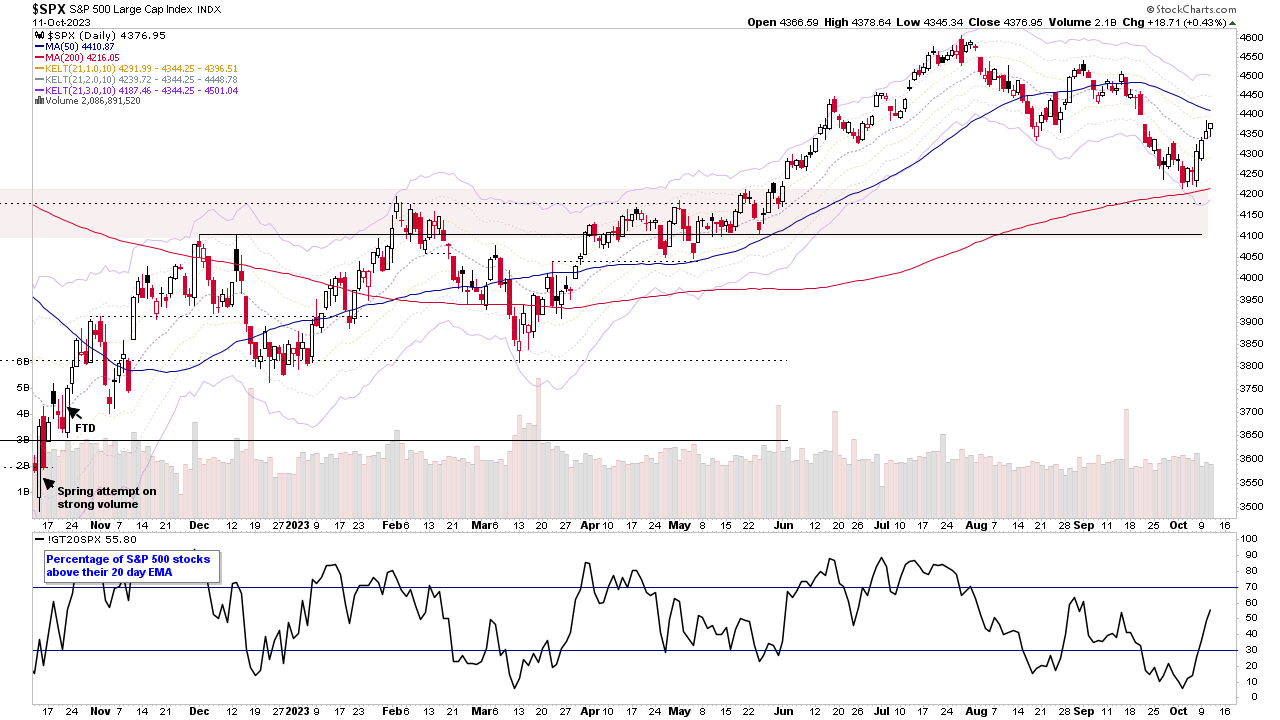

The Stage Analysis midweek video with a discussion of the major US stock market indexes, and short-term market breadth measures. Followed by a detailed look at the Sector Breadth charts and finishing with the recent watchlist stocks on multiple timeframes.

Read More

Blog

11 October, 2023

Stage Analysis Members Video – 11 October 2023 (46mins)

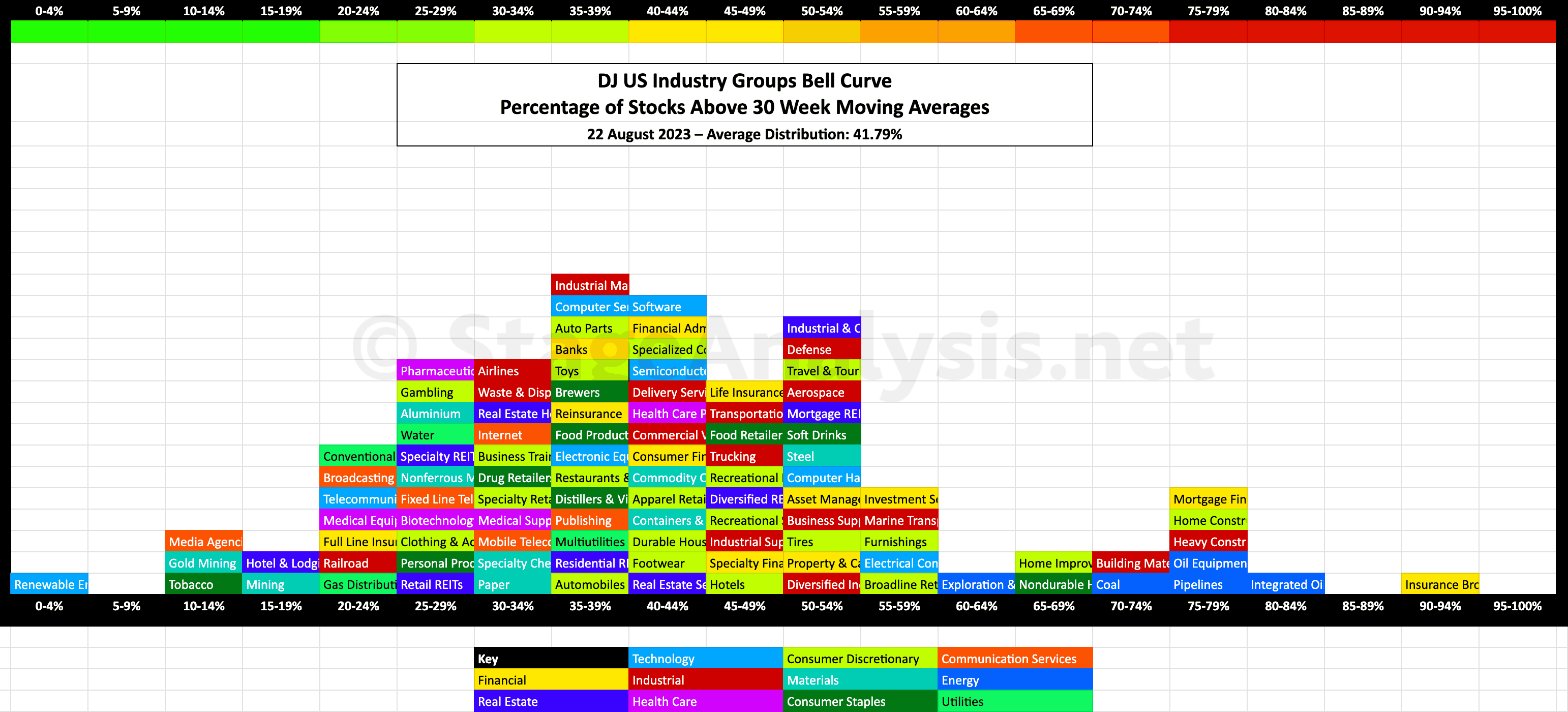

22 August, 2023

US Industry Groups Bell Curve – Exclusive to StageAnalysis.net

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More

03 July, 2023

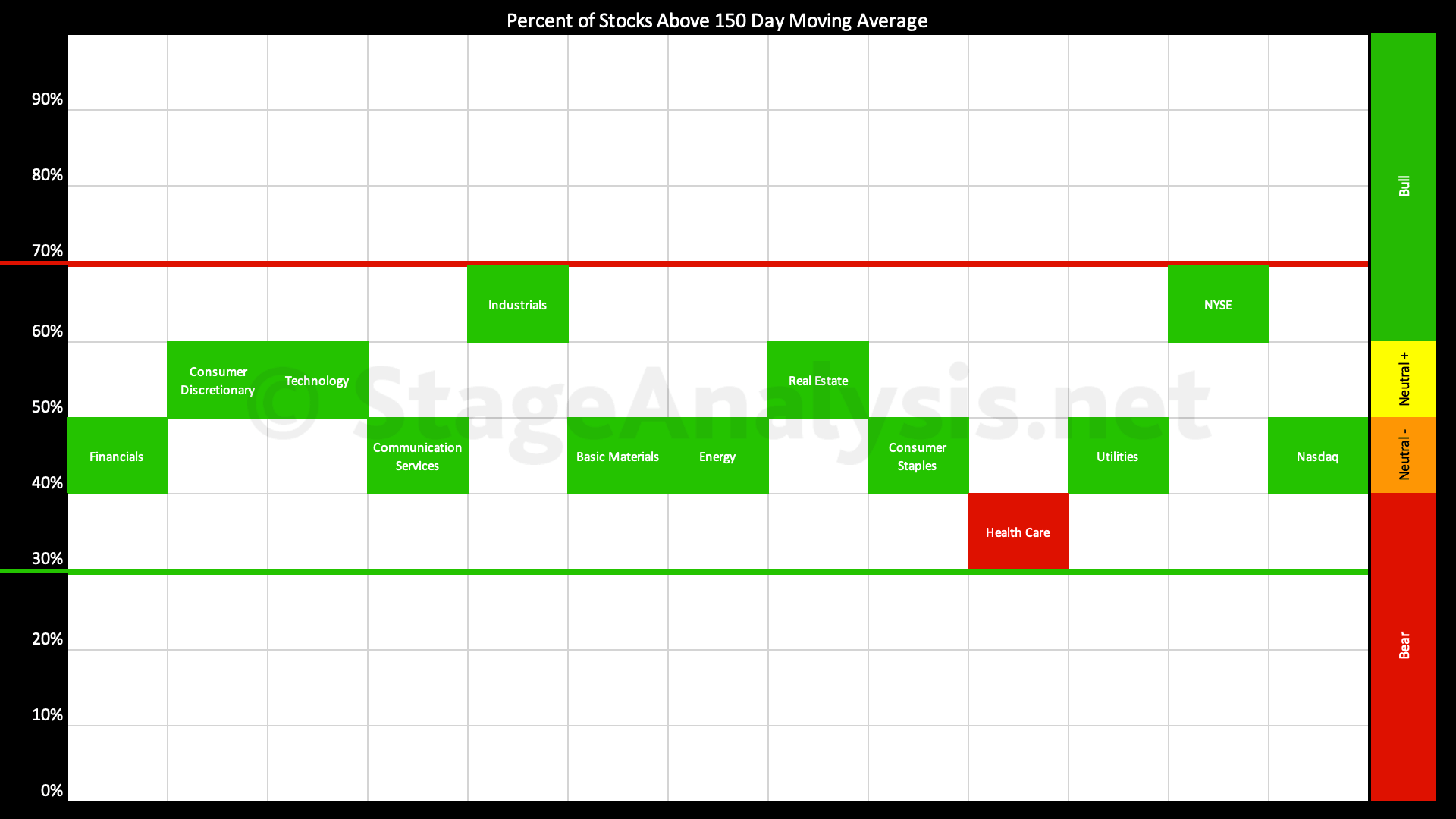

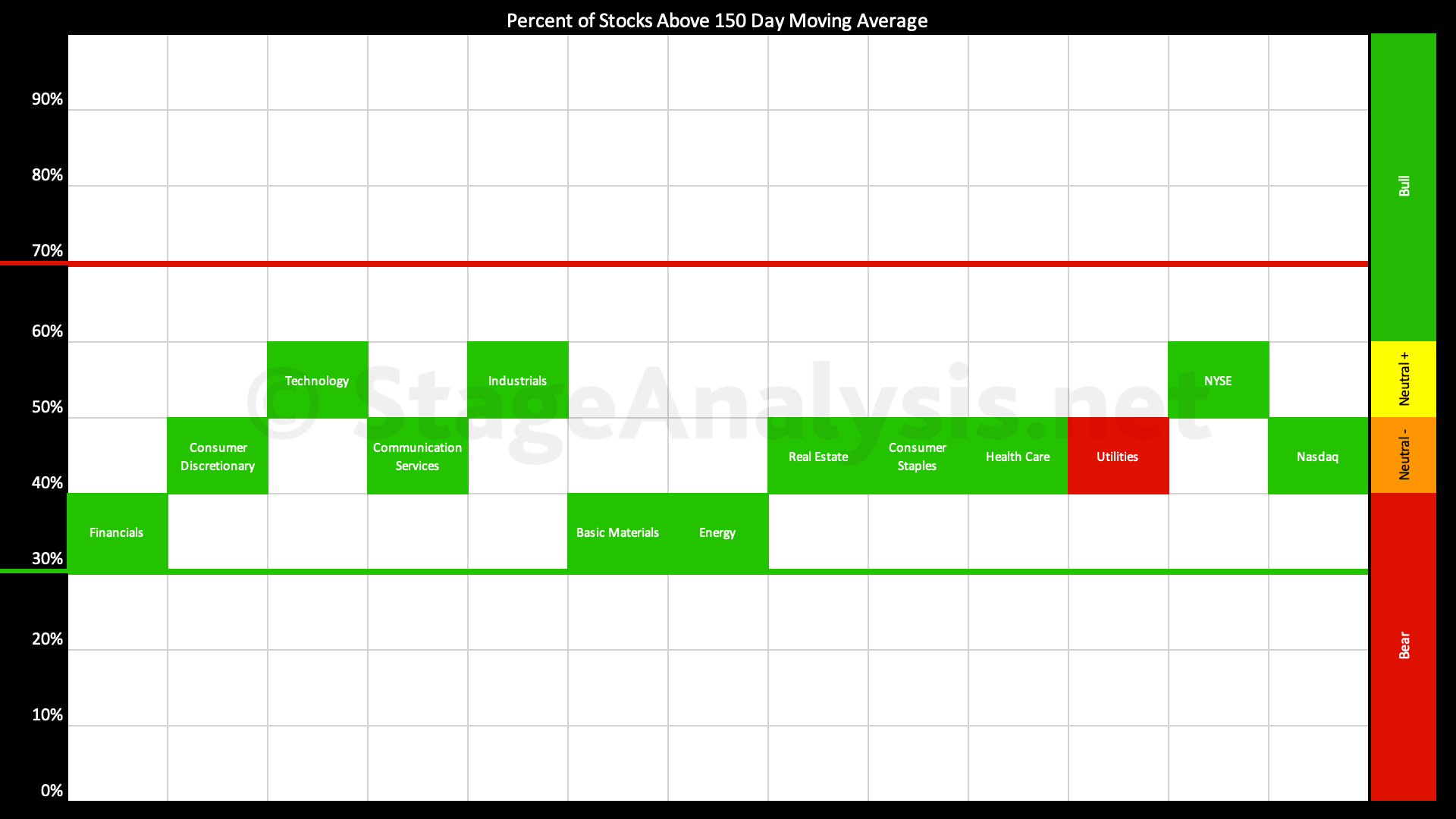

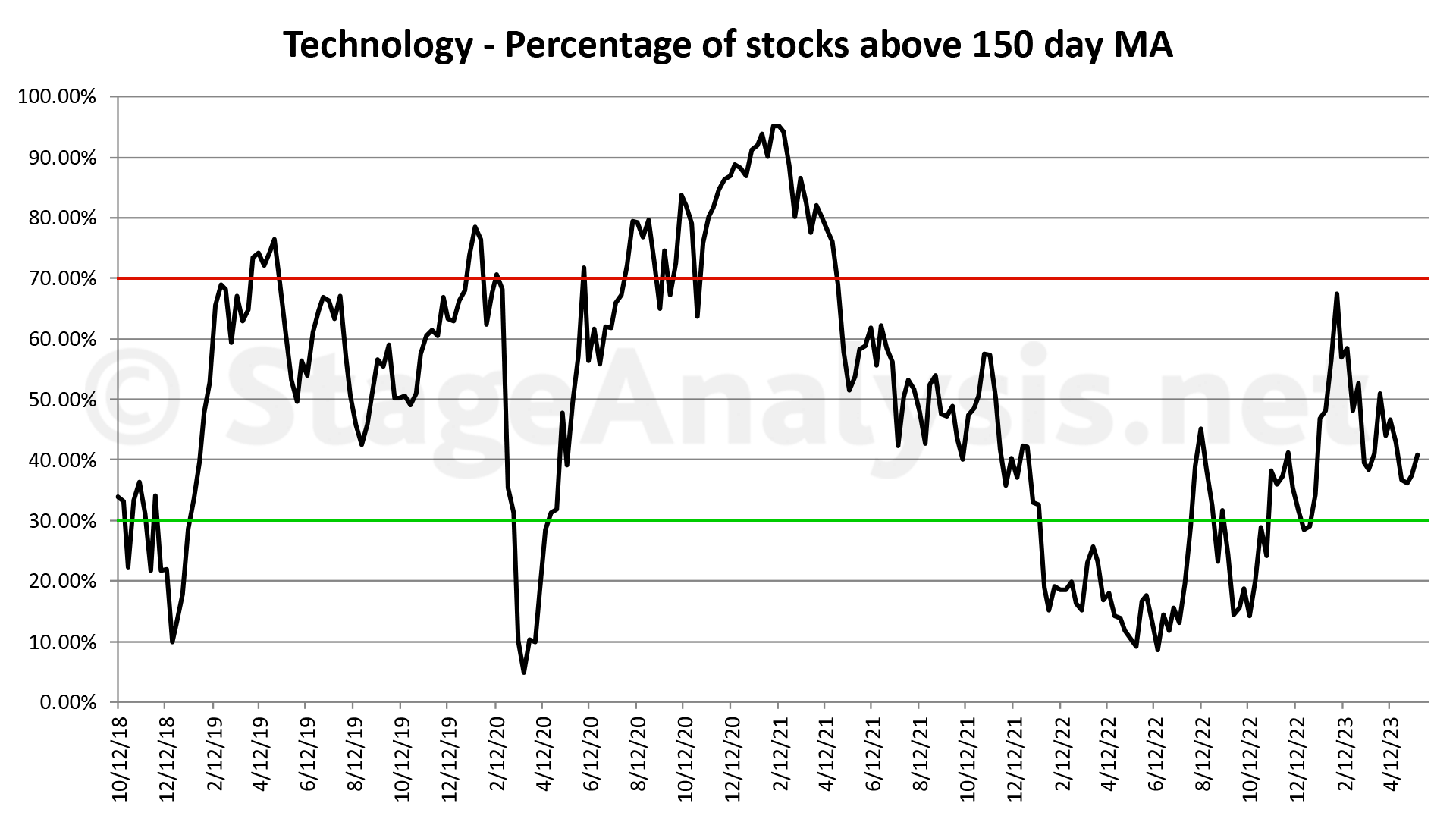

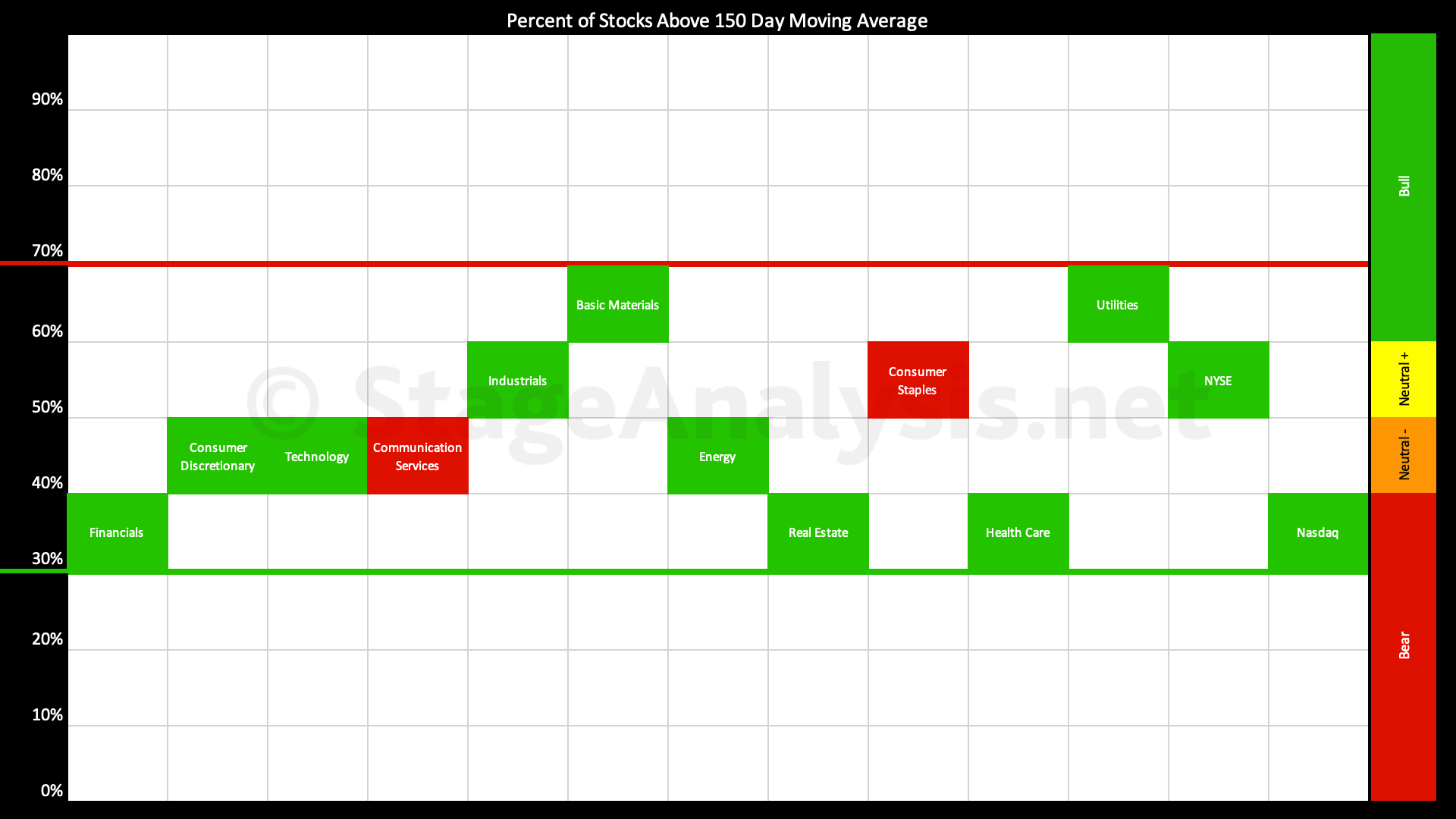

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

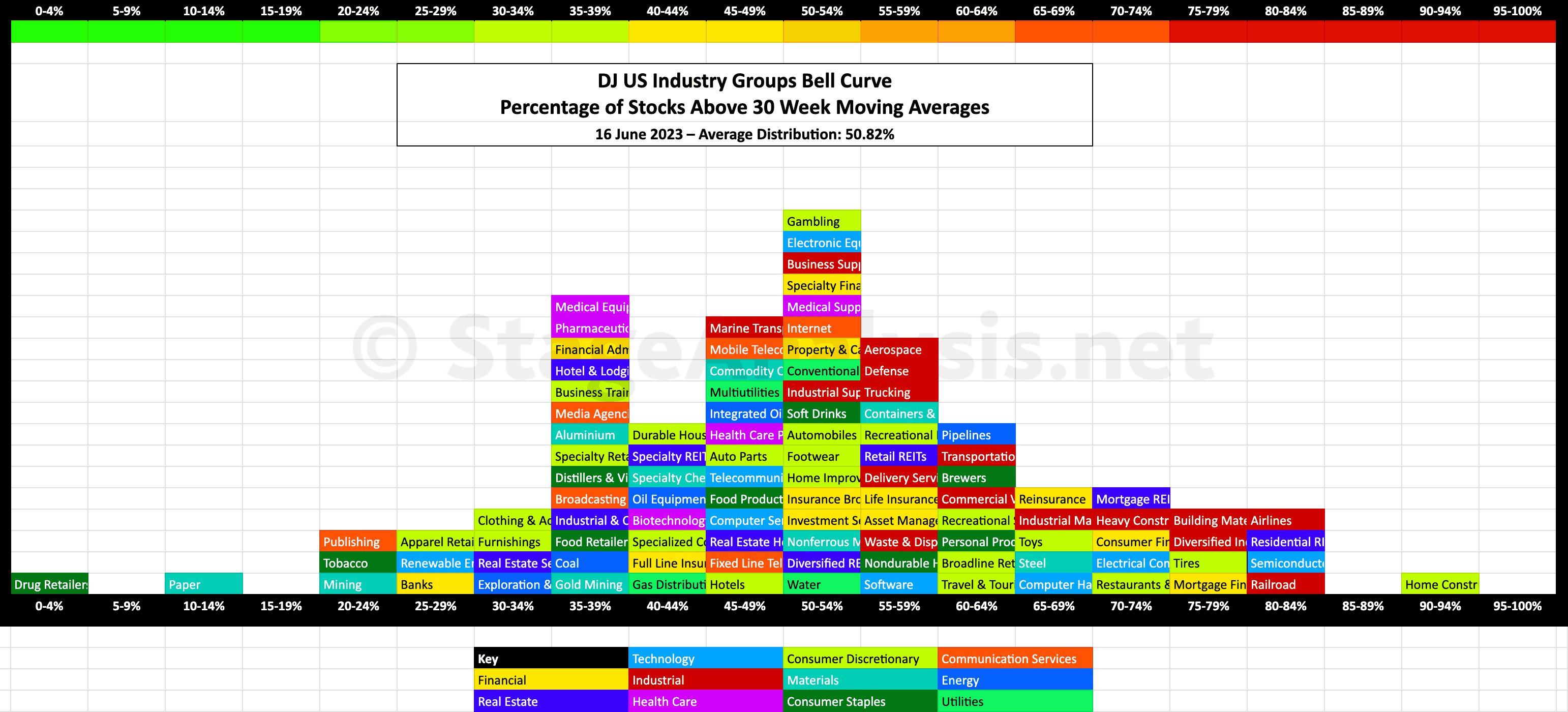

19 June, 2023

US Industry Groups Bell Curve – Exclusive to StageAnalysis.net

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More

12 June, 2023

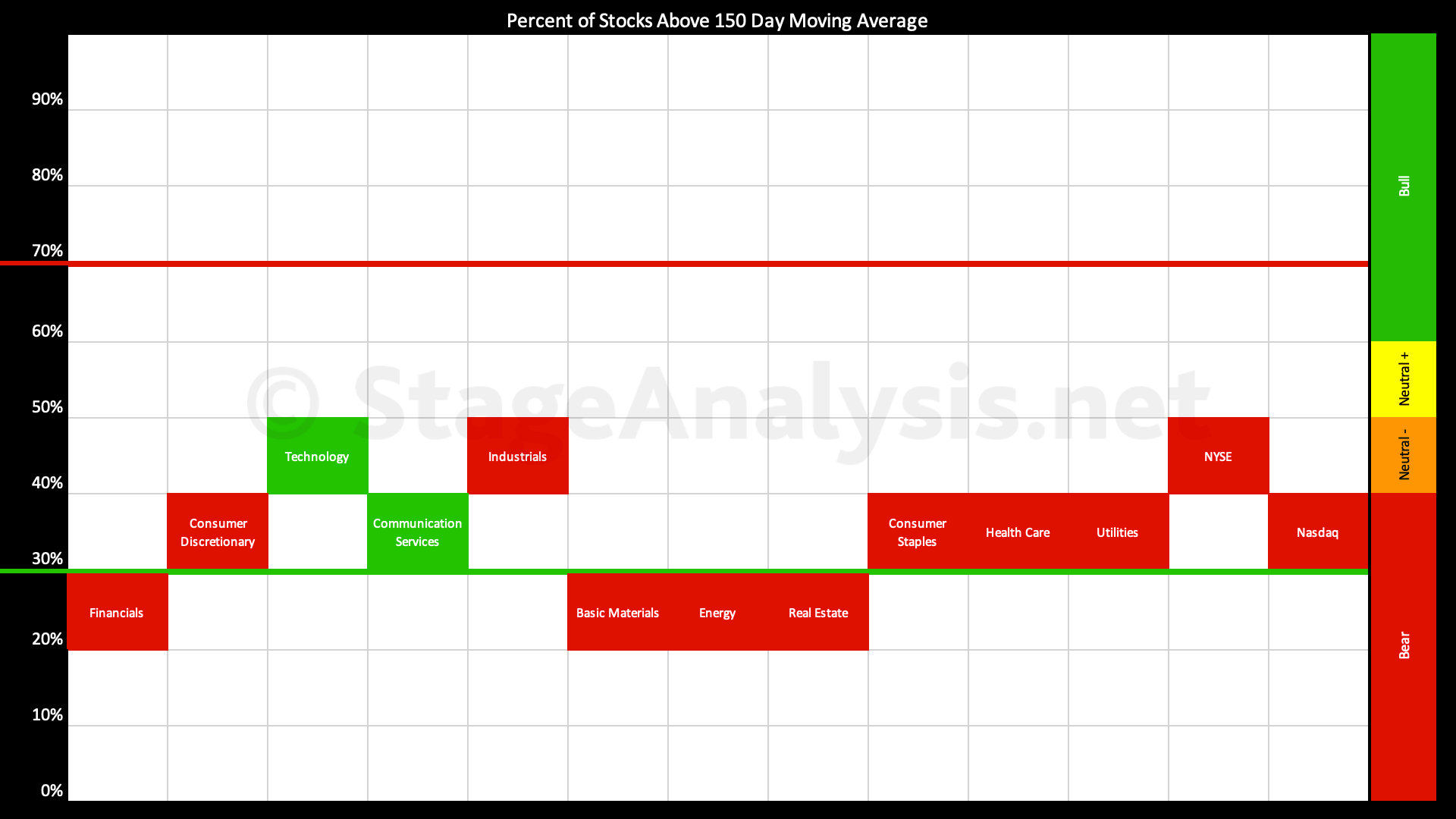

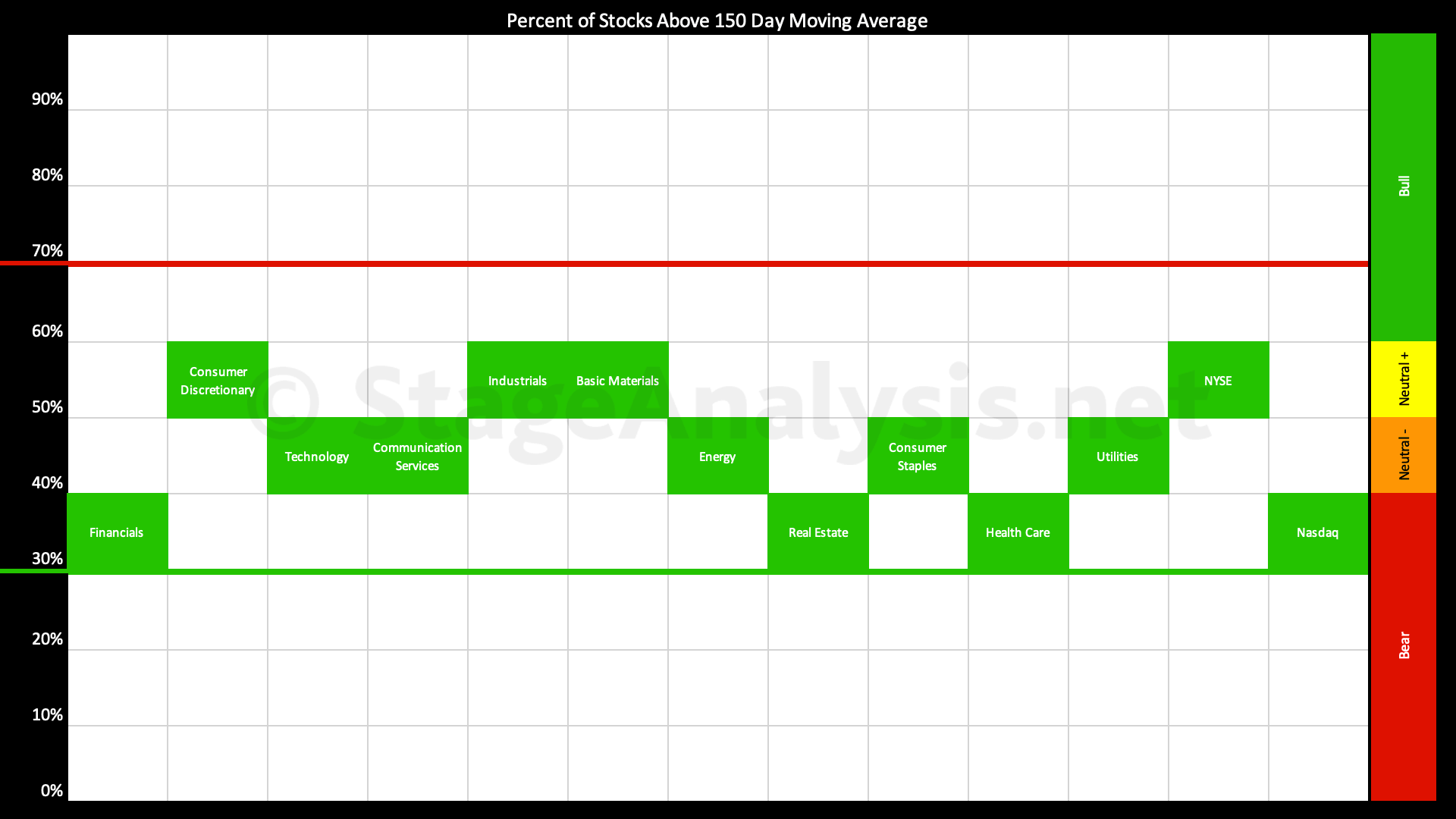

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

29 May, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

15 May, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

01 May, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors remains completely within the middle range. But with a weighting towards the lower end of the range. There has been a decline of -5.48%...

Read More

17 April, 2023

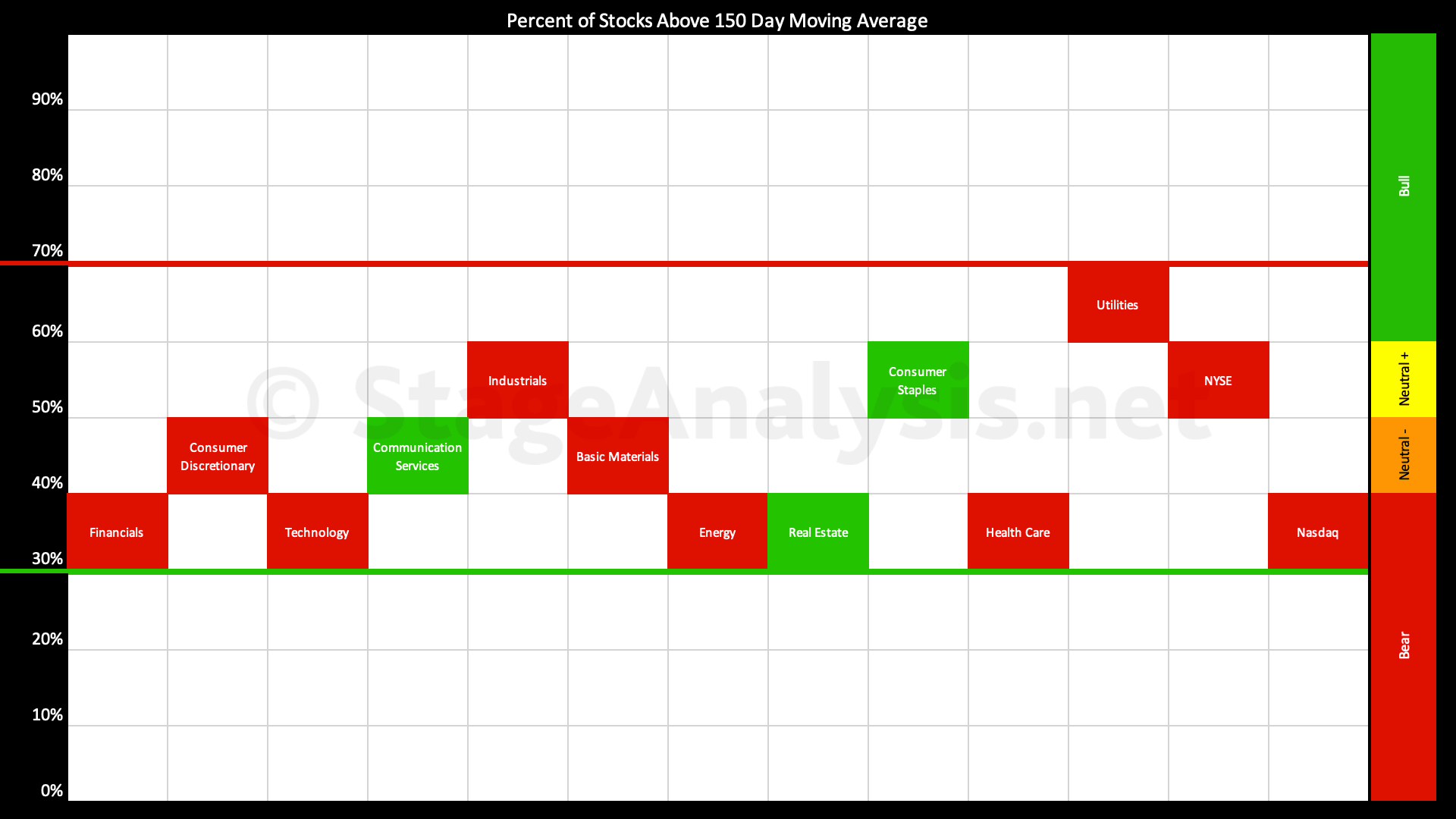

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors continues to edge to towards the middle of the range, with every sector clustered in the middle range, as can be see on the visual diagram...

Read More

03 April, 2023

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has returned back to the middle range over the last two weeks since the previous post on the 20th March 2023, with the overall average increasing by +12.51% to 46.82%...

Read More