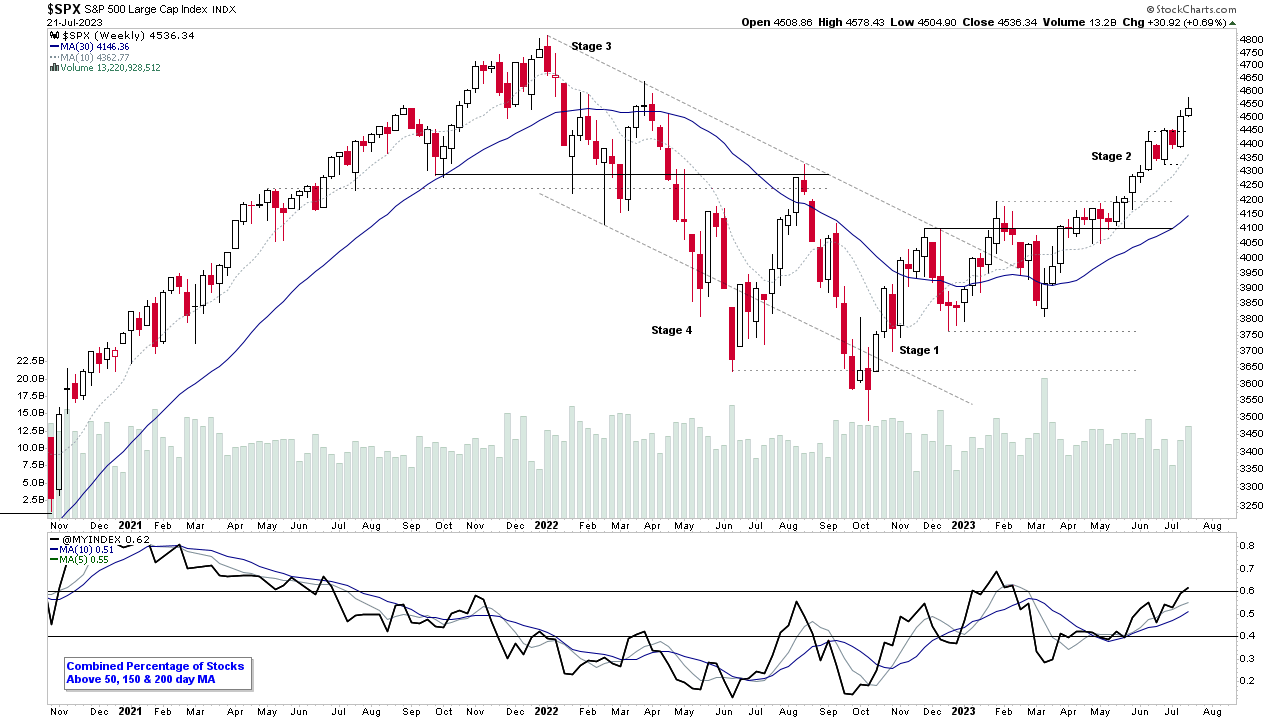

The regular weekend Stage Analysis members video featuring analysis of the major US indexes and futures charts, as well as the Industry Groups Relative Strength (RS) Rankings, the IBD Industry Group Bell Curve – Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence, Stage 2 stocks on volume and finally a look at some of the most recent stocks highlighted in the watchlist in detail, and on multiple timeframes...

Read More

Blog

23 July, 2023

Stage Analysis Members Video – 23 July 2023 (1hr 29mins)

23 July, 2023

US Stocks Watchlist – 23 July 2023

There were 22 stocks highlighted from the US stocks watchlist scans today. I'll discuss the watchlist stocks and group themes in detail in the members weekend video...

Read More

22 July, 2023

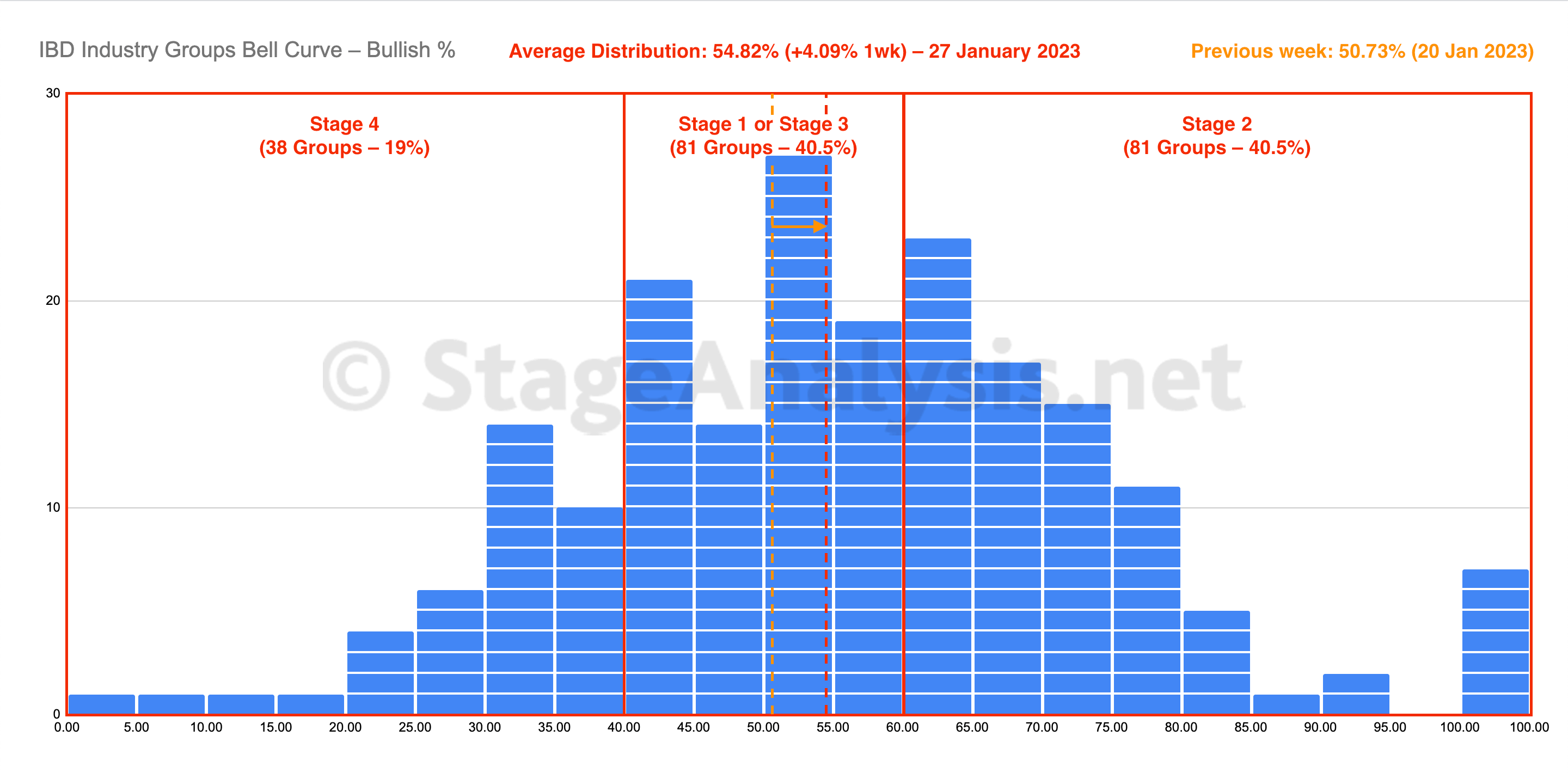

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent shows the few hundred industry groups plotted as a histogram chart and represents the percentage of stocks in each group that are on a point & figure (P&F) buy signal. This information provides a snapshot of the overall market health in a unique way, and is particularly useful for both market timing strategies and as a tool in aiding with the Stage Analysis methods "Forest to the Trees" approach, where we look for developing group themes...

Read More

22 July, 2023

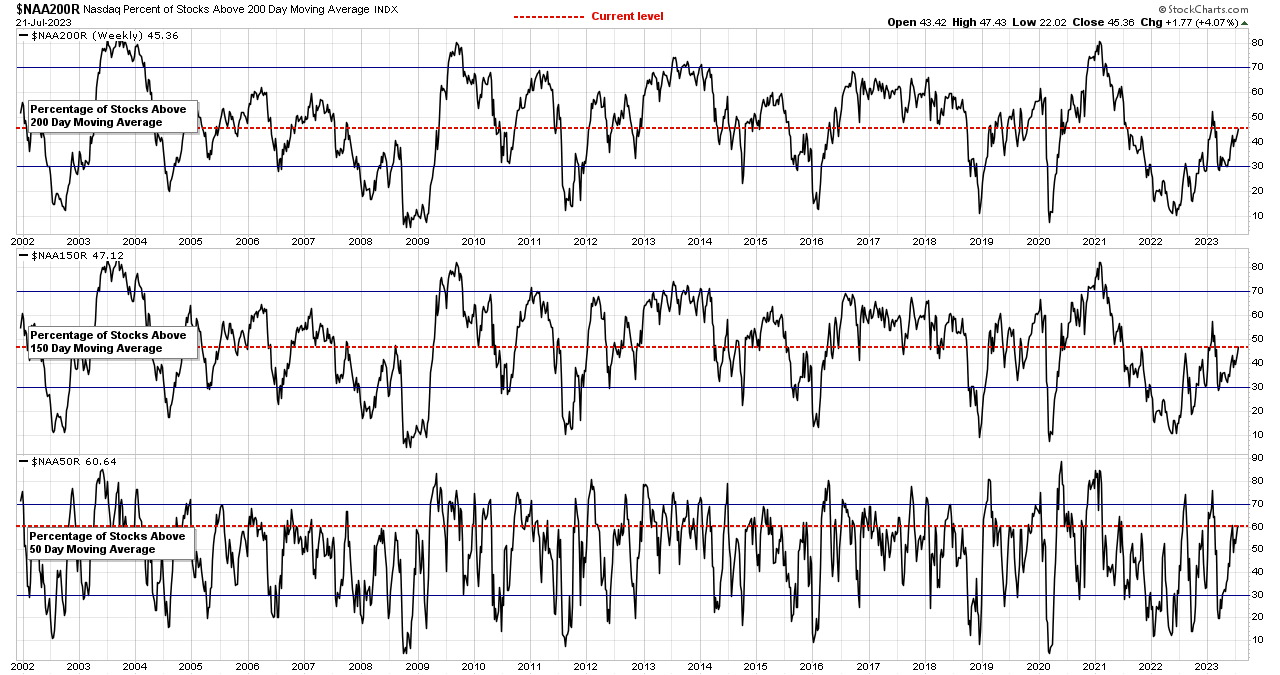

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

21 July, 2023

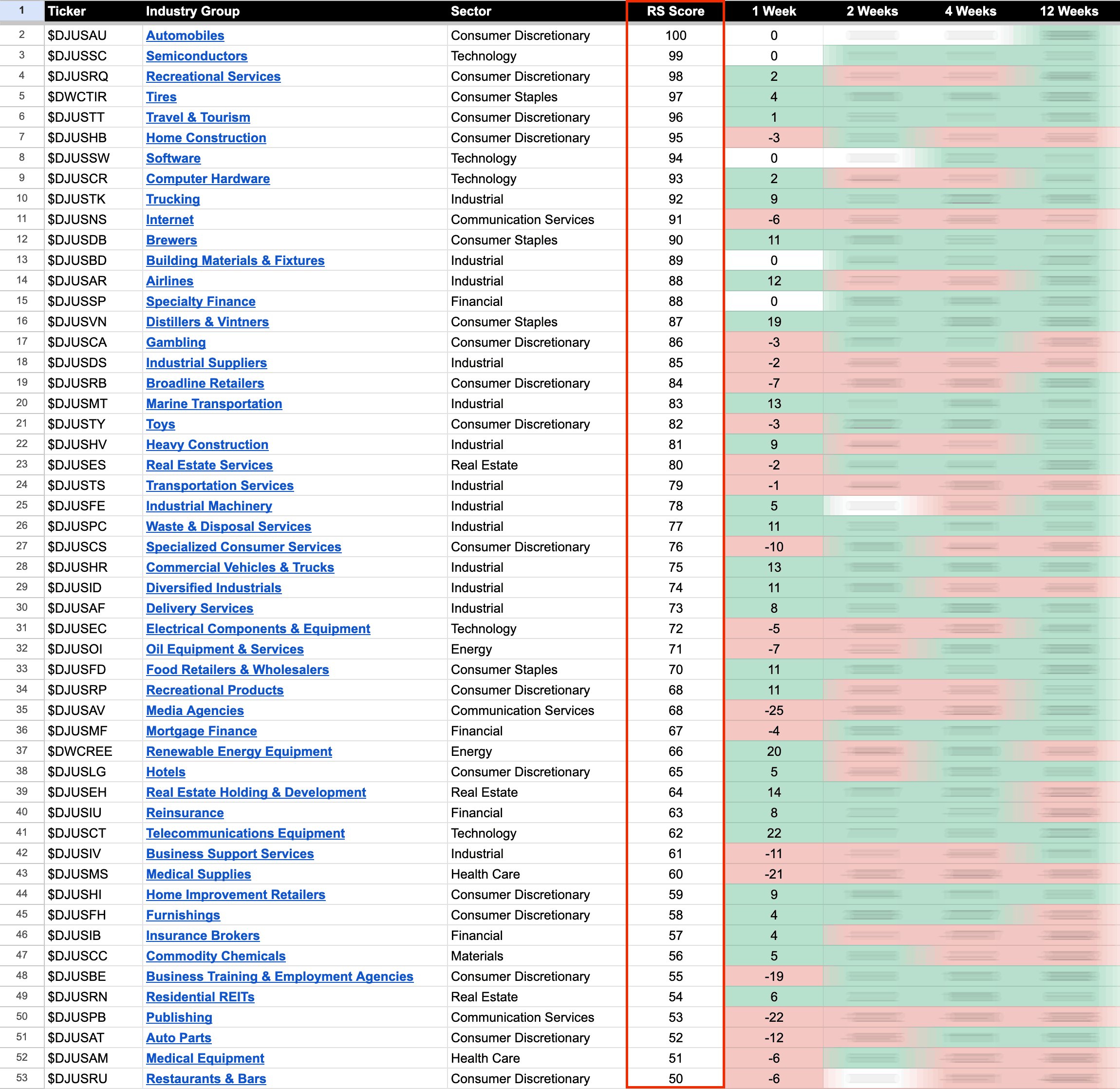

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

20 July, 2023

US Stocks Watchlist – 20 July 2023

There were 31 stocks highlighted from the US stocks watchlist scans today...

Read More

19 July, 2023

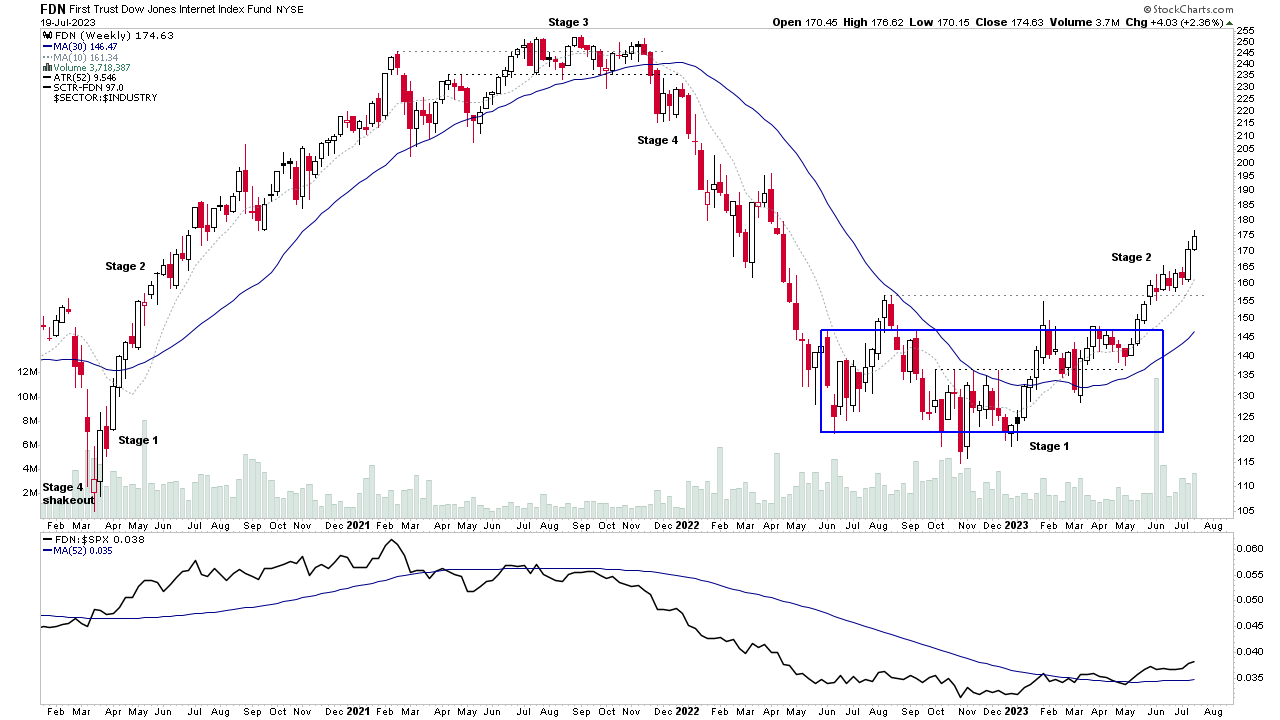

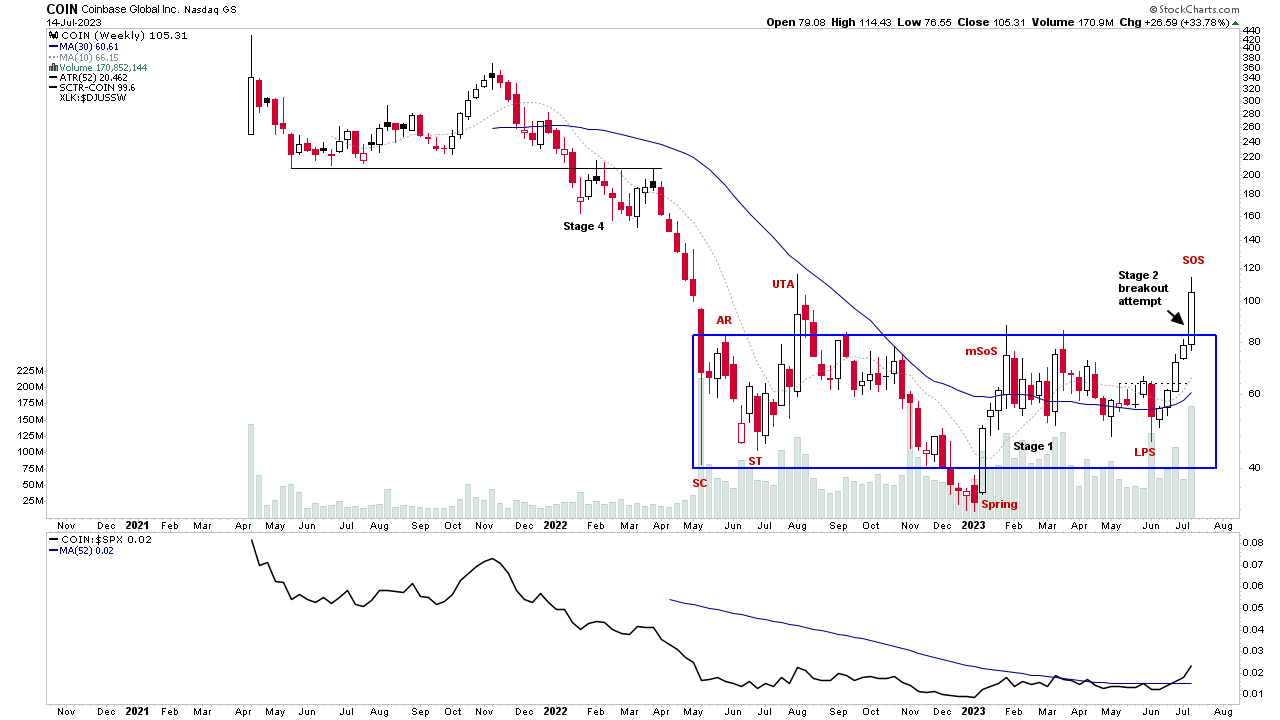

Group Focus Video: Internet – 19 July 2023 (49mins)

This weeks group focus video is on the Internet group, which has been one of the leading groups (in the top 10 of the RS Rankings) since mid March. So with earnings season underway, and multiple stocks from the group reporting in the coming weeks, it's a good time to review the groups overall position in its Stage 2 advance...

Read More

18 July, 2023

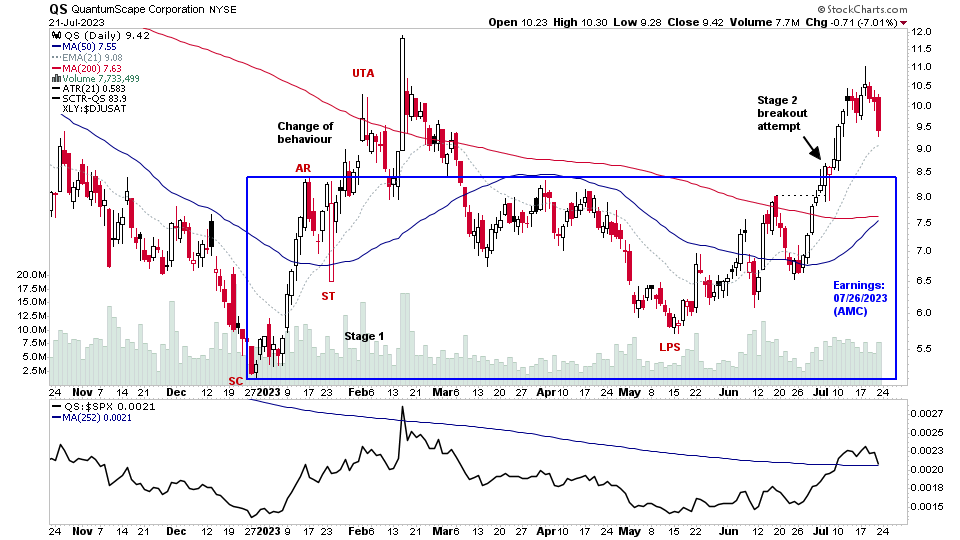

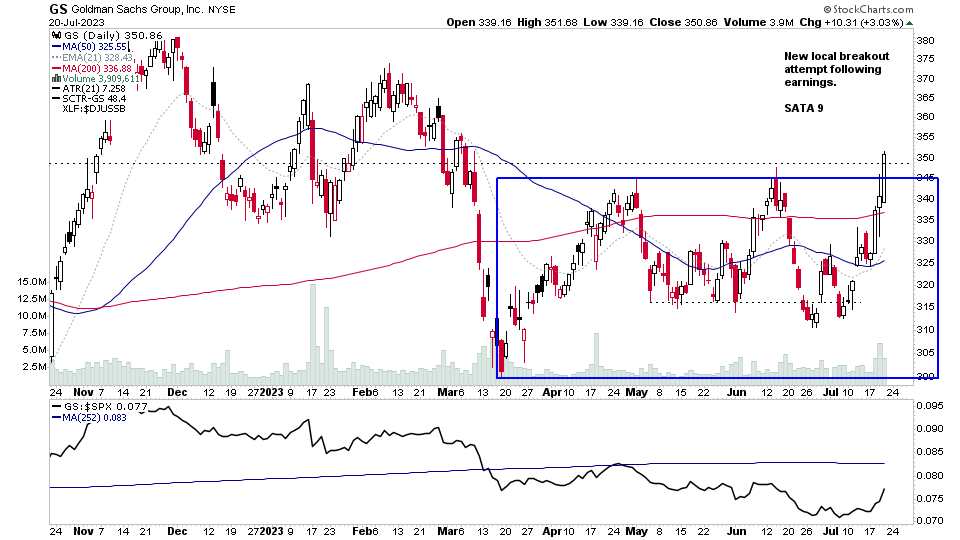

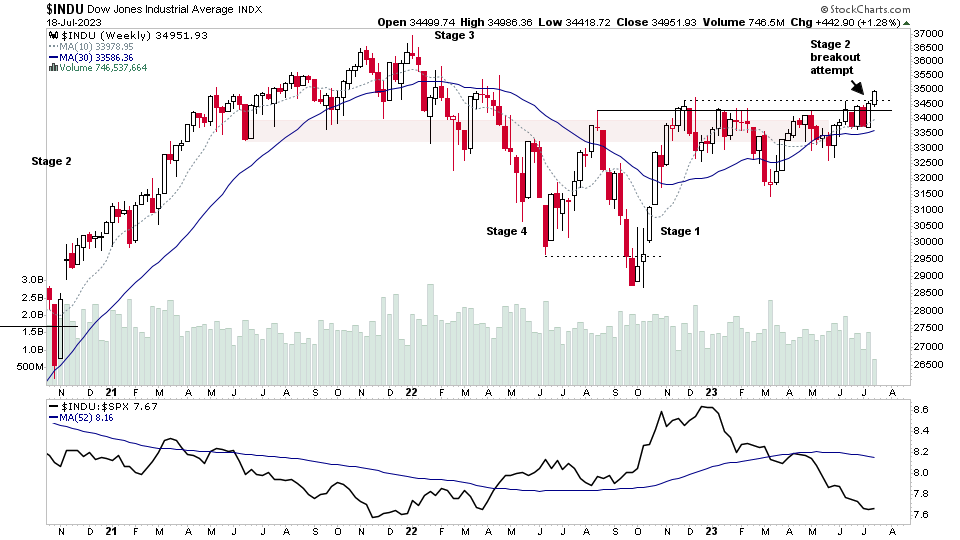

Dow Jones Stage 2 Breakout Attempt and the US Stocks Watchlist – 18 July 2023

There were 30 stocks highlighted from the US stocks watchlist scans today...

Read More

17 July, 2023

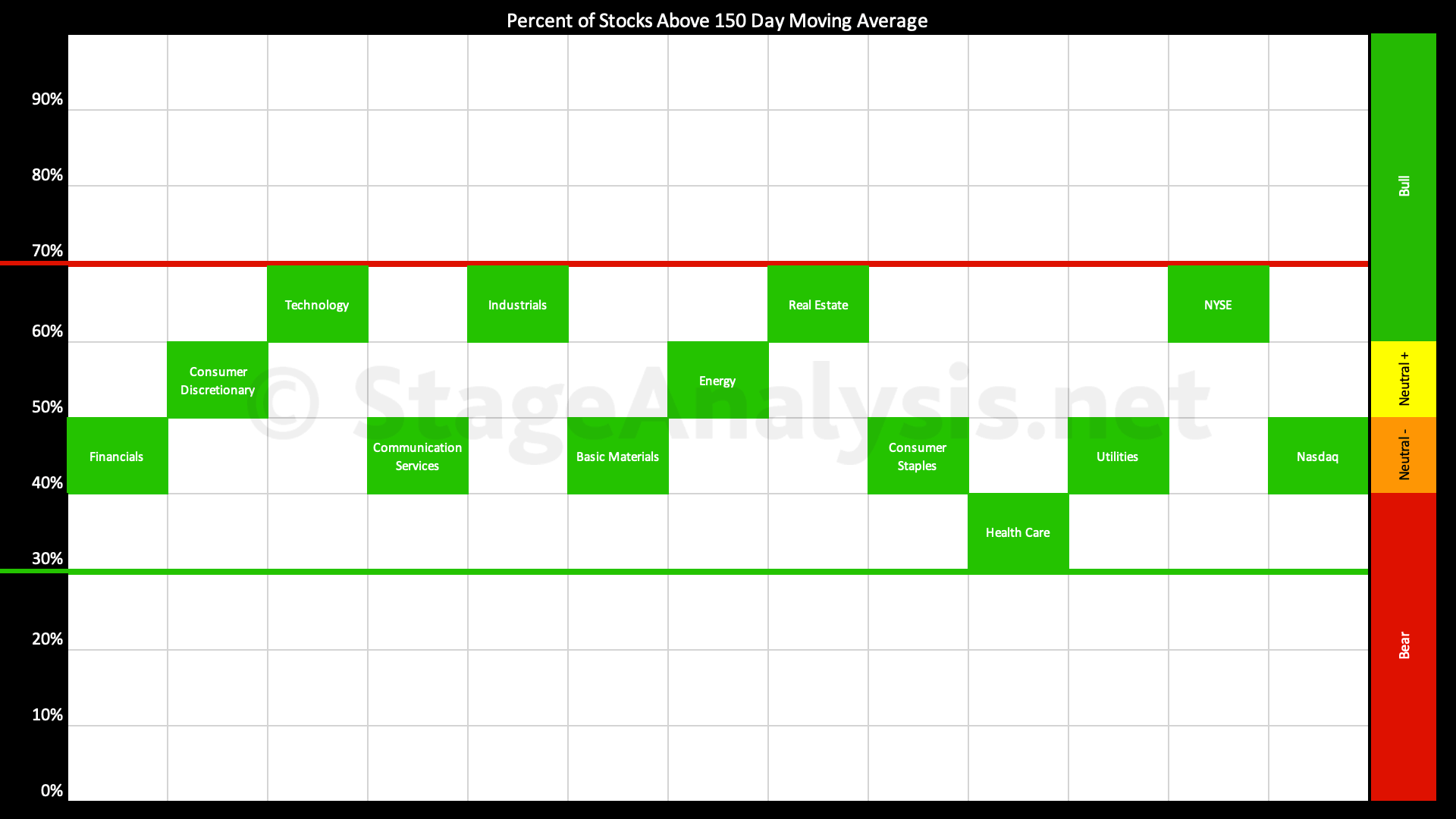

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

16 July, 2023

Stage Analysis Members Video – 16 July 2023 (1hr 25mins)

Stage Analysis members weekend video beginning with a discussion of some of the weeks strongest Stage 2 breakout attempts on volume, followed by the regular member content...

Read More