A relatively small list tonight following todays weak market action, but I wanted to highlight a few after-hours movers following earnings results, plus a couple of other stocks from the scans.

Read More

Blog

16 February, 2023

US Stocks Watchlist – 16 February 2023

15 February, 2023

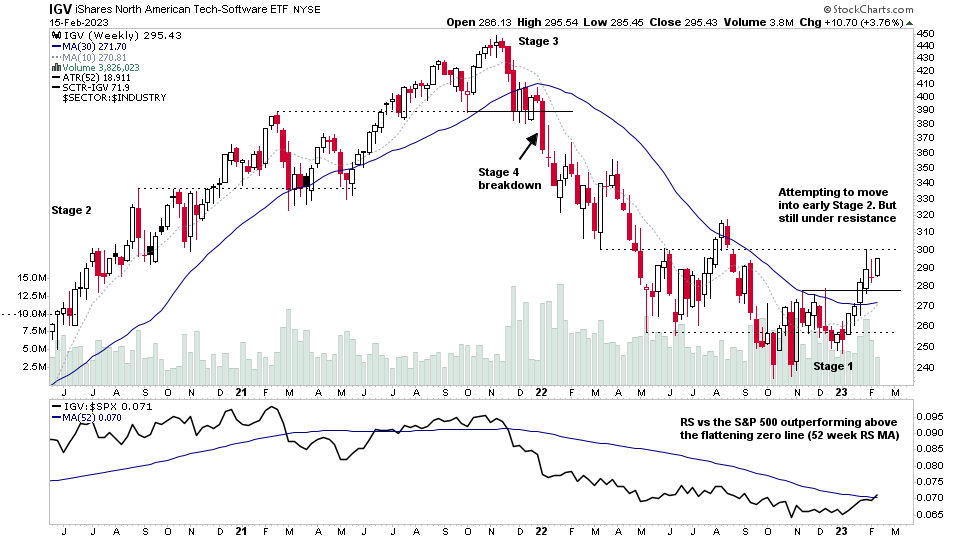

Software Group Focus Video – 15 February 2023 (54 mins)

Software has been a consistent theme in the watchlist posts over the last few months and the group has recently attempted to move into early Stage 2. So todays video is a special group focus on the best of the Software group stocks, with live markups and discussion on multiple timeframes of recent Stage 2 breakouts, early Stage 2 stocks, some still developing in Stage 1 and the strongest stocks in the group.

Read More

14 February, 2023

US Stocks Watchlist – 14 February 2023

There were 40 stocks highlighted from the US stocks watchlist scans today. Software and Semiconductors continue to dominate the watchlist scans with multiple stocks in each attempting to move into early Stage 2...

Read More

13 February, 2023

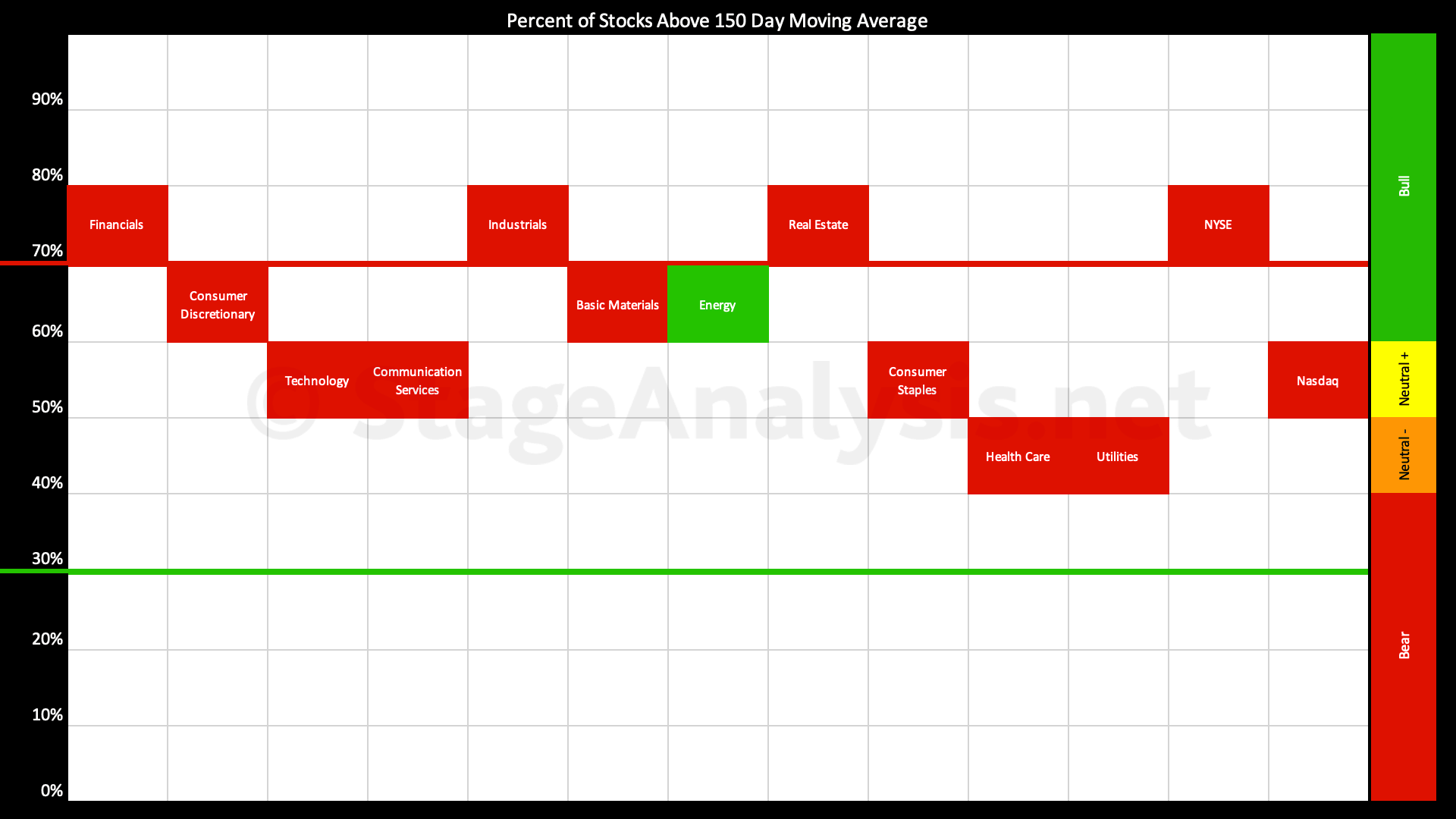

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors edge higher over the last three weeks since the previous post of the 23rd January 2023, increasing by a further +1.94% to 60.41% overall, which puts it just in the Stage 2 zone, but very tentatively so...

Read More

12 February, 2023

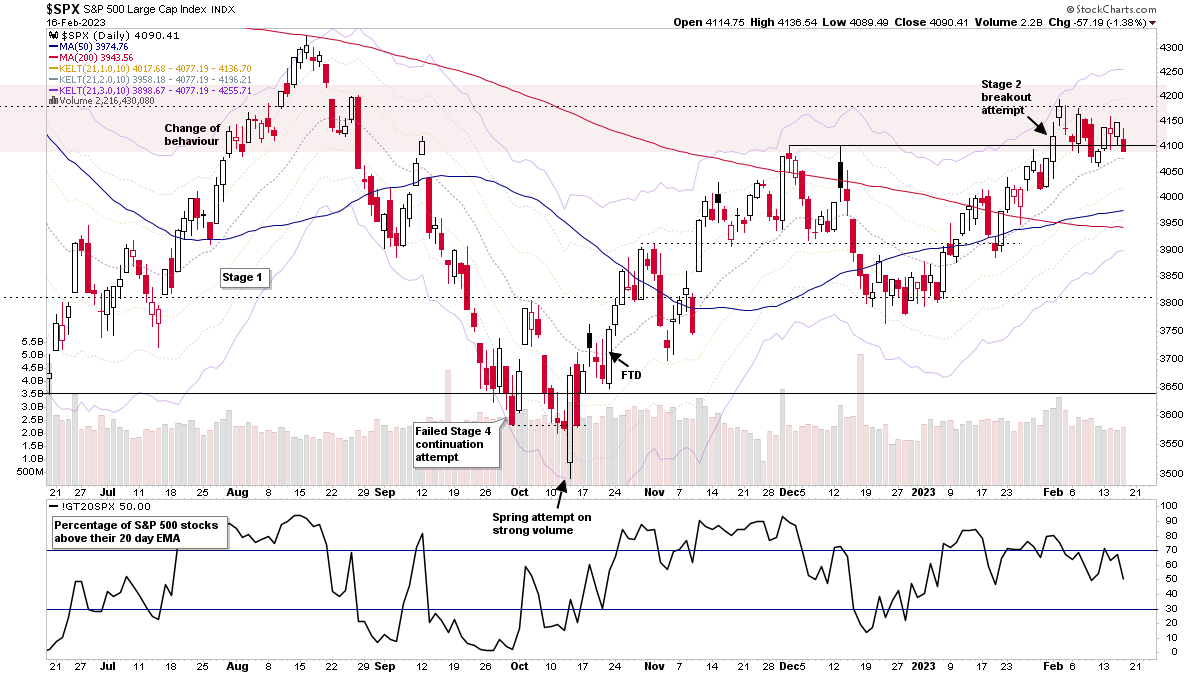

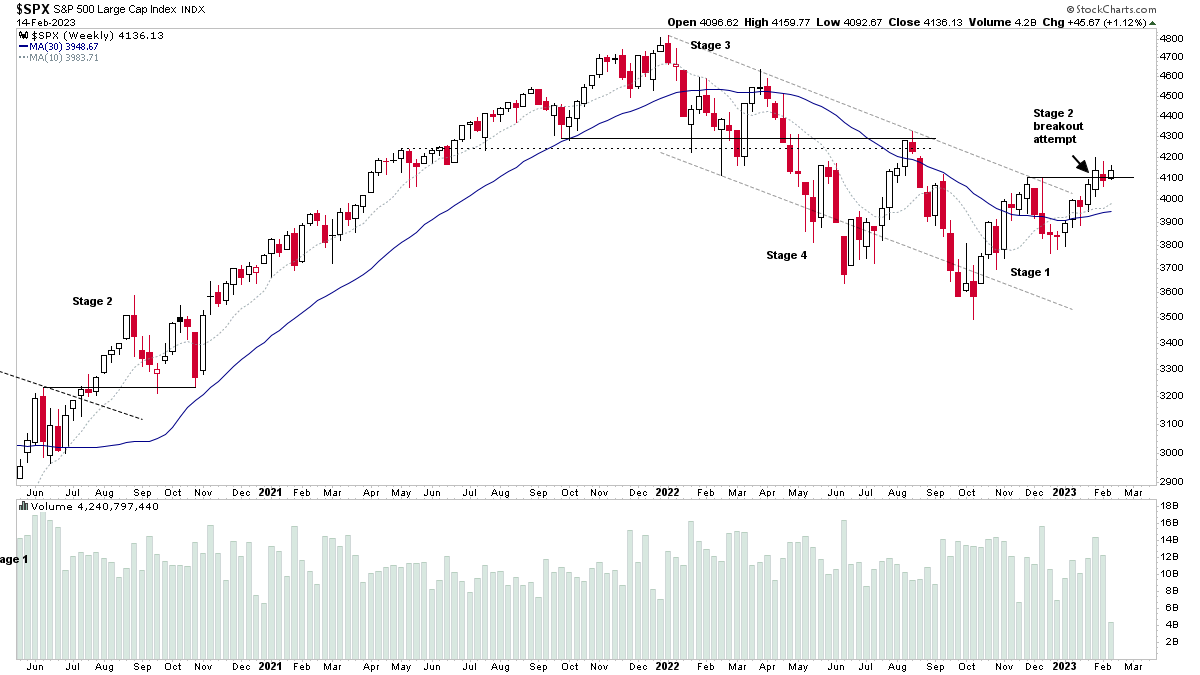

Stage Analysis Members Video – 12 February 2023 (1hr)

The Stage Analysis members weekend video featuring the regular content with the major US Indexes, the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

12 February, 2023

Home Construction Group Focus Video – 12 February 2023 (13mins)

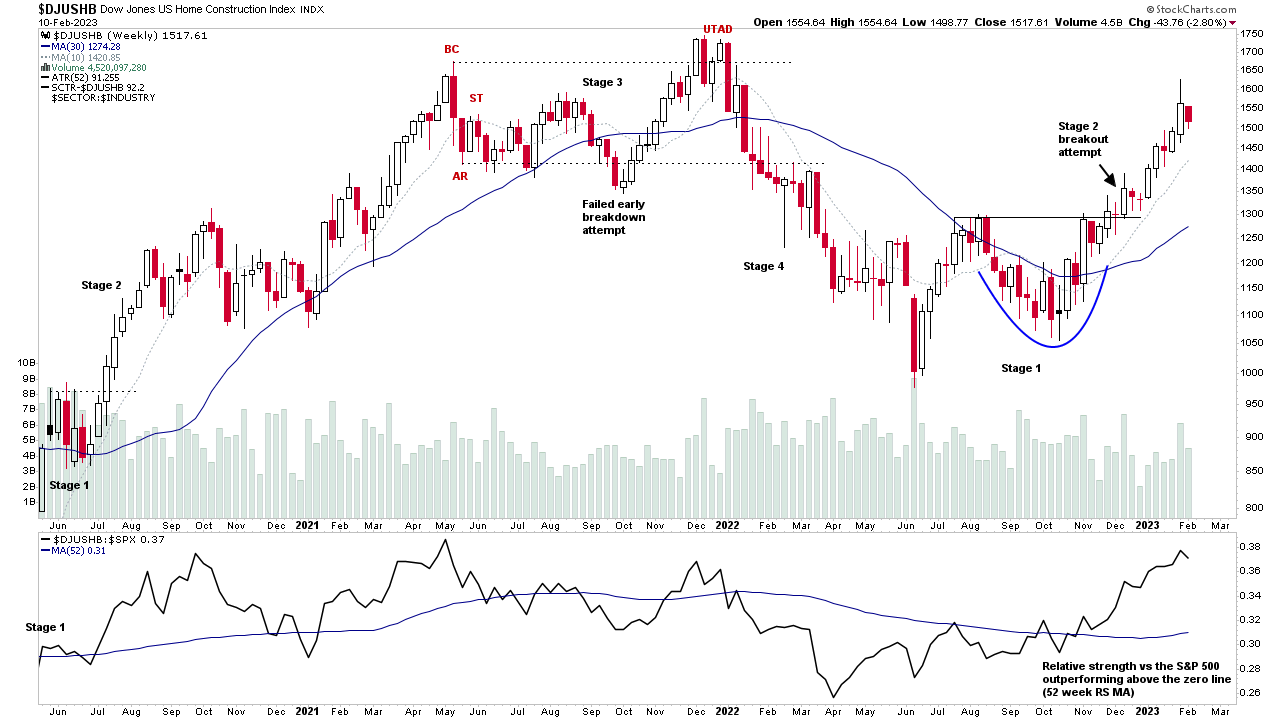

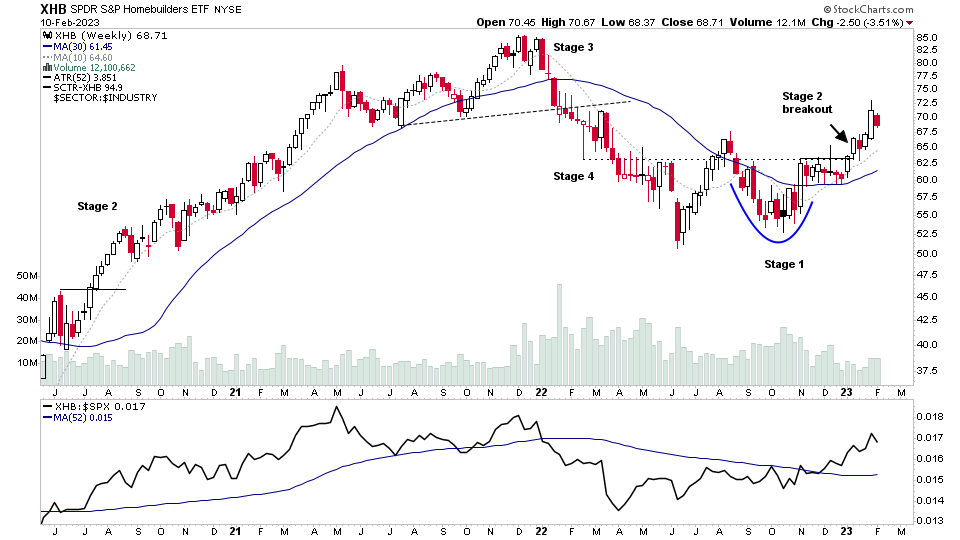

Special feature focusing on the Home Construction group, which has been in Stage 2 for a few months and is in the top 10 of the industry group relative strength rankings.

Read More

12 February, 2023

US Stocks Watchlist – 12 February 2023

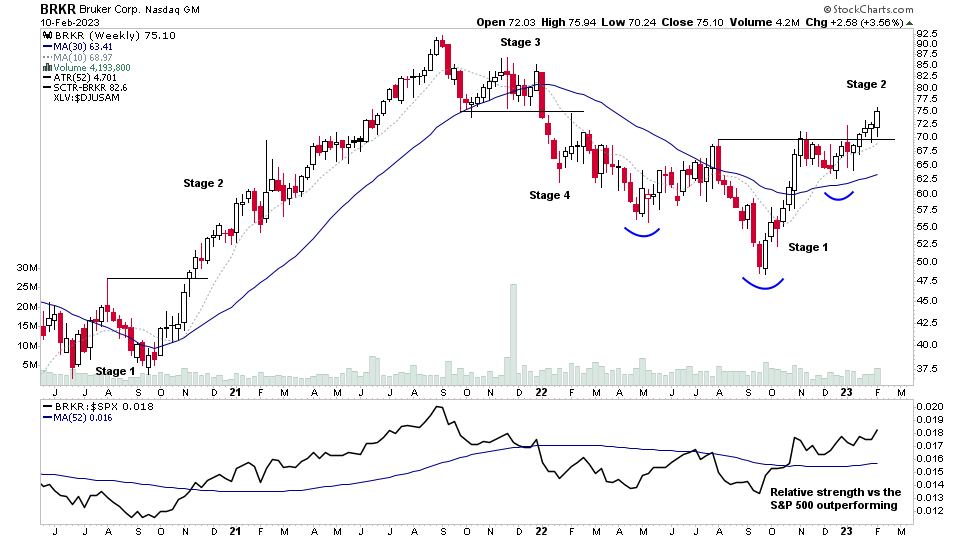

There were 44 stocks highlighted from the US stocks watchlist scans today. Home Construction is coming back into focus with multiple stocks in the group starting to report earnings in the coming week(s)...

Read More

11 February, 2023

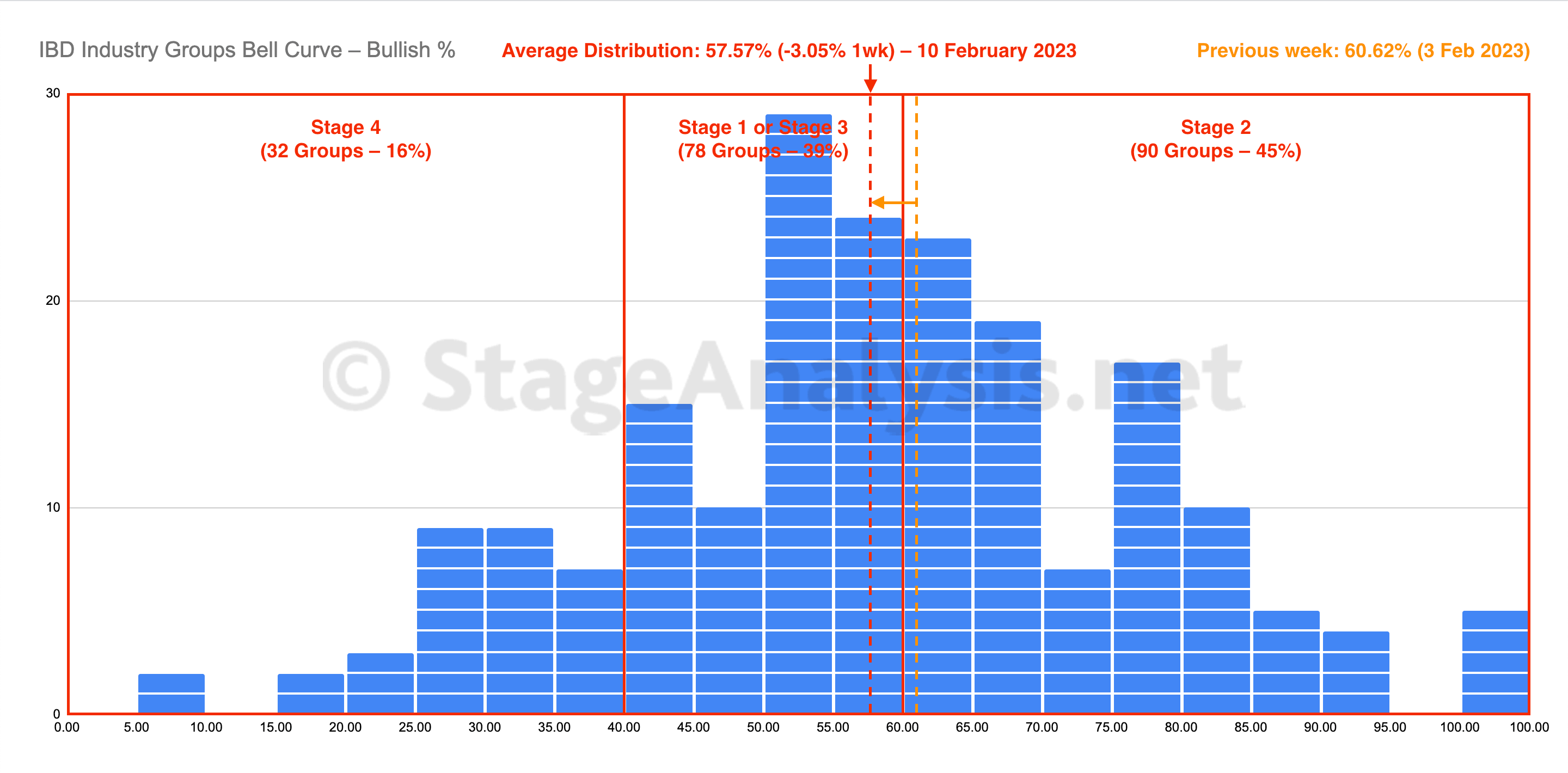

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve contracted by -3.05% this week, to close at 57.57% overall. The amount of groups in Stage 4 increased by +8 (+4%), and the amount of groups in Stage 2 decreased by -14 (-7%), while the amount groups in Stage 1 or Stage 3 increased by +6 (+3%).

Read More

10 February, 2023

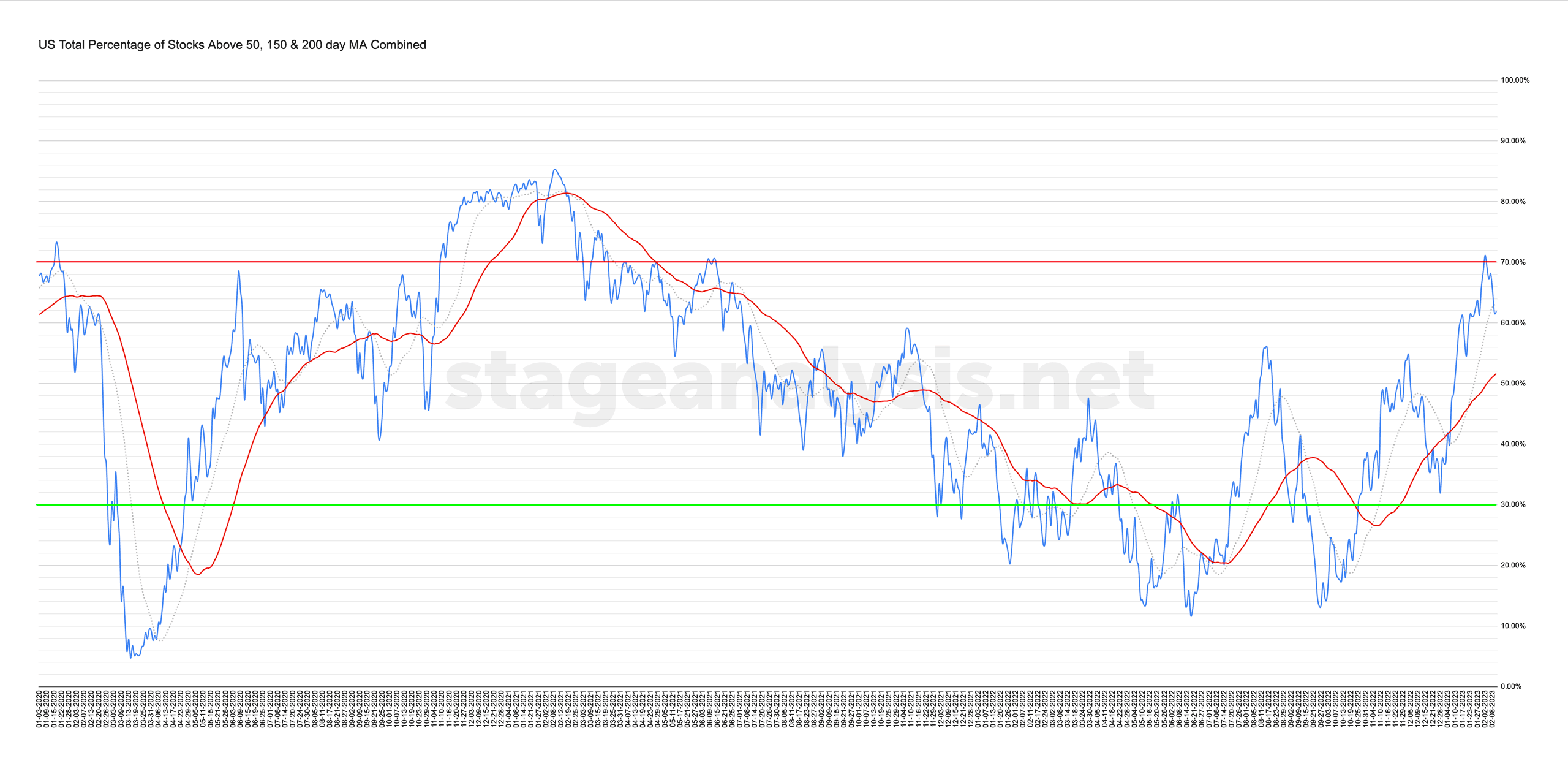

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

10 February, 2023

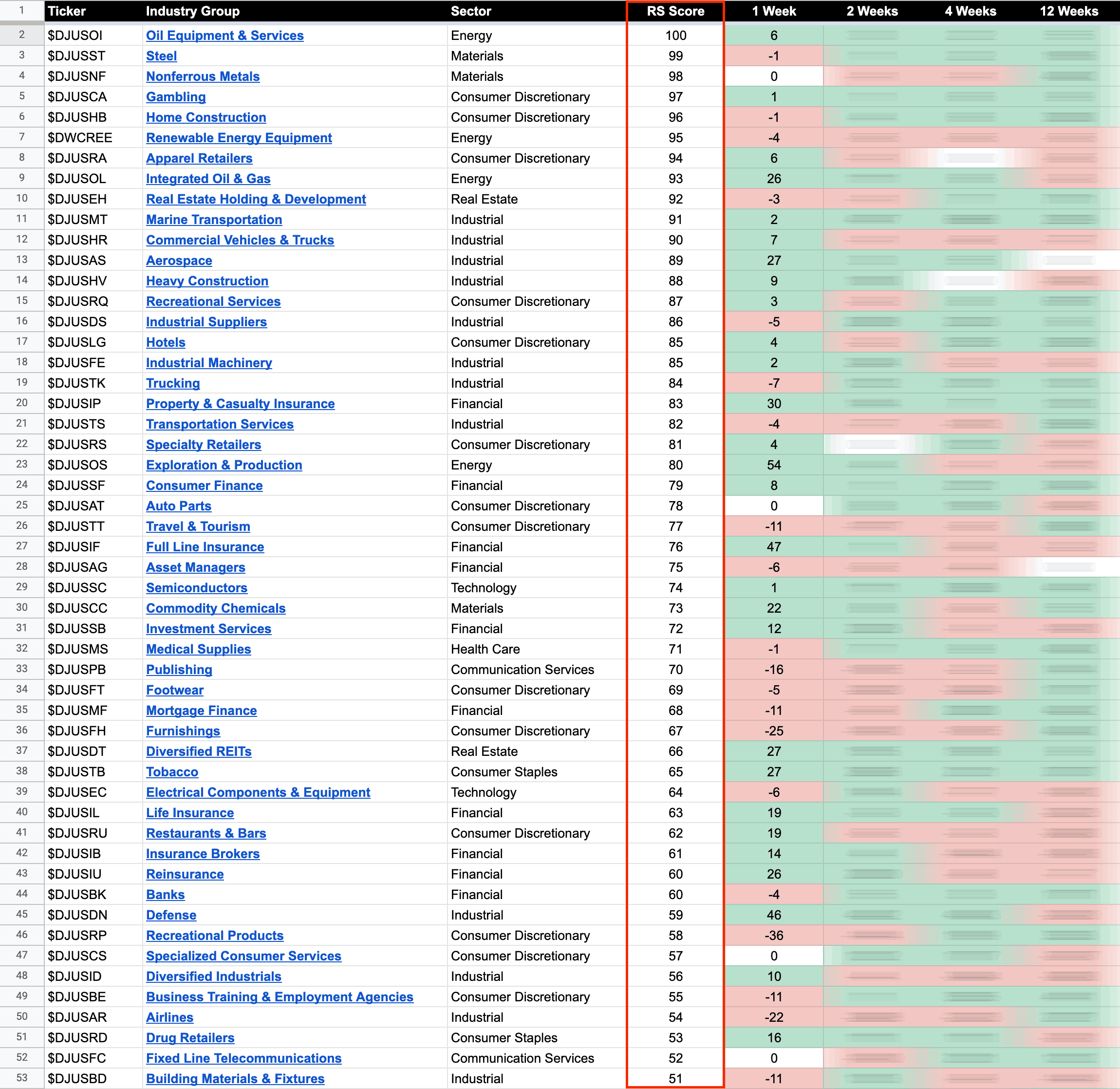

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More