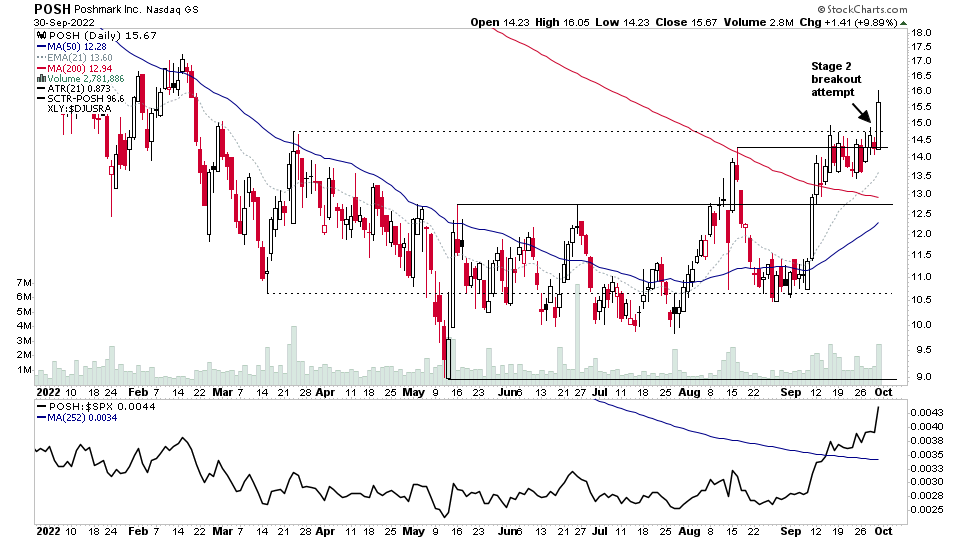

The S&P 500 made a Spring attempt on Monday and surged higher with a short-covering rally for a few days, but stalled at the declining 21-day EMA on Wednesday and Thursday and begin the Test on Friday (which often follows a Spring attempt if supply is still present)...

Read More

Blog

09 October, 2022

Stock Market Update and the US Stocks Watchlist – 9 October 2022

08 October, 2022

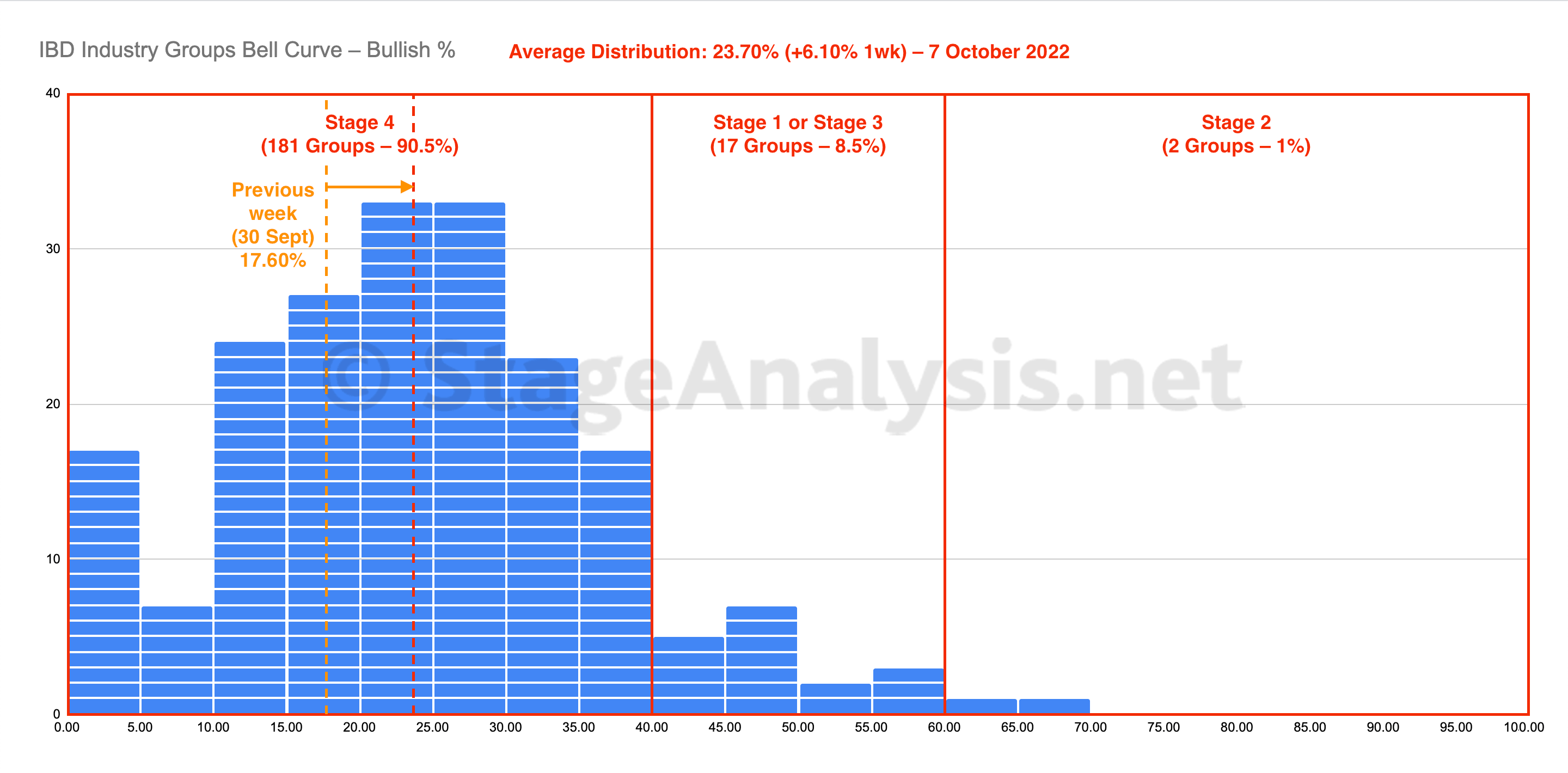

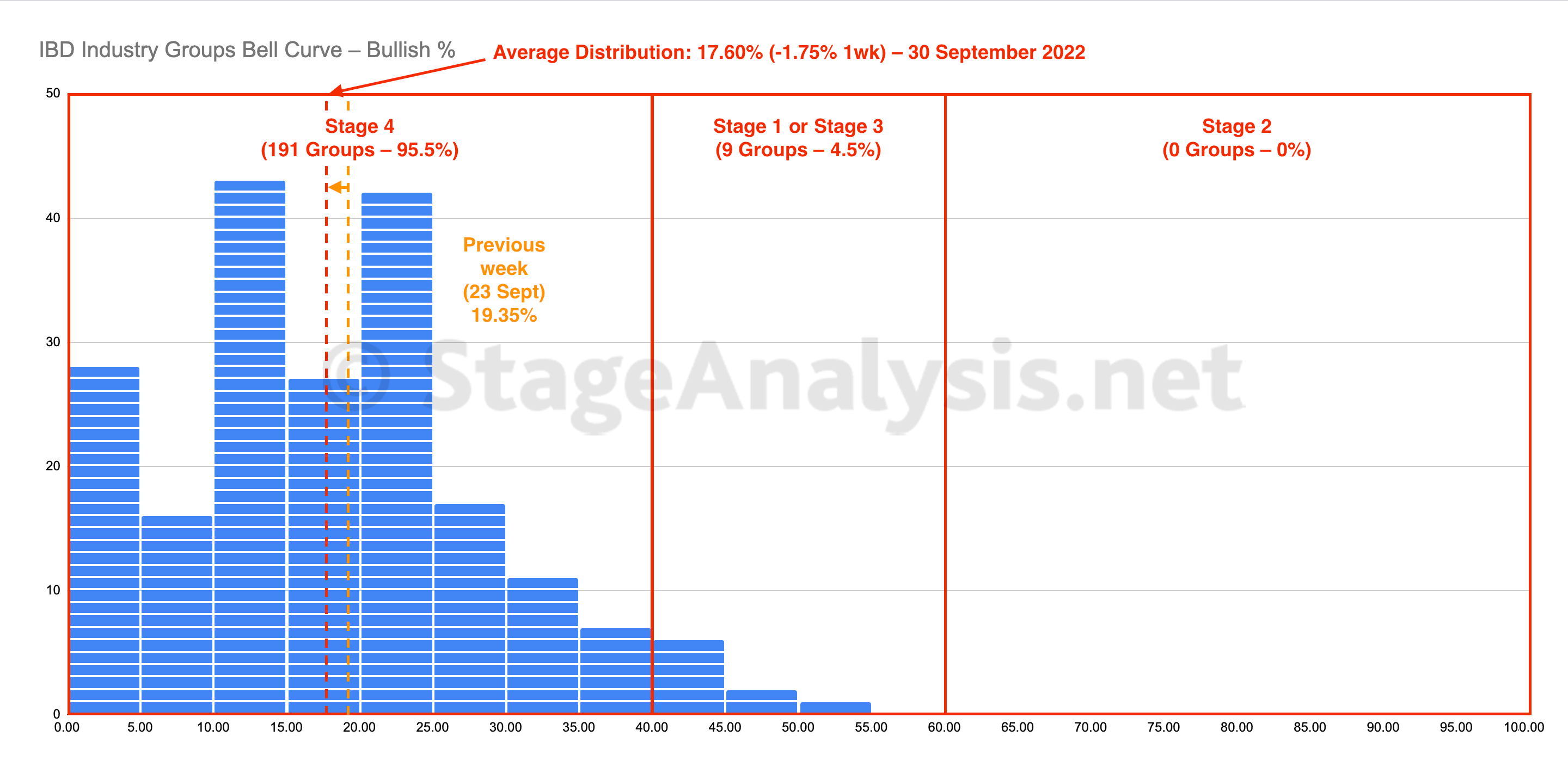

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent recovered from the previous weeks, year to date low and gained +6.10%, to close the week at 23.70%. The vast majority of groups (90.5%) are still in the Stage 4 zone (below the 40% level), but the amount in Stage 4 decreased by 5%...

Read More

08 October, 2022

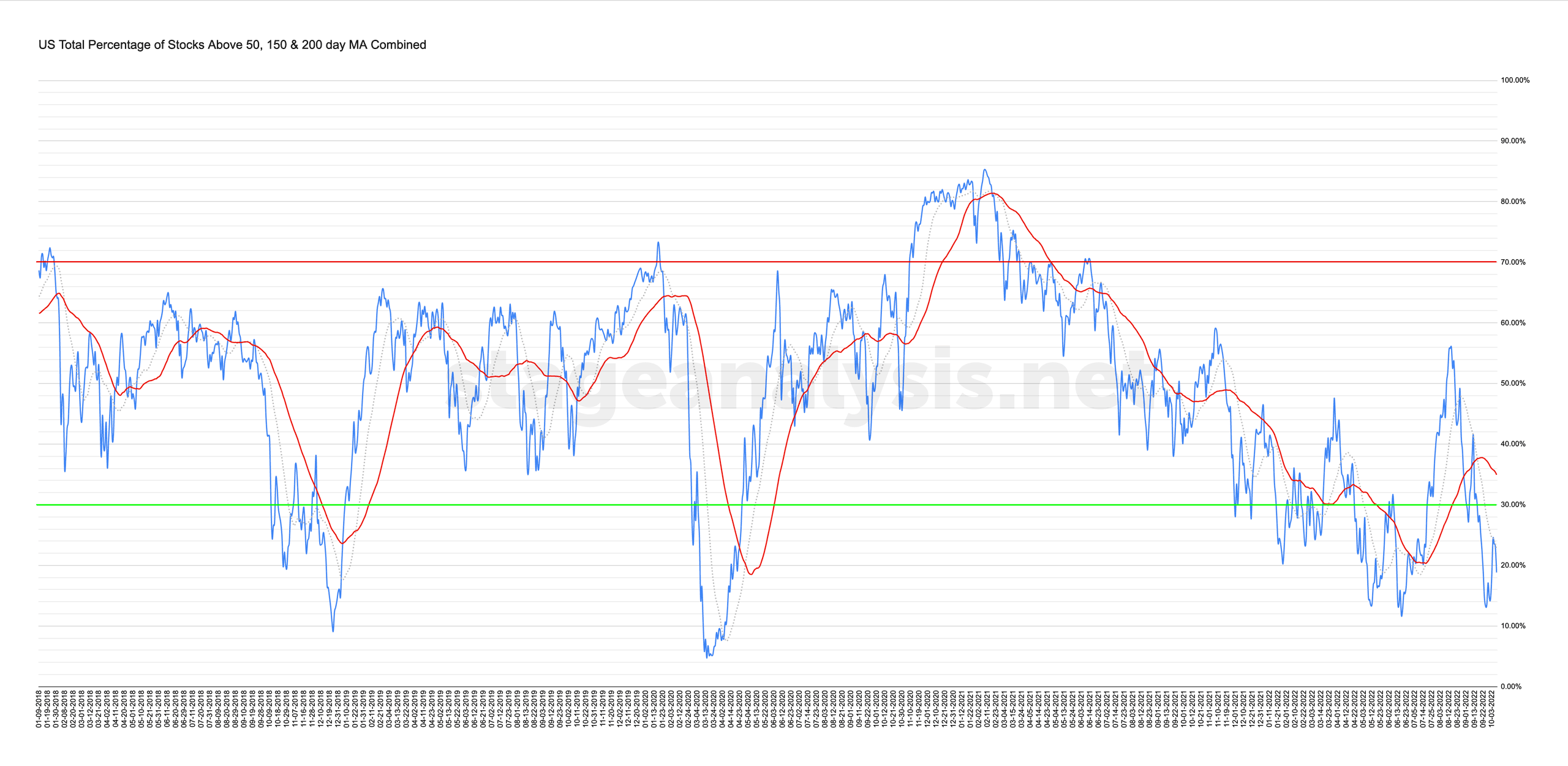

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

08 October, 2022

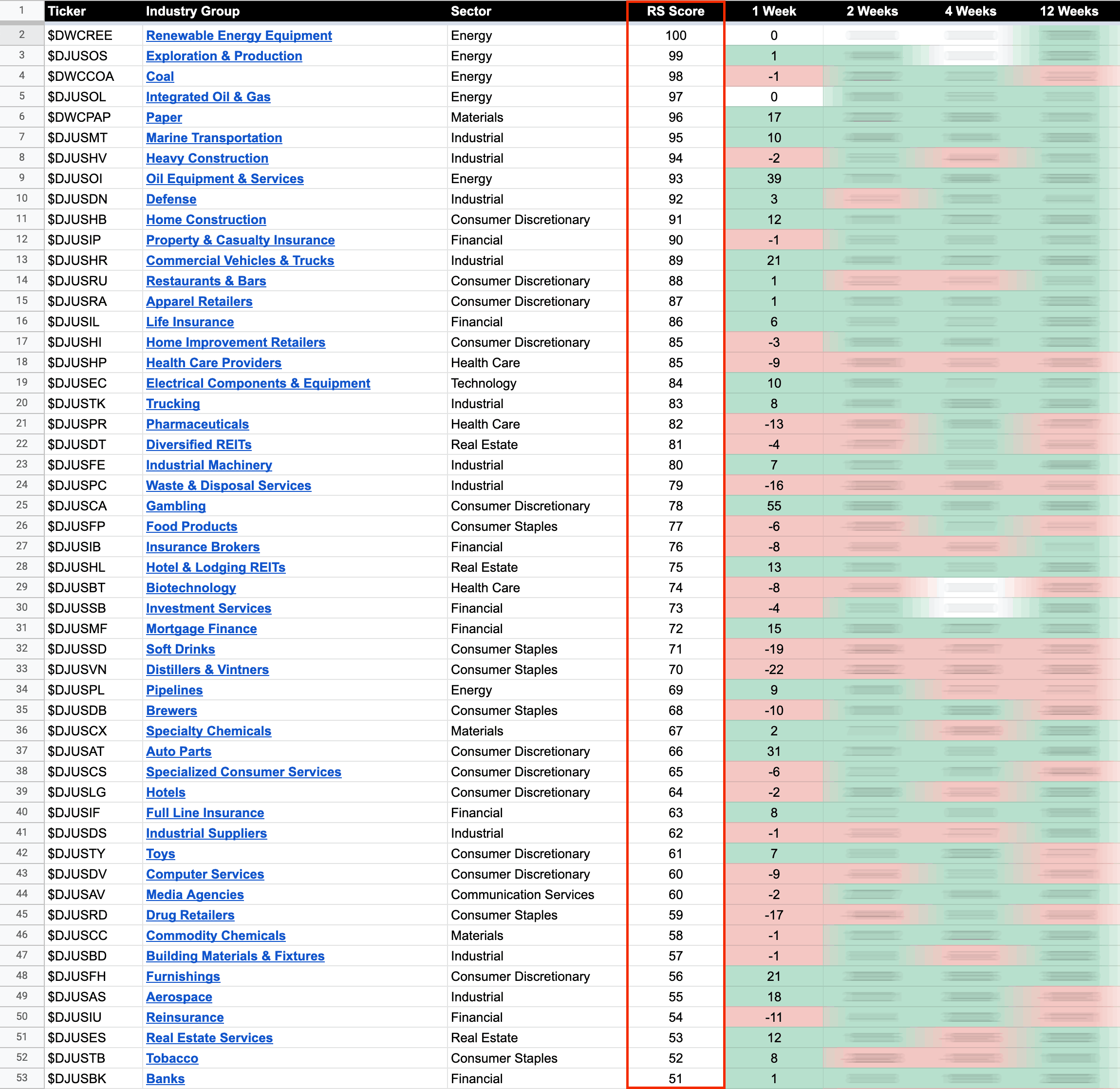

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

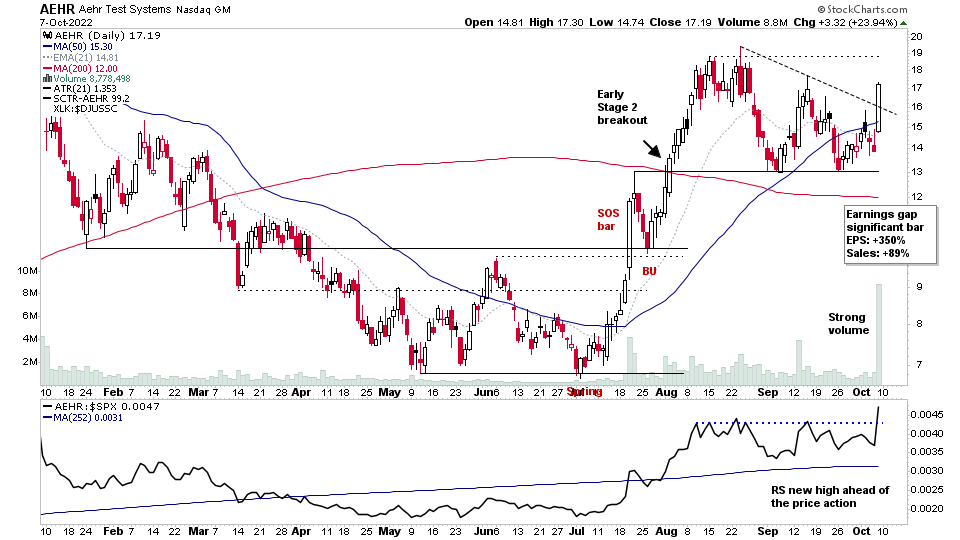

06 October, 2022

Stage Analysis Members Midweek Video – 6 October 2022 (48mins)

The members midweek video discussing the market, short-term market breadth and individual stocks from the watchlist in more detail.

Read More

05 October, 2022

Stock Market Update and the US Stocks Watchlist – 5 October 2022

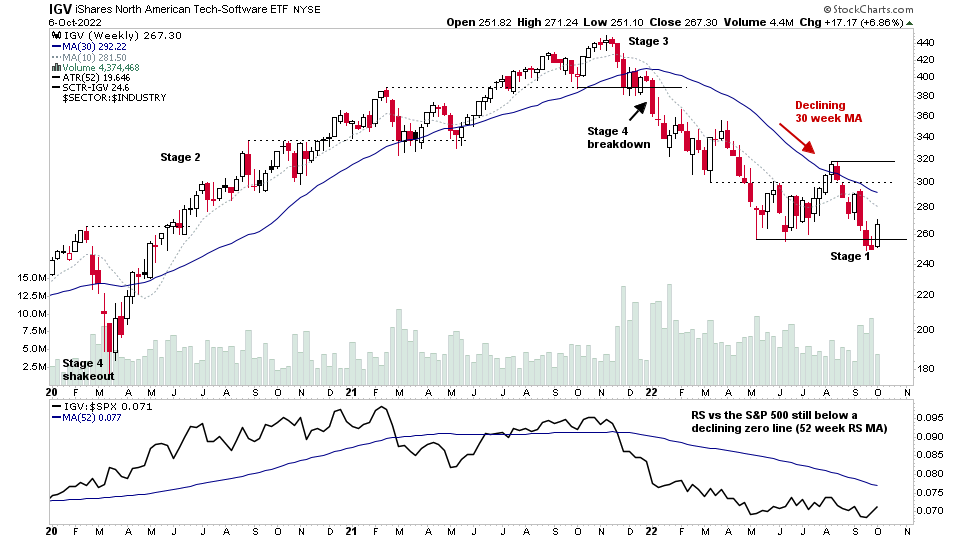

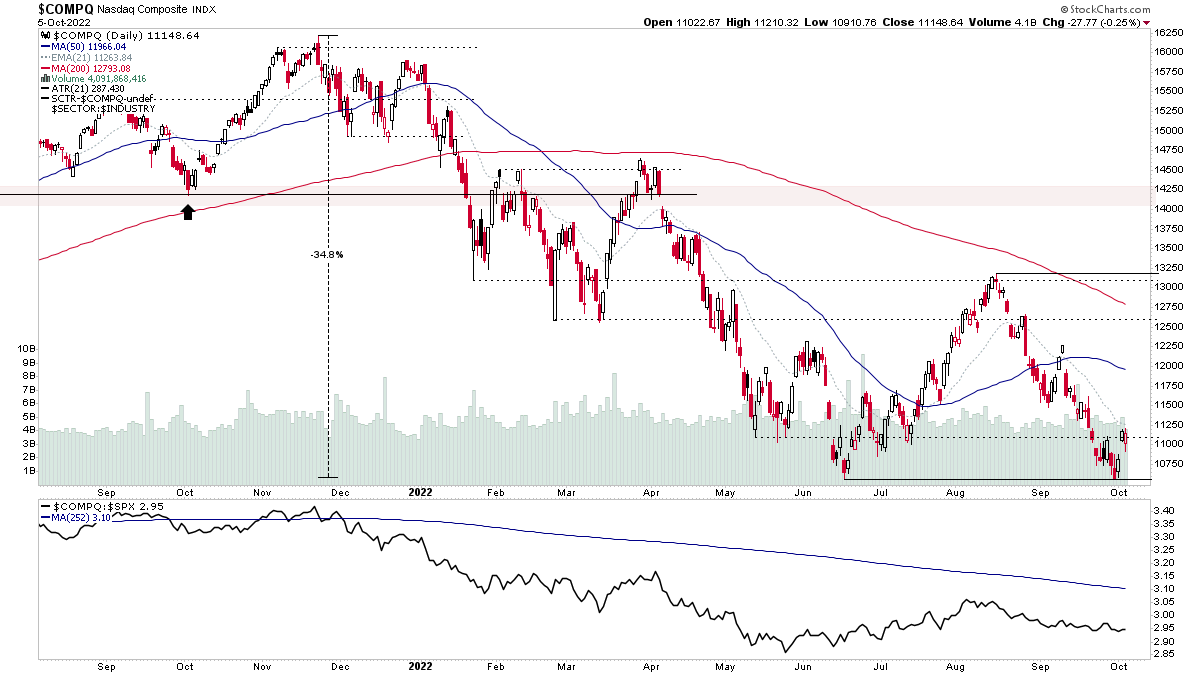

I've led with the Nasdaq Composite in todays post as the watchlist is once again dominated by Software stocks, as numerous stocks in the group continue to develop Stage 1 base structures, and the majority of Software/Technology stocks are listed in the Nasdaq.

Read More

04 October, 2022

Stock Market Update and the US Stocks Watchlist – 4 October 2022

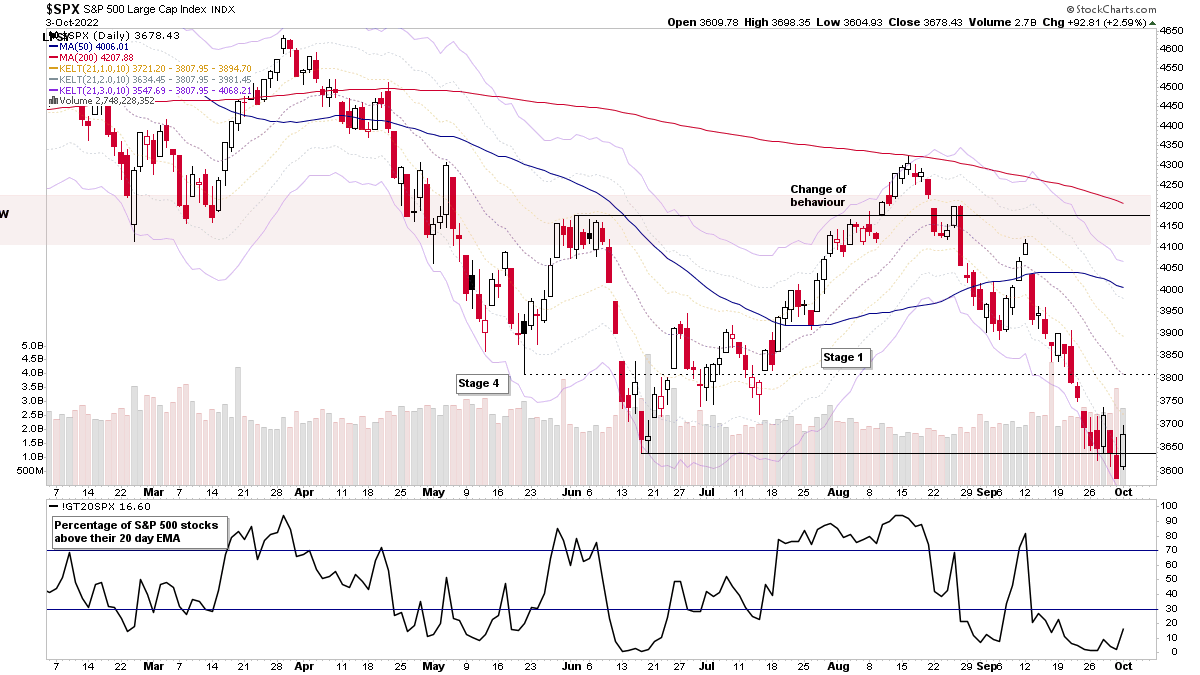

The S&P 500 (shown above) and other major indexes rallied strongly for a second day and the S&P 500 is making a Spring attempt from the lows of the developing range, which may still be potentially a developing Stage 1 base...

Read More

03 October, 2022

Stage Analysis Members Video and US Stocks Watchlist – 3 October 2022

The (delayed) members weekend video discussing the market, industry groups, market breadth and individual stocks from the watchlist in more detail.

Read More

02 October, 2022

US Stocks Watchlist – 2 October 2022

I highlighted the Precious Metals group in the US Stocks Industry Groups Relative Strength Rankings weekend post, and the watchlist scans also picked up a number of stocks from the group potentially transitioning from Stage 4B- towards Stage 1, as the PM group/s had a strong week, while the broad market ended lower breaking down from the recent range...

Read More

02 October, 2022

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent closed at a new low for 2022 with the average distribution at an extreme of 17.60%, which was a further decline of -1.75% on the previous week and has surpassed the 18.81% low set on June 17th...

Read More