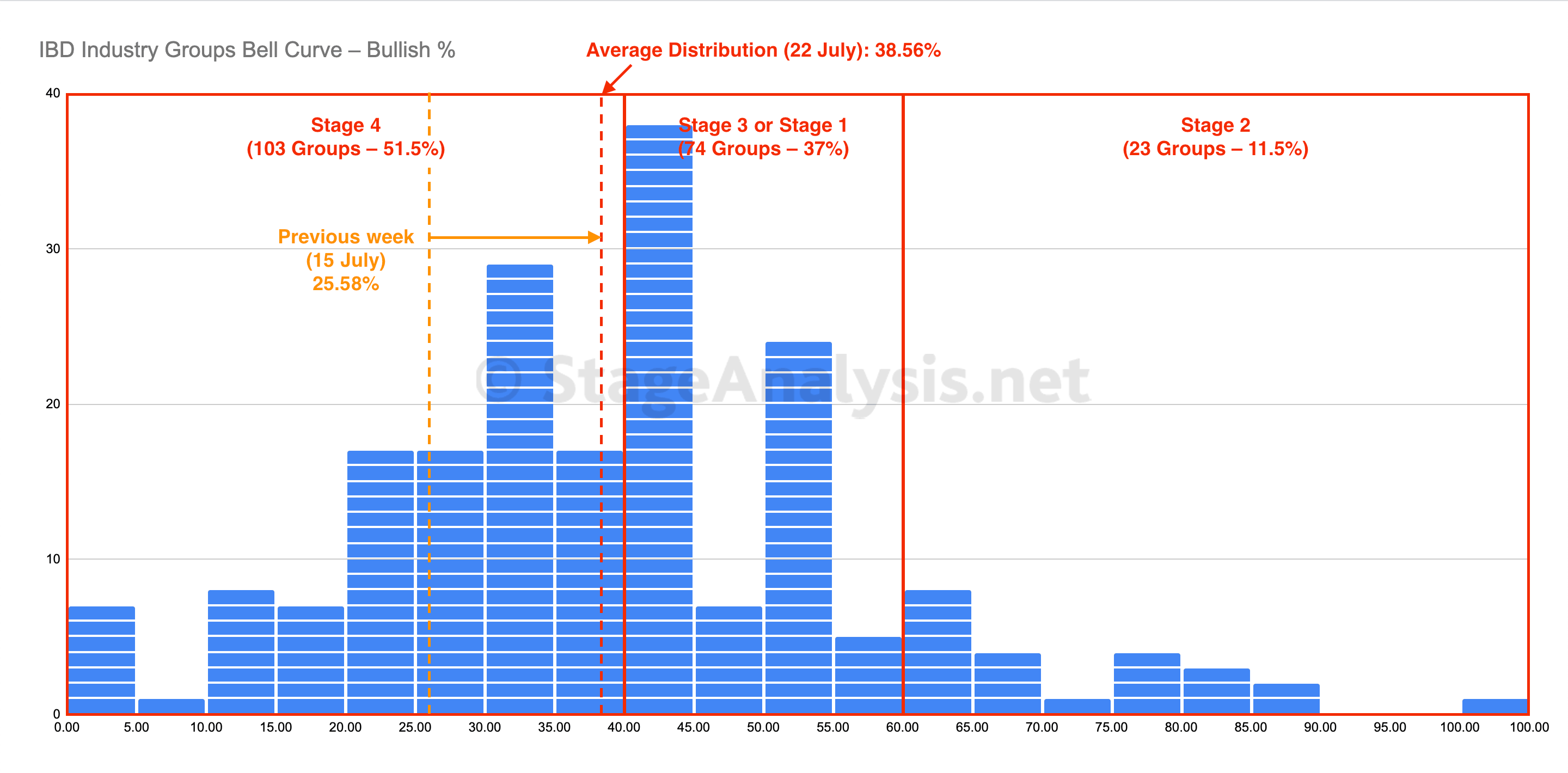

The IBD Industry Groups Bell Curve – Bullish Percent made as strong improvement over the last week with a +12.98% move into the high 30s, with more groups leaving the Stage 4 zone, and reentering previous Stage 3 ranges, and hence potentially shifting back towards Stage 1.

Read More

Blog

23 July, 2022

IBD Industry Groups Bell Curve – Bullish Percent

23 July, 2022

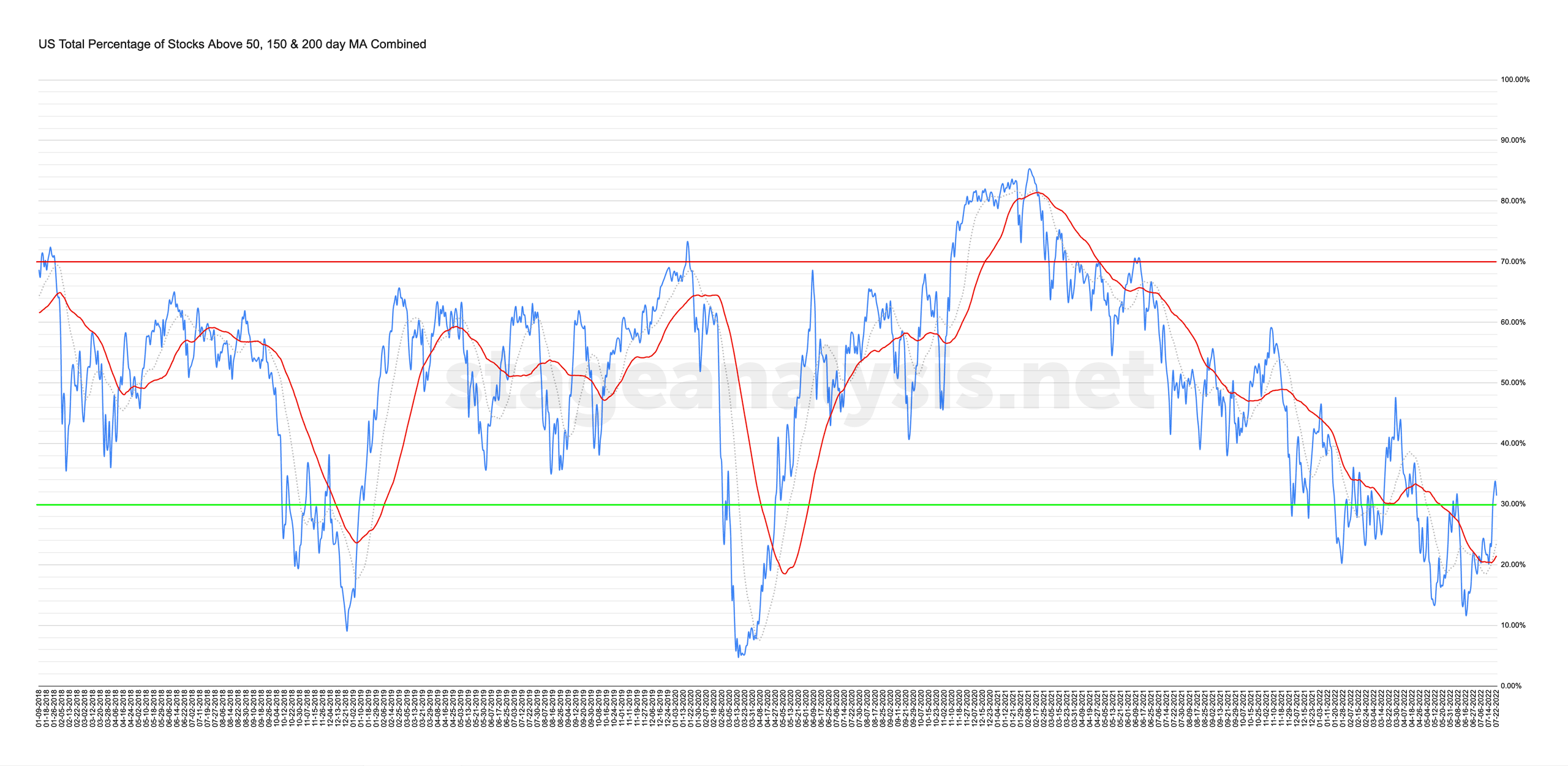

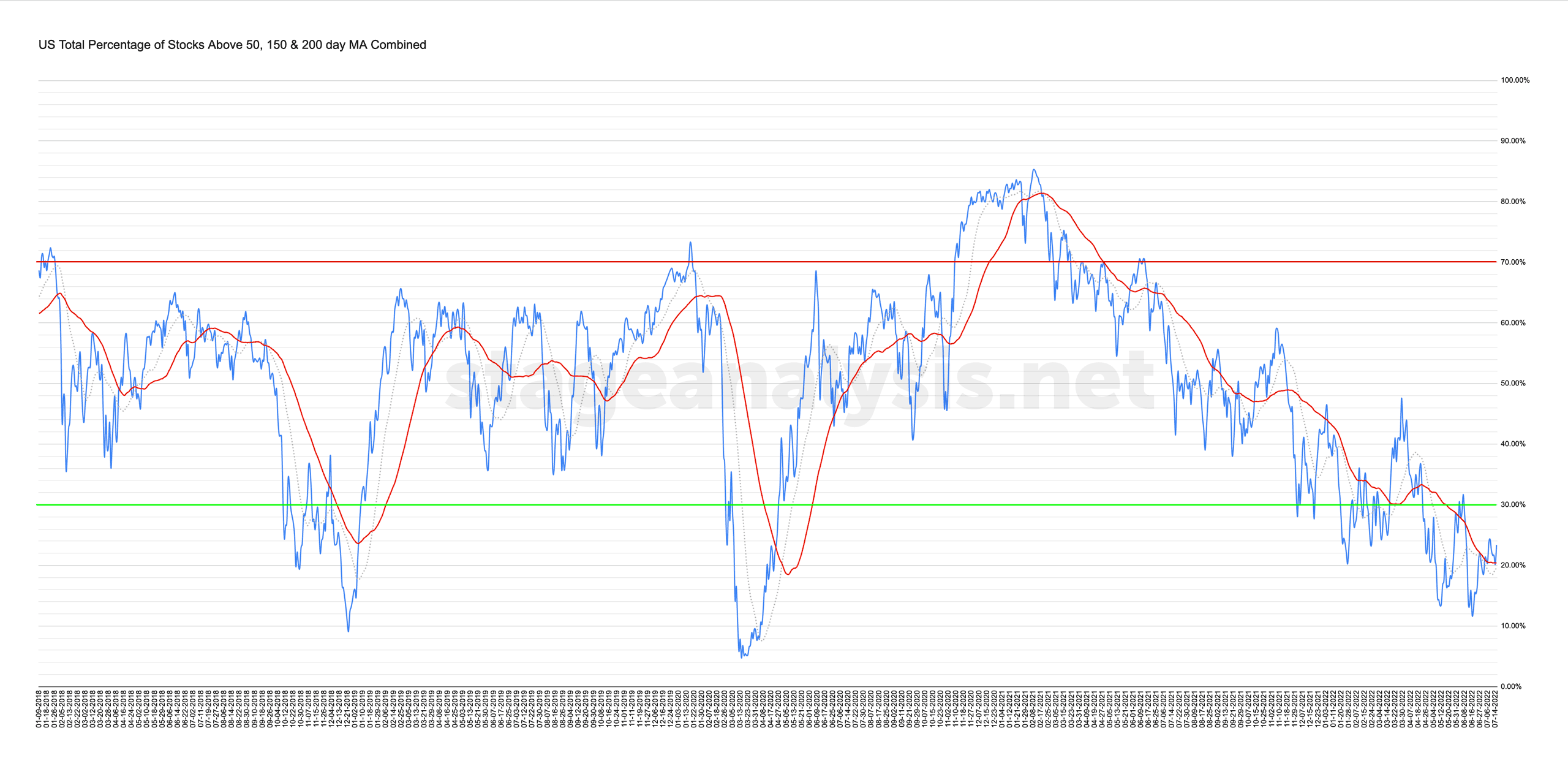

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

22 July, 2022

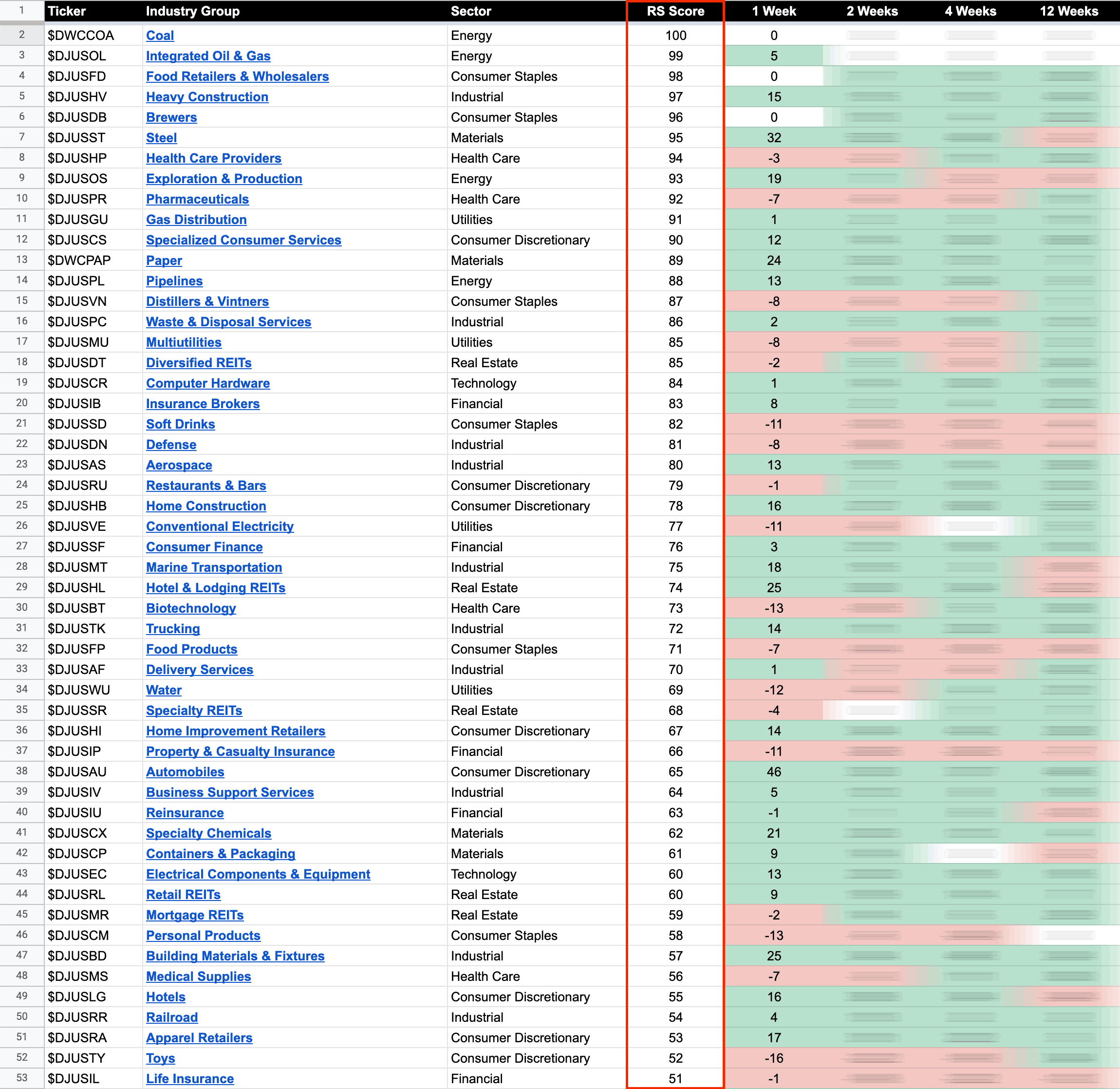

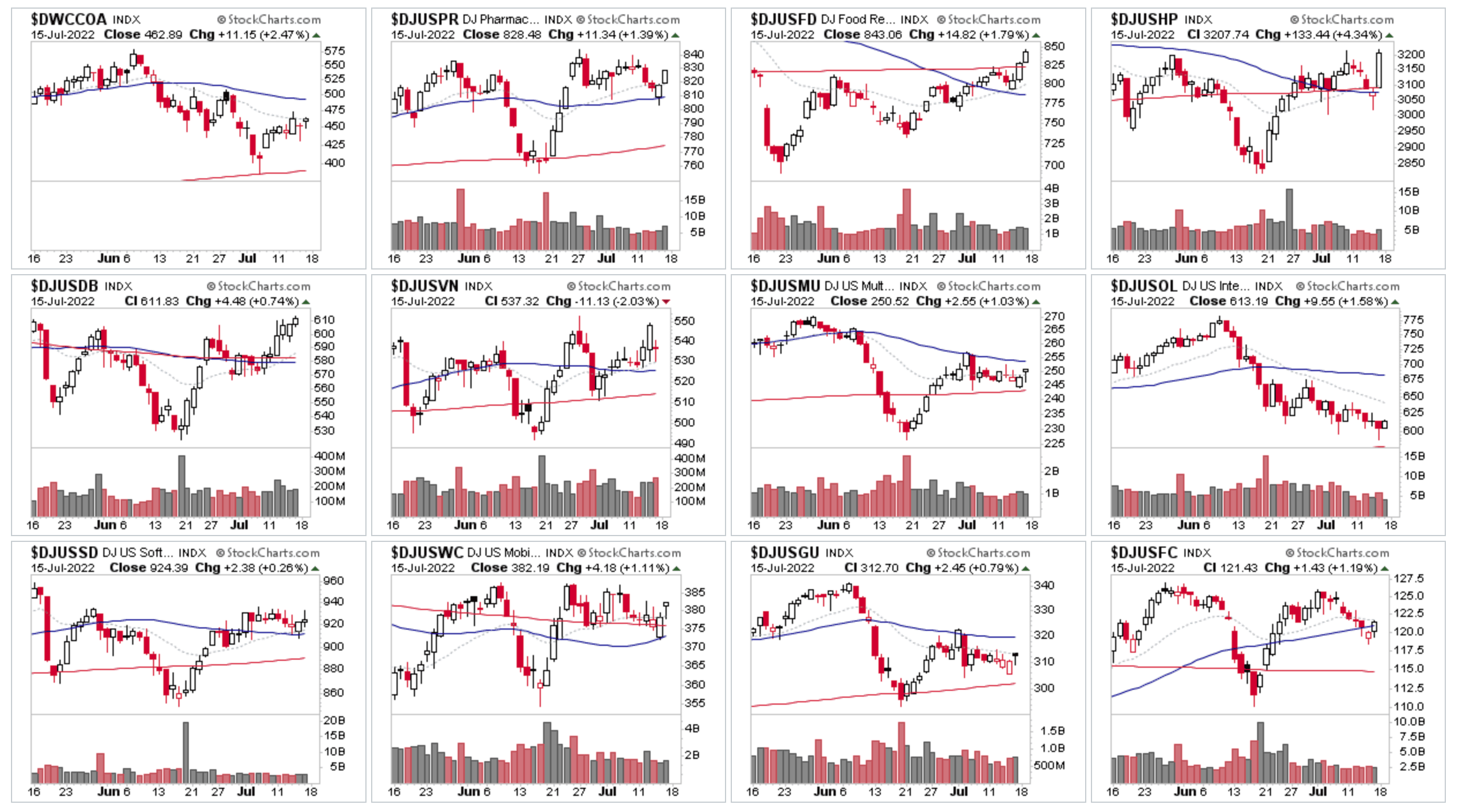

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

21 July, 2022

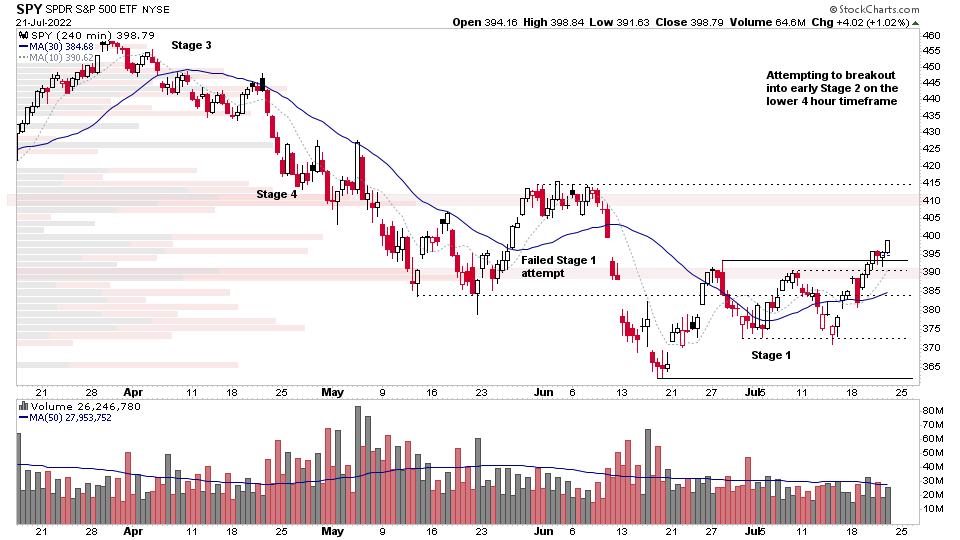

Stock Market Update and US Stocks Watchlist – 21 July 2022

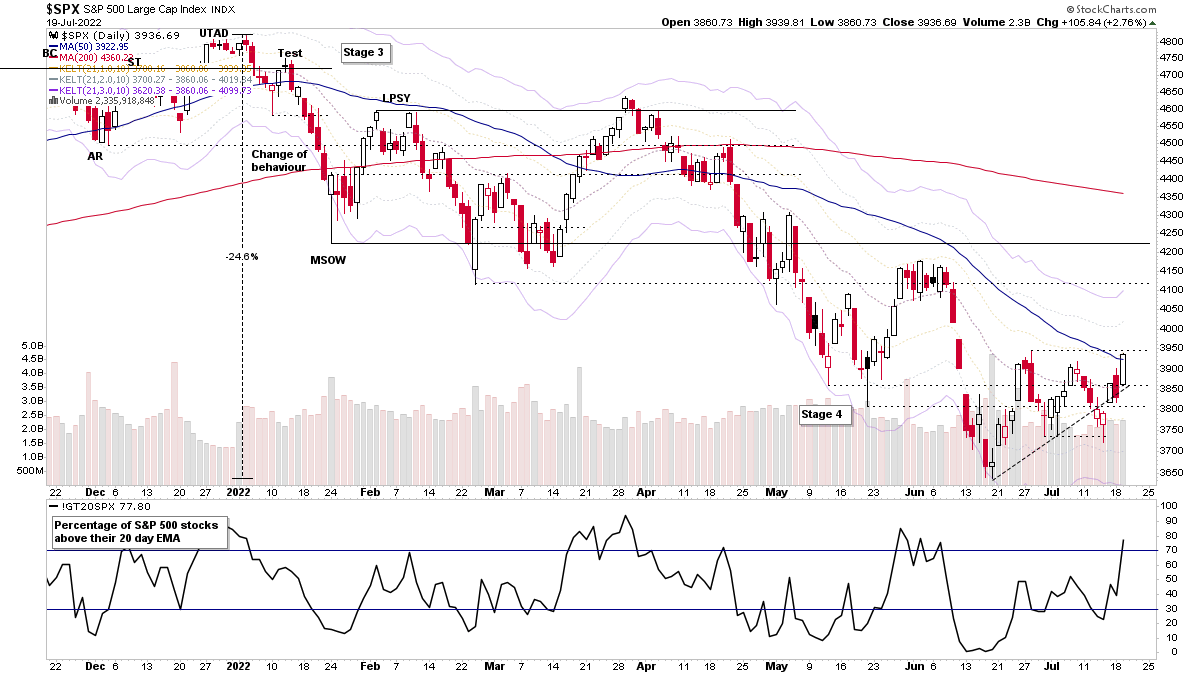

The S&P 500 continued higher for a third day in a row with a shakeout in the first hour before turning higher again. It closed above the +1x ATR level and has put in a higher high and higher low within the small rising channel / flag pattern of which it's approaching the upper end of.

Read More

20 July, 2022

Stage Analysis Members Midweek Video – 20 July 2022 (1hr 22mins)

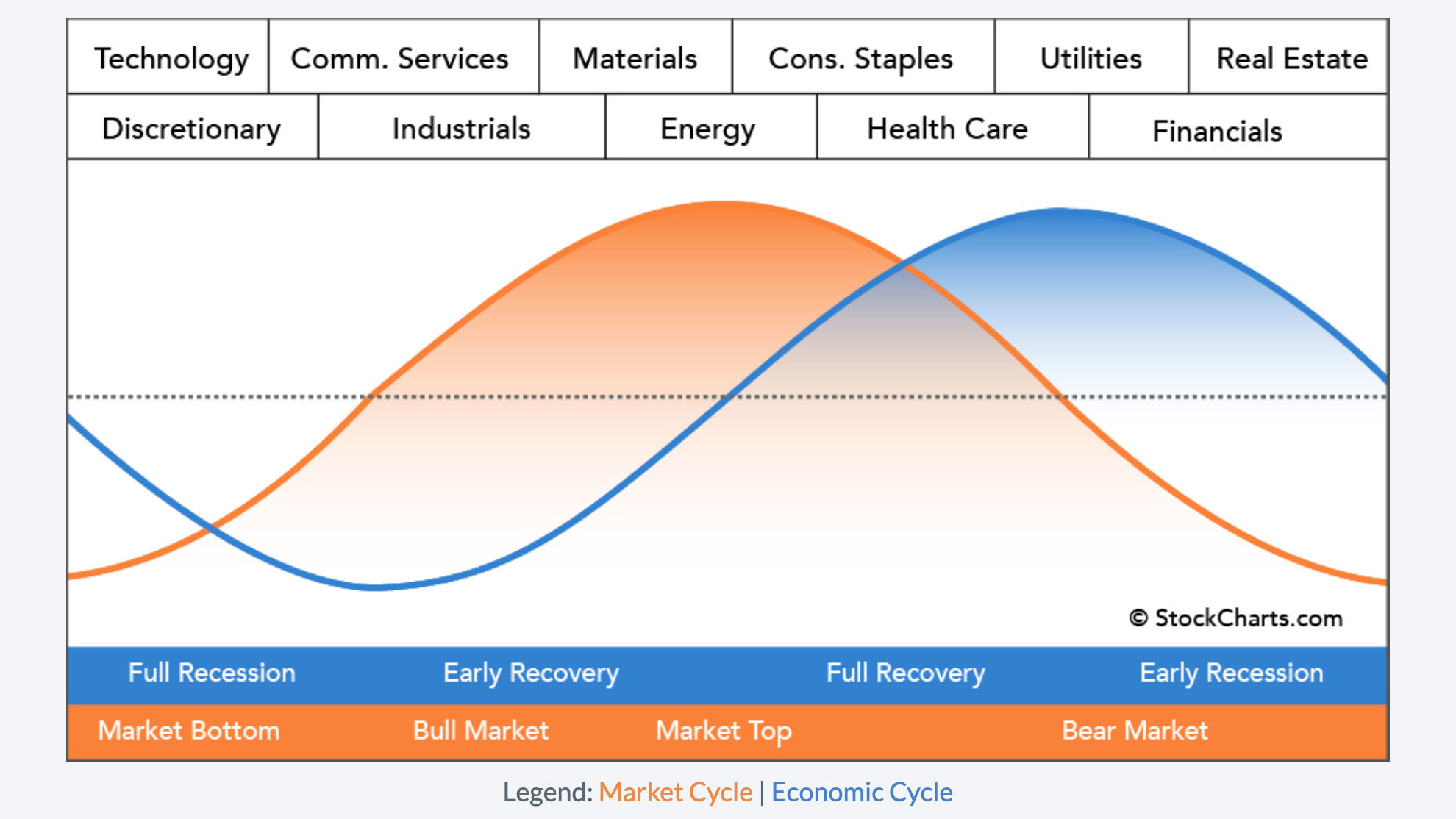

Tonights Stage Analysis Members midweek video begins with a look at the Sector Rotation Model that suggests the sectors that tend to lead the market at the different points in the market cycle and economic cycle. Followed by a brief chat of the recent article on the Top 5 Books To Learn the Wyckoff Method, before discussing the Major Index charts...

Read More

19 July, 2022

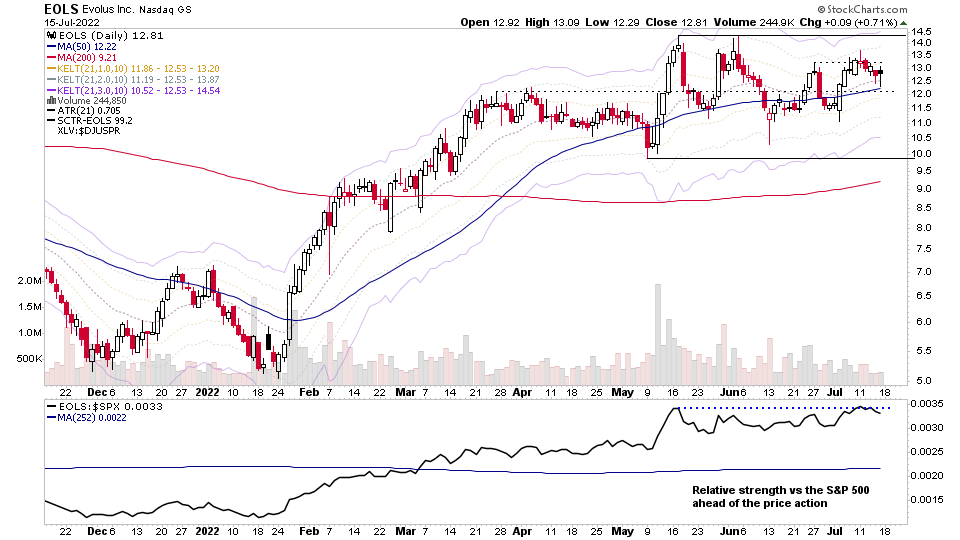

Stock Market Update and US Stocks Watchlist – 19 July 2022

The S&P 500, Nasdaq and Russell 2000 Small Caps all managed to close above their 50 day moving averages for the first time in many months. However, they are all still in the range of the recent minor swing highs and testing their +1x ATR levels, and so could easily flip back below their 50 day MAs again if follow through action fails to materialise in the coming days.

Read More

19 July, 2022

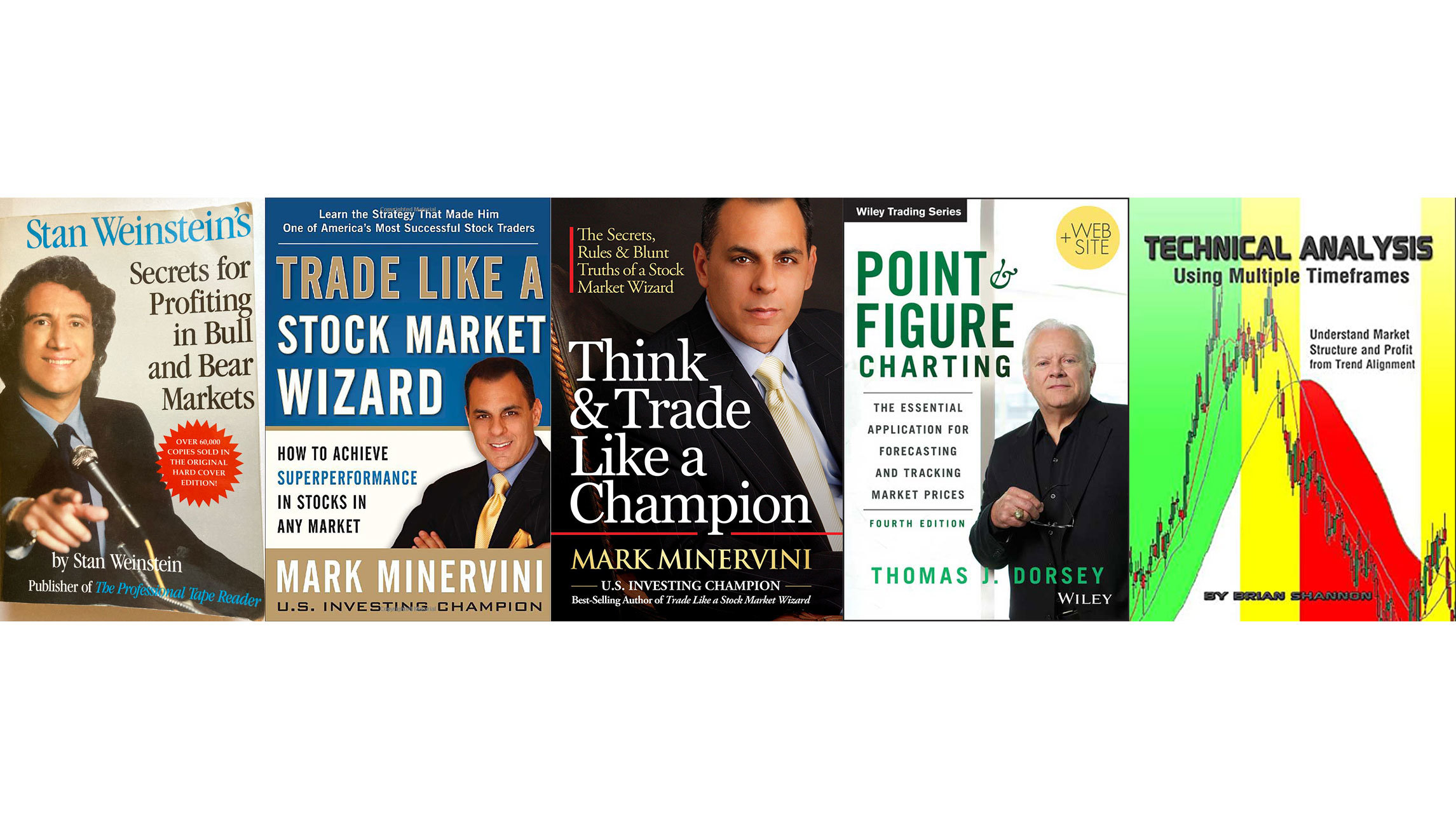

Top 5 Books To Learn Stan Weinstein’s Stage Analysis Method

The Stage Analysis method this website is based upon comes from Stan Weinstein's classic book, which is called Stan Weinstein's Secrets For Profiting in Bull and Bear Markets. The method has stood the test of time through multiple extremes of both bull and bear markets over the last 30+ years; and to this day Stan Weinstein still runs his institutional investment service called the Global Trend Alert – which he launched in the early 1990s.*

Read More

17 July, 2022

Stage Analysis Members Weekend Video – 17 July 2022 (1hr 30mins)

The Stage Analysis Members weekend video starts with a look at US Stocks Industry Groups Relative Strength Rankings and some of the groups on the move and stocks from those groups. Then in the members only content first a review of the Major Indexes – S&P 500, Nasdaq, Russell 2000 as well as chart analysis of Oil, Copper, Treasuries, Gold and the VIX...

Read More

17 July, 2022

US Stocks Watchlist – 17 July 2022

For the watchlist from the weekend scans...

Read More

16 July, 2022

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More