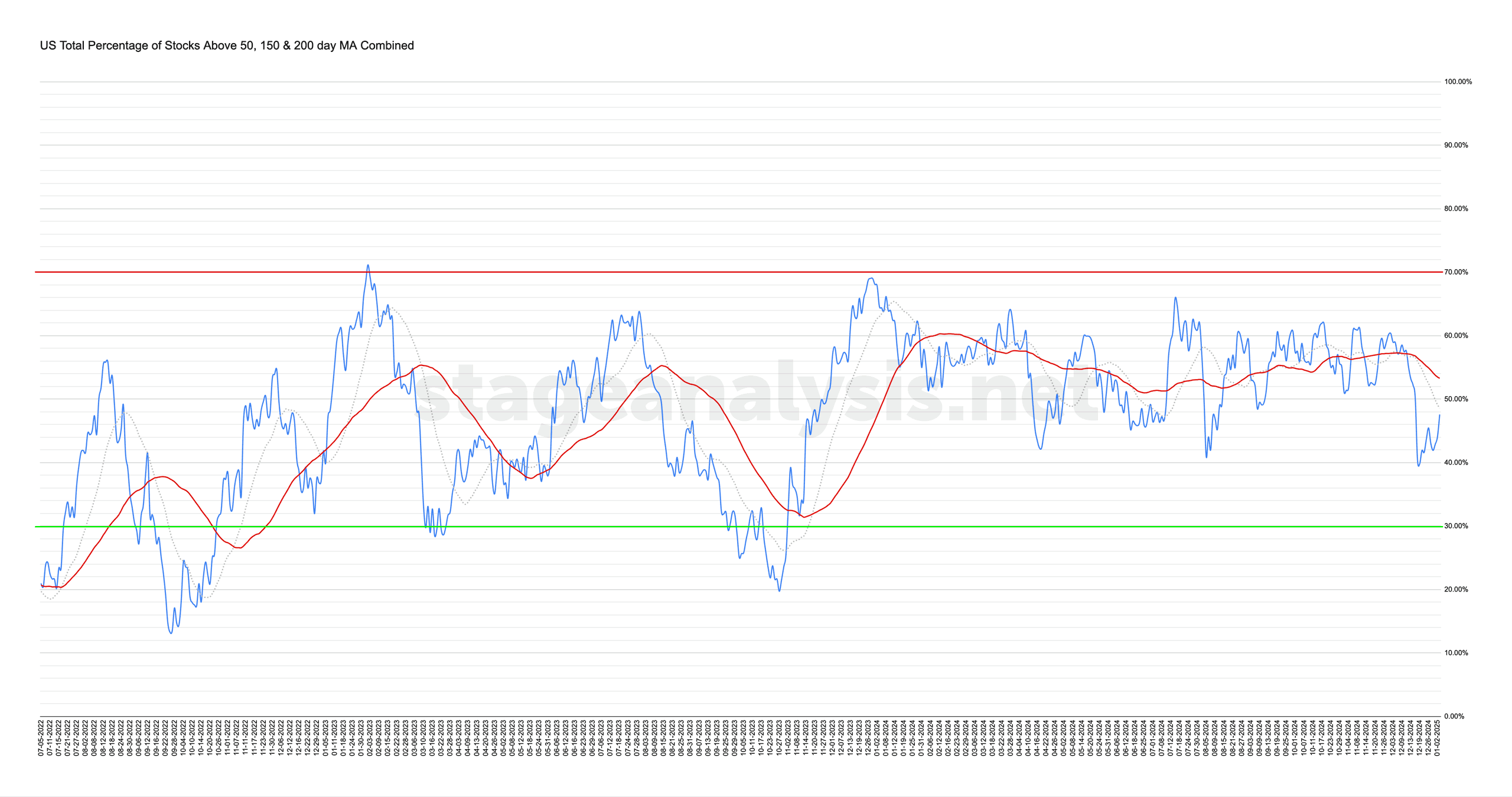

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +4.56% this week. Therefore, the overall combined average is at 47.58% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

Blog

02 January, 2025

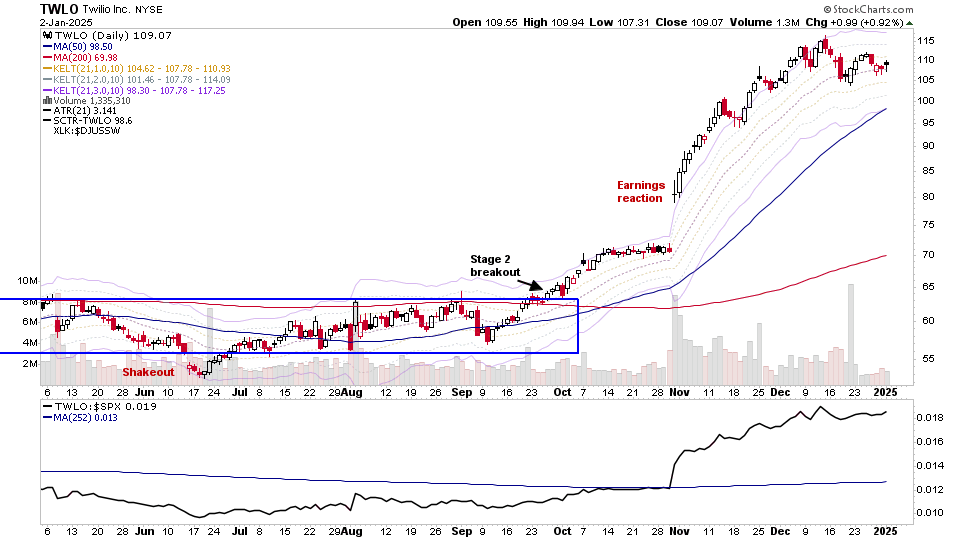

US Stocks Watchlist – 2 January 2025

There were 25 stocks highlighted from the US stocks watchlist scans today...

Read More

29 December, 2024

Stage Analysis Members Video – 29 December 2024 (54mins)

Stage Analysis members video discussing the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

28 December, 2024

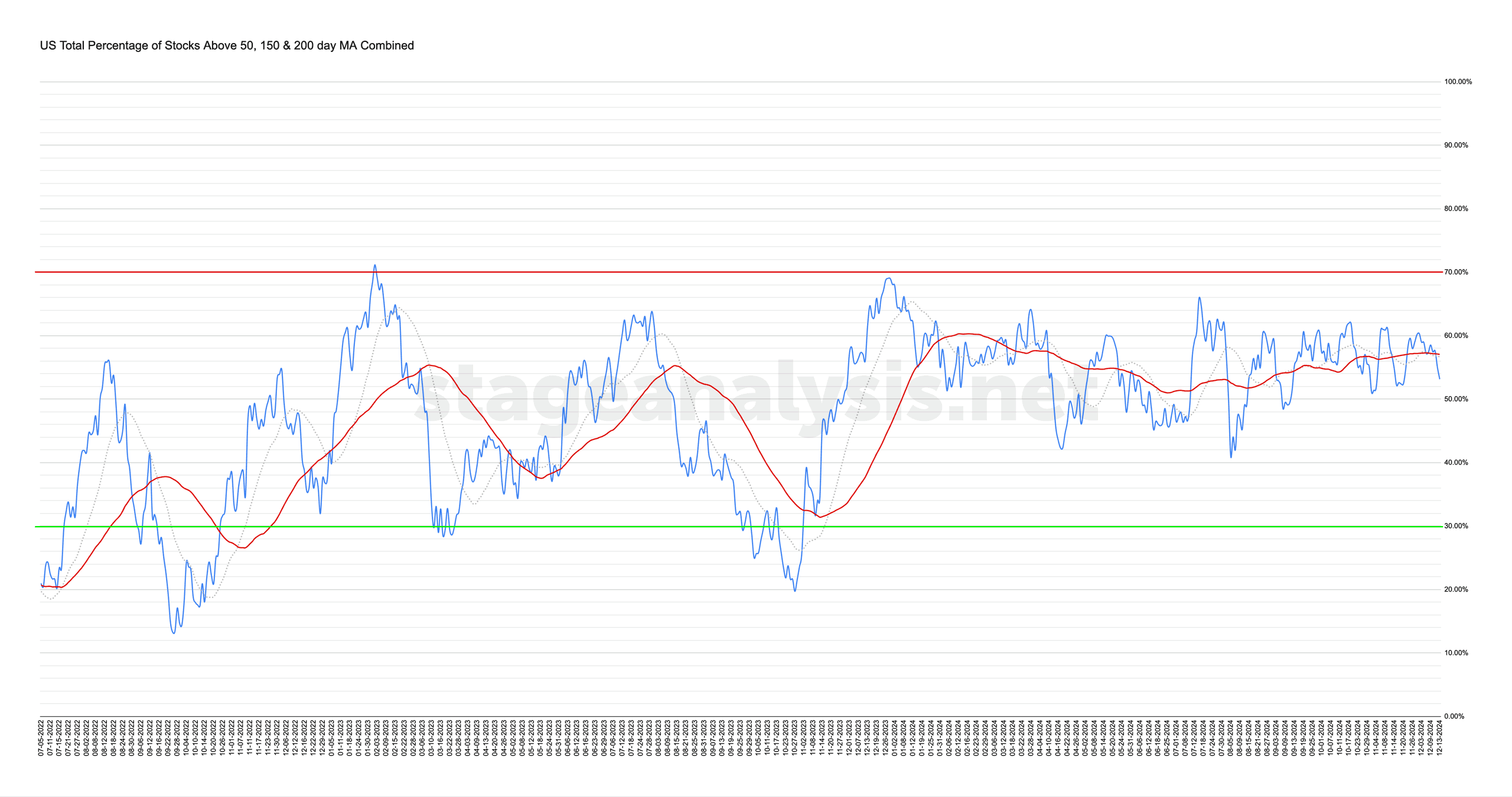

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) increased by +1.12% this week. Therefore, the overall combined average is at 43.02% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

22 December, 2024

Stage Analysis Members Video – 22 December 2024 (1hr 11mins)

Stage Analysis members video discussing the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, the Significant Bars, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

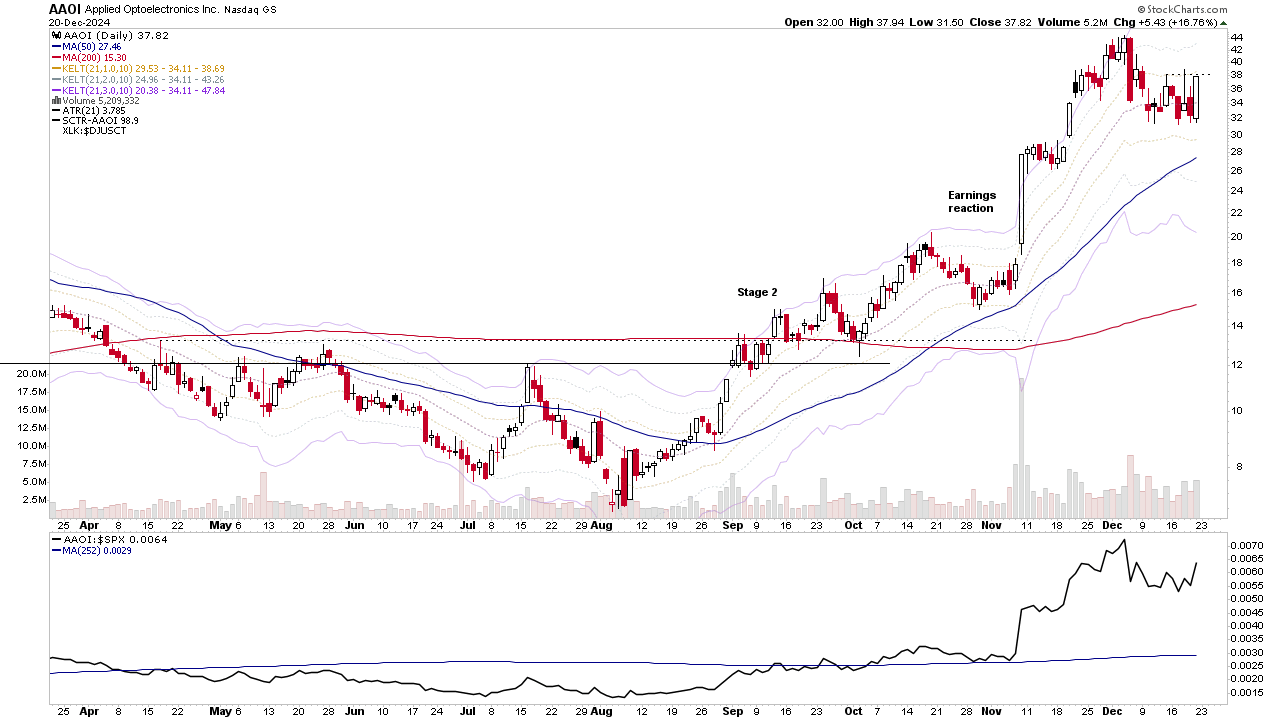

20 December, 2024

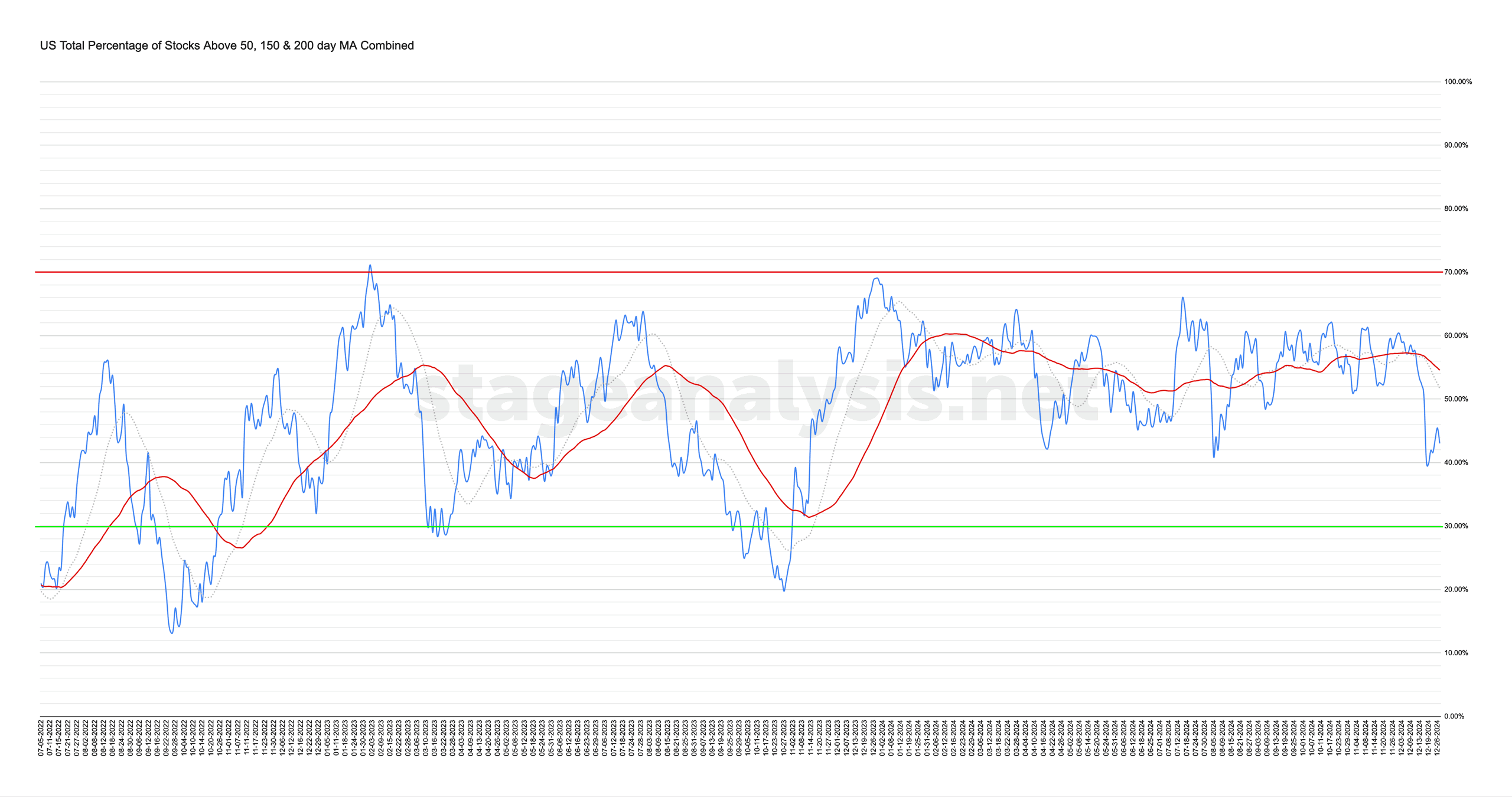

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -11.31% this week. Therefore, the overall combined average is at 41.90% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

20 December, 2024

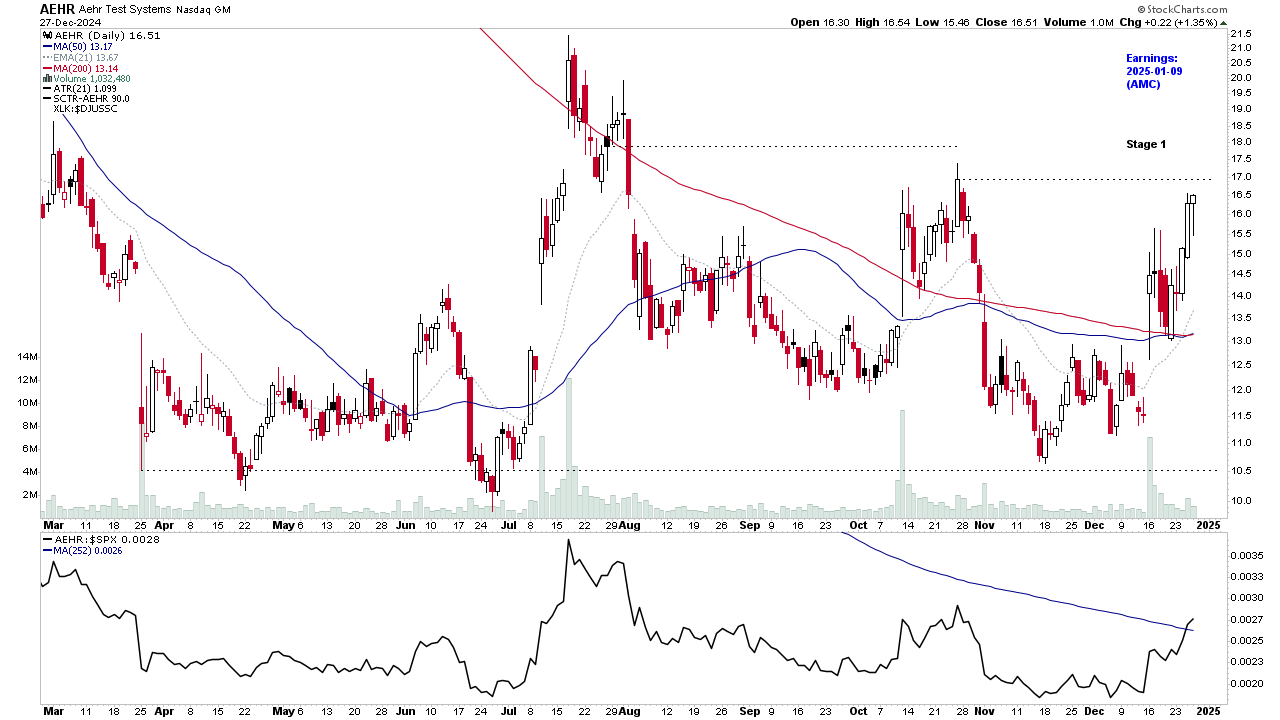

US Stocks Watchlist – 19 December 2024

There were 11 stocks highlighted from the US stocks watchlist scans today...

Read More

15 December, 2024

Stage Analysis Members Video – 15 December 2024 (59mins)

Stage Analysis members video discussing the Significant Bars, then the US Watchlist Stocks in detail on multiple timeframes, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update.

Read More

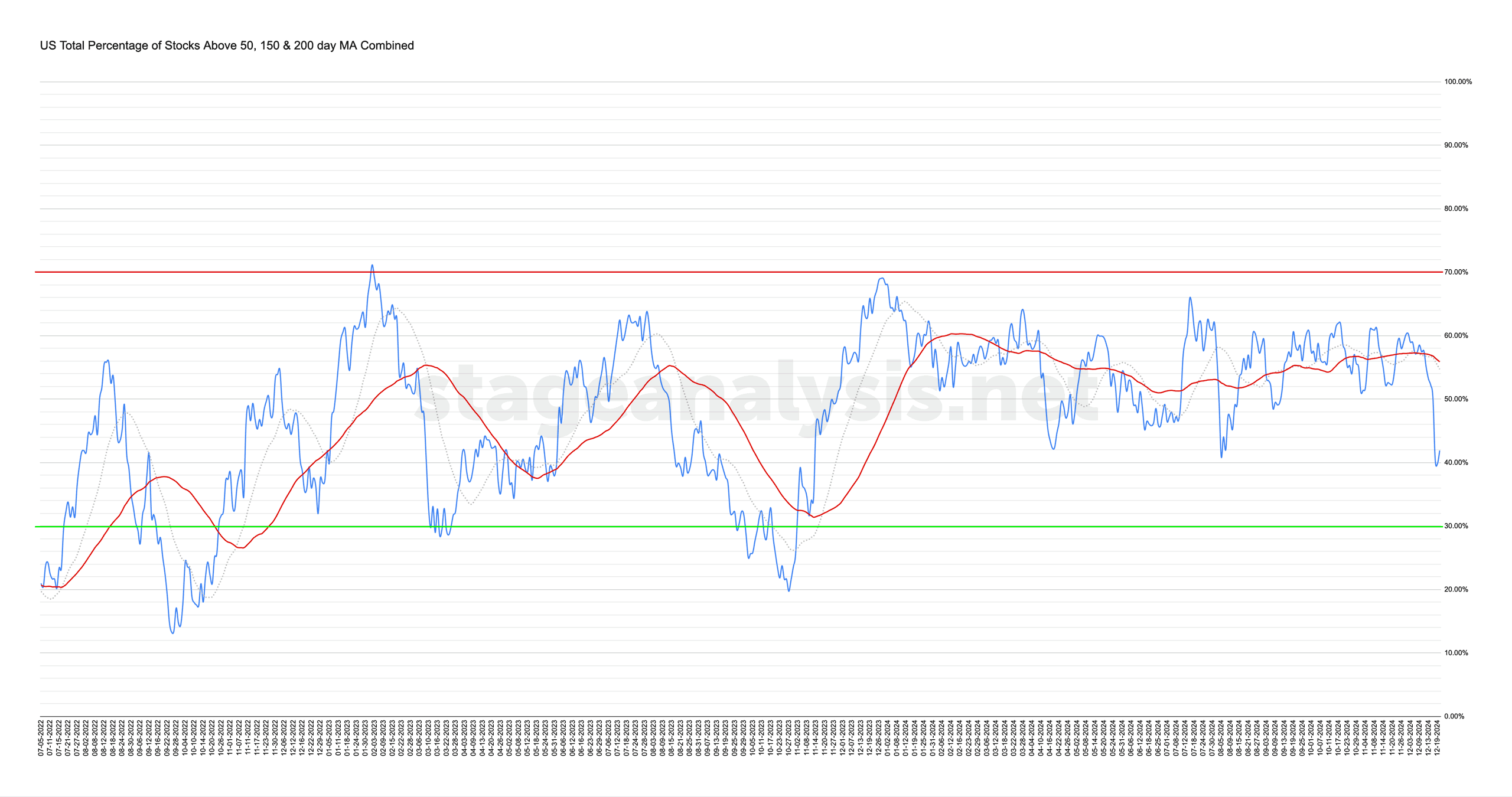

14 December, 2024

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -4.15% this week. Therefore, the overall combined average is at 53.21% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

13 December, 2024

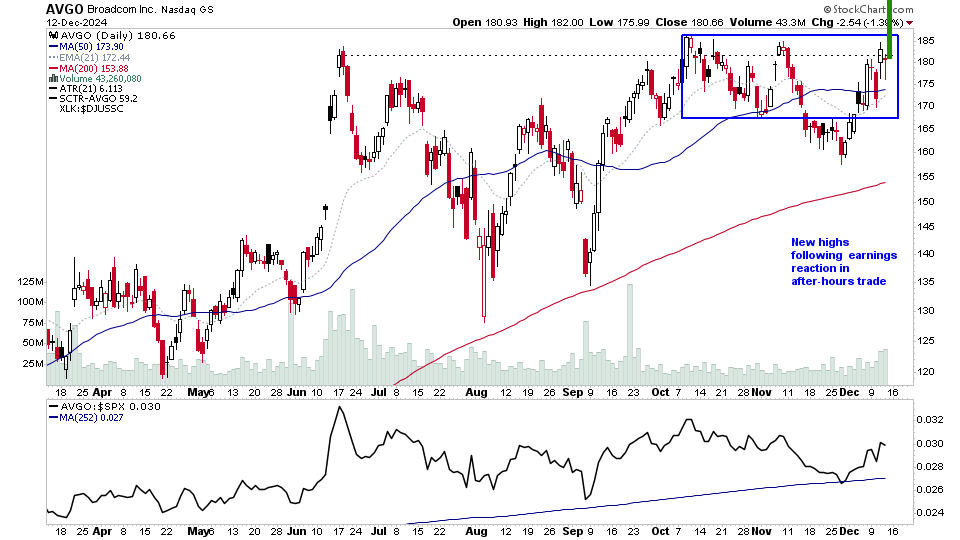

US Stocks Watchlist – 12 December 2024

There were 15 stocks highlighted from the US stocks watchlist scans today...

Read More