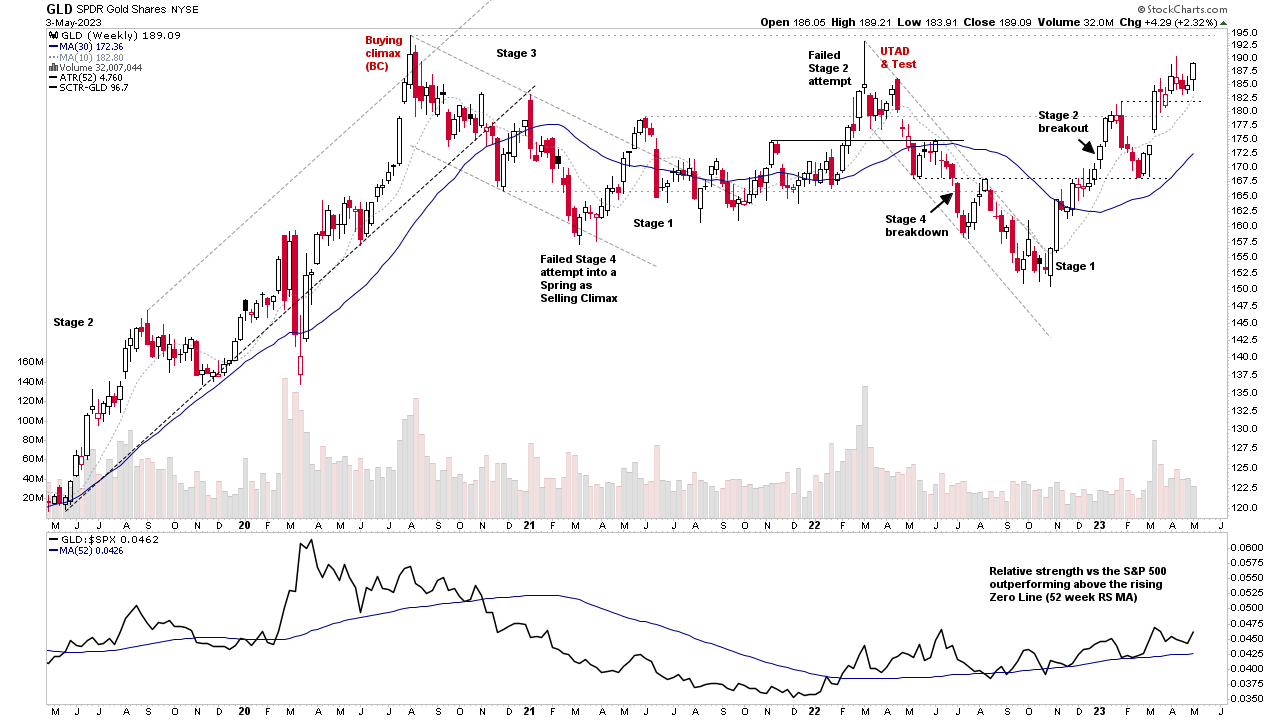

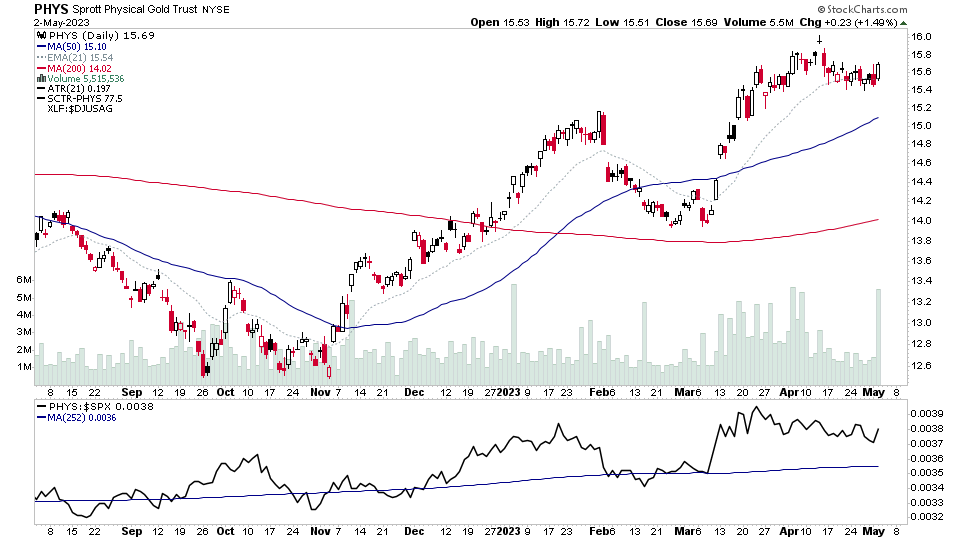

A special group focus on Gold and Silver & the US precious metals miners, following on from the previous post focusing on the group on 13th March – which was around the Stage 2 secondary entry zone...

Read More

Blog

02 May, 2023

US Stocks Watchlist – 2 May 2023

There were 24 stocks highlighted from the US stocks watchlist scans today...

Read More

01 May, 2023

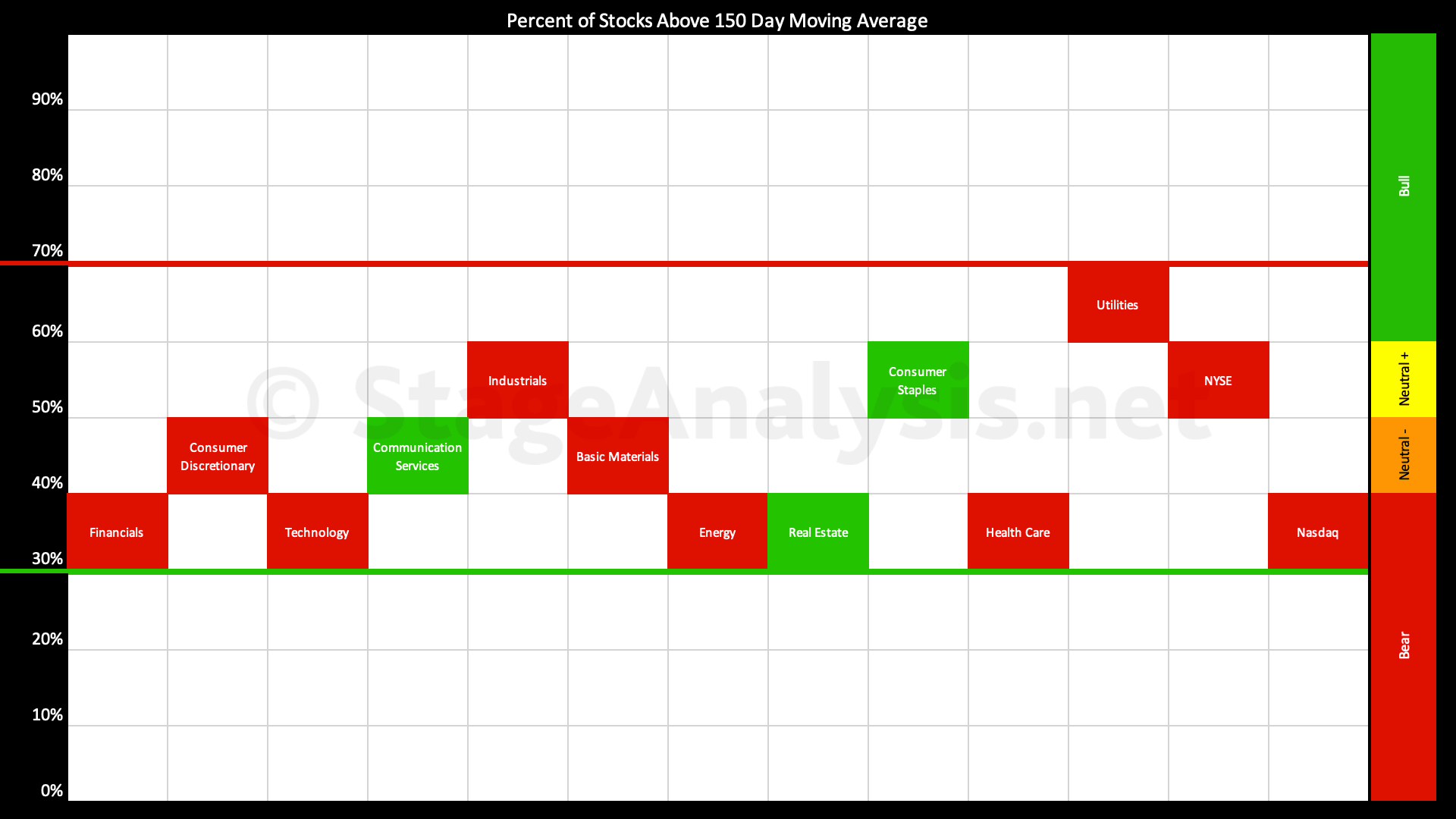

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors remains completely within the middle range. But with a weighting towards the lower end of the range. There has been a decline of -5.48%...

Read More

30 April, 2023

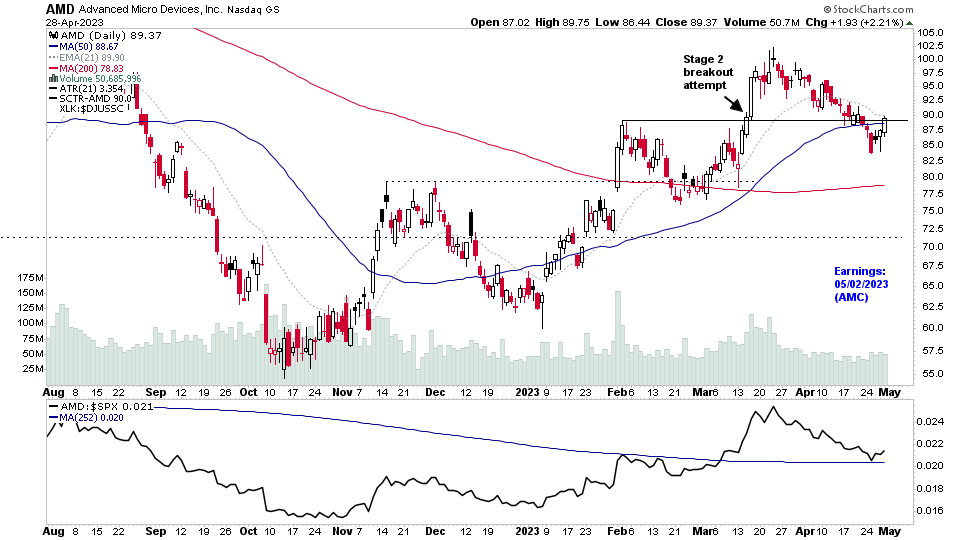

Stage Analysis Members Video – 30 April 2023 (1hr 31mins)

Stage Analysis members weekend video beginning by discussing this weeks Stage 2 stocks with strong volume moves. Followed by the Major Indexes Update, US Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update, and the US Watchlist Stocks in Detail...

Read More

30 April, 2023

US Stocks Watchlist – 30 April 2023

There were 20 stocks highlighted from the US stocks watchlist scans today. I'll discuss the watchlist stocks and group themes in detail in the members weekend video, which will posted later today (Sunday)...

Read More

29 April, 2023

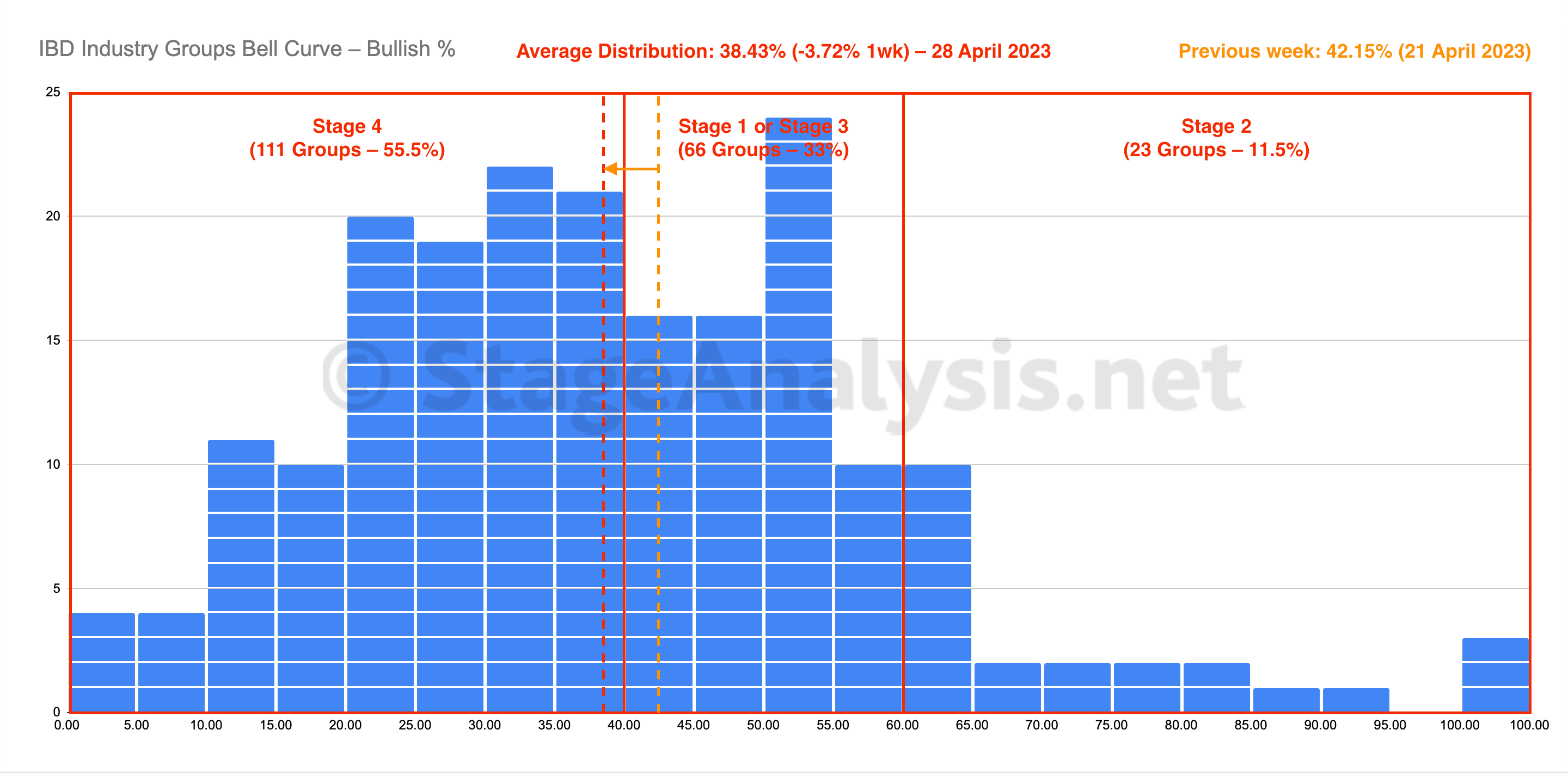

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve declined this week by -3.72% to finish at 38.43% overall. The amount of groups in Stage 4 increased by 20 (+10%), and the amount of groups in Stage 2 decreased by 7 (-3.5%), while the amount groups in Stage 1 or Stage 3 decreased by 13 (-6.5%)...

Read More

29 April, 2023

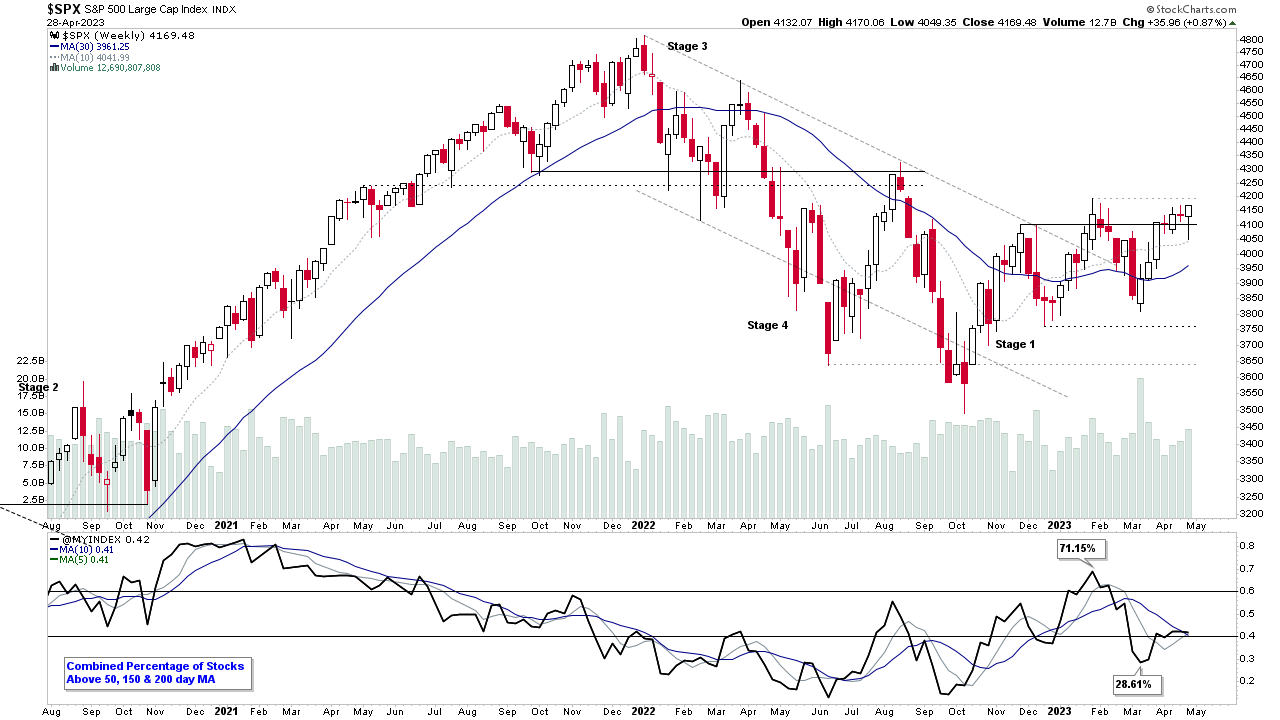

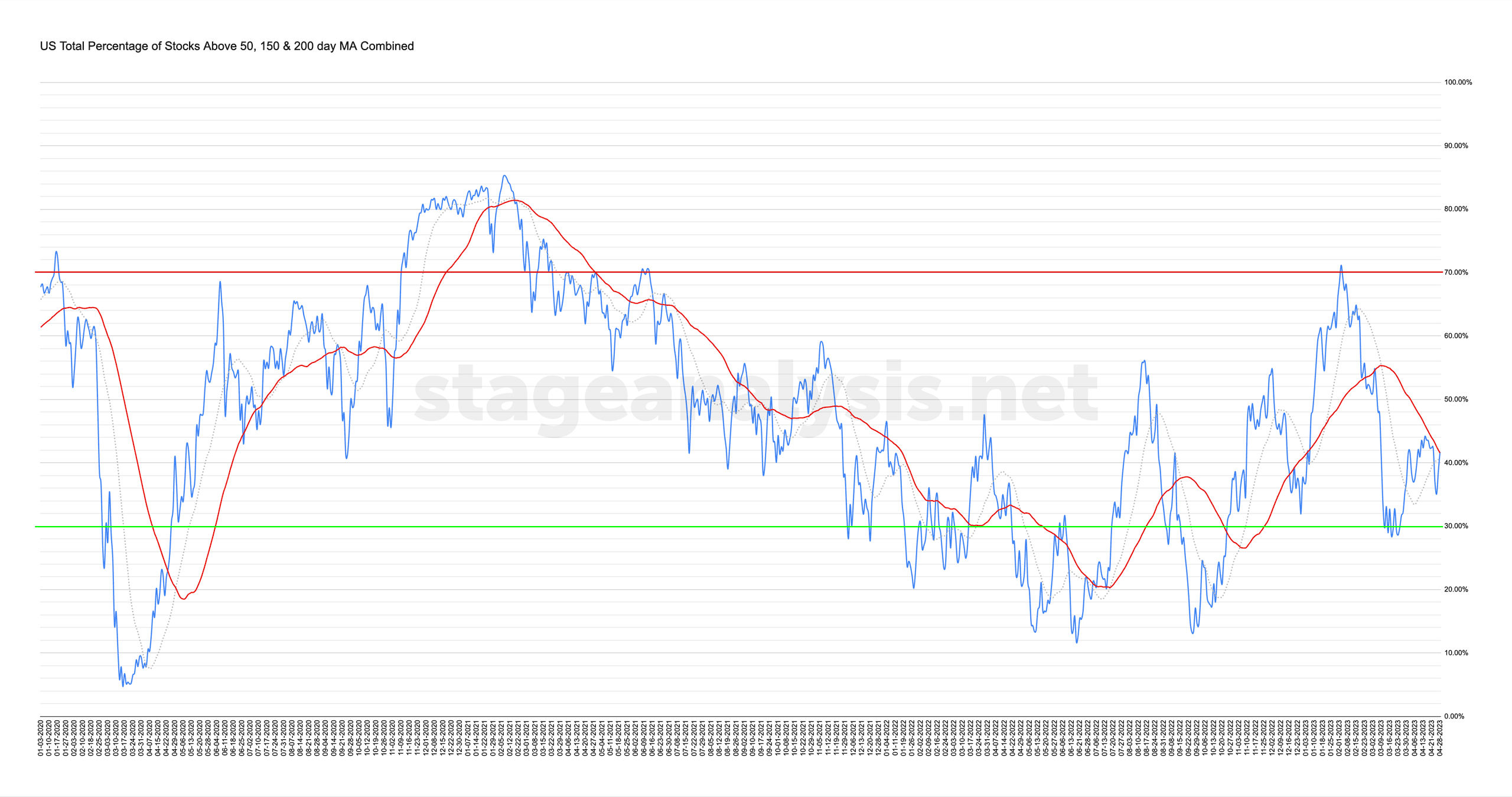

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

28 April, 2023

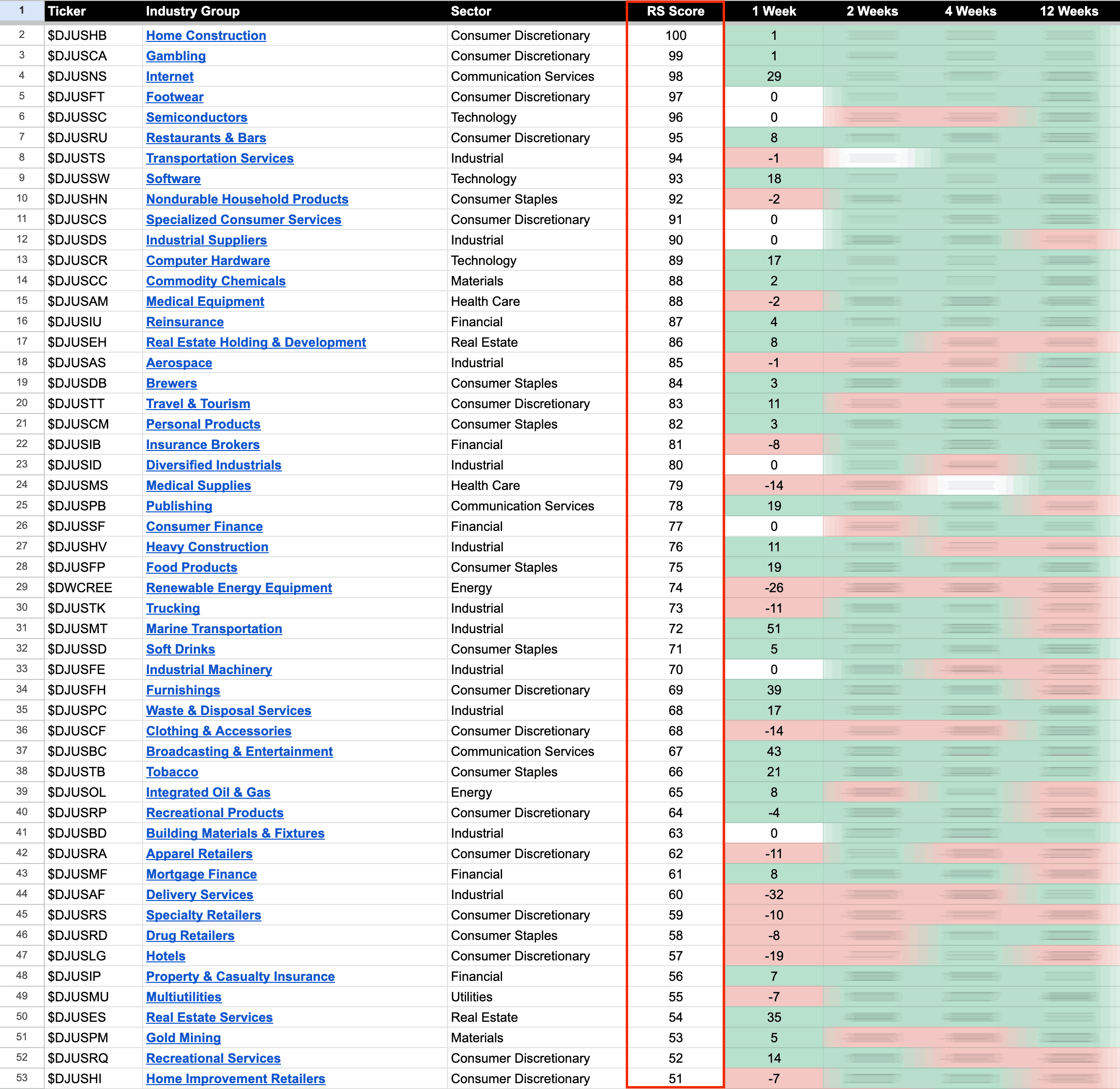

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

28 April, 2023

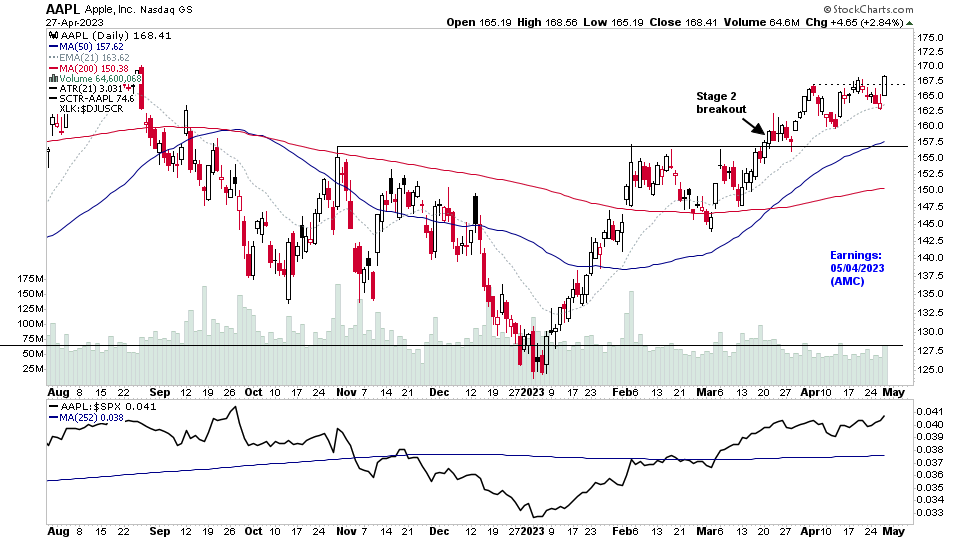

US Stocks Watchlist – 27 April 2023

There were 22 stocks highlighted from the US stocks watchlist scans today...

Read More

26 April, 2023

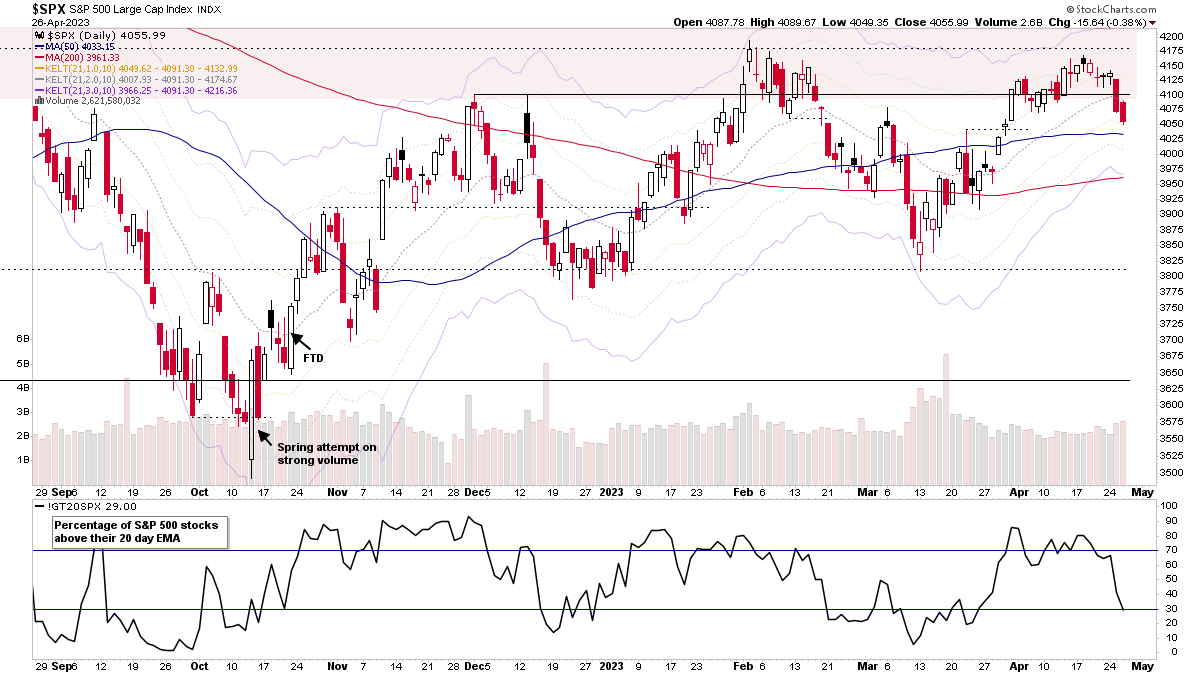

Stage Analysis Midweek Video – 26 April 2023

A brief midweek video today covering the major US indexes and short-term breadth measures...

Read More