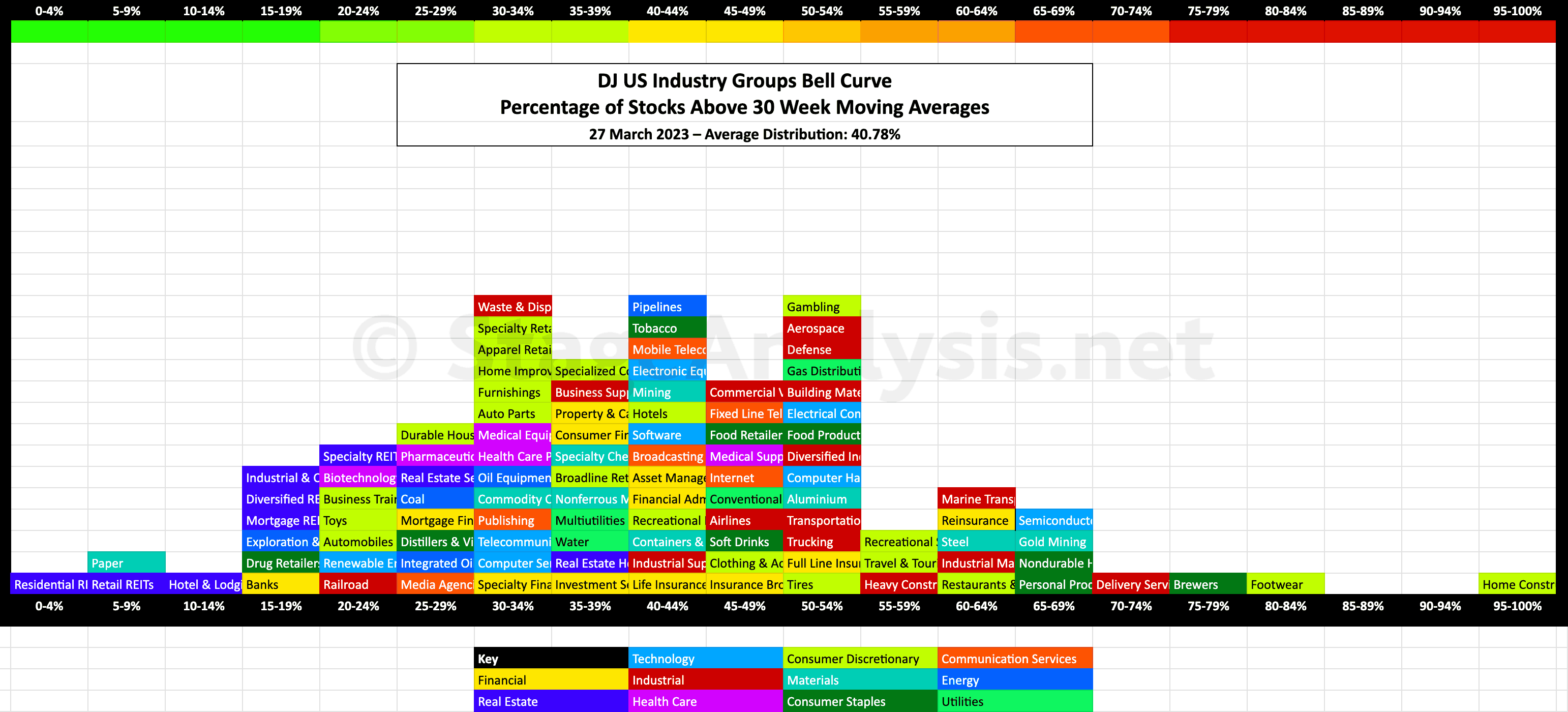

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More

Blog

26 March, 2023

Stage Analysis Members Video – 26 March 2023 (1hr 20mins)

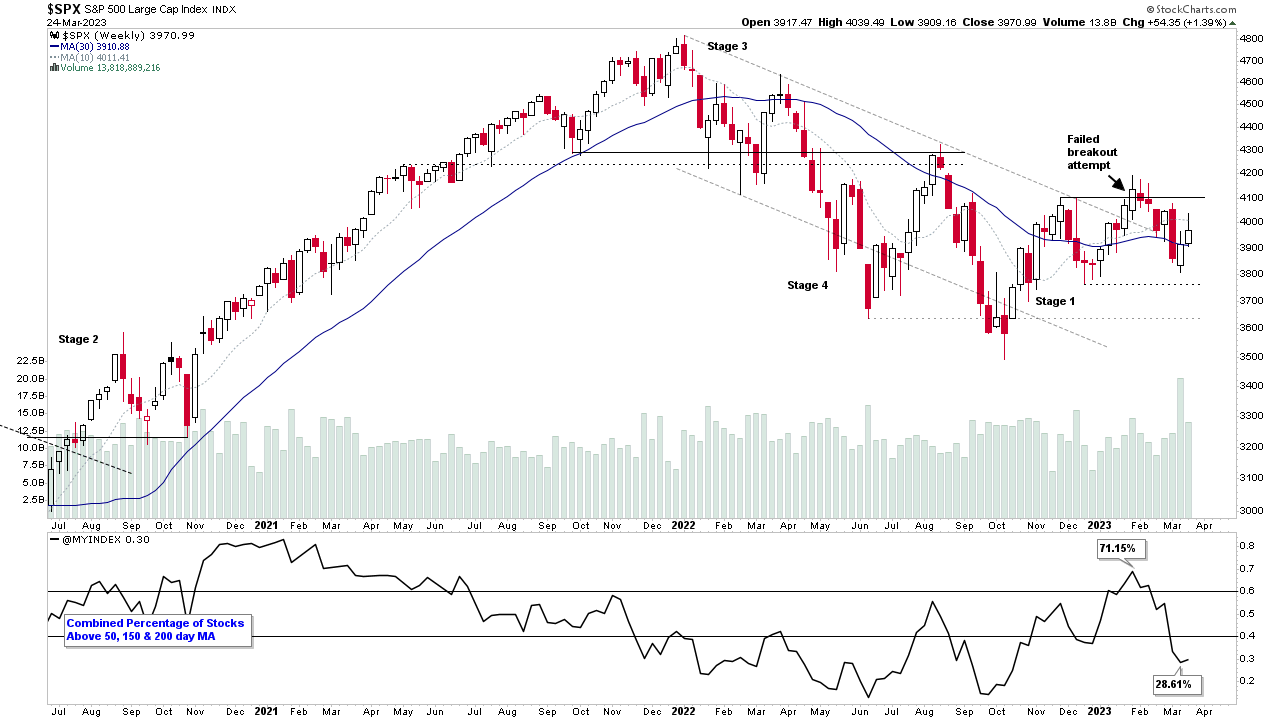

The Stage Analysis members weekend video with the Major Indexes Update, Futures, Sector Breadth, US Stocks Industry Groups RS Rankings, IBD Industry Groups Bell Curve – Bullish Percent, Market Breadth Update – Weight of Evidence and the US Watchlist Stocks in detail with live markups on multiple timeframes...

Read More

20 March, 2023

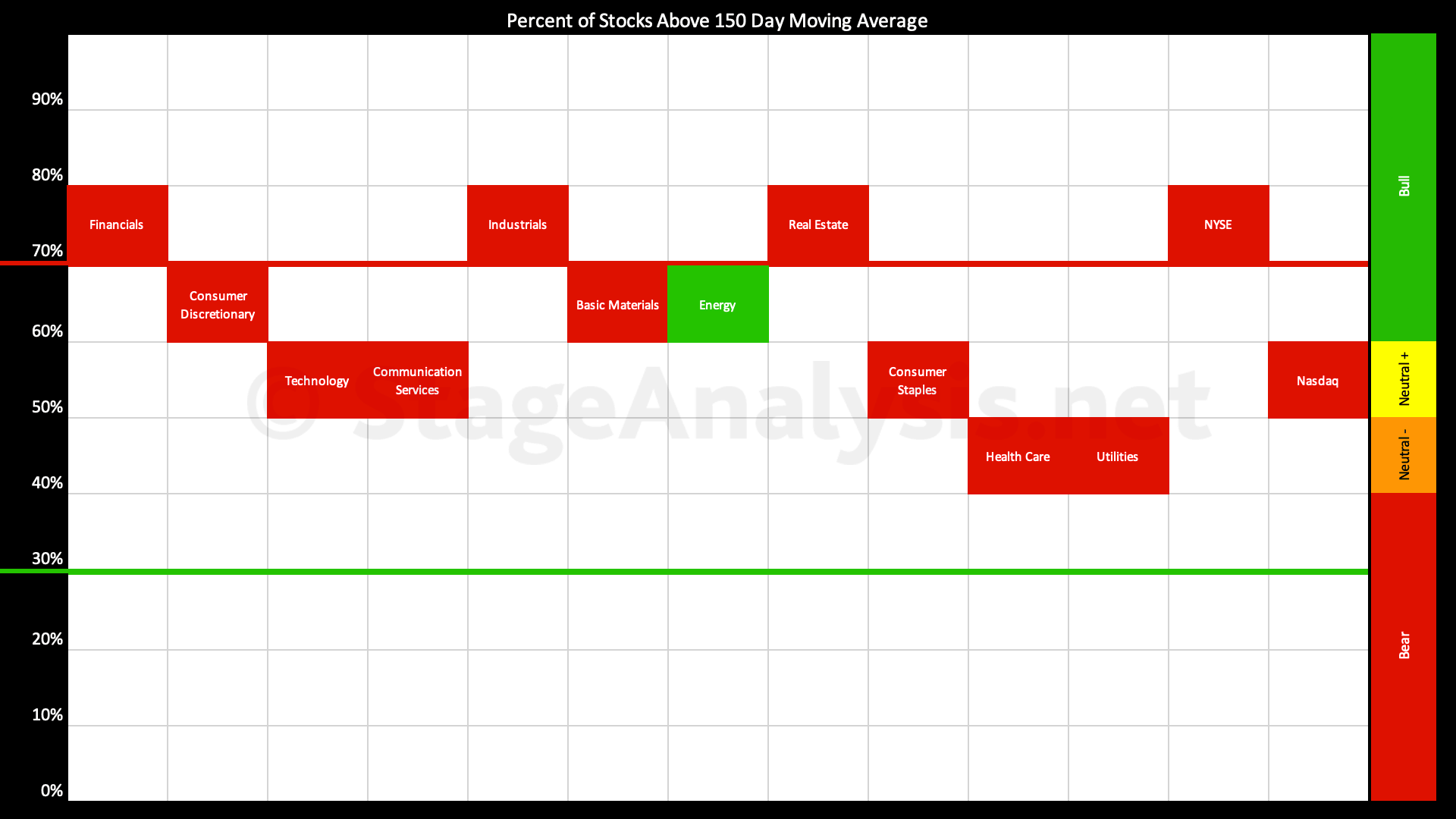

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

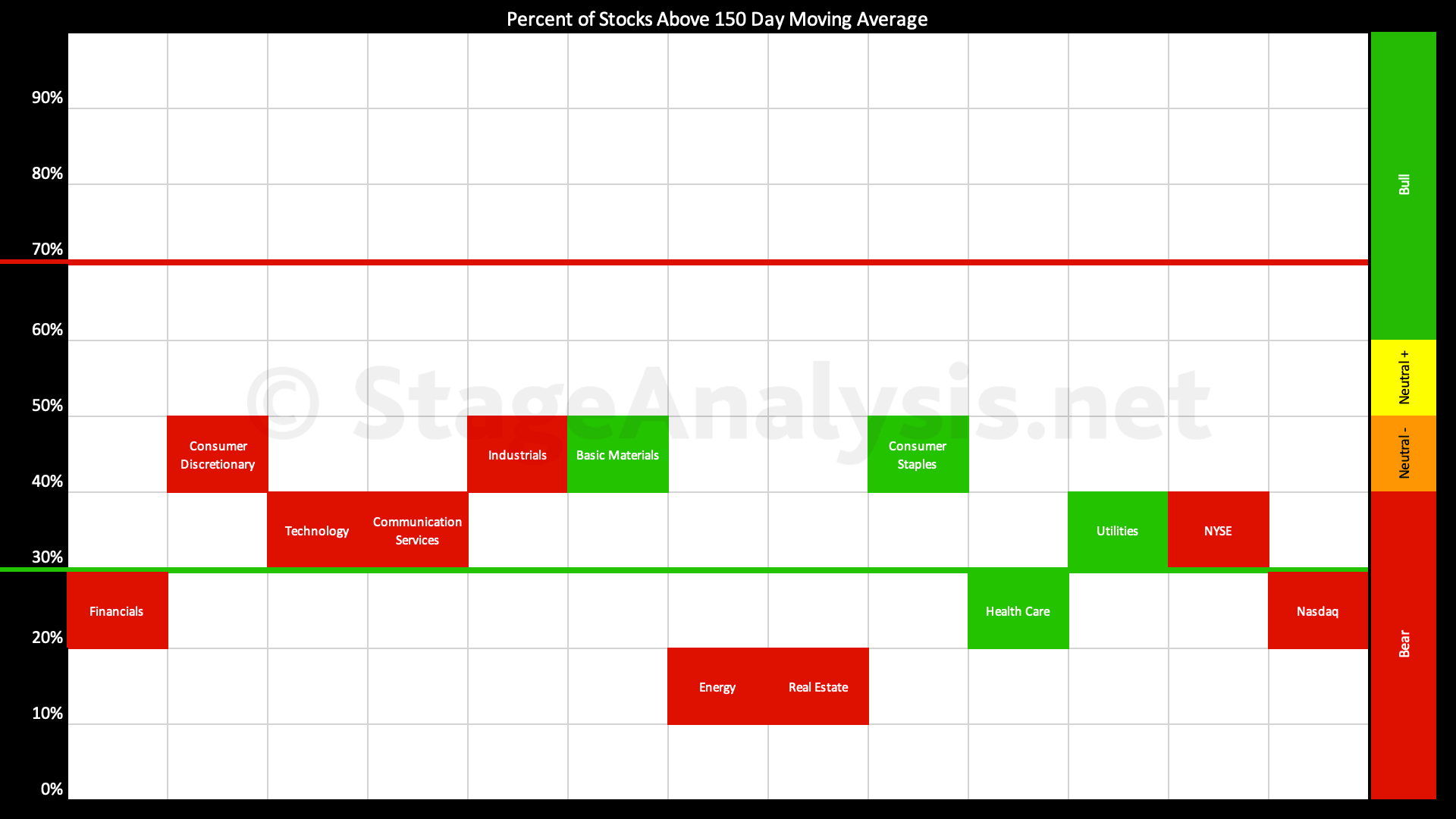

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has dropped significantly since the previous post of the 6th March 2023, decreasing by -16.88% to 34.31% overall, which moves the overall average into the lower third, which is the Stage 4 zone...

Read More

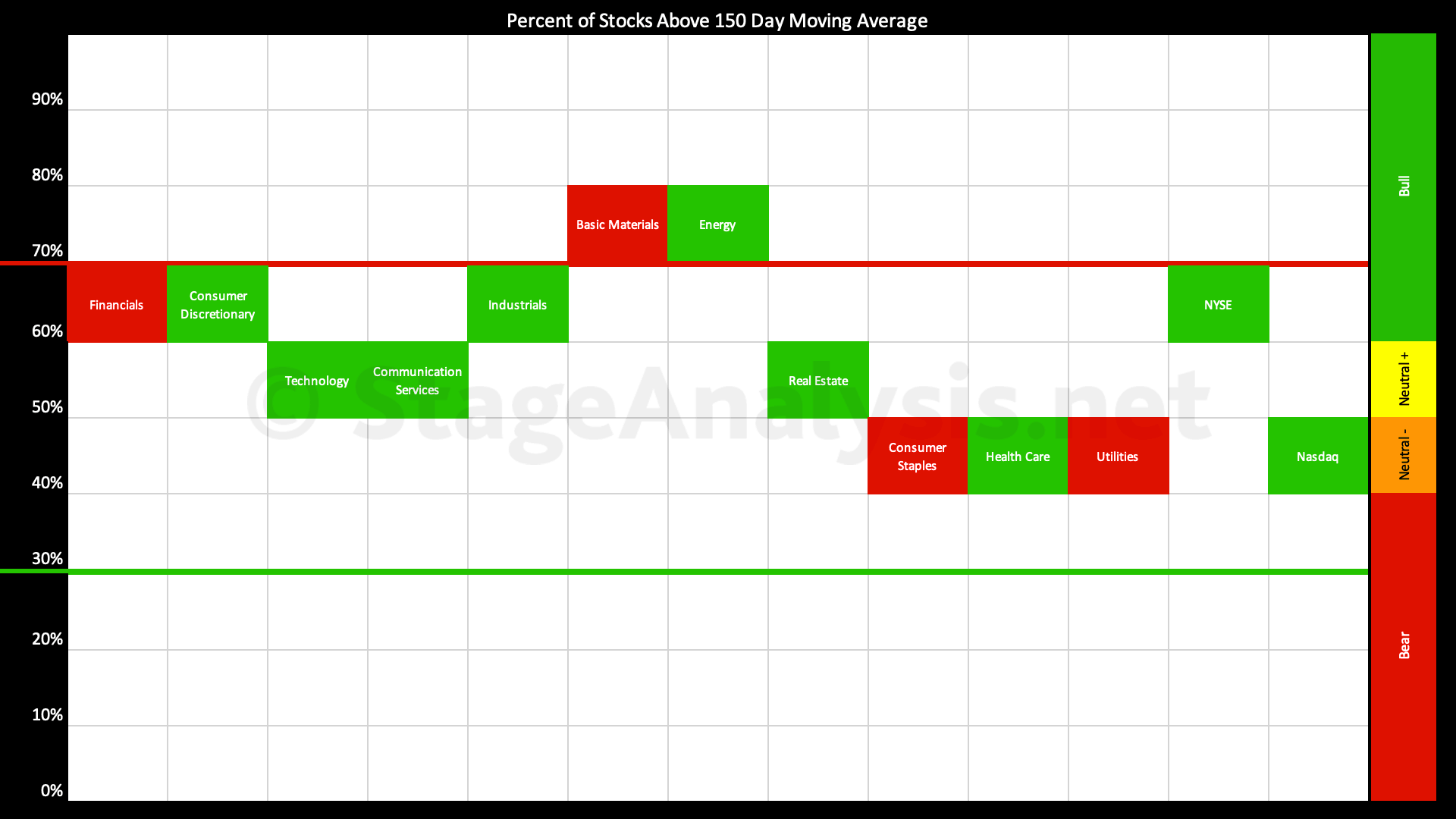

06 March, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

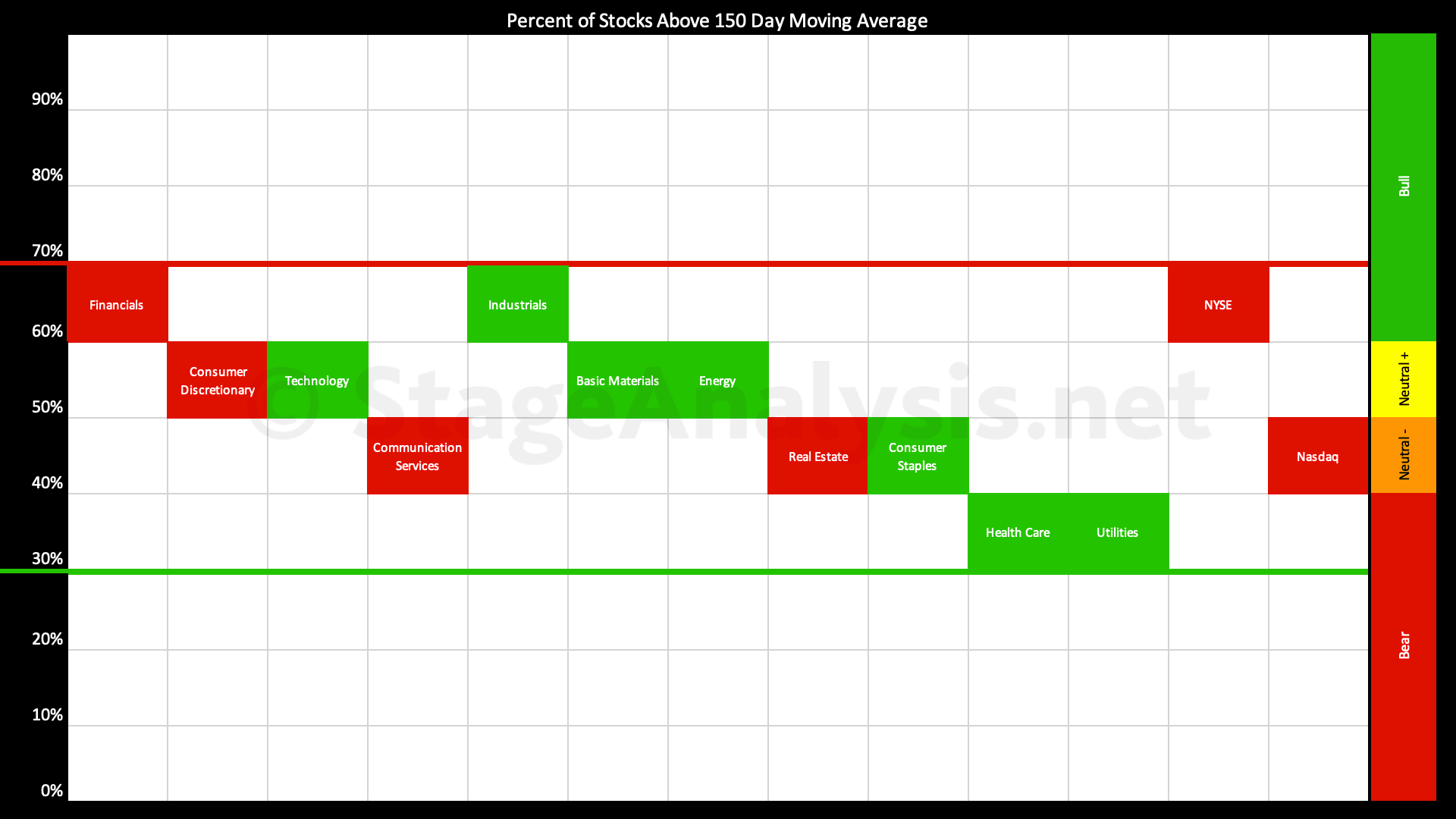

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has pulled back since the previous post, decreasing by -9.22% to 51.19% overall, which moves it back into the middle of the range, which is the neutral zone.

Read More

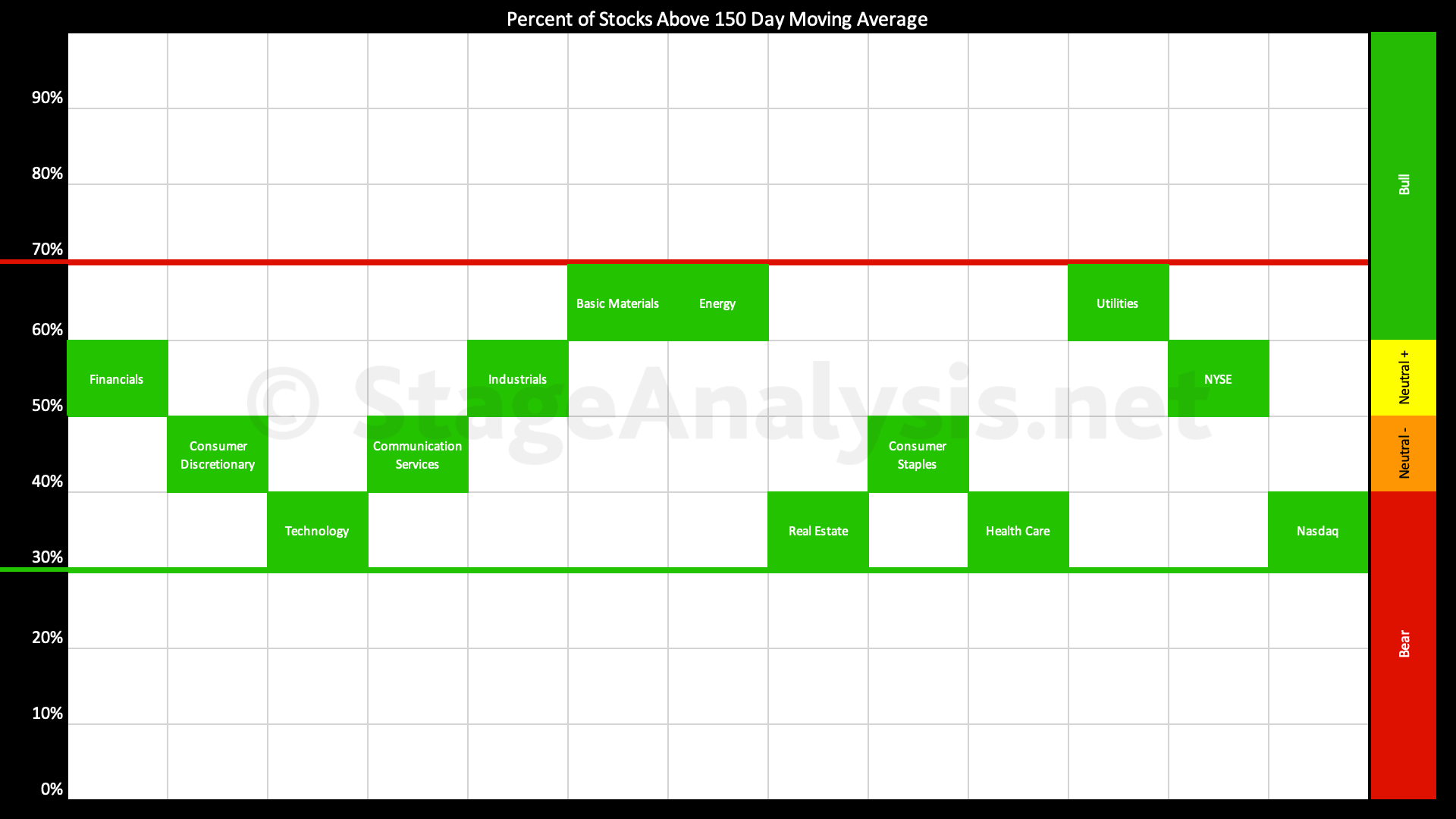

13 February, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors edge higher over the last three weeks since the previous post of the 23rd January 2023, increasing by a further +1.94% to 60.41% overall, which puts it just in the Stage 2 zone, but very tentatively so...

Read More

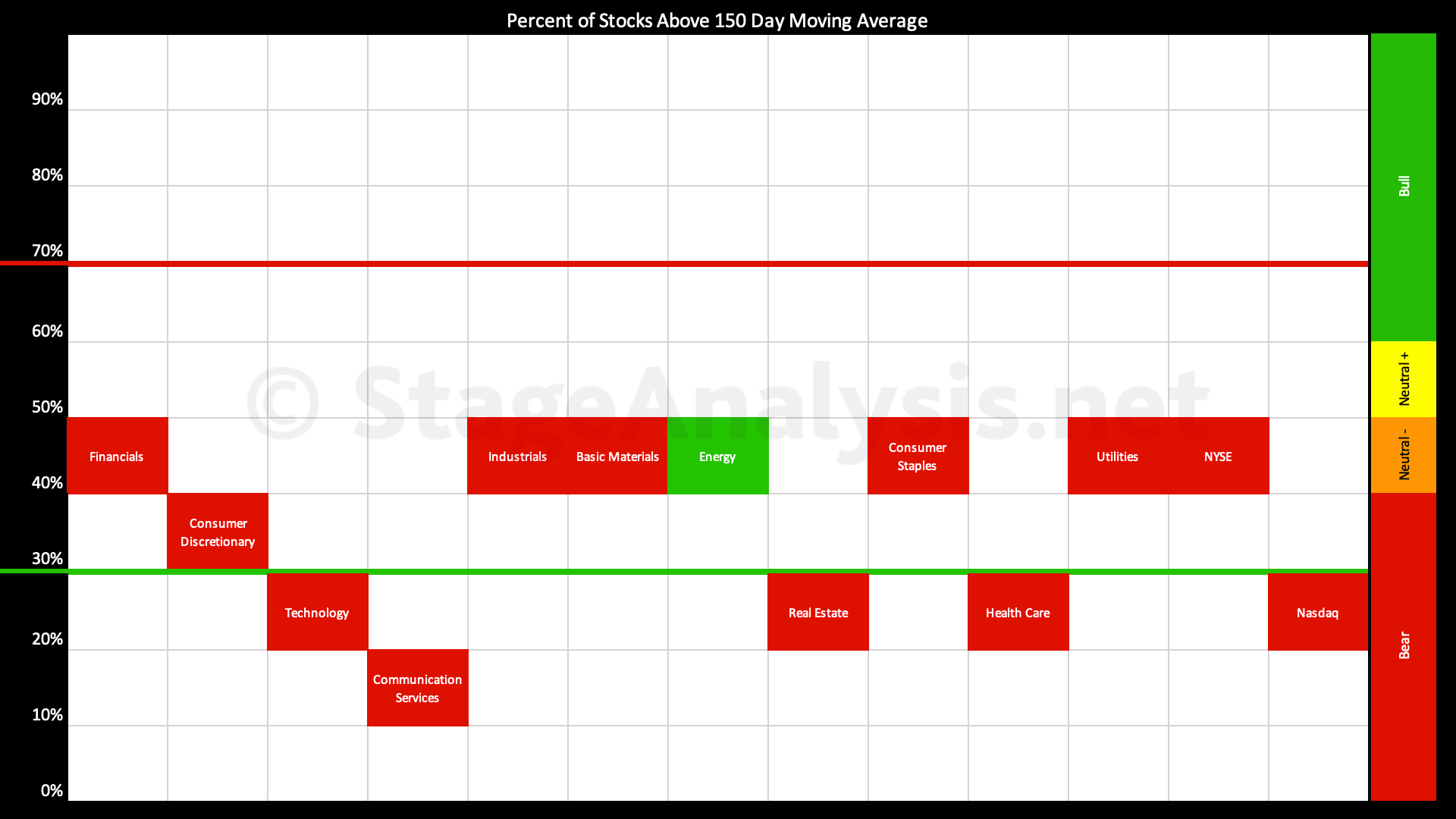

23 January, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has shown continued improvement over the last two weeks since the previous post of the 9th January 2023, increasing by a further +9.07% to 58.47% overall, which puts it at the top of the middle range (Neutral+), which is the Stage 1 zone.

Read More

09 January, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has moved higher by +12.92% over the last three weeks since the previous post of the 19th December, and so the overall average is now at 49.40%, which is firmly back in the Stage 1 zone in the middle of the range.

Read More

19 December, 2022

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has declined by -9.72% since the previous post on the 28th November, and so the overall average is now at 36.48% which is tipping it back into the Stage 4 zone once more, which it's spent the majority of 2022 in...

Read More

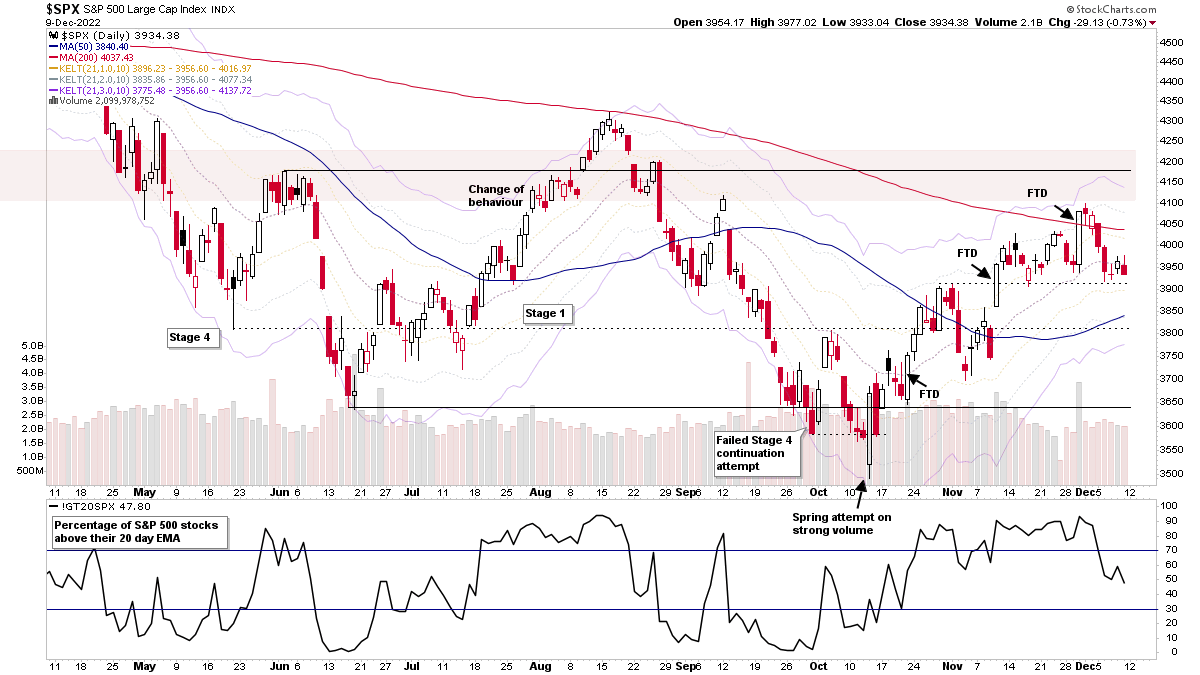

11 December, 2022

Stage Analysis Members Video – 11 December 2022 (1hr 5mins)

The Stage Analysis members weekend video discussing the market breadth charts to determine the weight of evidence, IBD industry group bell curve – percentage above 30 week MA and the bullish percent, industry groups relative strength, market indexes, and the US watchlist stocks in detail on multiple timeframes.

Read More

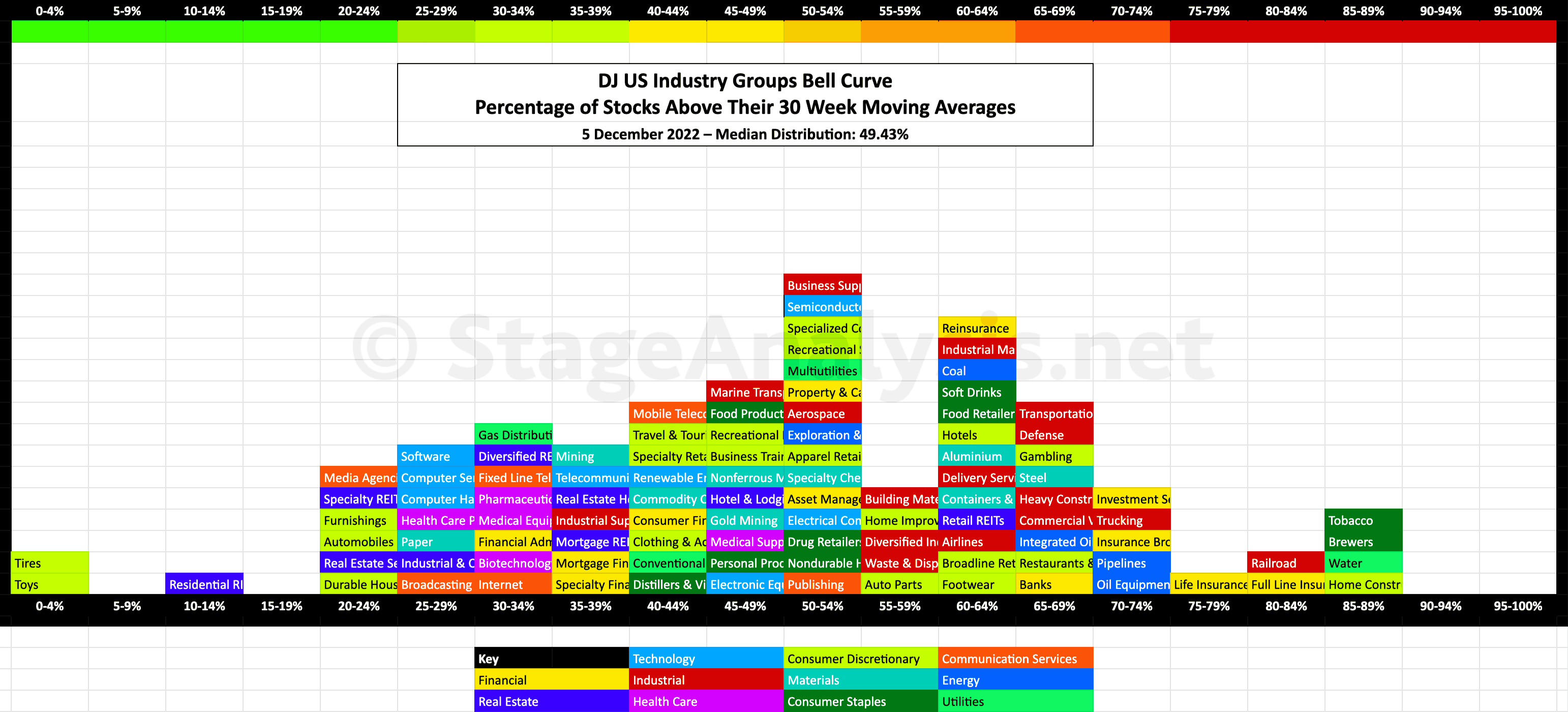

05 December, 2022

US Industry Groups Bell Curve – Exclusive to StageAnalysis.net

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More