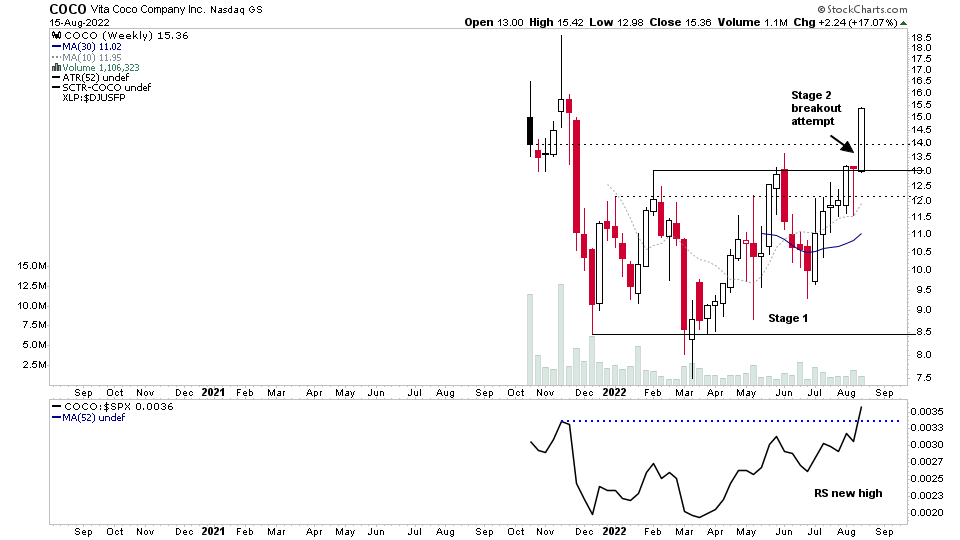

Stage 2 Breakout Attempt – COCO was highlighted multiple times in the watchlist since May as it developed a Stage 1 base and moved into late Stage 1B. The last time I highlighted it was on the 25th July at $12 ,as it tightened up near the top of the range and held above the short-term moving averages.

Read More

Blog

15 August, 2022

US Stocks Watchlist – 15 August 2022

14 August, 2022

Stage Analysis Members Weekend Video – 14 August 2022 (1hr 32mins)

This weeks Stage Analysis Members weekend video begins with a detailed run through of the weekend watchlist stocks on multiple timeframes, with live markups of the charts and explanations of what we are looking for in each.

Read More

14 August, 2022

US Stocks Watchlist – 14 August 2022

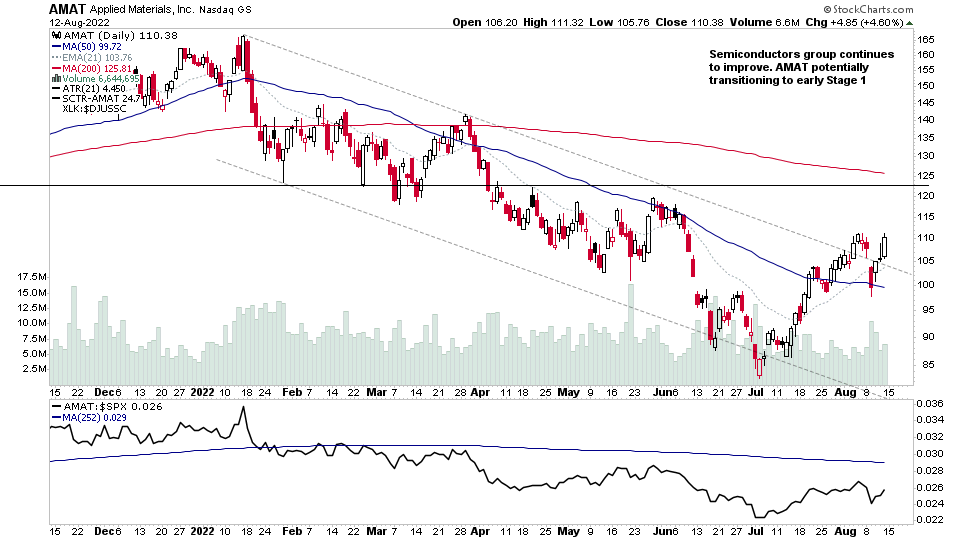

Semiconductors was the dominant theme in the weekend scans, with multiple stocks in the group recovering strongly from weakness caused by the NVDA pre-earnings release early in the week. I did an in-focus on the Semiconductors group in the US Stocks Industry Groups Relative Strength Rankings post on Friday evening, including some market breadth data on the group. So take a look at that if you haven't already.

Read More

13 August, 2022

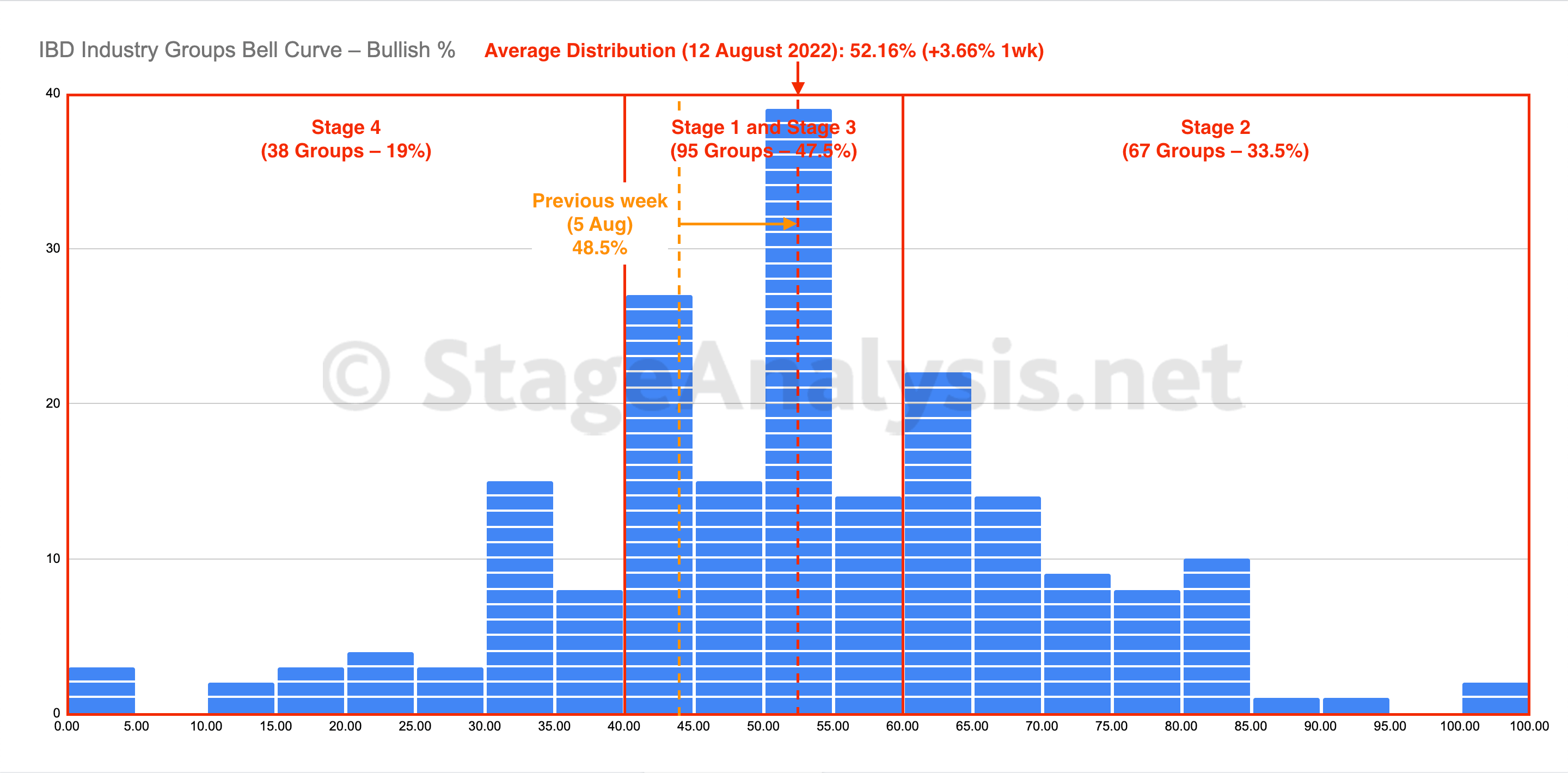

IBD Industry Groups Bell Curve – Bullish Percent

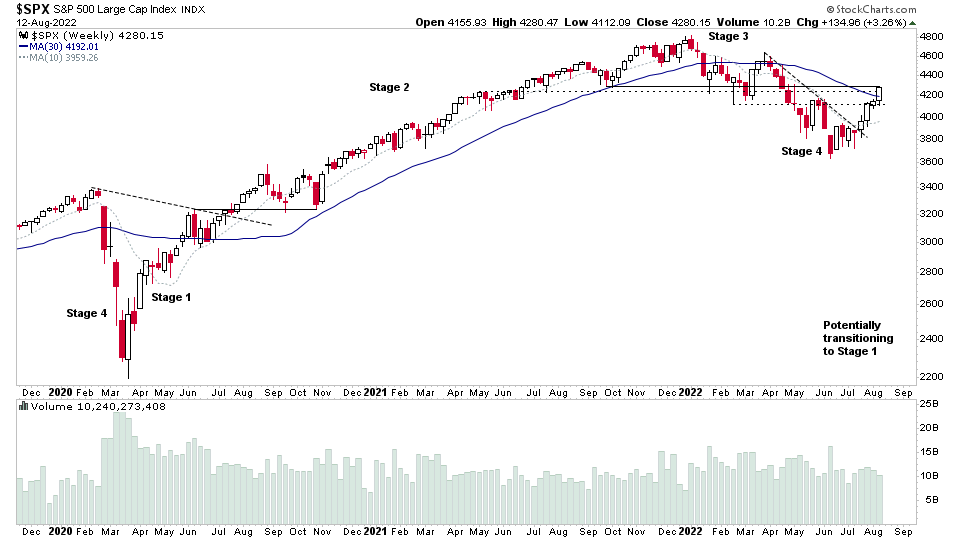

The IBD Industry Groups Bell Curve – Bullish Percent continued to improve over the last week, crossing the mid point of the bell curve and pushing further into the Stage 1 zone (40% to 60% range). With an additional 9.5% of groups leaving the Stage 4 zone (below 40%).

Read More

13 August, 2022

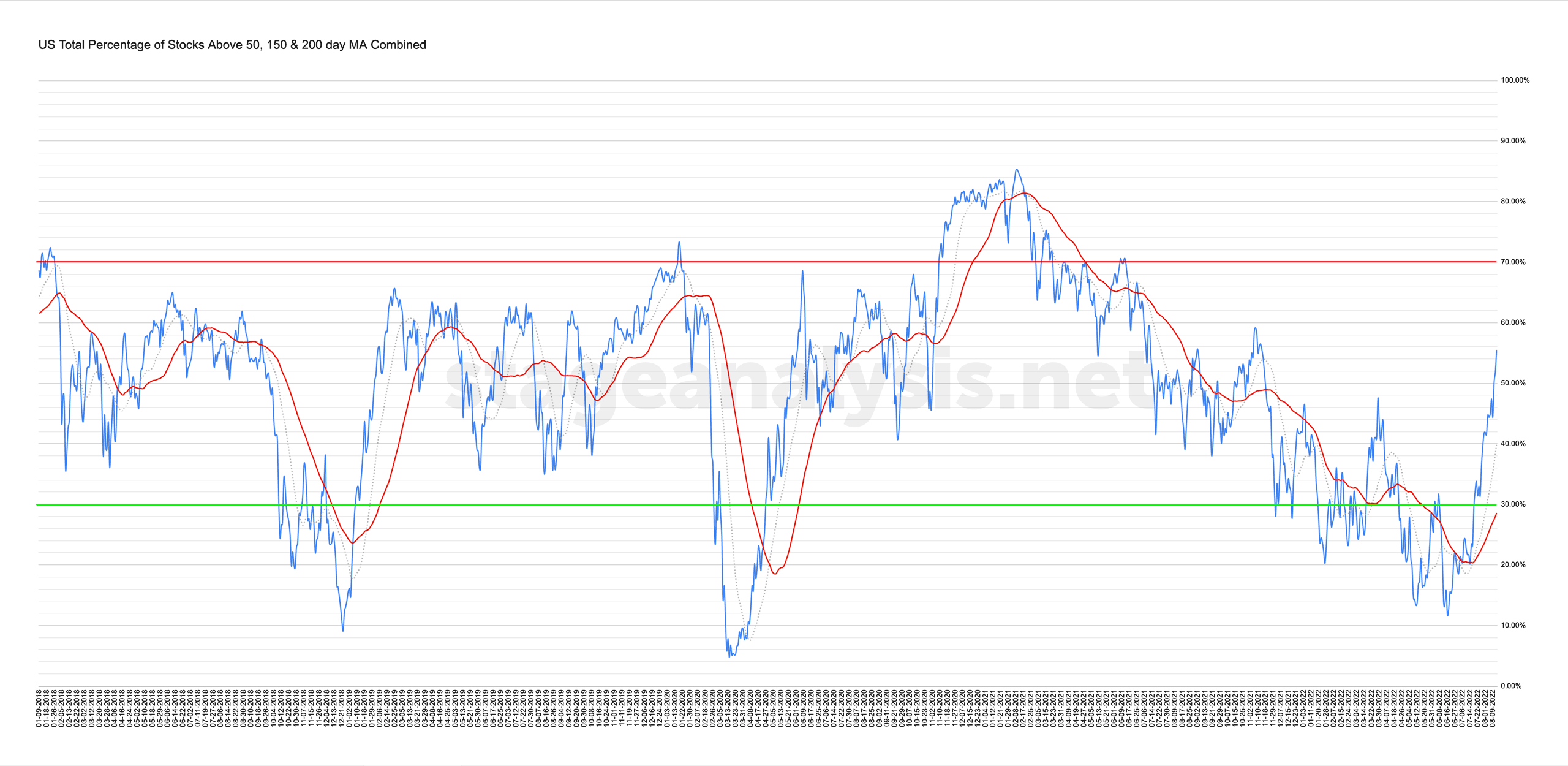

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

12 August, 2022

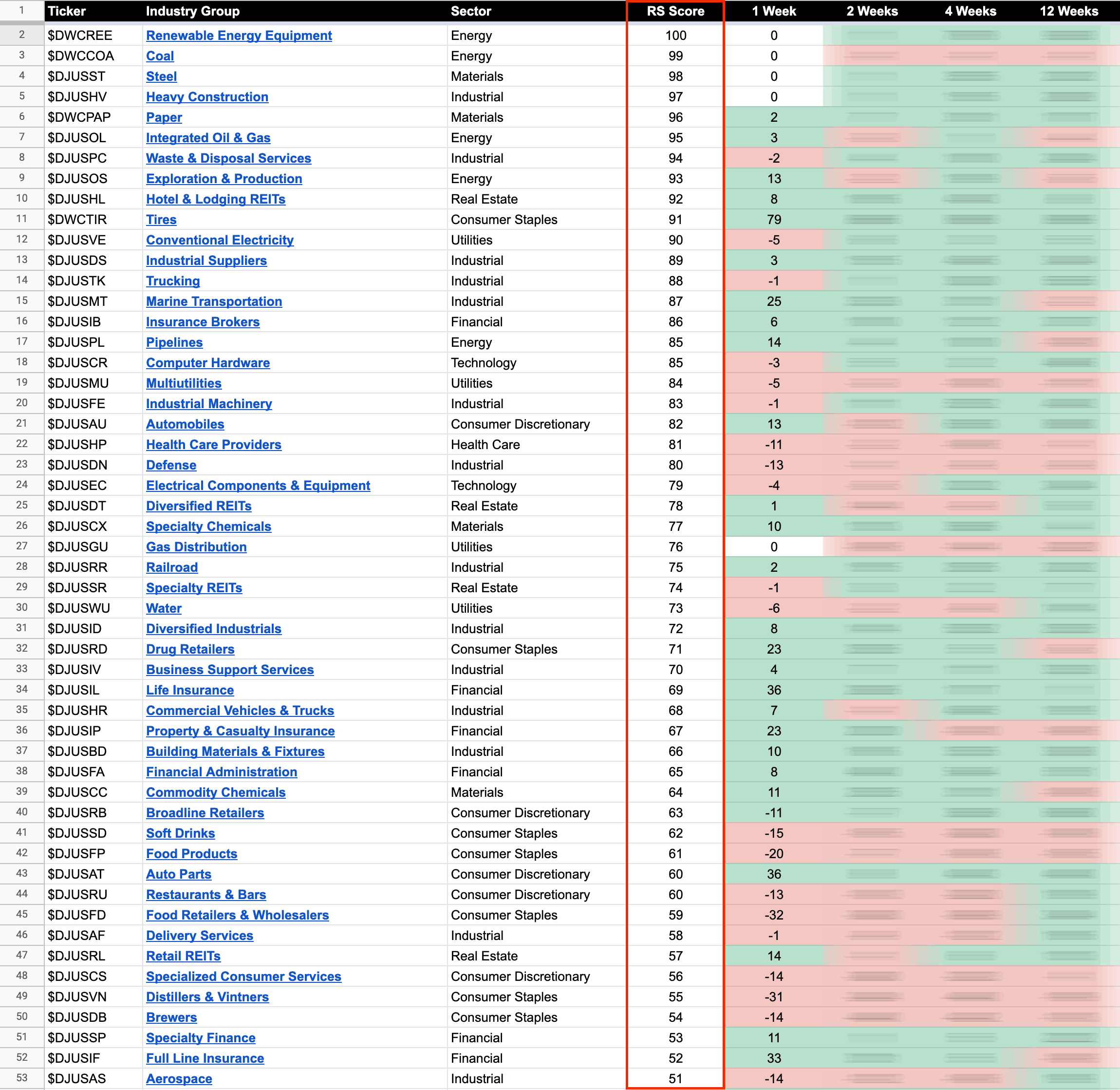

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

12 August, 2022

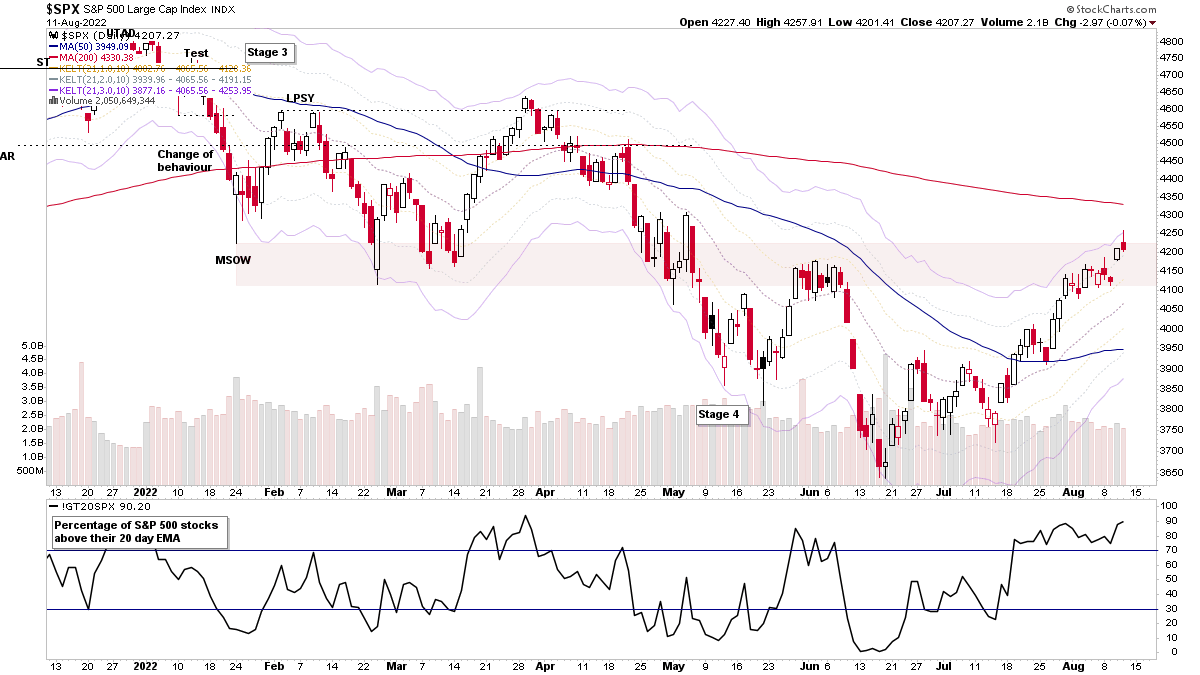

Stock Market Update and US Stocks Watchlist – 11 August 2022

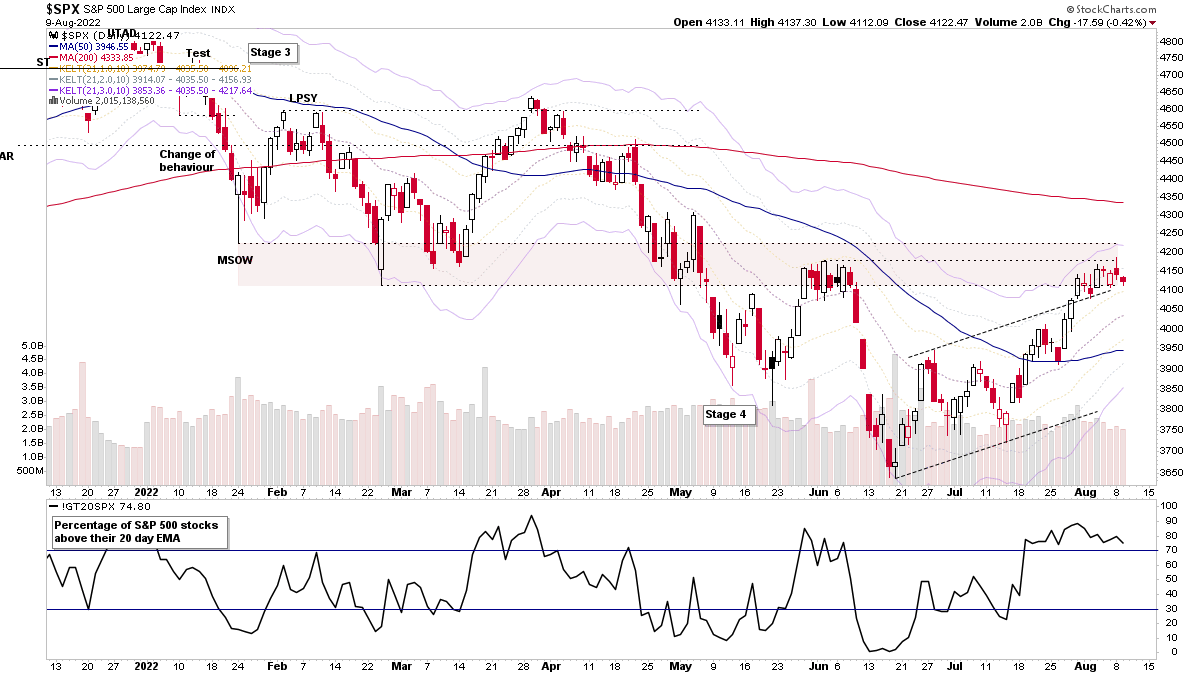

The S&P 500 gapped higher at the open, but spent the majority of the day pulling back, as multiple major indexes (i.e the S&P 500, Nasdaq Composite, Nasdaq 100 etc) all tested their year to date Anchored Volume Weighted Average Price (Anchored VWAP) and reversed back through to close the day negative. However, none broke the prior days lows and they all remain above their +1x ATR levels currently...

Read More

11 August, 2022

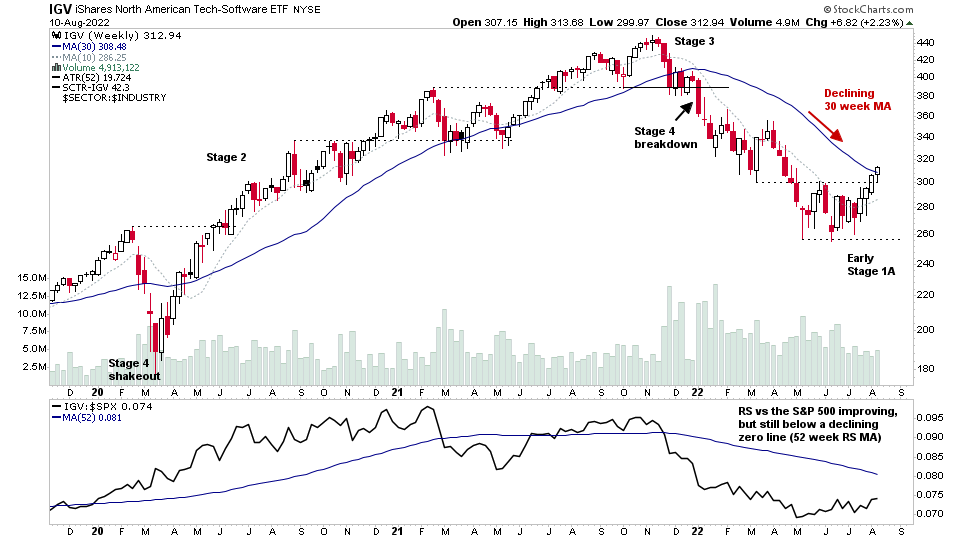

Video: Software Stocks Group Focus – Stage 1 Bases Proliferate – 10 August 2022 (1hr 7mins)

Todays Stage Analysis Members midweek video is a special feature on the Software group, which has been rising up the relative strength rankings over the last month, and has seen many stocks from the group appearing in the watchlist, due to the large number of stocks bases transitioning towards Stage 1, as well as a smaller number of stronger stocks in the group making the move into early Stage 2...

Read More

10 August, 2022

US Stocks Watchlist – 9 August 2022

For the watchlist from Tuesdays scans...

Read More

07 August, 2022

Stage Analysis Members Weekend Video – 7 August 2022 (1hr 30mins)

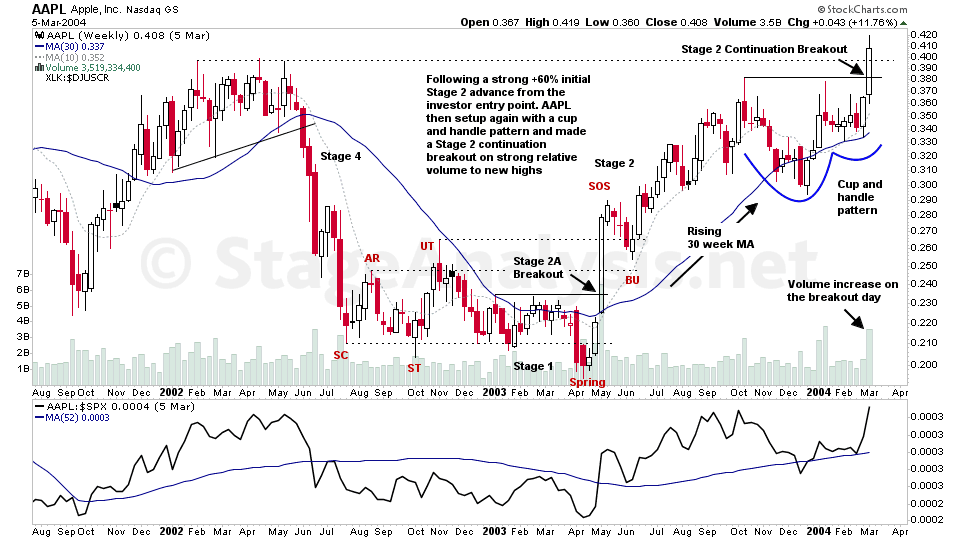

With the increased interest in Stan Weinstein's Stage Analysis method recently, I thought it would be useful to begin this weekends video with an educational feature on the Stage 2A entry point, using the example of AAPL from May 2003...

Read More