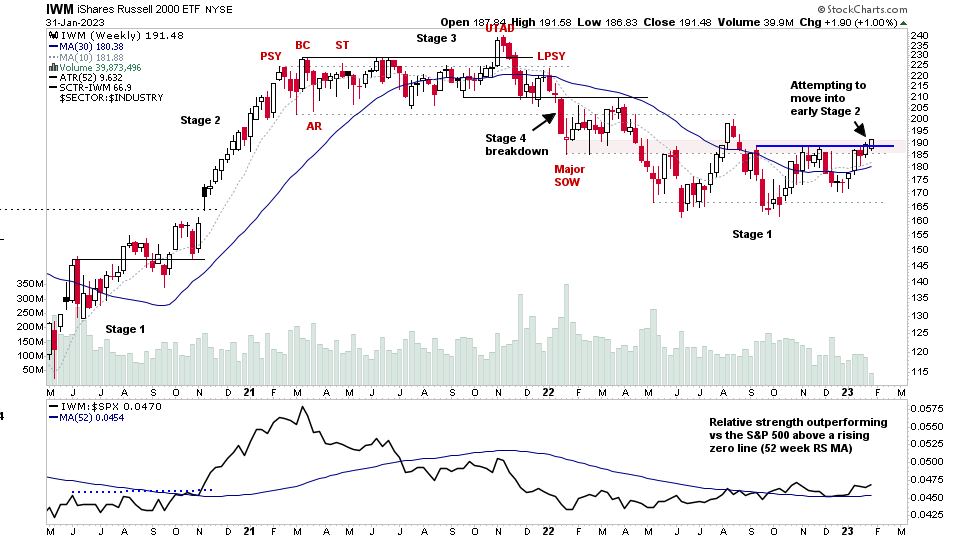

Russell 2000 Small Cap ETF Attempting to Make a Stage 2 Breakout and Small Caps Stocks Watchlist – 31 January 2023

Todays post is a special feature looking at the Small Caps, as ahead of the FOMC on Wednesday, the Russell 2000 Small Caps ETF (IWM) is attempting to breakout into early Stage 2 (see above weekly and daily charts). Hence, with Stage Analysis its the perfect time to drill down into this area of the market, looking at the Small Cap sector Relative Strength, leading Small Cap stocks already in early Stage 2 or testing their Stage 2 level, and some of the market breadth stats from the group to get a broader picture of their internal health...

Read More

30 January, 2023

US Stocks Watchlist – 30 January 2023

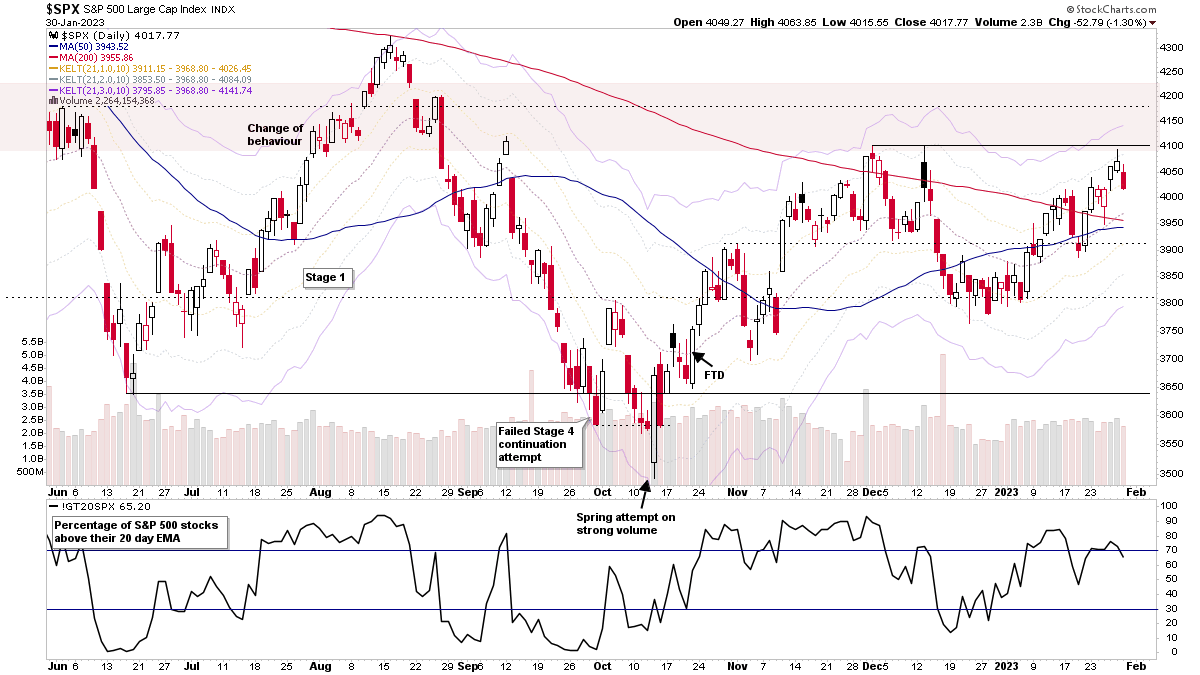

The market pulled back today at key resistance, with multiple market indexes testing their Stage 2 levels at the end of last week. The Fed meeting looms over the market this week, which will be a key driver as to whether the market breaks out into a potential early Stage 2 environment or fails once more and reverses lower – which was the pattern through 2022. So it could be a pivotal week...

Read More