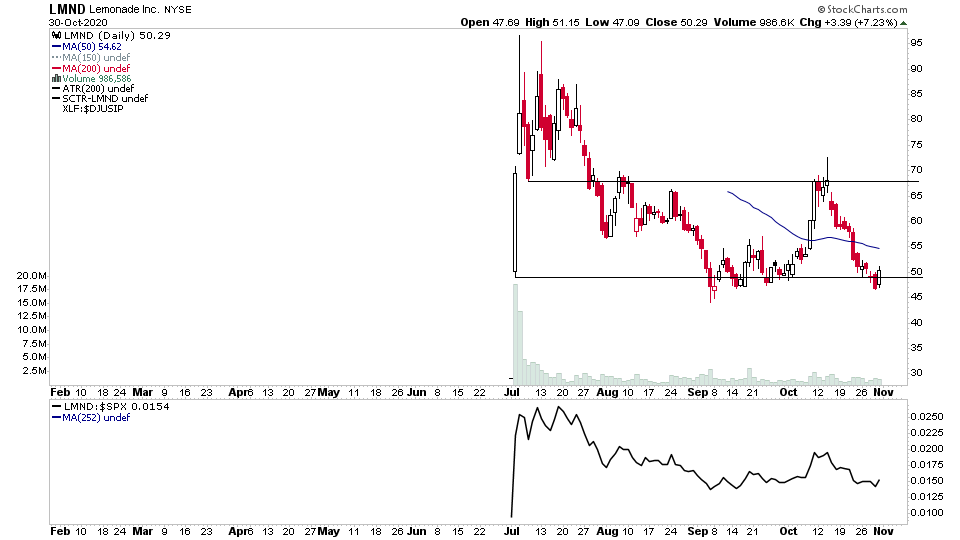

For the watchlist from the weekend scans - ACHC, BIDU, CAT, DLB, FIT, GOOG, GSHD, KC, LMND, SA, TSM

Read More

Blog

01 November, 2020

US Breakout Stocks Watchlist - 1 November 2020

29 October, 2020

US Breakout Stocks Watchlist - 29 October 2020

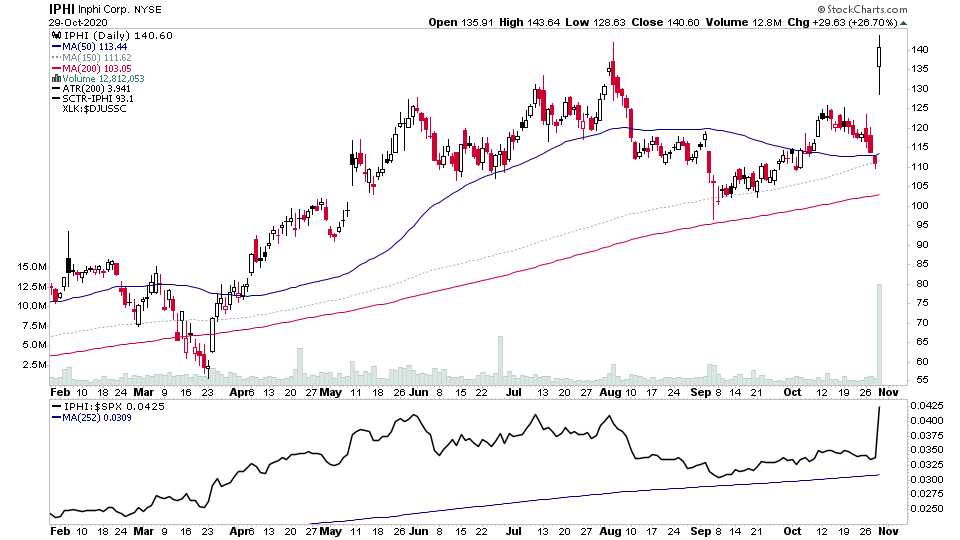

For the watchlist from Thursdays scans - IPHI, IQ, JD, PDD, RAMP

Read More

29 October, 2020

US Breakout Stocks Watchlist - 28 October 2020

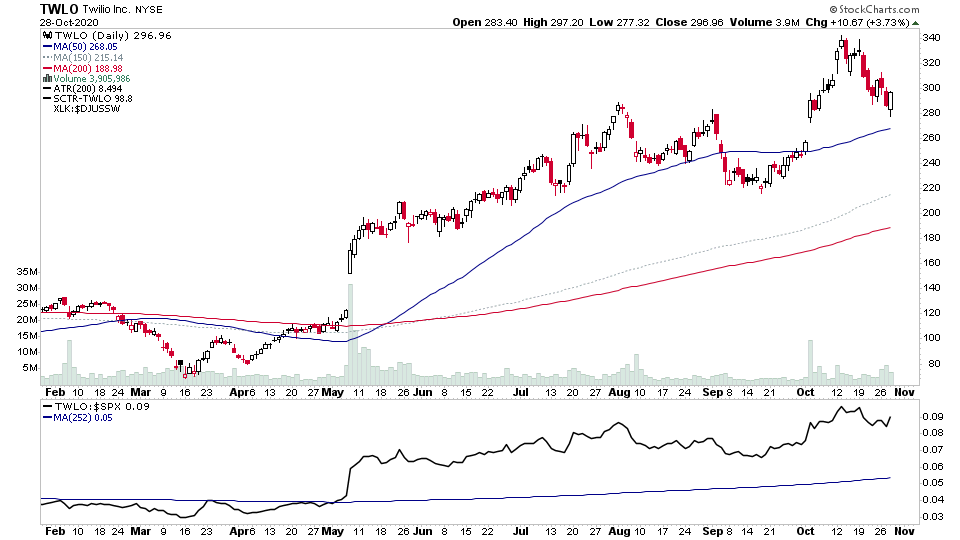

For the watchlist from Tuesdays scans - AAXN, CHWY, FIT, FSLR, GNRC, MDB, TWLO

Read More

27 October, 2020

US Breakout Stocks Watchlist - 27 October 2020

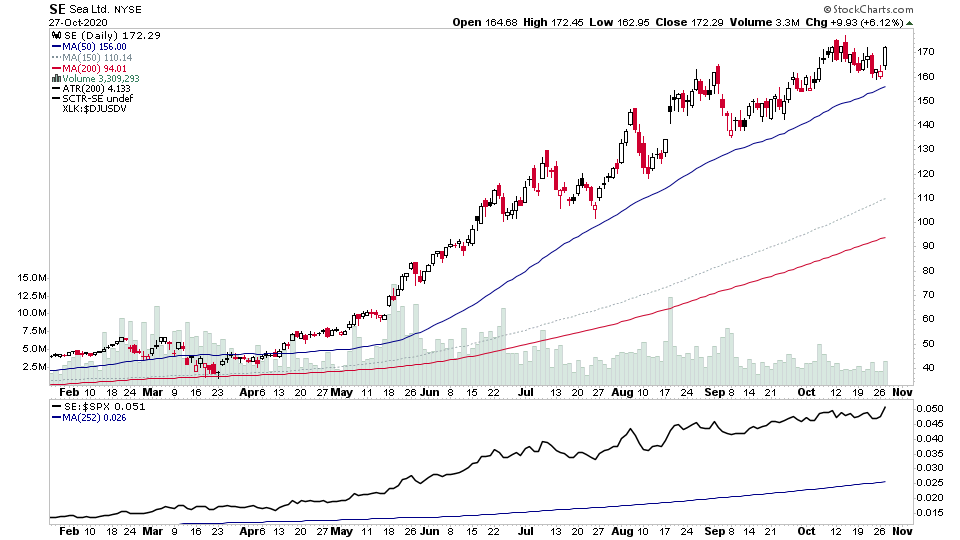

For the watchlist from Tuesdays scans - AMZN, AXNX, BABA, JD, SE, VSTO

Read More

26 October, 2020

US Breakout Stocks Watchlist - 26 October 2020

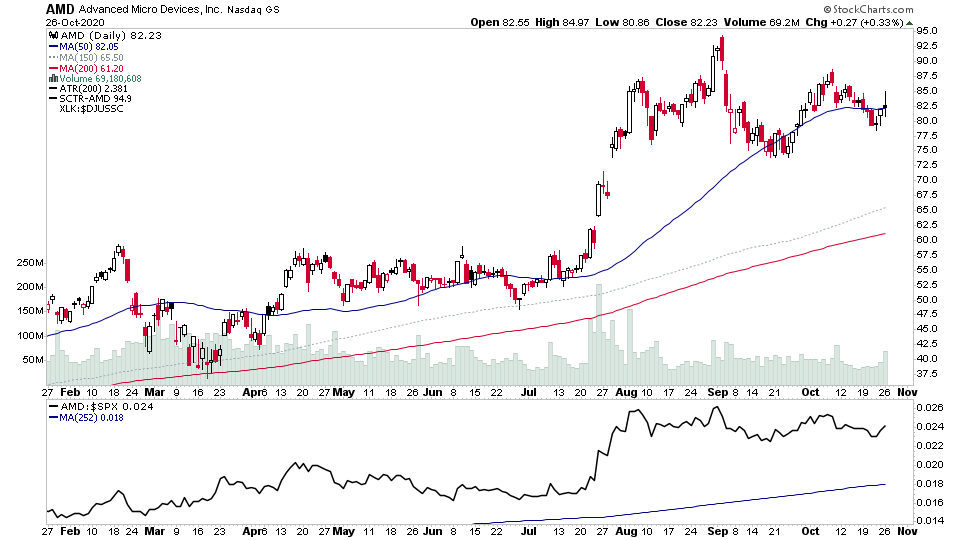

For the watchlist from Mondays scans - AMD, DXCM, ELF, MPWR, SHOP, VCRA

Read More

25 October, 2020

US Breakout Stocks Watchlist - 25 October 2020

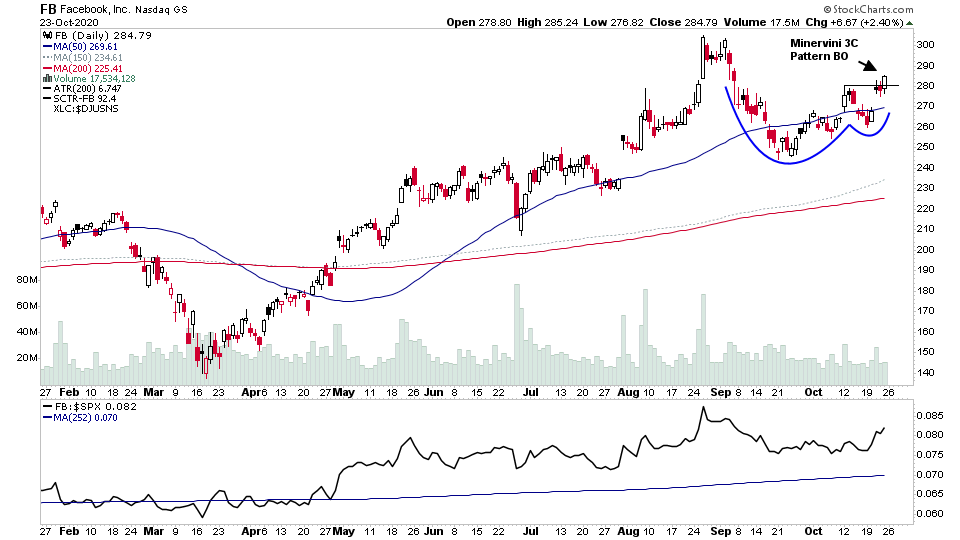

For the watchlist from the weekend scans - AIMC, AXNX, BABA, BILL, COUP, CRSR, CRWD, DDOG, DT, ETHUSD, FB, GOOGL, SPOT, TSLA, YY

Read More

22 October, 2020

US Breakout Stocks Watchlist - 22 October 2020

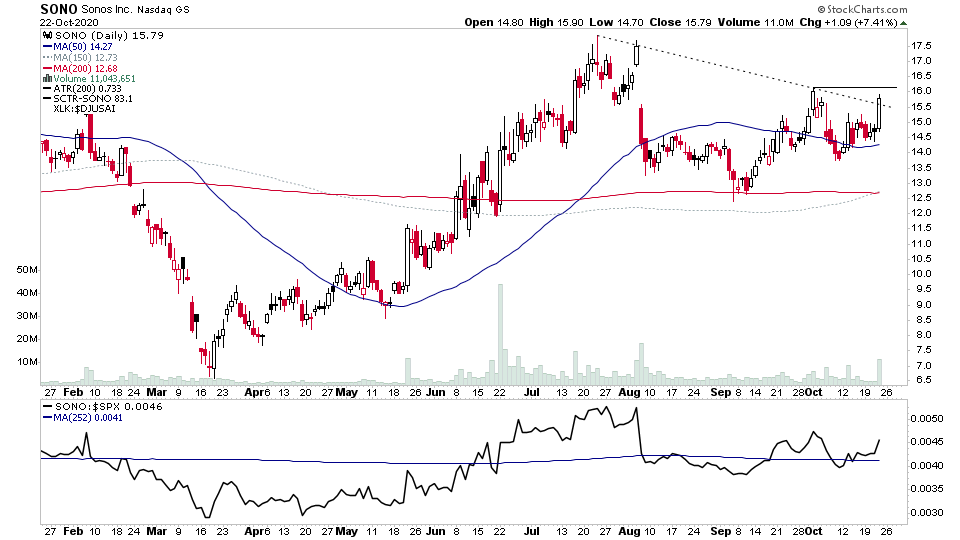

For the watchlist from Thursdays scans - ARRY, ALGN, CELH, SONO, SPLK, TW

Read More

21 October, 2020

US Breakout Stocks Watchlist - 21 October 2020

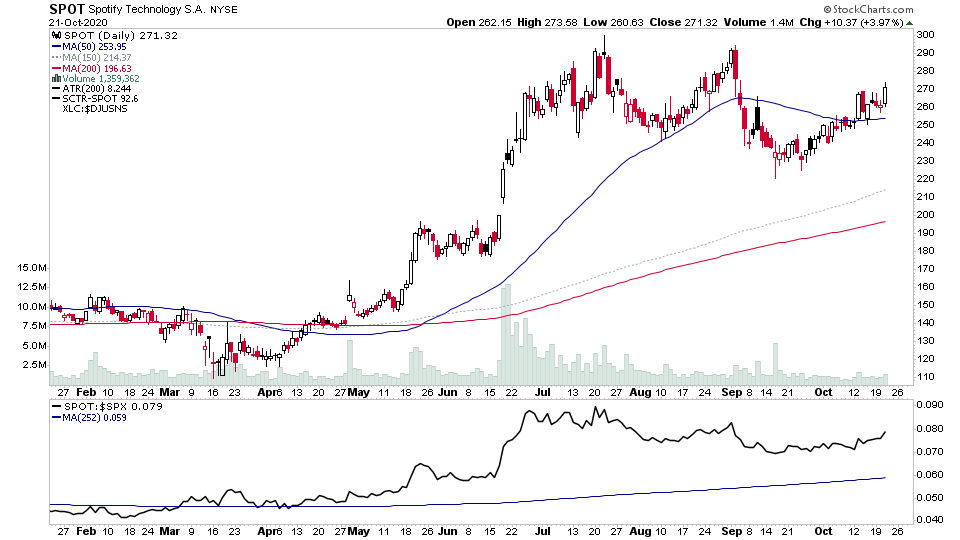

Large caps back in focus today with 5 of the 6 watchlist stocks in household names and a few earnings gaps in the mix as you'd expect with earnings season getting underway this week. For the watchlist from Wednesdays scans - CALX, FB, GOOG, PYPL, SNAP, SPOT

Read More

20 October, 2020

US Breakout Stocks Watchlist - 20 October 2020

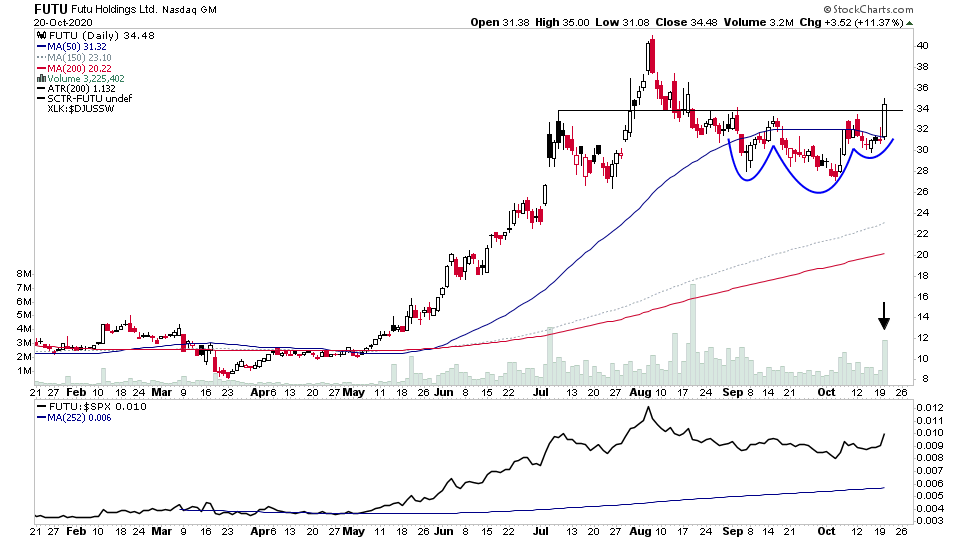

For the watchlist from Tuesdays scans - CSIQ, FUTU, IRBT, JD, LSCC

Read More

19 October, 2020

US Breakout Stocks Watchlist - 19 October 2020

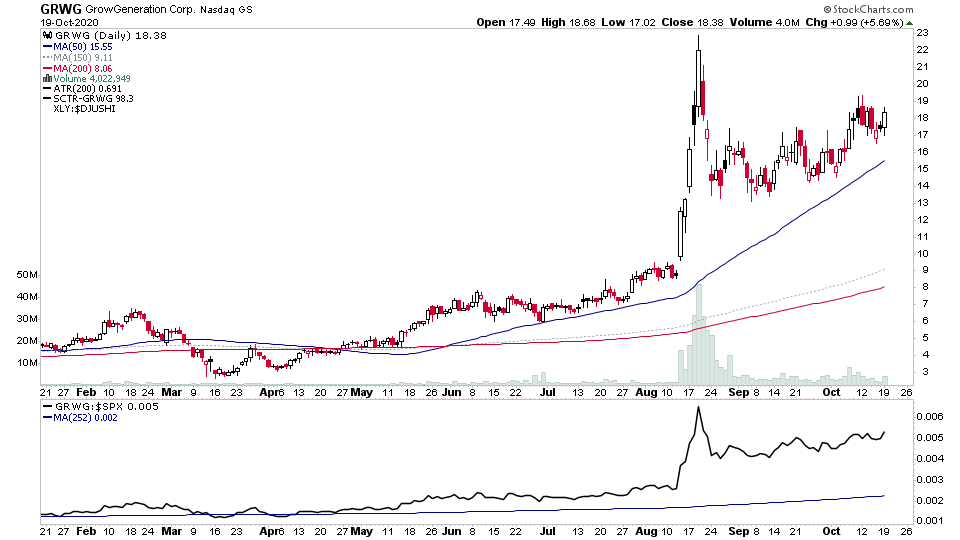

For the watchlist from Mondays scans - AXTI, DOYU, GRWG, MAXR

Read More