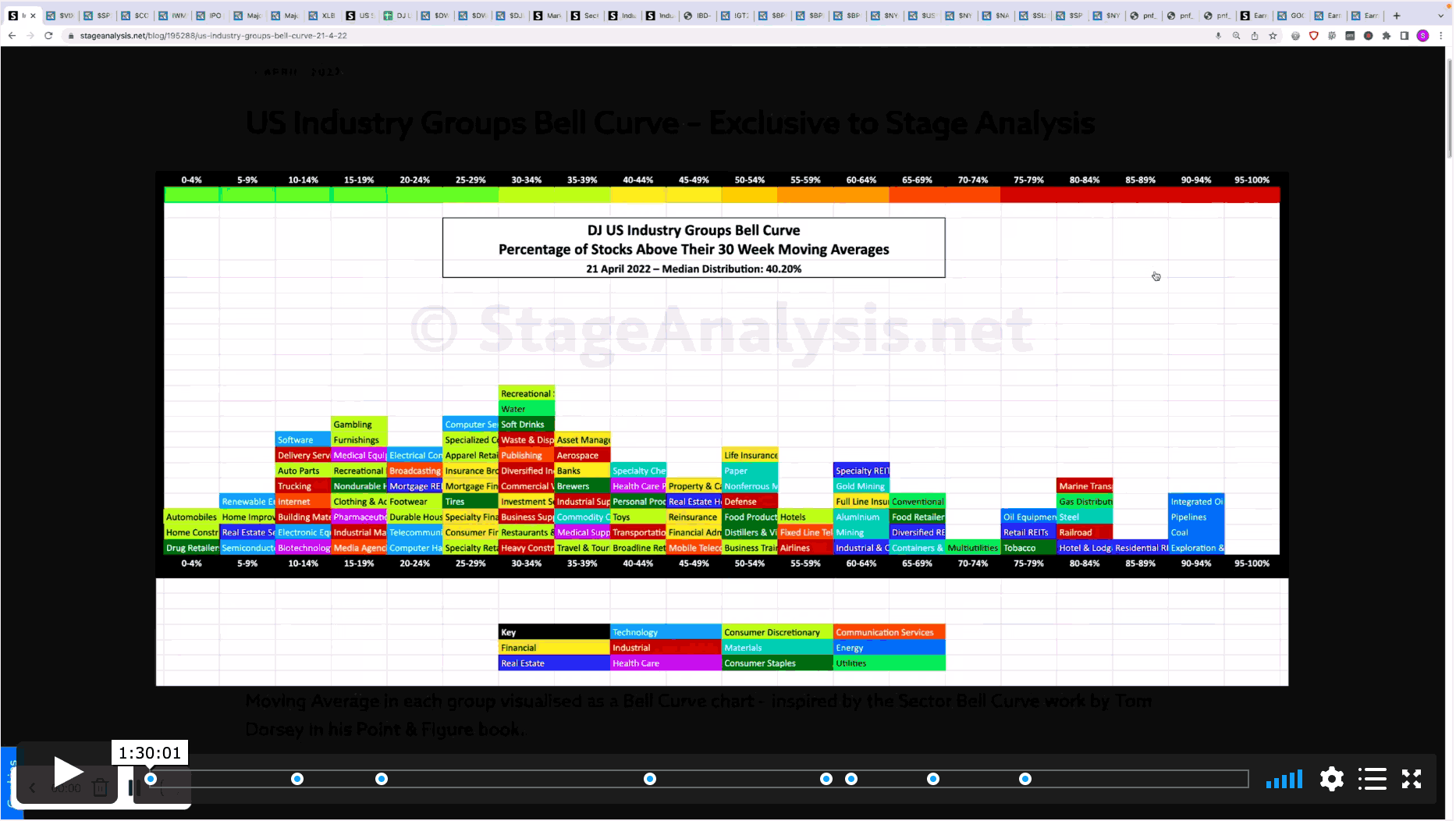

This weekends Stage Analysis Members Video features analysis of the Major US Stock Market Indexes – S&P 500, Nasdaq Composite, Russell 2000 and the individual US Market Sectors Stages. Plus the a detailed look at the US Industry Groups Relative Strength focusing on the Change of Behaviour in the strongest RS groups...

Read More

Blog

21 April, 2022

Stage Analysis Members Midweek Video - 20 April 2022 (56 mins)

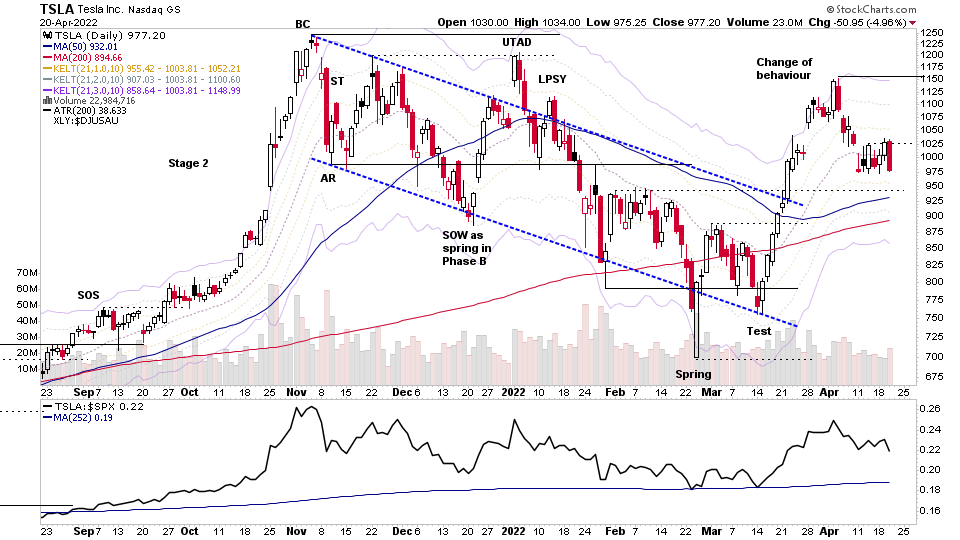

Stage Analysis Members Midweek Video with a FREE preview covering the Stage 4 continuation breakdown in NFLX Netflix, and then members only content going through the Major Indexes, Short Term Market Breadth Charts, todays after hours moves from earnings in TSLA and UAL. The Uranium group attempt to rebound and the US Stocks Watchlist and Group Themes in more detail.

Read More

17 April, 2022

Stage Analysis Members Weekend Video – 17 April 2022 (1hr 14mins)

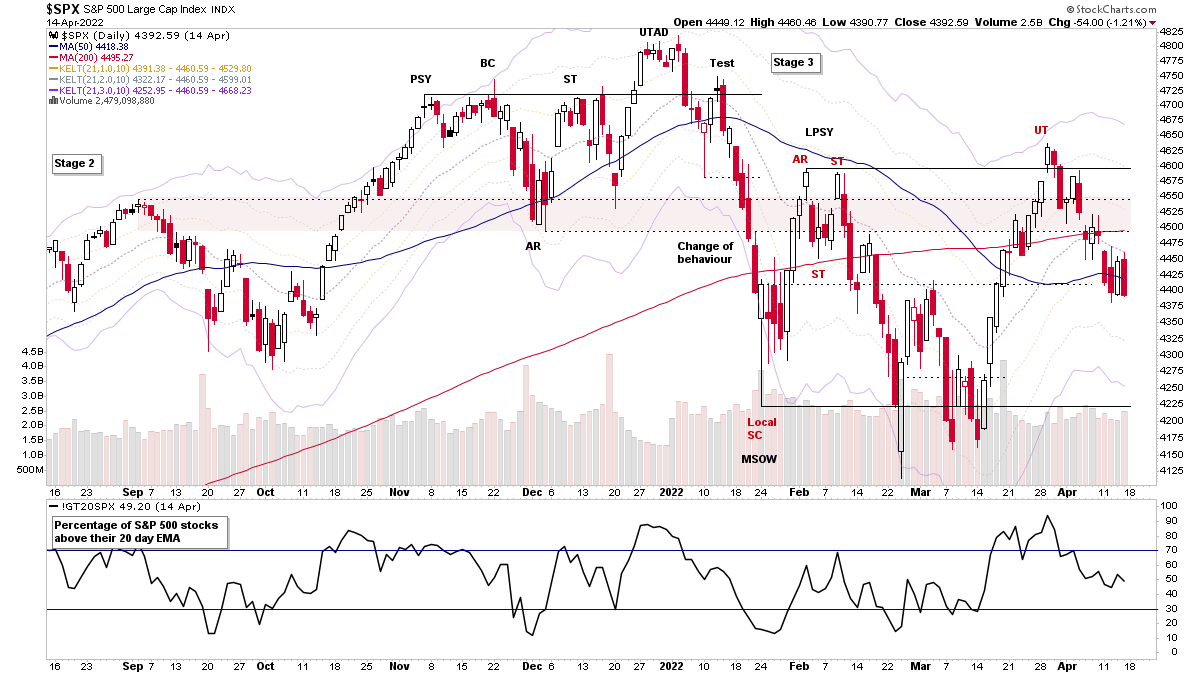

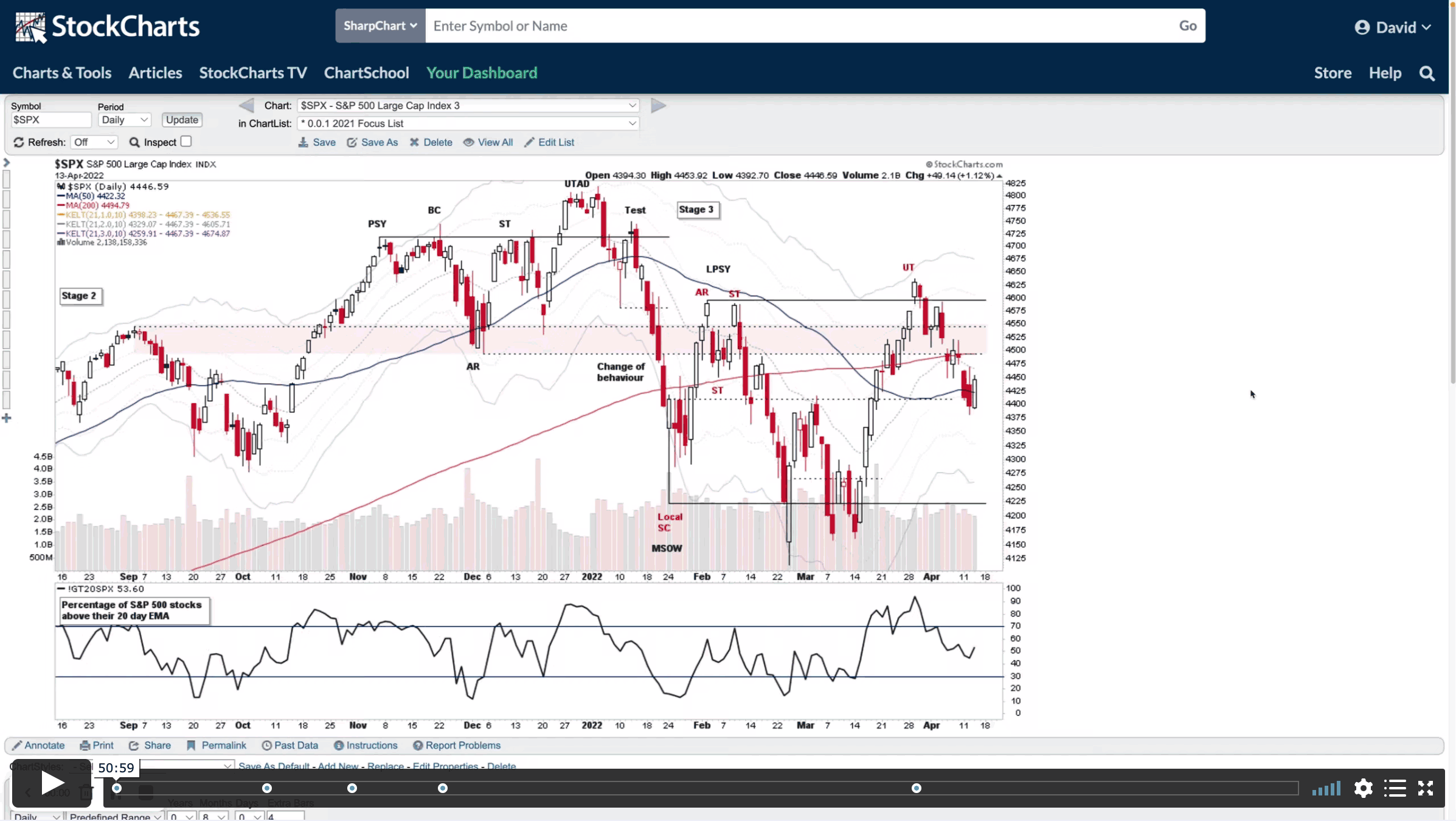

This weekends Stage Analysis Members Video features analysis of the Major US Stock Market Indexes – S&P 500, Nasdaq Composite, Russell 2000 etc, plus a detailed run through of the key Market Breadth charts (with exclusive charts only on Stage Analysis) in order to determine the Weight of Evidence...

Read More

14 April, 2022

Stage Analysis Members Midweek Video - 14 April 2022 (50 mins)

The Stage Analysis Members Midweek Video covers the major indexes, short term market breadth charts, AAPL and TSLA attempts to the hold their short term MAs.The group themes from the last week, and the US watchlist stocks in more detail...

Read More

10 April, 2022

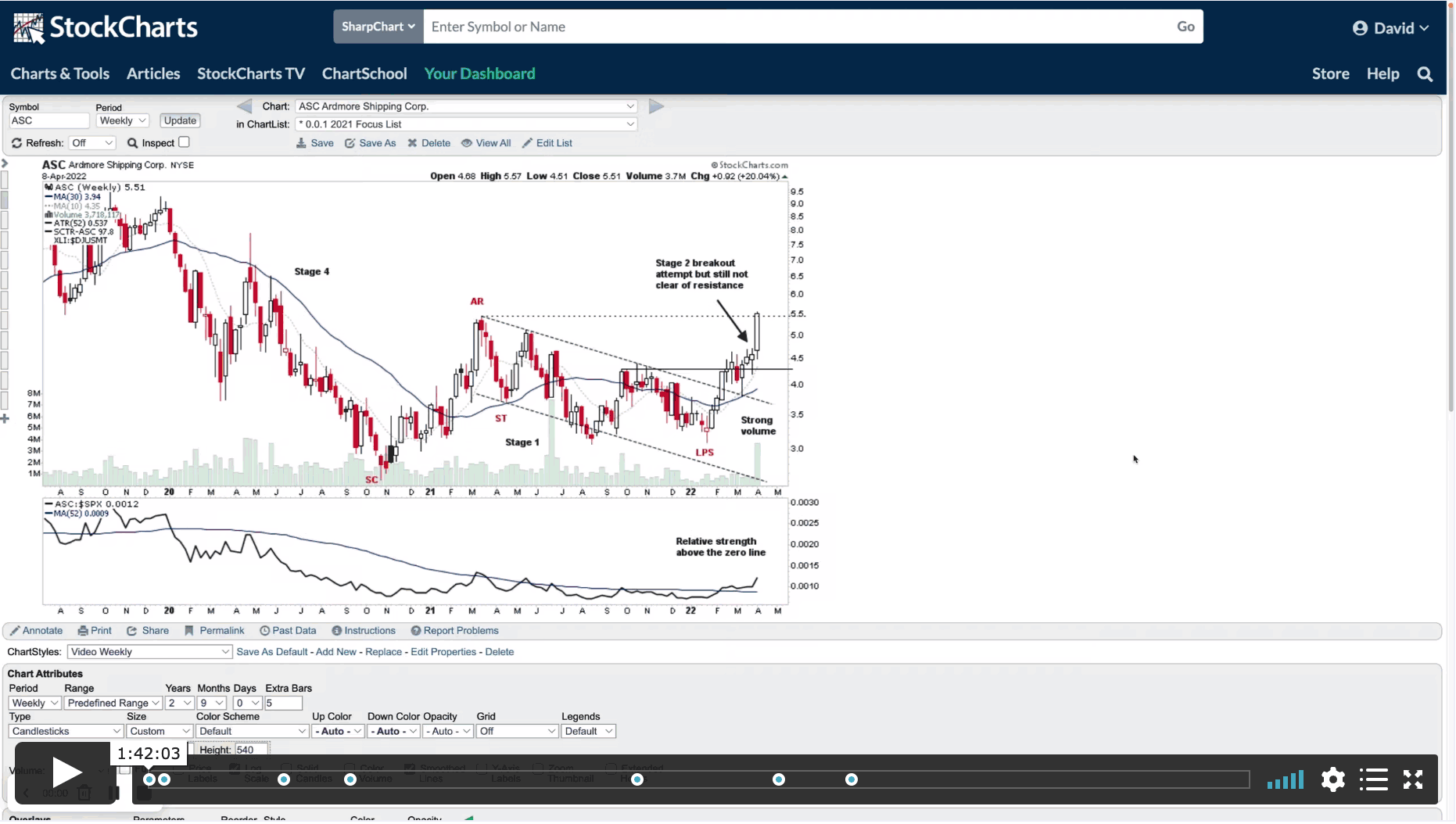

Stage Analysis Members Weekend Video – 10 April 2022 (1hr 42mins)

This weekends Stage Analysis Members Video features the Major Indexes – Nasdaq, S&P 500, Russell 2000, Sector Relative Strength, Market Breadth charts to determine the Weight of Evidence, Industry Group Relative Strength. A Group Focus on the Uranium Stocks and the US Stocks Watchlist in detail with marked up charts and explanations of the group themes and what I'm looking for in various stocks.

Read More

07 April, 2022

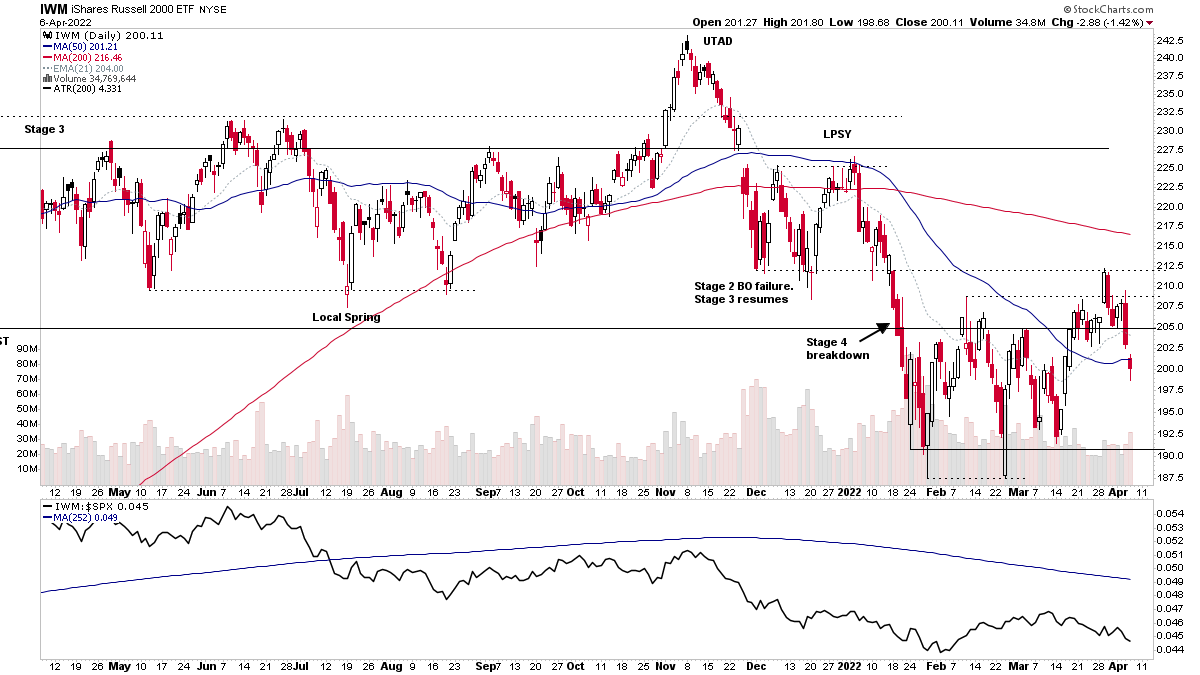

Stage Analysis Members Midweek Video - 6 April 2022

This weeks Members Midweek Video focuses on some of the recent areas of weakness, like the Semiconductors groups, plus brief reviews of some of other featured groups in the last few months – as well as the regular midweek features on the indexes, short term market breadth charts and the watchlist stocks in focus.

Read More

03 April, 2022

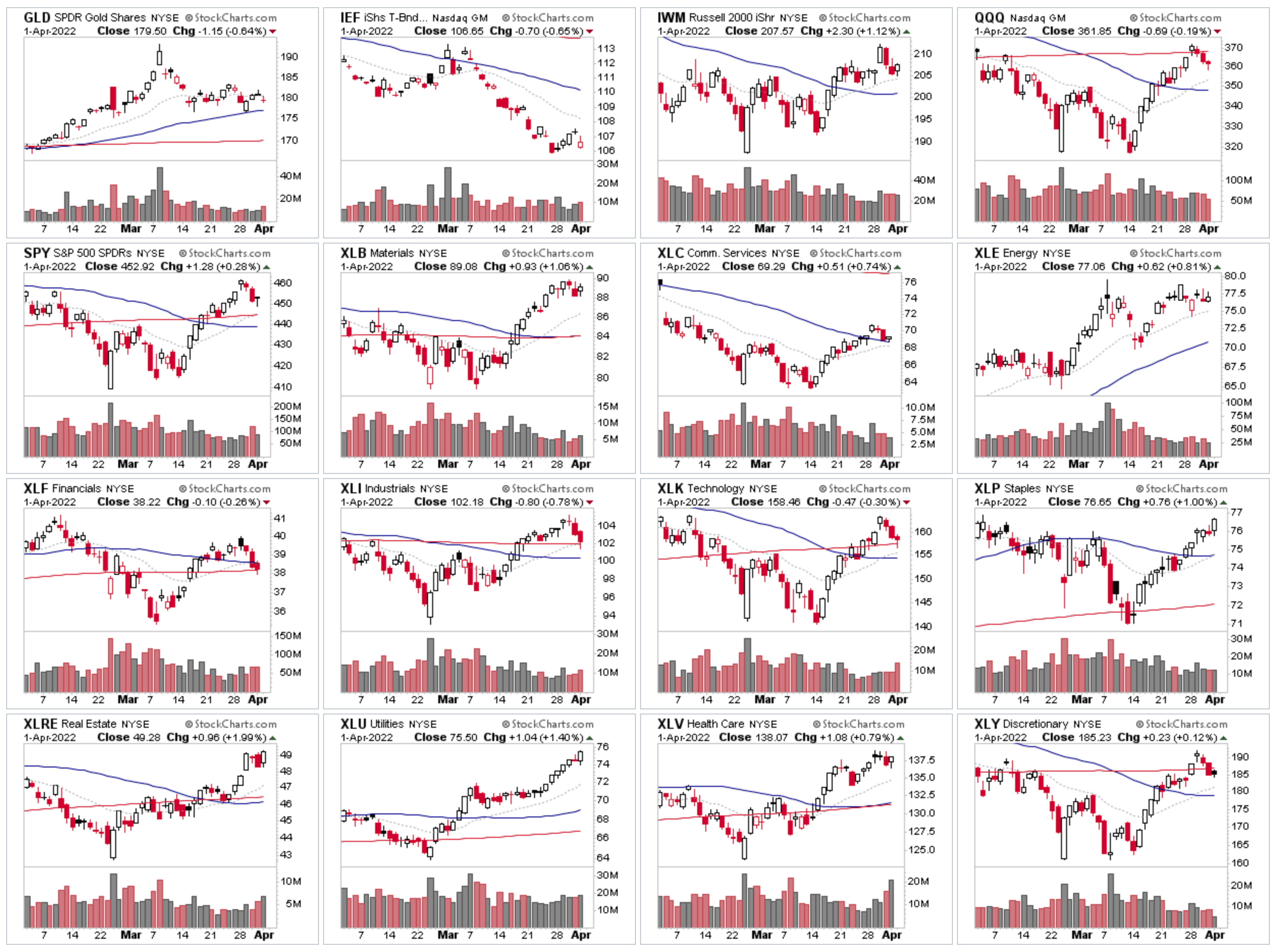

Stage Analysis Members Weekend Video - 3 April 2022 (1hr 24mins)

In this weekends members video I discuss the Stan Weinstein Interview on Twitter Spaces, as well as the regular content of the Major Indexes, Sectors Relative Strength Tables & Charts, Industry Group RS Tables and Themes, Market Breadth: Weight of Evidence, 2x Weekly Volume Stocks and the US Watchlist Stocks in detail.

Read More

26 March, 2022

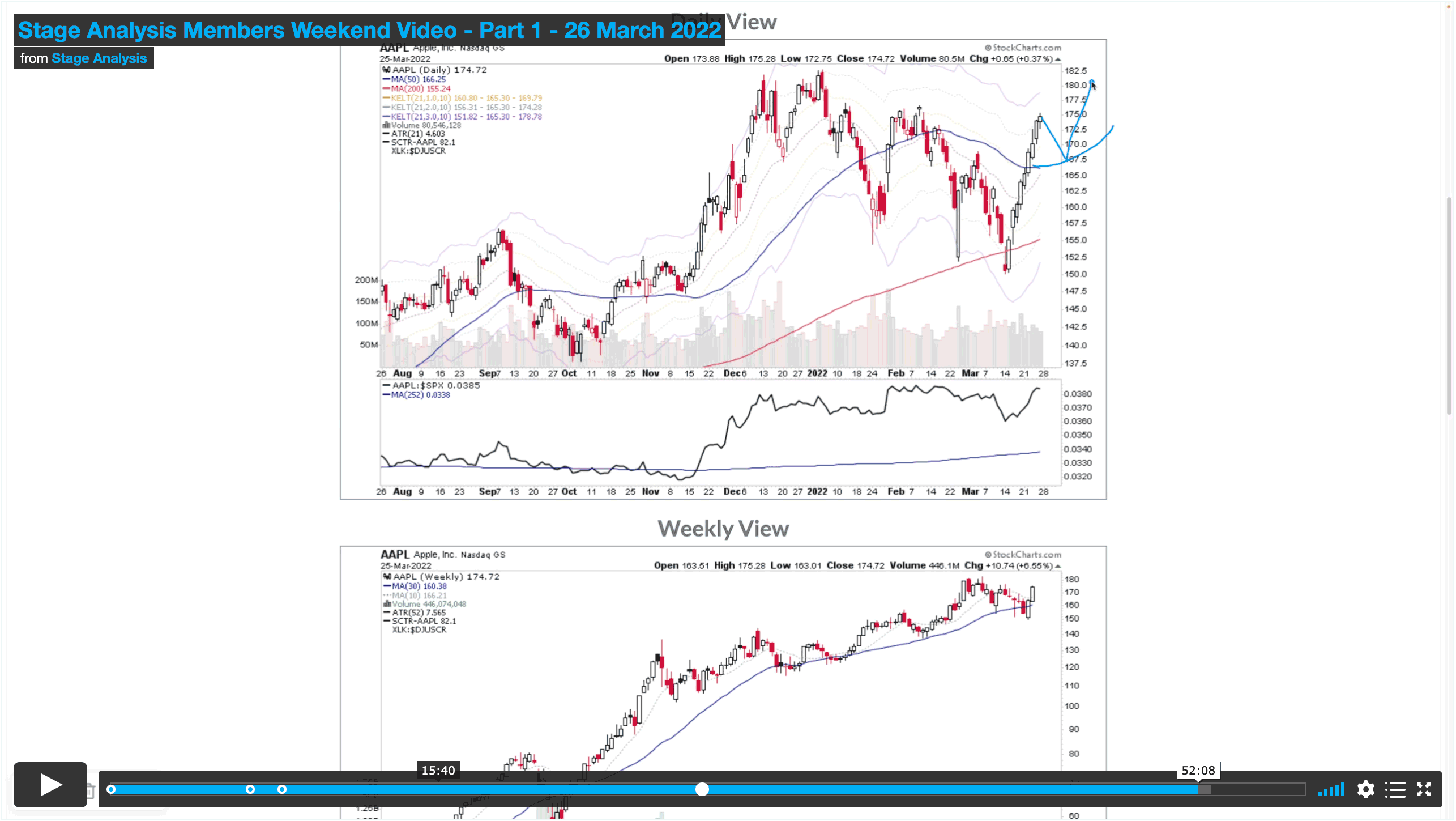

Stage Analysis Members Weekend Video – Part 1 – 26 March 2022 (57 mins)

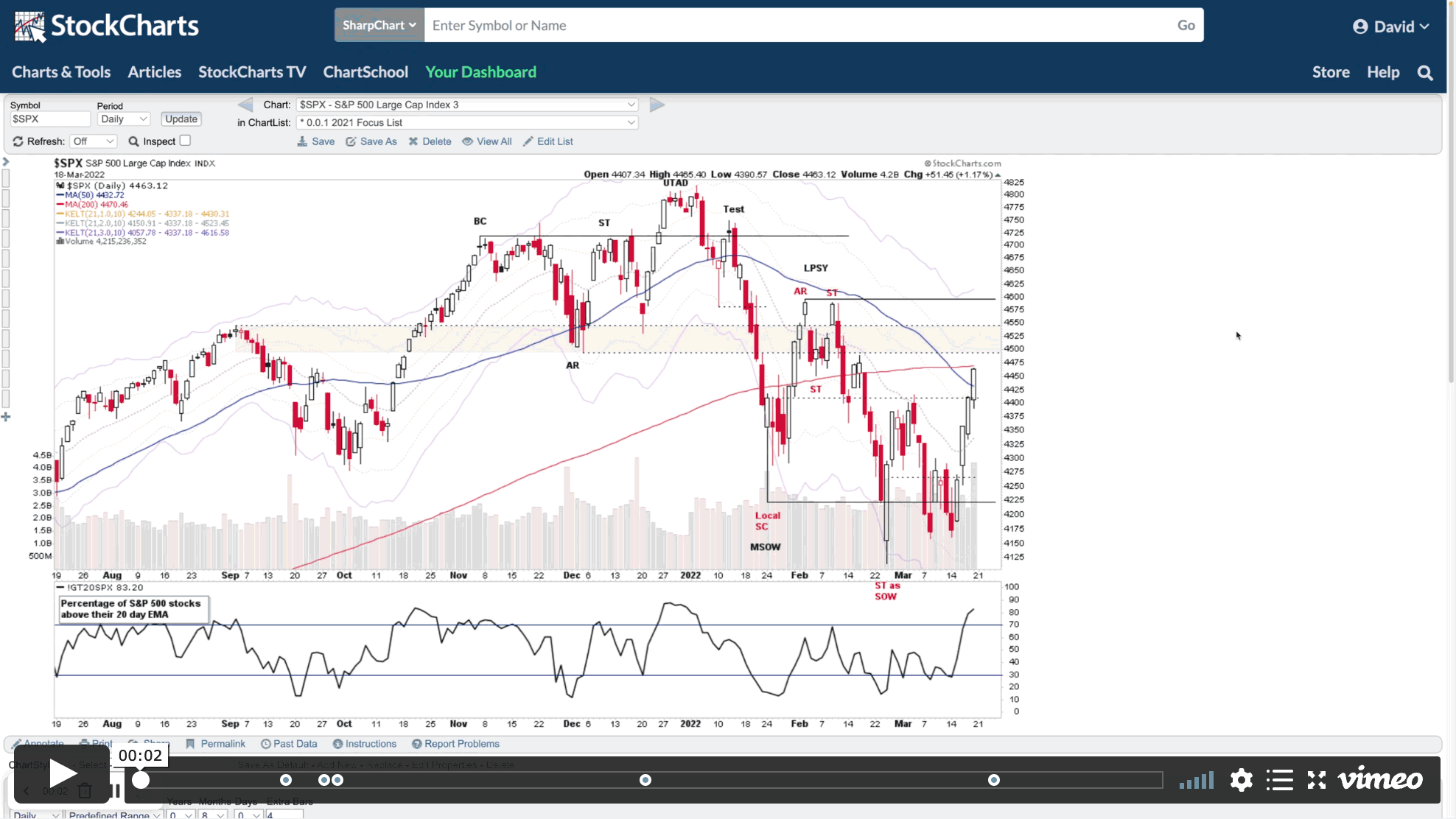

In Part 1 of the Stage Analysis Members Video I cover the Major Indexes (i.e. S&P 500, Nasdaq Composite, Russell 2000 and the VIX etc), US Sectors Relative Strength Rankings and charts, Market Breadth charts to determine the Weight of Evidence, and the US Stocks Industry Group Relative Strength Tables and the Groups in focus this week.

Read More

24 March, 2022

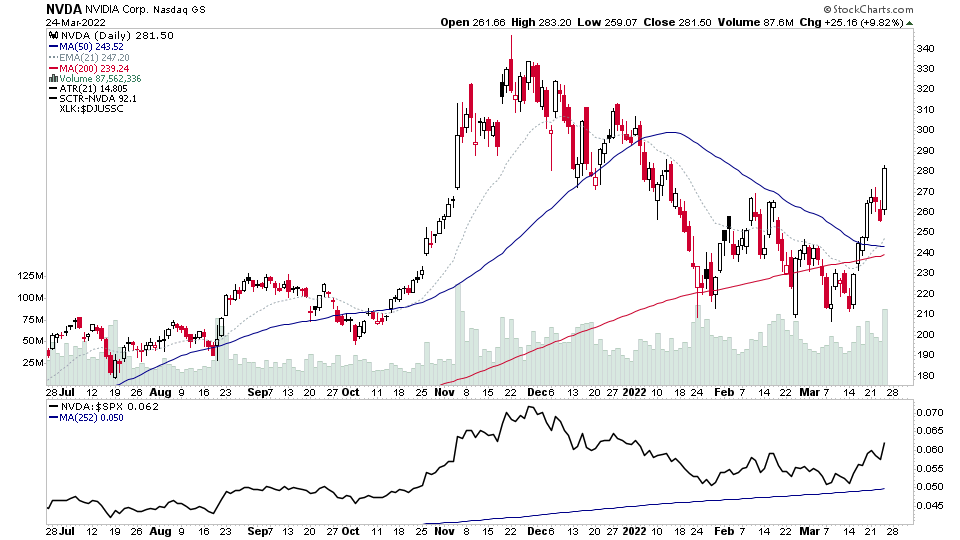

US Stocks Watchlist - 24 March 2022

The Nasdaq 100 continued to make progress higher in the range, and as the 4 hour chart attached shows, it's a change of behaviour over the last three months downtrend.

Read More

20 March, 2022

Stage Analysis Members Weekend Video – 20 March 2022 (1hr 17 mins)

Stage Analysis Members Video covering the Major Indexes (i.e. S&P 500, Nasdaq Composite, Russell 2000 and the VIX etc), Market Breadth charts to determine the Weight of Evidence, Industry Group Relative Strength Tables and the Groups in focus this week. Plus the US Stocks Watchlist.

Read More