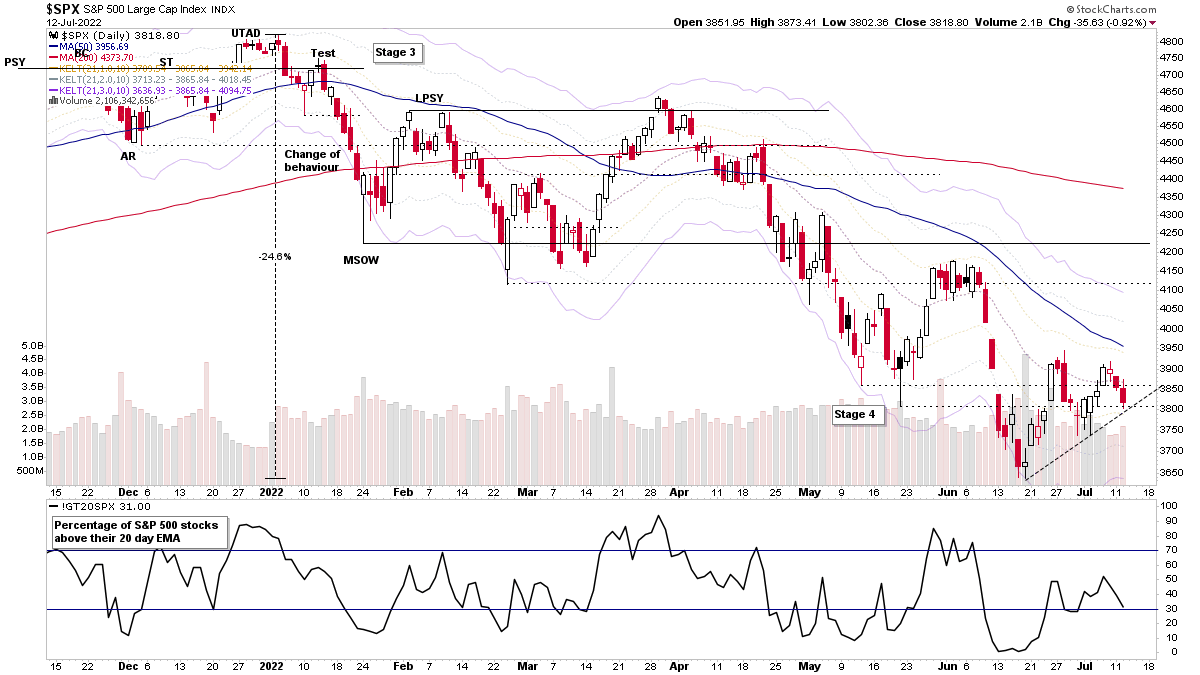

The stock market continues to drift back below the short term moving averages in a flag type pattern ahead of the beginning of earning season, which gets underway on this week with some major financials reporting on Thursday and Friday...

Read More

Blog

12 July, 2022

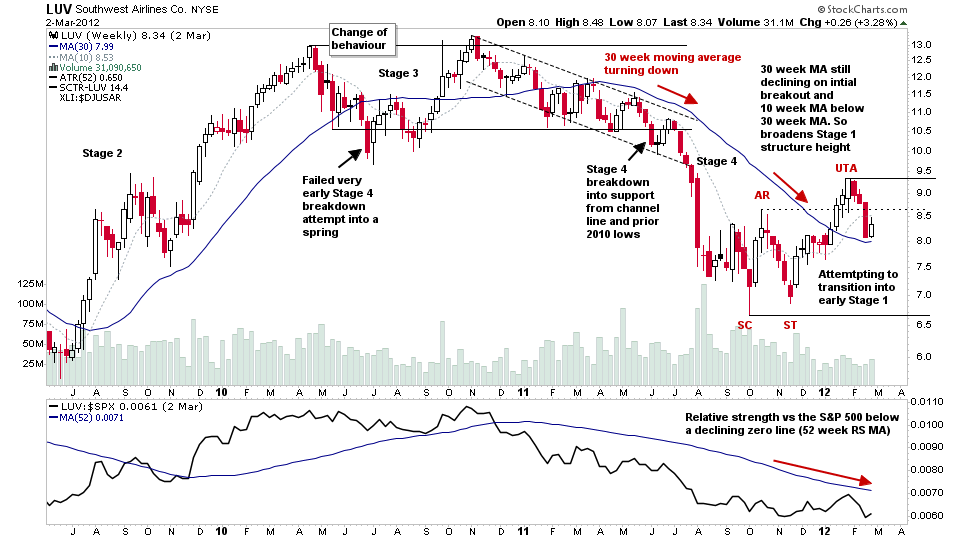

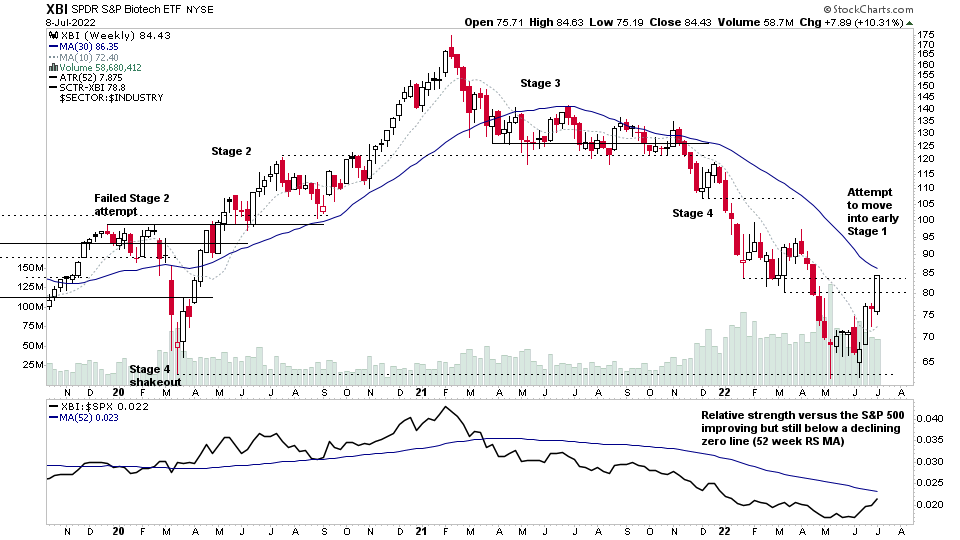

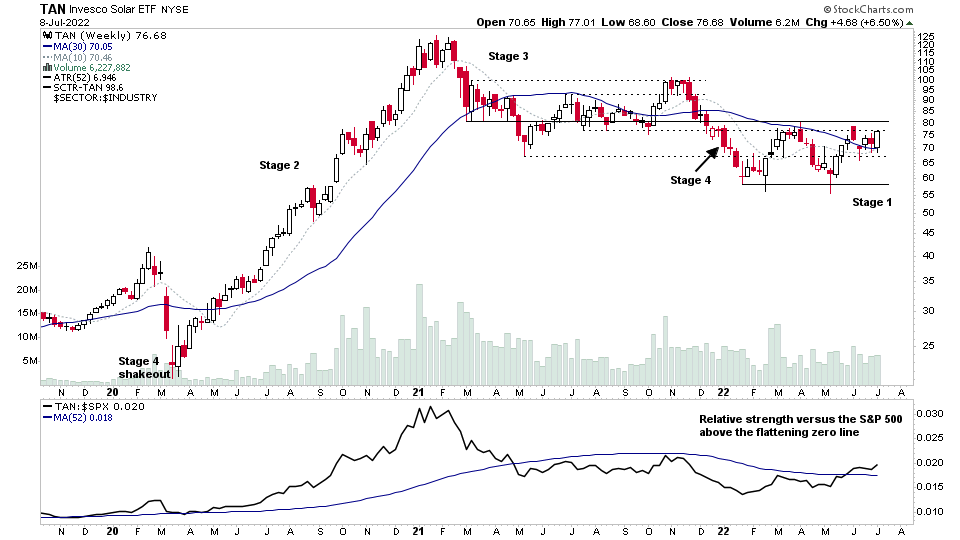

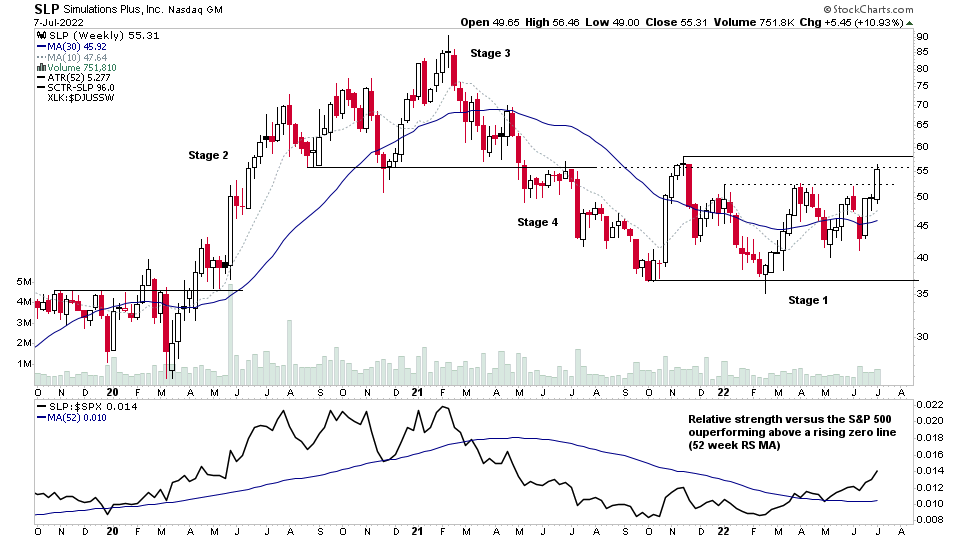

Learn: How Stocks Transition From the Stage 4 Declining Phase to the Stage 1 Basing Phase

One of the hardest aspects of Stan Weinstein's Stage Analysis method is identifying when a stock / etf / index etc is transitioning from one Stage to another. The Stage Analysis Investor method entry points are at the Stage 2 breakout point, and on a successful backup to the Stage 2 breakout following the breakout...

Read More

10 July, 2022

Stage Analysis Members Weekend Video – 10 July 2022 (1hr 39mins)

In this weeks Stage Analysis Members video we look at the in-focus group – Biotechnology, which has been showing a lot of relative strength in the short term as it attempts to rebound from a deep Stage 4 decline back into potential Stage 1, and look at a few of the strongest stocks from the group...

Read More

10 July, 2022

US Stocks Watchlist – 10 July 2022

For the watchlist from the weekend scans...

Read More

09 July, 2022

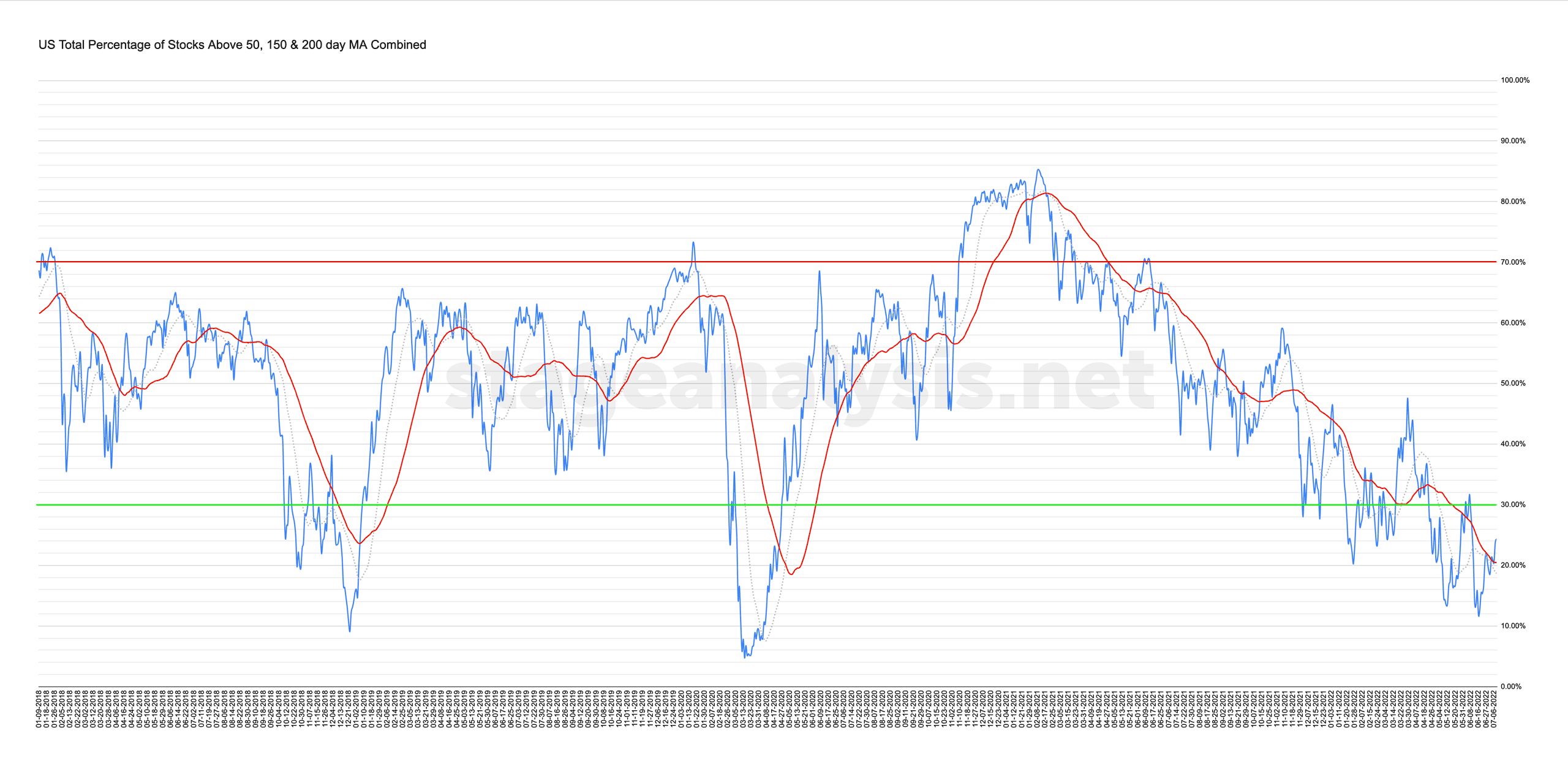

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

09 July, 2022

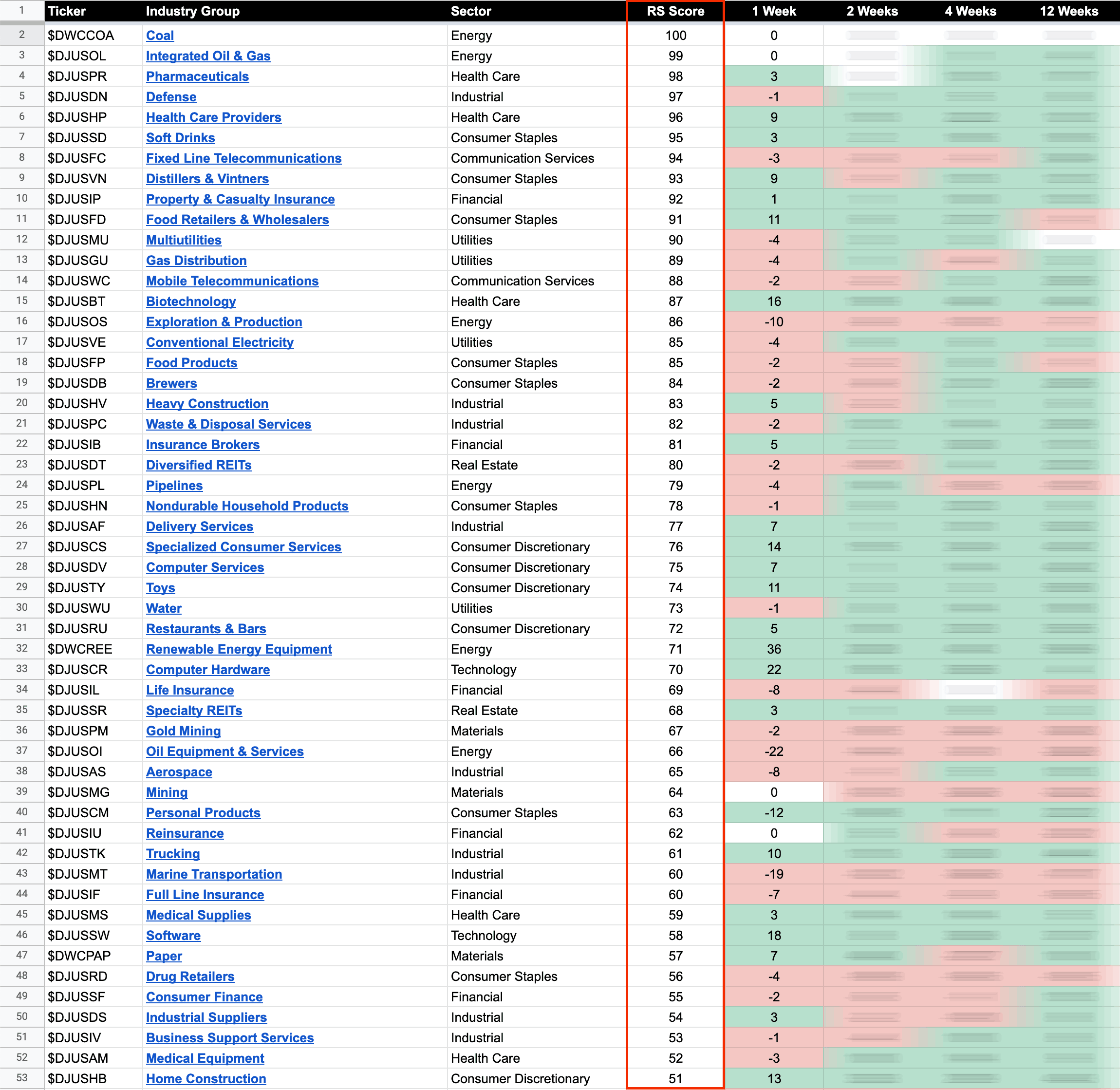

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

07 July, 2022

US Stocks Watchlist – 7 July 2022

For the watchlist from Thursdays scans...

Read More

07 July, 2022

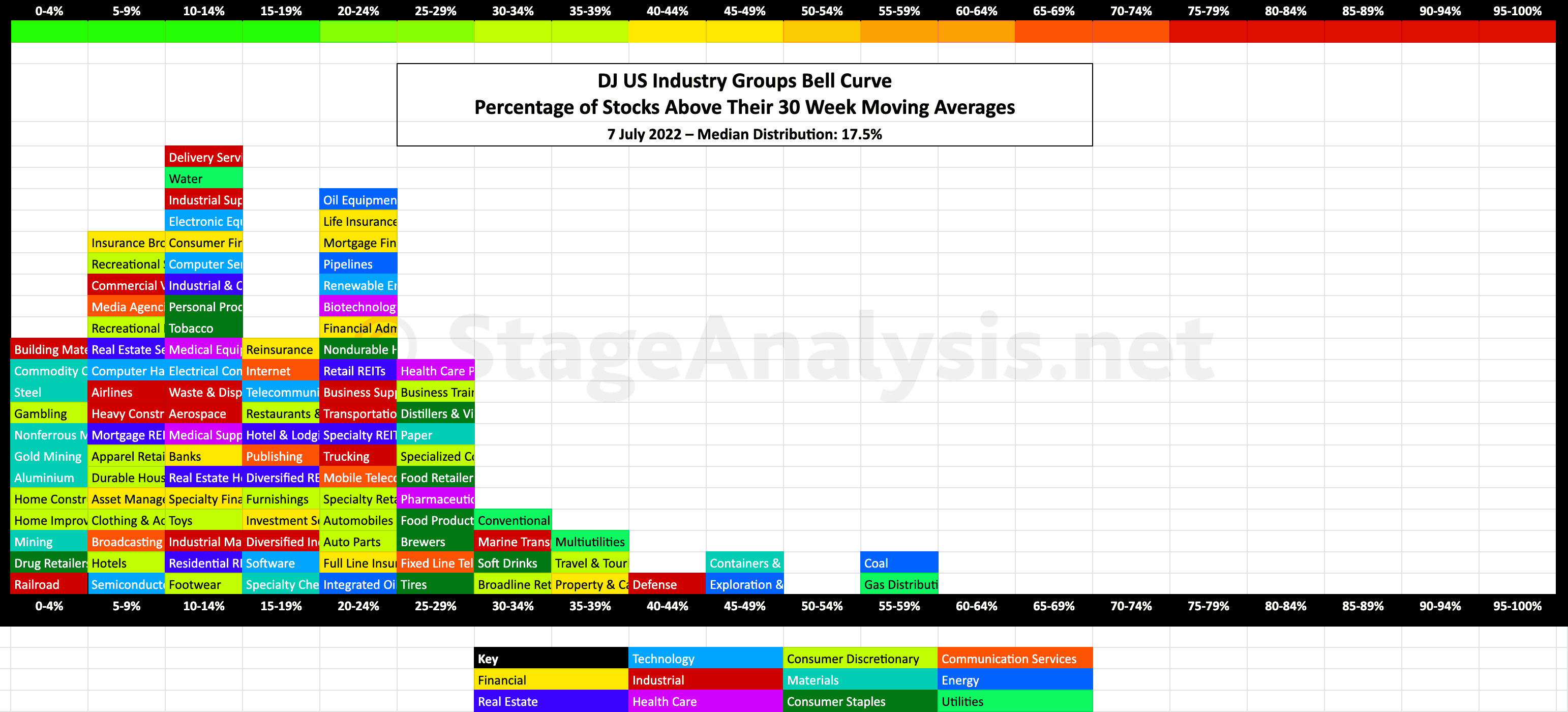

US Industry Groups Bell Curve – Exclusive to Stage Analysis

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart – inspired by the Sector Bell Curve work by Tom Dorsey in his Point & Figure book....

Read More

06 July, 2022

Stage Analysis Members Midweek Video – 6 July 2022 (1hr 21mins)

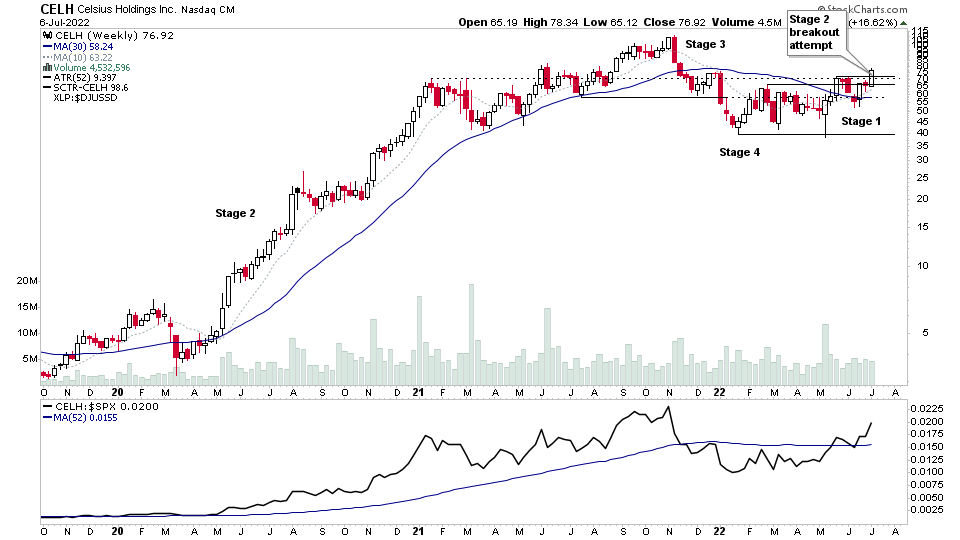

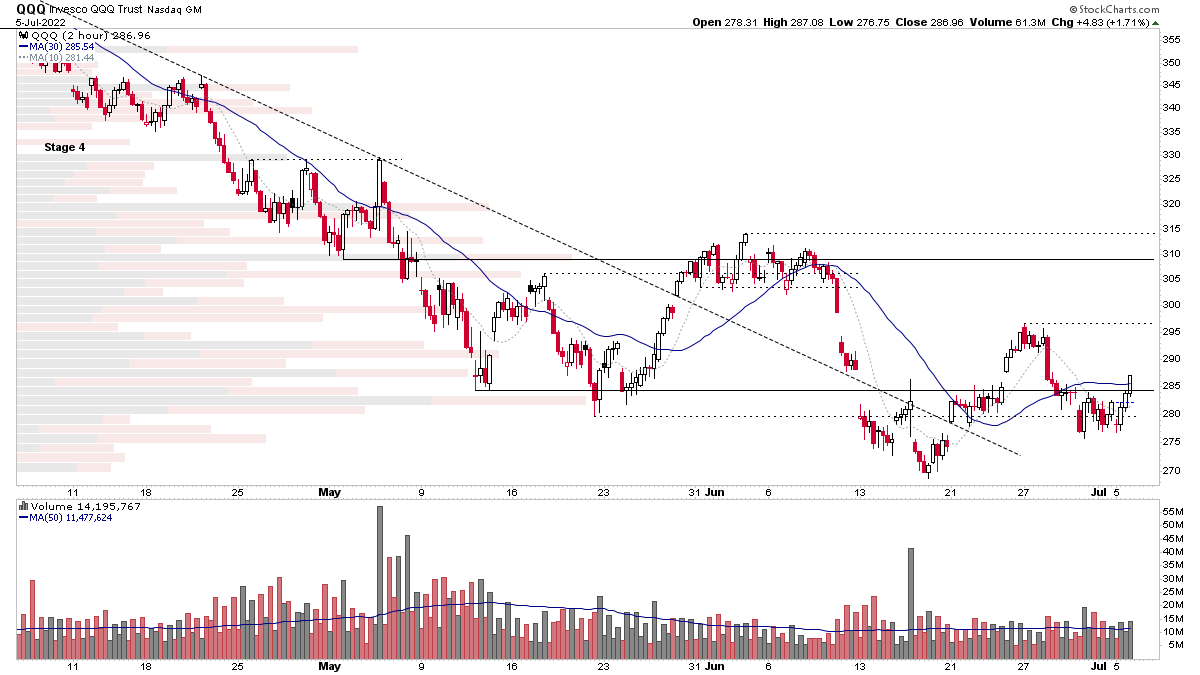

Midweek video covering the Stage 2 breakout attempt in CELH. Plus an In Focus segment on the Biotech (XBI) and Chinese (FXI) ETFs. Followed by the Major Indexes Update – S&P 500, Nasdaq Composite and Russell 2000, and short term Market Breadth charts, and then an in-depth run through of the recent US Watchlist Stocks...

Read More

05 July, 2022

Stock Market Update and US Stocks Watchlist – 5 July 2022

A mixed day in the stock market with the NYSE stocks down while the Nasdaq stocks were up. So rotation was the theme with money flowing out of the stronger RS areas, such as the Coal stocks, with the group chart now approaching its 200 day MA and moving into Stage 3...

Read More