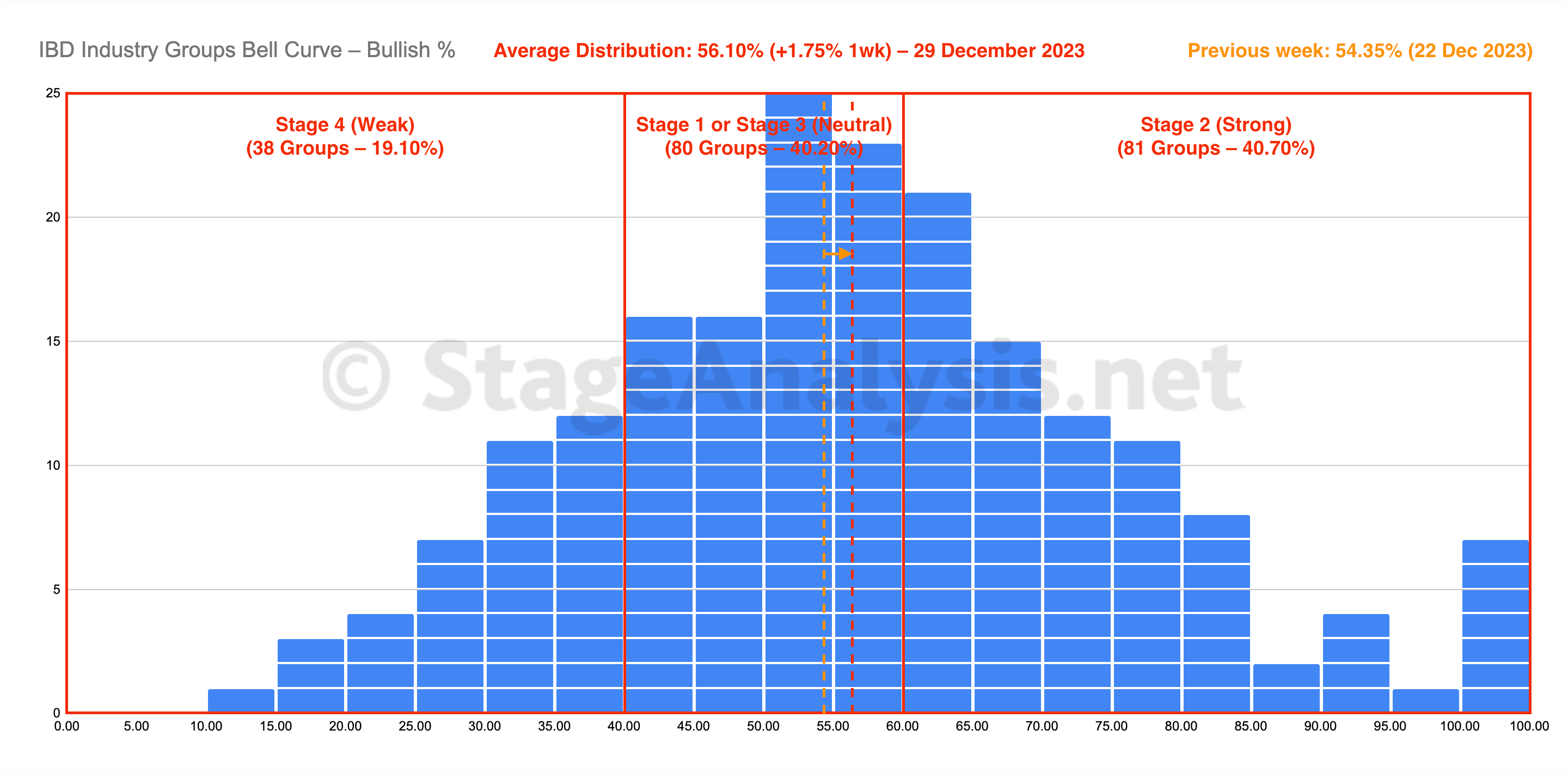

The IBD Industry Groups Bell Curve increased by +1.75% this week to finish at 56.10% overall. The amount of groups in Stage 4 (Weak) decreased by 10 (-5%), and the amount of groups in Stage 2 (Strong) increased by 8 (+4%), while the amount groups in Stage 1 or Stage 3 (Neutral) decreased by 2 (-1%).

Read More

Blog

30 December, 2023

IBD Industry Groups Bell Curve – Bullish Percent

29 December, 2023

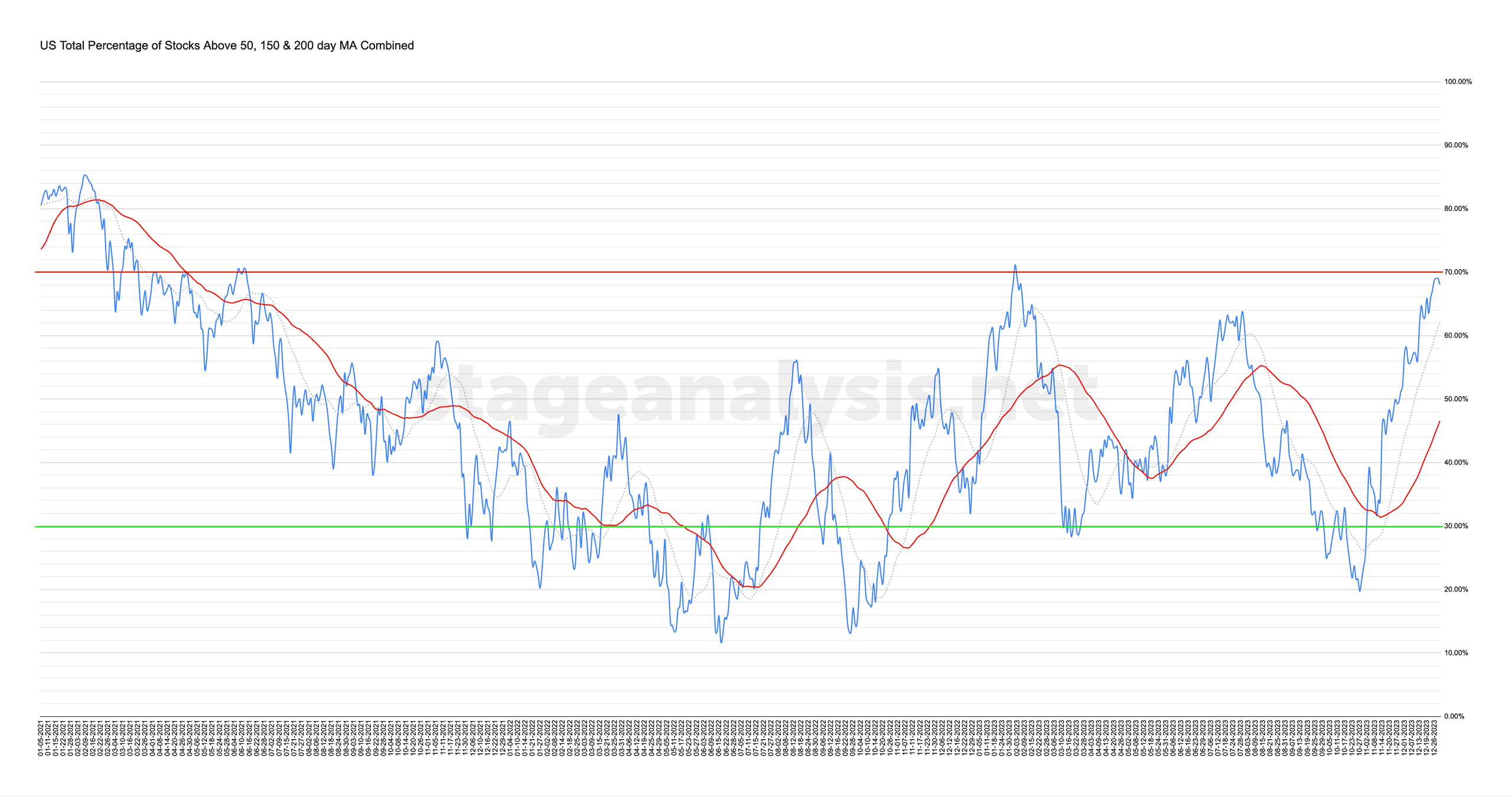

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

29 December, 2023

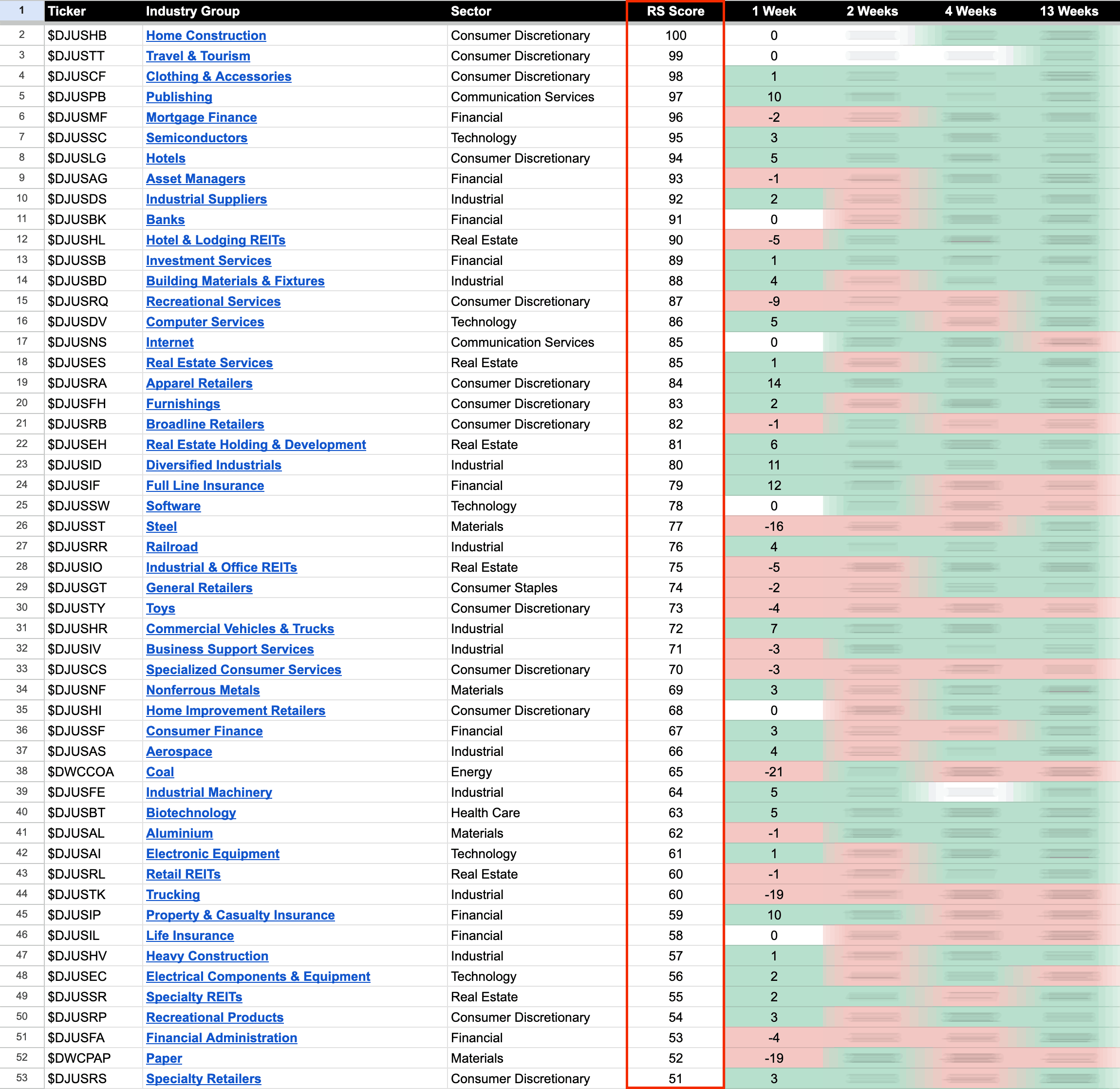

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

27 December, 2023

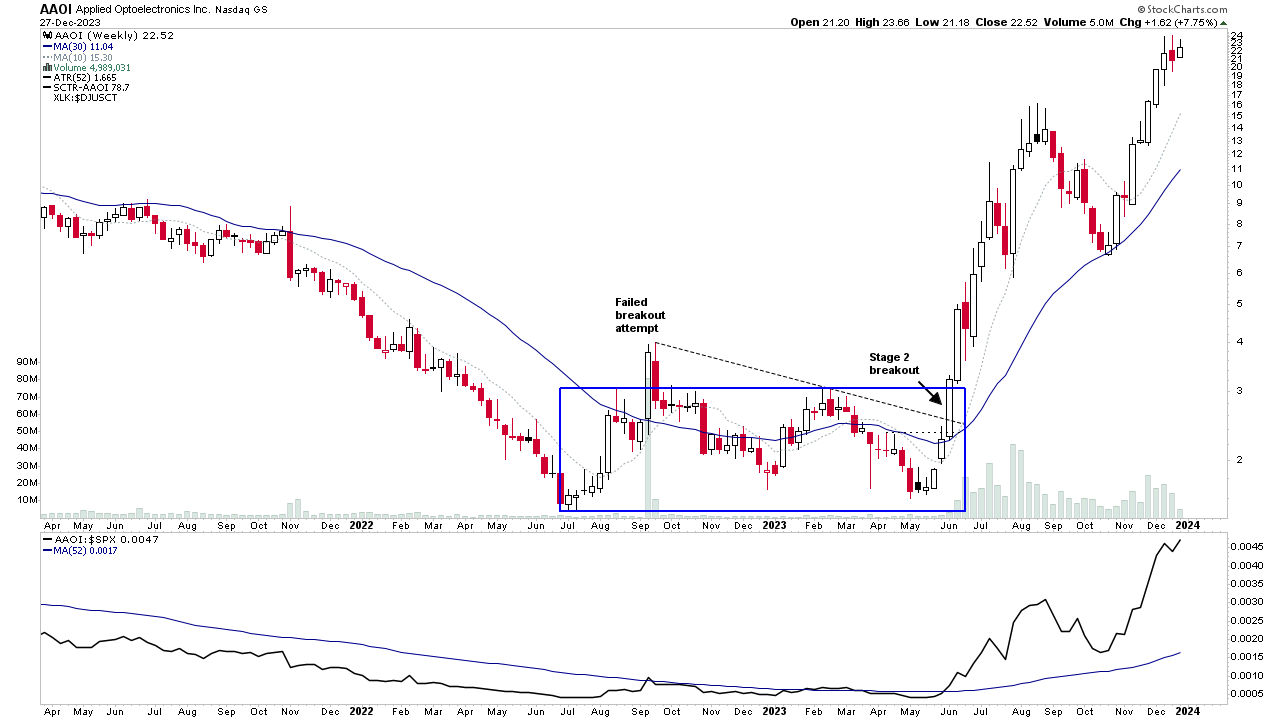

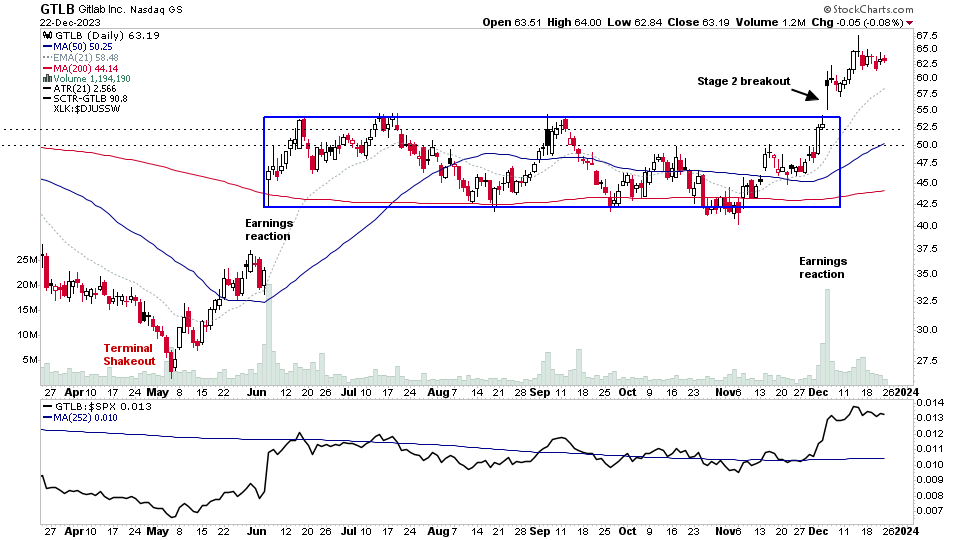

2023 Stage Analysis Stock Leaders – 27 December 2023 (35mins)

2023 has seen many exceptional Stage 2 advances in individual stocks as the major US indexes moved higher in Stage 2 advances of their own. So this short 35 minute video discusses fifteen of this years best Stage 2 moves and the characteristics that they developed as they moved into early Stage 2, to help you recognise what to look for in future stocks as they move towards the investor method entry point/s.

Read More

24 December, 2023

US Stocks Watchlist – 24 December 2023

There were 17 stocks highlighted from the US stocks watchlist scans today...

Read More

23 December, 2023

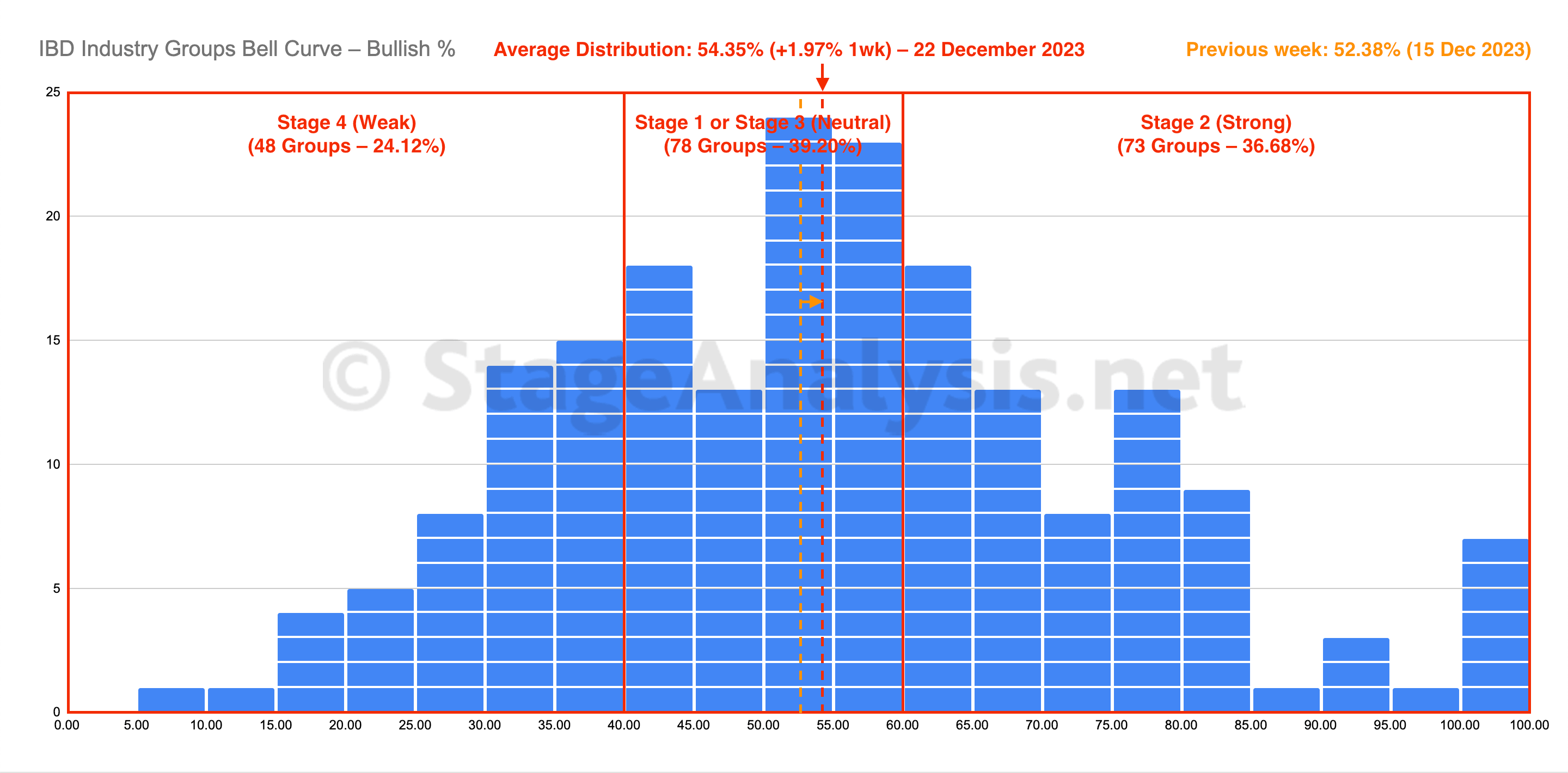

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve increased by +1.97% this week to finish at 54.35% overall. The amount of groups in Stage 4 (Weak) decreased by 7 (-3.5%), and the amount of groups in Stage 2 (Strong) increased by 10 (+5%), while the amount groups in Stage 1 or Stage 3 (Neutral) decreased by 3 (-1.5%).

Read More

22 December, 2023

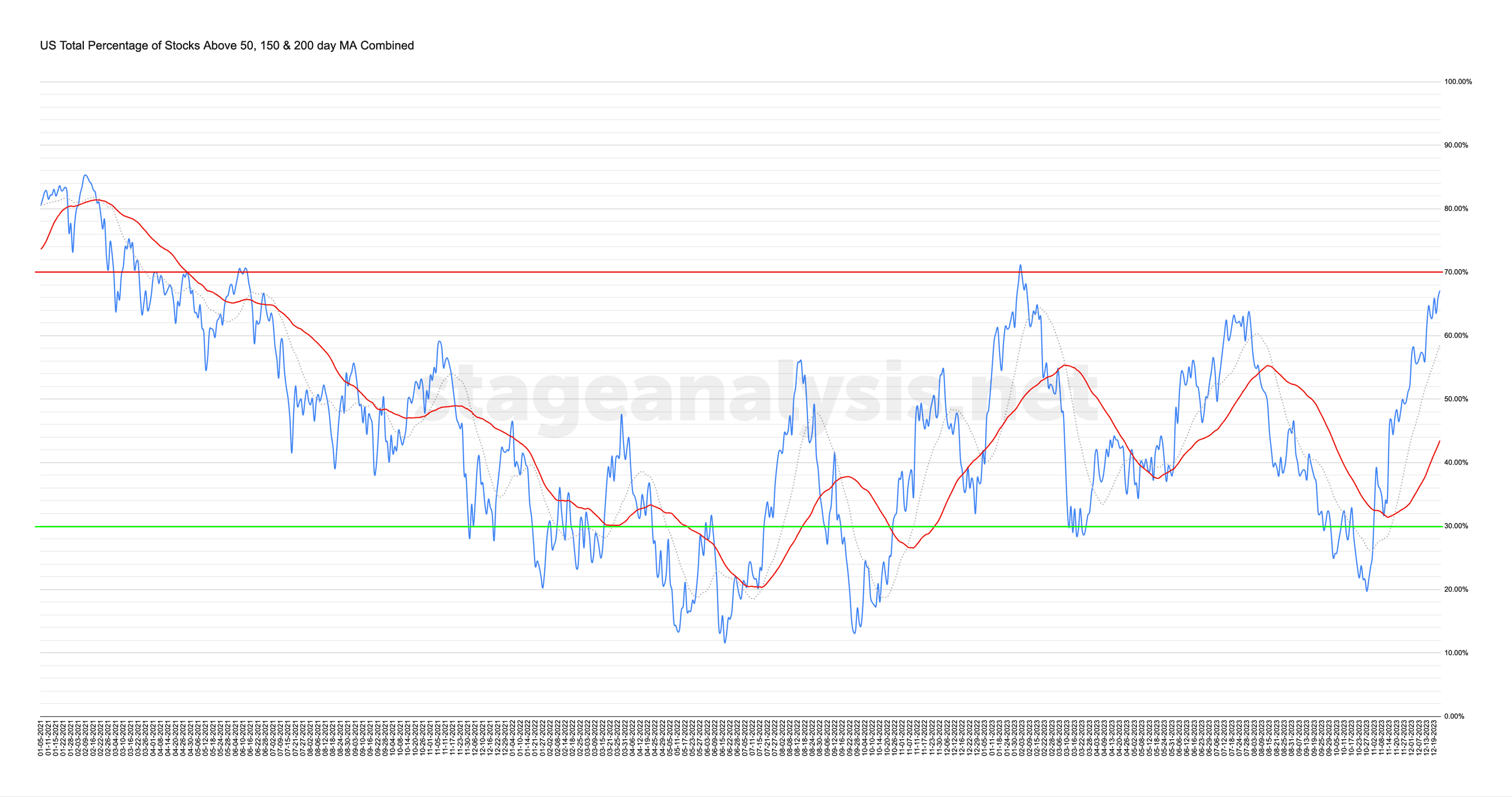

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

22 December, 2023

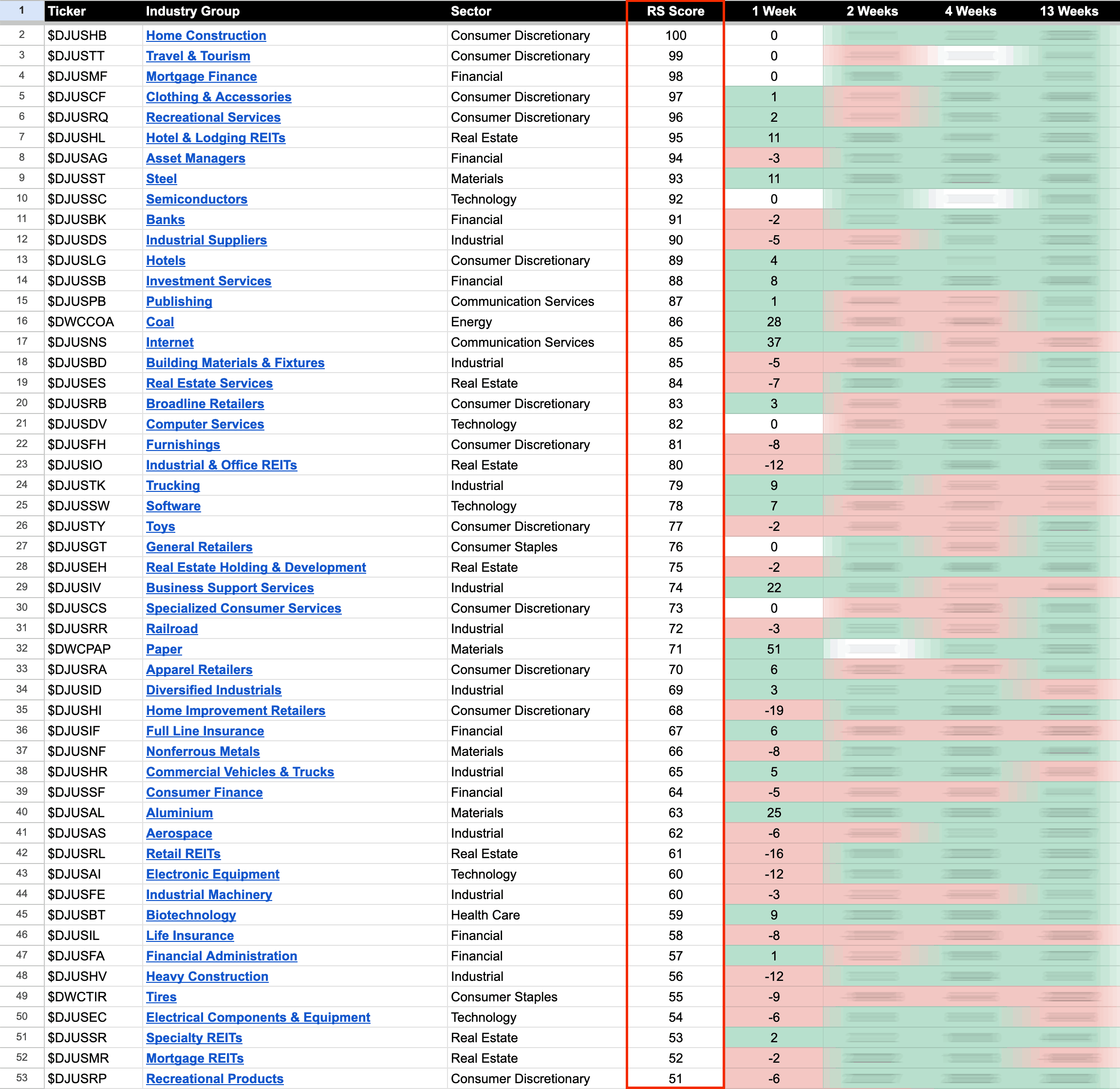

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

21 December, 2023

US Stocks Watchlist – 21 December 2023

There were 24 stocks highlighted from the US stocks watchlist scans today...

Read More

20 December, 2023

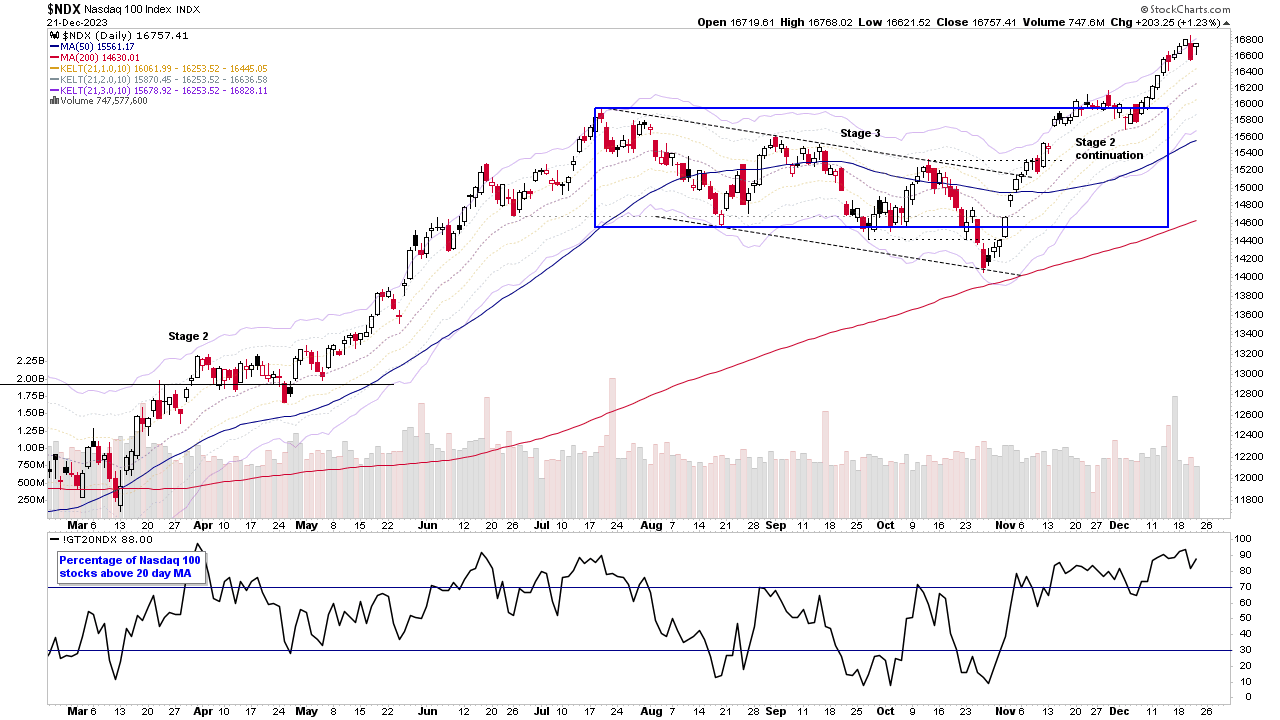

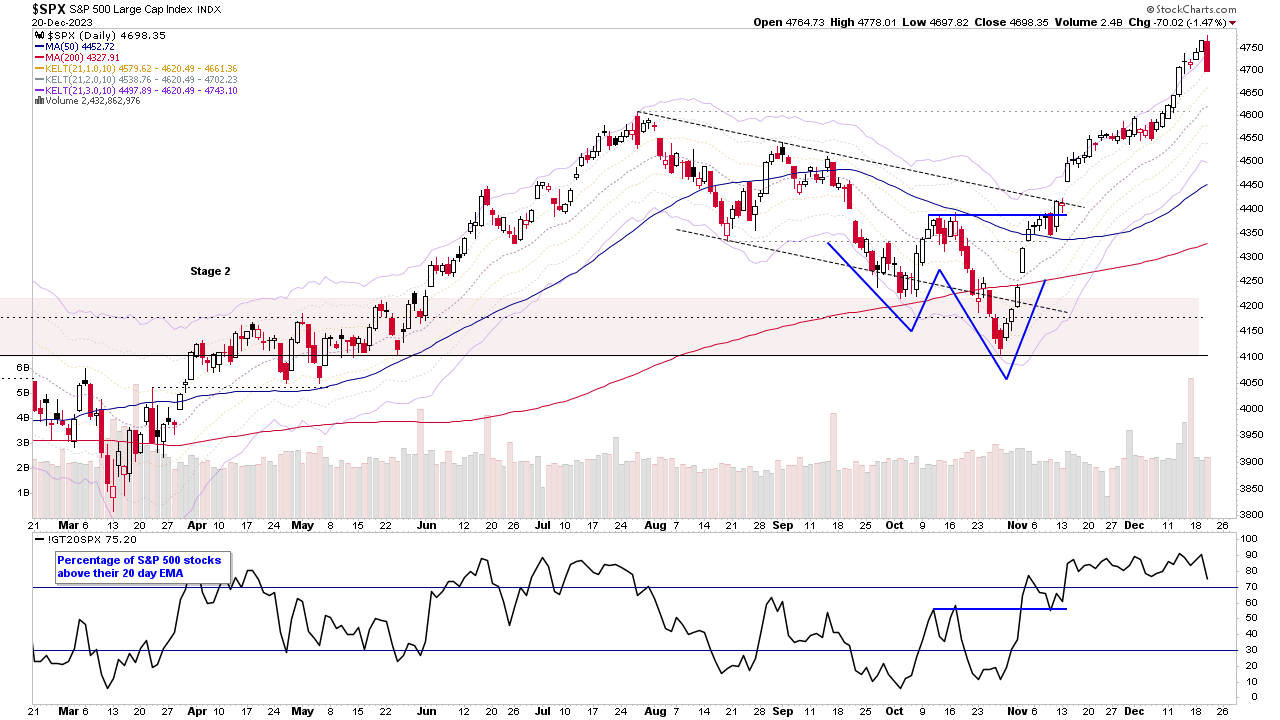

Stage Analysis Members Video – 20 December 2023 (47mins)

Stage Analysis midweek video discussing of the major US stock market indexes following todays pullback, plus the short-term market breadth measures, and the recent watchlist stocks on multiple timeframes.

Read More