The Stage Analysis midweek video discussing of the major US stock market indexes, short-term market breadth measures, Bitcoin and Ethereum updated analysis, and the recent watchlist stocks on multiple timeframes.

Read More

Blog

08 November, 2023

Stage Analysis Members Video – 8 November 2023 (56mins)

07 November, 2023

US Stocks Watchlist – 7 November 2023

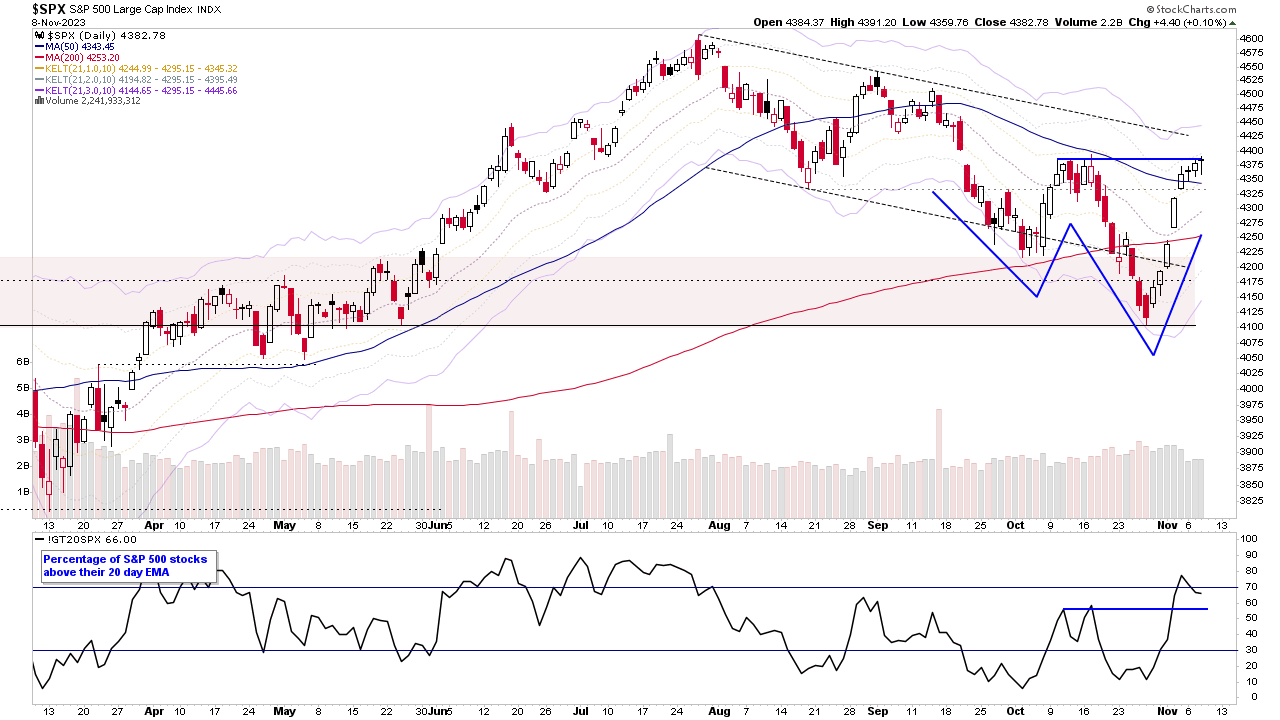

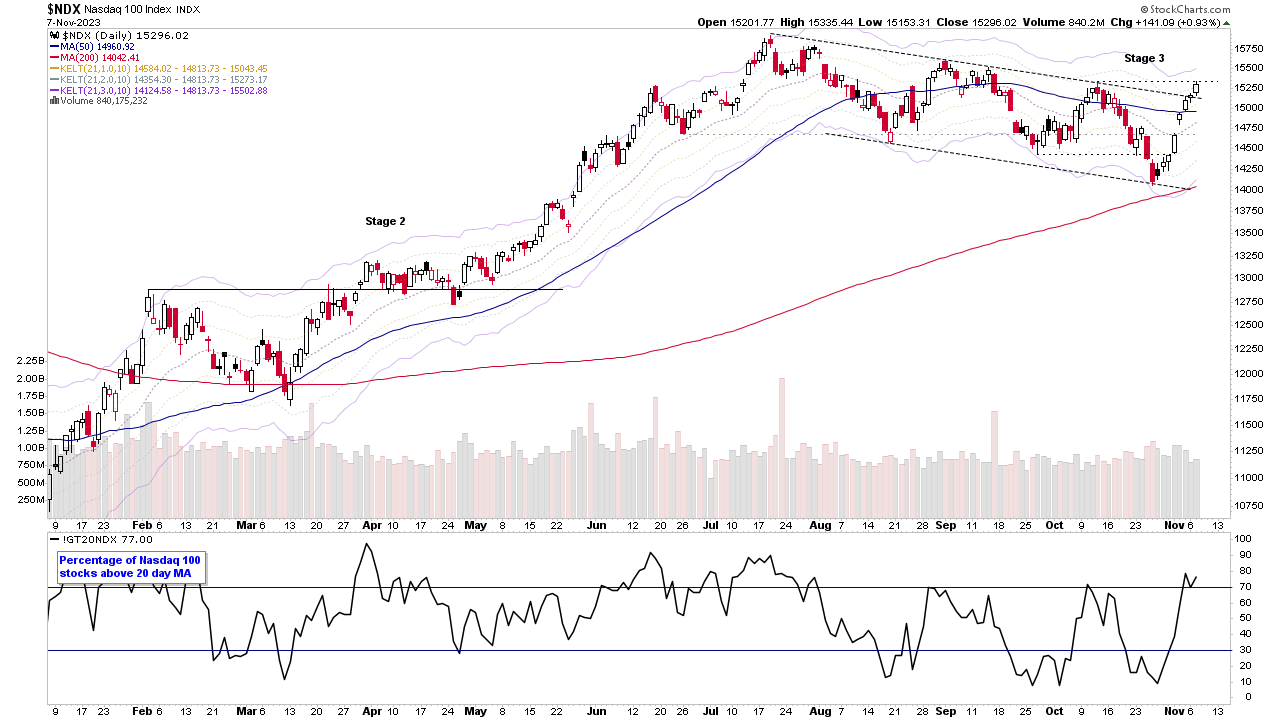

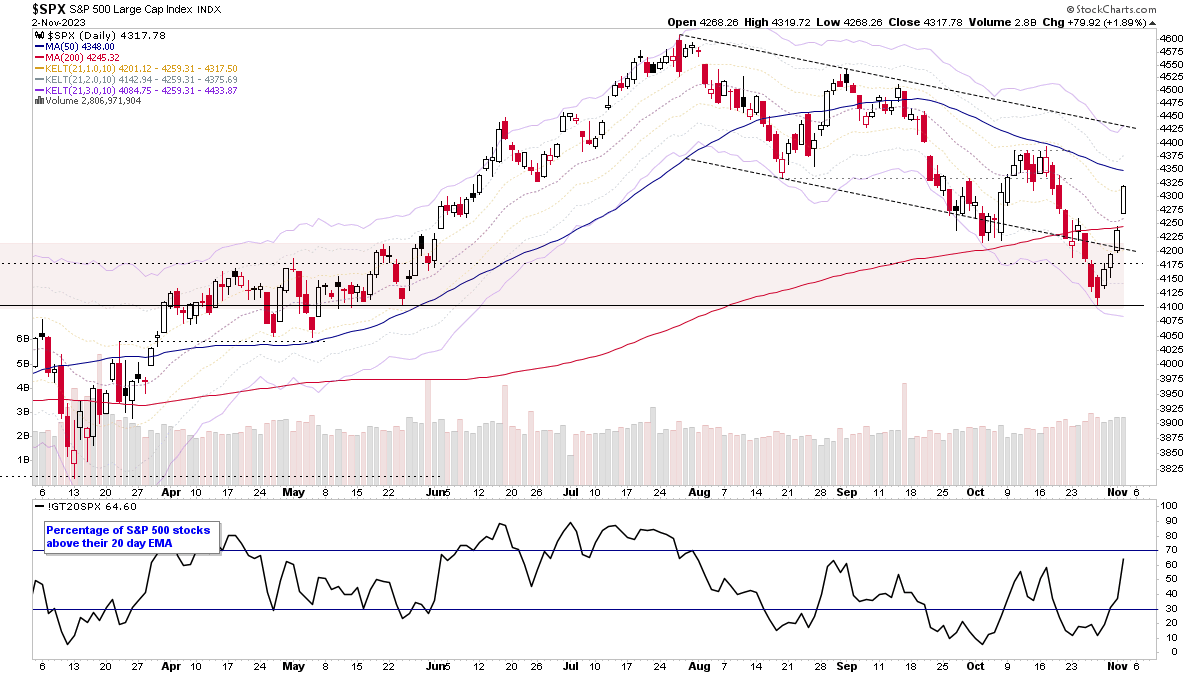

Consumer Discretionary and Technology stocks led today, boosting the Nasdaq 100, which has more than half of its stocks in those two sectors, and it's now pushing up to test the October pivot high, with 77% of its stocks currently above their 20 day EMA, and 54% above their 50 day MA, and 60% above their 200 day MA. So, although the Nasdaq 100 is technically in Stage 3 (i.e. within a distributional range), it is showing a positive short-term change of behaviour...

Read More

06 November, 2023

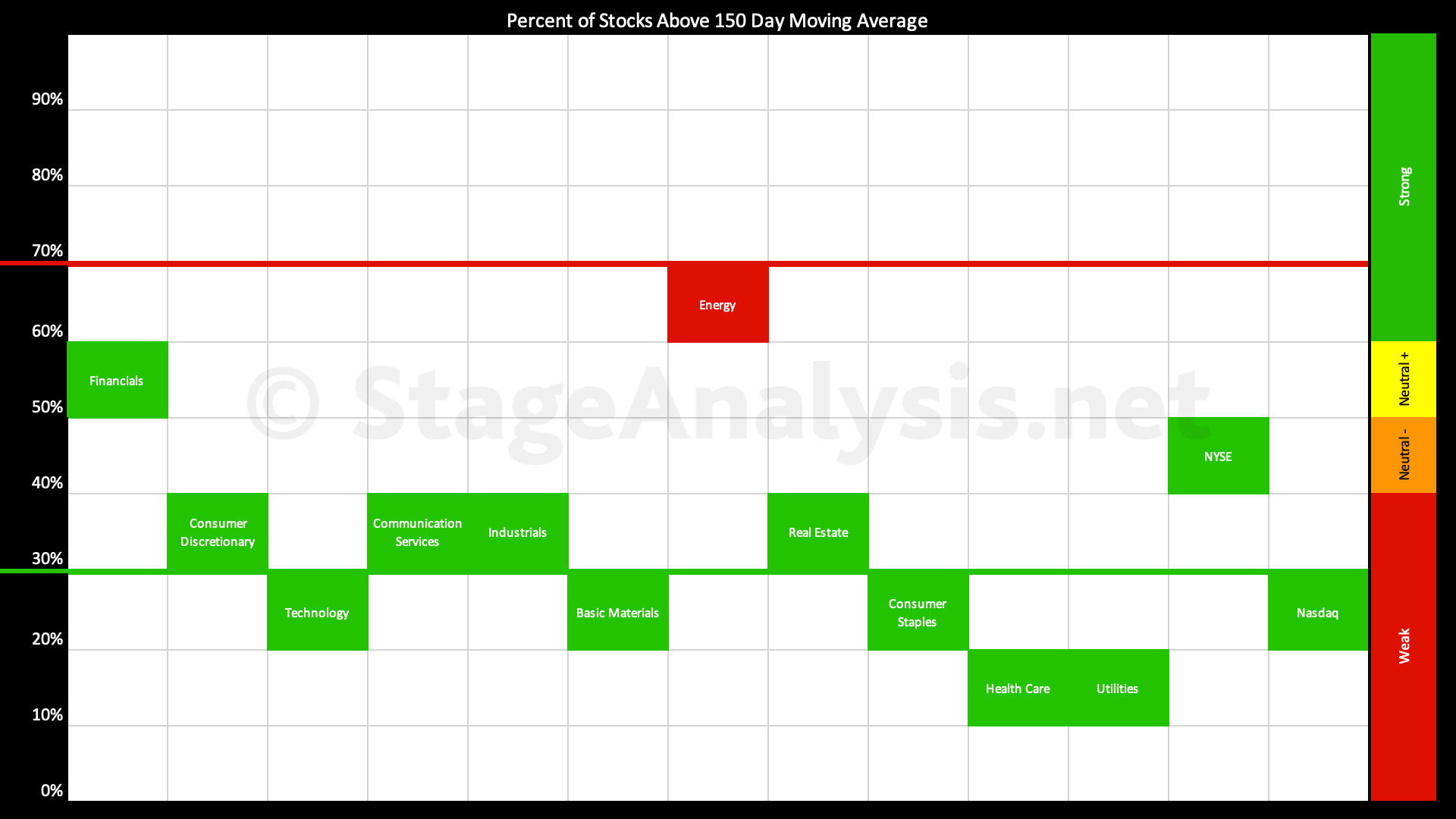

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

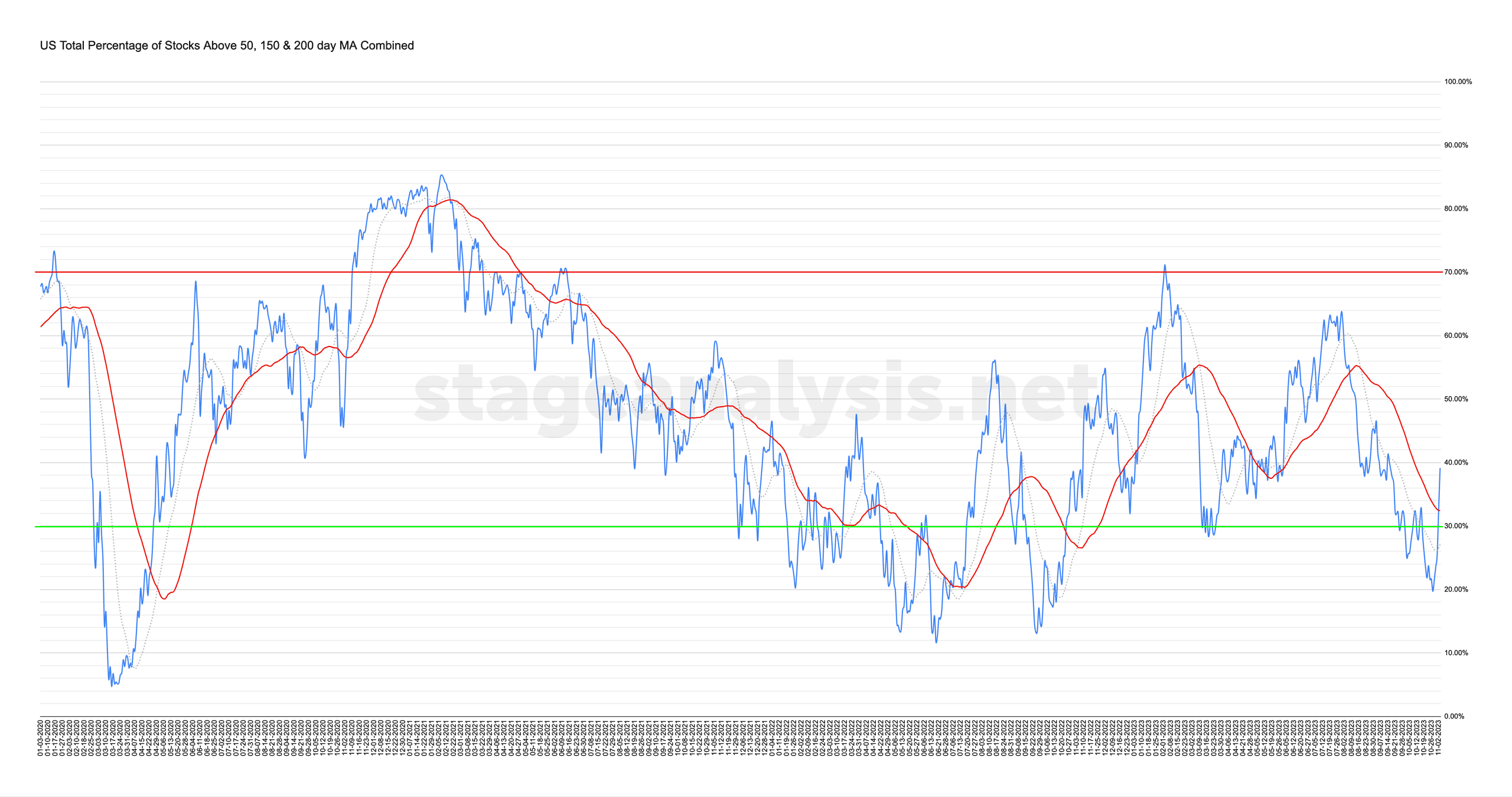

The percentage of US stocks above their 150 day moving averages in the 11 major sectors increased by +10.13% since the previous post on the 23rd October 2023, with a strong rebound from the lower zone up through the key 30% level. Which is a positive change for this contrarian breadth indicator...

Read More

05 November, 2023

Stage Analysis Members Video – 5 November 2023 (1hr 33mins)

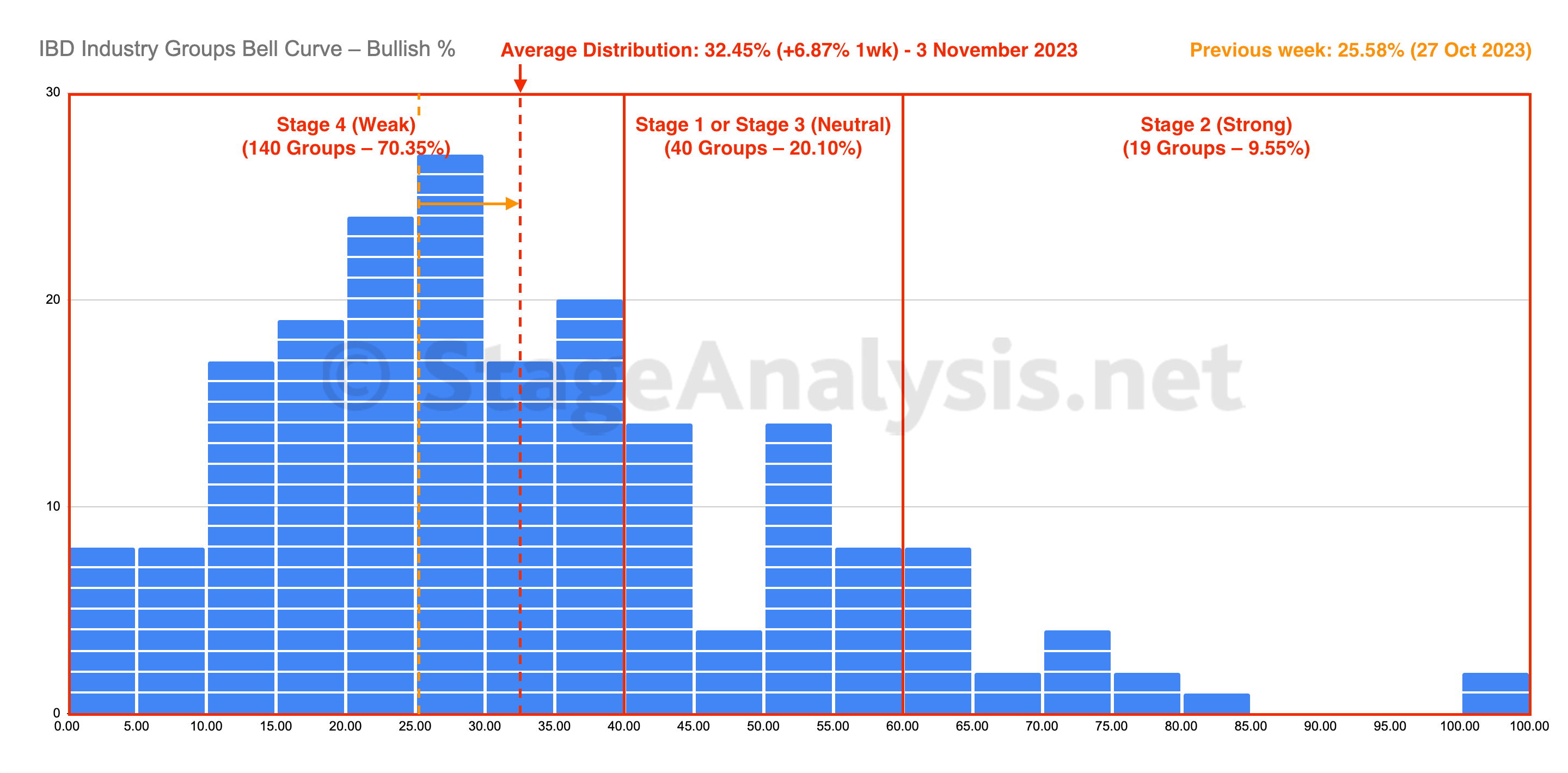

The Stage Analysis members weekend video begins with a look at some of the weeks significant bars in individual stocks, after a huge change of behaviour in the broad market. Followed by the regular weekend content of the Major US Indexes, the Futures Charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, and US watchlist stocks in detail on multiple timeframes.

Read More

05 November, 2023

US Stocks Watchlist – 5 November 2023

There were 29 stocks highlighted from the US stocks watchlist scans today. I'll discuss the watchlist stocks and group themes in detail in the members weekend video, which will be posted later on Sunday.

Read More

04 November, 2023

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve increased by +6.87% this week to finish at 32.45% overall. The amount of groups in Stage 4 (Weak) decreased by 23 (-11.6%), and the amount of groups in Stage 2 (Strong) increased by 3 (+1.5%), while the amount groups in Stage 1 or Stage 3 (Neutral) increased by 20 (+10%)...

Read More

04 November, 2023

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

03 November, 2023

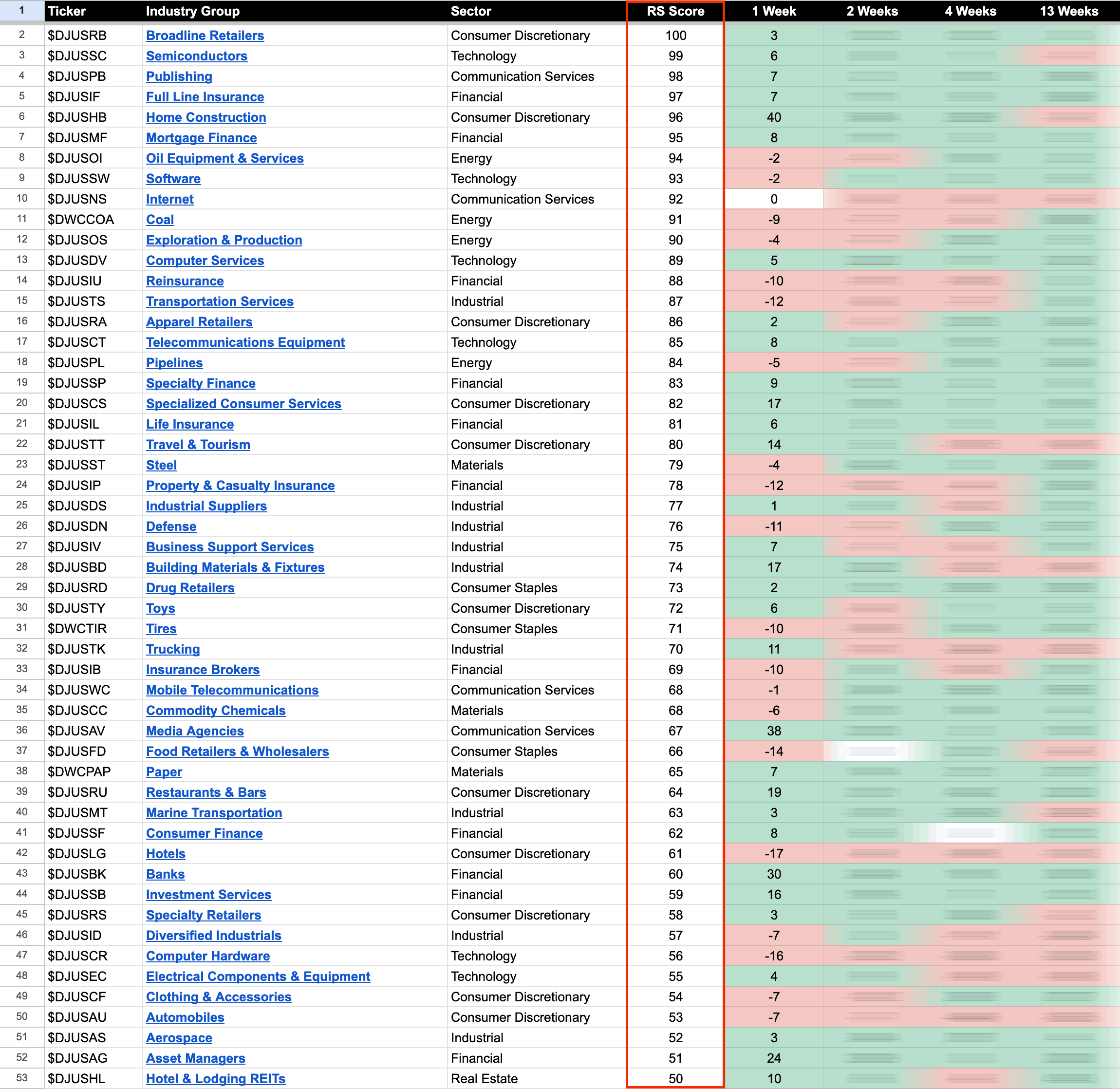

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

03 November, 2023

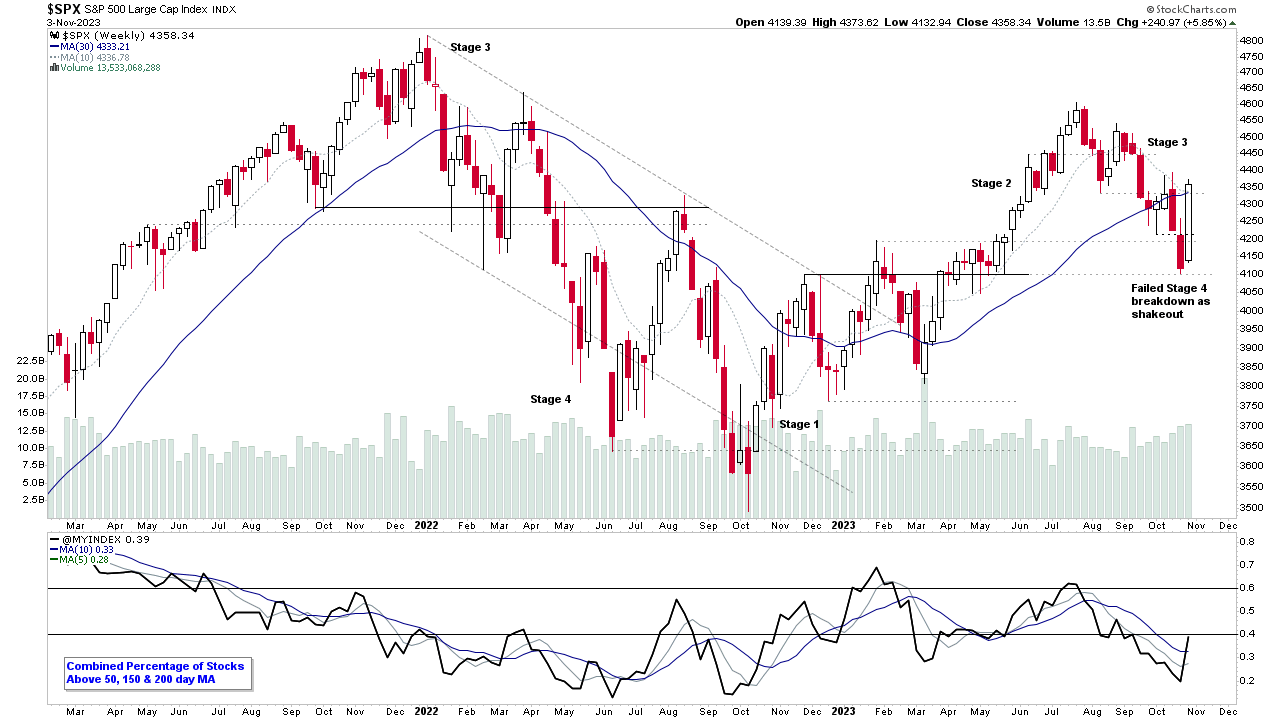

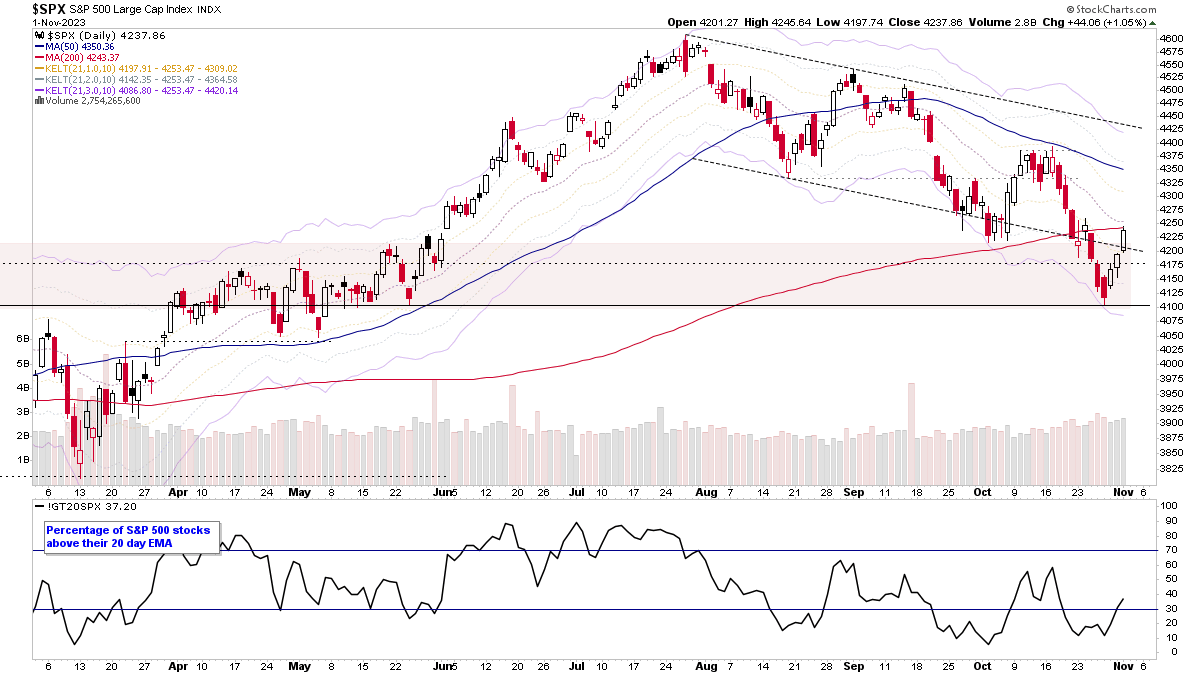

S&P 500 Regains Its 200 Day MA and the US Stocks Watchlist – 2 November 2023

The S&P 500 moved higher for a fourth day, and put in a second Follow Through Day (FTD) in a row, which is a CAN SLIM method term, that is used for identifying a potential short-term change of trend. This was also seen in the other major US indexes...

Read More

01 November, 2023

Stage Analysis Members Video – 1 November 2023 (49mins)

Stage Analysis midweek video discussing of the major US stock market indexes, short-term market breadth measures and the recent watchlist stocks on multiple timeframes.

Read More