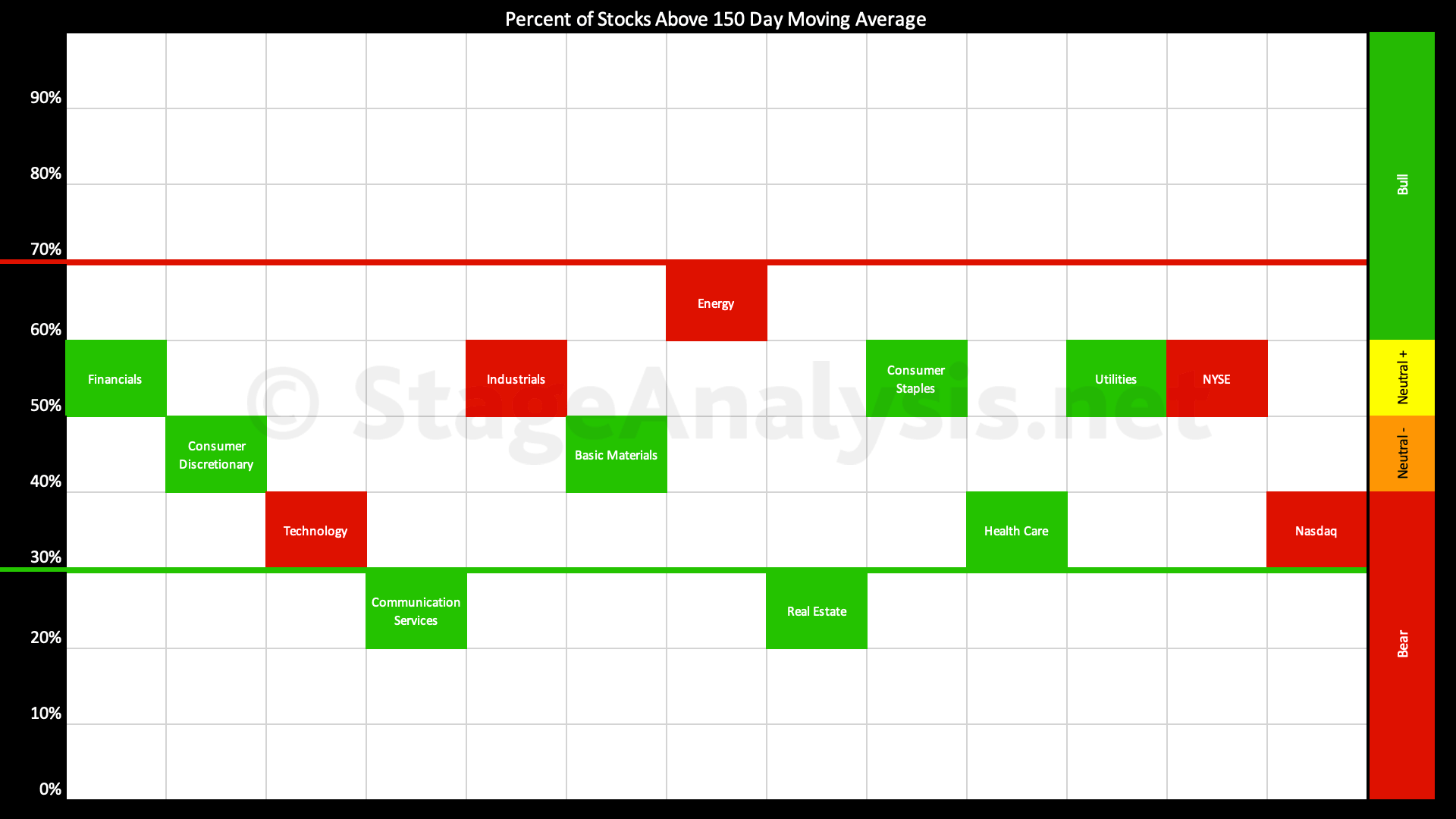

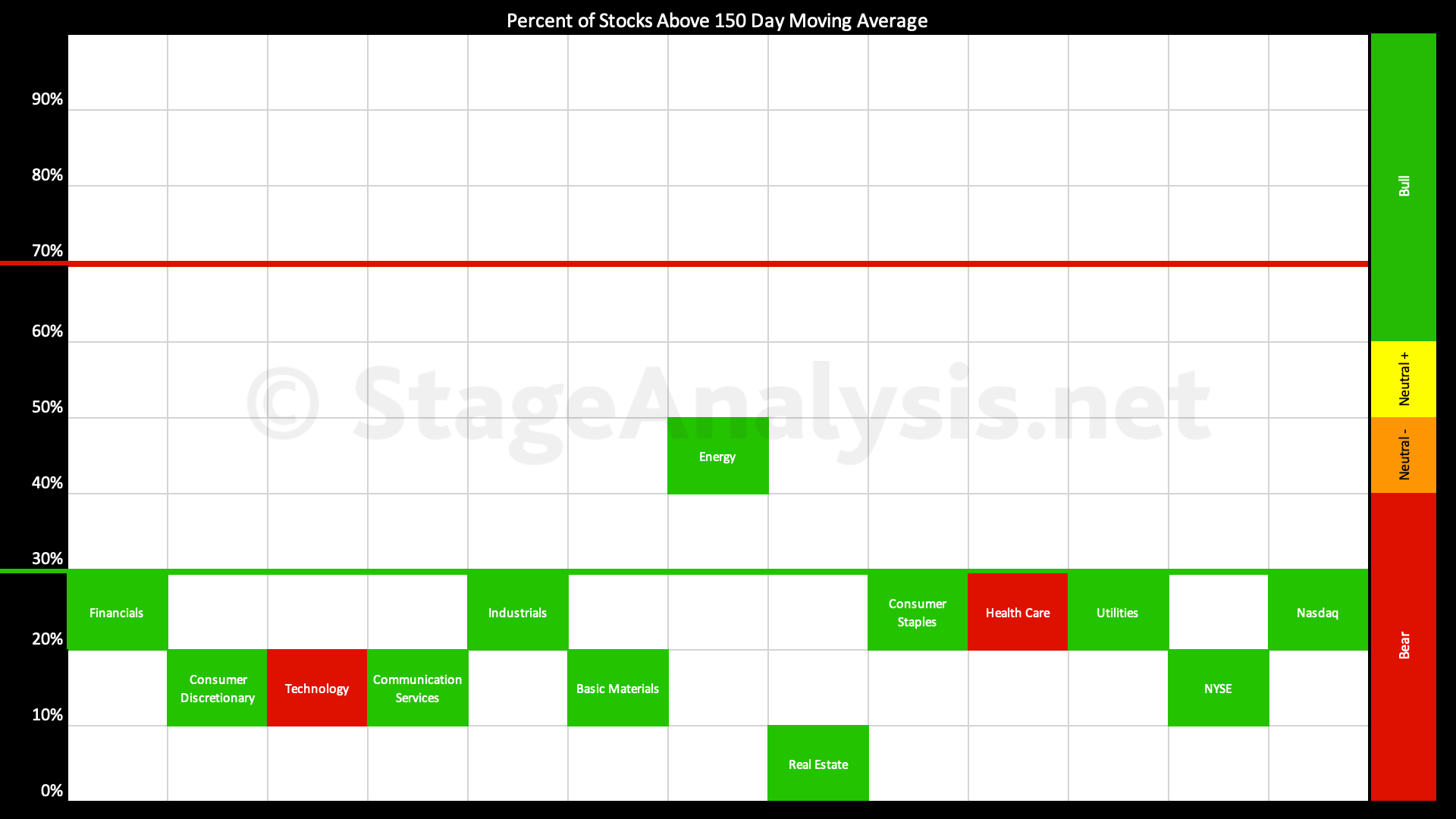

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has continued to improve since my previous post on the 9th November, which was the day before the secondary Follow Through Day (FTD) in multiple of the major US stock market indexes.

Read More

Blog

13 November, 2022

Stage Analysis Members Video – 13 November 2022 (1hr 21mins)

The Stage Analysis members weekend video, this week discussing the significant bar in the US Dollar Index and price and volume action in the major stock market indexes. Plus Stage Analysis of the individual sectors and the Industry Groups Relative Strength Rankings, with a look in more depth of some of the groups making the strongest moves. Also discussion of the strong shift in the IBD Industry Groups Bell Curve – Bullish Percent data, and the Market Breadth Update to help to determine the current Weight of Evidence. And finishing with live markups of the weekends US Stocks Watchlist.

Read More

09 November, 2022

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has improved over the last month since my previous post on the 11th October when it was starting to rebound from lowest reading of the year at 14.76% on the 30th September...

Read More

12 October, 2022

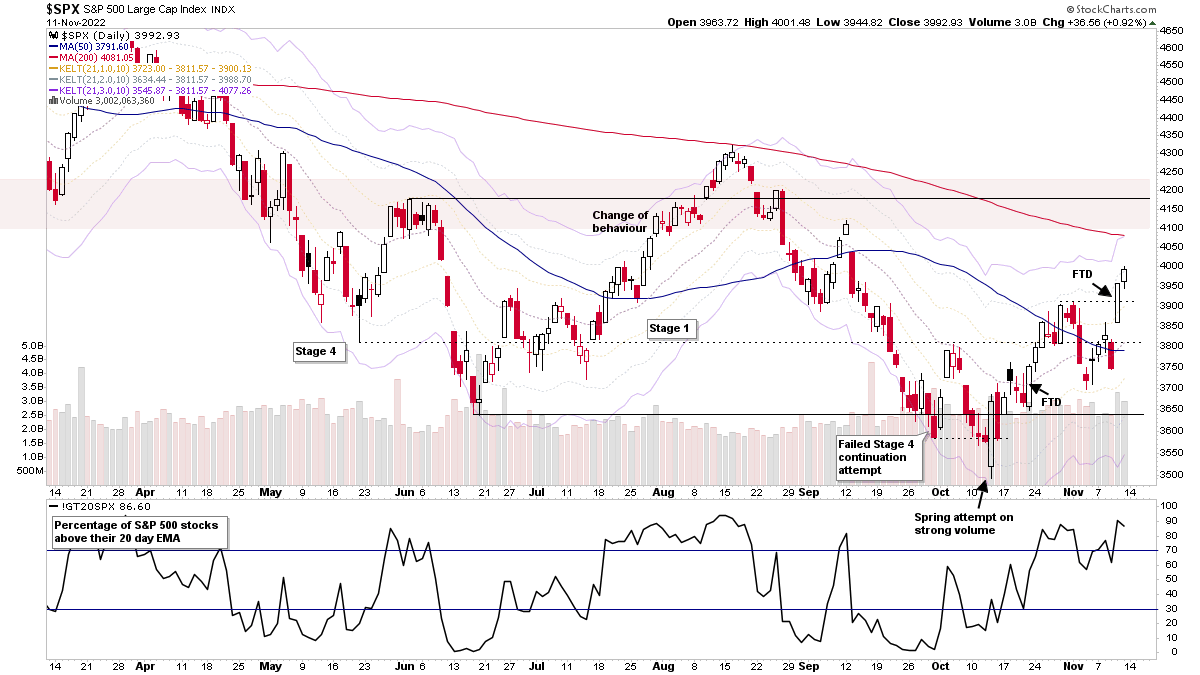

Stage Analysis Members Midweek Video – 12 October 2022 (1hr 1min)

The members midweek video discussing the market, sector breadth, short-term market breadth and individual stocks from the watchlist in more detail...

Read More

11 October, 2022

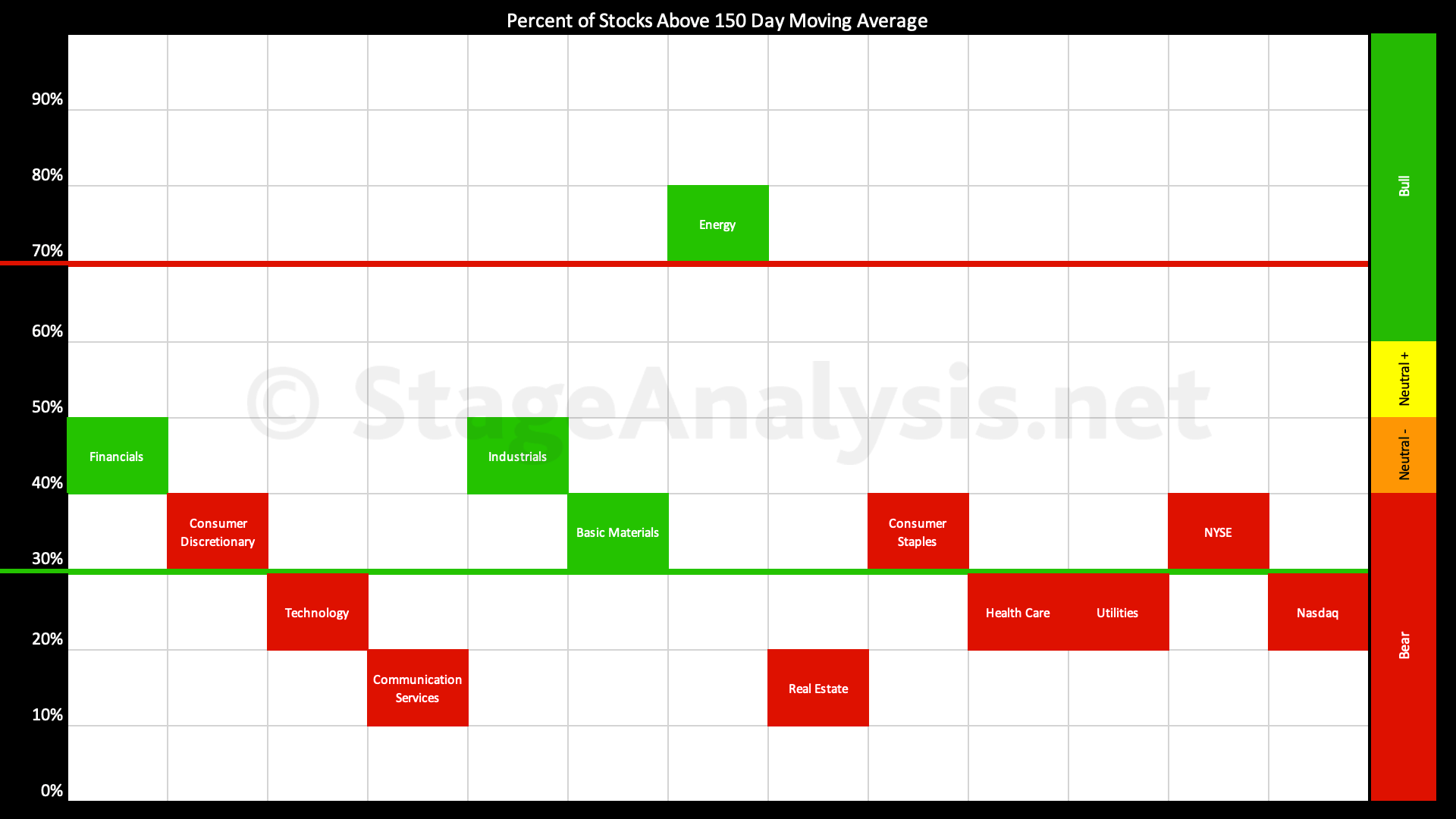

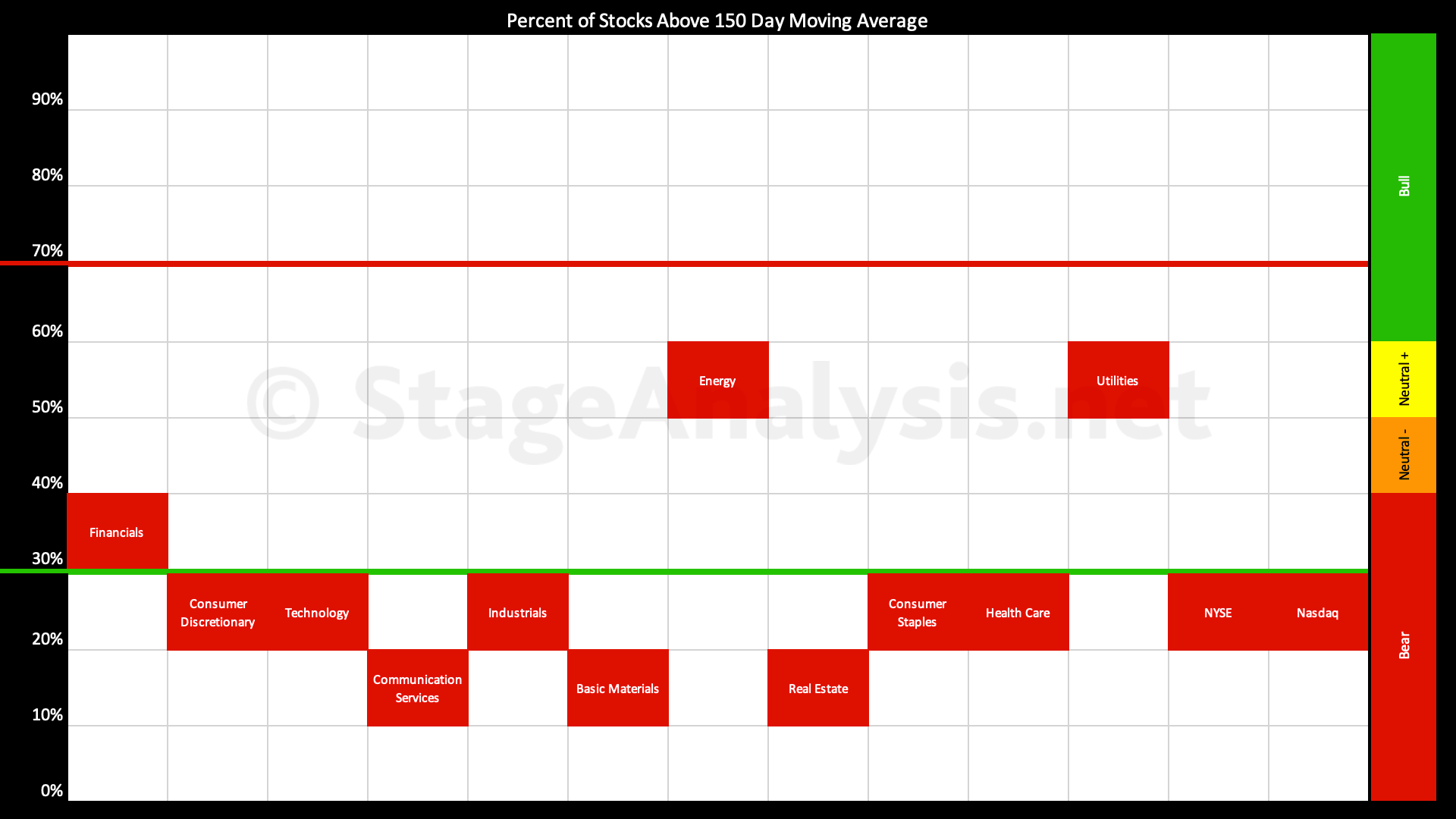

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has declined by a further -10.27% over the last three weeks since the last sector breadth post, and is currently at 18.90%, which is one of the lowest readings of the year to date...

Read More

19 September, 2022

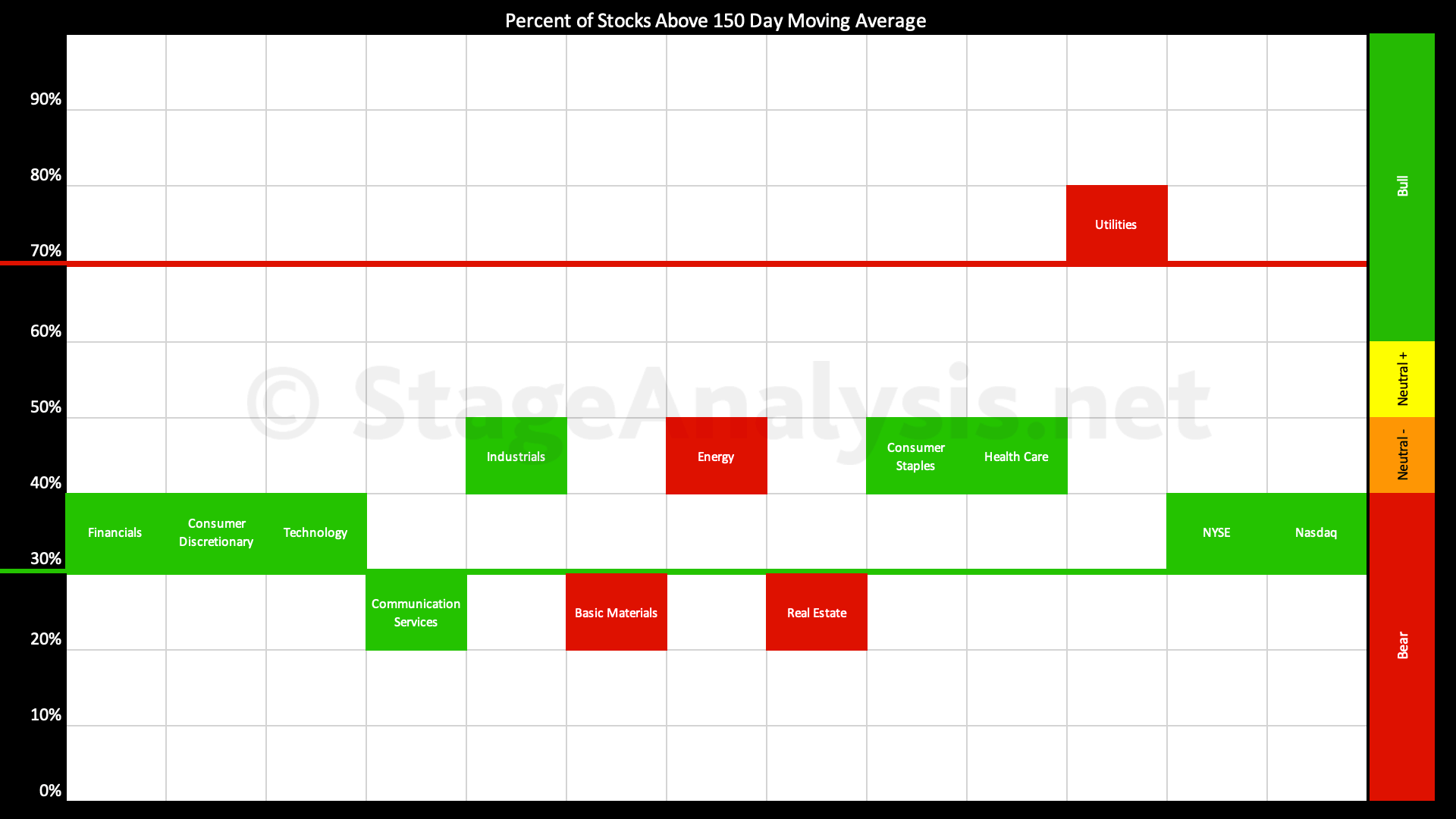

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors declined by -9.98% over the last week to close the week at 29.17%, which is back in the lower range in the Stage 4 zone. Only the Utilities and Energy sectors are in the 40% to 60% range in the Stage 1 / Stage 3 zone. However, no sectors are currently above 60%, and so there are no sectors currently in the Stage 2 zone...

Read More

07 August, 2022

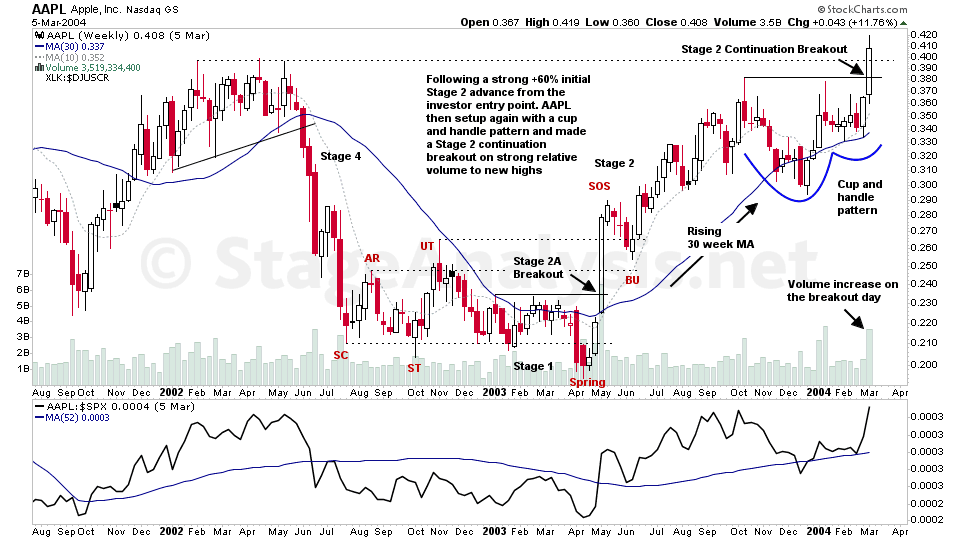

Stage Analysis Members Weekend Video – 7 August 2022 (1hr 30mins)

With the increased interest in Stan Weinstein's Stage Analysis method recently, I thought it would be useful to begin this weekends video with an educational feature on the Stage 2A entry point, using the example of AAPL from May 2003...

Read More

06 August, 2022

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

There has been steady improvement in the Percentage of US Stocks Above Their 150 day Moving Averages over the last 5 weeks since I produced the sector breadth diagram and table, with a +15.91% improvement over the period and a few more sectors moving into the Stage 1 zone (40% to 60% range), and one sector moving into the Stage 2 zone (above 60%)...

Read More

07 July, 2022

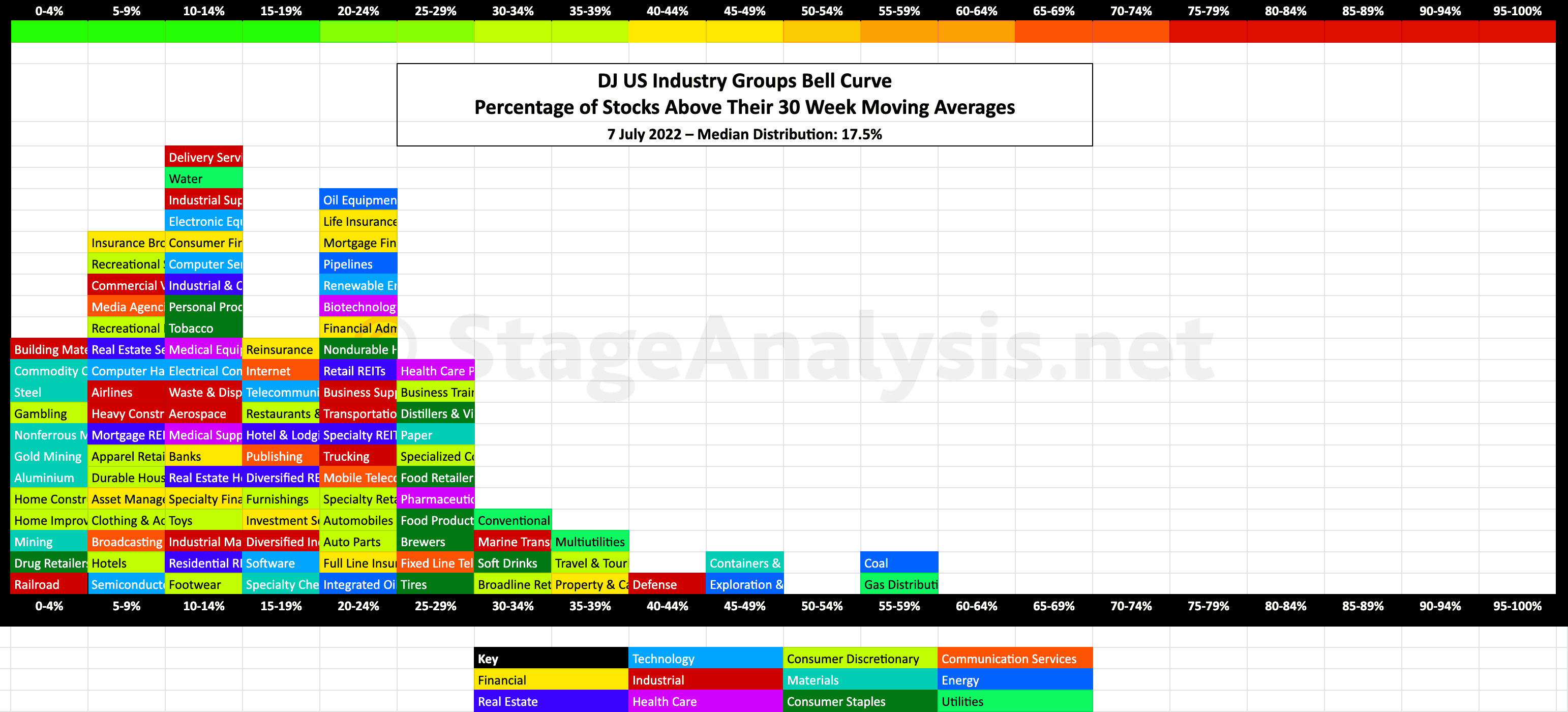

US Industry Groups Bell Curve – Exclusive to Stage Analysis

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart – inspired by the Sector Bell Curve work by Tom Dorsey in his Point & Figure book....

Read More

03 July, 2022

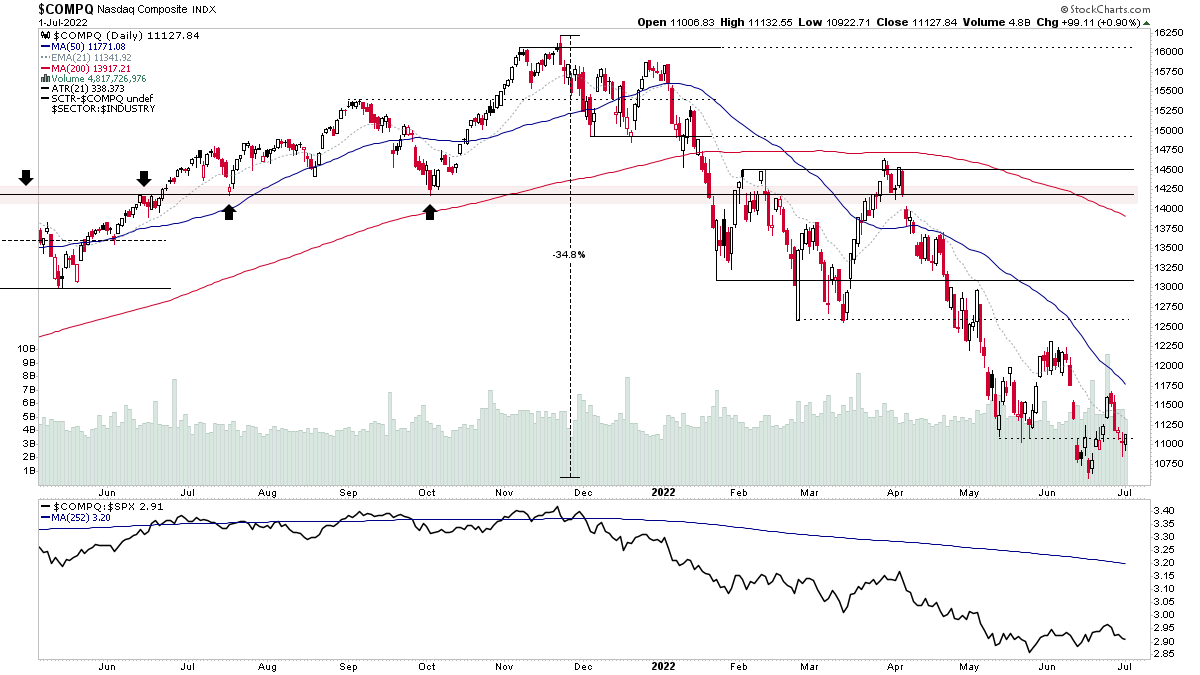

Stage Analysis Members Weekend Video – 3 July 2022 (1hr 20mins)

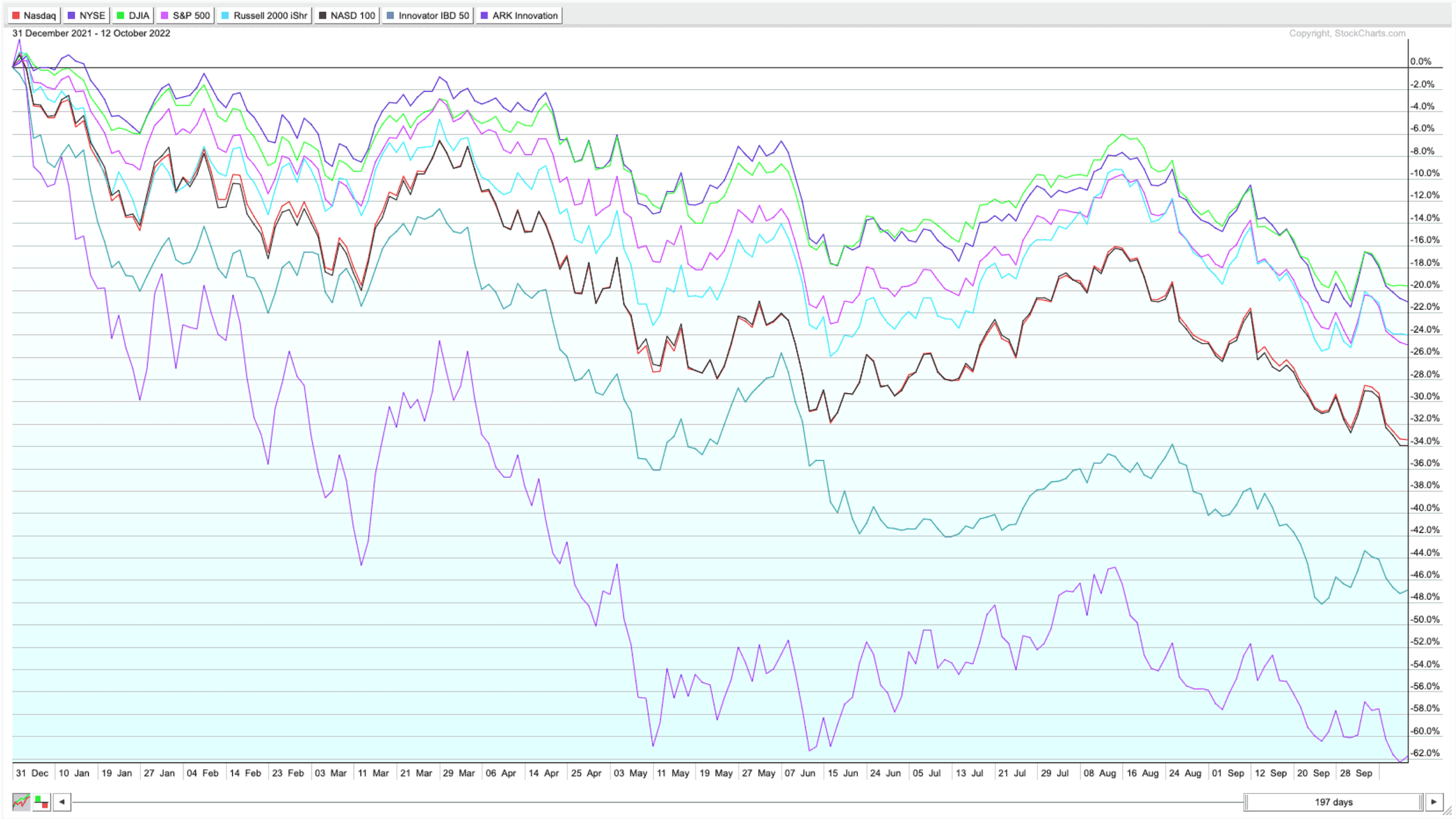

The Stage Analysis Members Weekend Video this week covers the Major Indexes with analysis of S&P 500, Nasdaq, Russell 2000, as well as Oil, Copper, US 7-10 Year Treasuries & Gold...

Read More