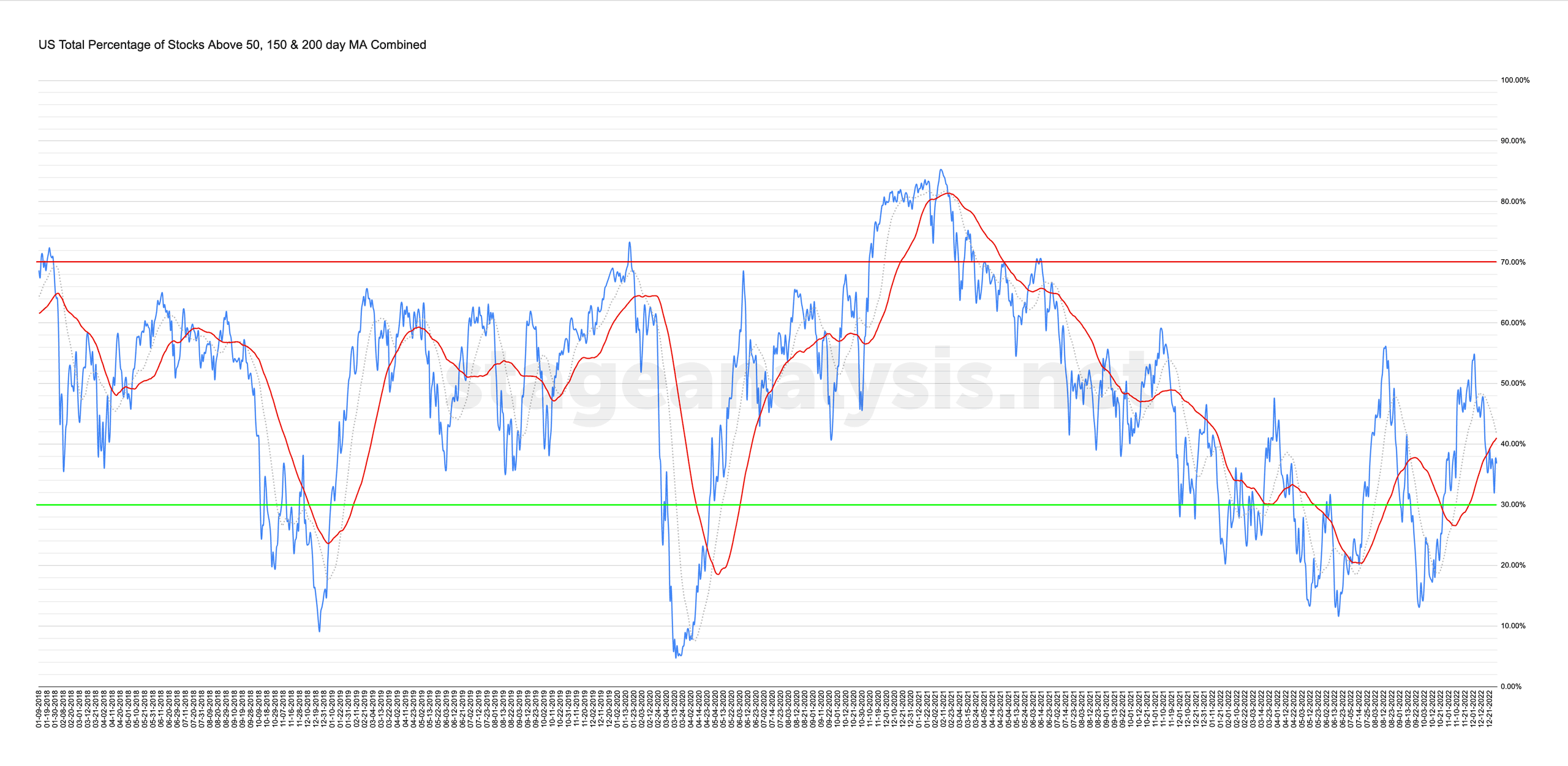

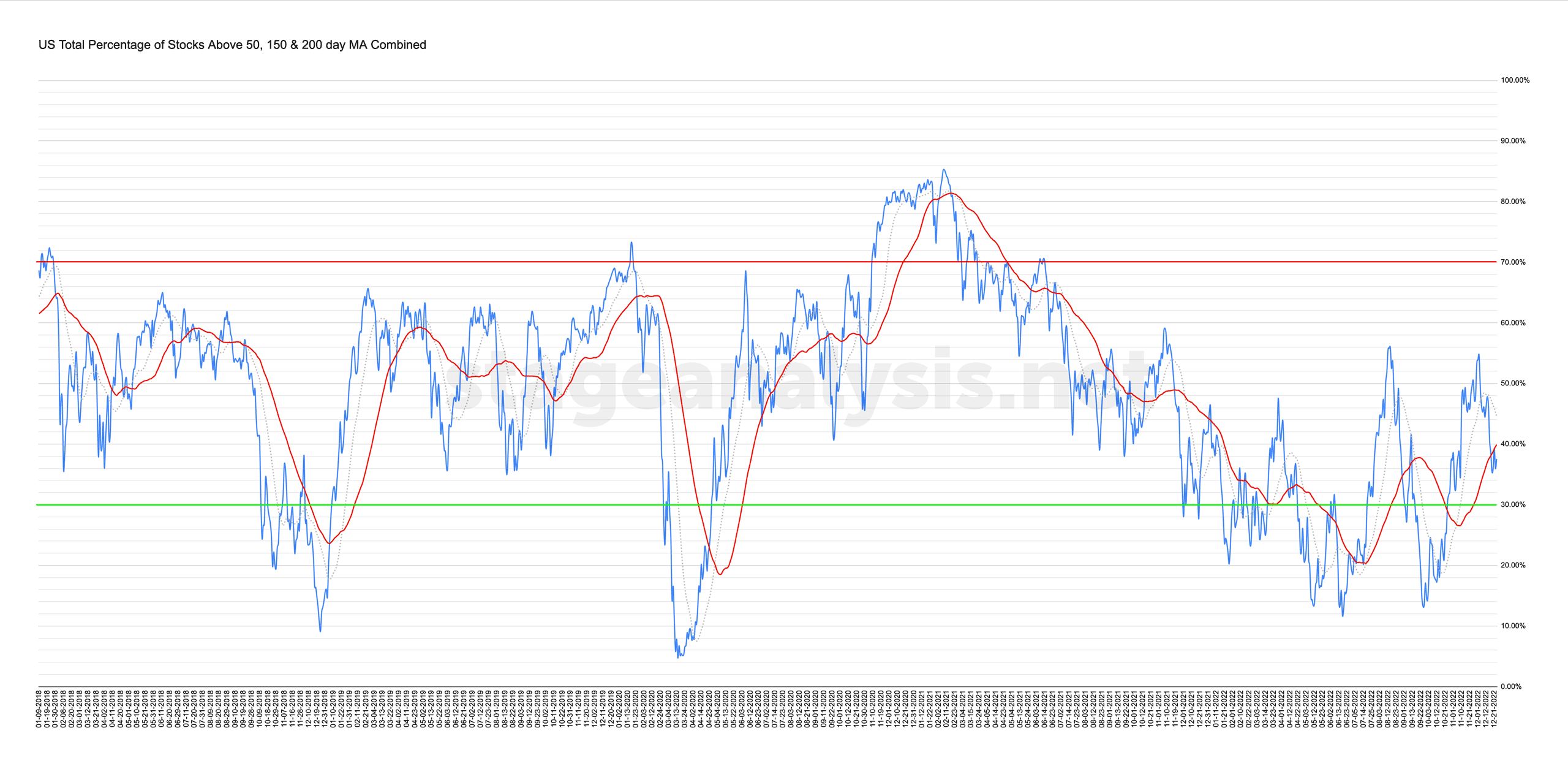

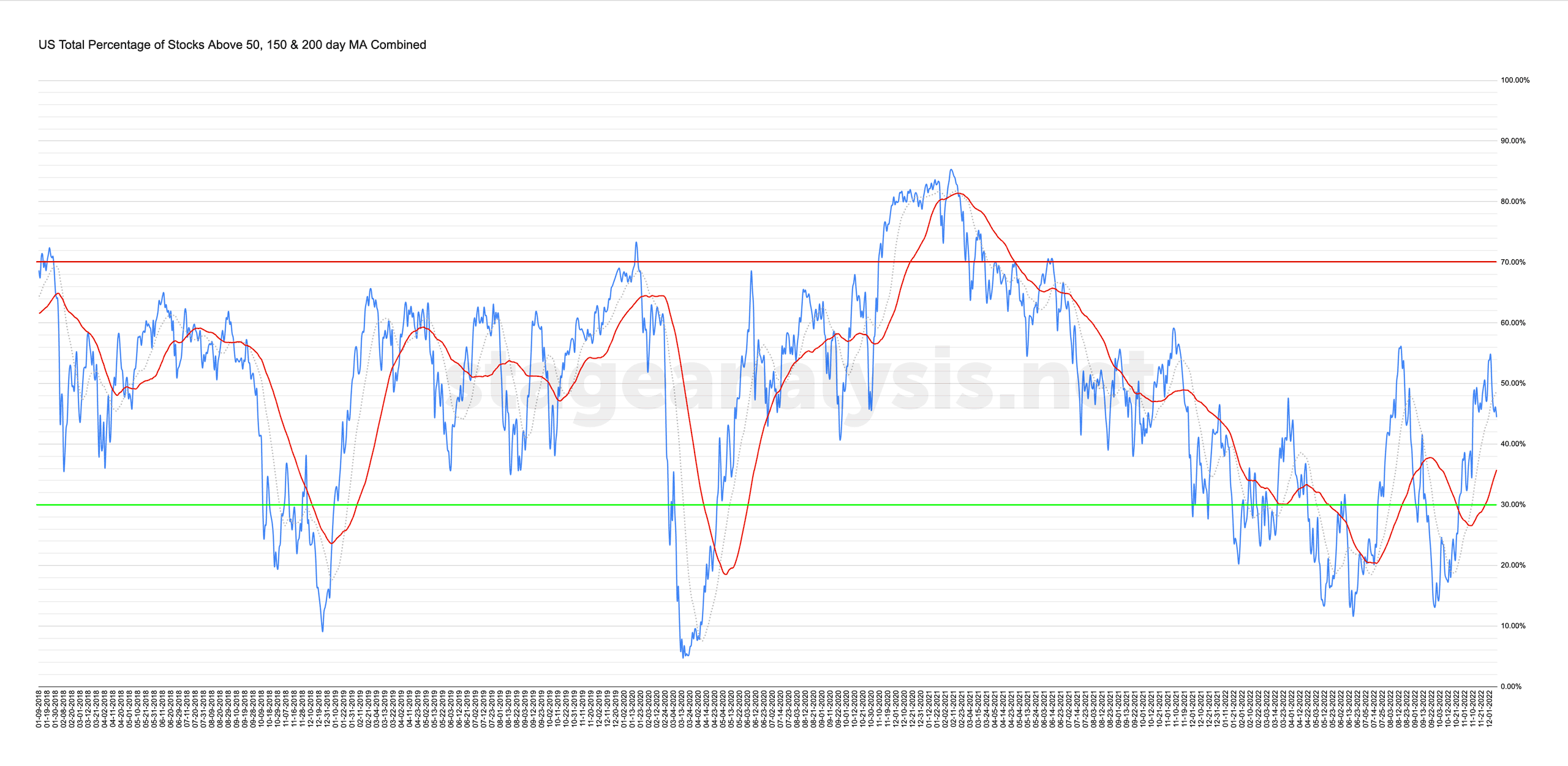

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

Blog

24 December, 2022

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

21 December, 2022

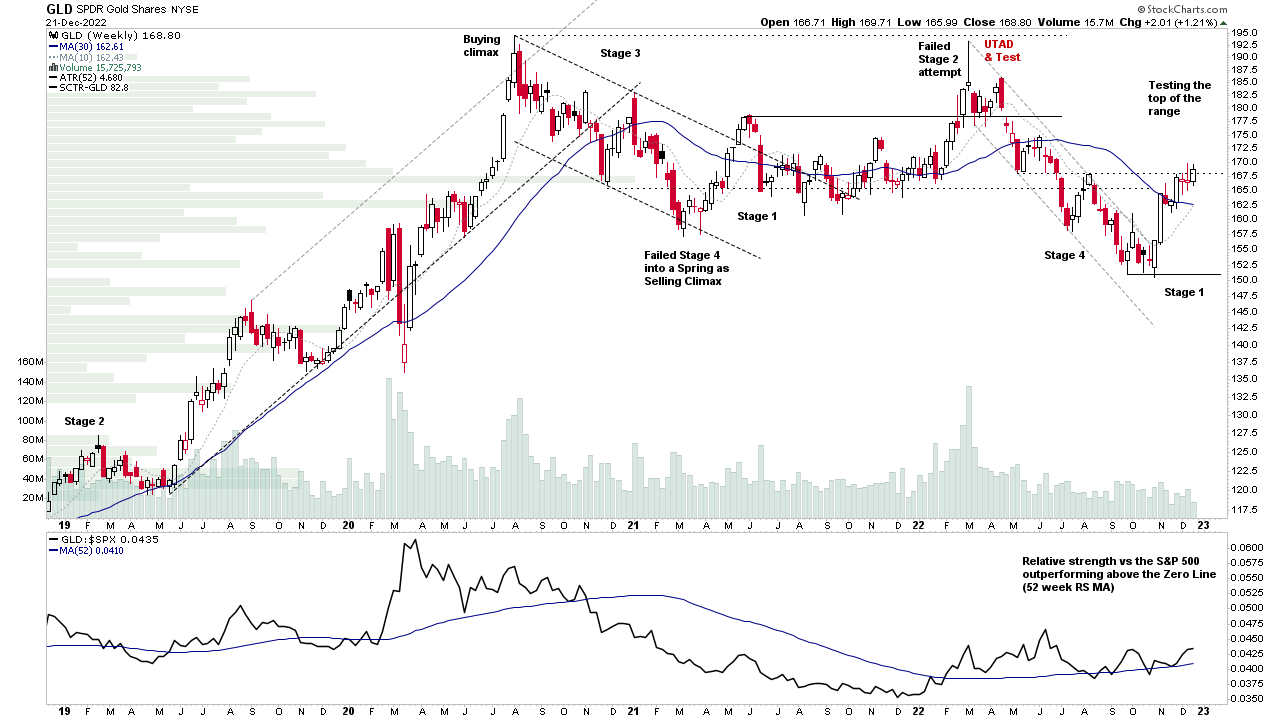

Stage Analysis Members Video – 21 December 2022 (56mins)

The Stage Analysis members midweek video discussing Gold, Silver & The US Dollar, the S&P 500 & Nasdaq 100 Equal Weight Comparisons, short-term market breadth indicators and the US watchlist stocks in more detail with live markups of the individual stocks and group themes.

Read More

19 December, 2022

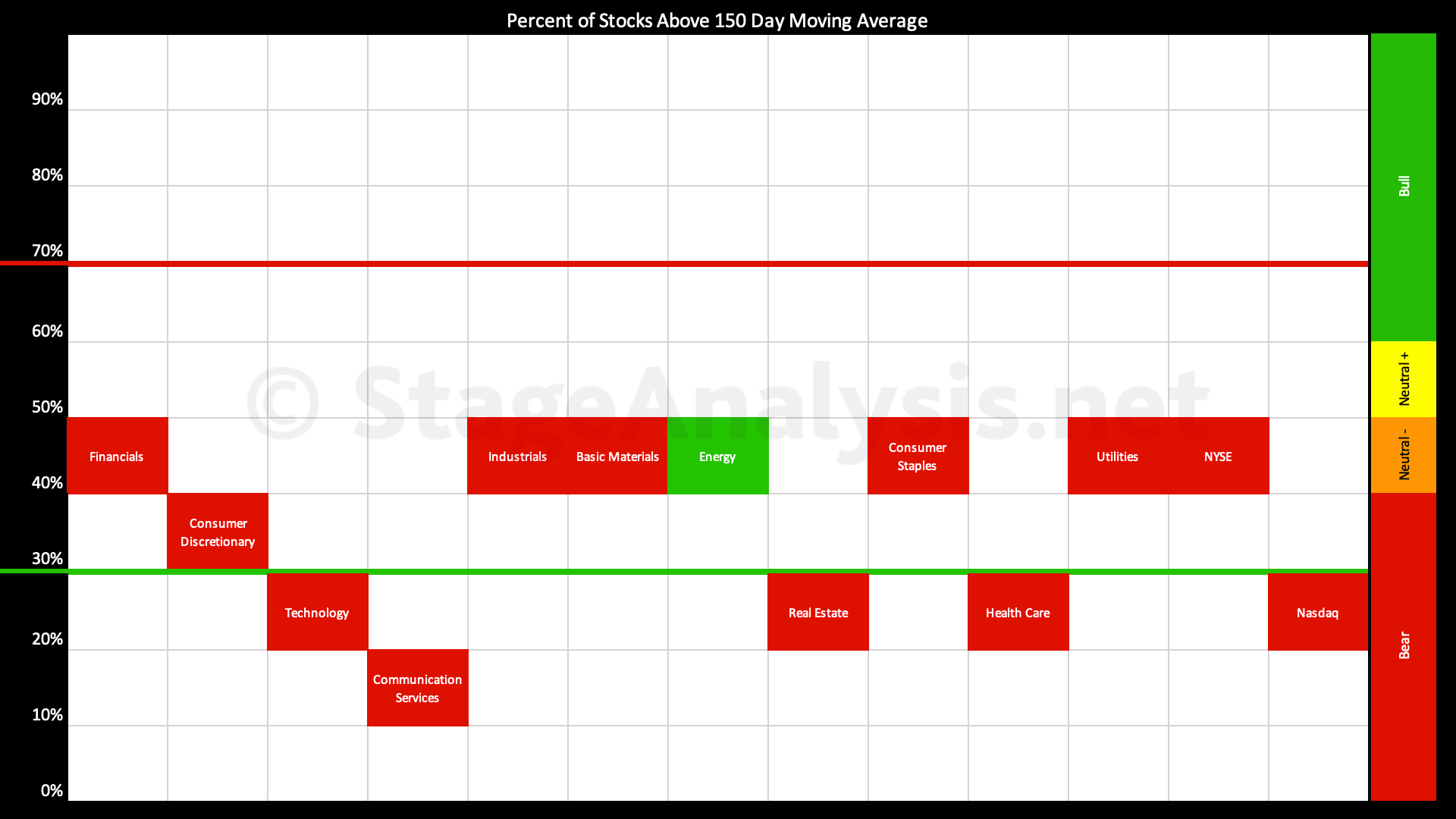

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

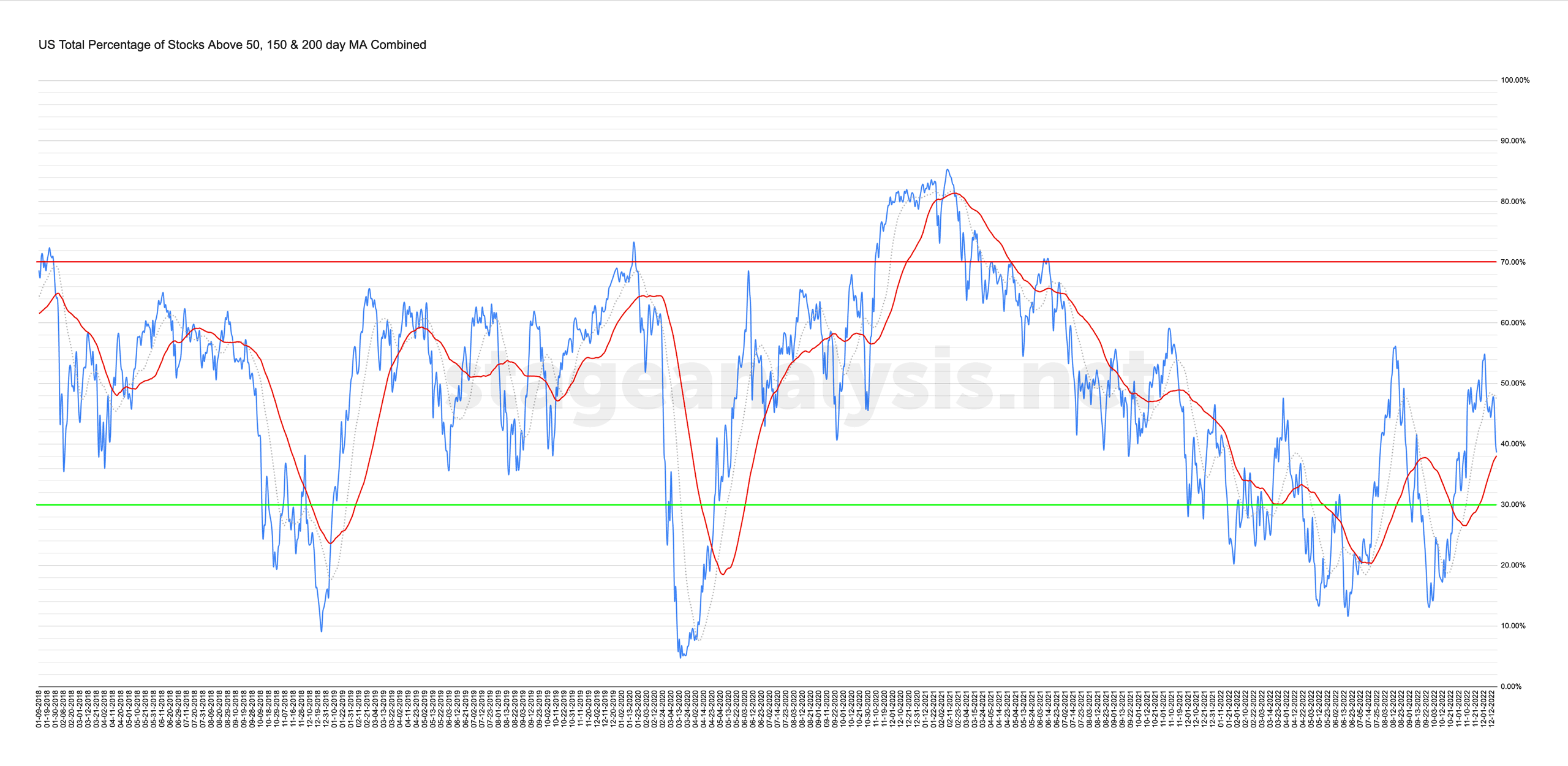

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has declined by -9.72% since the previous post on the 28th November, and so the overall average is now at 36.48% which is tipping it back into the Stage 4 zone once more, which it's spent the majority of 2022 in...

Read More

18 December, 2022

Stage Analysis Members Video – 18 December 2022 (1hr 23mins)

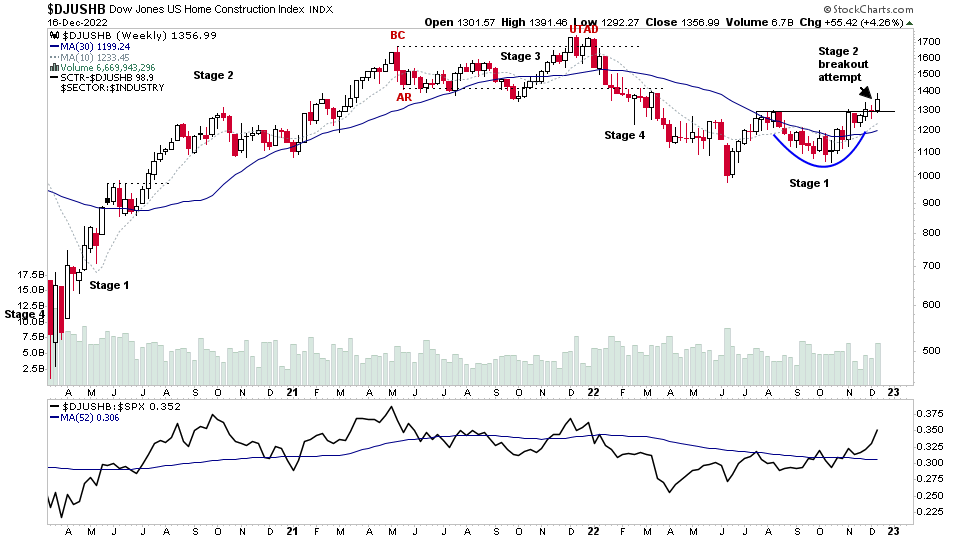

The Stage Analysis members weekend video begins this week with a special focus on the Home Construction Group stocks, of which multiple stocks within the group made a Stage 2 breakout attempt this week against the weak market action...

Read More

17 December, 2022

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

14 December, 2022

Stage Analysis Members Video – 14 December 2022 (1hr 2 mins)

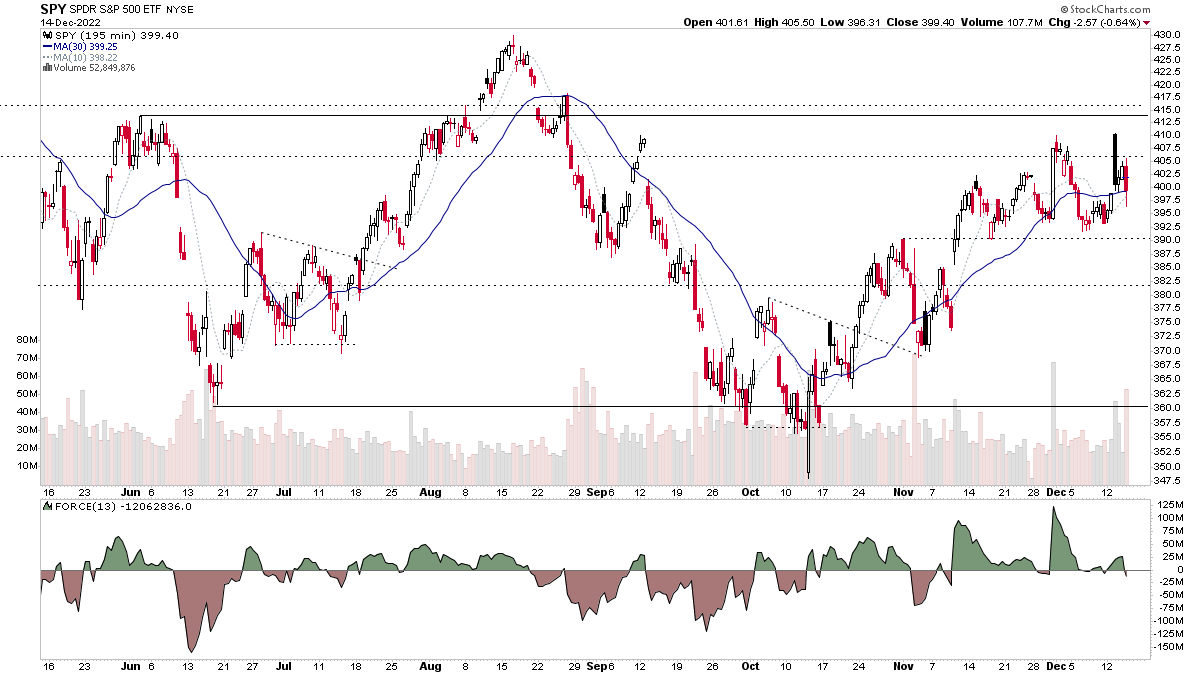

The Stage Analysis members midweek video discussing the S&P 500, VIX and the Dollar Index, short-term market breadth indicators and the US watchlist stocks in more detail with live markups of the individual stocks and group themes.

Read More

11 December, 2022

Stage Analysis Members Video – 11 December 2022 (1hr 5mins)

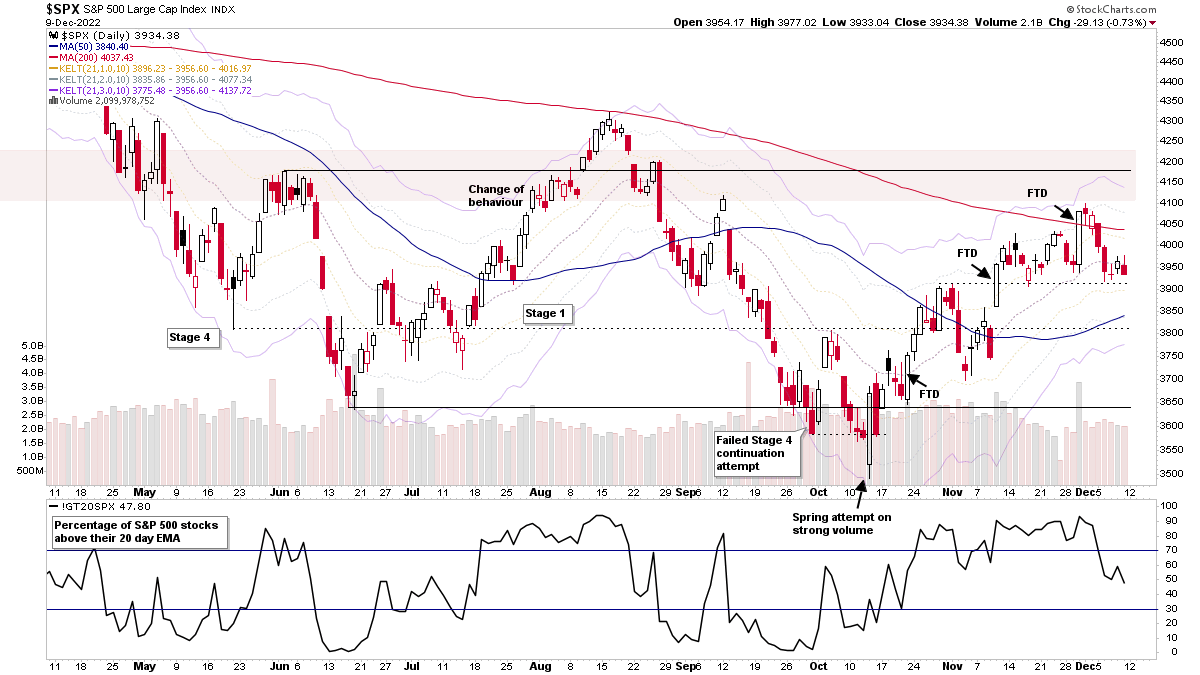

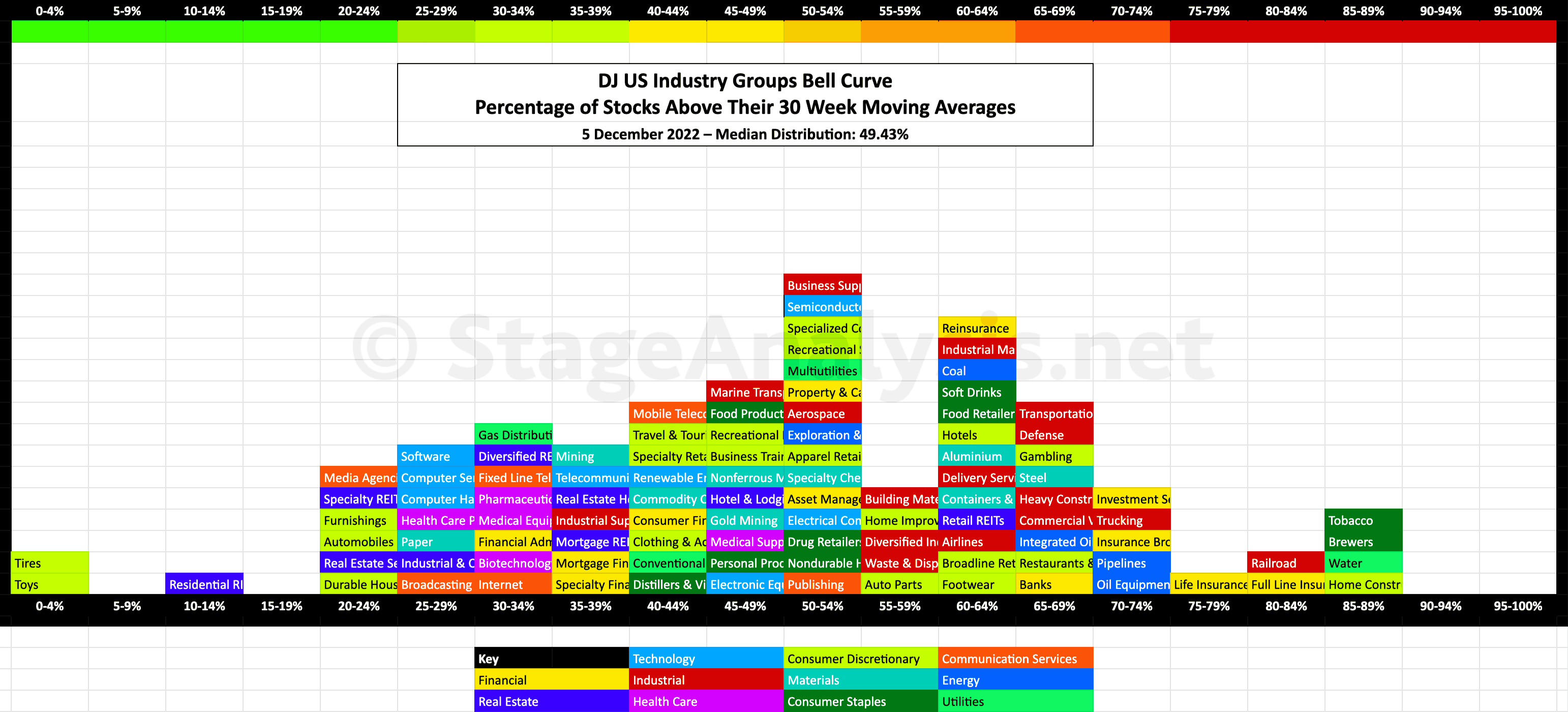

The Stage Analysis members weekend video discussing the market breadth charts to determine the weight of evidence, IBD industry group bell curve – percentage above 30 week MA and the bullish percent, industry groups relative strength, market indexes, and the US watchlist stocks in detail on multiple timeframes.

Read More

10 December, 2022

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

05 December, 2022

US Industry Groups Bell Curve – Exclusive to StageAnalysis.net

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart...

Read More