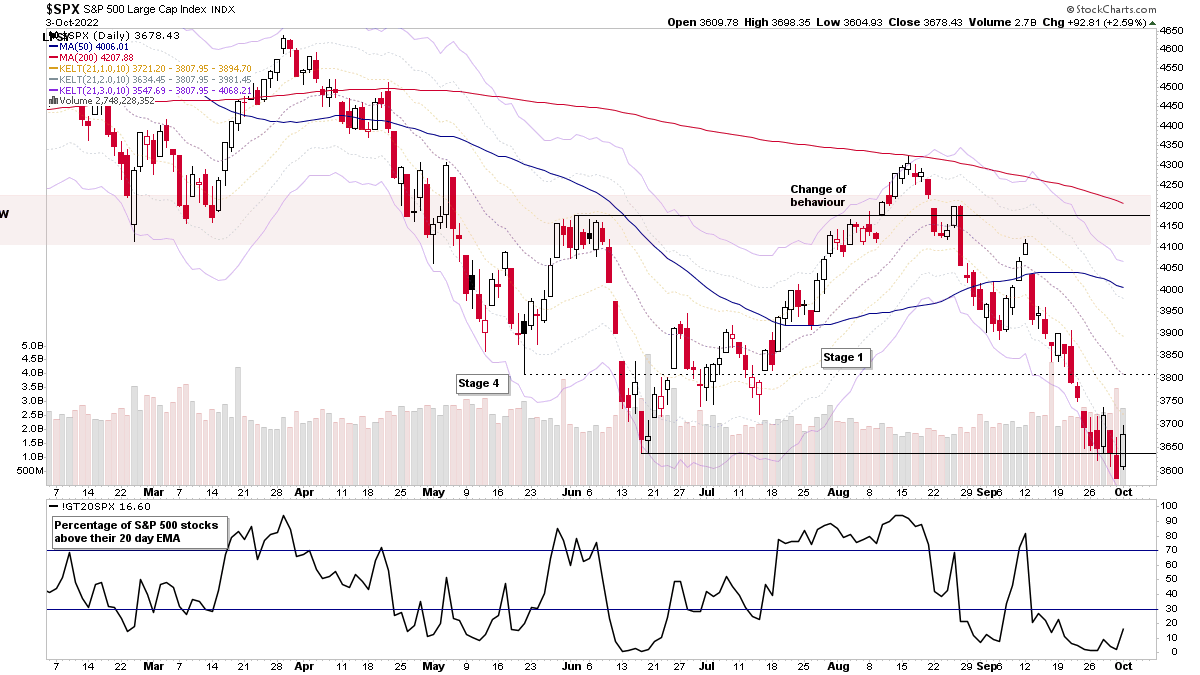

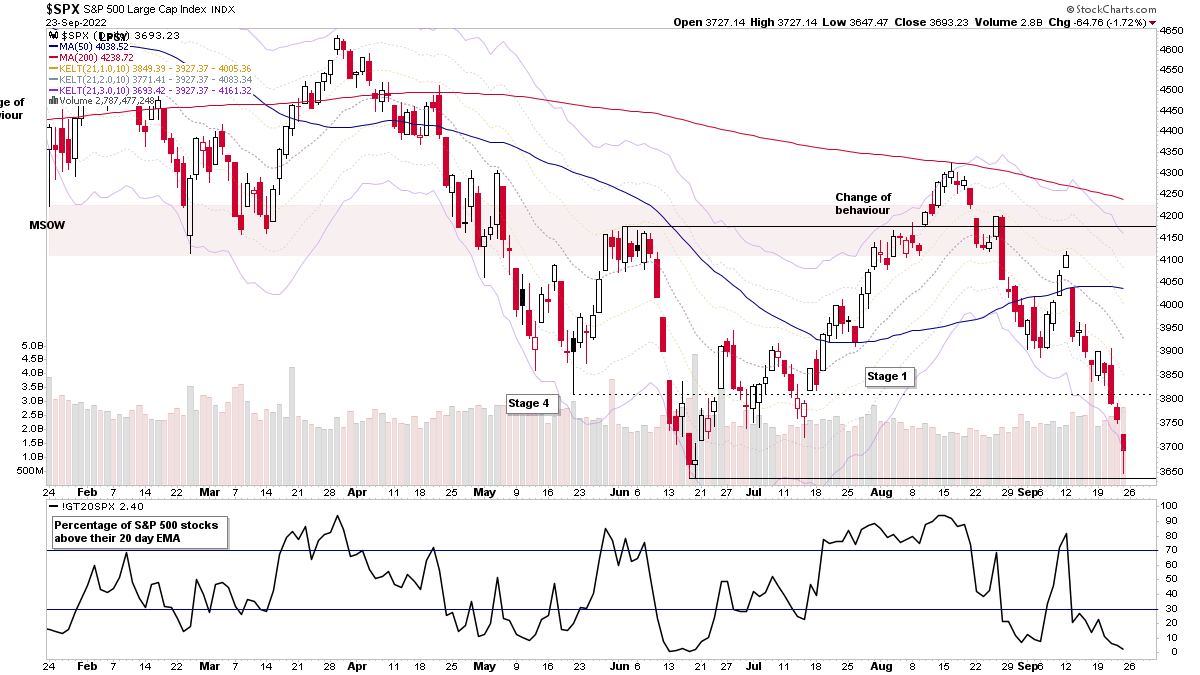

The S&P 500 (shown above) and other major indexes rallied strongly for a second day and the S&P 500 is making a Spring attempt from the lows of the developing range, which may still be potentially a developing Stage 1 base...

Read More

Blog

04 October, 2022

Stock Market Update and the US Stocks Watchlist – 4 October 2022

03 October, 2022

Stage Analysis Members Video and US Stocks Watchlist – 3 October 2022

The (delayed) members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail.

Read More

02 October, 2022

US Stocks Watchlist – 2 October 2022

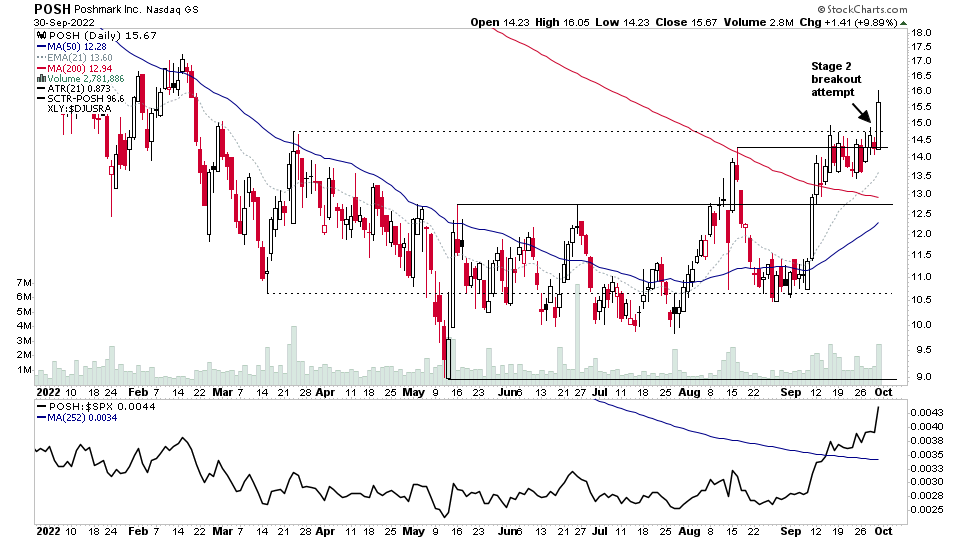

I highlighted the Precious Metals group in the US Stocks Industry Groups Relative Strength Rankings weekend post, and the watchlist scans also picked up a number of stocks from the group potentially transitioning from Stage 4B- towards Stage 1, as the PM group/s had a strong week, while the broad market ended lower breaking down from the recent range...

Read More

02 October, 2022

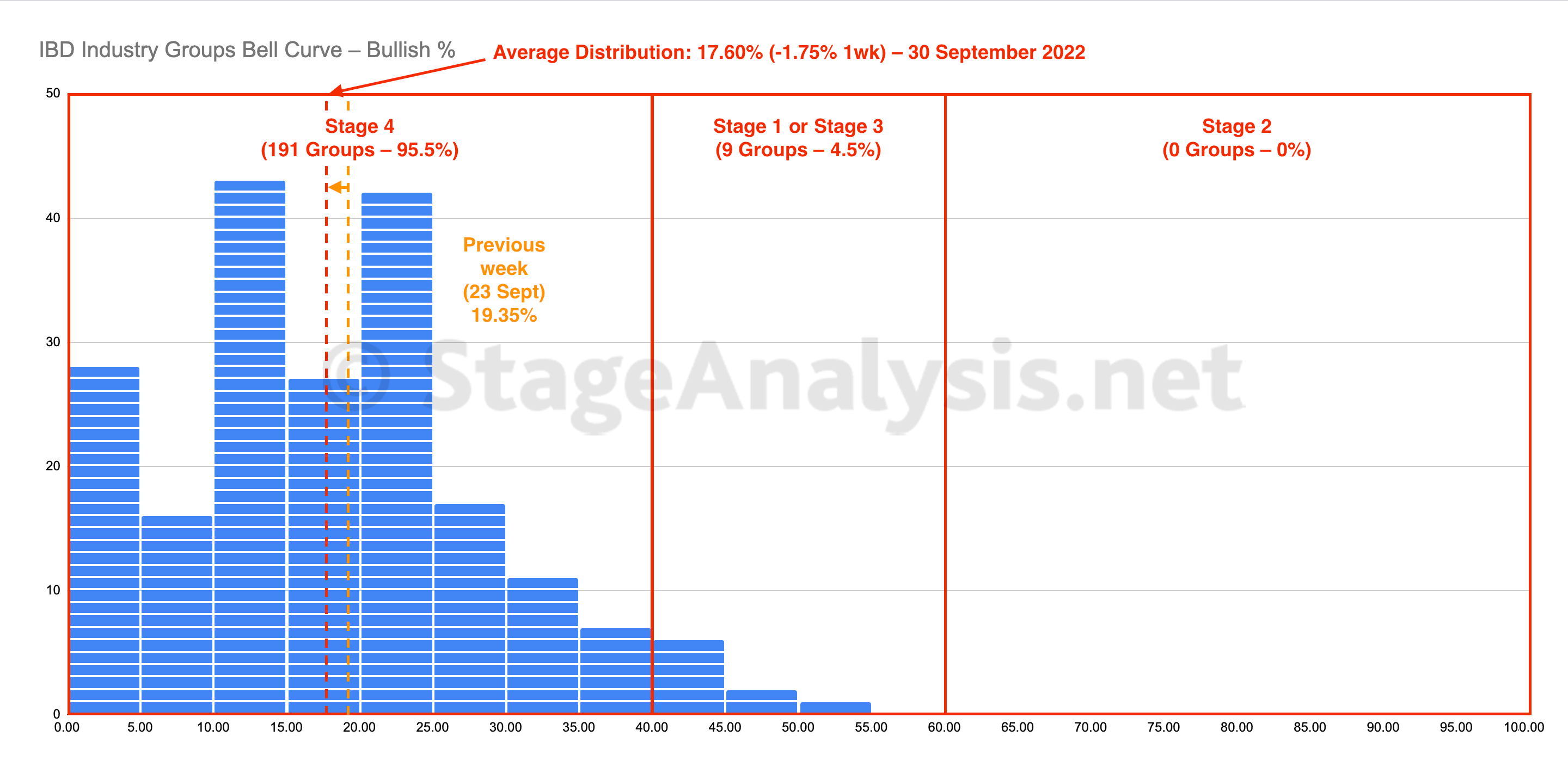

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent closed at a new low for 2022 with the average distribution at an extreme of 17.60%, which was a further decline of -1.75% on the previous week and has surpassed the 18.81% low set on June 17th...

Read More

02 October, 2022

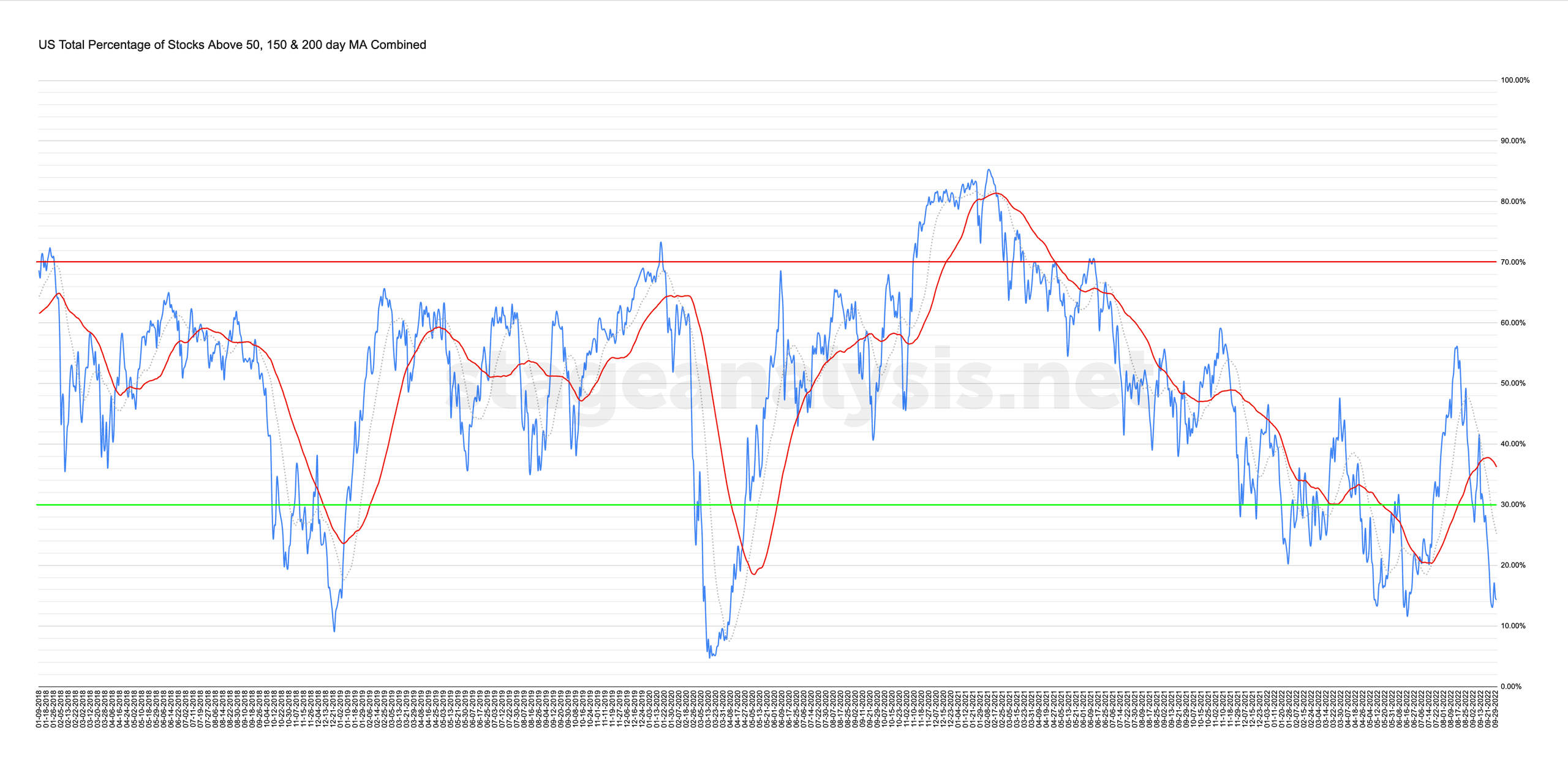

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

01 October, 2022

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

28 September, 2022

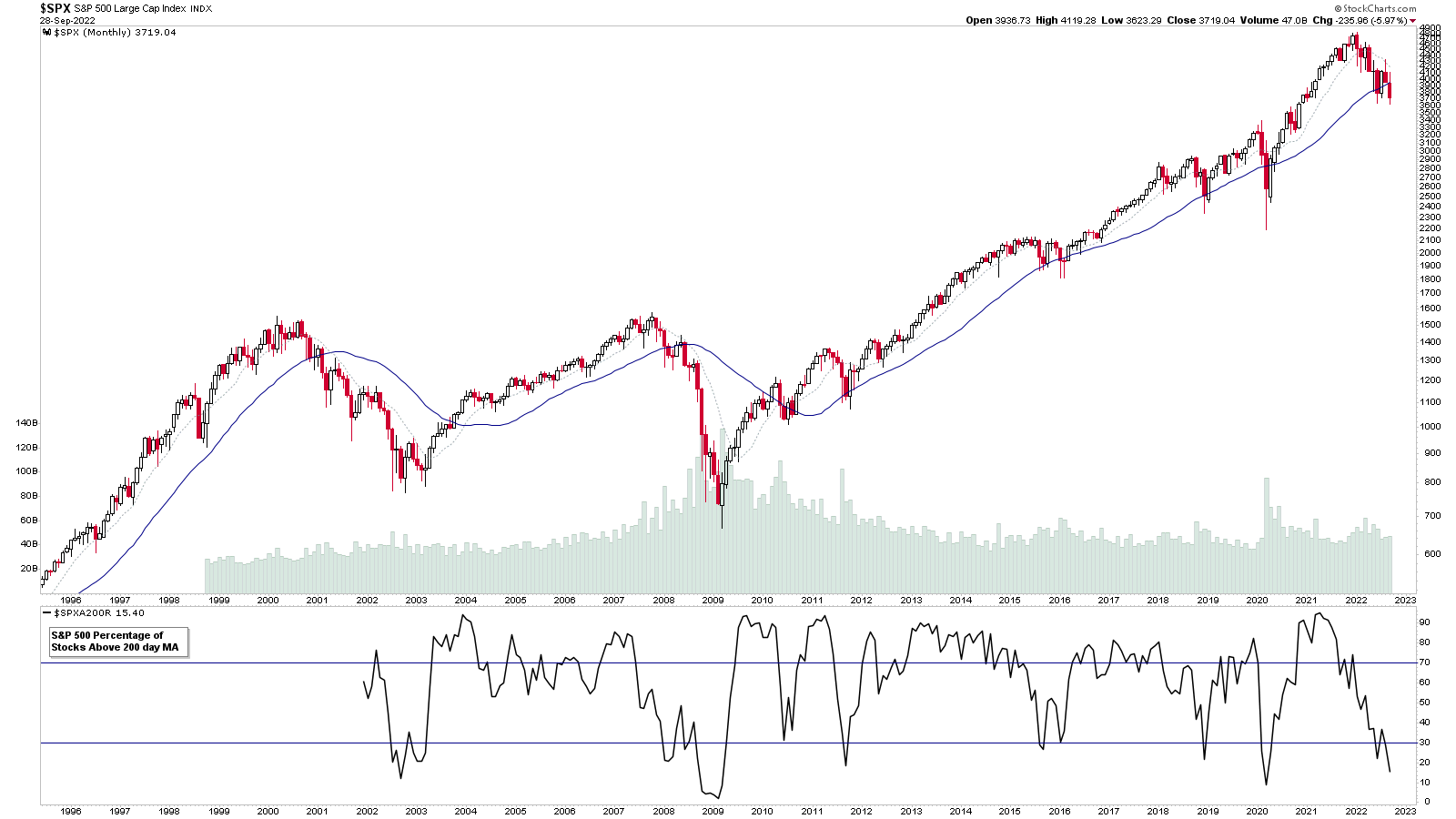

Stage Analysis Members Midweek Video – 28 September 2022 (59mins)

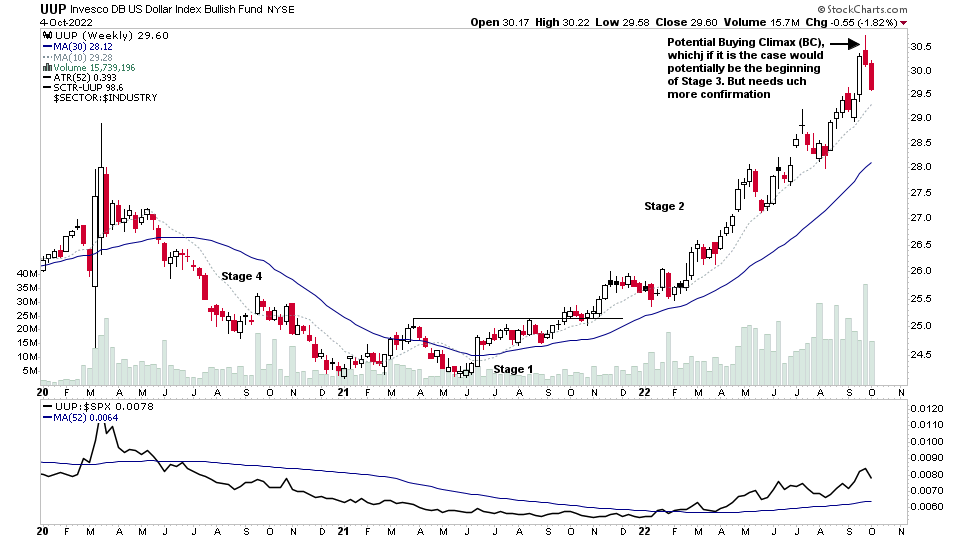

Midweek video reviewing the S&P 500 on multiple timeframes, including the 25 year monthly chart with breadth. Plus the VIX and Dollar Index and short-term market breadth. And finally going through some of the watchlist stocks and some additions from todays scans.

Read More

28 September, 2022

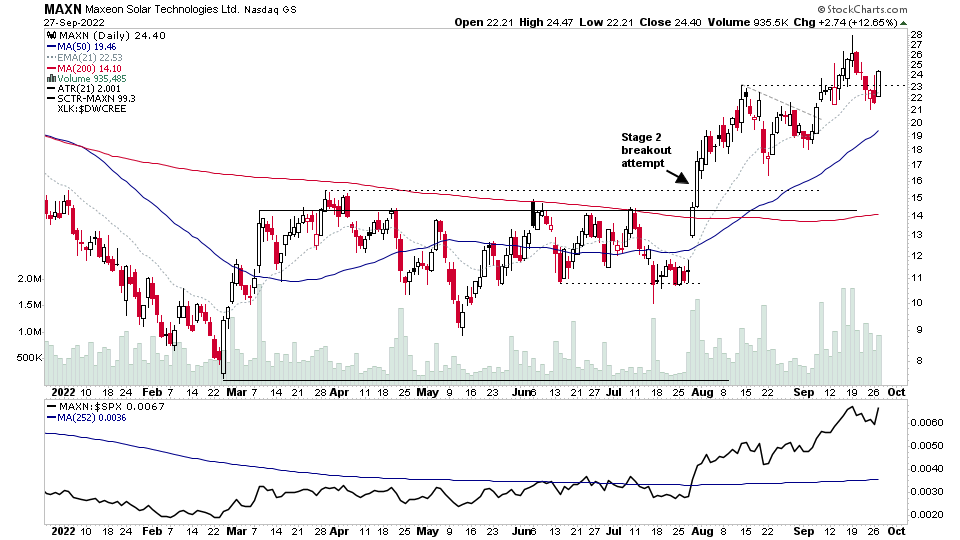

US Stocks Watchlist – 27 September 2022

The market attempted to bounce today with a typical characteristic of bear markets of the higher open that then gets sold into. However, the market failed to close below the June low, and ended slightly off the bottom of the range, with many stocks in similar positions, with three days of consolidation around the lows of their bases...

Read More

26 September, 2022

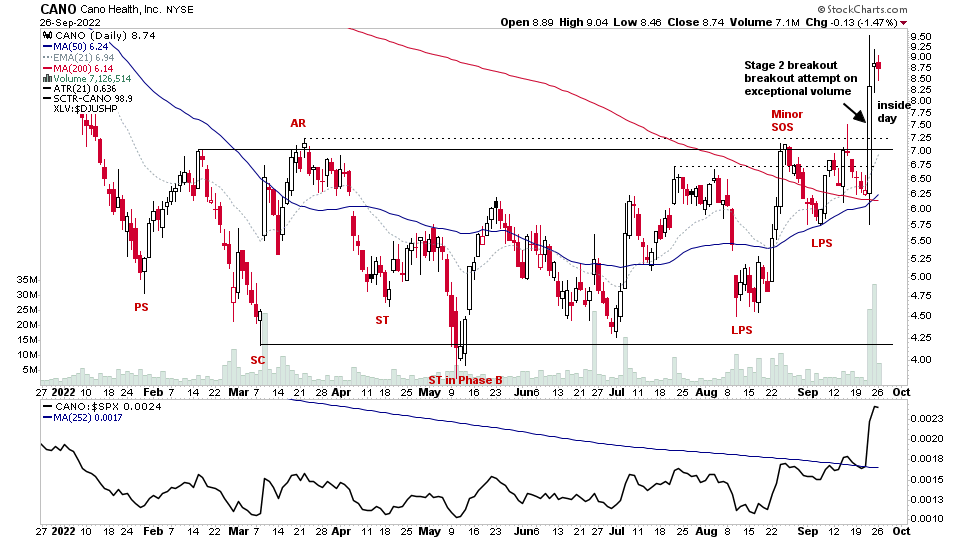

US Stocks Watchlist – 26 September 2022

The daily scans remain muted with the current market environment, and with the market position where it is (see intraday S&P 500 chart above), there are numerous stocks testing the lower end of their recent ranges, and lots making Stage 4 continuation breakdown attempts...

Read More

25 September, 2022

Stage Analysis Members Weekend Video – 25 September 2022 (1hr 5mins)

The regular members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail...

Read More