The Stage Analysis members weekend video begins with a discussion of the major US stocks and how to use the Stage Analysis Screener to find weakness. Followed by the Stages Summary, Relative Strength Rankings, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update and ETFs on the move.

Read More

Blog

23 February, 2025

Stage Analysis Members Video – 23 February 2025 (38mins)

22 February, 2025

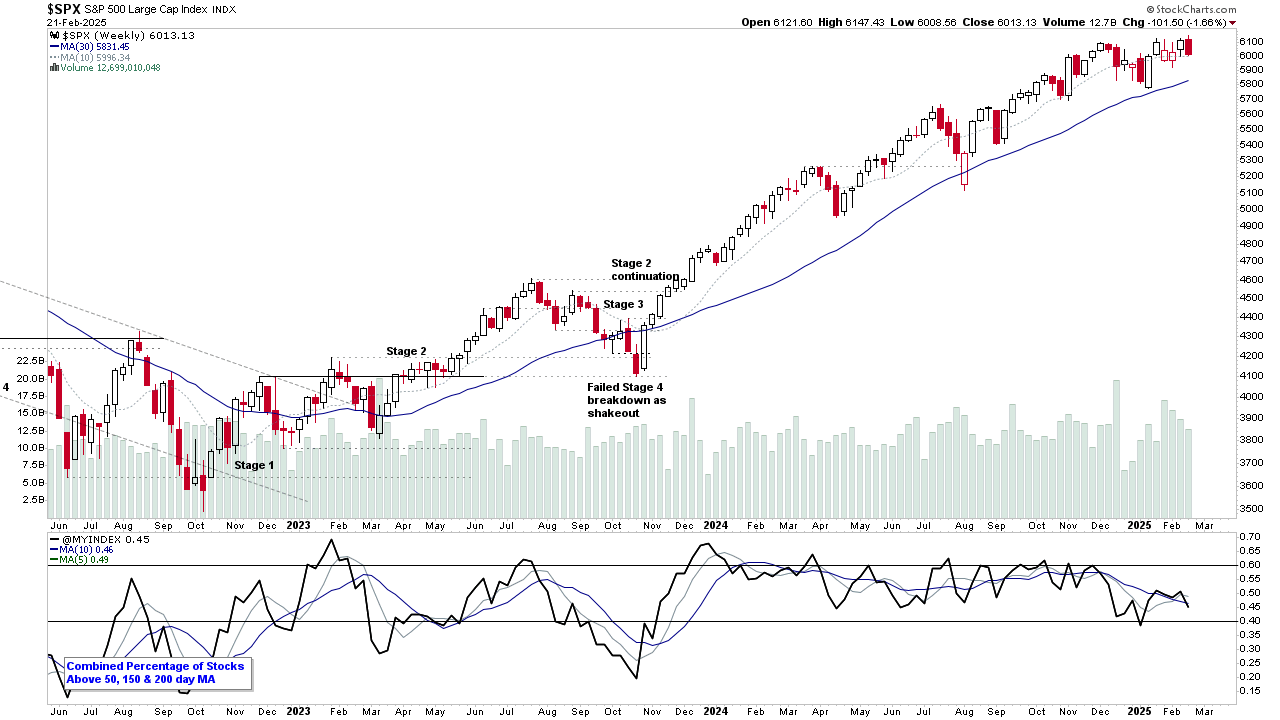

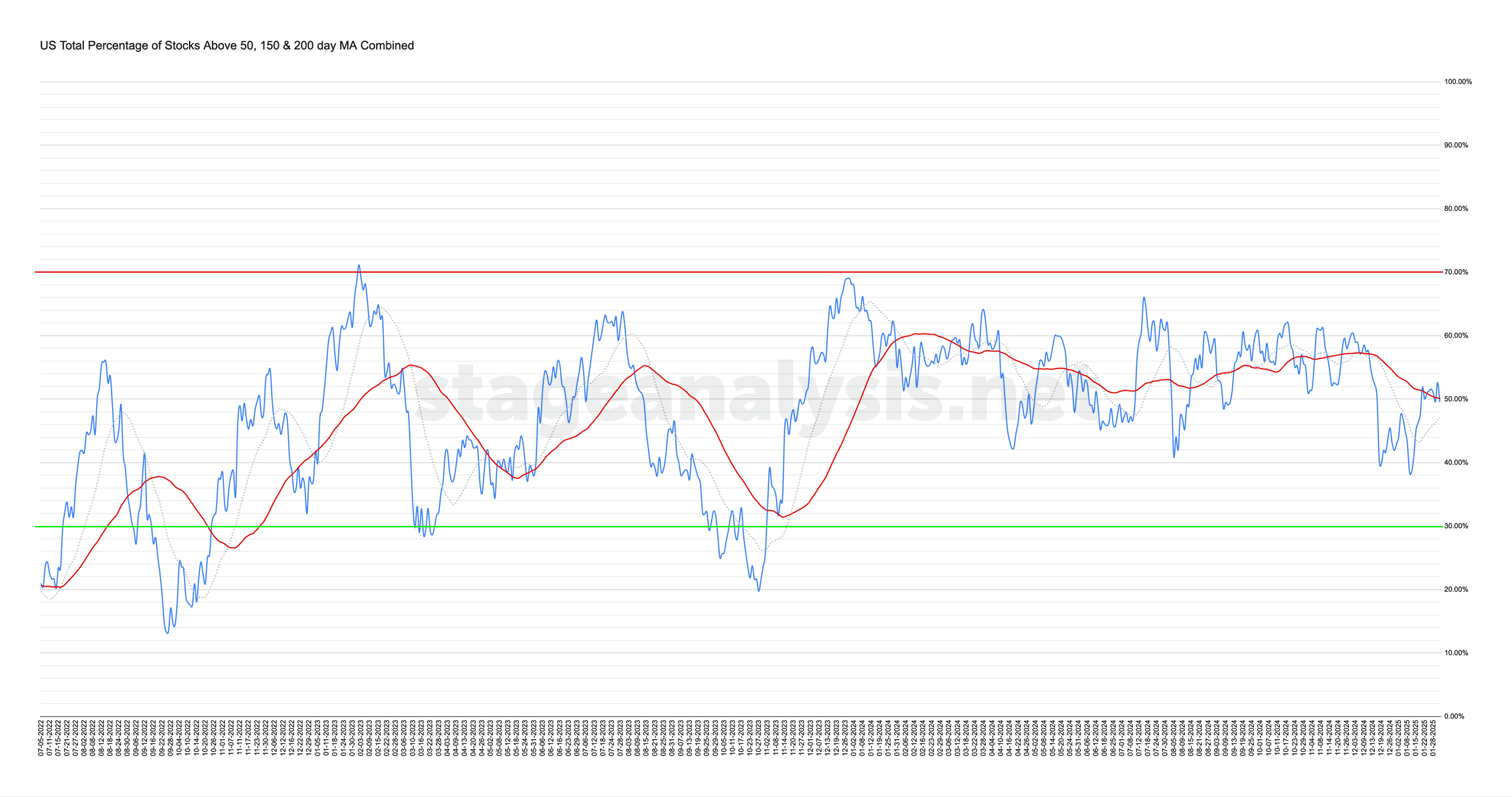

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

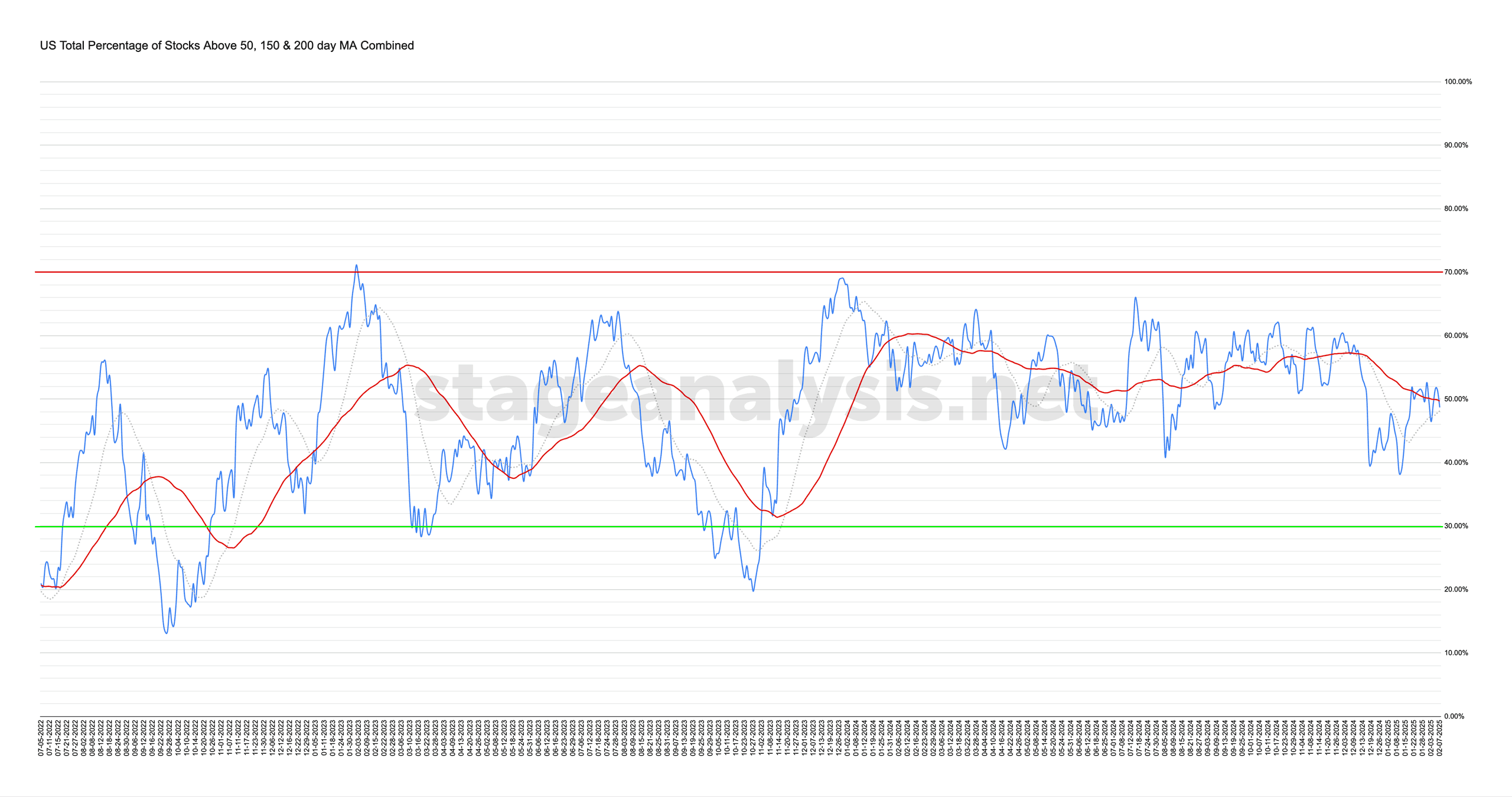

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -5.82% this week. Therefore, the overall combined average is at 45.09% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

20 February, 2025

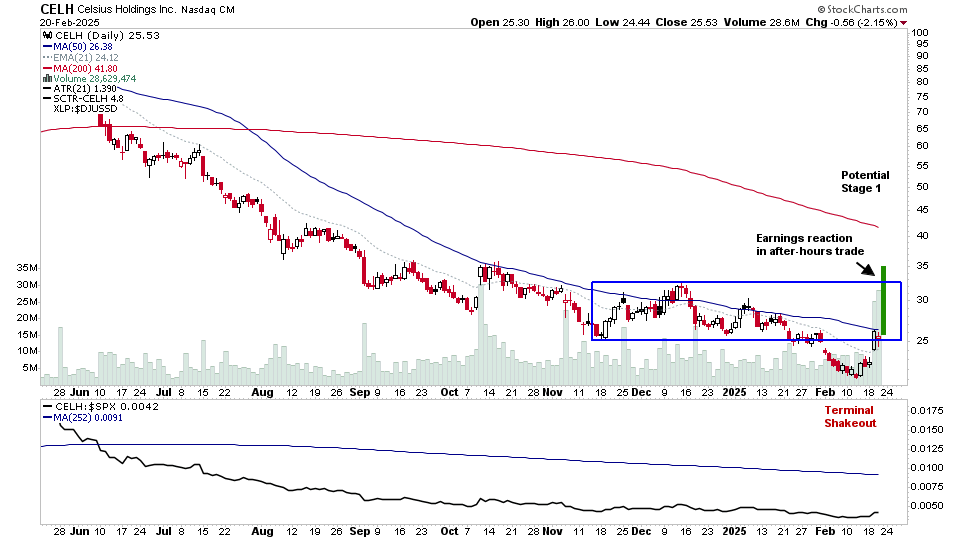

US Stocks Watchlist – 20 February 2025

There were 15 stocks highlighted from the US stocks watchlist scans today...

Read More

16 February, 2025

Stage Analysis Members Video – 16 February 2025 (58mins)

The Stage Analysis members weekend video begins with discussion of the the US Watchlist Stocks in detail on multiple timeframes, Stages Summary including the new Sub-stages summary added this week. Relative Strength Rankings, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update and ETFs on the move.

Read More

13 February, 2025

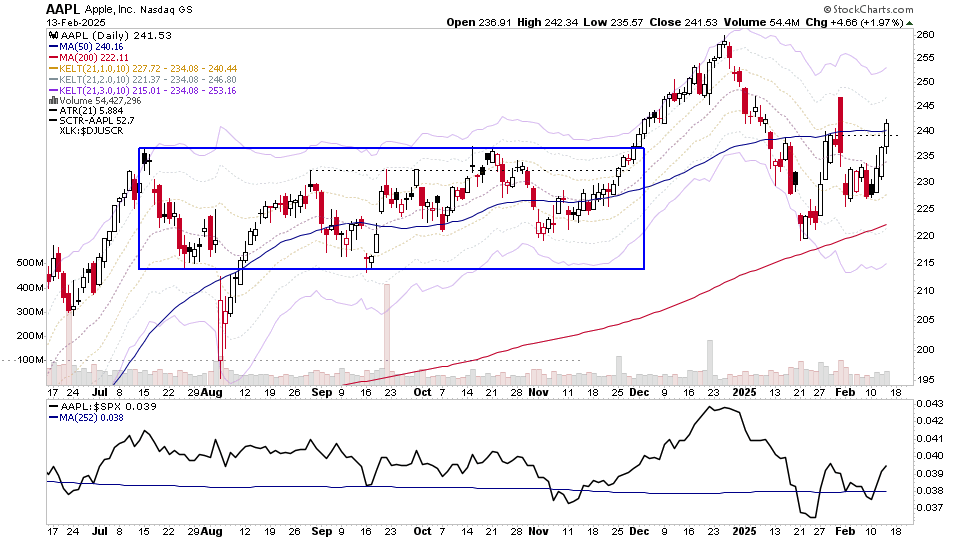

US Stocks Watchlist – 13 February 2025

There were 16 stocks highlighted from the US stocks watchlist scans today...

Read More

09 February, 2025

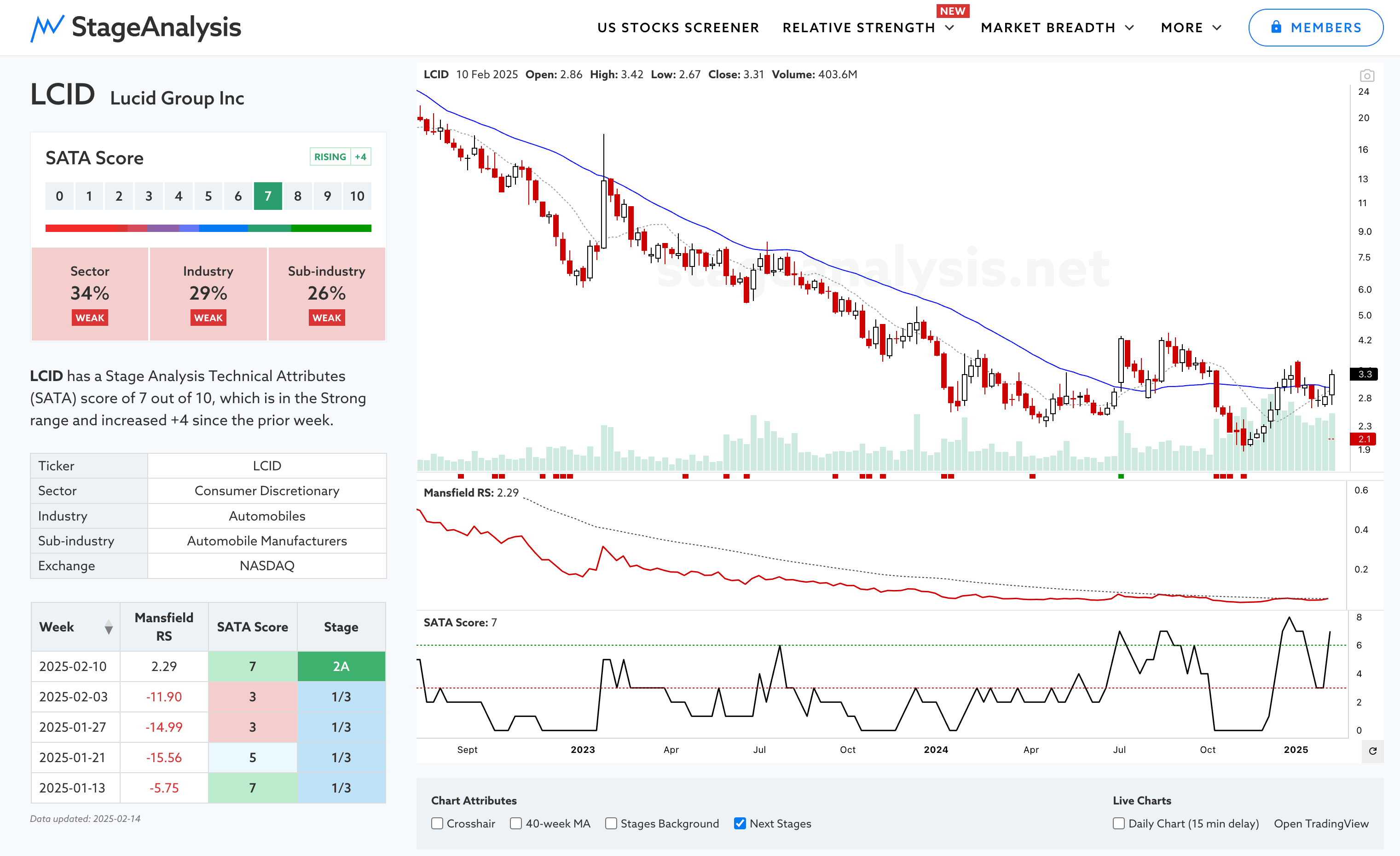

Stage Analysis Members Video – 9 February 2025 (1hr)

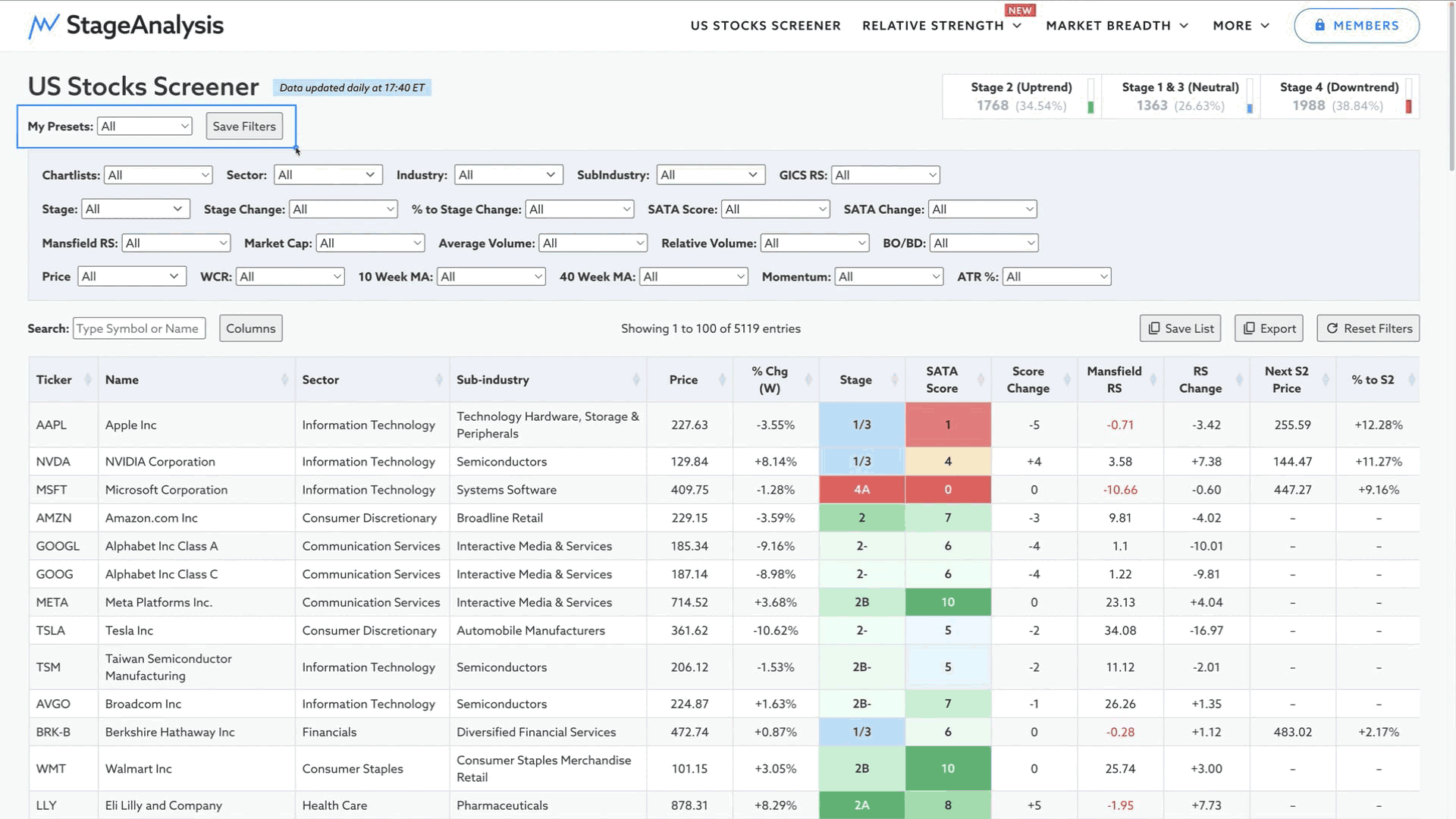

More new features have been added to the Stage Analysis Screener. So we begin the video by discussing how to use the NEW My Presets dropdown that is visible above the filters section. Followed by the US Watchlist Stocks in detail on multiple timeframes, Relative Strength Rankings, the Sector breadth and Sub-industries Bell Curves, the key Market Breadth Charts to determine the Weight of Evidence, Bitcoin & Ethereum and the Major US Stock Market Indexes Update and ETFs on the move.

Read More

08 February, 2025

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -0.84% this week. Therefore, the overall combined average is at 48.68% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More

06 February, 2025

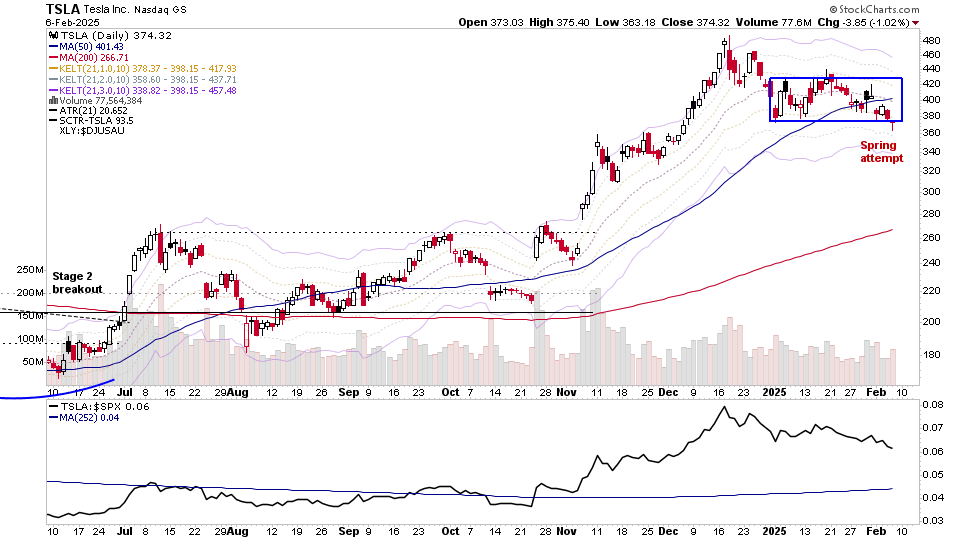

US Stocks Watchlist – 6 February 2025

There were 14 stocks highlighted from the US stocks watchlist scans today...

Read More

02 February, 2025

Stage Analysis Members Video – 2 February 2025 (1hr 13mins)

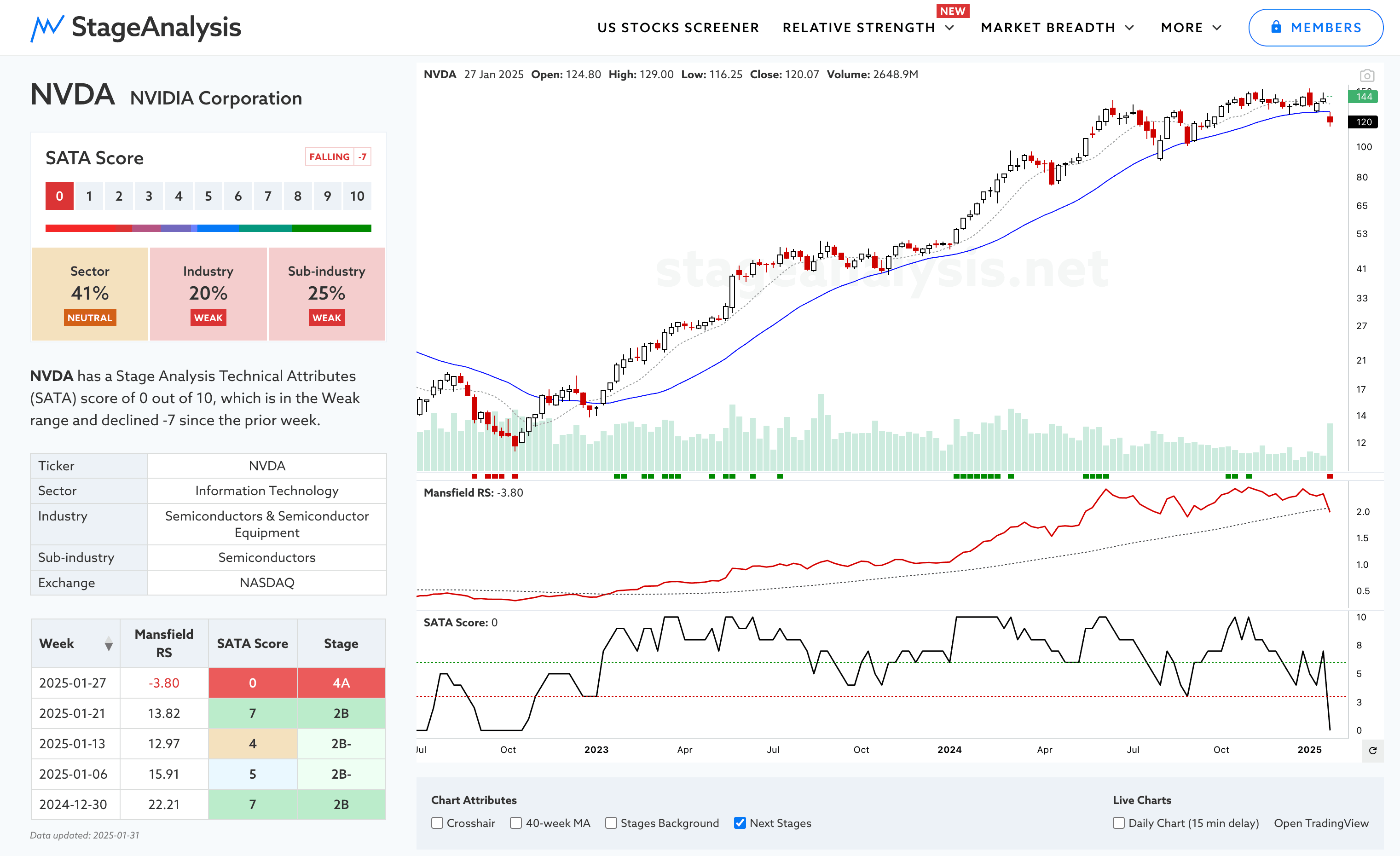

This weeks video starts with a discussion of NVDA, as it made its first Stage 4A breakdown attempt in multiple years. Followed by how to use the new screener filters to find stocks in similar positions to what I show in the US Watchlist Stocks posts each week...

Read More

01 February, 2025

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

The US Total Percentage of Stocks above their 50 Day, 150 Day & 200 Day Moving Averages (shown above) decreased by -1.76% this week. Therefore, the overall combined average is at 49.52% in the US market (NYSE and Nasdaq markets combined) above their short, medium and long term moving averages.

Read More