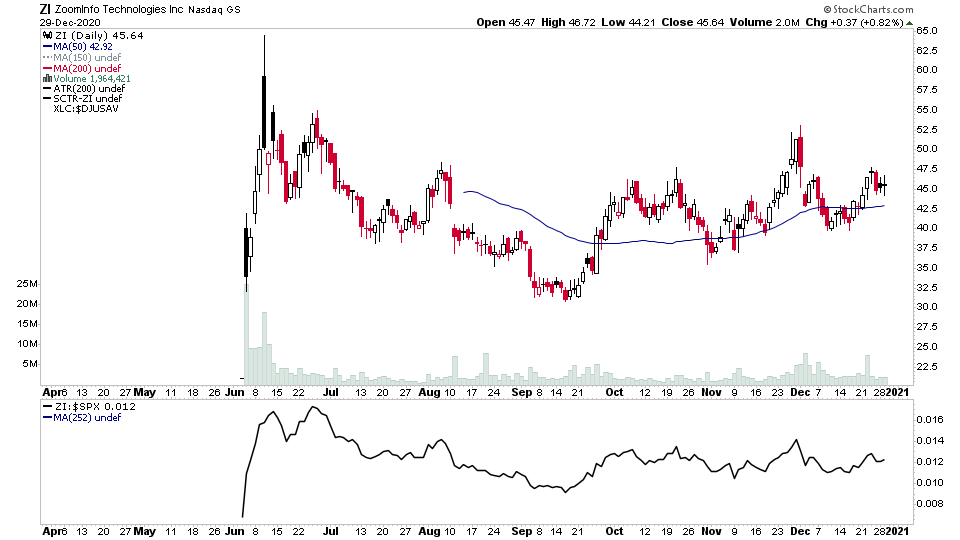

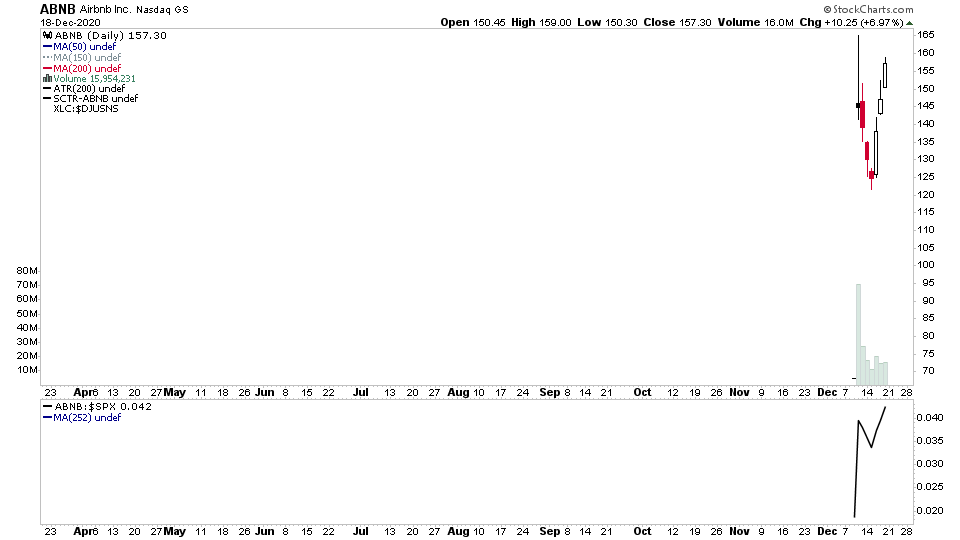

For the watchlist from Tuesdays scans - ABNB, AI, DADA, EXPE, IMMR, NFLX, OZON, PDD, UBER, ZI

Read More

Blog

29 December, 2020

US Stocks Watchlist - 29 December 2020

21 December, 2020

US Stocks Watchlist - 21 December 2020

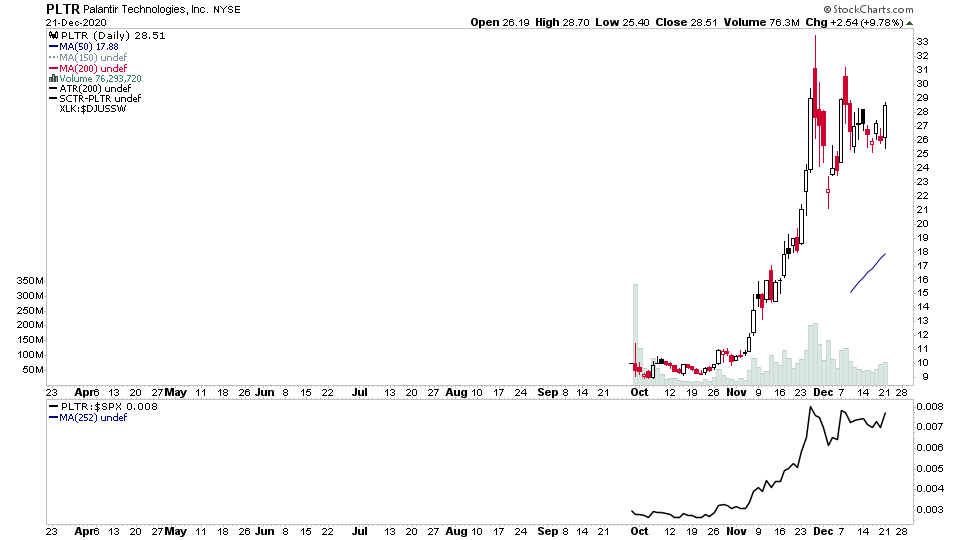

For the watchlist from Mondays scans - DM, ELYS, FUV, NNDM, OPEN, PCTY, PLTR, RIOT, UBER

Read More

20 December, 2020

US Stocks Watchlist - 20 December 2020

For the watchlist from the weekend scans - ABNB, ACN, AI, DASH, DT, KGC, LAZR, MAXN, SUMO, TLS, UBER, UPST, WIX, YALA, YSG, ZI

Read More

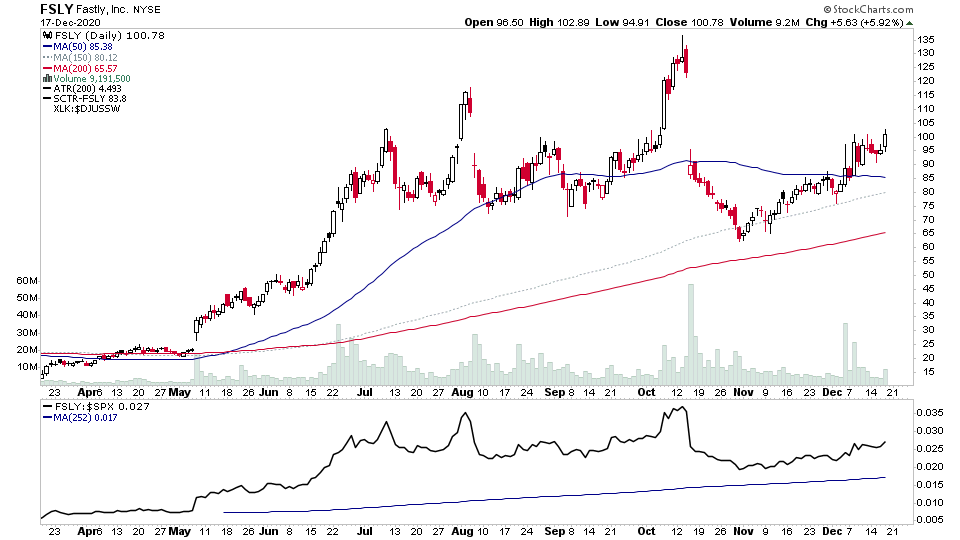

17 December, 2020

US Stocks Watchlist - 17 December 2020

For the watchlist from Thursdays scans - APPN, AQB, AR, FSLY, FUV, GLUU, NNDM, NVAX

Read More

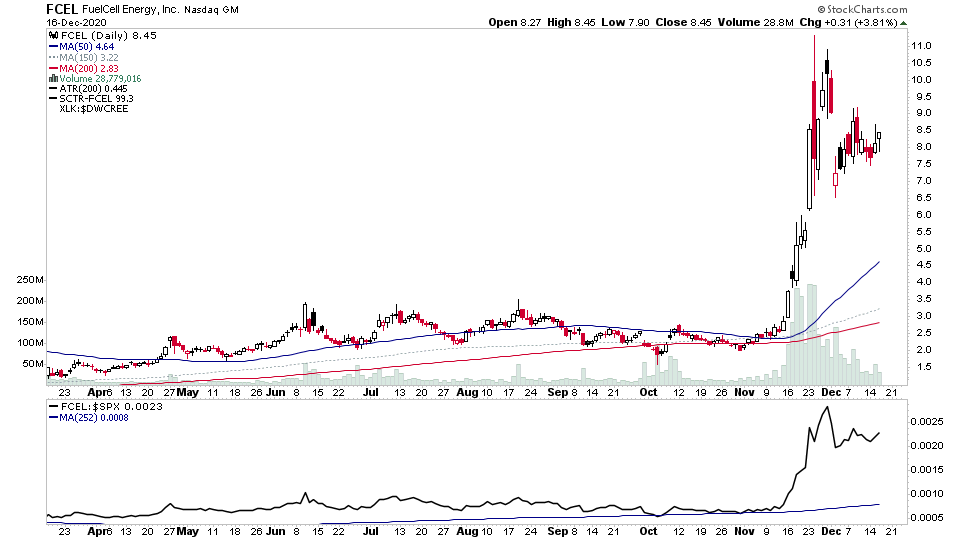

16 December, 2020

US Stocks Watchlist - 16 December 2020

For the watchlist from Wednesdays scans - AG, AMZN, COUP, DKNG, FCEL, SHOP, ZS

Read More

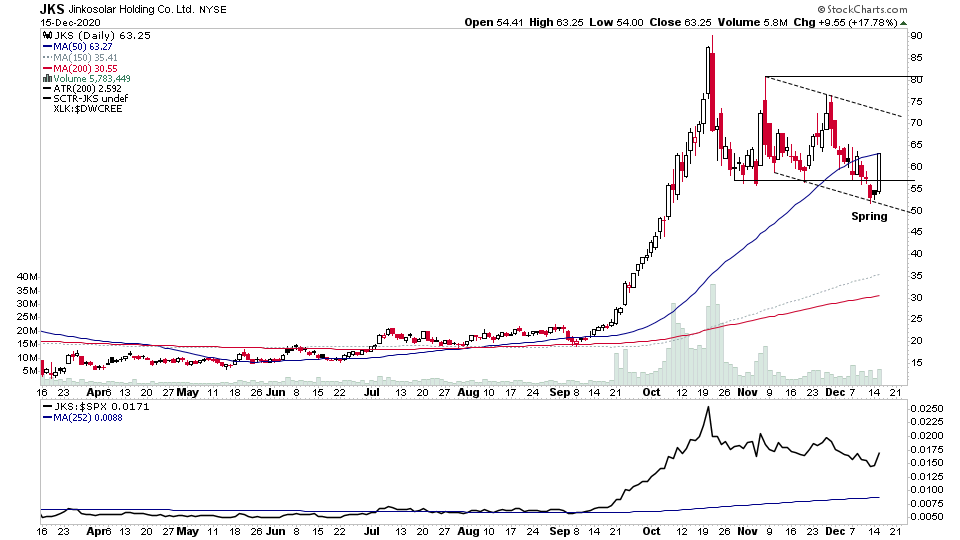

15 December, 2020

US Stocks Watchlist - 15 December 2020

For the watchlist from Tuesdays scans - AAPL, CSIQ, CYBR, EBAY, EXPE, FSLR, HL, JKS, LOVE, MGI, NOVA, RIOT, RUN, SHOP, SNOW, SONO

Read More

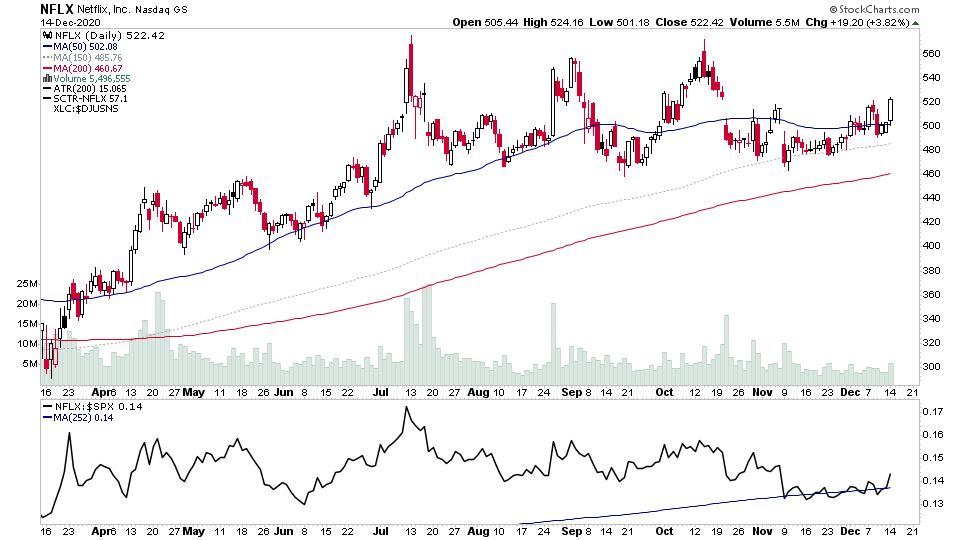

14 December, 2020

US Breakout Stocks Watchlist - 14 December 2020

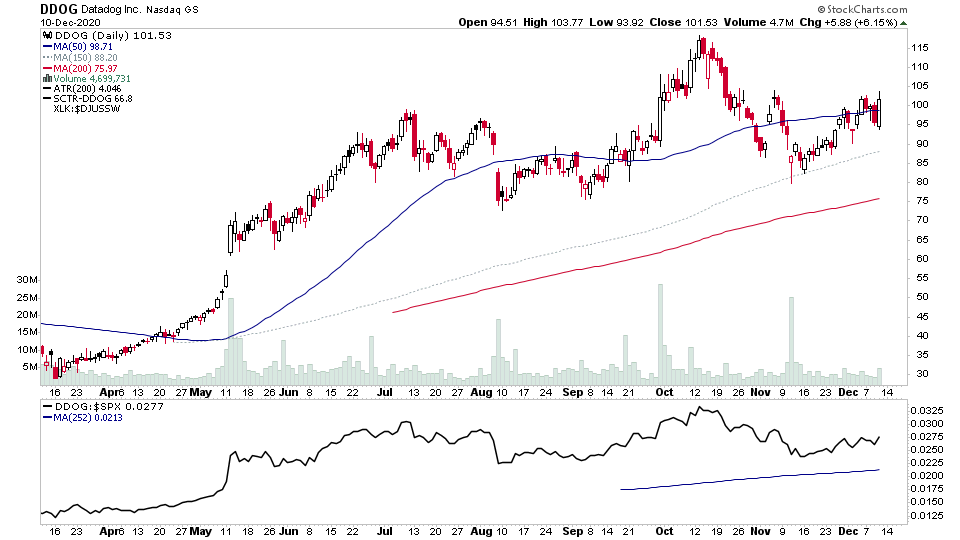

For the watchlist from Mondays scans - AAXN, ALT, CRSR, DDOG, DVAX, NFLX, PYPL, SOL

Read More

13 December, 2020

US Breakout Stocks Watchlist - 11 December 2020

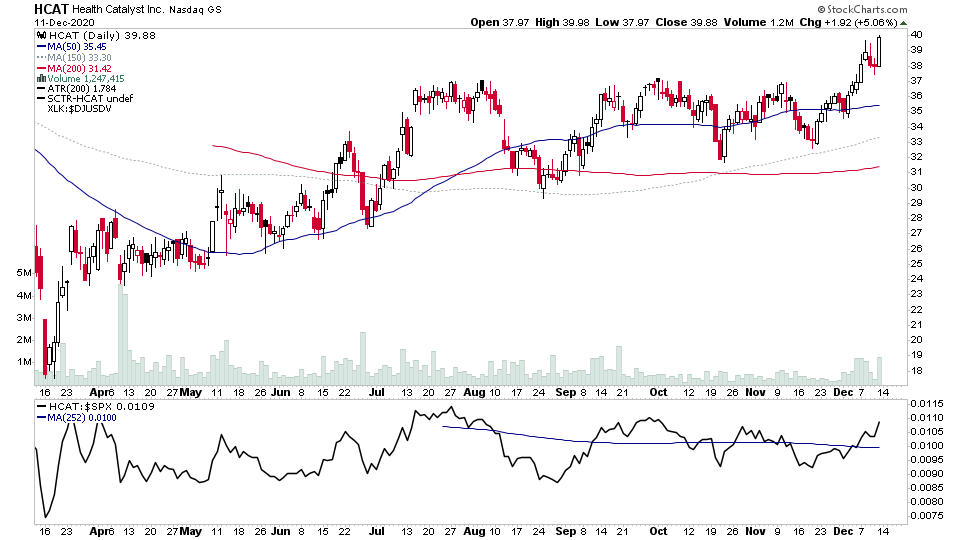

For the watchlist from the weekend scans - AMD, BAND, DBX, DIS, DOMO, EGHT, FSLY, HCAT, ORBC, SAIL, SDGR

Read More

10 December, 2020

US Breakout Stocks Watchlist - 10 December 2020

For the watchlist from Thursdays scans - ADPT, AR, CCJ, CRIS, DDOG, LOVE, TWLO, WIX

Read More

09 December, 2020

US Breakout Stocks Watchlist - 9 December 2020

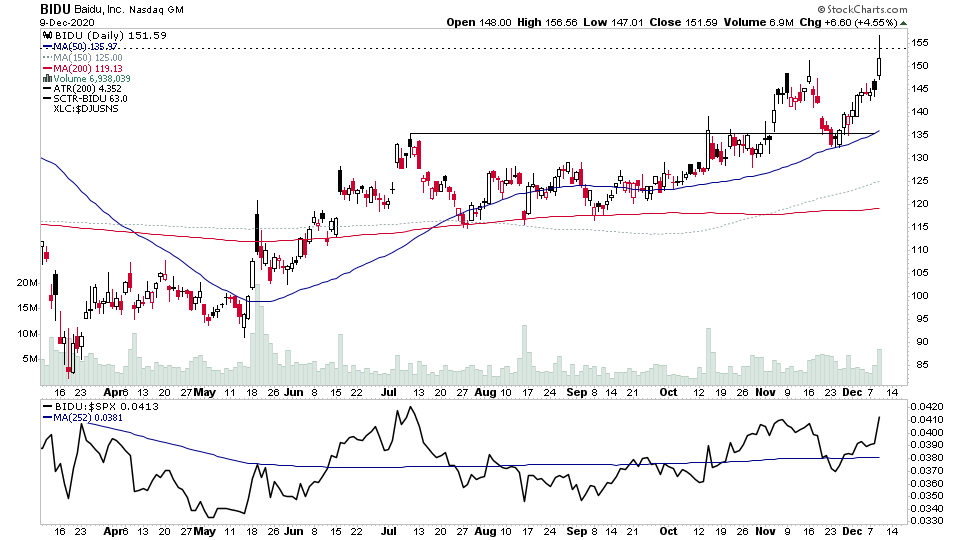

For the watchlist from Wednesdays scans - BIDU, BKNG, EXPE, IBKR, YNDX

Read More