The Stage Analysis Members Midweek Video covers the major indexes, short term market breadth charts, AAPL and TSLA attempts to the hold their short term MAs.The group themes from the last week, and the US watchlist stocks in more detail...

Read More

Blog

11 April, 2022

Stock Market Weakness Continues – Plus The US Stocks Watchlist – 11 April 2022

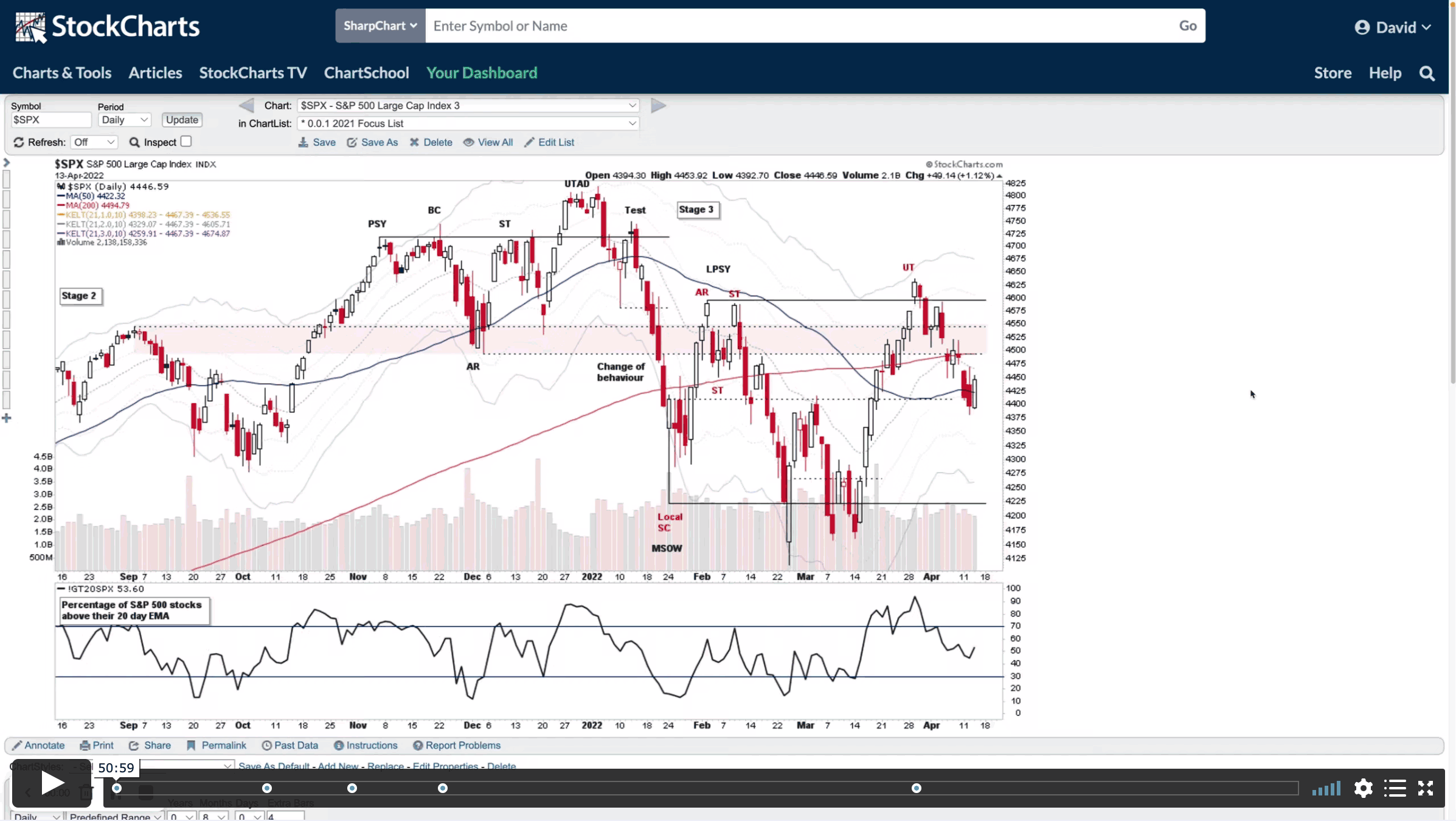

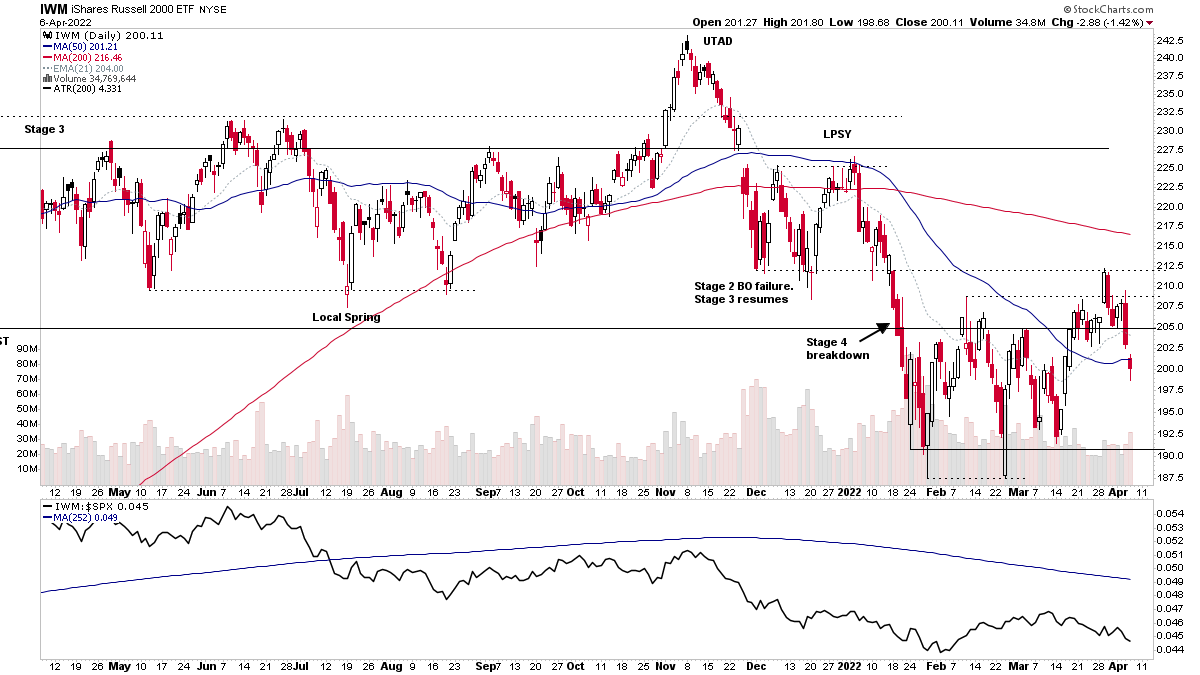

The broad market came under more pressure today, but I thought it would be interesting to focus on some of the weekly charts of the mega cap stocks which are currently struggling in various Phases of Stage 3...

Read More

10 April, 2022

Stage Analysis Members Weekend Video – 10 April 2022 (1hr 42mins)

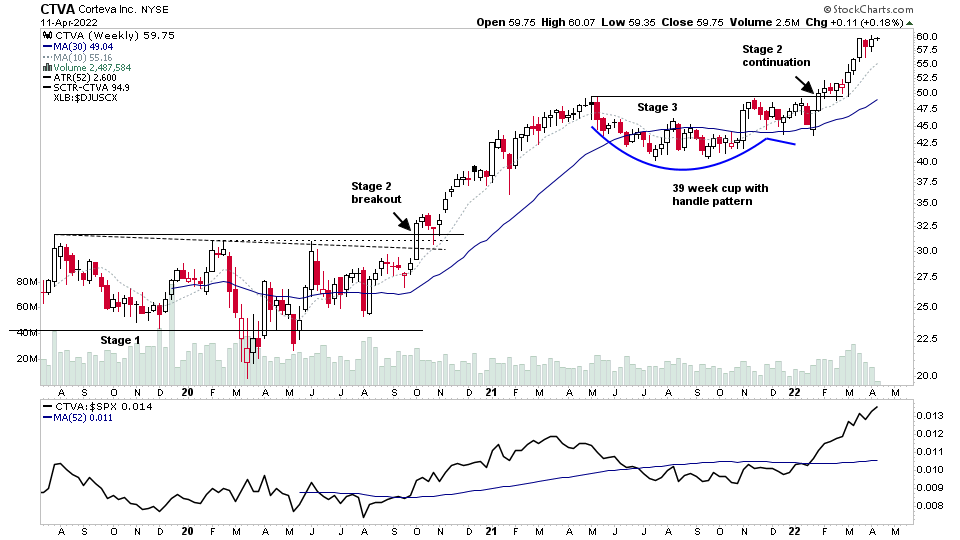

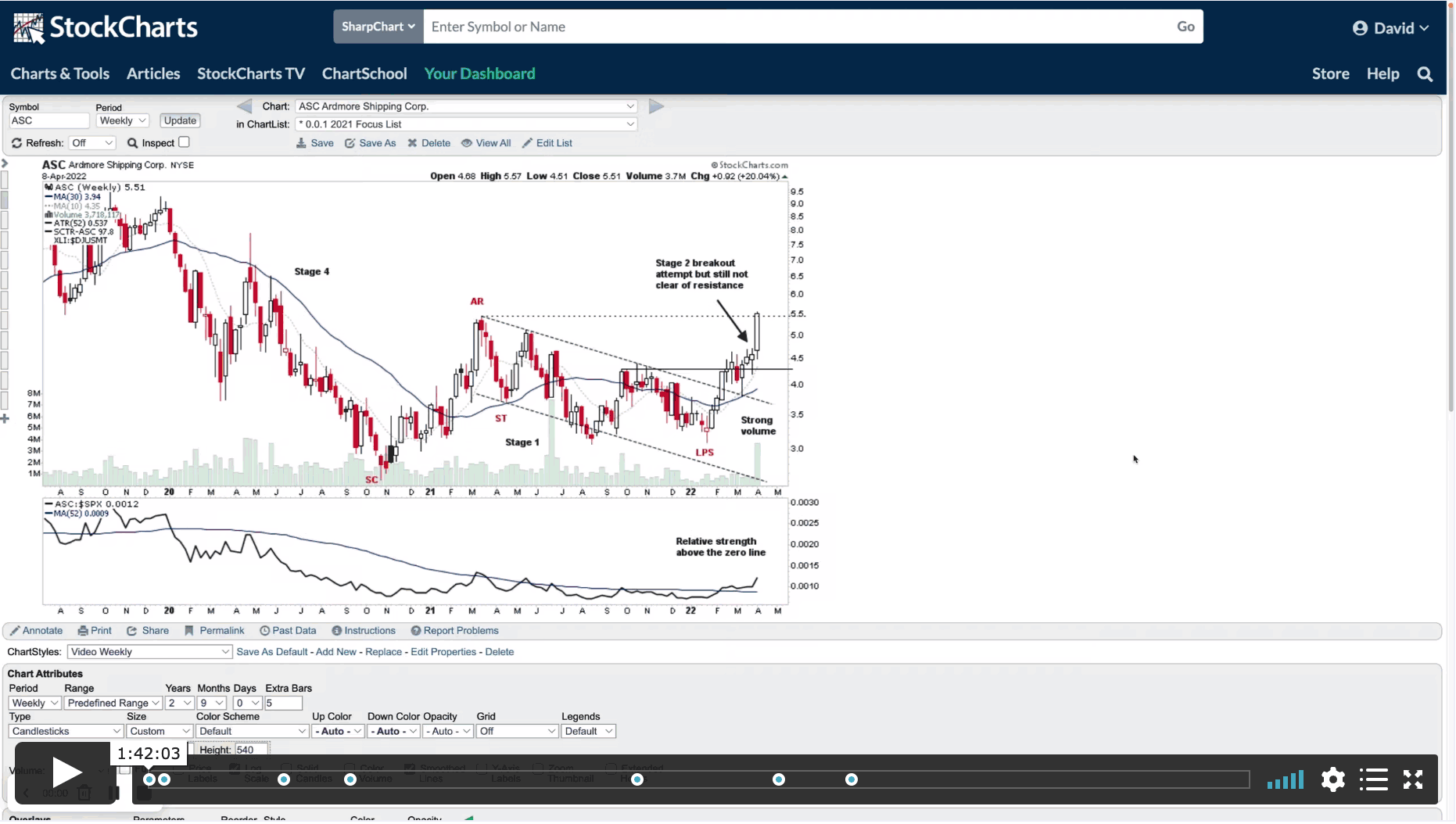

This weekends Stage Analysis Members Video features the Major Indexes – Nasdaq, S&P 500, Russell 2000, Sector Relative Strength, Market Breadth charts to determine the Weight of Evidence, Industry Group Relative Strength. A Group Focus on the Uranium Stocks and the US Stocks Watchlist in detail with marked up charts and explanations of the group themes and what I'm looking for in various stocks.

Read More

09 April, 2022

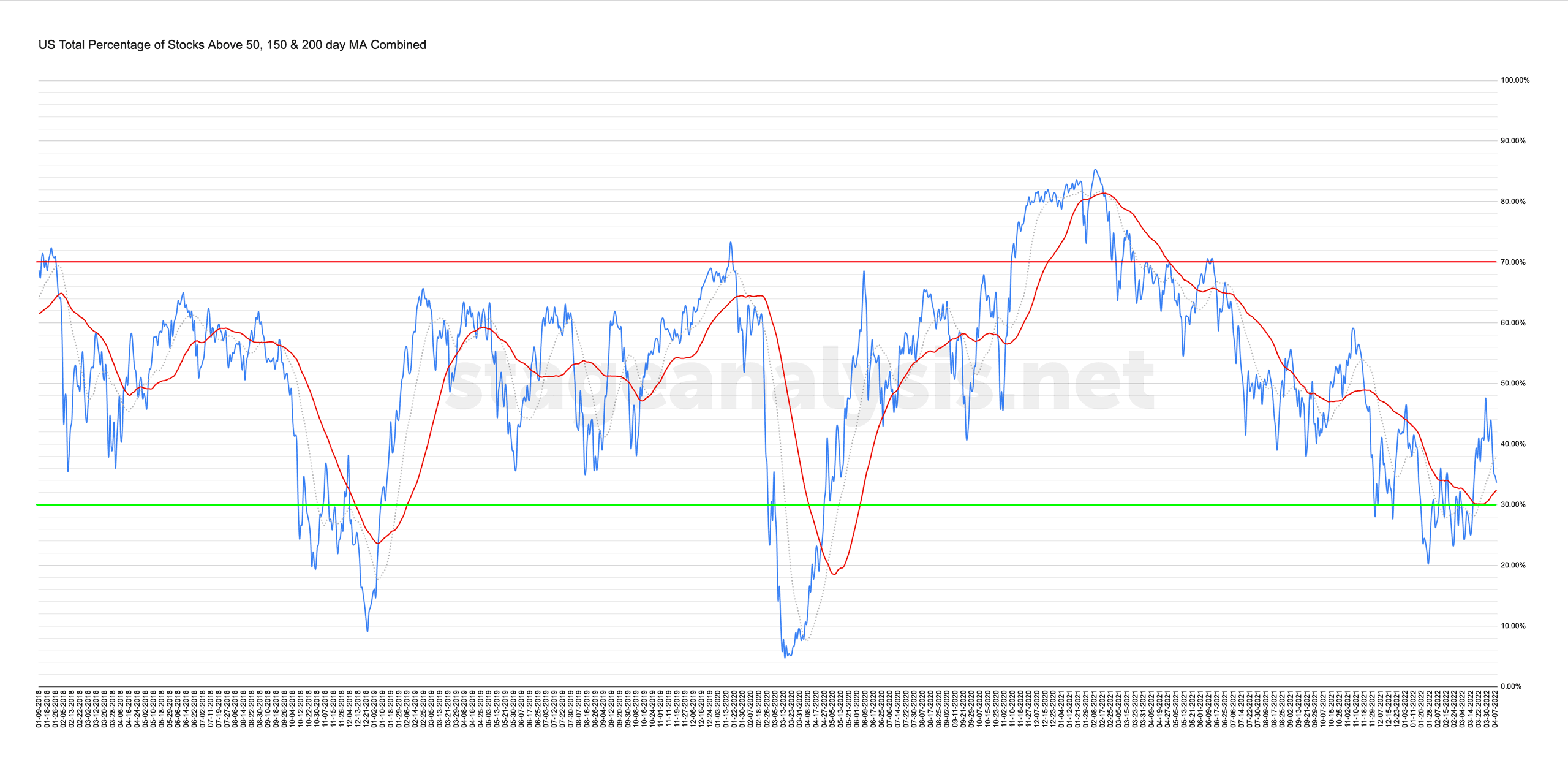

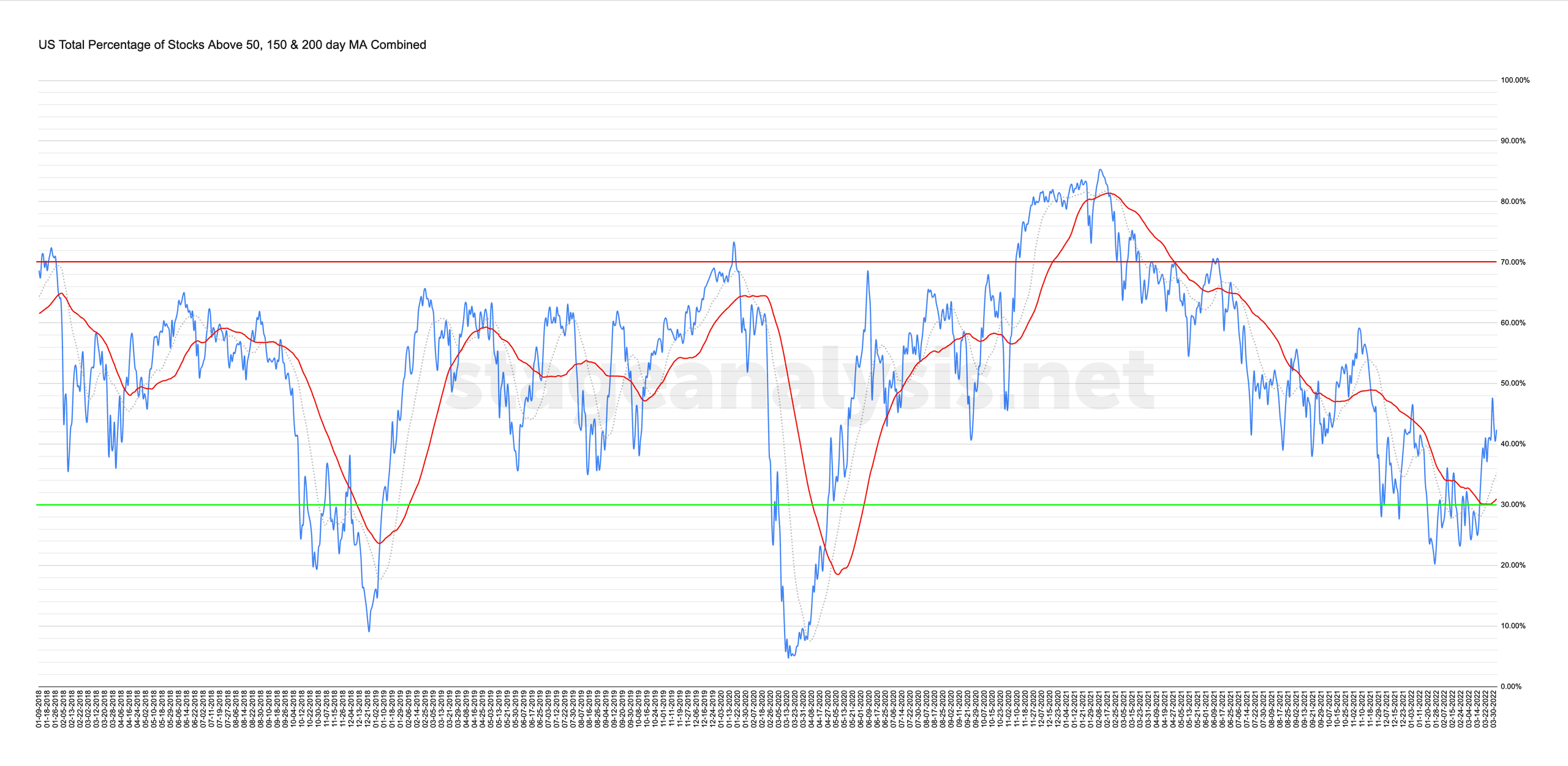

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

07 April, 2022

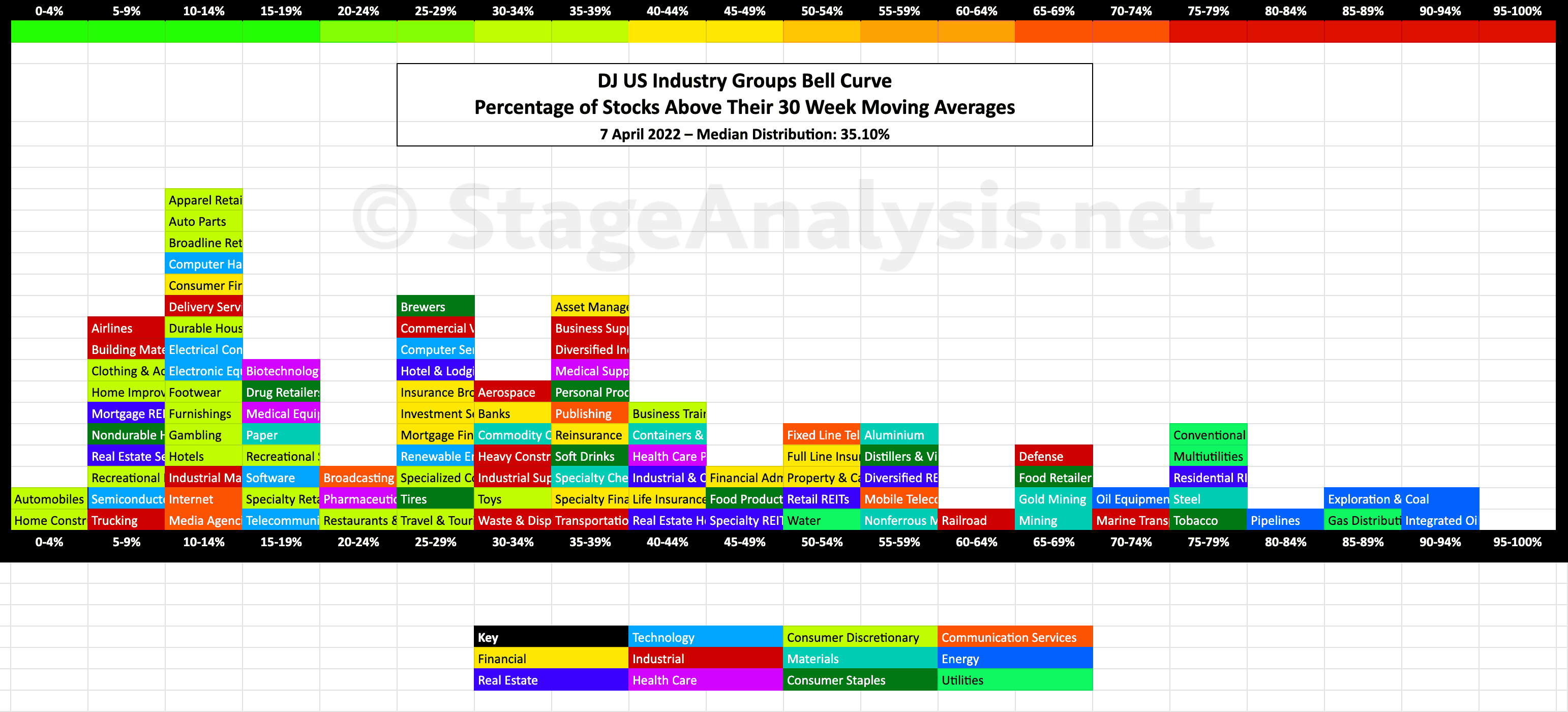

US Industry Groups Bell Curve – Exclusive to Stage Analysis

Updated exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart – inspired by the Sector Bell Curve work by Tom Dorsey in his Point & Figure book....

Read More

07 April, 2022

Stage Analysis Members Midweek Video - 6 April 2022

This weeks Members Midweek Video focuses on some of the recent areas of weakness, like the Semiconductors groups, plus brief reviews of some of other featured groups in the last few months – as well as the regular midweek features on the indexes, short term market breadth charts and the watchlist stocks in focus.

Read More

03 April, 2022

Stage Analysis Members Weekend Video - 3 April 2022 (1hr 24mins)

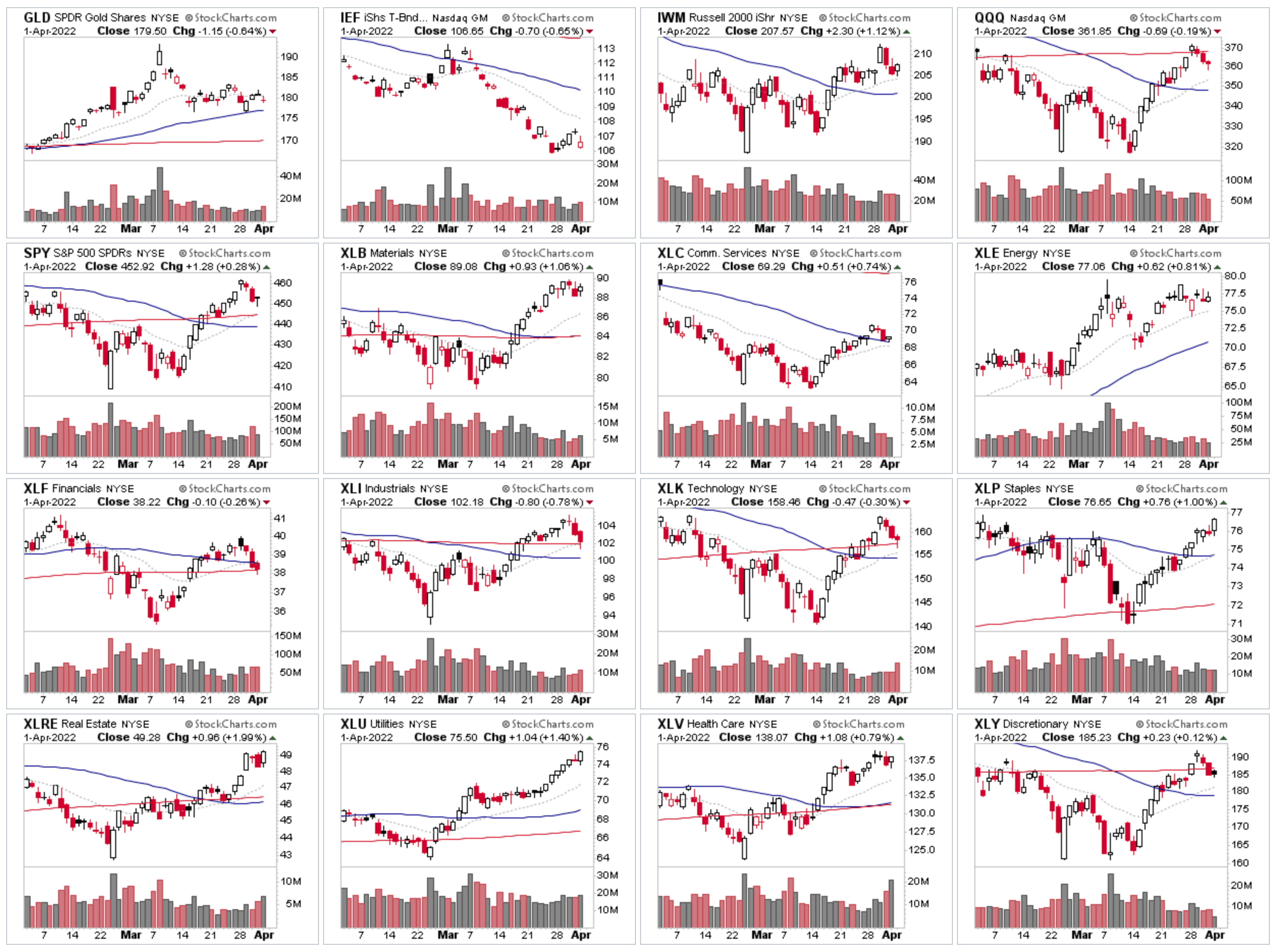

In this weekends members video I discuss the Stan Weinstein Interview on Twitter Spaces, as well as the regular content of the Major Indexes, Sectors Relative Strength Tables & Charts, Industry Group RS Tables and Themes, Market Breadth: Weight of Evidence, 2x Weekly Volume Stocks and the US Watchlist Stocks in detail.

Read More

02 April, 2022

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

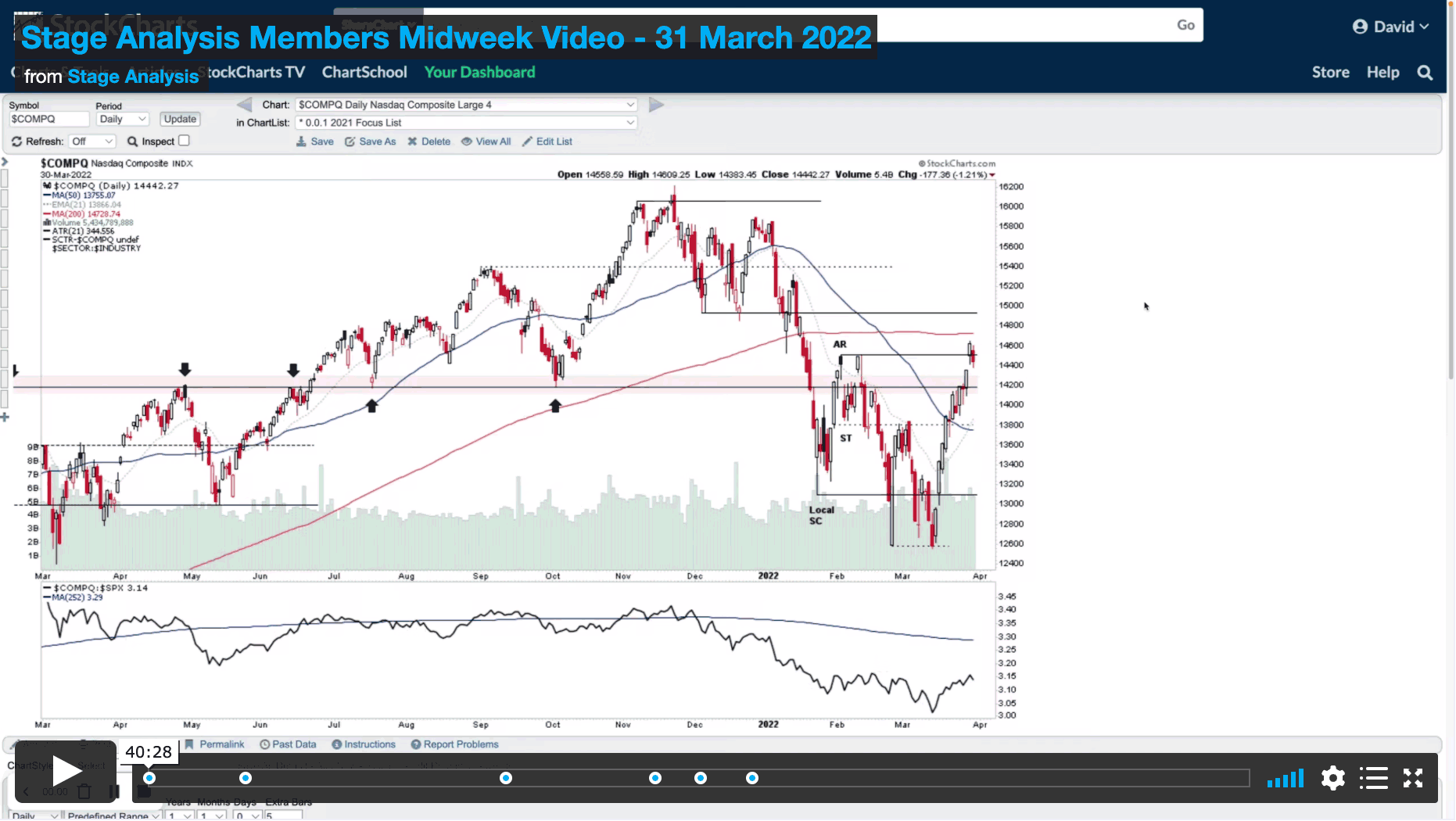

31 March, 2022

Stage Analysis Members Midweek Video - 31 March 2022 (40mins)

Todays video covers the Major Indexes, Short term market breadth, Bitcoin and Ethereum's Stage 2 attempt on the daily timeframe and the US Stocks Watchlist. I also spend the first 13 mins talking through how to use the watchlist based on the methods entry points and important cookie updates that break videos if they are not selected. So make sure that you accept them to be able to view the videos, as Vimeo videos only play once they are accepted.

Read More

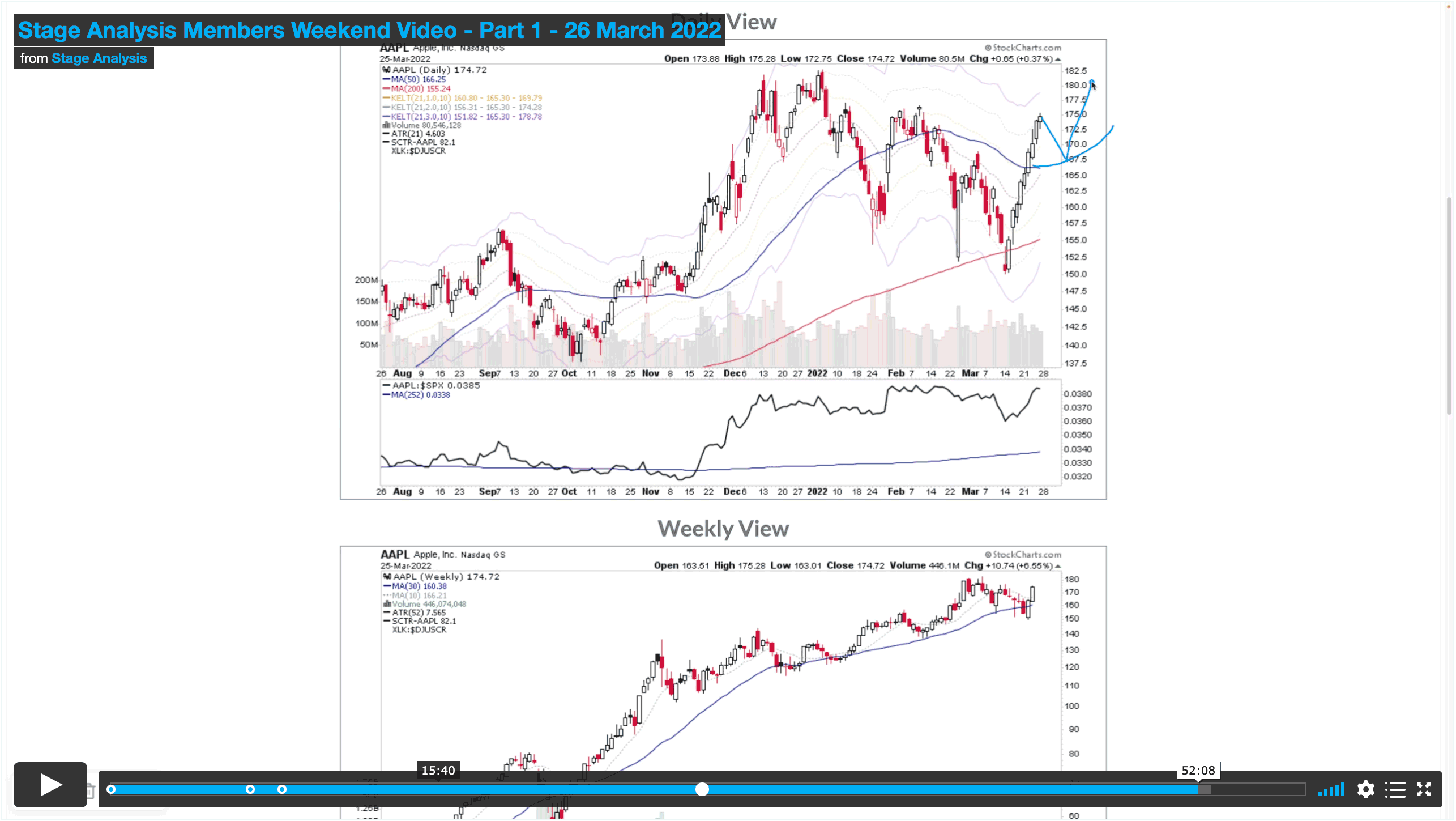

26 March, 2022

Stage Analysis Members Weekend Video – Part 1 – 26 March 2022 (57 mins)

In Part 1 of the Stage Analysis Members Video I cover the Major Indexes (i.e. S&P 500, Nasdaq Composite, Russell 2000 and the VIX etc), US Sectors Relative Strength Rankings and charts, Market Breadth charts to determine the Weight of Evidence, and the US Stocks Industry Group Relative Strength Tables and the Groups in focus this week.

Read More