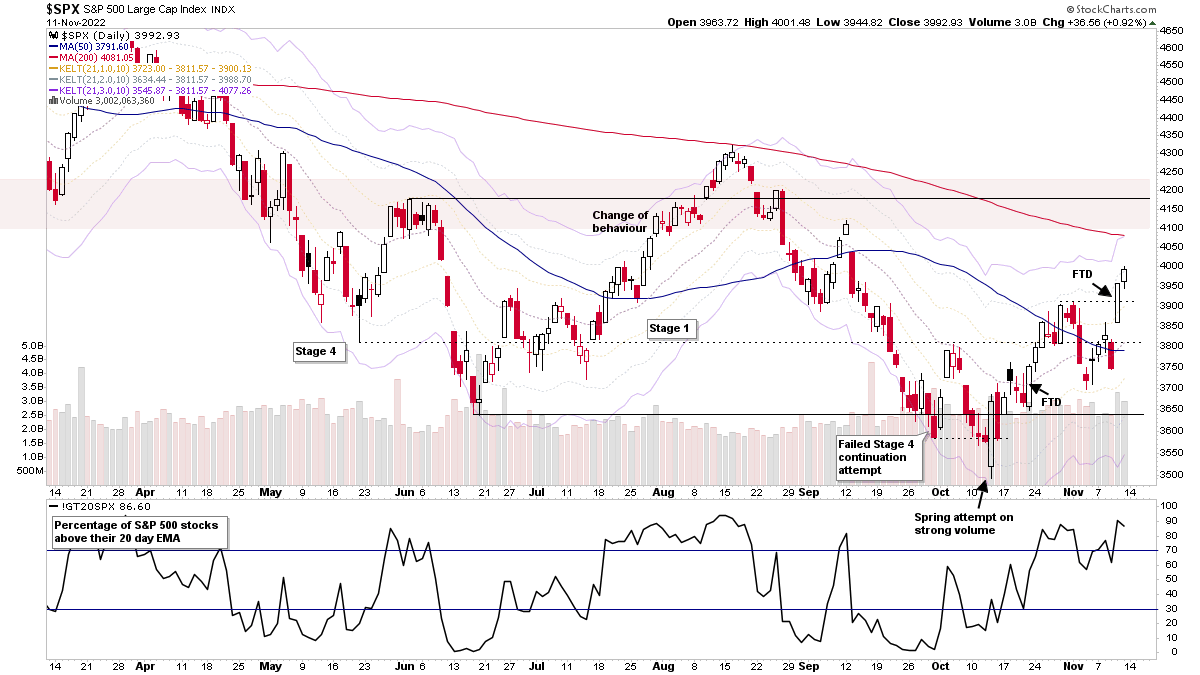

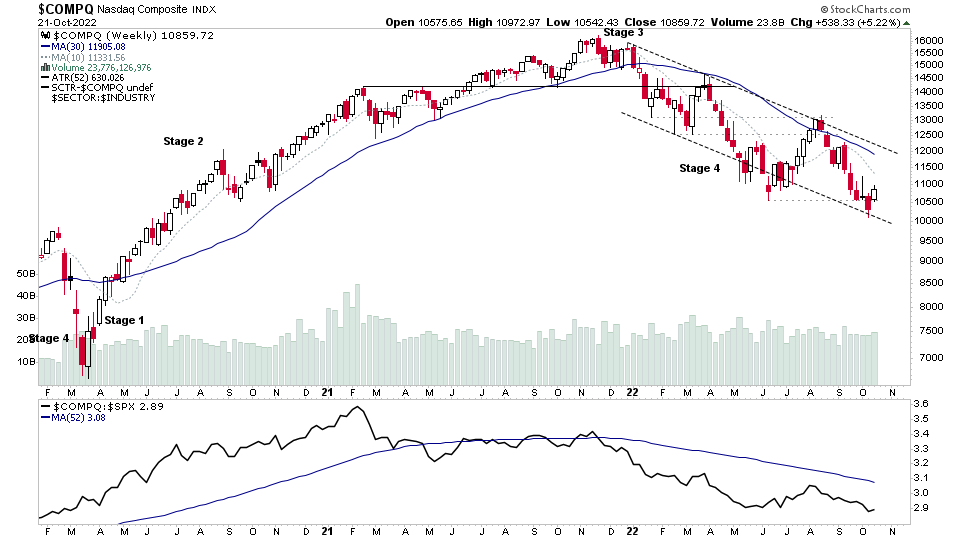

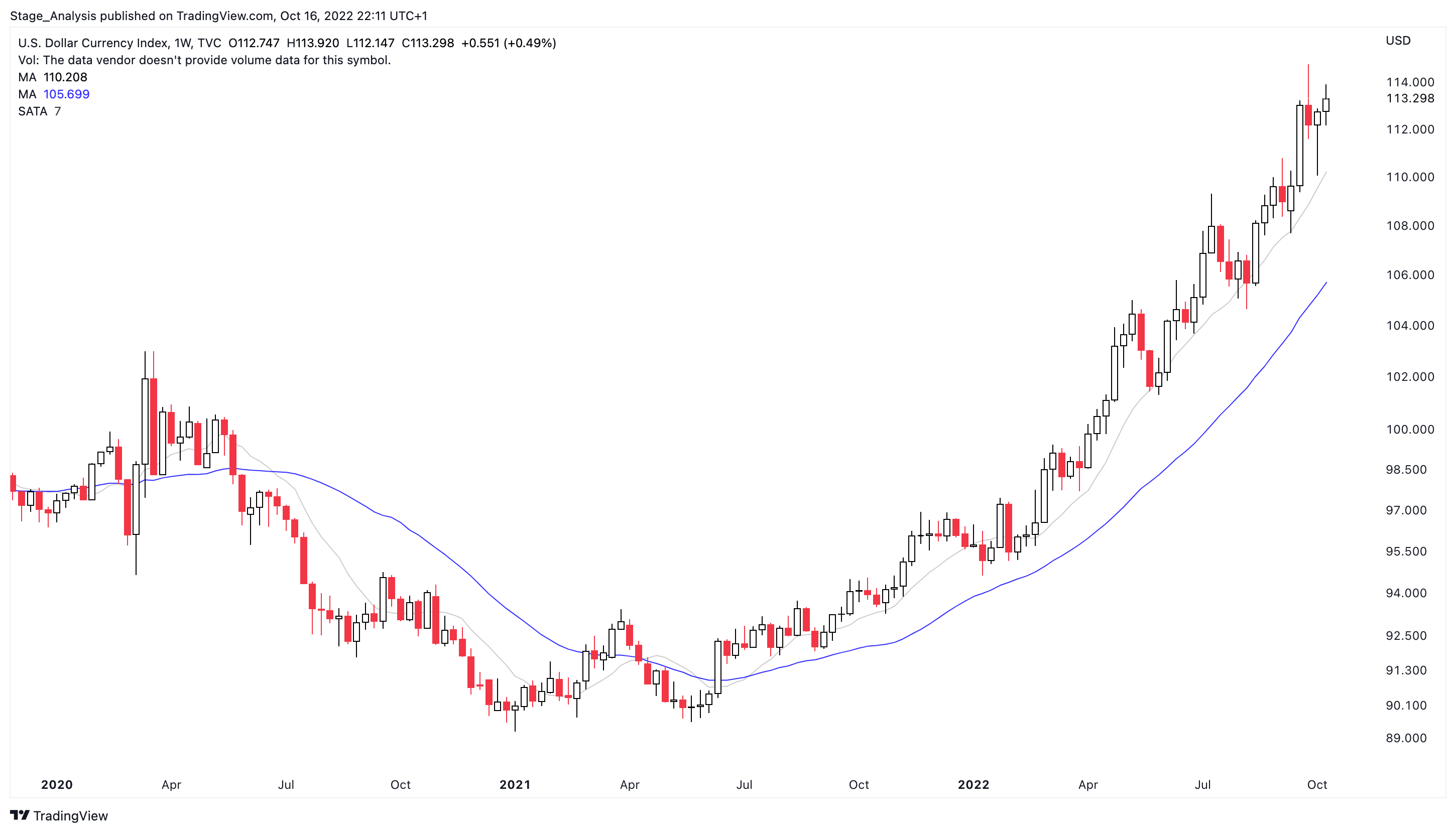

The Stage Analysis members weekend video, this week discussing the significant bar in the US Dollar Index and price and volume action in the major stock market indexes. Plus Stage Analysis of the individual sectors and the Industry Groups Relative Strength Rankings, with a look in more depth of some of the groups making the strongest moves. Also discussion of the strong shift in the IBD Industry Groups Bell Curve – Bullish Percent data, and the Market Breadth Update to help to determine the current Weight of Evidence. And finishing with live markups of the weekends US Stocks Watchlist.

Read More

Blog

13 November, 2022

Stage Analysis Members Video – 13 November 2022 (1hr 21mins)

06 November, 2022

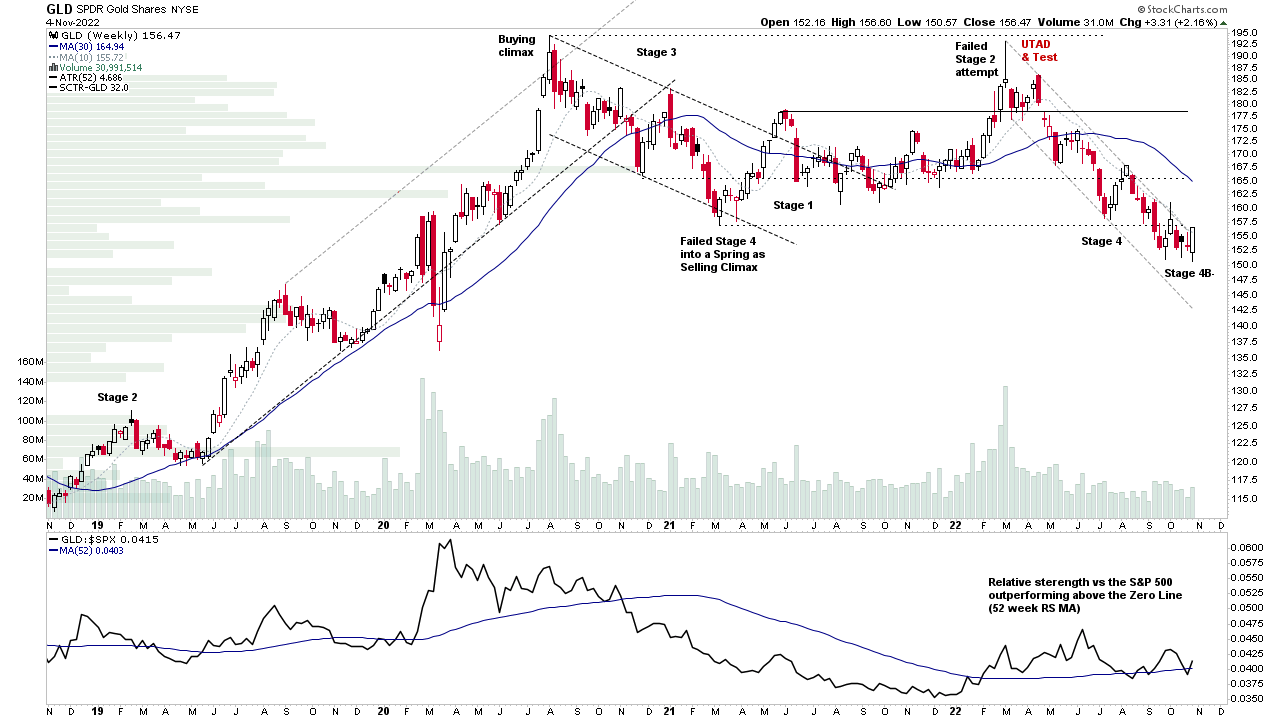

Stage Analysis Members Video Part 1 – 6 November 2022 (59mins)

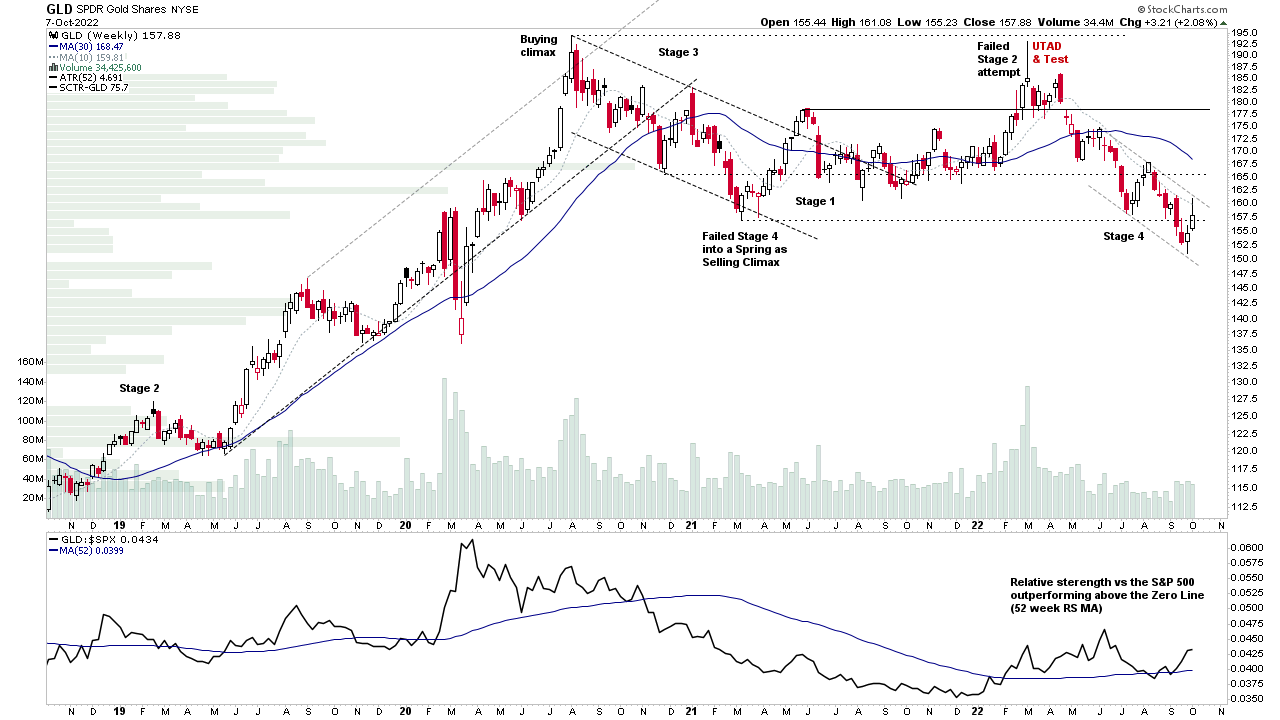

Part 1 of the regular members weekend video beginning with a special focus on Gold and Silver, and the Gold Miners group. Following that we discuss the Stage Analysis of the Major Indexes, and the Industry Groups Relative Strength Rankings, with a look in more depth of some of the groups making the strongest moves. Plus a look at the IBD Industry Groups Bell Curve – Bullish Percent and finally the Market Breadth Update to help to determine the current Weight of Evidence.

Read More

30 October, 2022

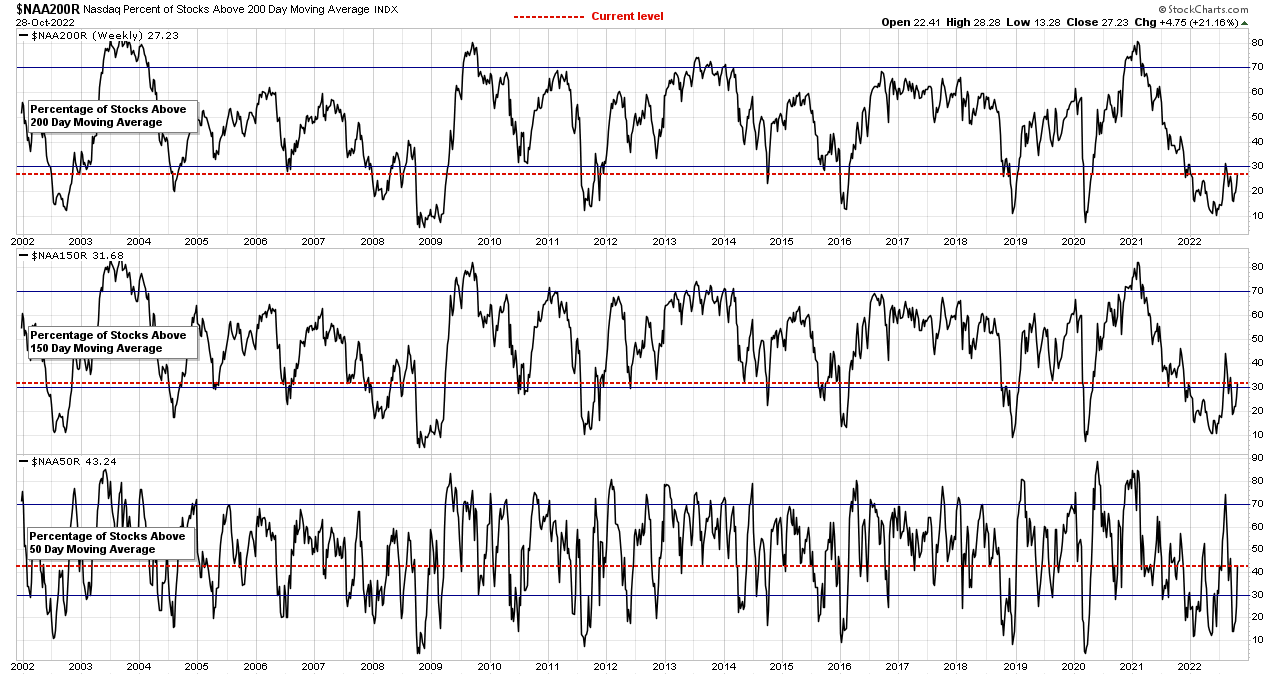

Stage Analysis Members Video Part 3 – Market Breadth – 30 October 2022 (18 mins)

Part 3 of the regular members weekend video discussing the market breadth to determine the weight of evidence.

Read More

30 October, 2022

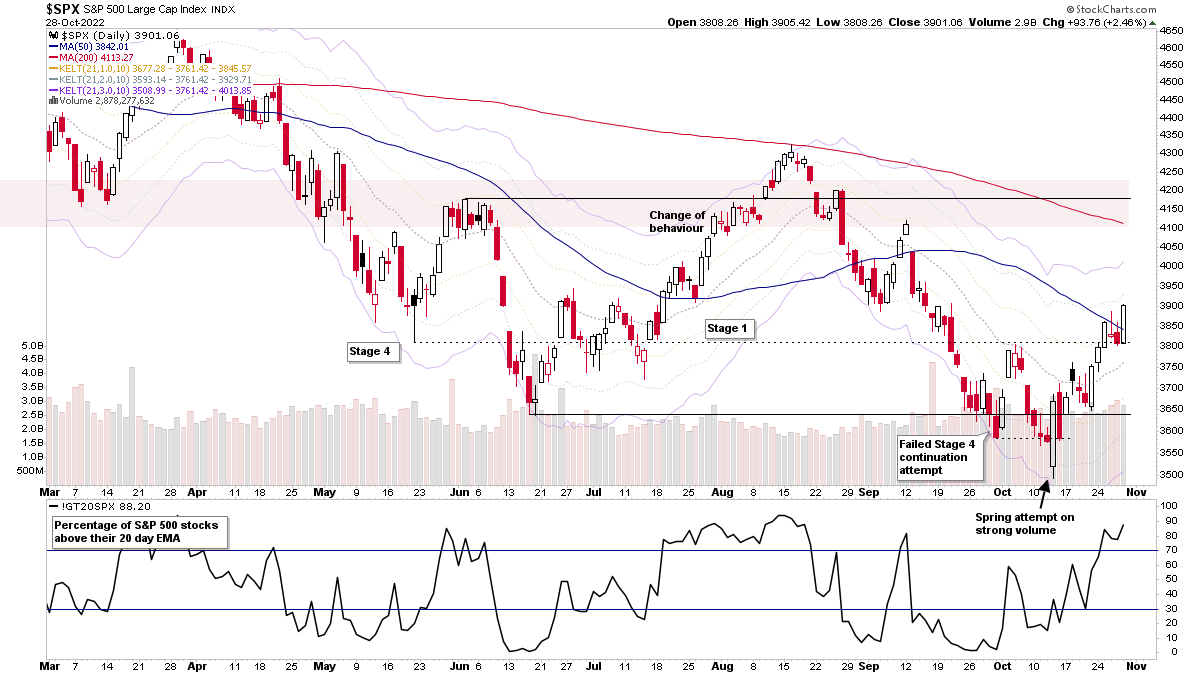

Stage Analysis Members Video Part 2 – US Market Review – 30 October 2022 (28 mins)

Part 2 of the regular members weekend video discussing the market, industry groups and market breadth to determine the weight of evidence.

Read More

23 October, 2022

Stage Analysis Members Video Part 2 – 23 October 2022 (58 mins)

Part 2 of the regular members weekend video discussing the market, commodities, industry groups and market breadth to determine the weight of evidence.

Read More

16 October, 2022

Stage Analysis Members Weekend Video – 16 October 2022 (1hr 14mins)

The regular members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail.

Read More

09 October, 2022

Stage Analysis Members Weekend Video – 9 October 2022 (1hr 27mins)

The regular members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail. This week beginning with a special feature on Gold and Silver and the Miners as they show near term relative strength and attempt to move towards Stage 4B- or Stage 1.

Read More

03 October, 2022

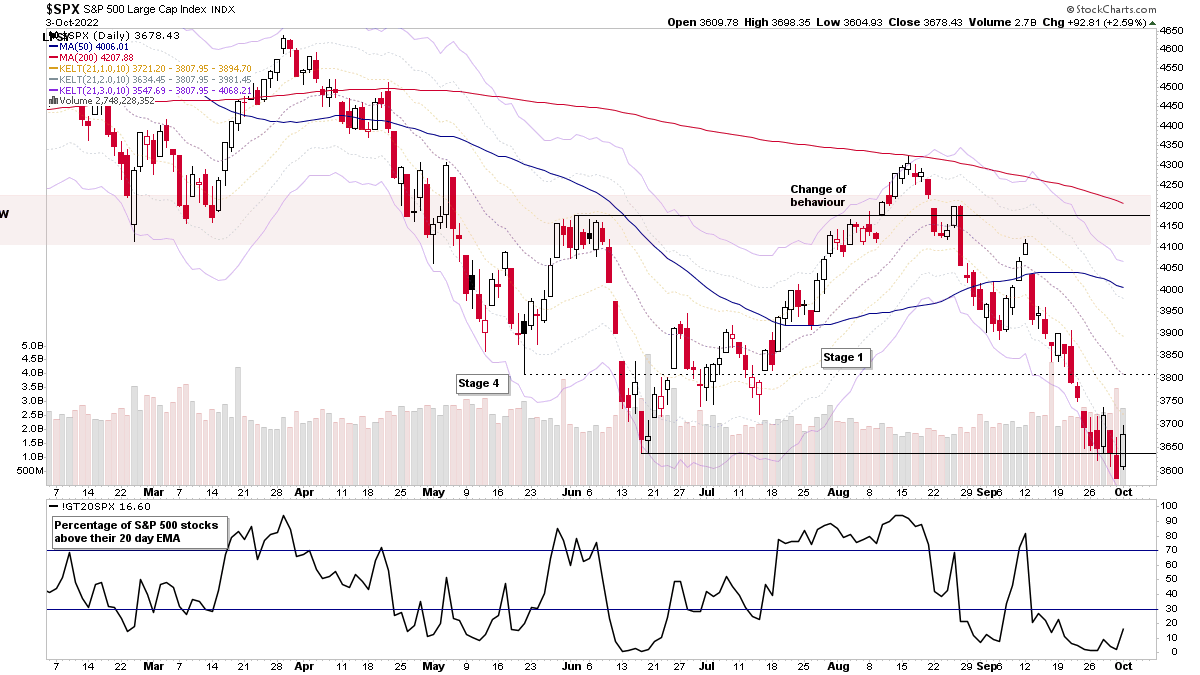

Stage Analysis Members Video and US Stocks Watchlist – 3 October 2022

The (delayed) members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail.

Read More

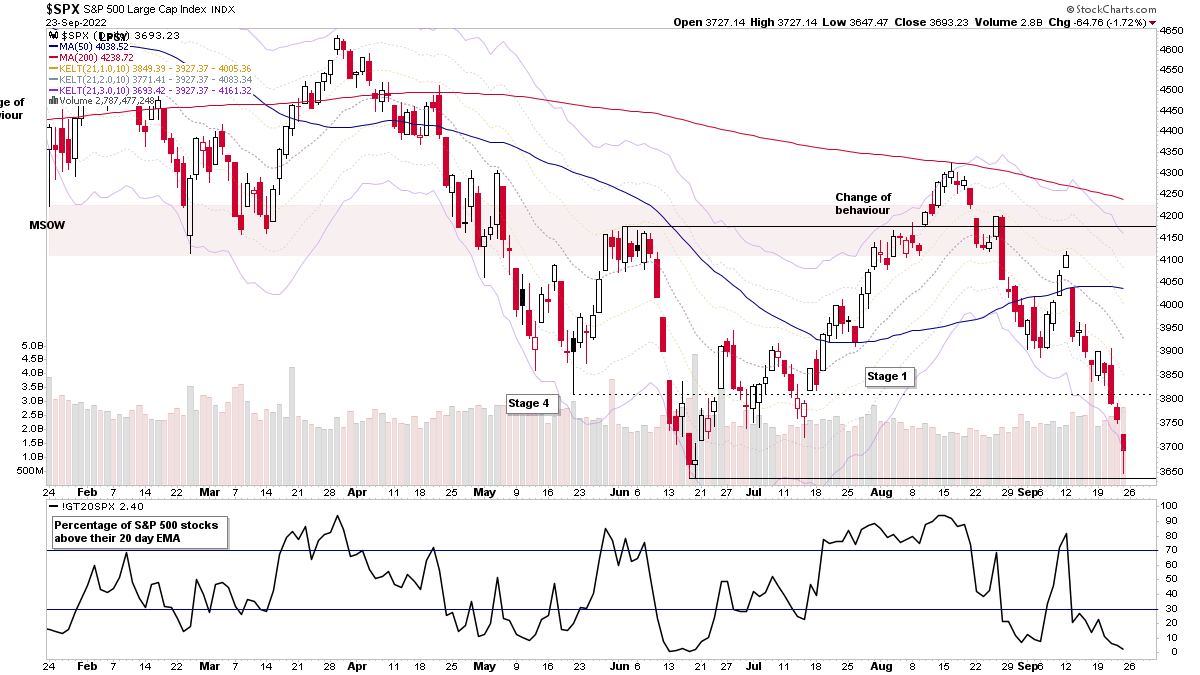

25 September, 2022

Stage Analysis Members Weekend Video – 25 September 2022 (1hr 5mins)

The regular members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail...

Read More

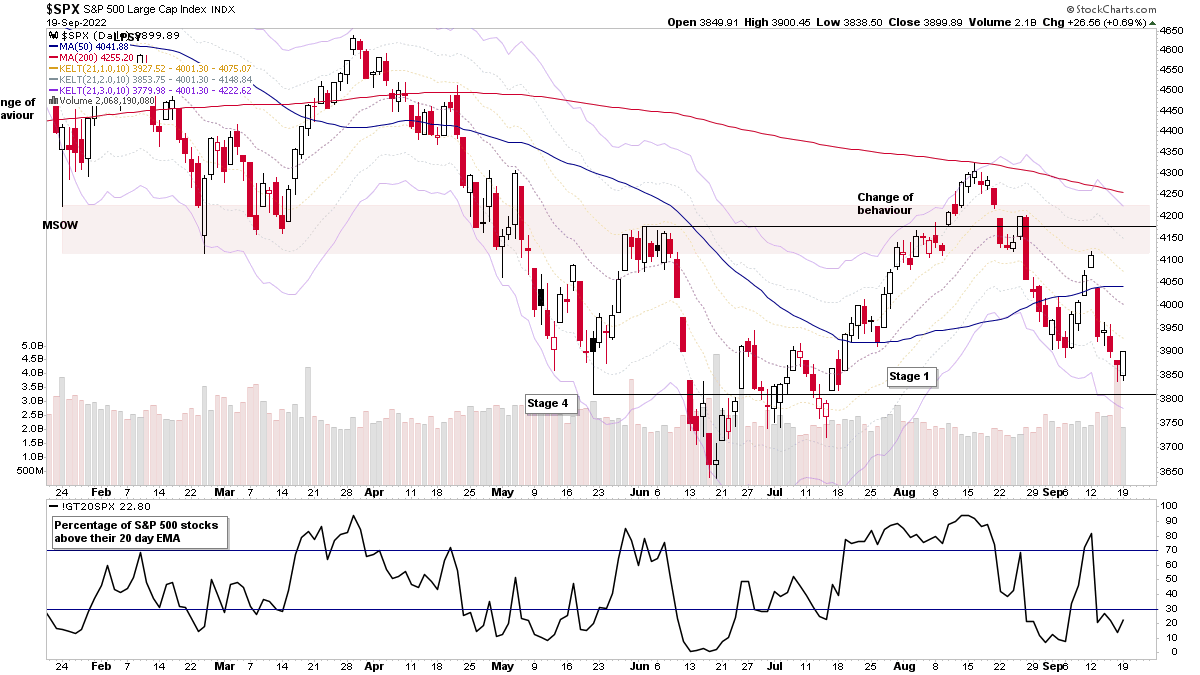

19 September, 2022

Stock Market Update and the US Stocks Watchlist – 19 September 2022

The S&P 500 attempted to begin to reverse from last weeks sharp decline, with an engulfing candle from Fridays undercut of the recent swing low within the broader range. So there is potential for a local spring, but only if it can follow through strongly...

Read More