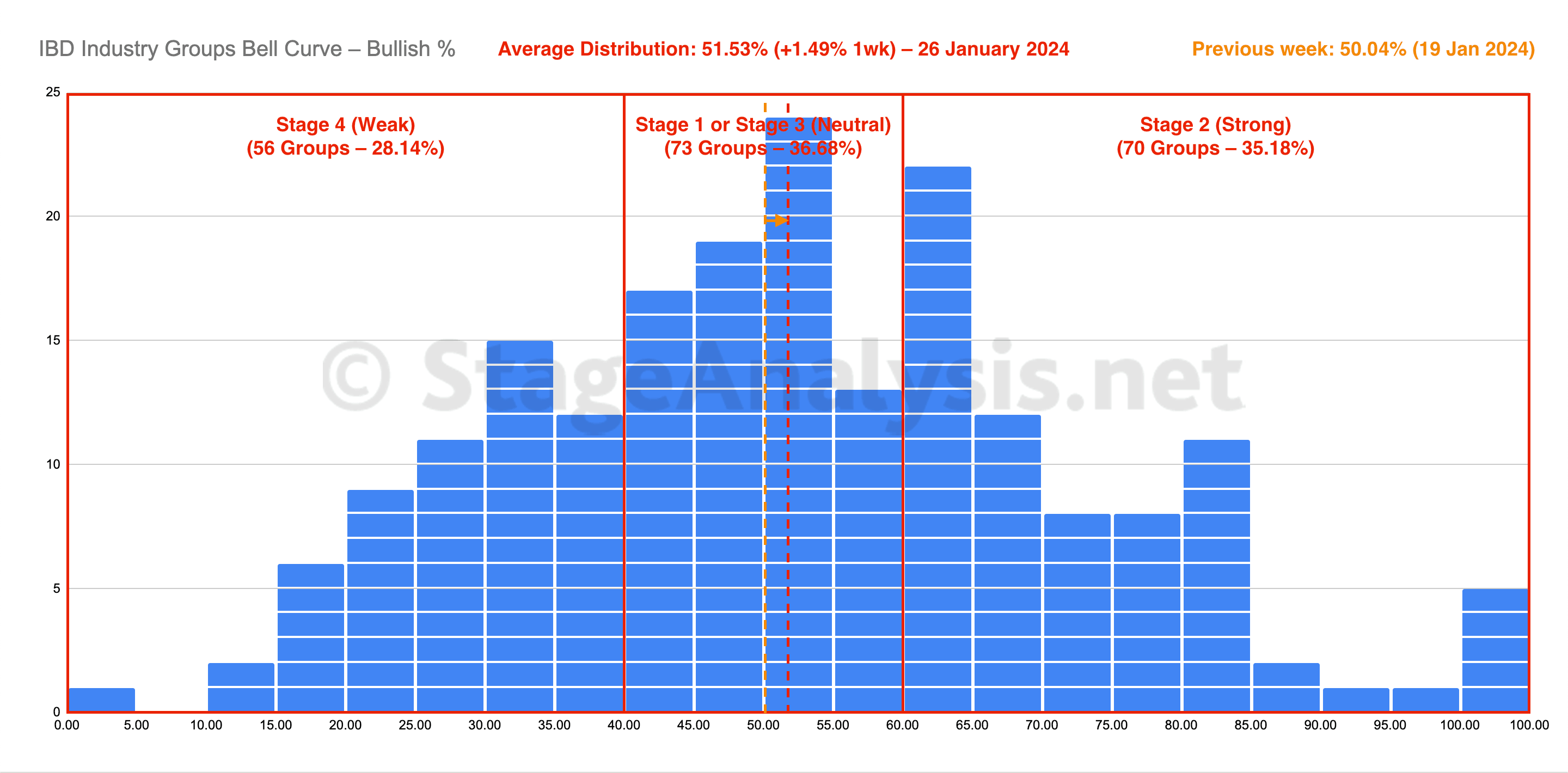

The IBD Industry Groups Bell Curve increased by +1.49% this week to finish at 51.53% overall. The amount of groups in Stage 4 (Weak) increased by 8 (+4%), and the amount of groups in Stage 2 (Strong) decreased by 6 (-3%), while the amount groups in Stage 1 or Stage 3 (Neutral) decreased by 2 (-1%)...

Read More

Blog

27 January, 2024

IBD Industry Groups Bell Curve – Bullish Percent

27 January, 2024

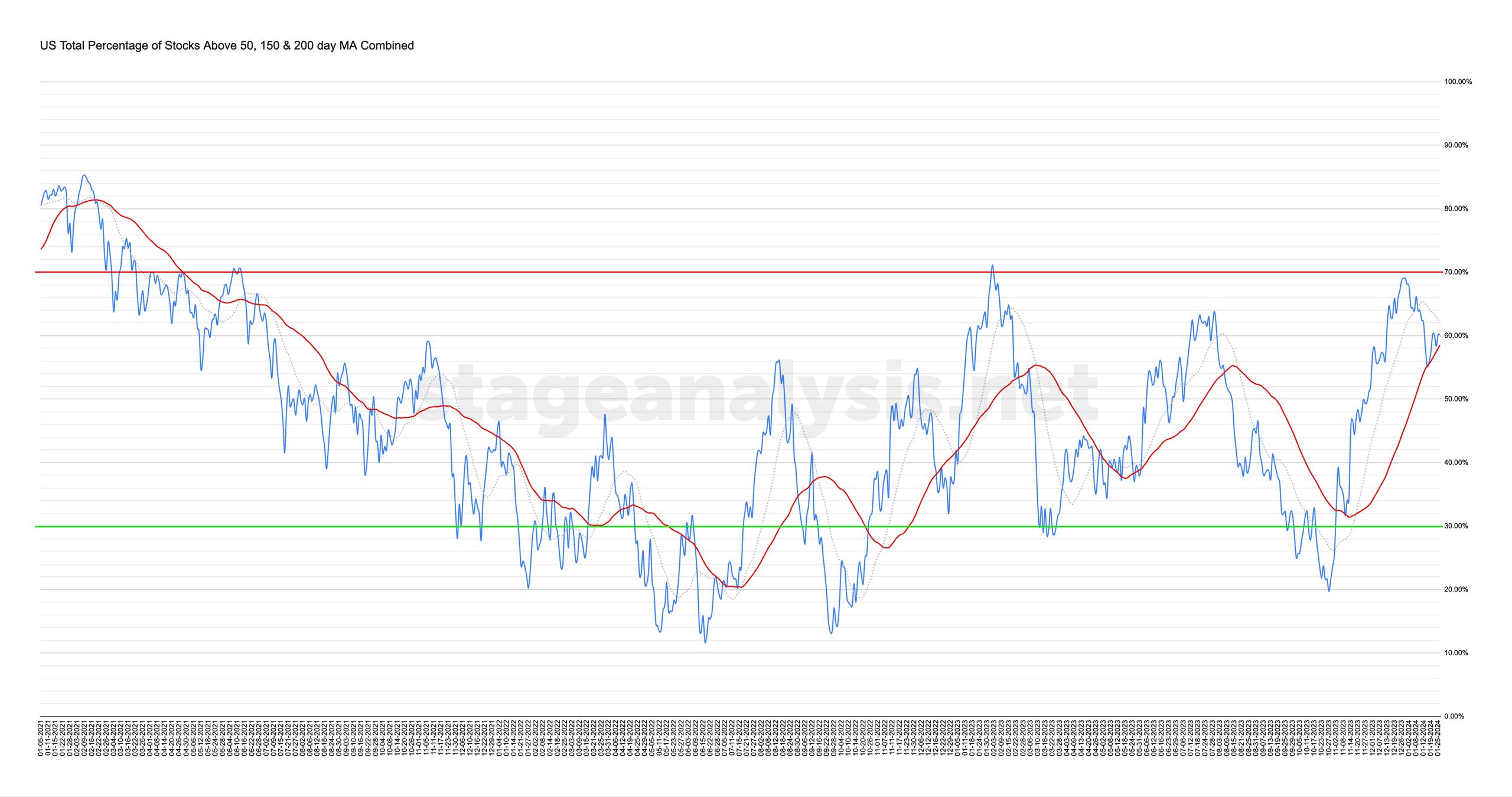

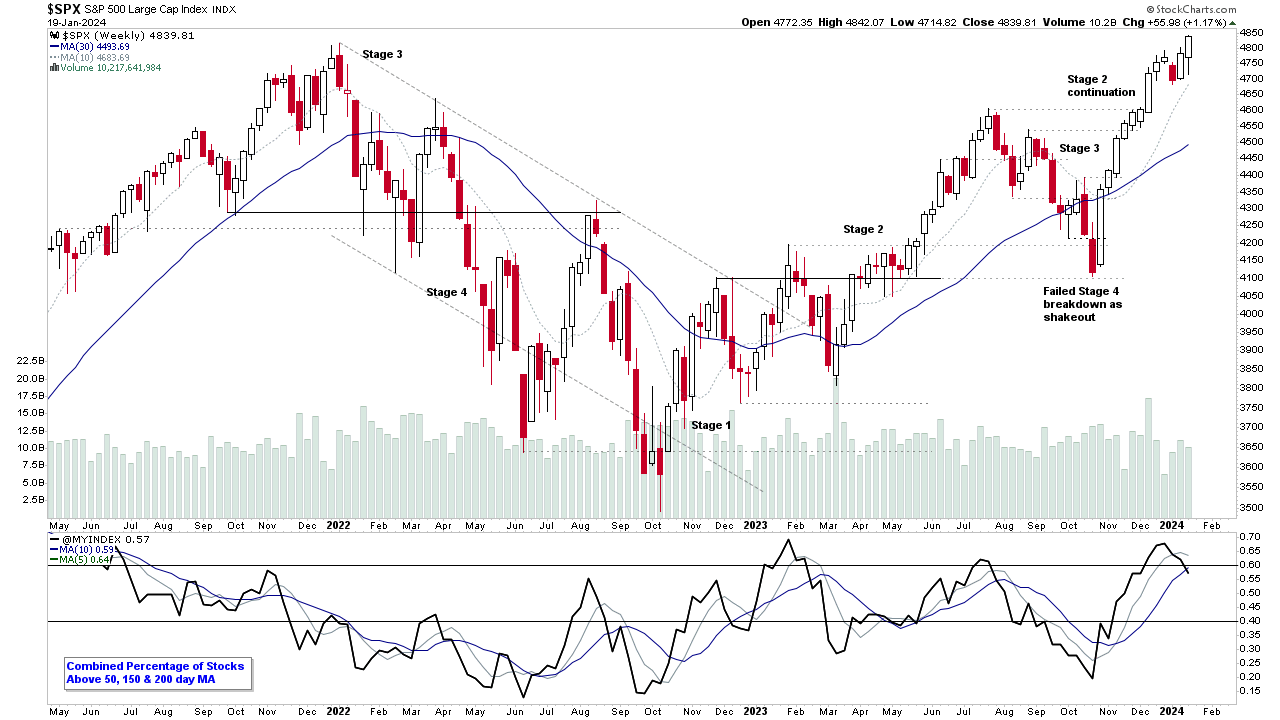

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by +2.85% this week. Therefore, the overall combined average is at 60.15% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages...

Read More

26 January, 2024

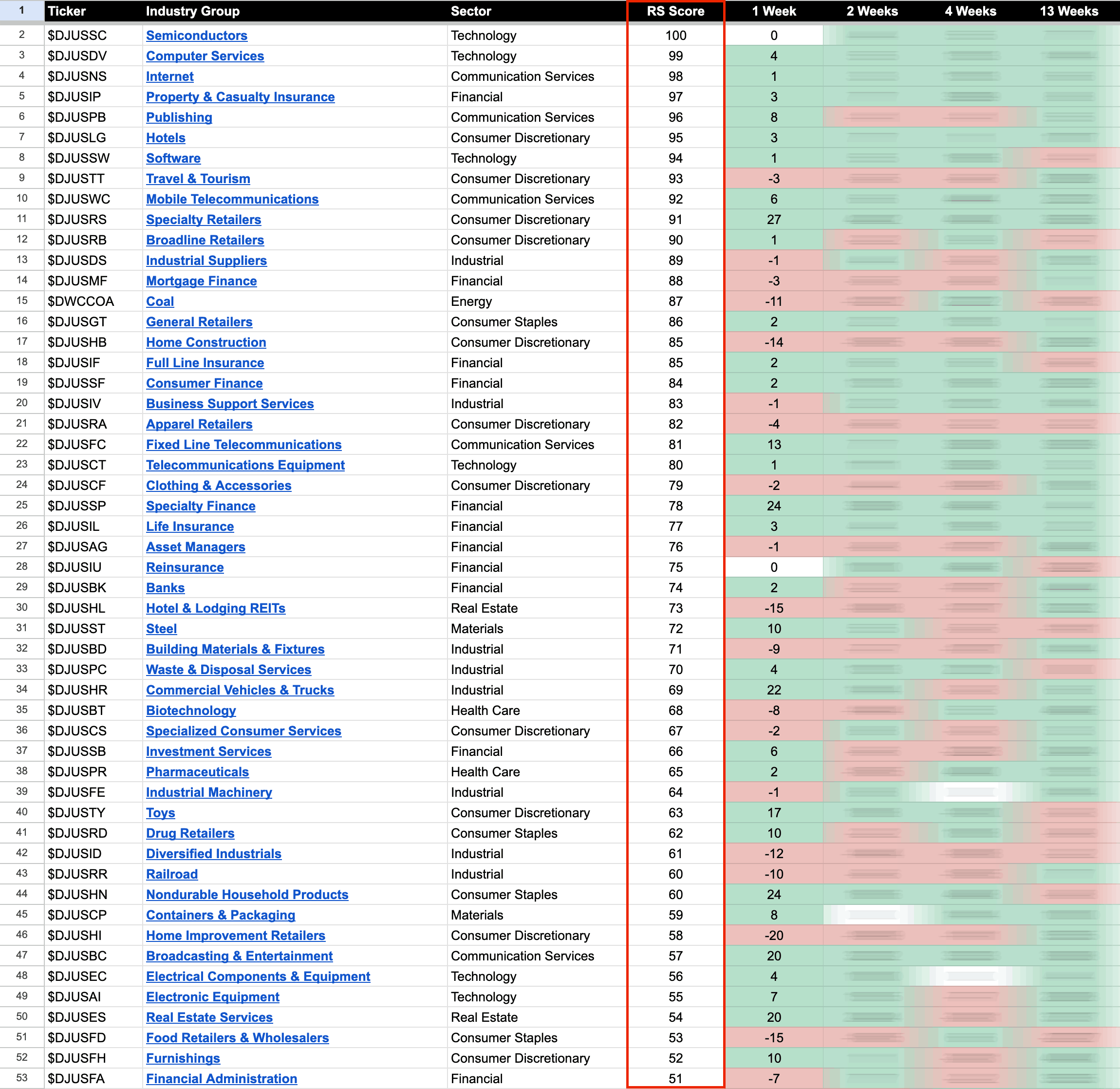

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

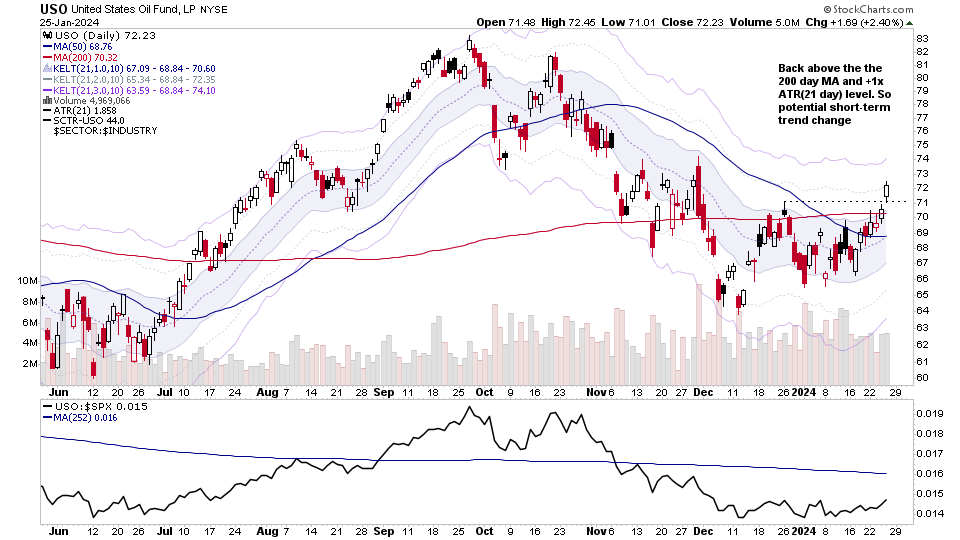

25 January, 2024

US Stocks Watchlist – 25 January 2024

There were 30 stocks highlighted from the US stocks watchlist scans today...

Read More

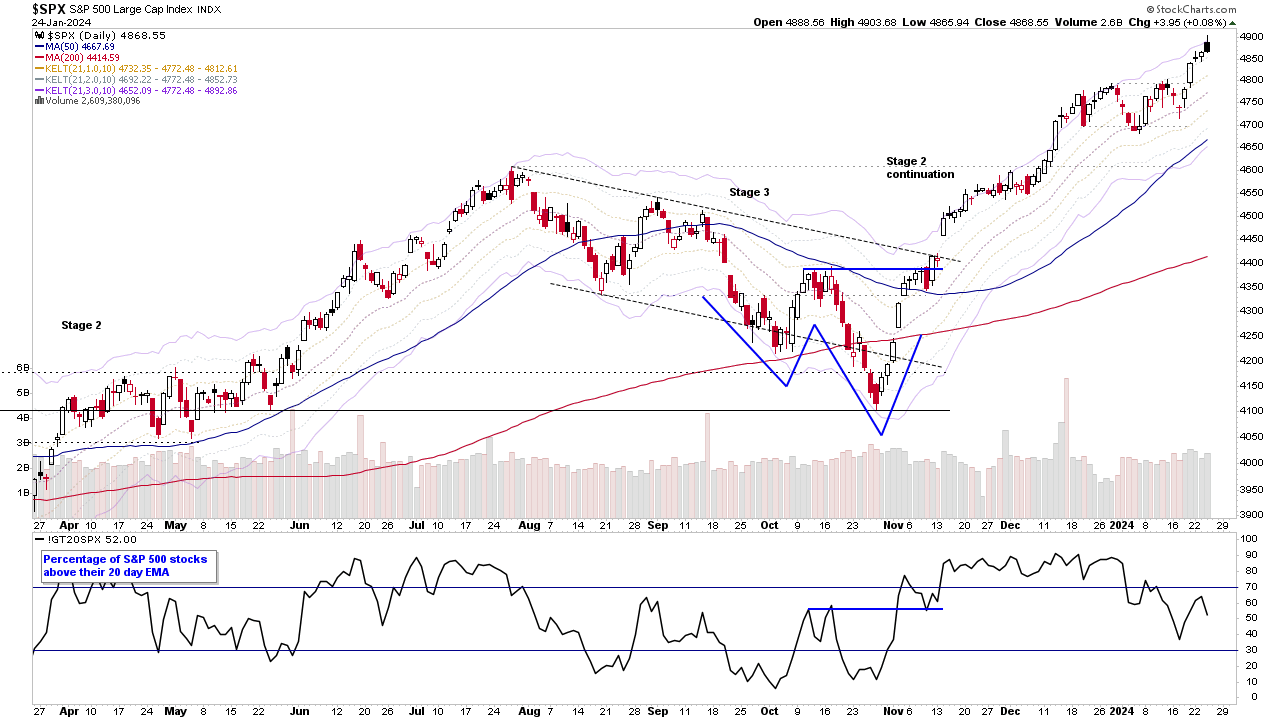

24 January, 2024

Stage Analysis Members Video – 24 January 2024 (53mins)

Stage Analysis midweek video discussing of the major US stock market indexes, short-term market breadth measures, and finishing with a look at the most recent watchlist stocks on multiple timeframes...

Read More

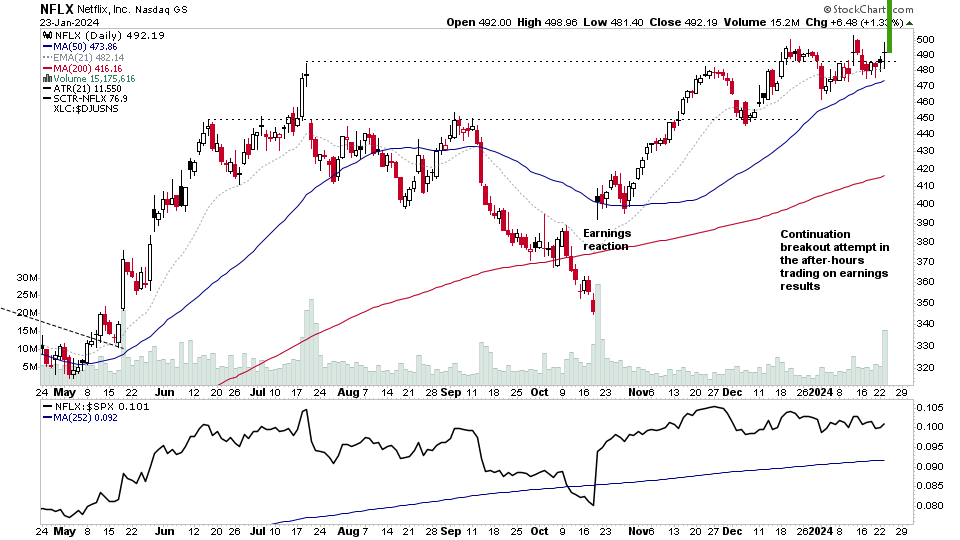

23 January, 2024

US Stocks Watchlist – 23 January 2024

There were 20 stocks highlighted from the US stocks watchlist scans today...

Read More

22 January, 2024

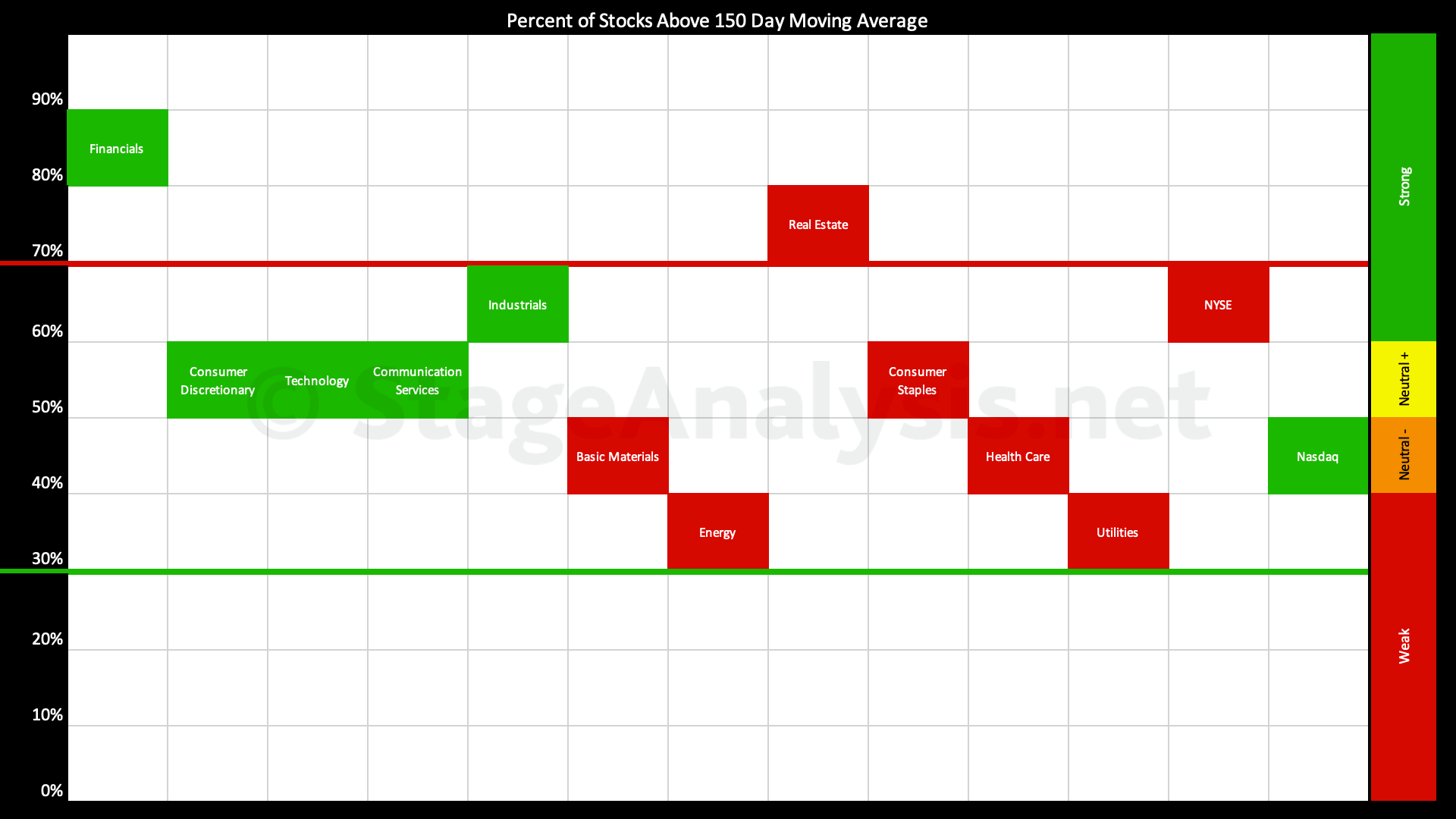

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day moving averages in the 11 major sectors decreased by -5.95% since the previous post on the 8th January 2024, moving the overall average to 54.08%, which is in the Neutral+ zone (50% to 59.99% range)...

Read More

21 January, 2024

Stage Analysis Members Video – 21 January 2024 (1hr 26mins)

Stage Analysis members weekend video discussing the Major US Stock Market Indexes, the Futures charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, the key Market Breadth Charts to determine the Weight of Evidence, Significant Weekly Bars and the most recent US watchlist stocks in detail on multiple timeframes...

Read More

21 January, 2024

US Stocks Watchlist – 21 January 2024

There were 22 stocks highlighted from the US stocks watchlist scans today...

Read More

20 January, 2024

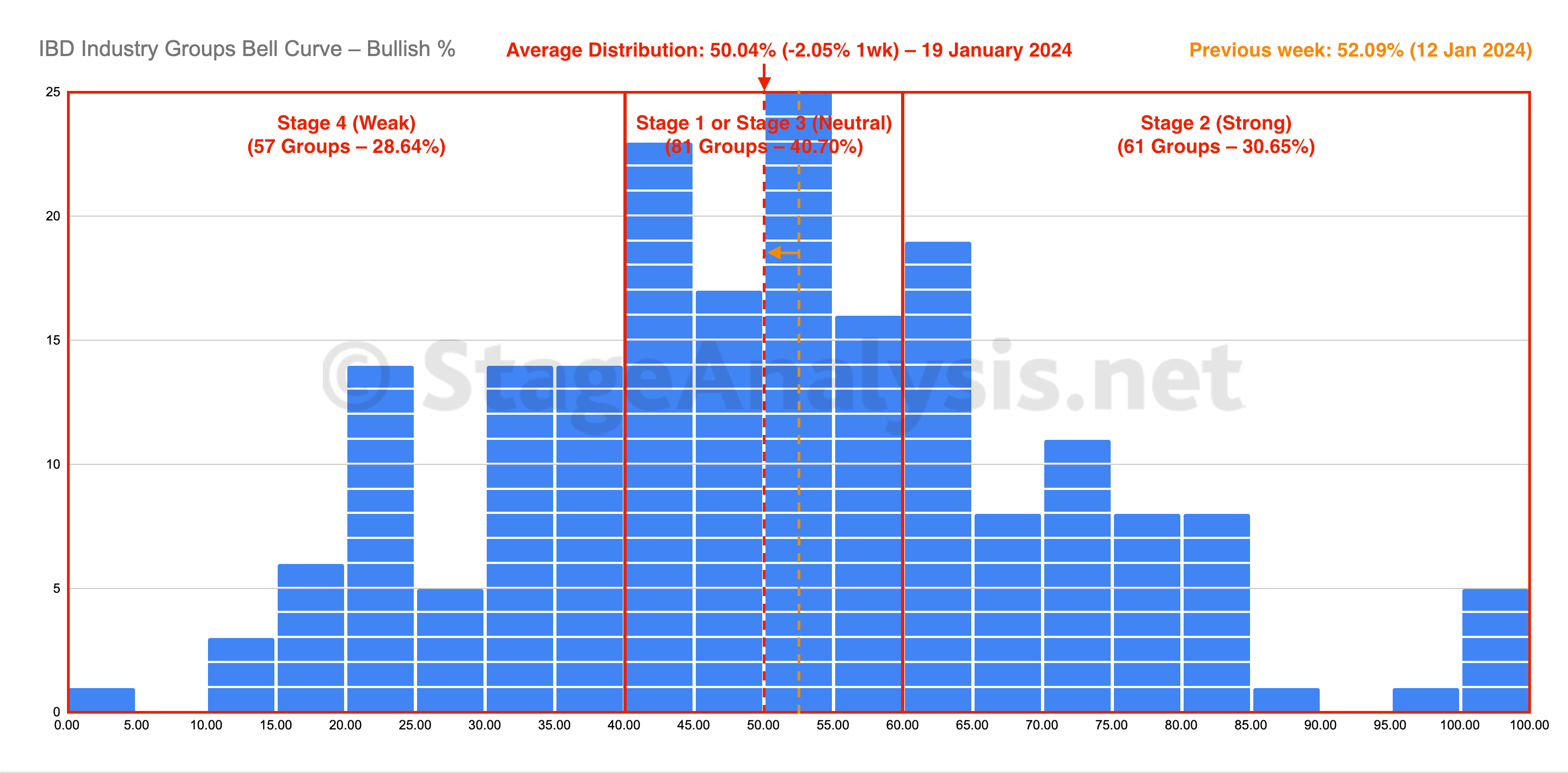

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve decreased by -2.05% this week to finish at 50.04% overall. The amount of groups in Stage 4 (Weak) increased by 8 (+4%), and the amount of groups in Stage 2 (Strong) decreased by 6 (-3%), while the amount groups in Stage 1 or Stage 3 (Neutral) decreased by 2 (-1%)...

Read More