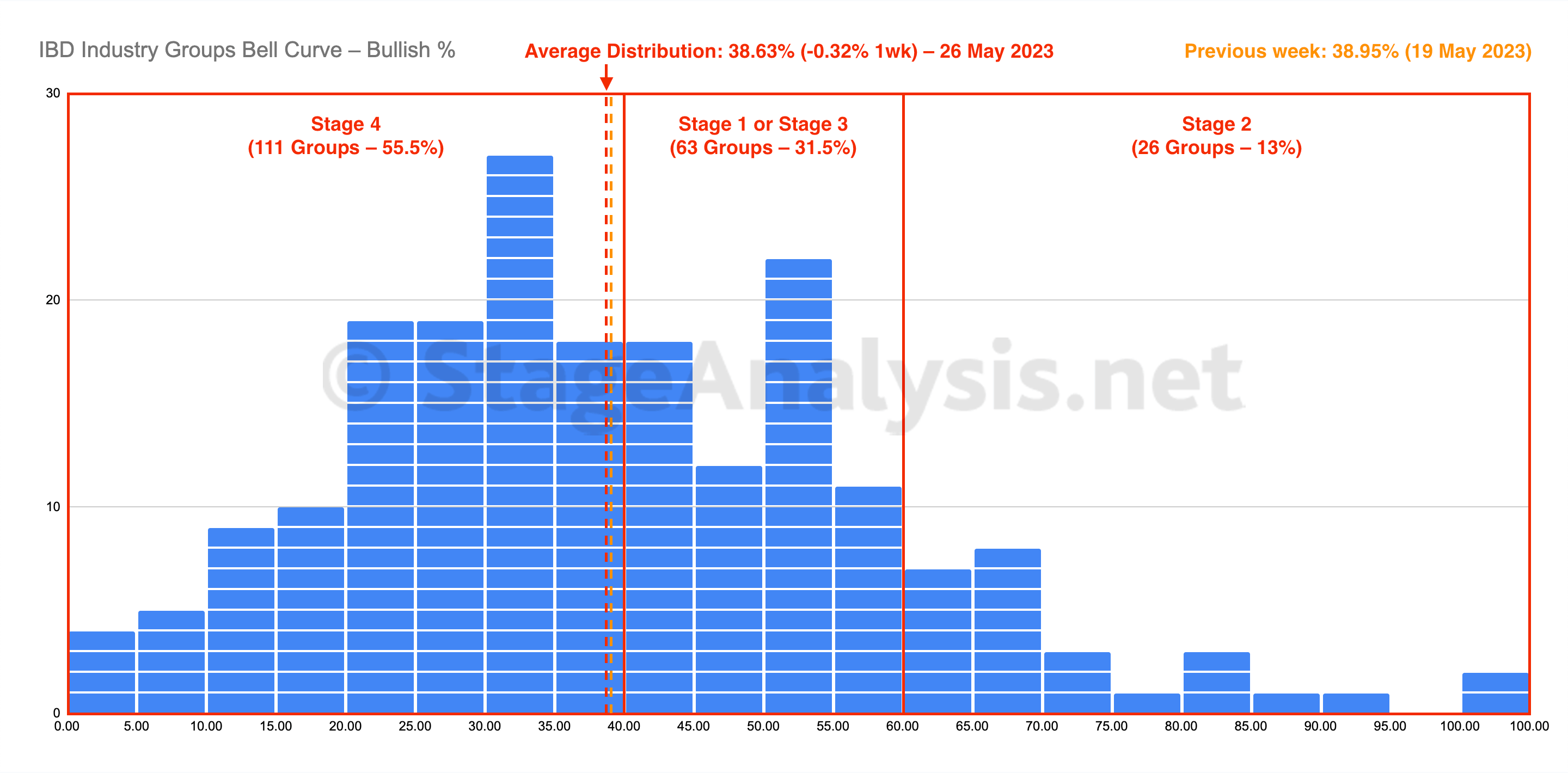

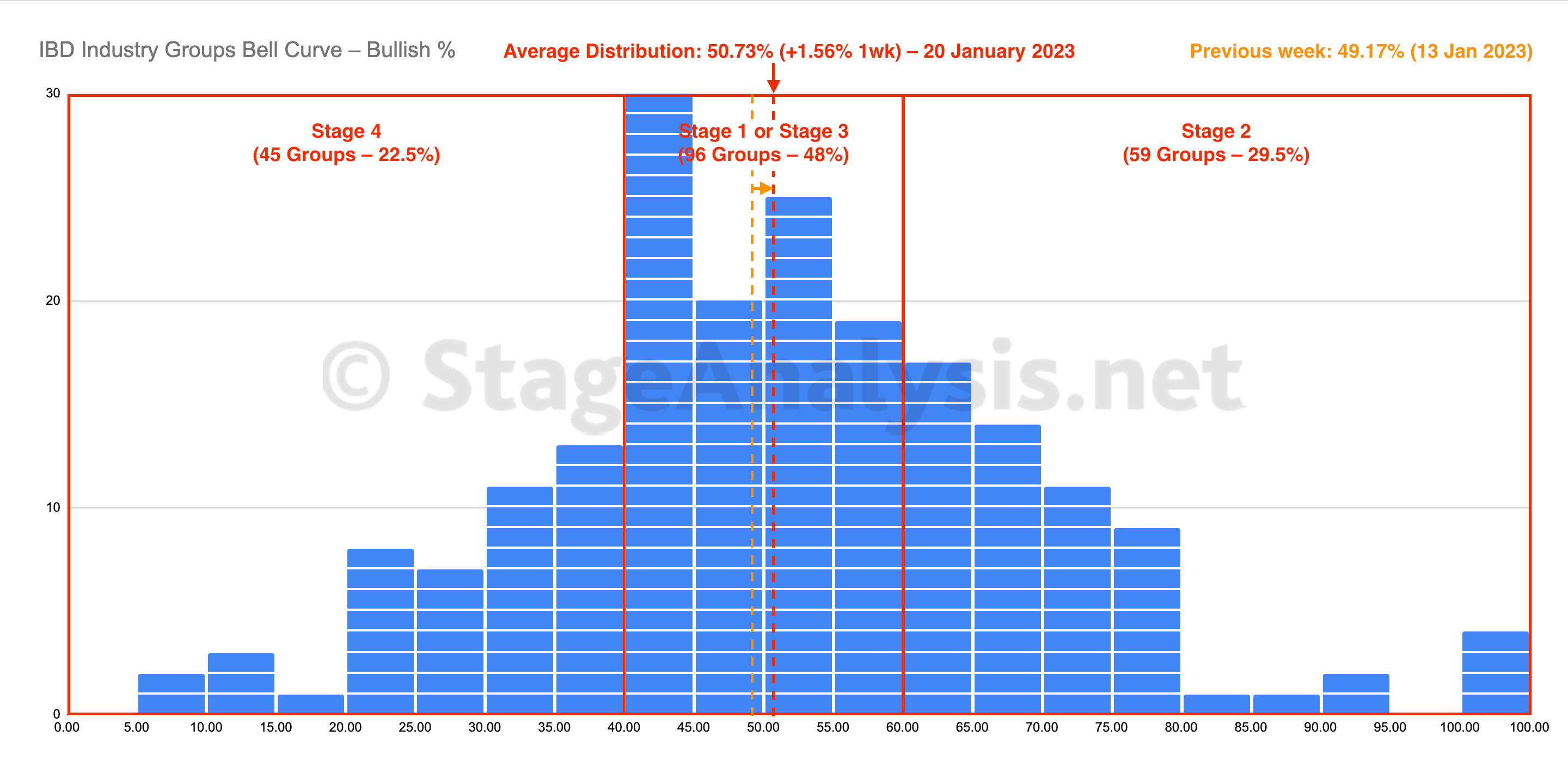

The IBD Industry Groups Bell Curve decreased by -0.32% this week to finish at 38.63% overall. The amount of groups in Stage 4 increased by 4 (+2%), and the amount of groups in Stage 2 increased by 2 (+1%), while the amount groups in Stage 1 or Stage 3 decreased by 7 (-3.5%).

Read More

Blog

27 May, 2023

IBD Industry Groups Bell Curve – Bullish Percent

27 May, 2023

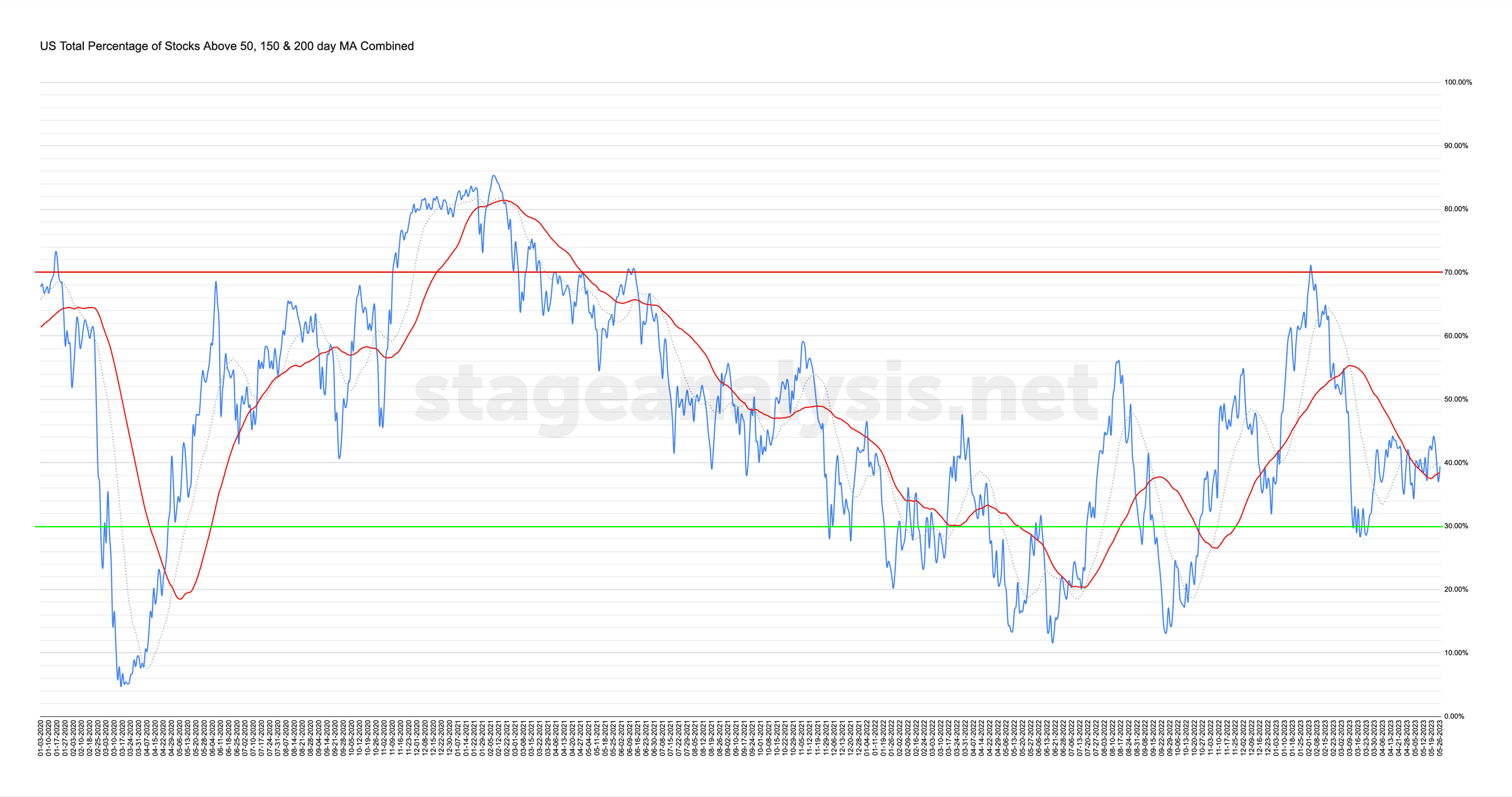

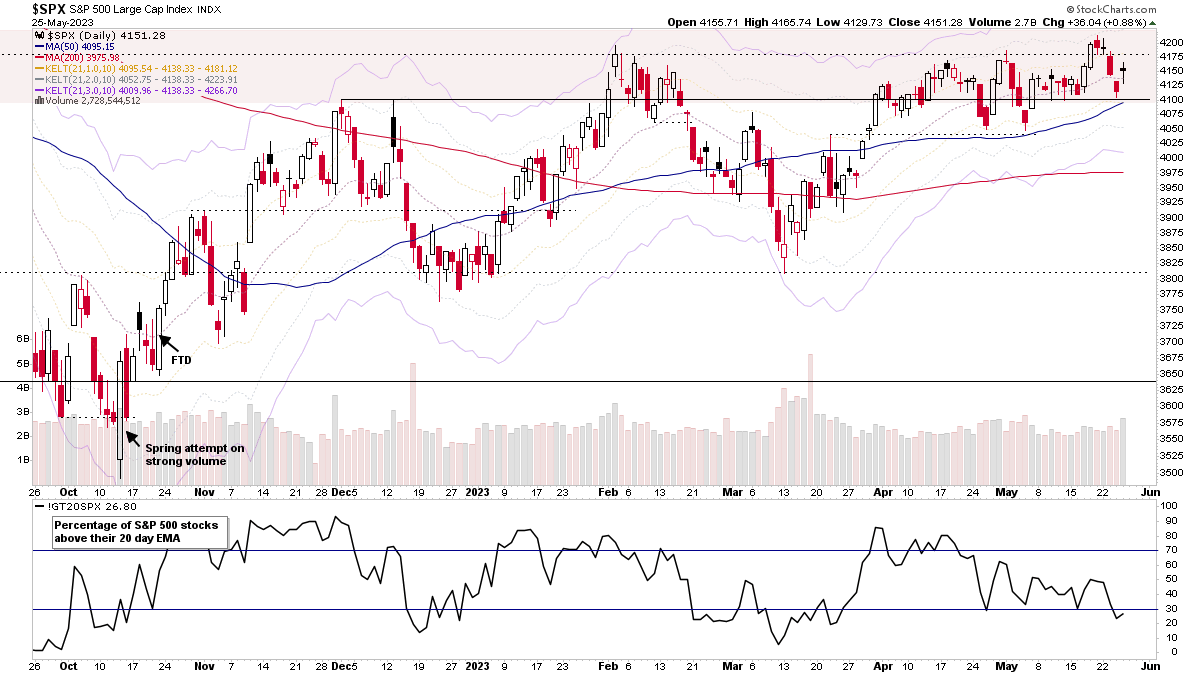

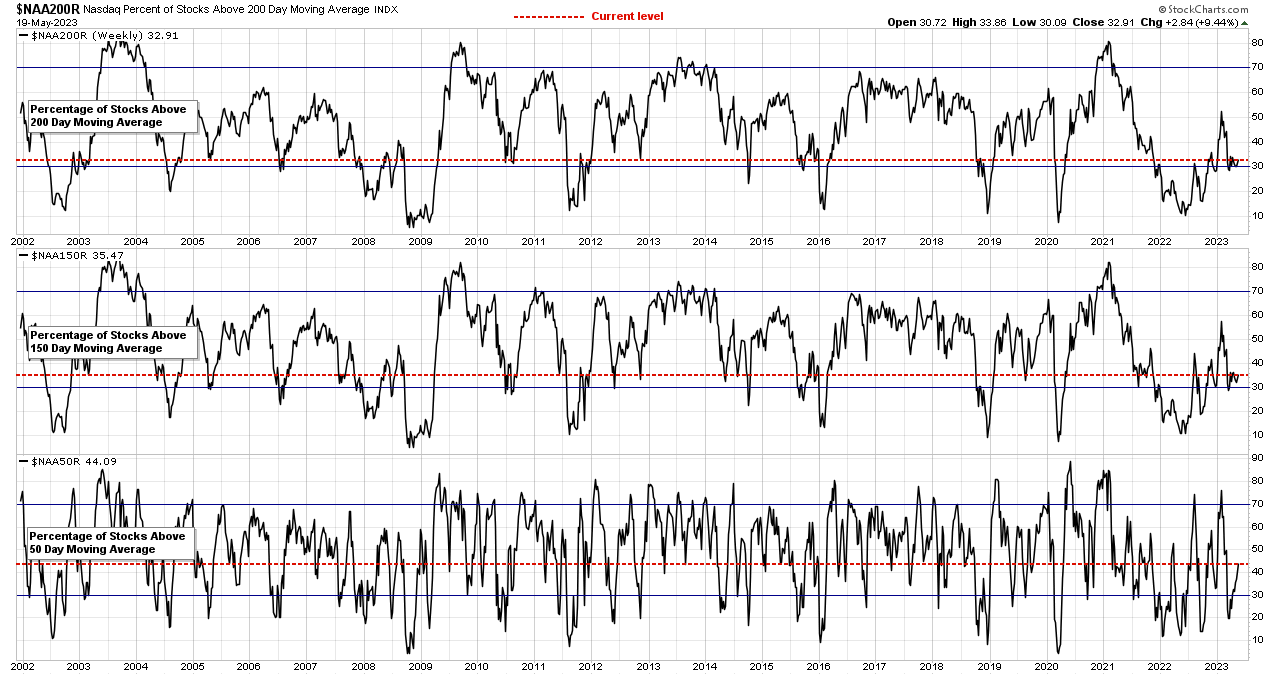

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

26 May, 2023

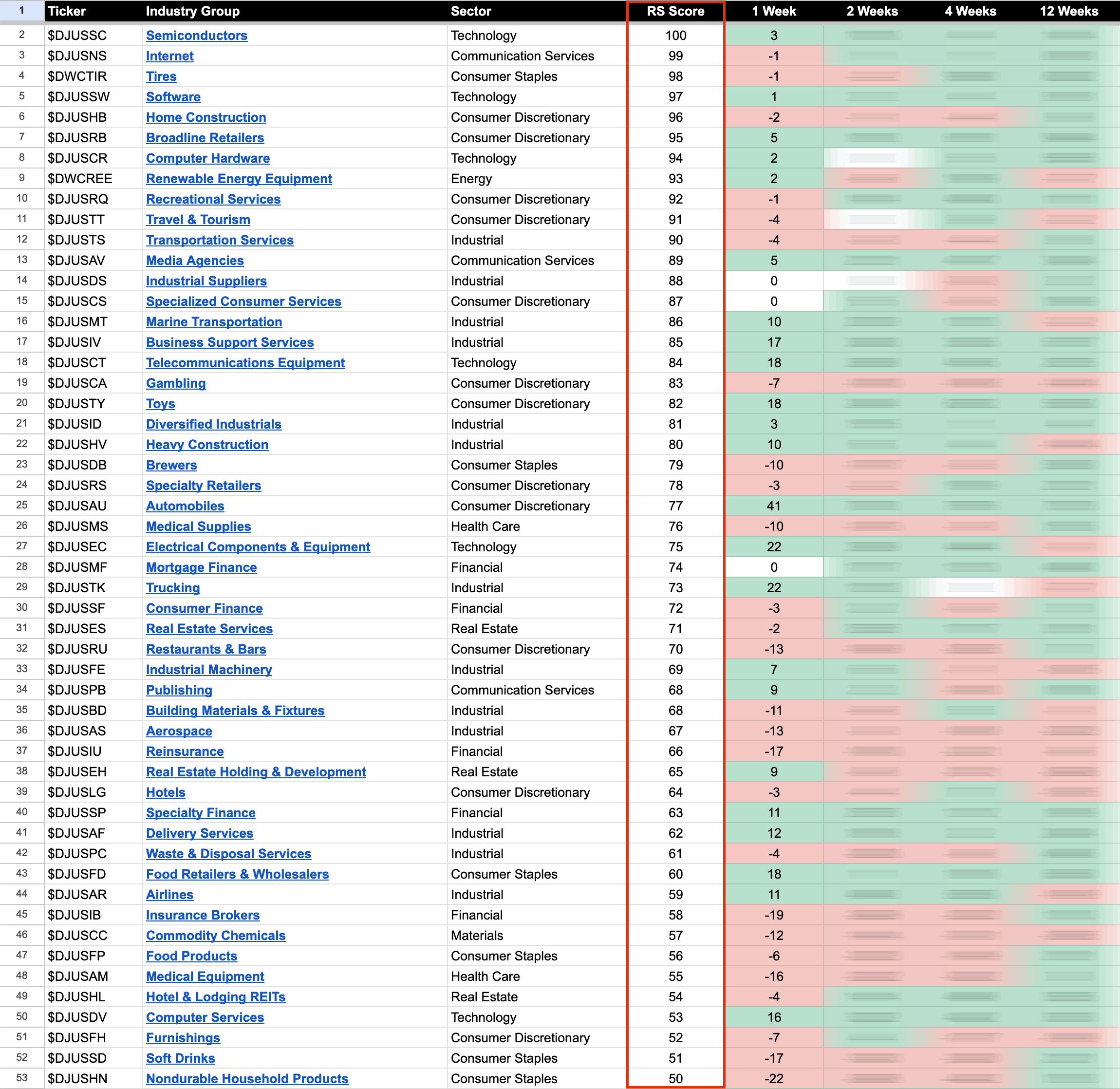

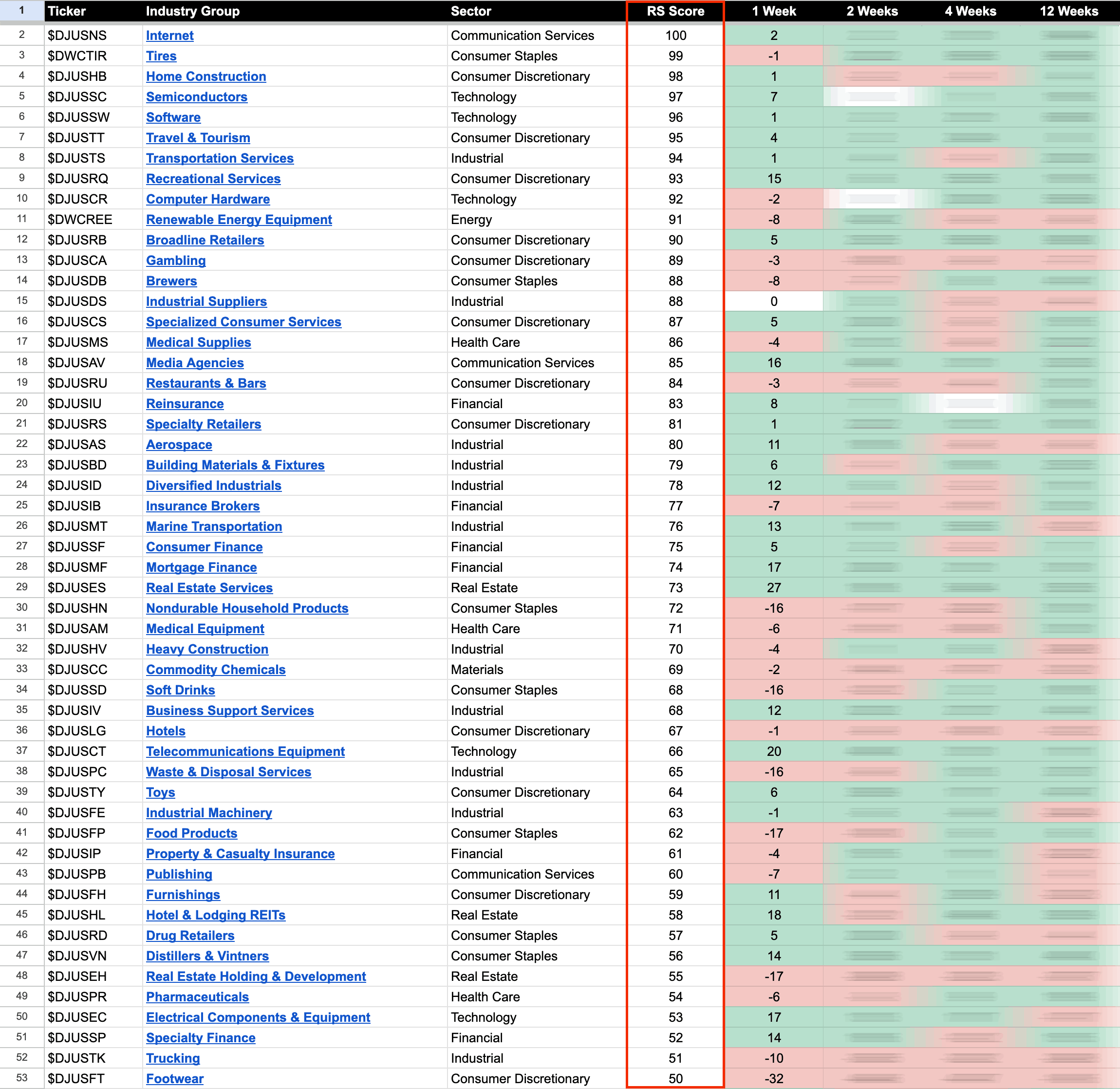

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

25 May, 2023

US Stocks Watchlist – 25 May 2023

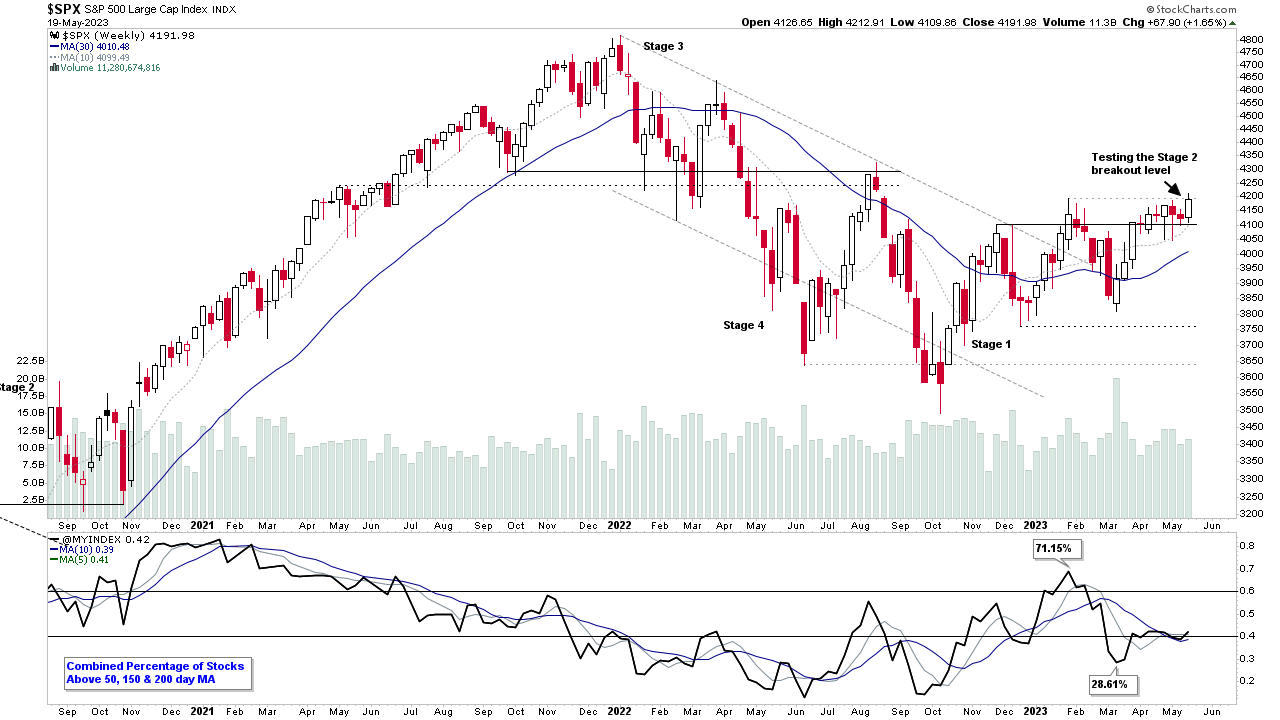

The bifurcated market continues with the Nasdaq 100 making higher highs in early Stage 2, while the S&P 500 consolidates at the top of its Stage 1 base structure, and the Russell 2000 Small Caps continues to decline, and hold below its 200 day MA...

Read More

24 May, 2023

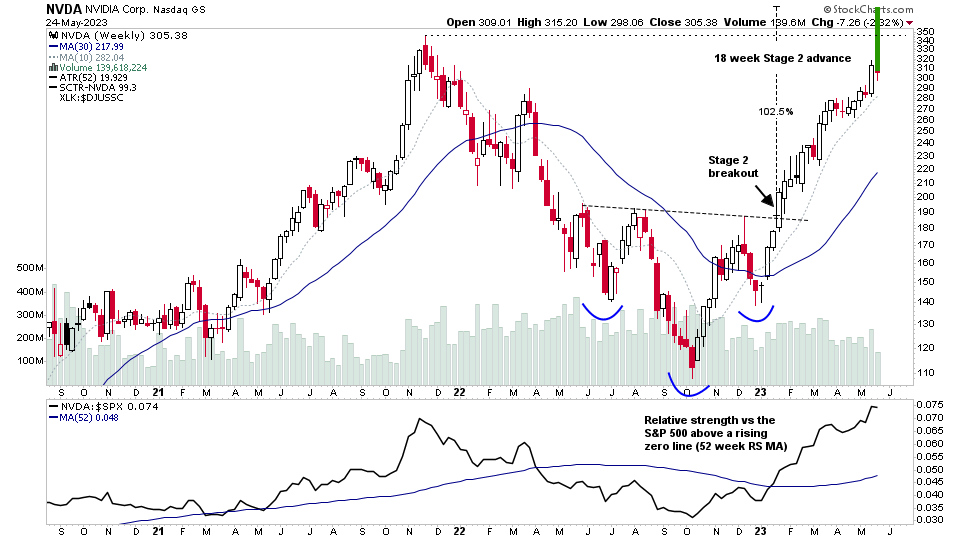

NVDA Earnings Surprise and the US Stocks Watchlist – 24 May 2023

NVDA is the most talked about stock in the after-hours today, following its earnings results and guidance. With a huge move to new all time highs (380.60 currently in the after-hours), which puts it at over 100% above its 23rd January Stage 2 breakout entry point...

Read More

23 May, 2023

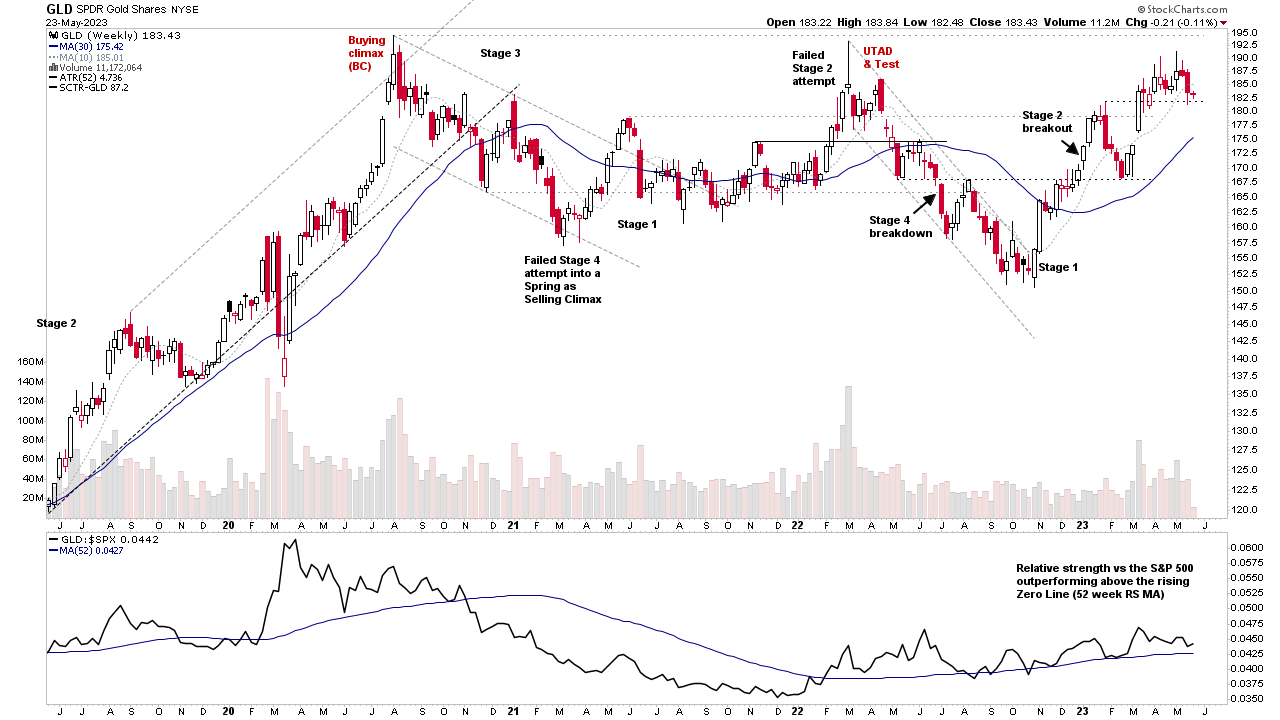

Group Focus: Gold and Silver and the Precious Metals Miners – 23 May 2023 (25 mins)

The main theme from the watchlist scans today was the Gold Mining group, so I thought it would be interesting to do a follow-up on the group, which I've discussed previously in detail around the Stage 2 entry zones...

Read More

21 May, 2023

Stage Analysis Members Video – 21 May 2023 (1hr 14mins)

Stage Analysis weekend video discussing some of the weeks most significant Stage 2 Breakouts and Continuation attempts, plus the regular weekly member content of the Major Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, and Market Breadth Update to help to determine the weight of evidence...

Read More

20 May, 2023

IBD Industry Groups Bell Curve – Bullish Percent

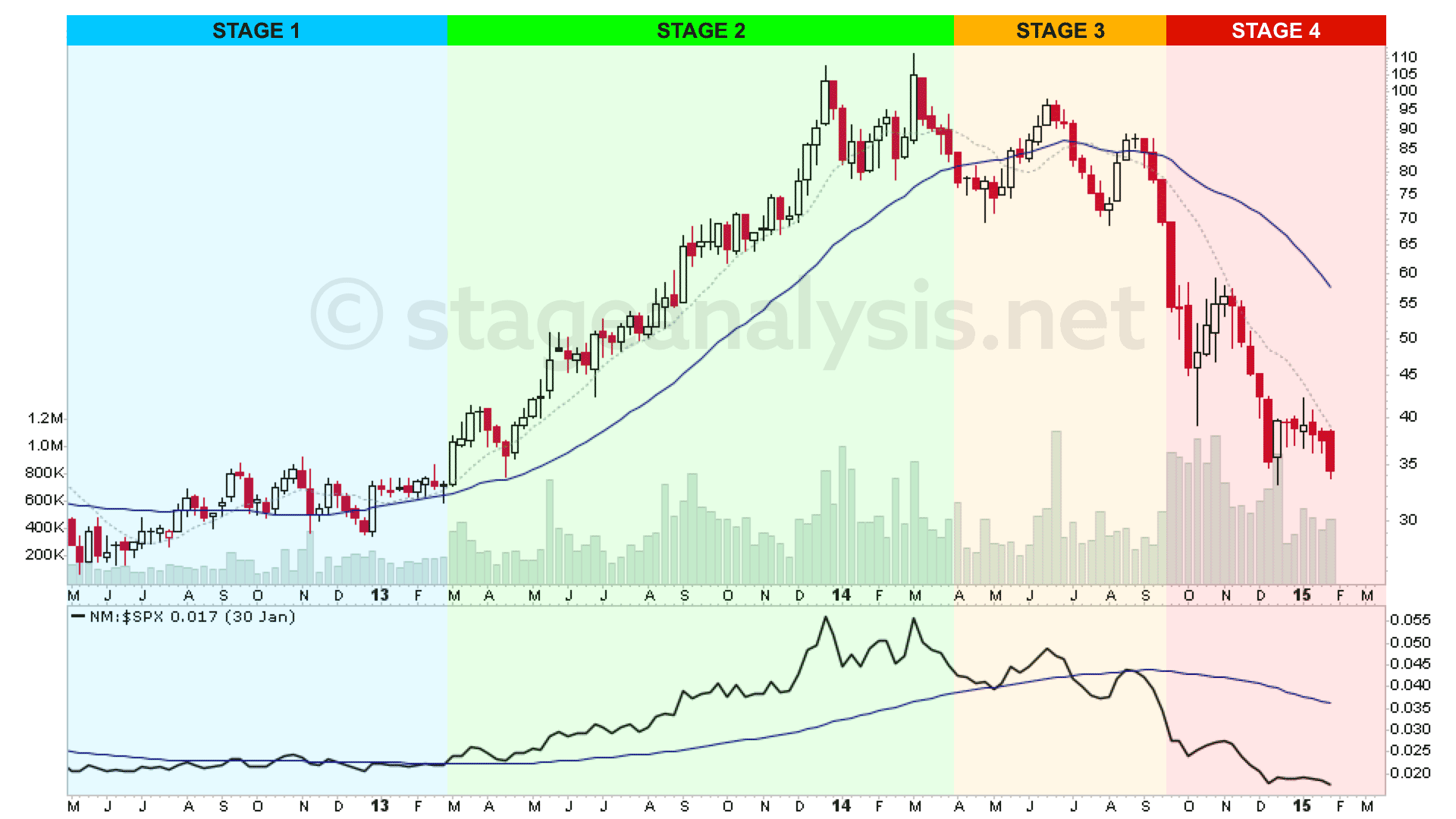

The IBD Industry Groups Bell Curve – Bullish Percent shows the few hundred industry groups plotted as a histogram chart and represents the percentage of stocks in each group that are on a point & figure (P&F) buy signal. This information provides a snapshot of the overall market health in a unique way, and is particularly useful for both market timing strategies and as a tool in aiding with the Stage Analysis methods "Forest to the Trees" approach, where we look for developing group themes...

Read More

20 May, 2023

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

20 May, 2023

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More