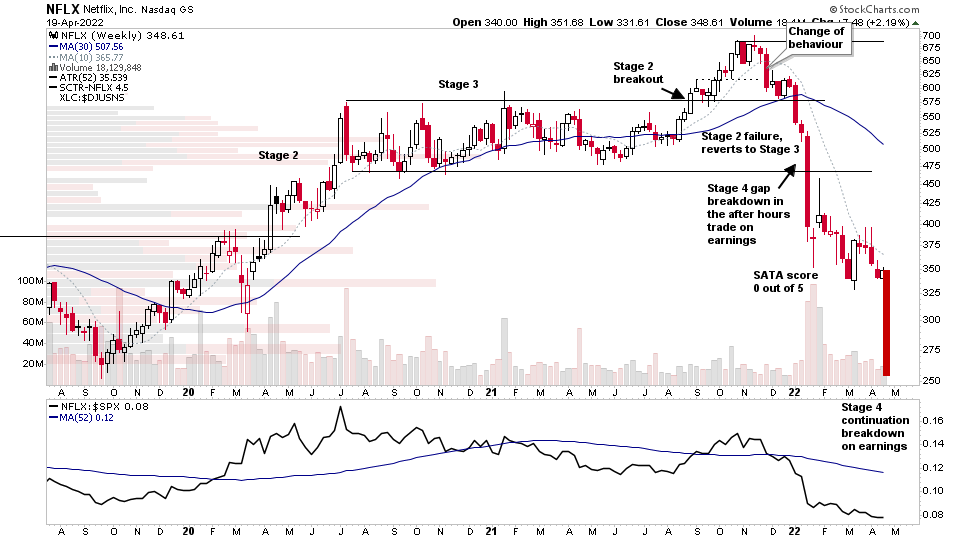

NFLX (Netflix) reacted poorly to it earnings again and made its second large gap down of the year so far. The first of which was on the announcement of the previous earnings. And so it made a Stage 4 continuation breakdown with a massive gap of over -25% in the after hours trade and has now retraced the entire previous Stage 2 advance...

Read More

Blog

18 April, 2022

Stock Market Struggling to Find Direction and the US Stocks Watchlist – 18 April 2022

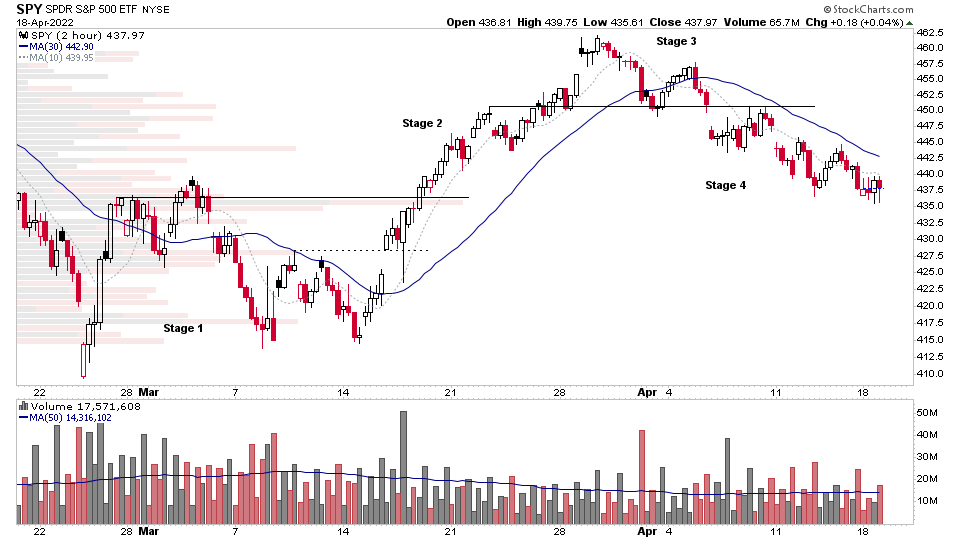

Stage Analysis can be used on multiple timeframes. So one of the best uses of that is to use it to help to determine the short term trend, which can be useful for swing trading purposes, or for fine tuning entry points, as well as general risk management uses...

Read More

17 April, 2022

Stage Analysis Members Weekend Video – 17 April 2022 (1hr 14mins)

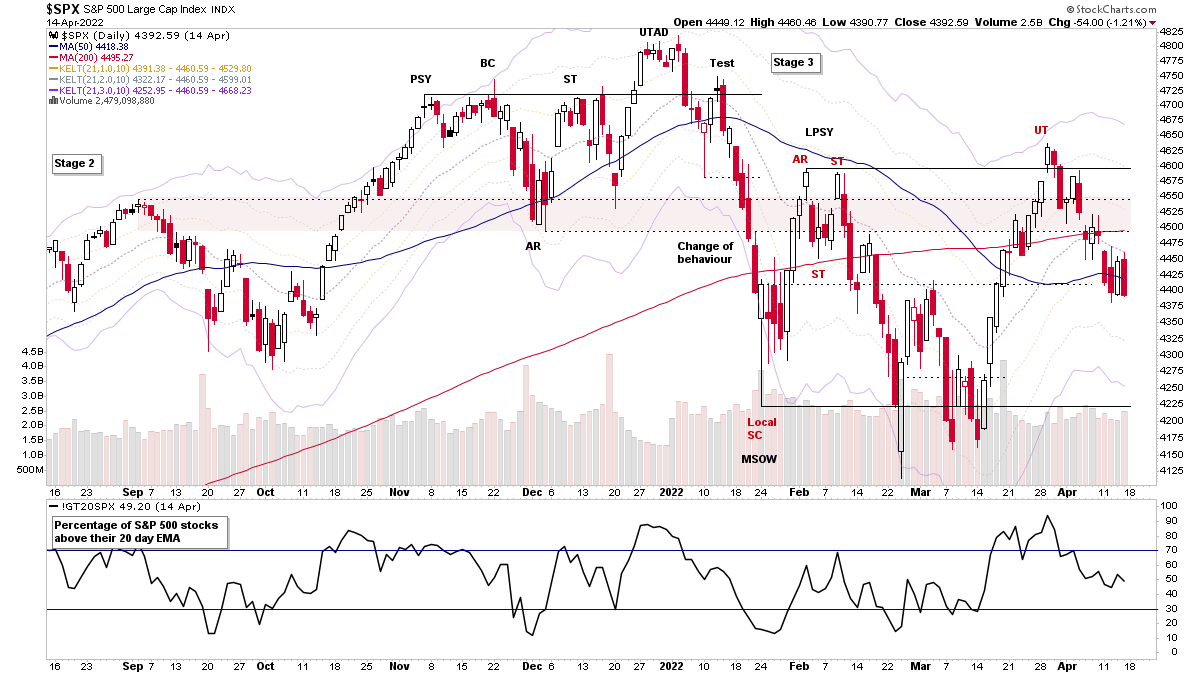

This weekends Stage Analysis Members Video features analysis of the Major US Stock Market Indexes – S&P 500, Nasdaq Composite, Russell 2000 etc, plus a detailed run through of the key Market Breadth charts (with exclusive charts only on Stage Analysis) in order to determine the Weight of Evidence...

Read More

17 April, 2022

US Stocks Watchlist – 17 April 2022

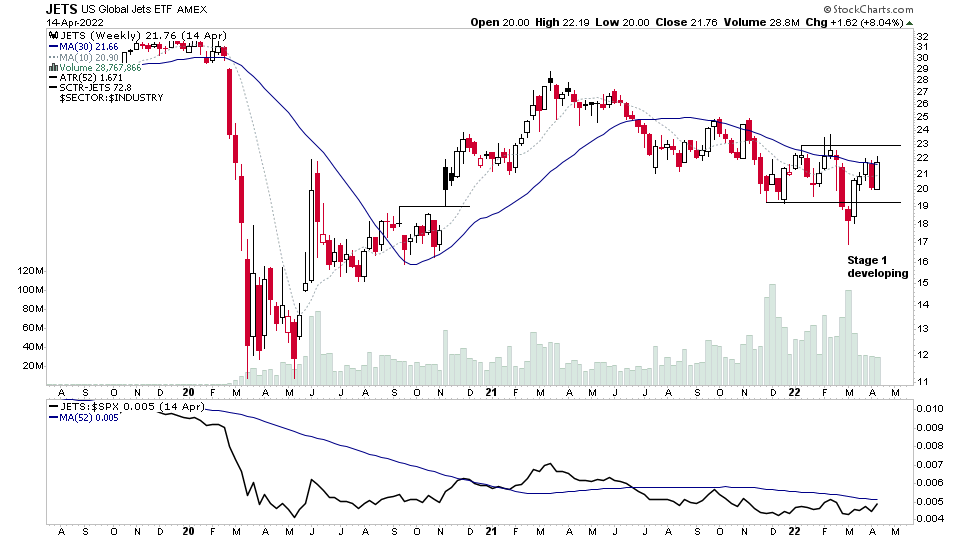

There were 34 stocks for the US stocks watchlist today. JETS, MAR, KBR, UUUU + 30 more...

Read More

15 April, 2022

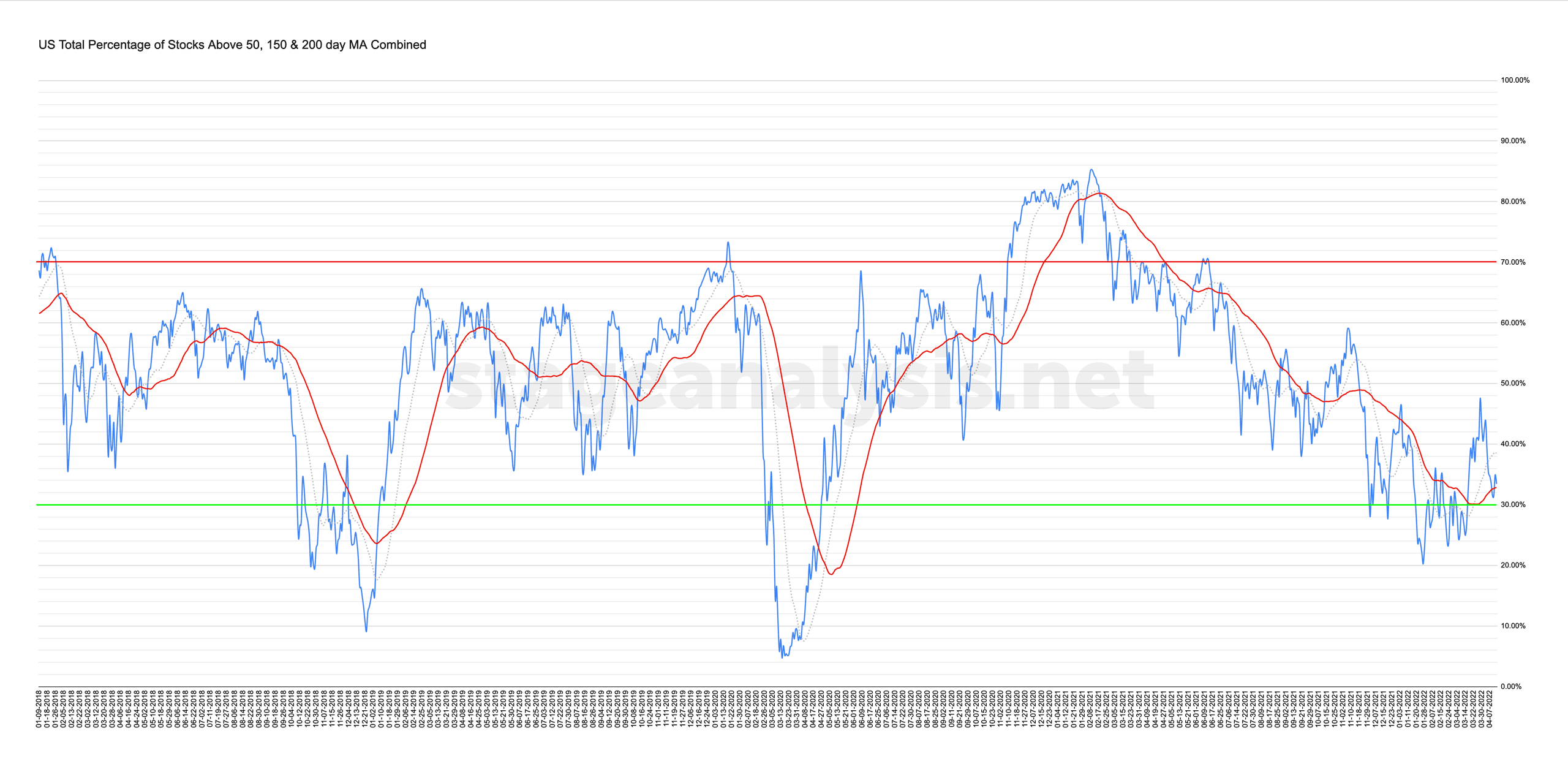

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

15 April, 2022

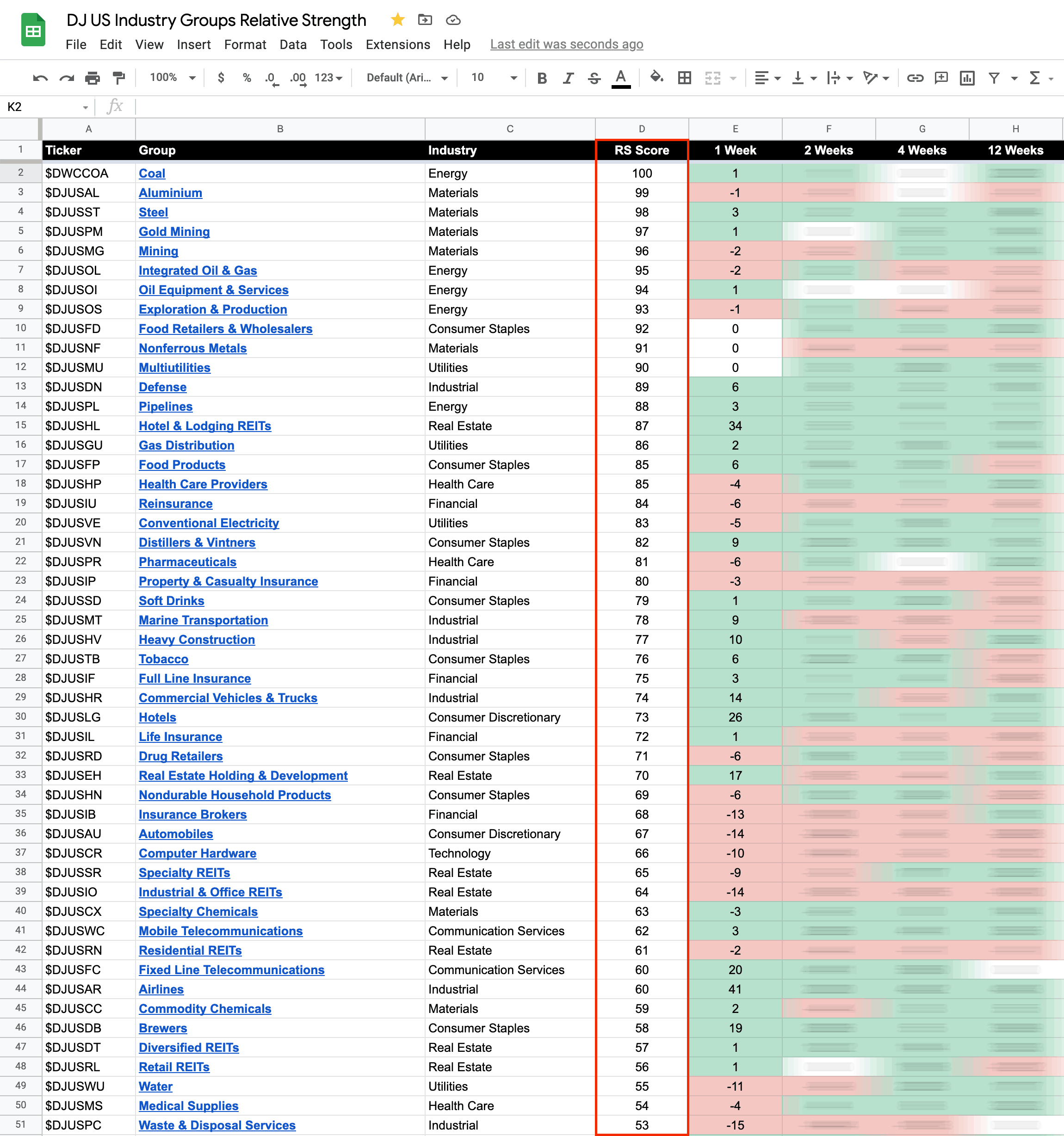

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

14 April, 2022

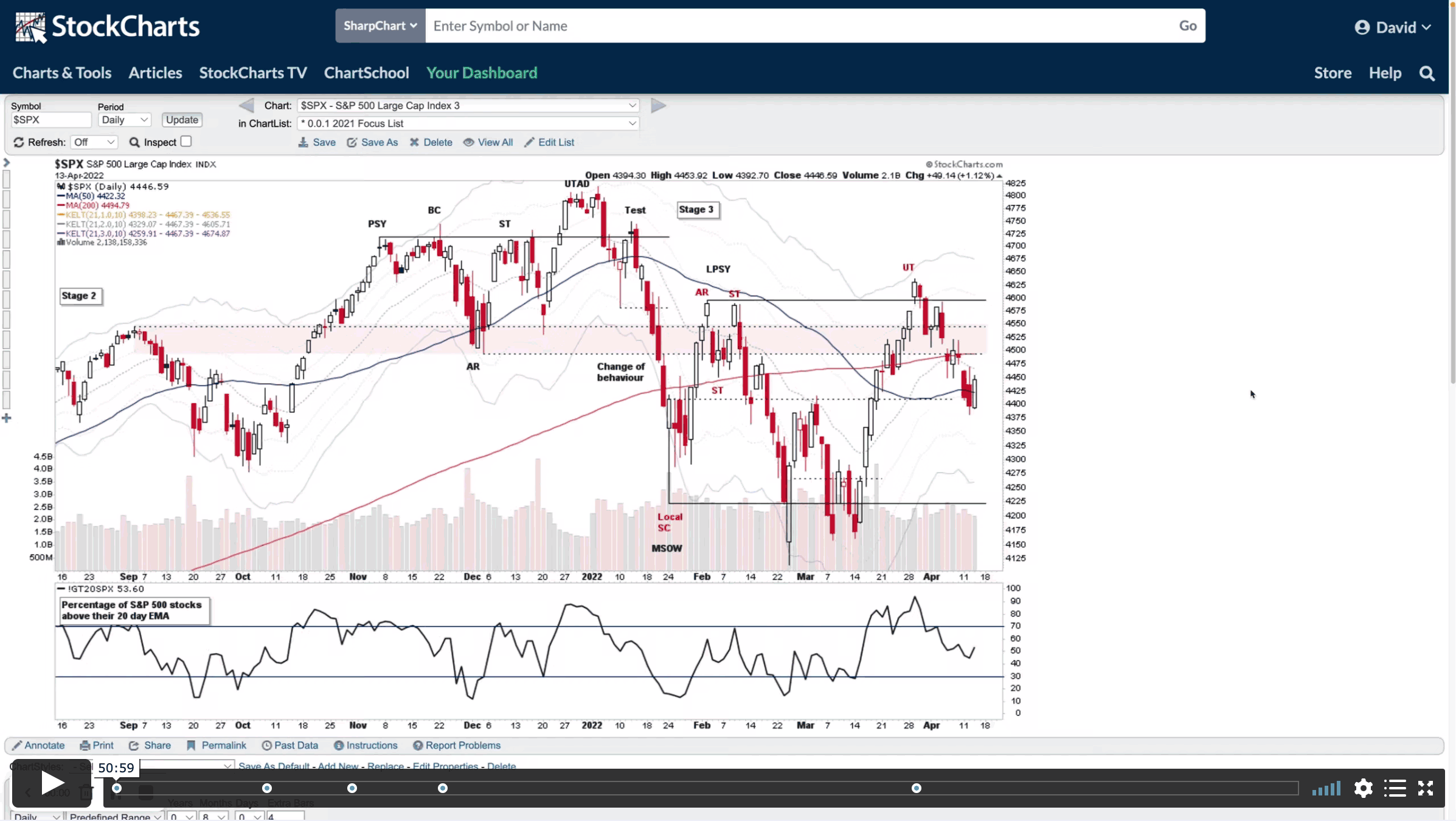

Stage Analysis Members Midweek Video - 14 April 2022 (50 mins)

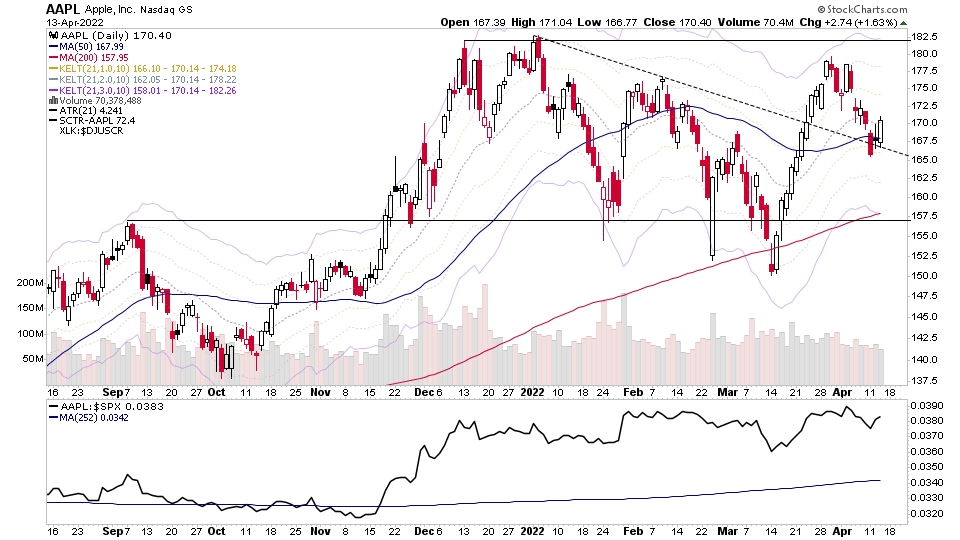

The Stage Analysis Members Midweek Video covers the major indexes, short term market breadth charts, AAPL and TSLA attempts to the hold their short term MAs.The group themes from the last week, and the US watchlist stocks in more detail...

Read More

13 April, 2022

Stock Market Wild Ride Continues – Attempts to Hold Short Term Moving Averages in Key Stocks and the US Stocks Watchlist – 13 April 2022

AAPL closed the day back above both its 50 day MA and the short term 21 day EMA and continues to hold the at top of the most recent down trendline. TSLA also revered back higher through its short term 21 day MA, as did many other stocks today, with a very high reading on the daily scan that I run for that of over 100...

Read More

12 April, 2022

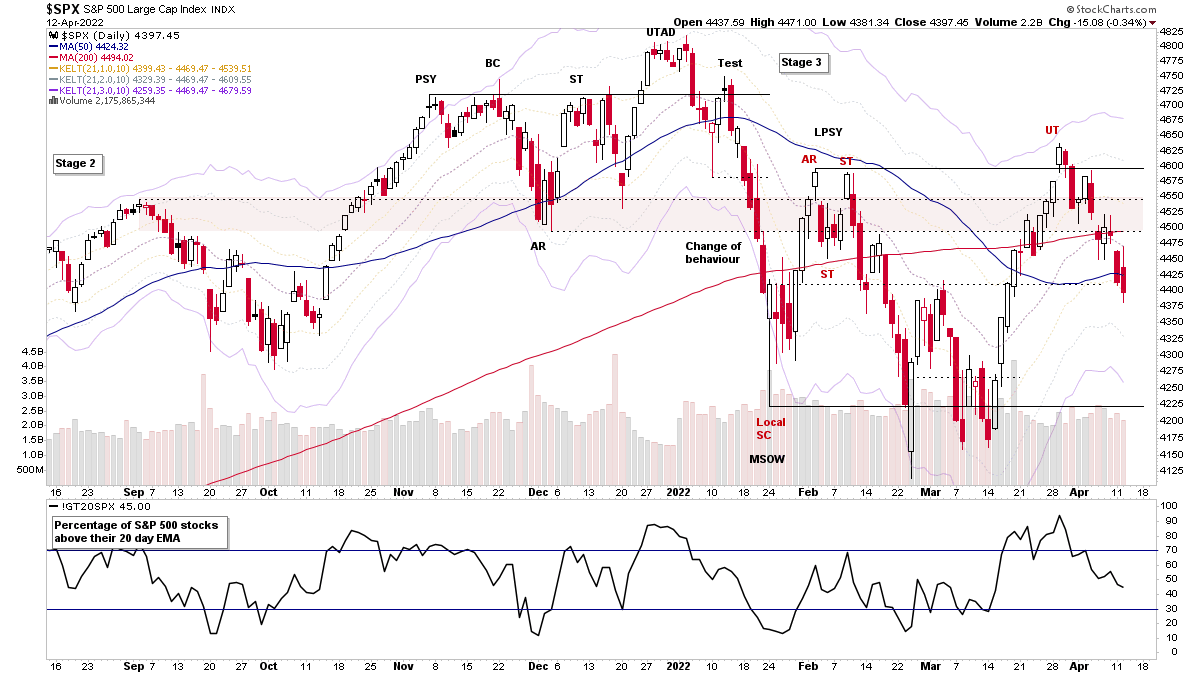

S&P 500 Fails To Hold the 50 Day MA for a Second Day and the US Stocks Watchlist – 12 April 2022

The S&P 500 opened back above the 50 day MA today, but the early enthusiasm soon diminished, and it rolled over at the short term 21 day EMA and turned lower again. Closing the day back below the 50 day MA for a second day and also the -1x ATR(21 day) level...

Read More

11 April, 2022

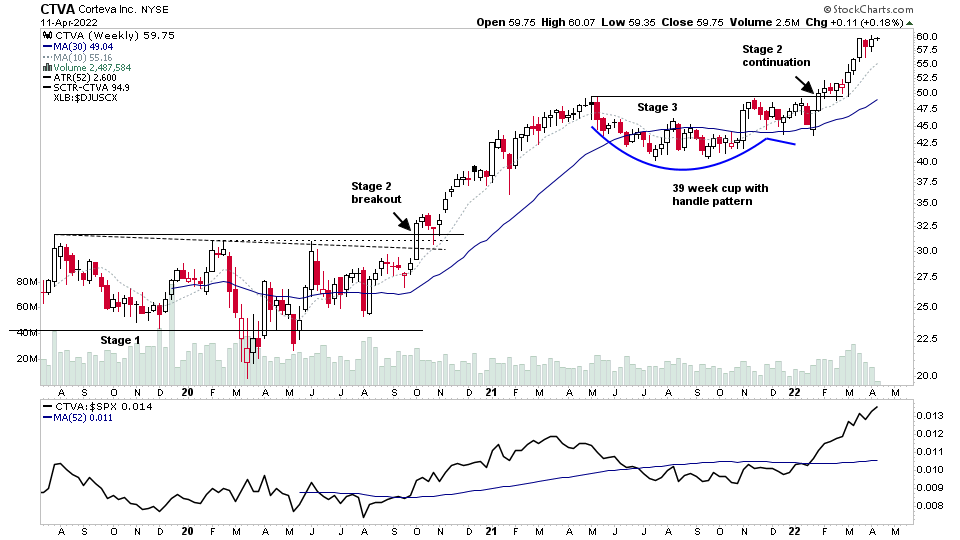

Stock Market Weakness Continues – Plus The US Stocks Watchlist – 11 April 2022

The broad market came under more pressure today, but I thought it would be interesting to focus on some of the weekly charts of the mega cap stocks which are currently struggling in various Phases of Stage 3...

Read More