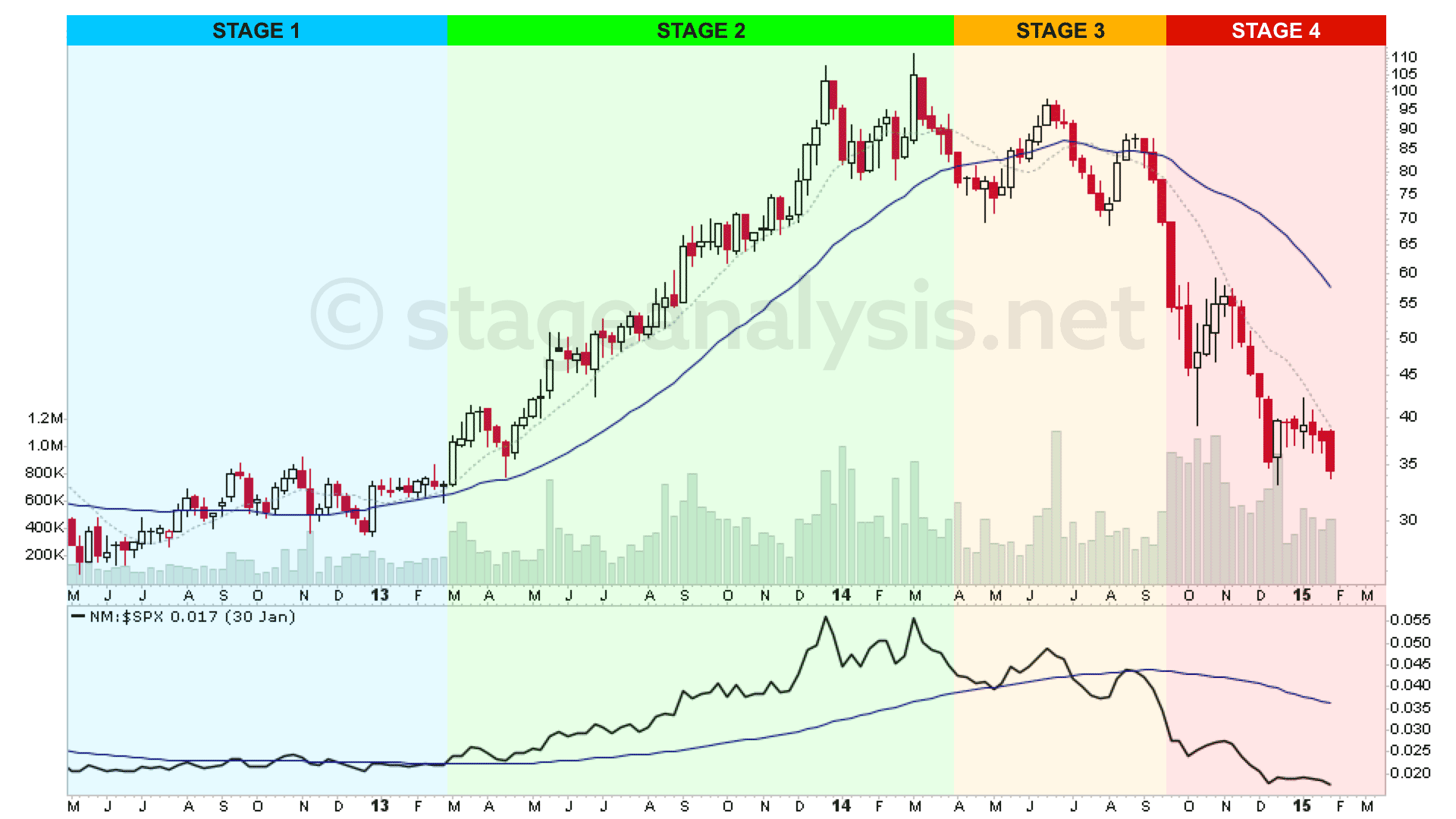

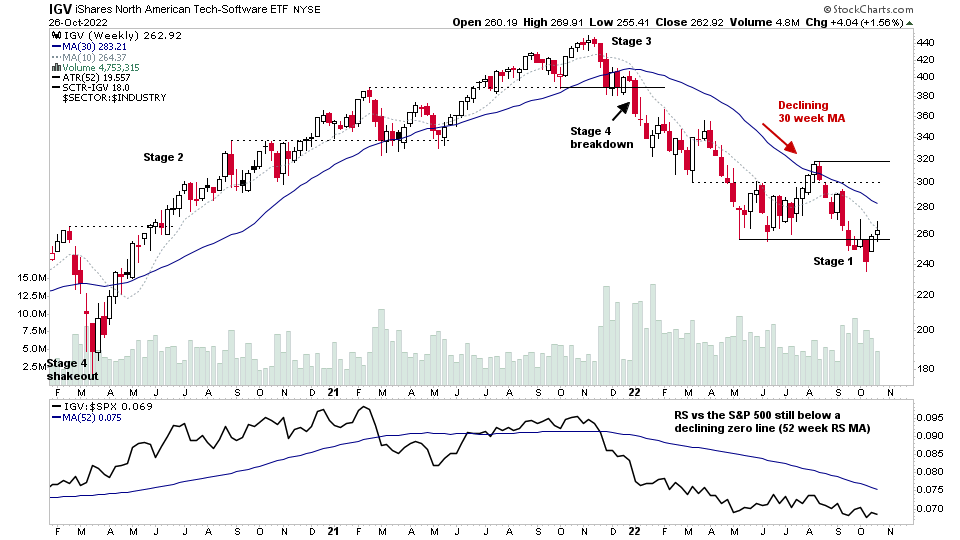

The members midweek video this week begins with a special group focus on the Software group, which I've talked about in the Stage Analysis videos a number of times over the summer months, as the stocks in the group have gradually moved towards Stage 1 type behaviour...

Read More

Blog

26 October, 2022

S&P 500 Testing the 50 Day MA and the US Stocks Watchlist – 25 October 2022

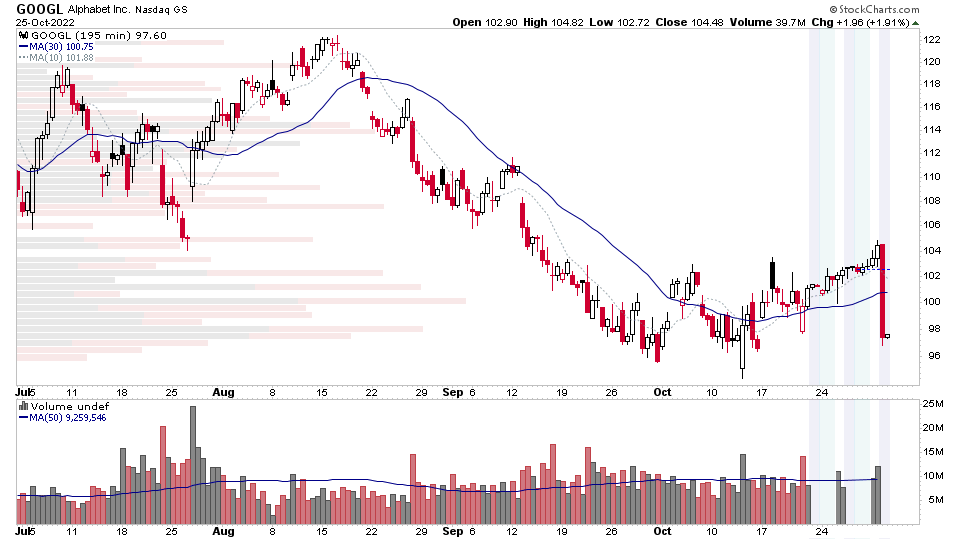

The major US markets rallied strongly today with expanding short-term breadth and a further Follow Through Day. However, it's Mega Cap earnings week, and GOOGL and MSFT kicked it off with negatively received earnings reports...

Read More

24 October, 2022

S&P 500 Testing the Top of the Intraday Stage 1 Range and the US Stocks Watchlist – 24 October 2022

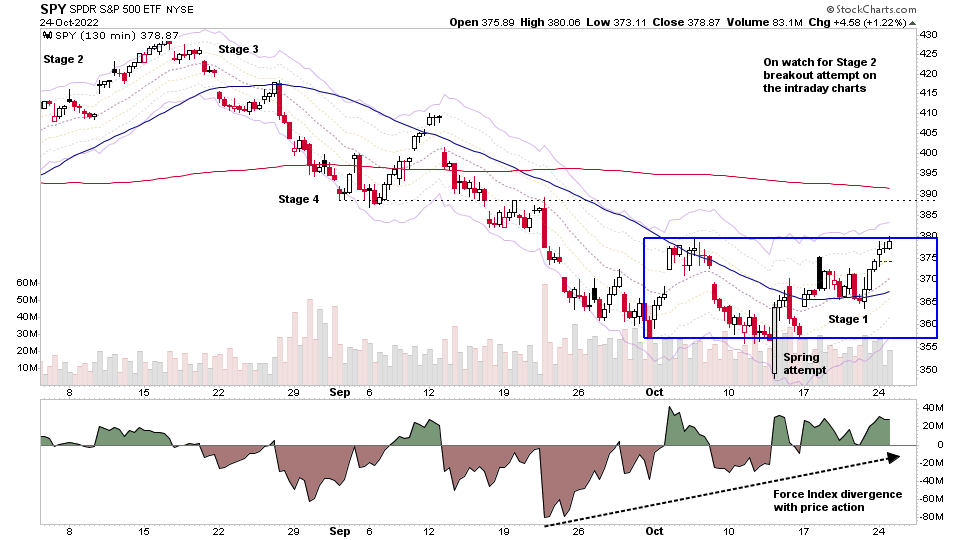

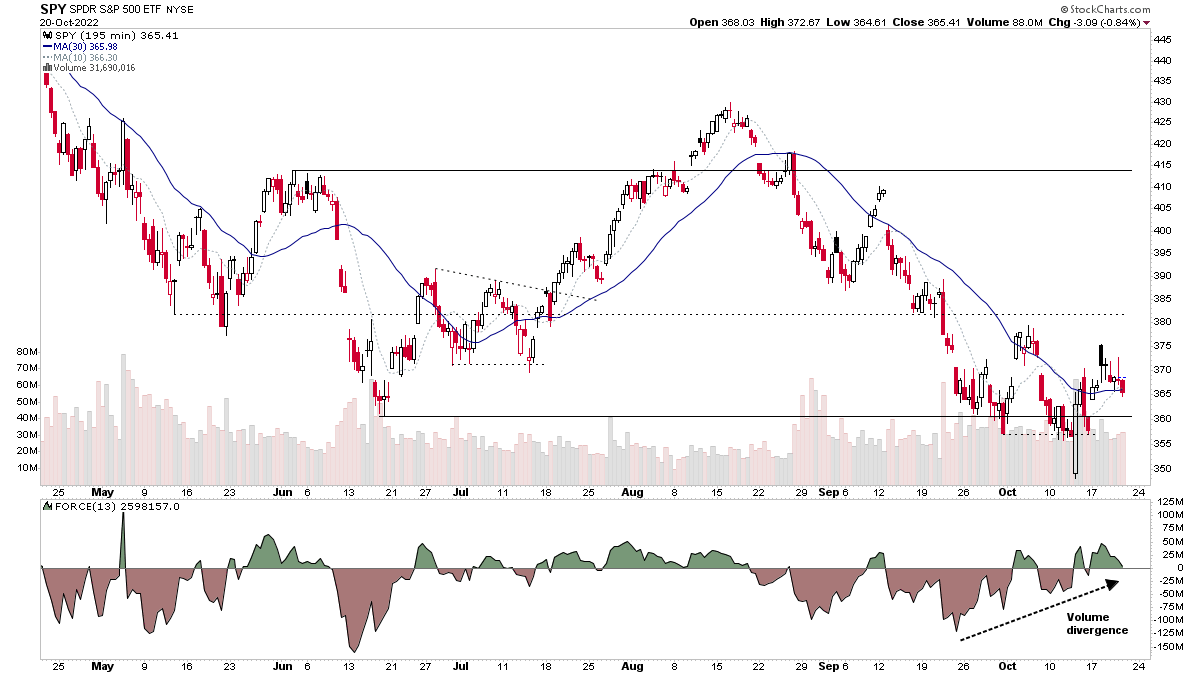

The S&P 500 (shown above via the SPY etf intraday 130 minute chart – 3 bars/day) continued higher towards the top of the October range that's developed as a Stage 1 base structure on the lower intraday timeframes, and is now testing the top of the range...

Read More

23 October, 2022

Stage Analysis Members Video Part 2 – 23 October 2022 (58 mins)

Part 2 of the regular members weekend video discussing the market, commodities, industry groups and market breadth to determine the weight of evidence.

Read More

23 October, 2022

Stage Analysis Members Video Part 1 – 23 October 2022 (43 mins)

Part 1 of the weekend video discussing the watchlist stocks from Thursday and the Weekend watchlist posts.

Read More

23 October, 2022

US Stocks Watchlist – 23 October 2022

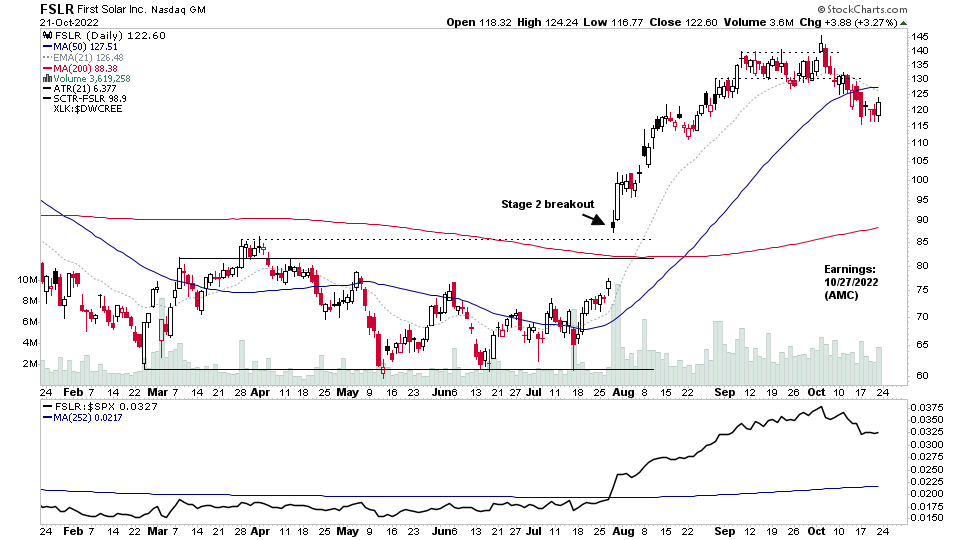

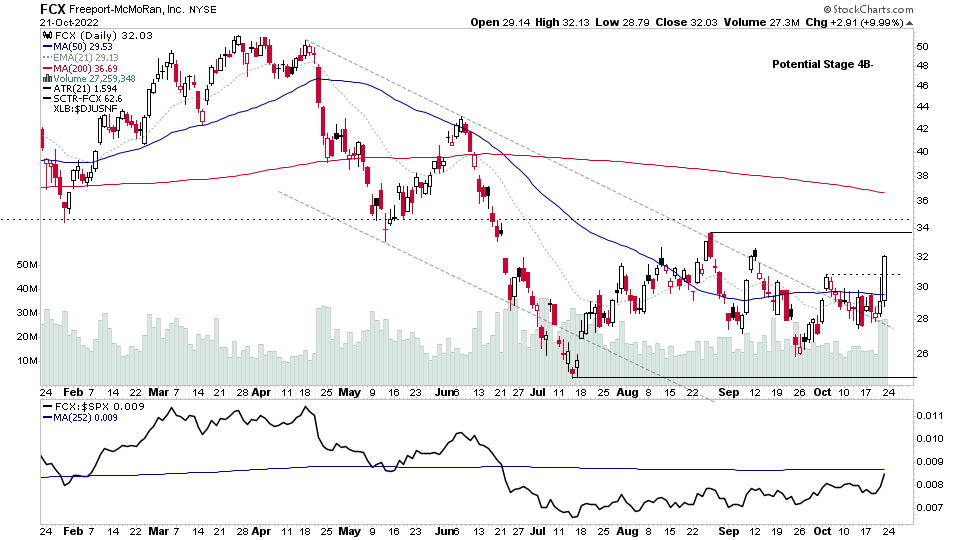

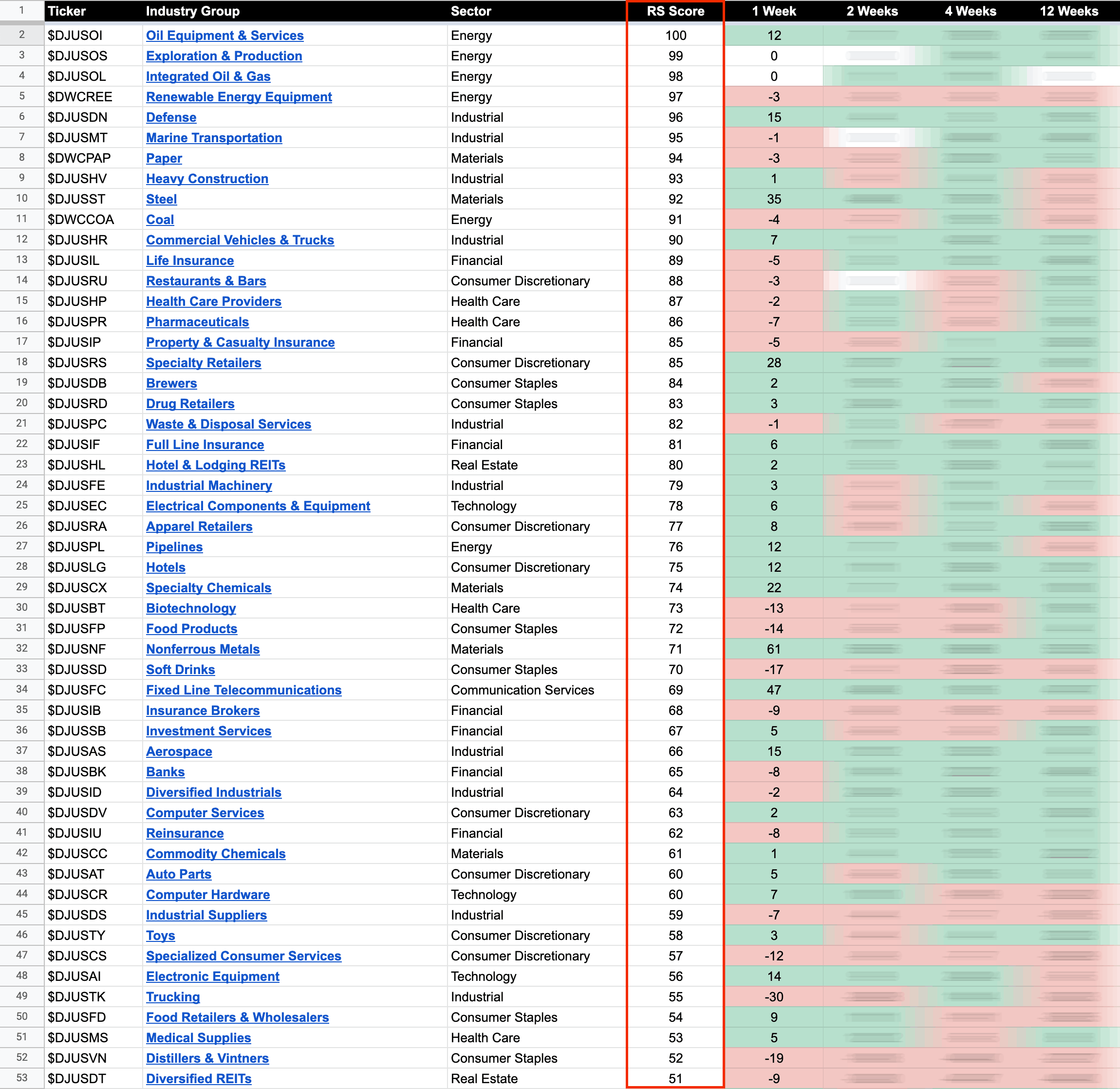

I noted the relative strength in the Nonferrous Metals and Steel groups in the RS rankings blog post on Friday, which have also featured strongly in the watchlist scans this weekend, as well as a number of other areas such as Gold Mining (Gold and Silver stocks) and the strength in some of the Technology groups as money rotated from more defensive groups/sectors into the more speculative areas on Friday...

Read More

22 October, 2022

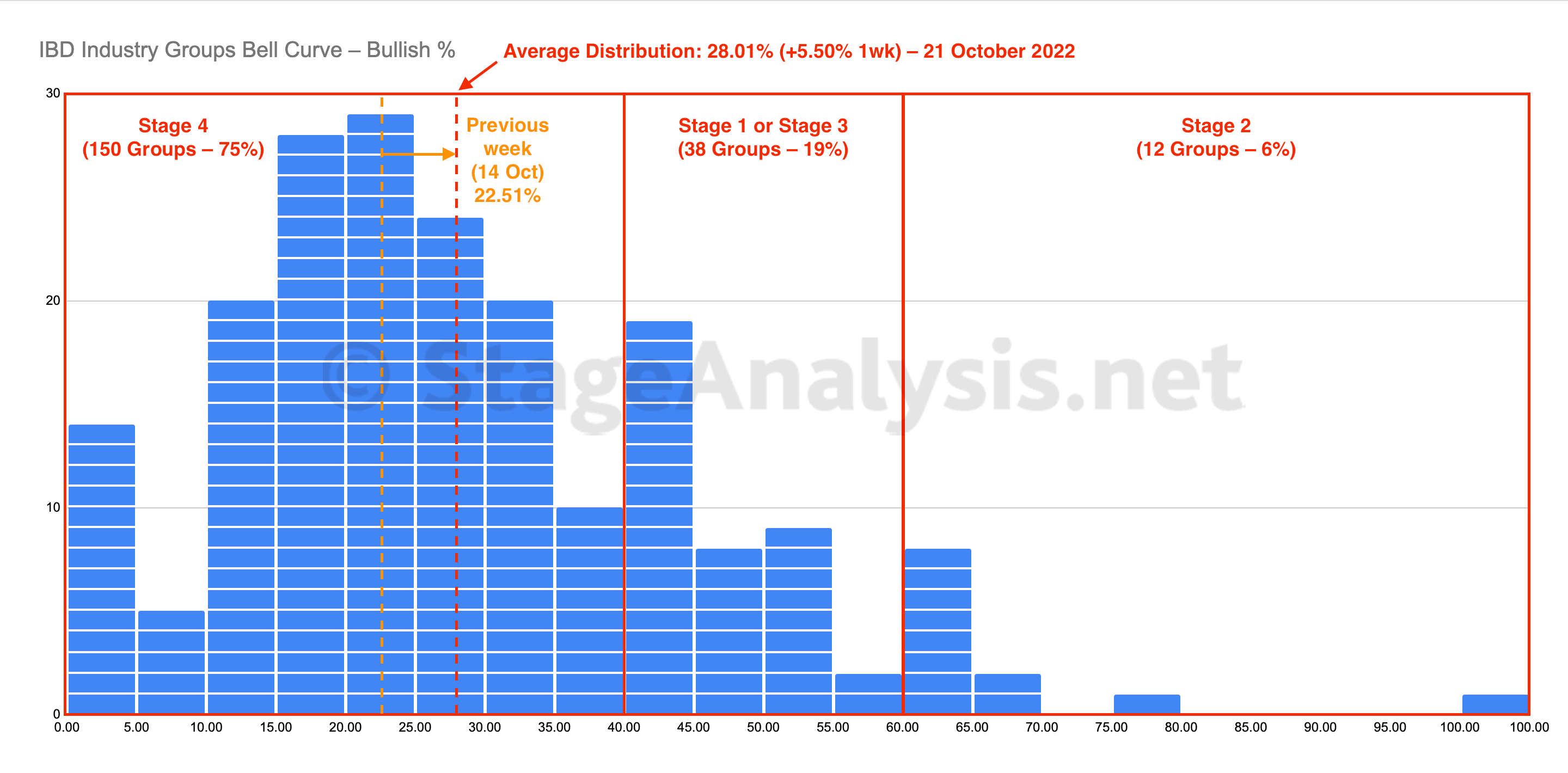

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent improved over the last week with 24 groups (-12%) less in the Stage 4 zone, and 14 groups (+7%) more groups in the neutral Stage 1 / Stage 3 zone and 10 groups (+5%) more moving into the Stage 2 zone...

Read More

22 October, 2022

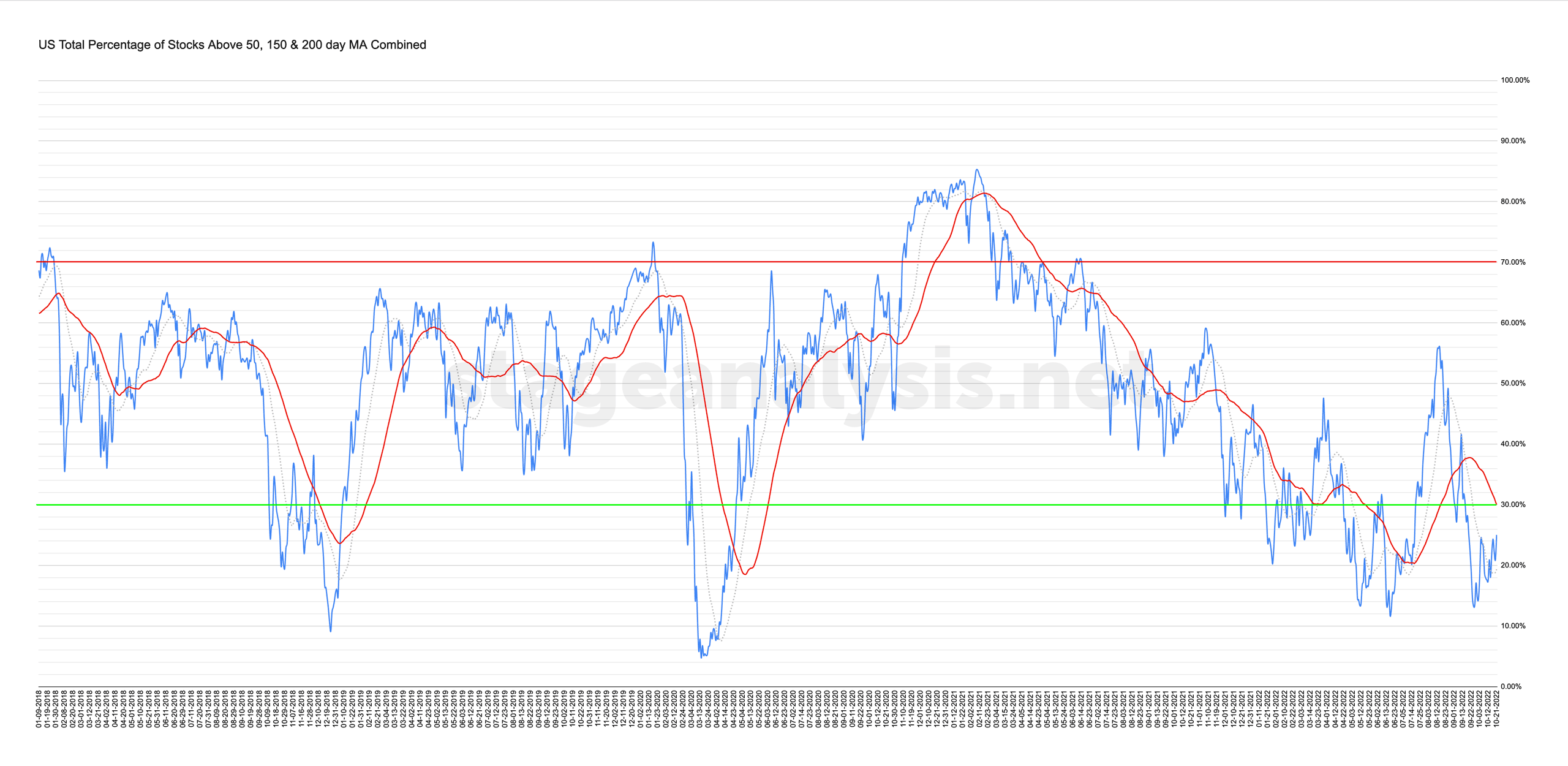

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

21 October, 2022

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

20 October, 2022

Stock Market Update and the US Stocks Watchlist – 20 October 2022

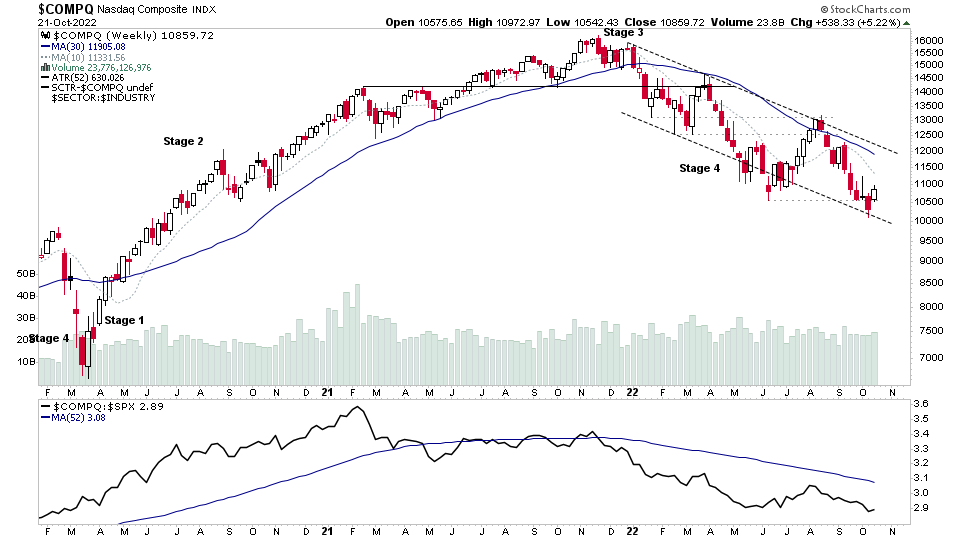

The S&P 500 and other major stock market indexes pulled back for another day, but remains above the swing low that formed a week ago on heavy volume on the 13th October...

Read More