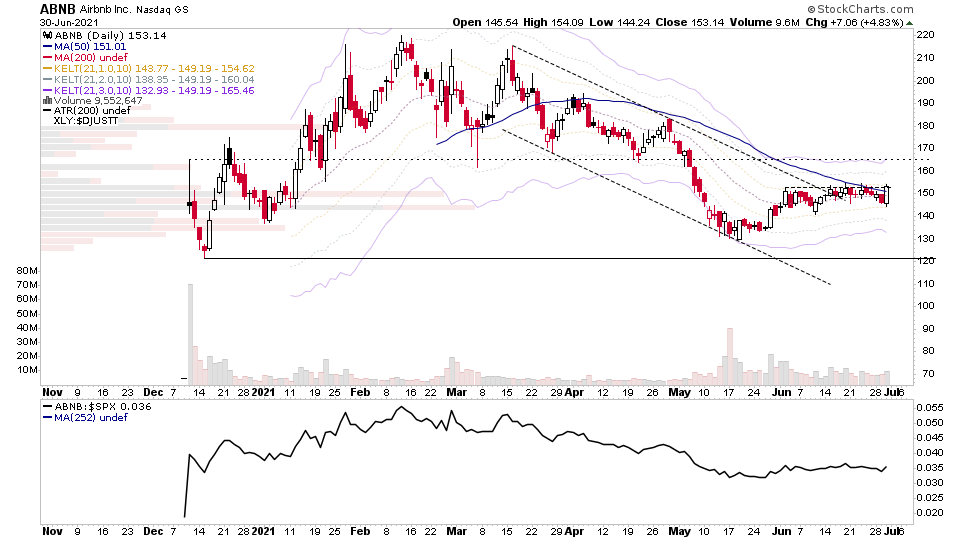

For the watchlist from Wednesdays scans - ABNB, BTU, CCIV, CPSH, CRSP, EDIT, MU, SIEN, SNAP, SRAC, TUYA, UPST, URBN, VMEO, YALA, ZIM

Read More

Blog

30 June, 2021

US Stocks Watchlist - 30 June 2021

29 June, 2021

US Stocks Watchlist - 29 June 2021

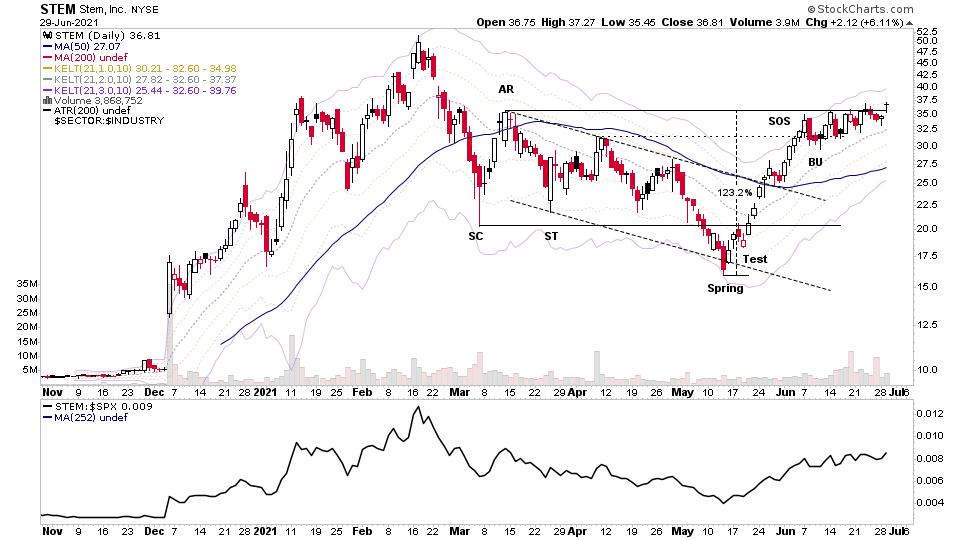

For the watchlist from Tuesdays scans - DELL, FUV, GP, HOL, KTOS, QFIN, STEM, TSP, ZH, ZLAB

Read More

28 June, 2021

US Stocks Watchlist - 28 June 2021

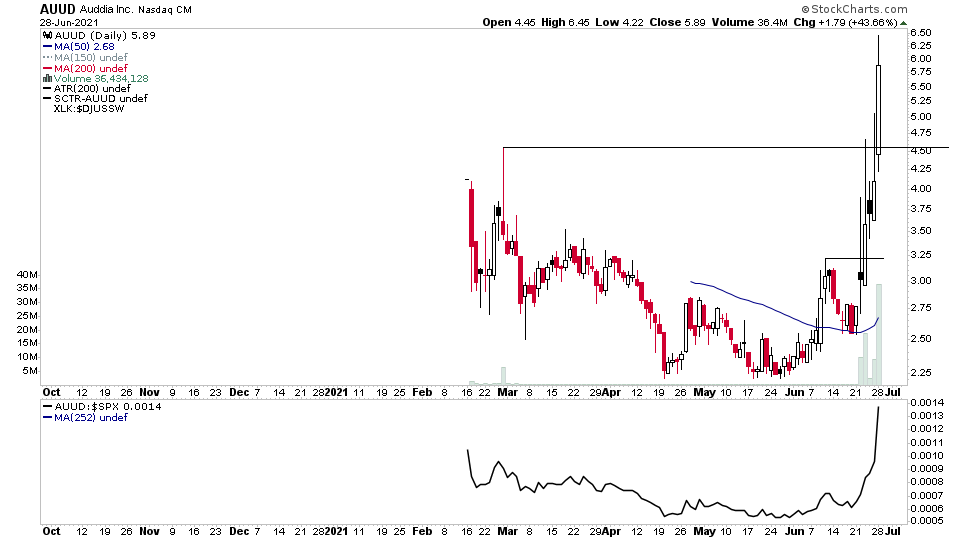

For the watchlist from Mondays scans - AMC, AUUD, COIN, CSIQ, GRWG, HIMX, MARA, MAXN, MNKD, MOGO, MSTR, NIO, PLUG, QS, RIOT, SFIX, SI, SKLZ, TIGR, TPIC, TSM, TXN, XONE, ZIP

Read More

27 June, 2021

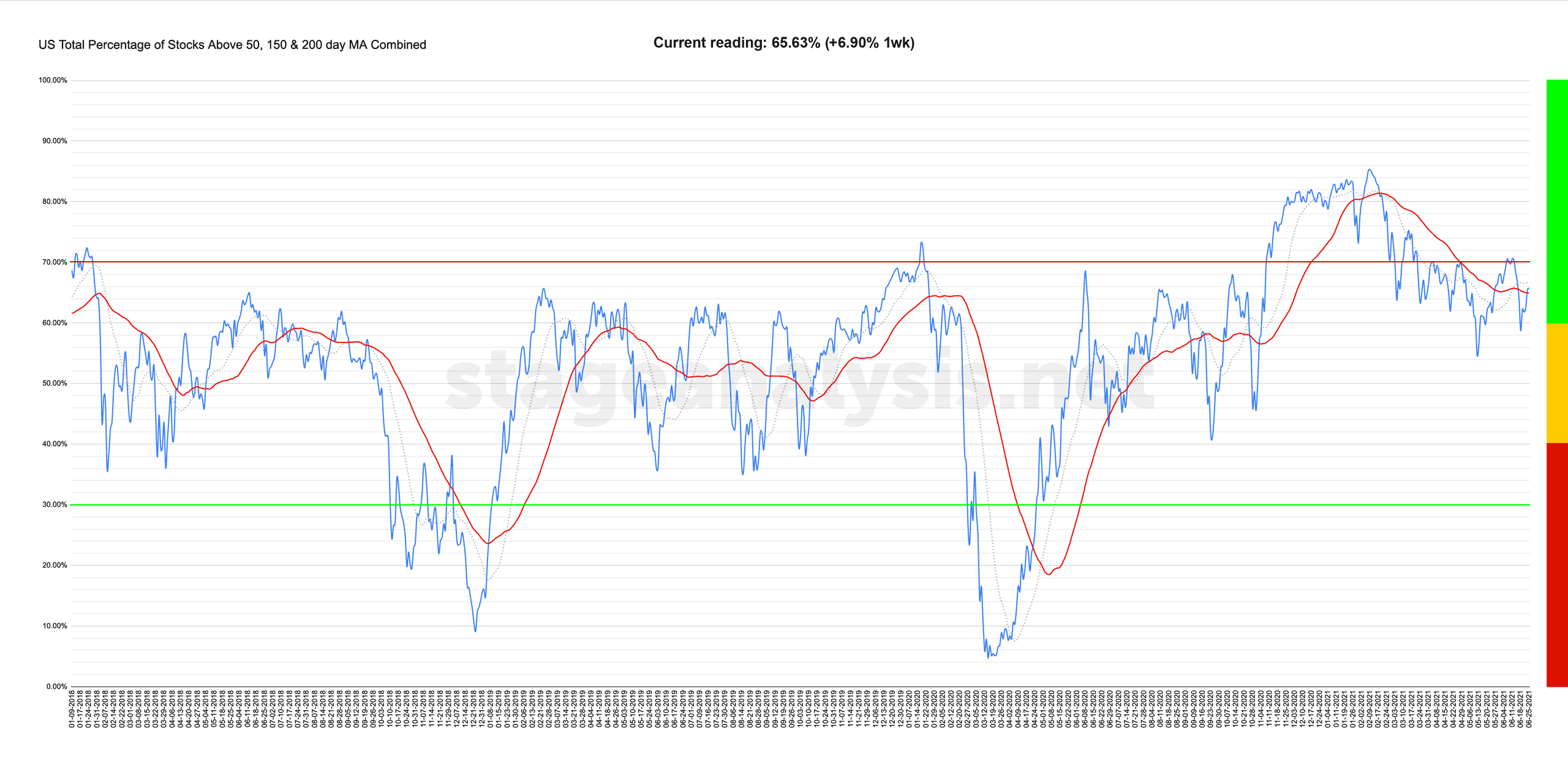

US Total Percentage of Stocks Above their 50 Day, 150 Day and 200 Day Moving Averages Combined

US Total Percentage of Stocks Above their 50 Day, 150 Day and 200 Day Moving Averages Combined. Closed back above the 50 day MA

Read More

27 June, 2021

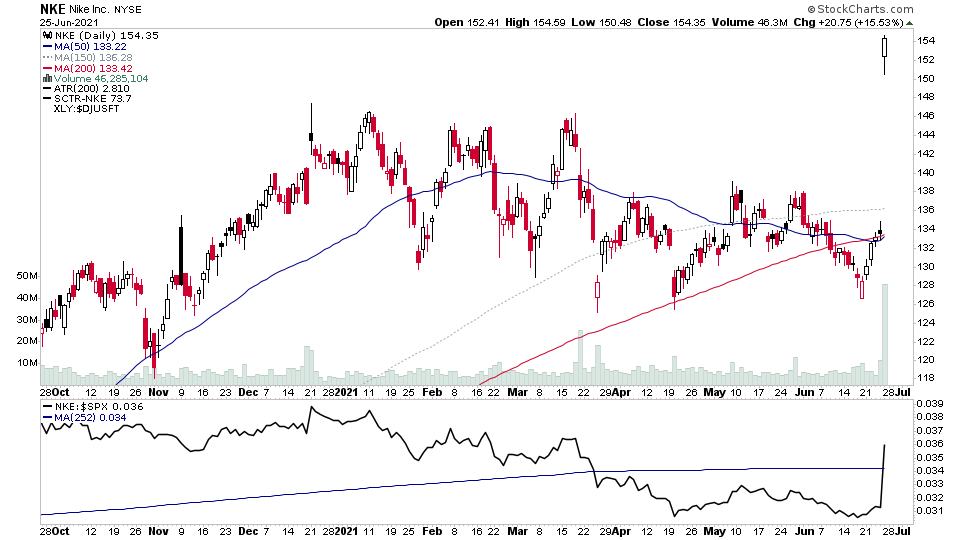

US Stocks Watchlist - 27 June 2021

For the watchlist from the weekend scans - NKE, VMEO, ZIM, PATH, CRCT, CRWD, DBGI, SEMR, TDUP, DECK, DOCN, AGFY, APOG, APP, APXT, BFLY, BIDU, CLII, CNXC, DRVN, EDR, LI, LPRO, NTLA, NXST, PLTR, ZBRA

Read More

26 June, 2021

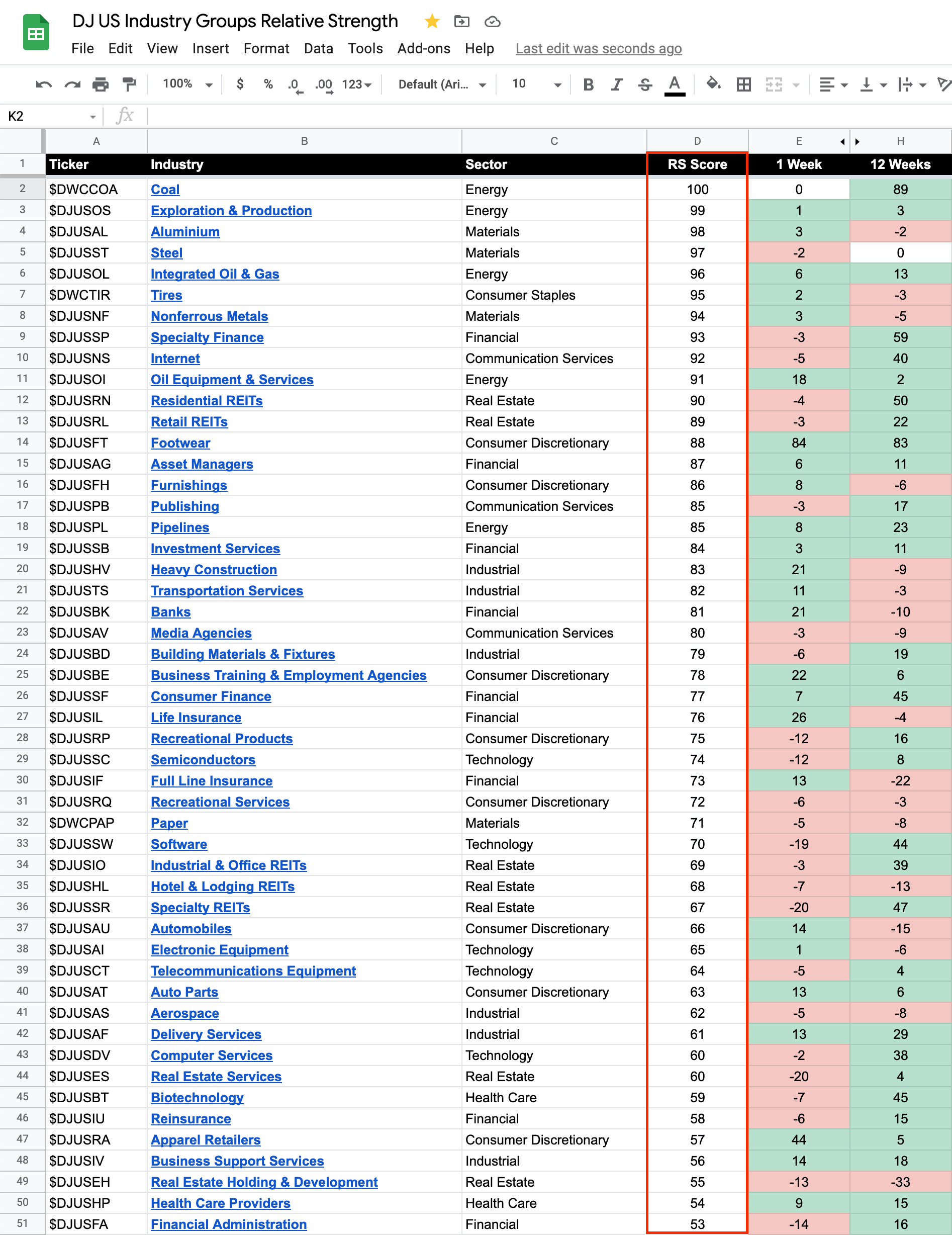

104 Dow Jones Sector Industry Groups sorted by Relative Strength

104 Dow Jones Sector Industry Groups sorted by Relative Strength. Purpose is to track RS changes across the groups each week using stockcharts SCTR rating. Attached current top 50 sectors plus sectors with the strongest moves this week and the last 12 weeks.

Read More

24 June, 2021

US Stocks Watchlist - 24 June 2021

For the watchlist from Thursdays scans - ACTG, BA, BEAM, BLNK, BOX, EC, EDIT, LAZR, LSCC, LX, MARA, MAXN, MGNI, MTSI, RAIL, SEMR, SI, TIGR, TSEM, TTD, VFF, VMEO, VRAY, WISH, WMG

Read More

23 June, 2021

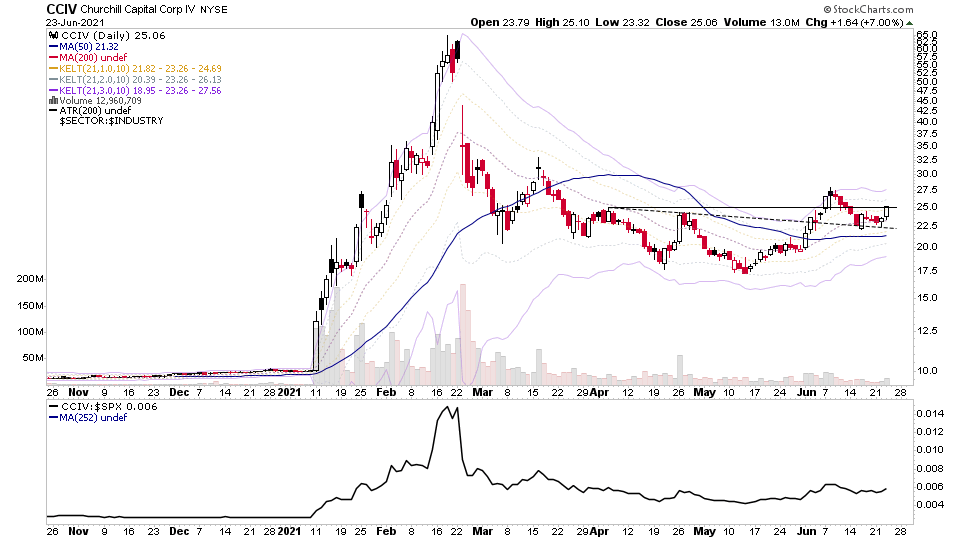

US Stocks Watchlist - 23 June 2021

For the watchlist from Wednesdays scans - AMBA, AMRS, BLDP, CCIV, CLII, FSR, GRWG, LMND, LYFT, MP, NNDM, NOVA, PATH, PERI, SPOT, SPWR, STAR, STNG, SUNW, TSLA

Read More

22 June, 2021

US Stocks Watchlist - 22 June 2021

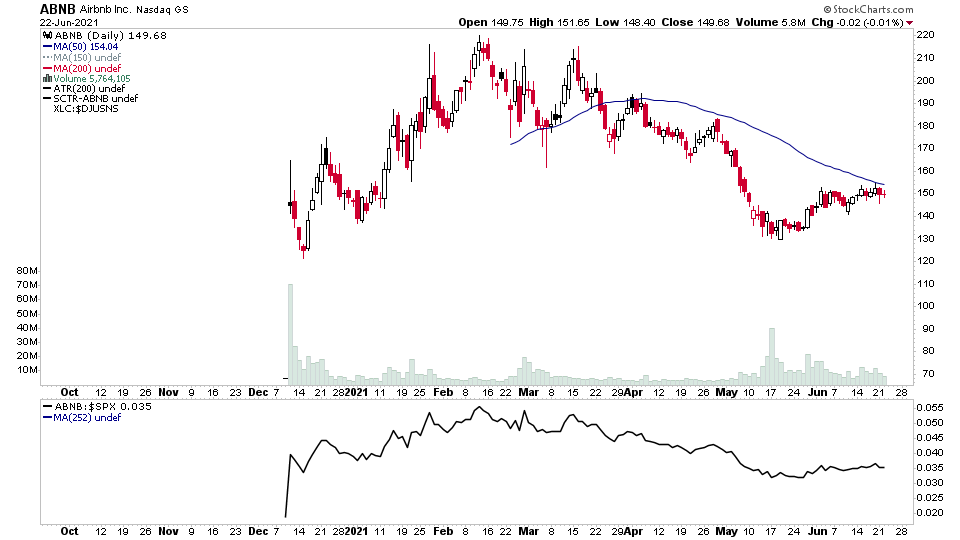

For the watchlist from Tuesdays scans - ABNB, AEO, AMD, BE, COIN, COST, DDD, DOCN, EMKR, FUBO, FUTU, KFY, LYV, MARA, PCT, PLUG, PTON, RIOT, RUN, SBH, SBLK, SCR, SI, SNOW, SPCE, SQ, SSYS, STEM, THMAU, UPST, UPWK, XONE

Read More

20 June, 2021

US Stocks Watchlist - 20 June 2021

For the watchlist from the weekend scans - BILI, DGNU, DMTK, DV, FVRR, LMND, MGI, OZON, PINS, ROKU, SKY, UPWK, ZIP

Read More