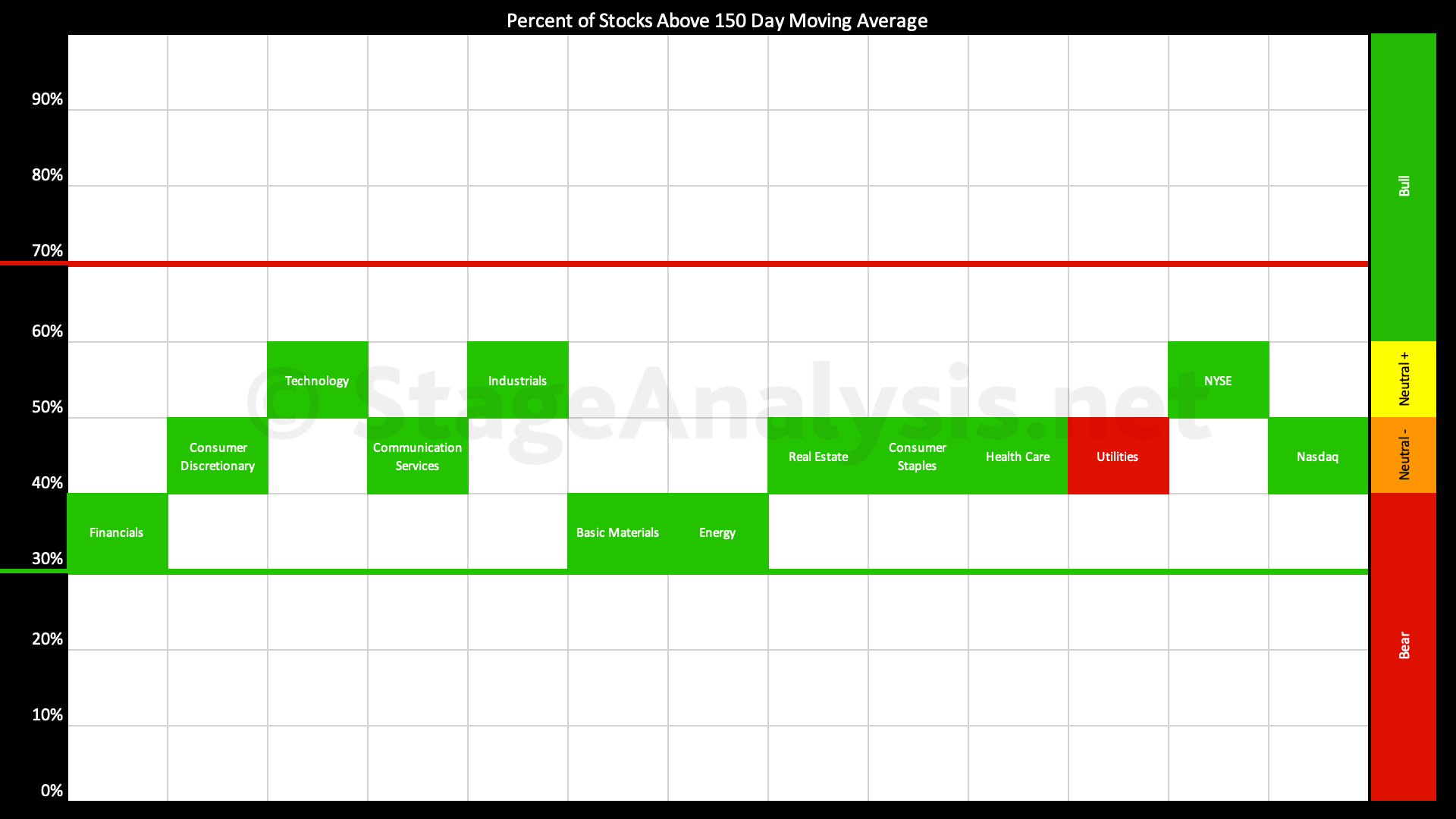

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

Blog

11 June, 2023

Stage Analysis Members Video – 11 June 2023 (1hr 21mins)

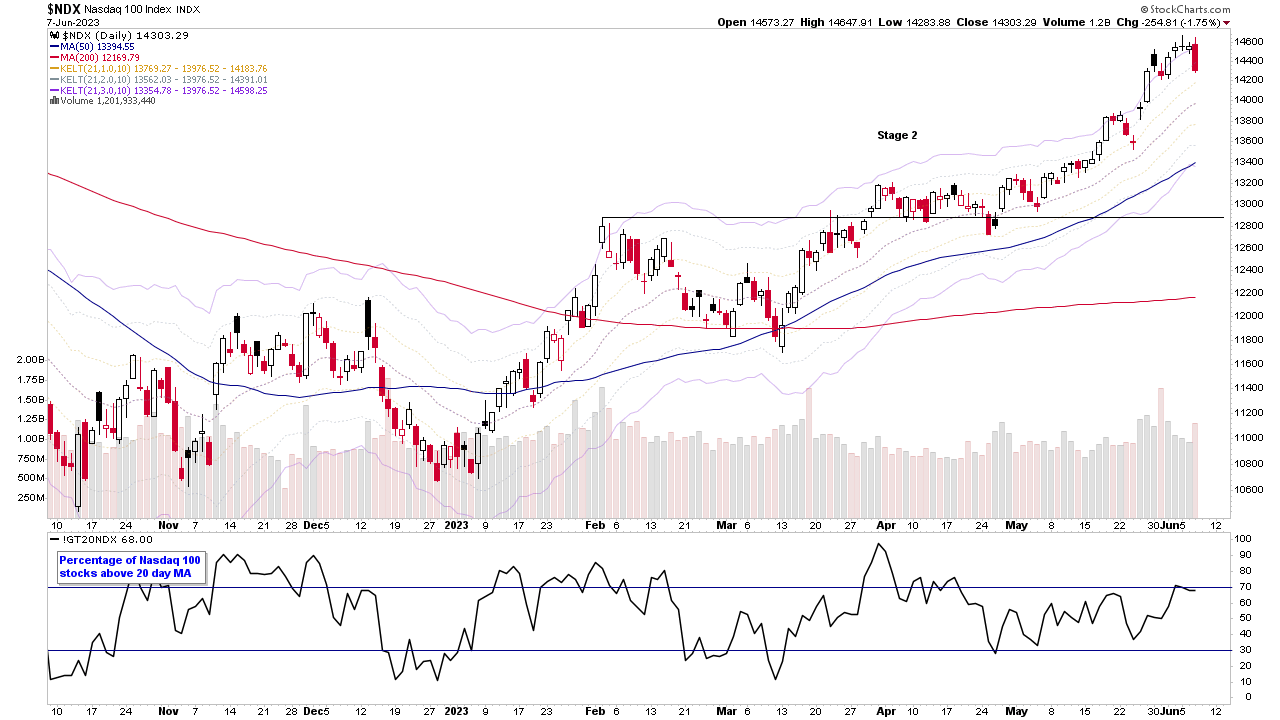

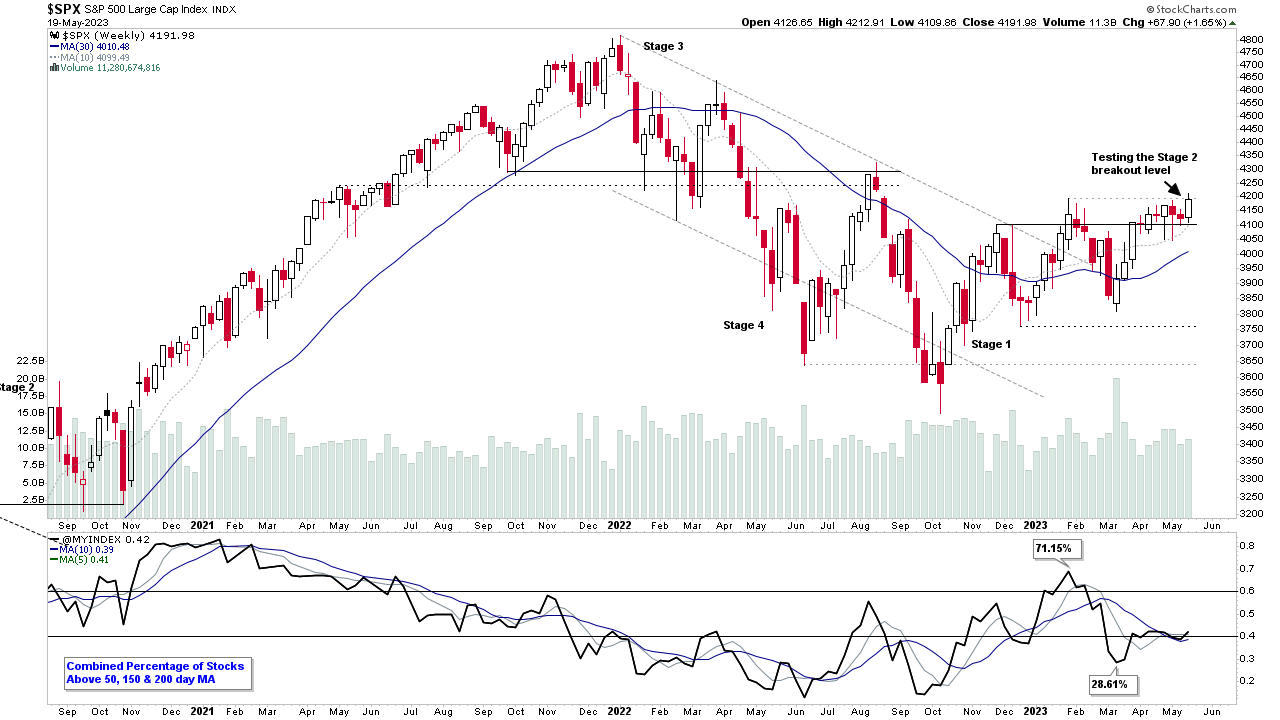

Stage Analysis weekend video beginning with the Major Indexes Update as the Small Caps continues to improve, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update to help to determine the weight of evidence, Stage 2 breakout attempts on volume and lastly discussing the US Watchlist Stocks from the weekend scans in detail on multiple timeframes.

Read More

10 June, 2023

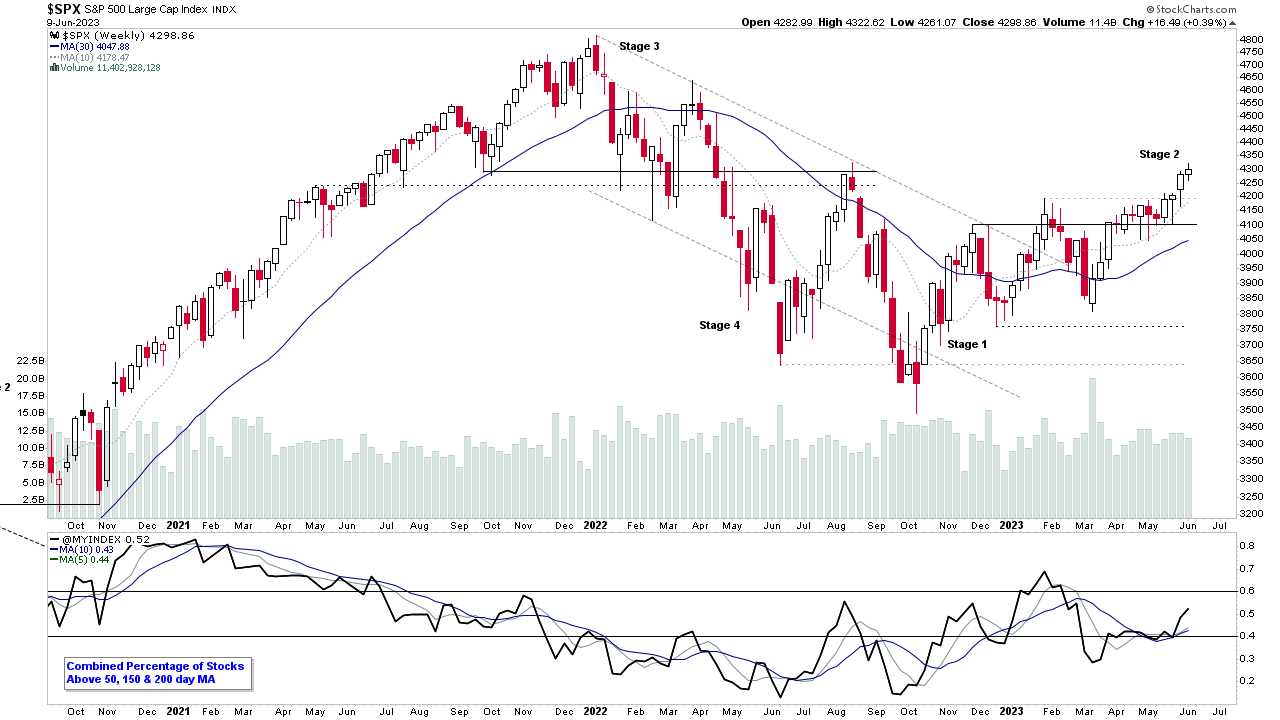

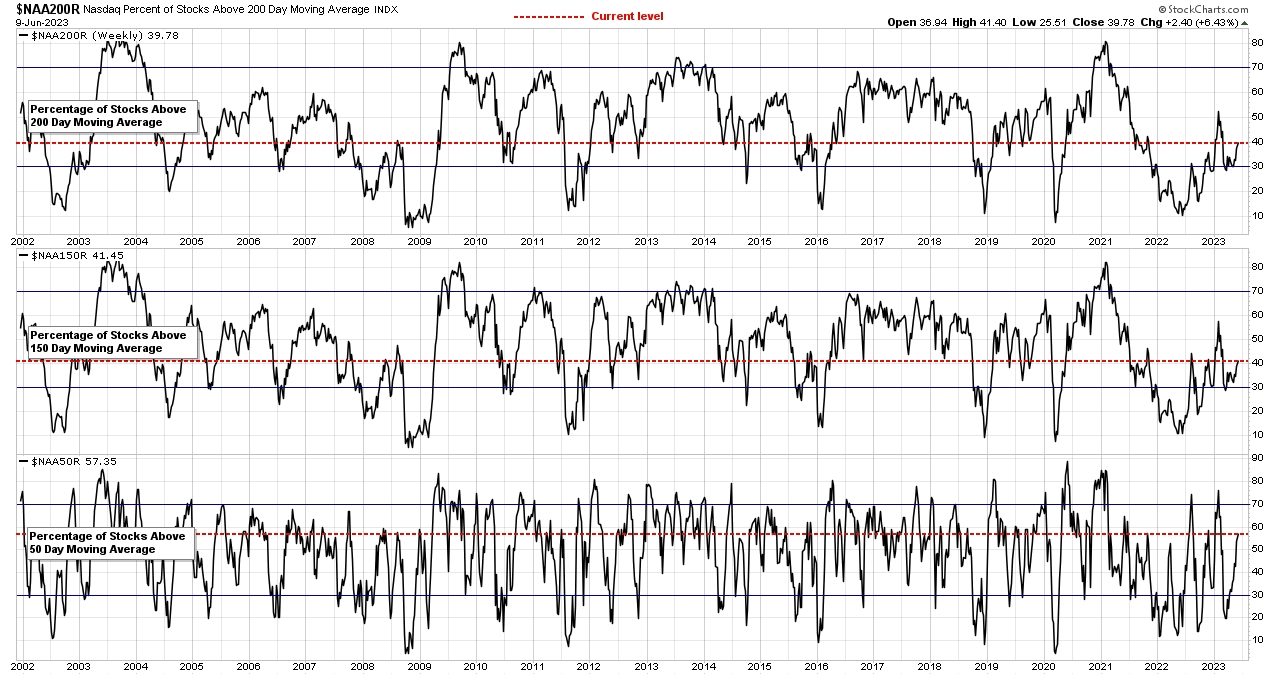

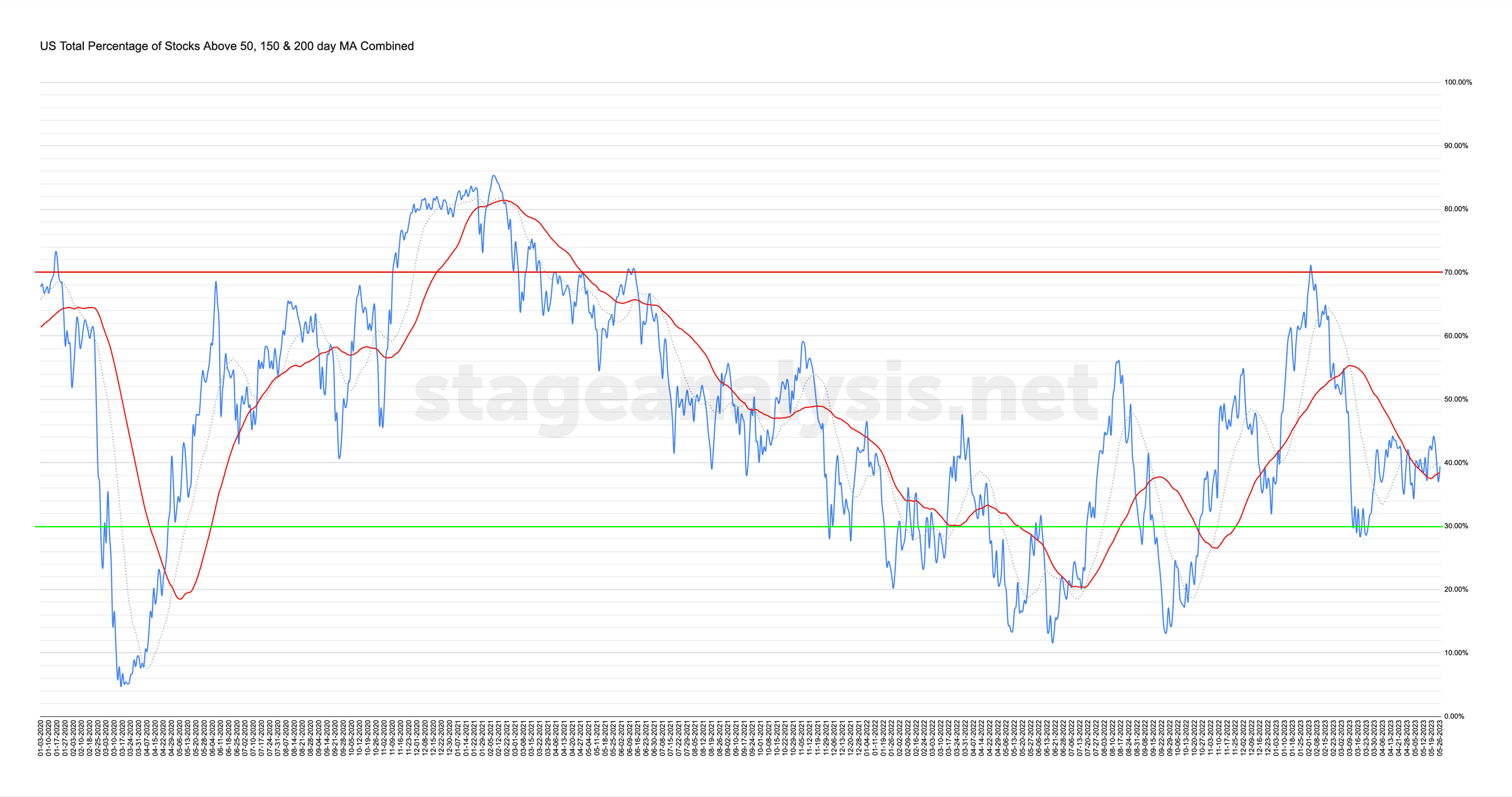

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

07 June, 2023

Stage Analysis Members Video – 7 June 2023 (59 mins)

The Stage Analysis members midweek video this week featuring analysis of the major US Indexes with discussion of the rotation to the Small Caps and NYSE stocks. Plus the short-term market breadth measures, followed by a detailed discussion and live markups of the most recently highlighted stocks for the US stocks watchlist.

Read More

04 June, 2023

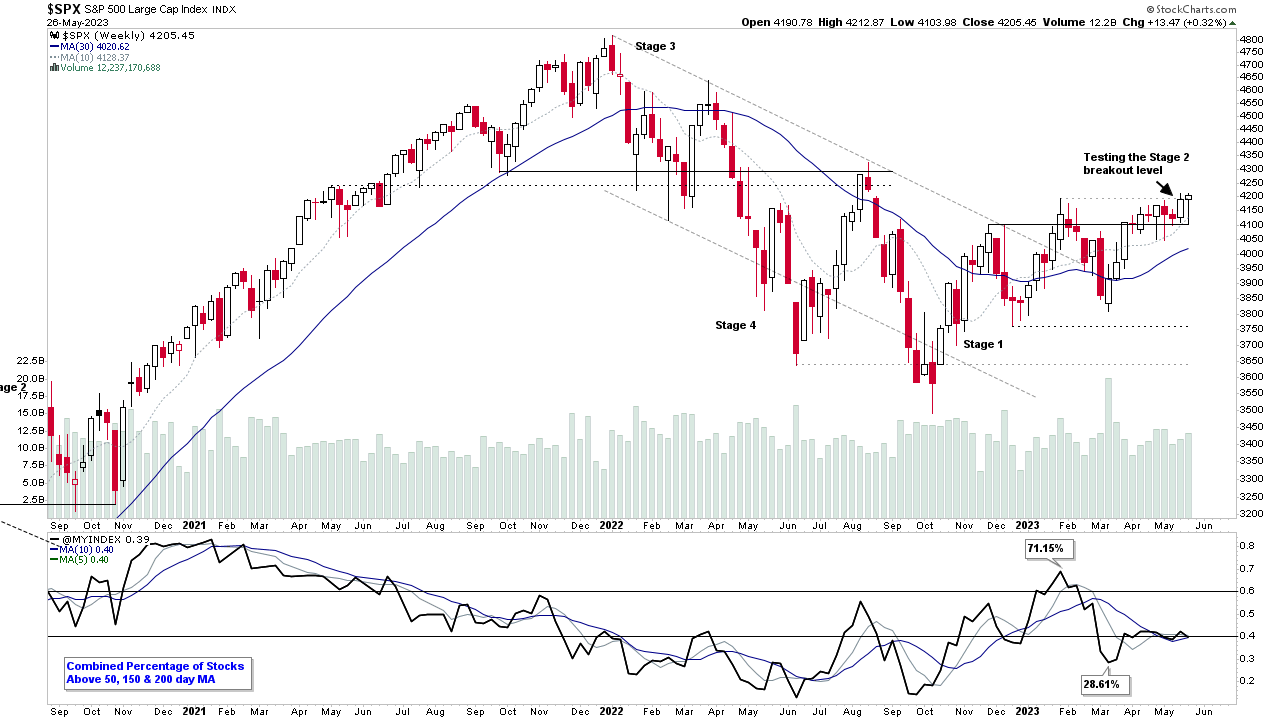

Stage Analysis Members Video – 4 June 2023 (1hr 25mins)

Stage Analysis weekend video featuring the regular weekly member content of the Stage 2 breakout attempts on volume, Major US Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update to help to determine the weight of evidence, and finishing by discussing the US Watchlist Stocks from the weekend scans in detail on multiple timeframes...

Read More

02 June, 2023

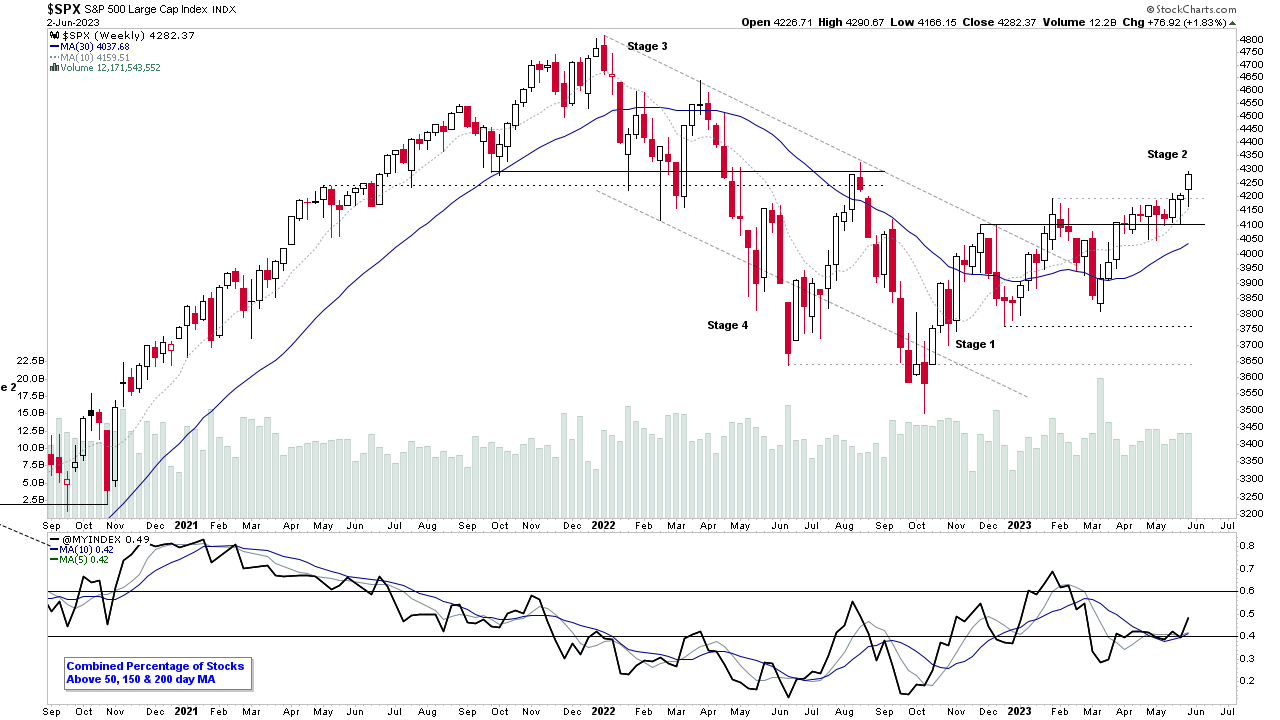

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

29 May, 2023

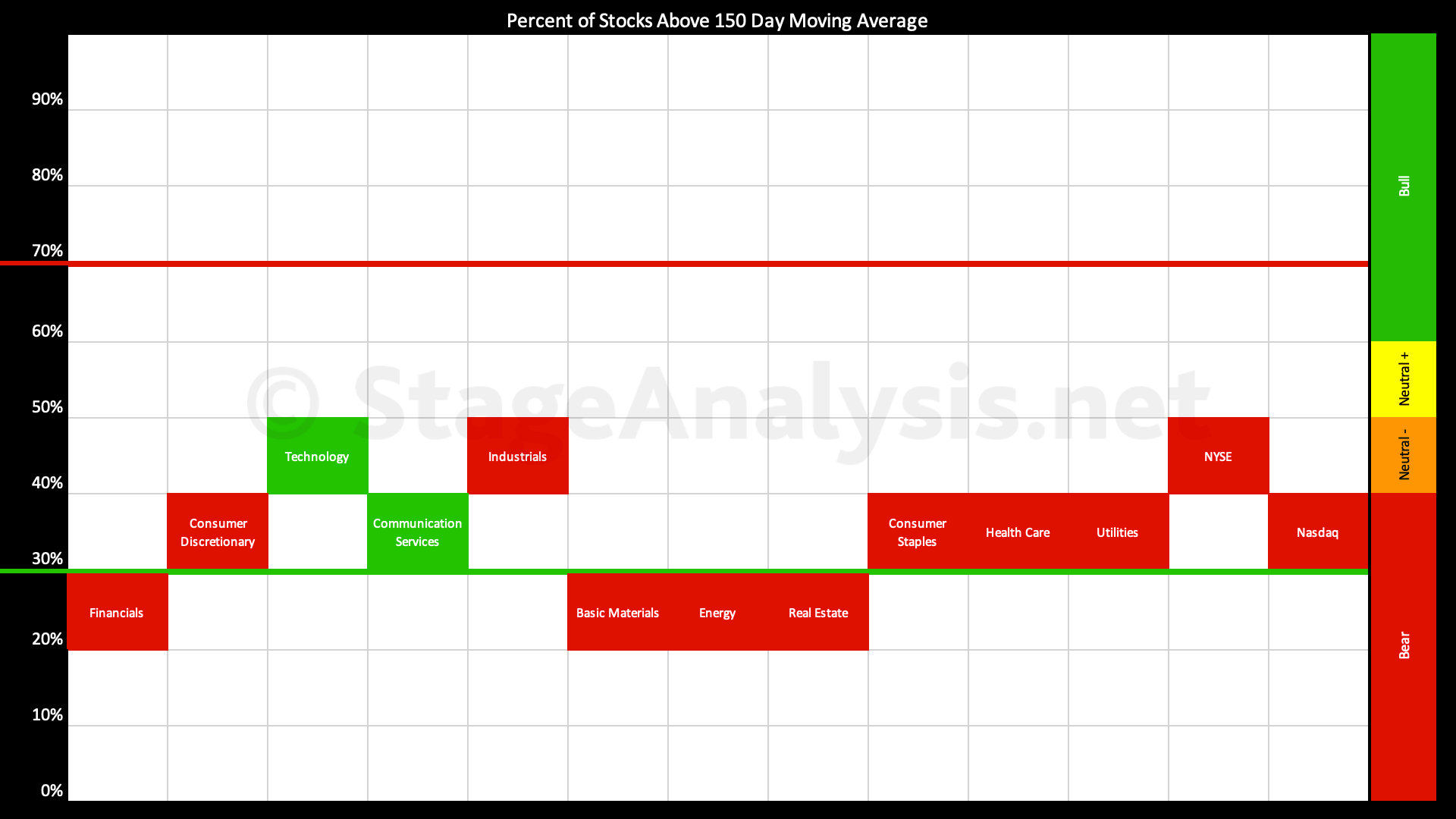

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

28 May, 2023

Stage Analysis Members Video – 28 May 2023 (1hr 27mins)

Stage Analysis weekend video featuring the regular weekly member content of the Major Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update to help to determine the weight of evidence, Stage 2 breakout attempts on volume and finishing by discussing the US Watchlist Stocks from the weekend scans in detail on multiple timeframes.

Read More

27 May, 2023

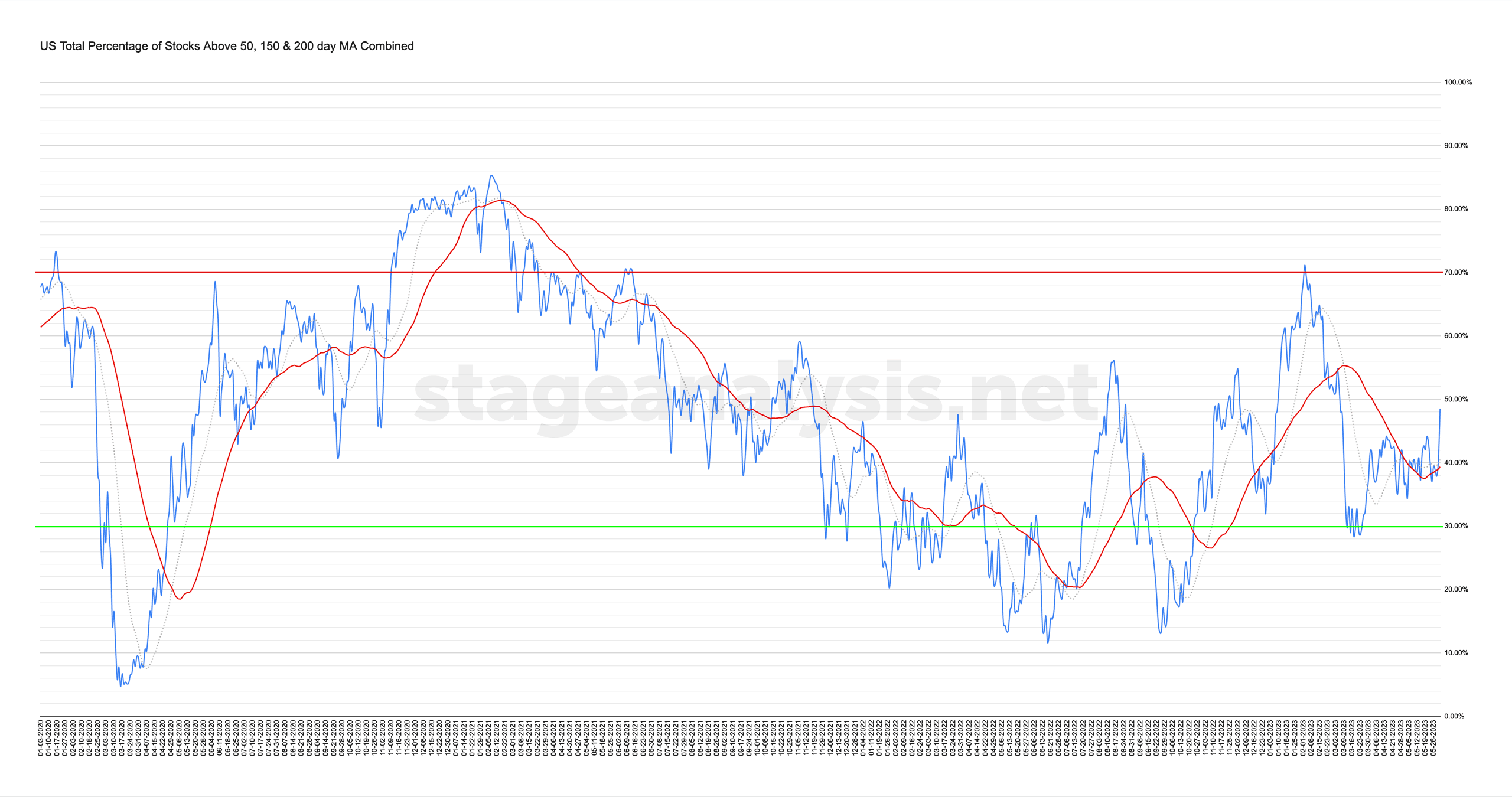

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

21 May, 2023

Stage Analysis Members Video – 21 May 2023 (1hr 14mins)

Stage Analysis weekend video discussing some of the weeks most significant Stage 2 Breakouts and Continuation attempts, plus the regular weekly member content of the Major Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, and Market Breadth Update to help to determine the weight of evidence...

Read More