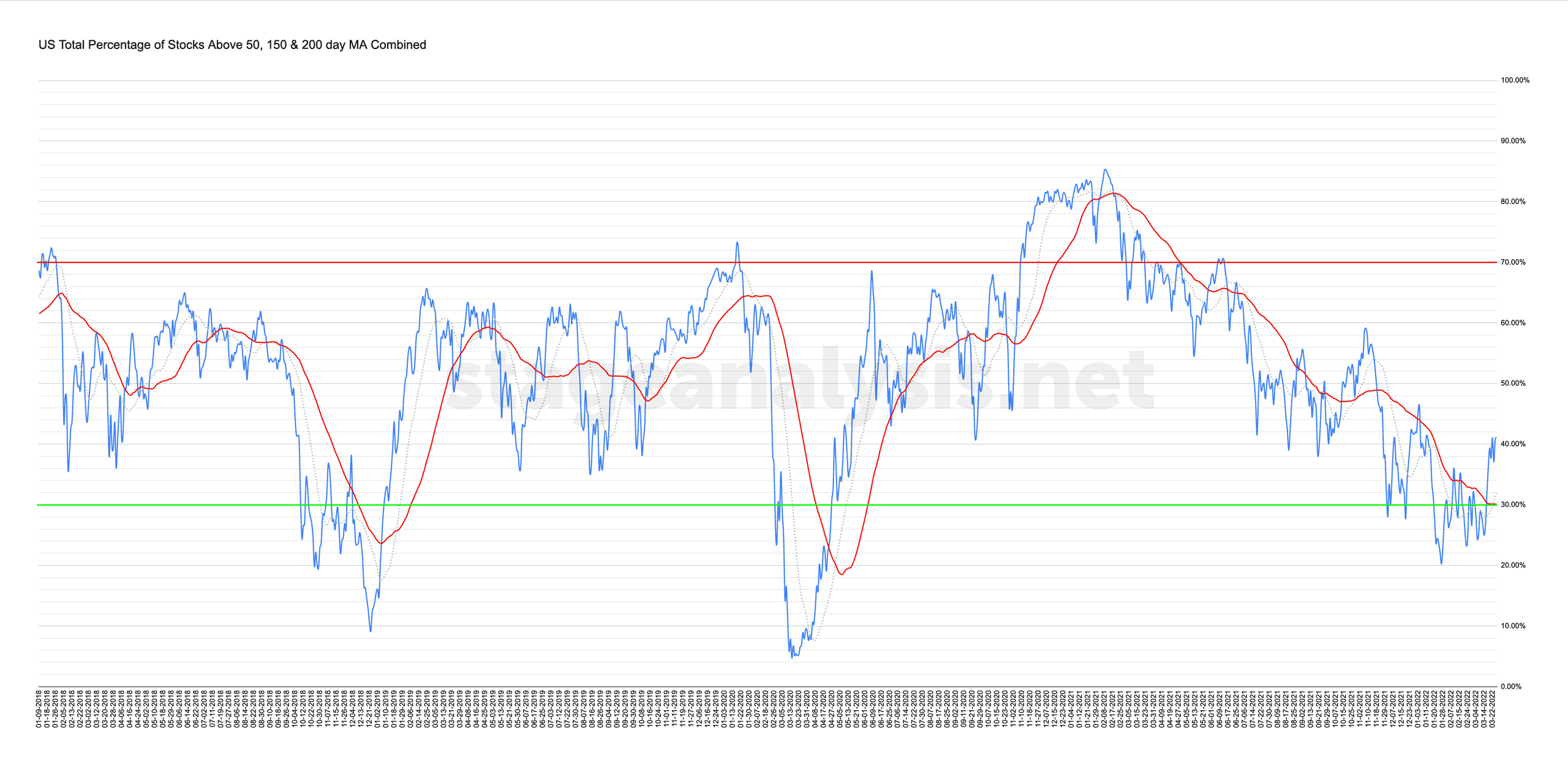

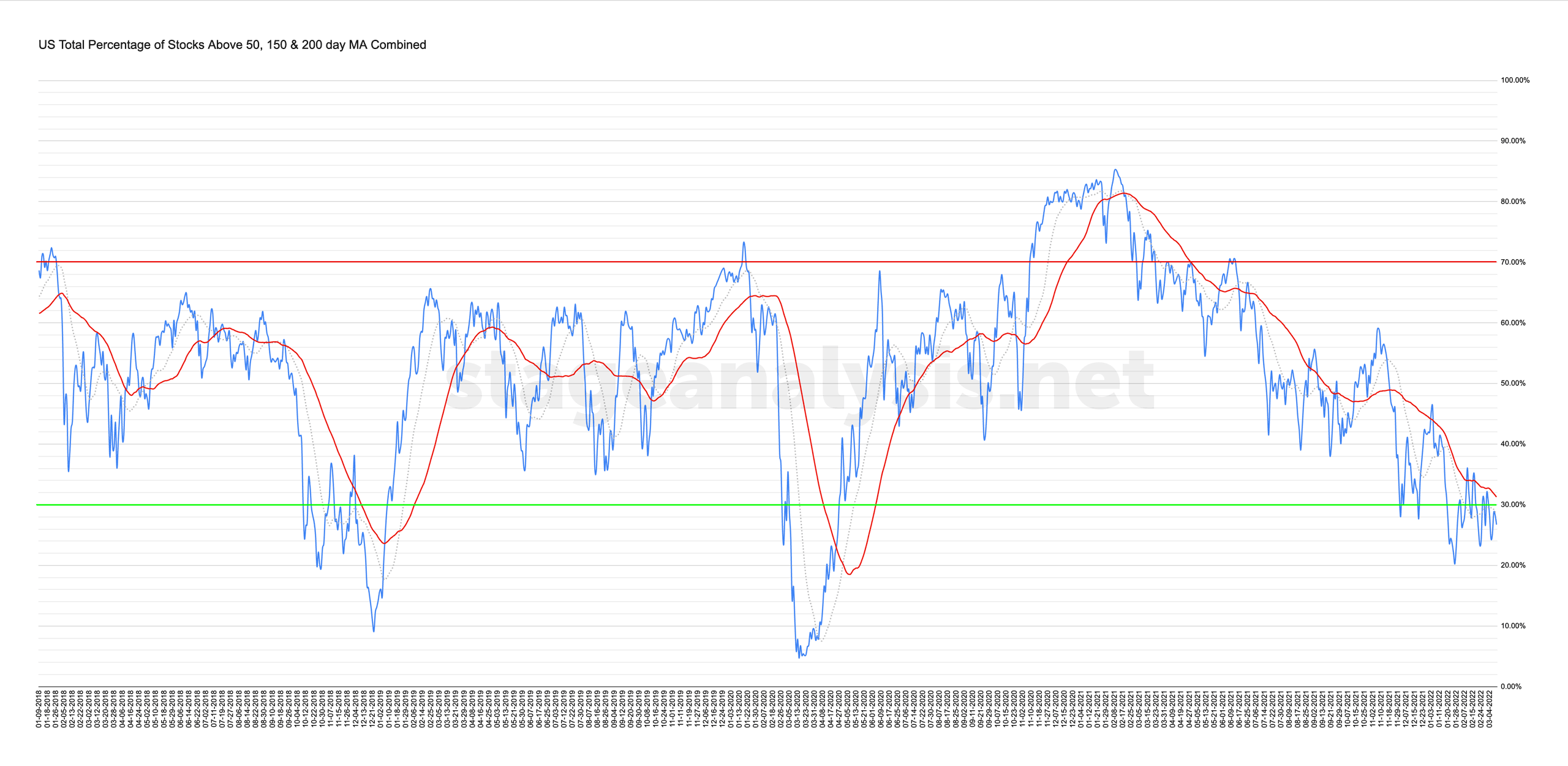

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

Blog

24 March, 2022

Stage Analysis Members Midweek Video - 23 March 2022 (54 mins)

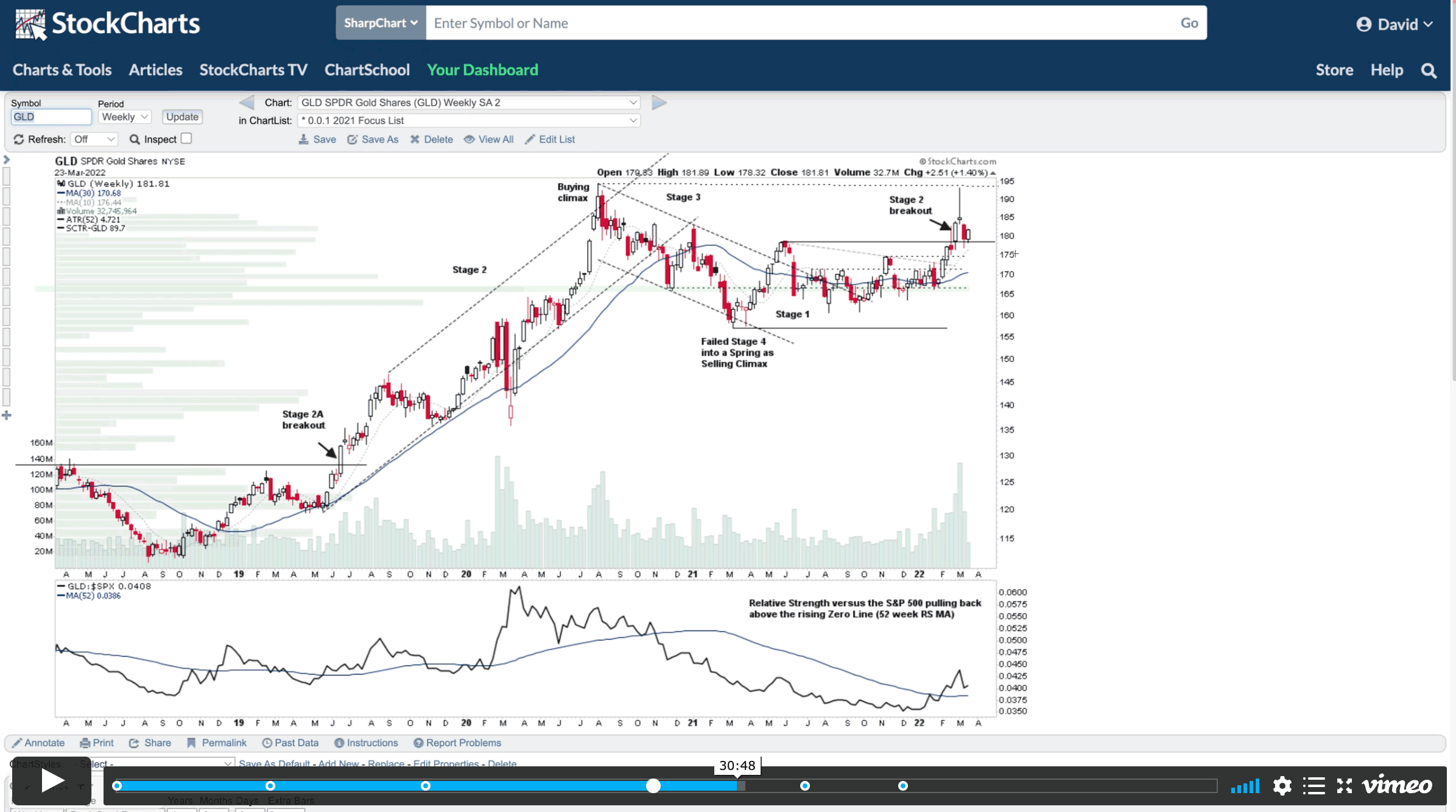

Stage Analysis Members Midweek Video covering the Major Indexes, Short Term Market Breadth Indicators, the 104 Industry Groups Exclusive Bell Curve diagram, the potential Stage 2 Backup Entry Zone for Gold, the daily Stage 1 base structures in Bitcoin & Ethereum and the US Watchlist Stocks in more detail.

Read More

22 March, 2022

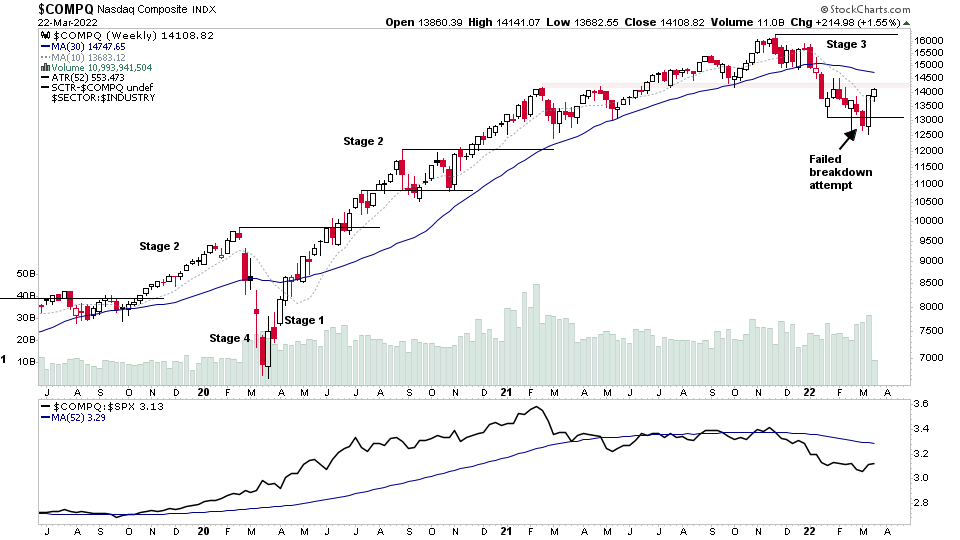

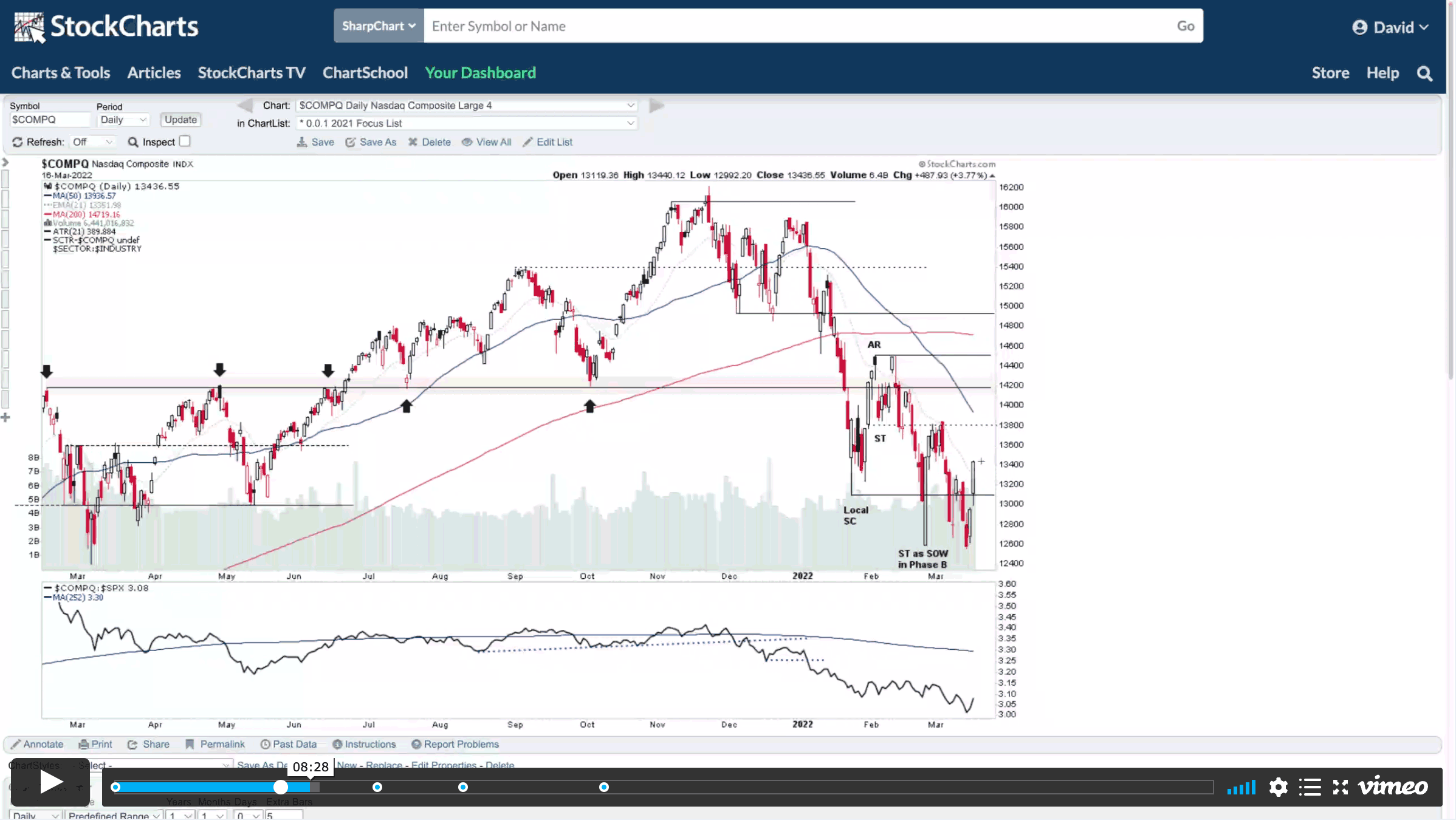

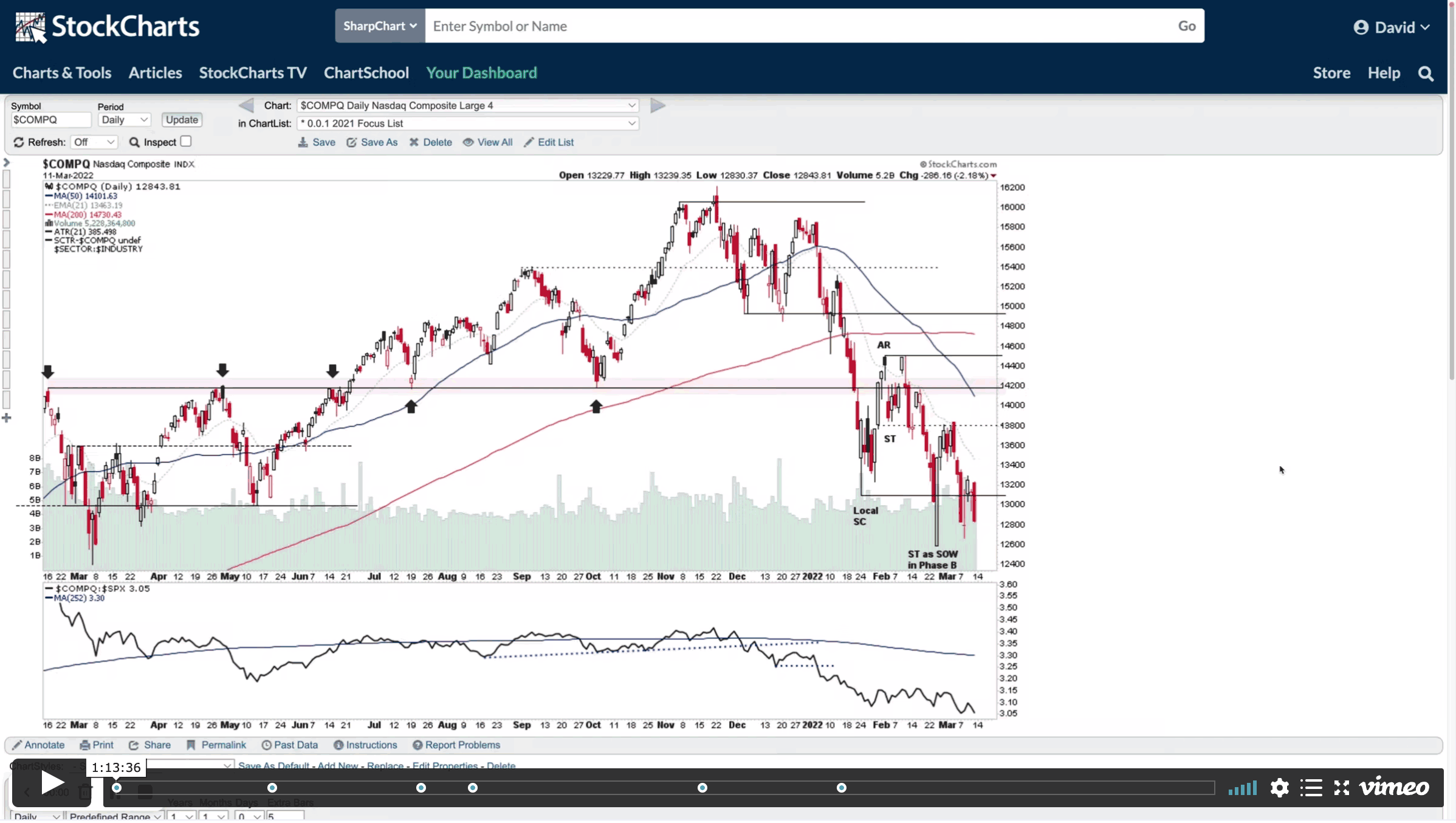

Nasdaq and S&P 500 Approaching Potential Resistance Zone and Further Market Breadth Improvements

The Nasdaq Composite is approaching a significant level of interest that has acted as both support and resistance five times or so in the past year. Hence, it is a key level to overcome in order for the short term Change of Behaviour that we've seen to turn into a more significant Change of Character – which would be more bullish. As although the initial Stage 4 breakdown attempt failed and the rebound has been strong, relative strength in the Nasdaq remains weak versus the S&P 500 and it's moving into a logical area for shorts to initiate a test of the recent price action...

Read More

22 March, 2022

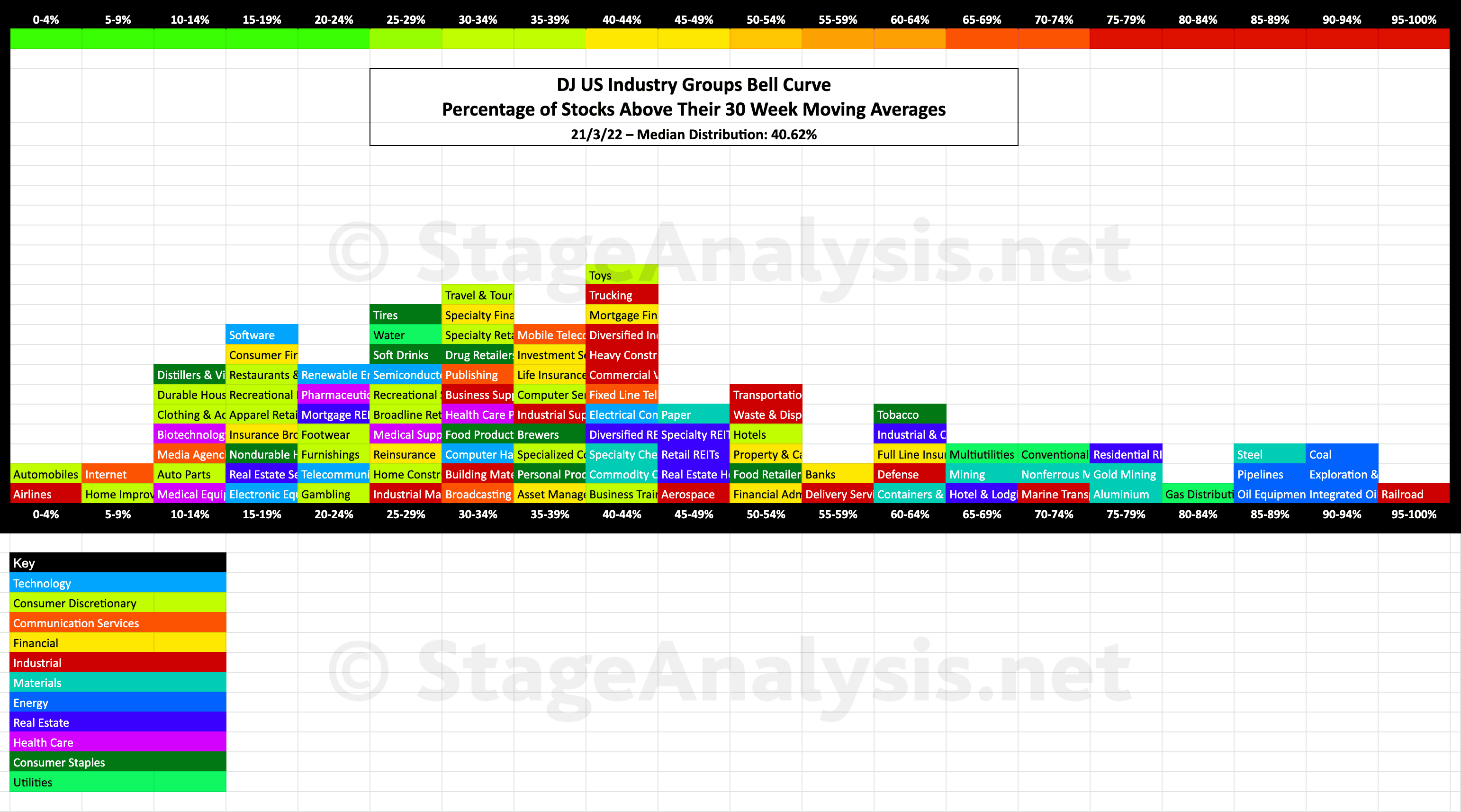

Industry Groups Bell Curve – Exclusive to Stage Analysis

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart – inspired by the Sector Bell Curve work by Tom Dorsey in his Point & Figure book....

Read More

20 March, 2022

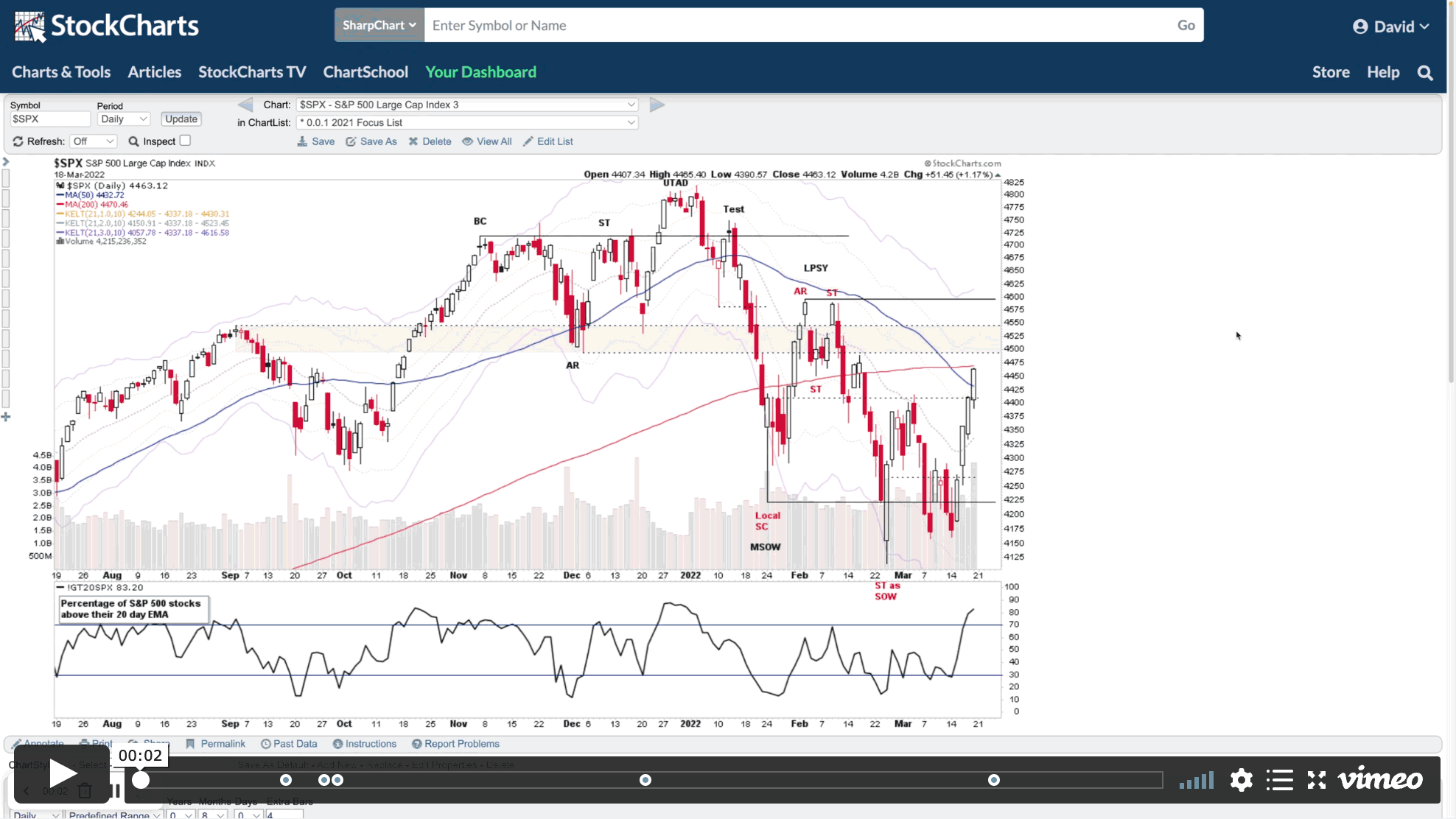

Stage Analysis Members Weekend Video – 20 March 2022 (1hr 17 mins)

Stage Analysis Members Video covering the Major Indexes (i.e. S&P 500, Nasdaq Composite, Russell 2000 and the VIX etc), Market Breadth charts to determine the Weight of Evidence, Industry Group Relative Strength Tables and the Groups in focus this week. Plus the US Stocks Watchlist.

Read More

19 March, 2022

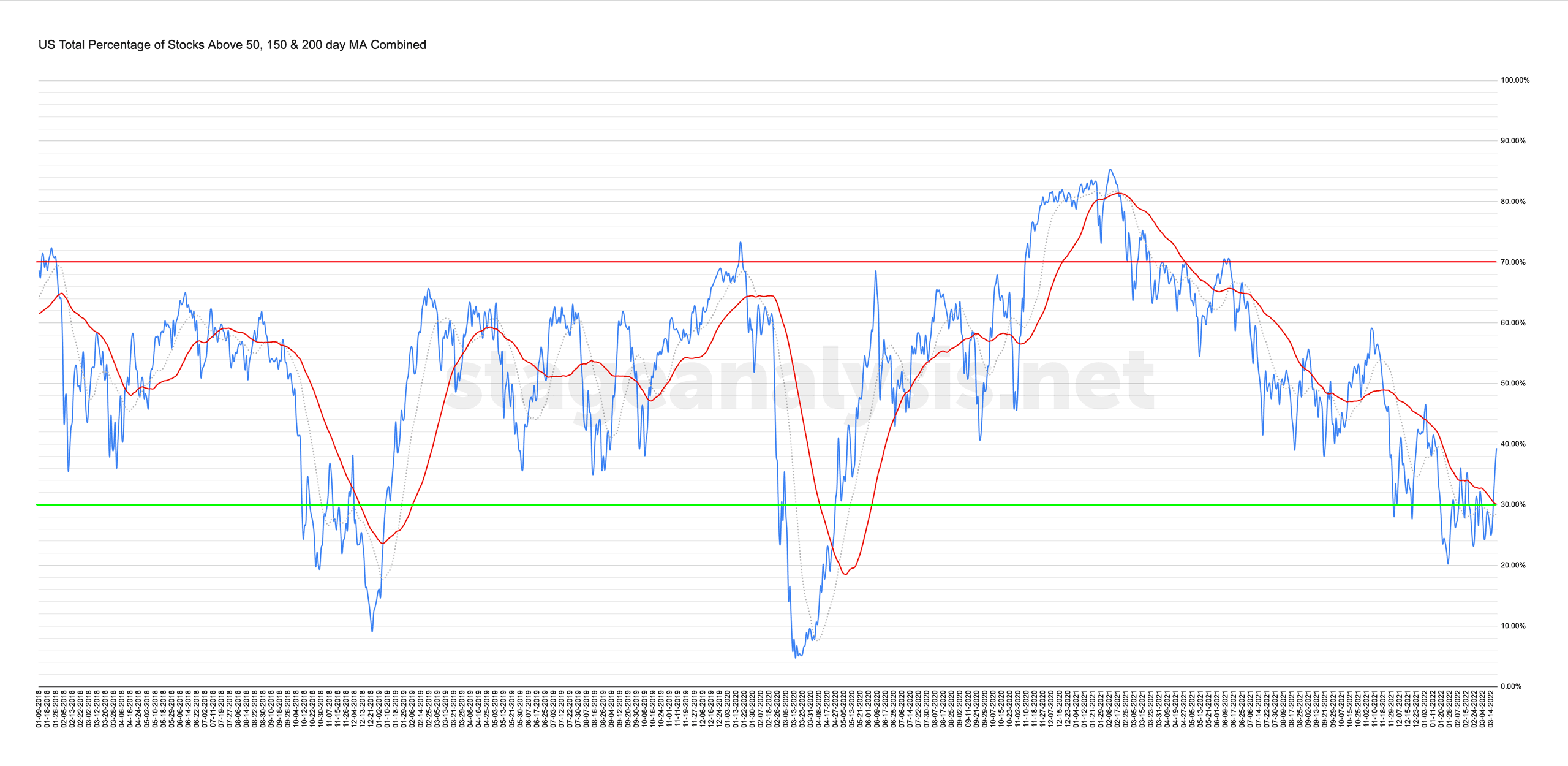

Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined – Status change to Neutral / Positive Environment

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

17 March, 2022

Stage Analysis Members Midweek Video - 16 March 2022 (47mins)

Members midweek video covering the market indexes, market breadth and US watchlist stocks in detail.

Read More

15 March, 2022

US Stocks Watchlist - 15 March 2022

There were 12 stocks for the US stocks watchlist today. Here's a small sample from the list: TMST, ATSG, JNPR, + 9 more...

Read More

13 March, 2022

Stage Analysis Members Weekend Video - 13 March 2022

Weekend Stage Analysis Members Video covering the Major Indexes, Commodities, ETFs in focus, the Sectors and Industry Group Relative Strength, Market Breadth Update and finally the US Stocks Watchlist in detail where I mark up the price and volume action that I'm looking for in and the developing themes from the watchlist.

Read More

11 March, 2022

Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More