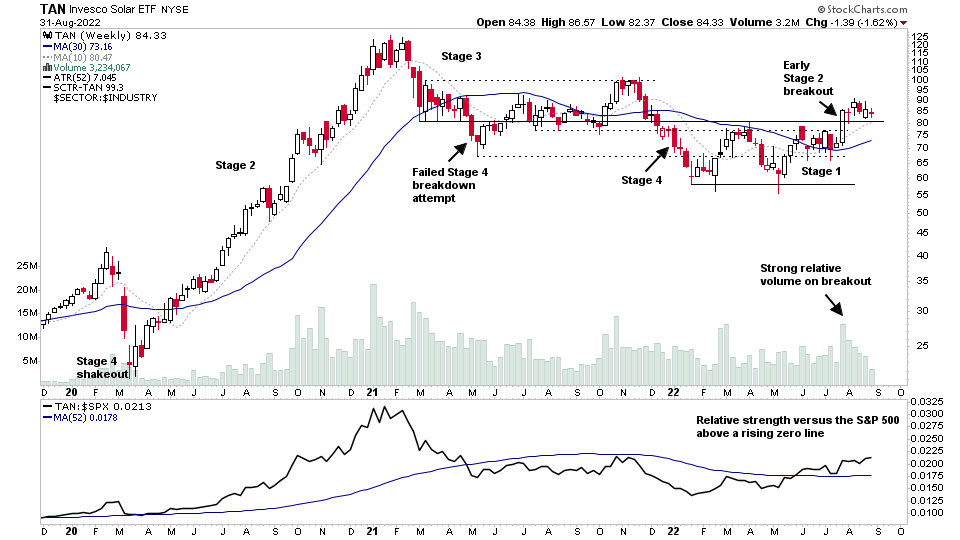

The Stage Analysis Members midweek video begins with a special group focus on the leading Renewable Energy stocks including TAN, ENPH, FSLR, ARRY, CSIQ, MAXN and others from the group...

Read More

Blog

30 August, 2022

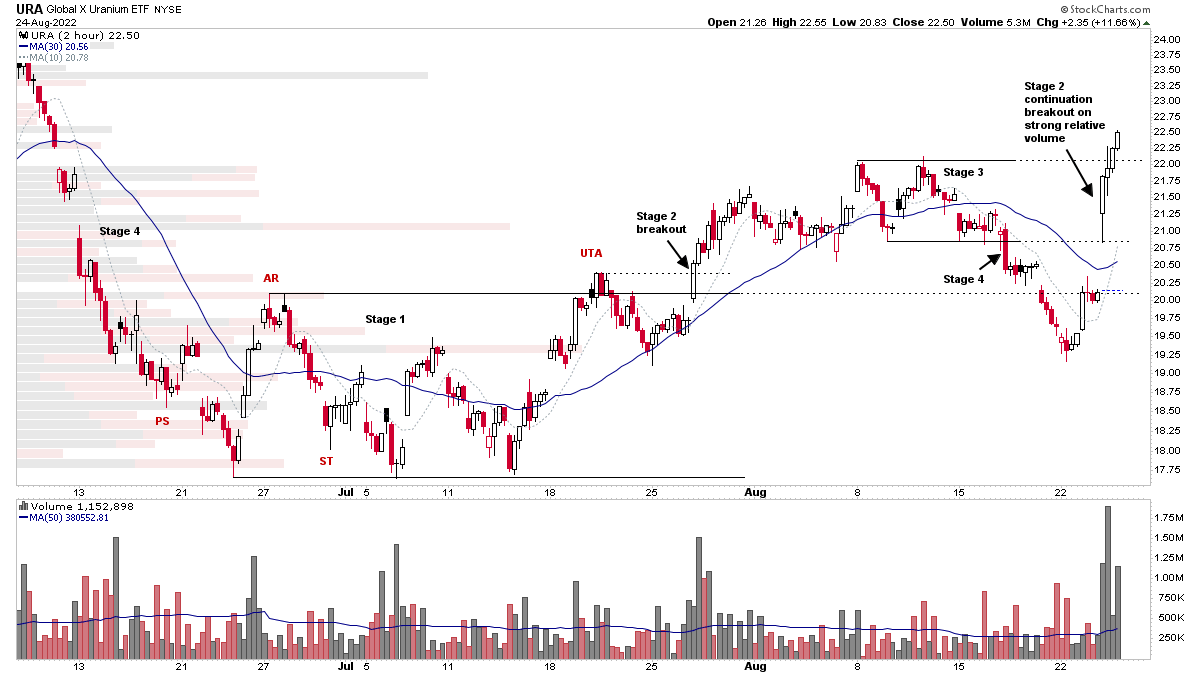

Uranium Stocks Attempting to Breakout and the US Stocks Watchlist – 29 August 2022

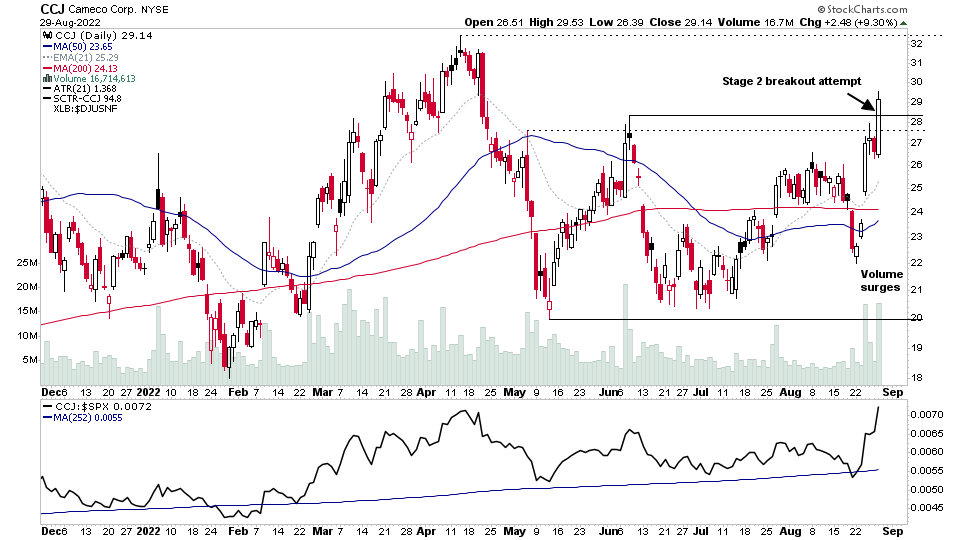

Uranium group stocks and ETFs were a major area of interest today, with multiple stocks from the group breaking out from base structures potentially into early Stage 2, although not yet clear from overhead resistance – i.e. CCJ, LEU, UUUU, URNM.

Read More

28 August, 2022

Stage Analysis Members Weekend Video – 28 August 2022 (1hr 32mins)

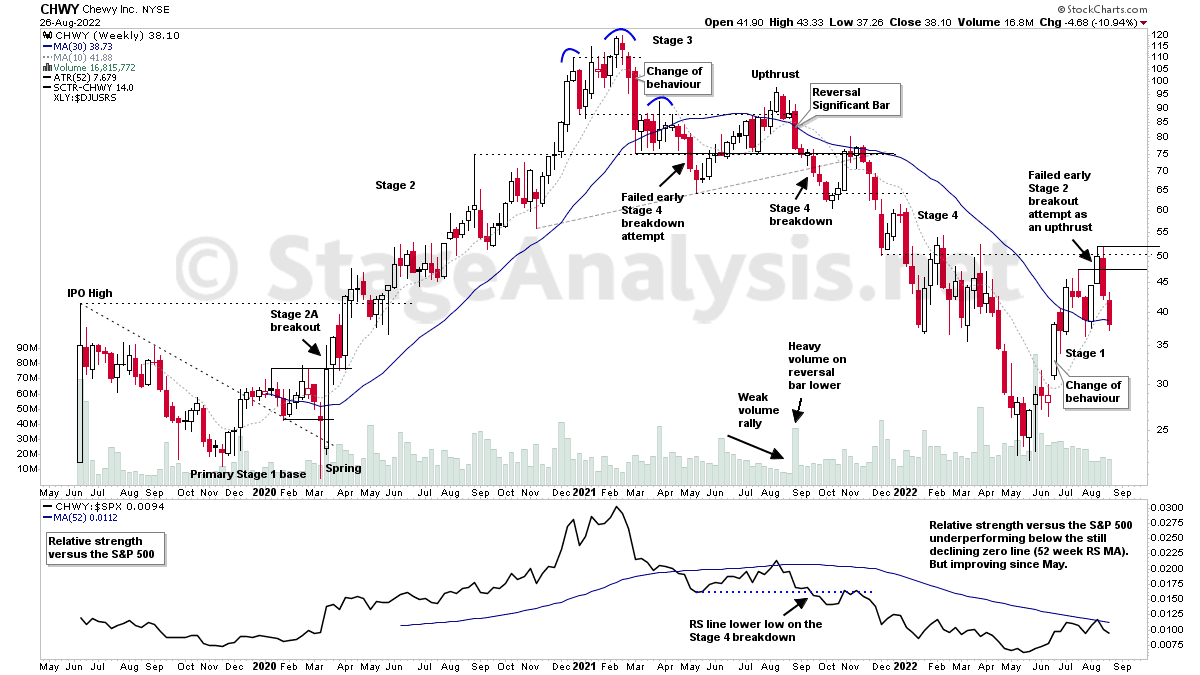

This weekends videos begins with an educational feature on the full Stage Analysis cycle from Stan Weinstein's method, discussing the entire four stages since the IPO in CHWY, and the multiple failed attempts to change Stage that is often seen. As real life is not like the textbooks...

Read More

28 August, 2022

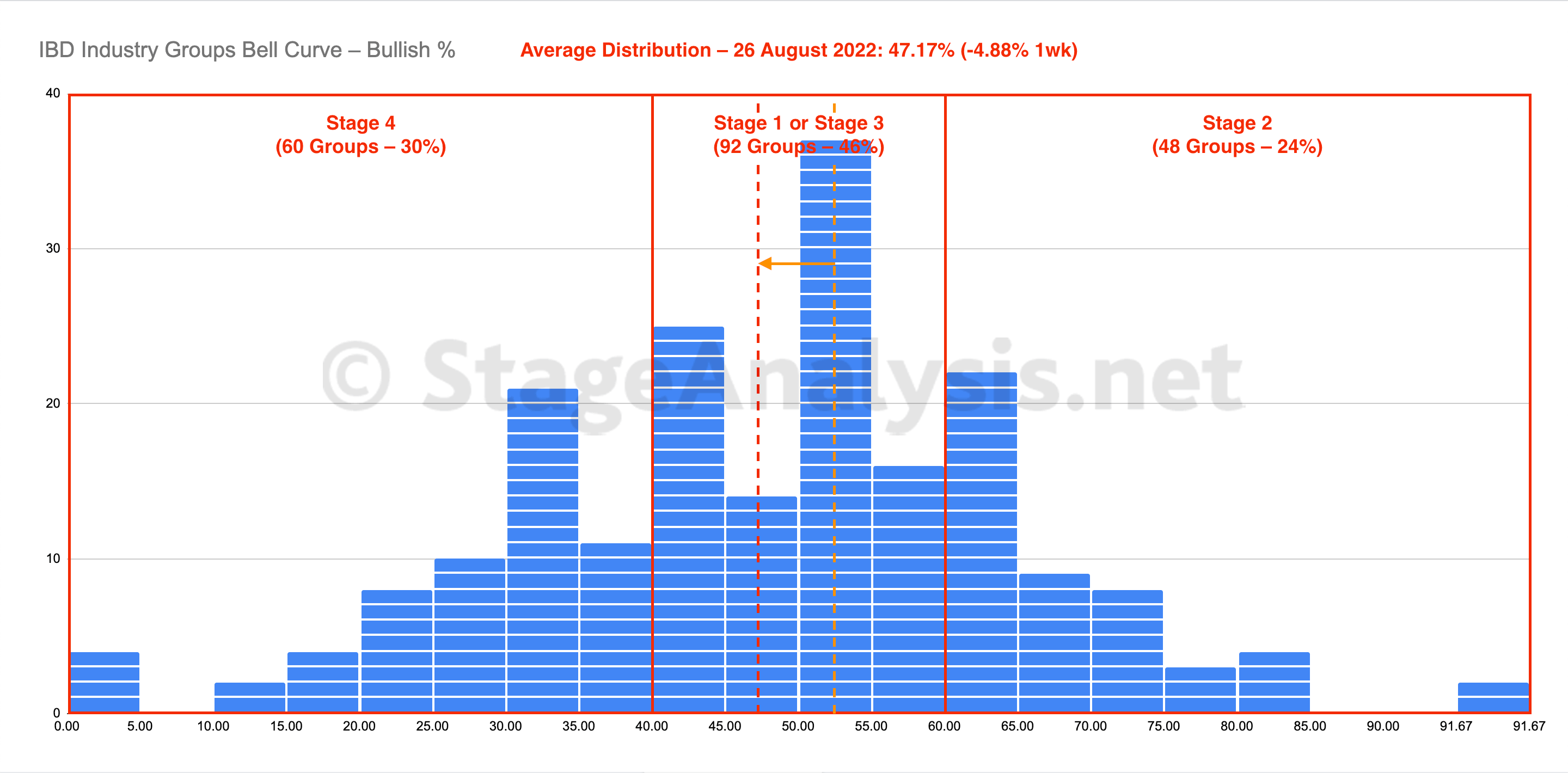

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent average distribution declined by a further -4.88% since the previous week, with 16 groups dropping out of the Stage 2 zone and 21 groups dropping back into the Stage 4 zone...

Read More

27 August, 2022

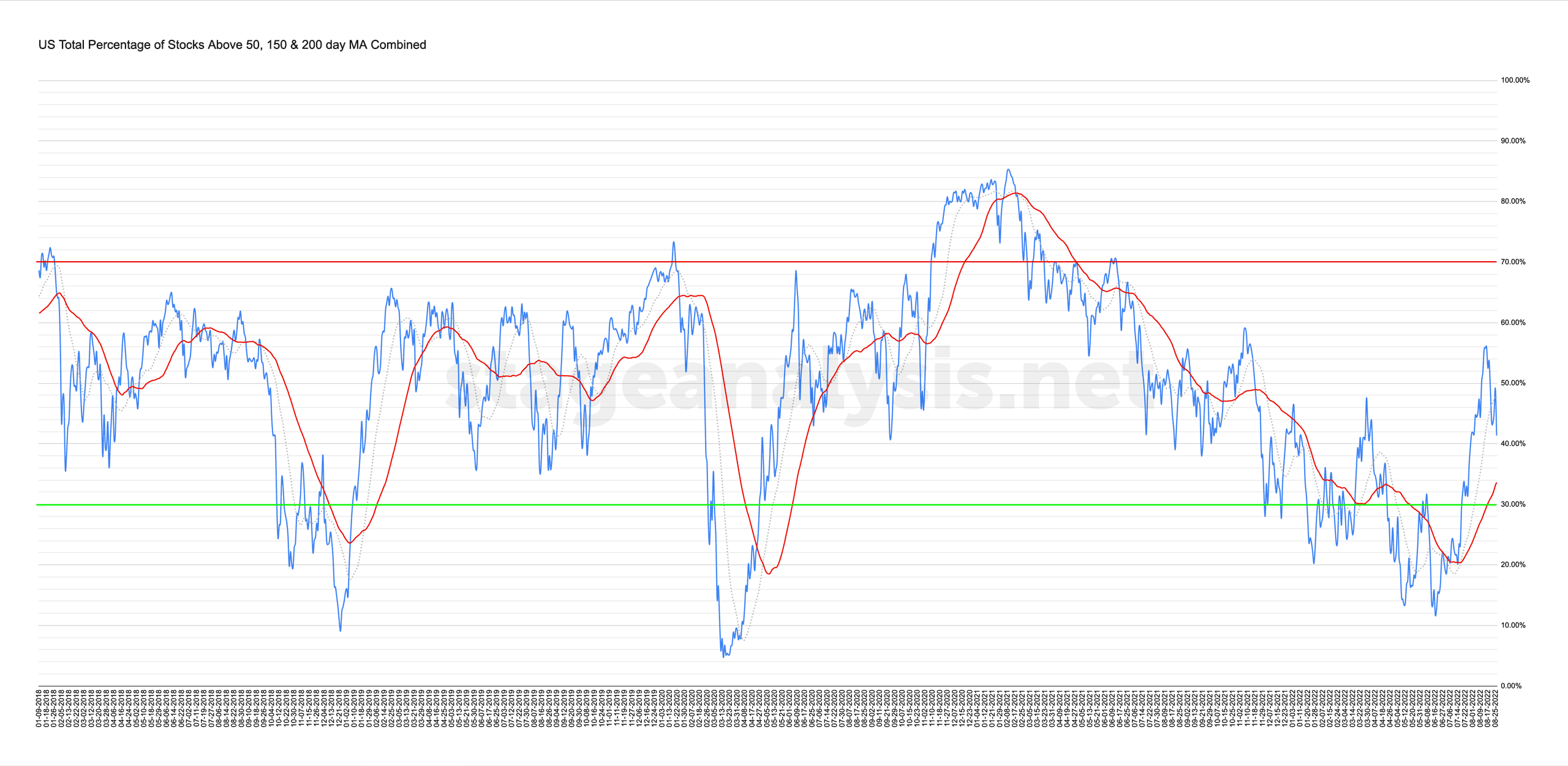

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

26 August, 2022

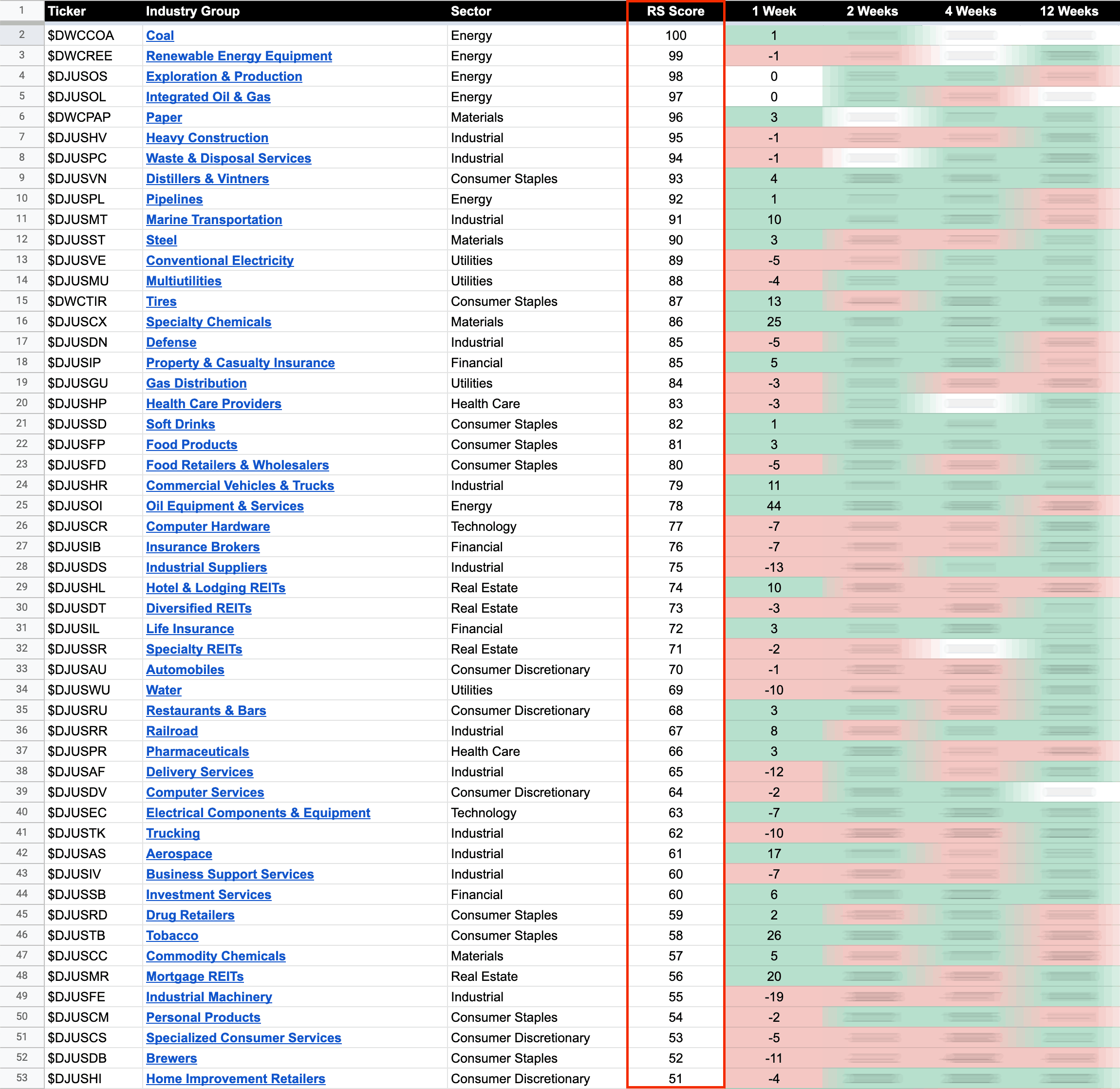

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

26 August, 2022

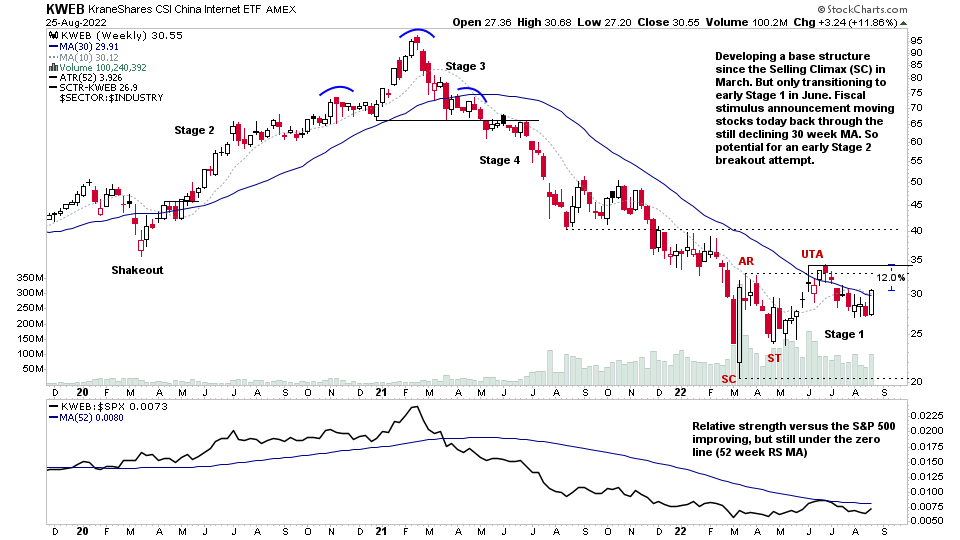

Chinese Stocks Proliferate in Stage 1 Bases and the US Stocks Watchlist – 25 August 2022

Chinese stocks have surged back into focus today with gap up moves in numerous stocks within developing weekly Stage 1 base structures in the group, that have been forming in some stocks for as much as 8 months+, after huge Stage 4 declines through 2021 across the group...

Read More

24 August, 2022

Stage Analysis Members Midweek Video – 24 August 2022 (1hr)

Todays Stage Analysis Members Video begins with a focus on the Uranium group, which formed a Sign of Strength bar in multiple stocks in the group today with strong relative volume, pushing the group towards the upper end of the recent base structure that's been developing as potential Stage 1. So there's a possibility that the group could attempt an early move Stage 2.

Read More

23 August, 2022

Stock Market Update and US Stocks Watchlist – 23 August 2022

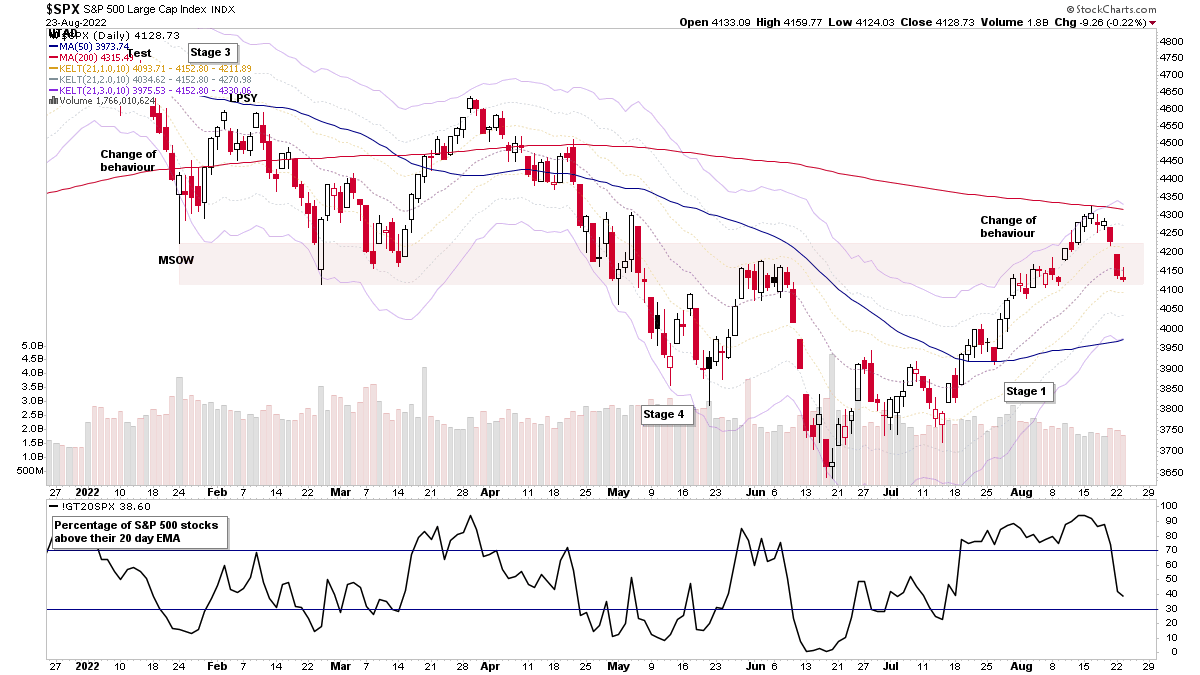

The major indexes, i.e. the S&P 500, Nasdaq, Russell 2000 etc, all continued to pullback today with a weak failed attempt to regain the 21 day EMA and then poor close near the bottom of the daily candle. So all had a second daily close below the 21 day EMA and the short-term market breadth indicators, such as the S&P 500 percentage of stocks above their 20 day EMA (which can be seen in the top chart), continued lower also and closed at 38.60%.

Read More

23 August, 2022

US Stocks Watchlist – 22 August 2022

Renewable Energy Equipment was big feature in tonights watchlist, as multiple stocks in this leading group are pulling back towards short-term MAs, and so could be near to actionable areas if the market doesn't fall apart that is...

Read More