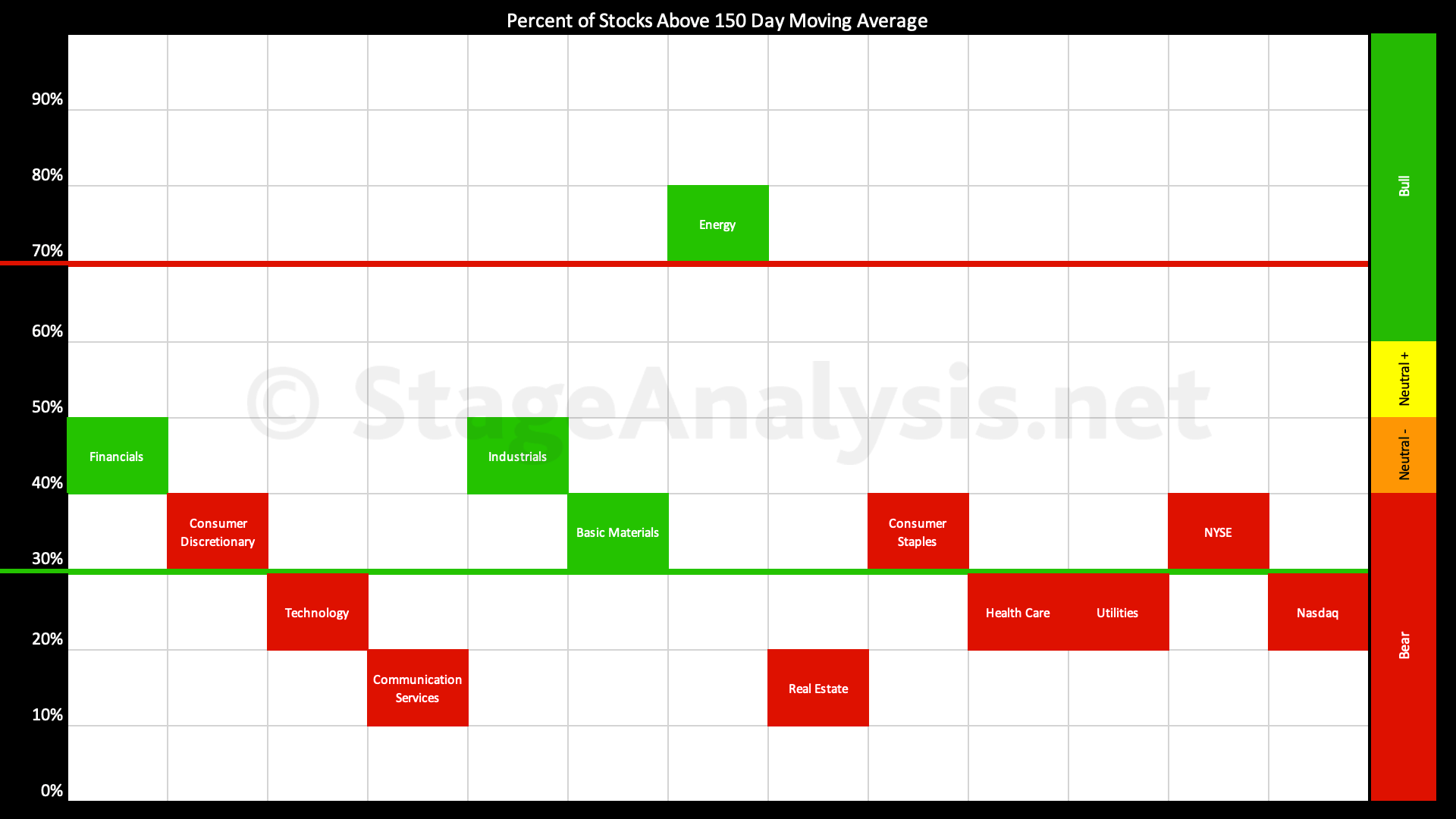

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has improved over the last month since my previous post on the 11th October when it was starting to rebound from lowest reading of the year at 14.76% on the 30th September...

Read More

Blog

09 November, 2022

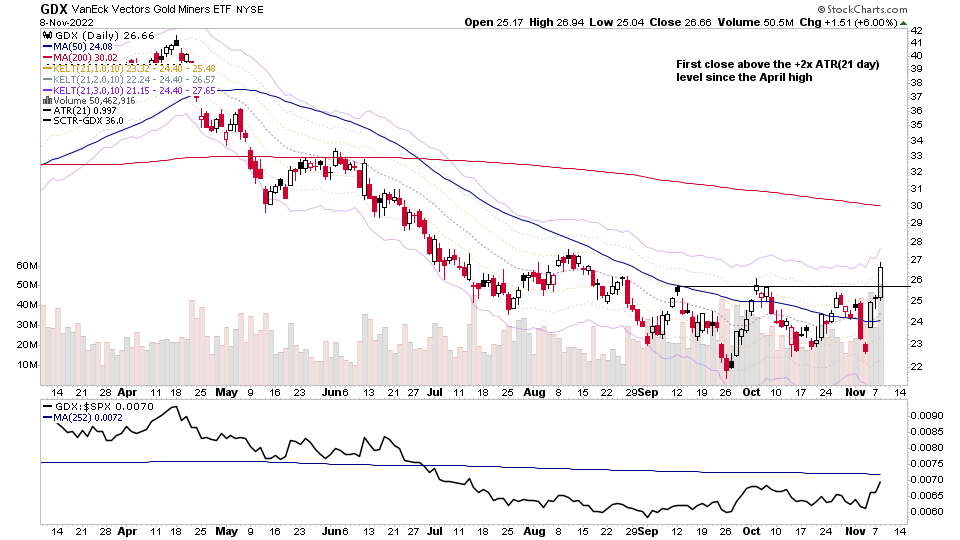

Precious Metals Stocks Showing Strong Relative Strength and the US Stocks Watchlist – 8 November 2022

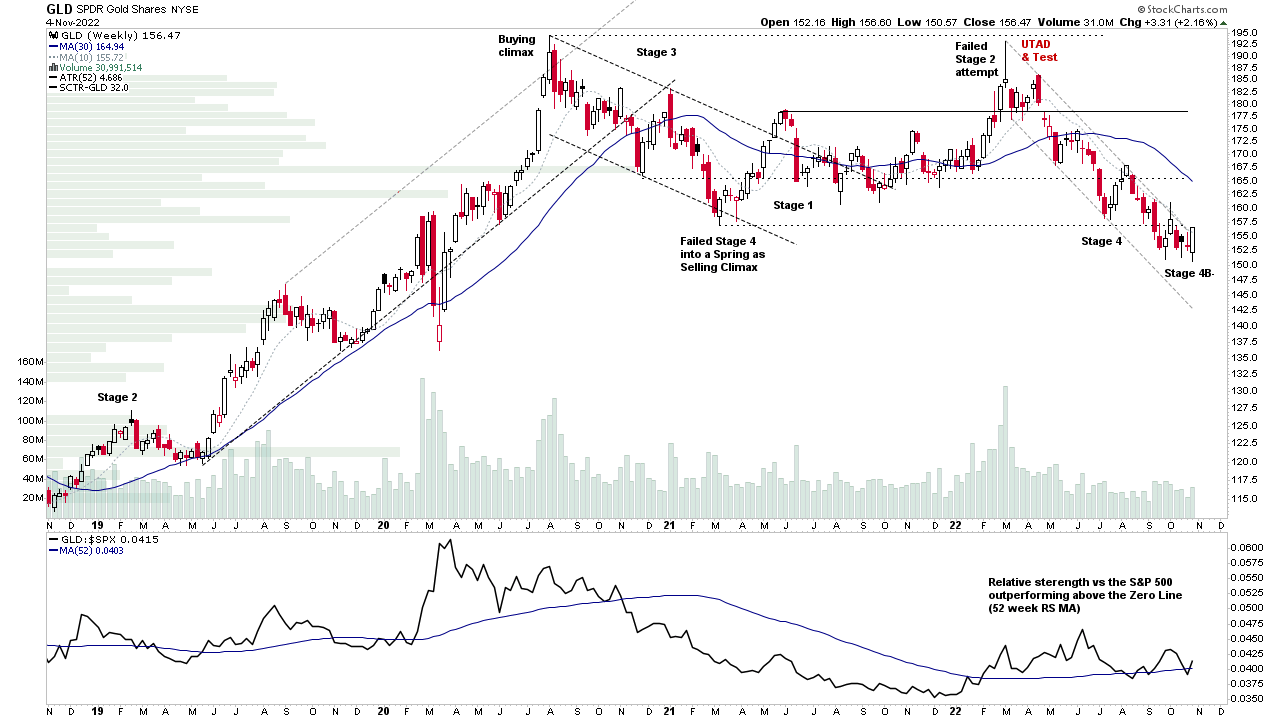

The precious metals stocks – which I did a feature on in the weekend video – showed some the strongest relative strength today with multiple gold and silver stocks breaking out on volume from their recent base structures, and a couple are even attempting early Stage 2 breakouts (CDE & OR), but which still have declining 30 week MAs...

Read More

07 November, 2022

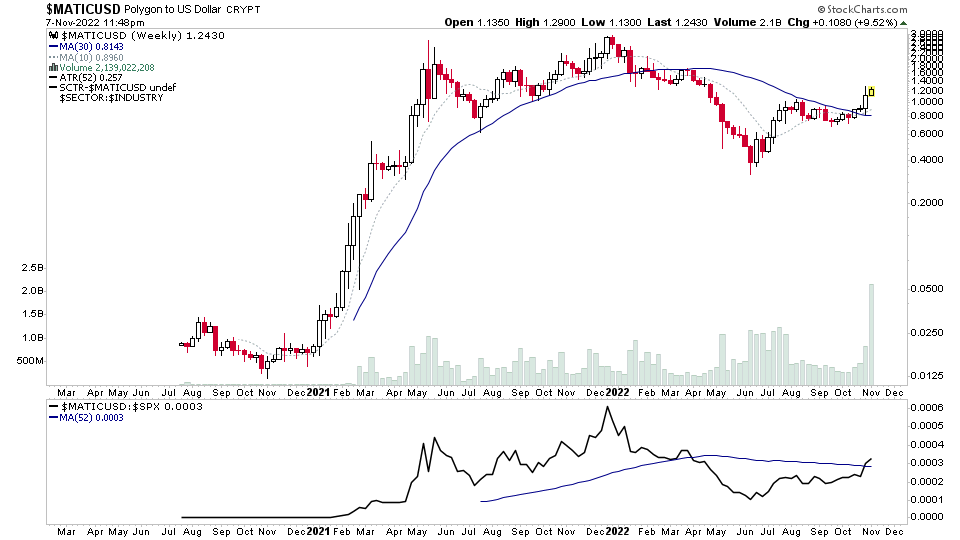

Video: Multiple Crypto Coins Developing Stage 1 Bases. Is Crypto Bottoming? (41 mins)

A video special feature on the major crypto coins, with Stages Analysis on multiple timeframes, as multiple crypto coins are starting to shows signs of developing Stage 1 base structures and even a few early Stage 2 breakouts. So is crypto about to make a comeback and make a new Stage 2 advance after the extreme Stage 4 decline that virtually all coins have had in 2022?

Read More

06 November, 2022

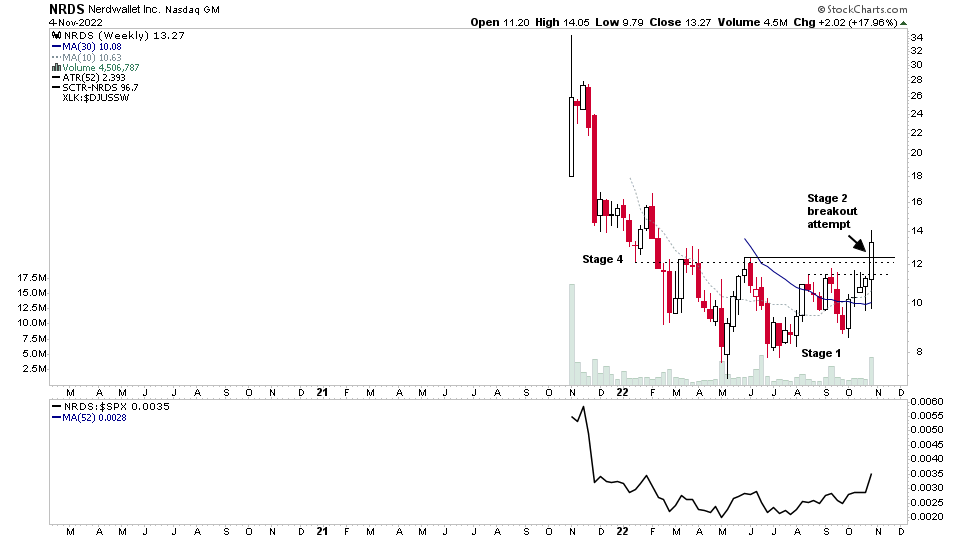

Stage Analysis Members Video Part 2 – Stage 2 Breakouts and US Watchlist Stocks – 6 November 2022 (42mins)

Part 2 of the Stage Analysis weekend video featuring analysis of some of the weeks Stage 2 breakout attempts and live markups and discussion of the levels of interest in the US Watchlist stocks.

Read More

06 November, 2022

Stage Analysis Members Video Part 1 – 6 November 2022 (59mins)

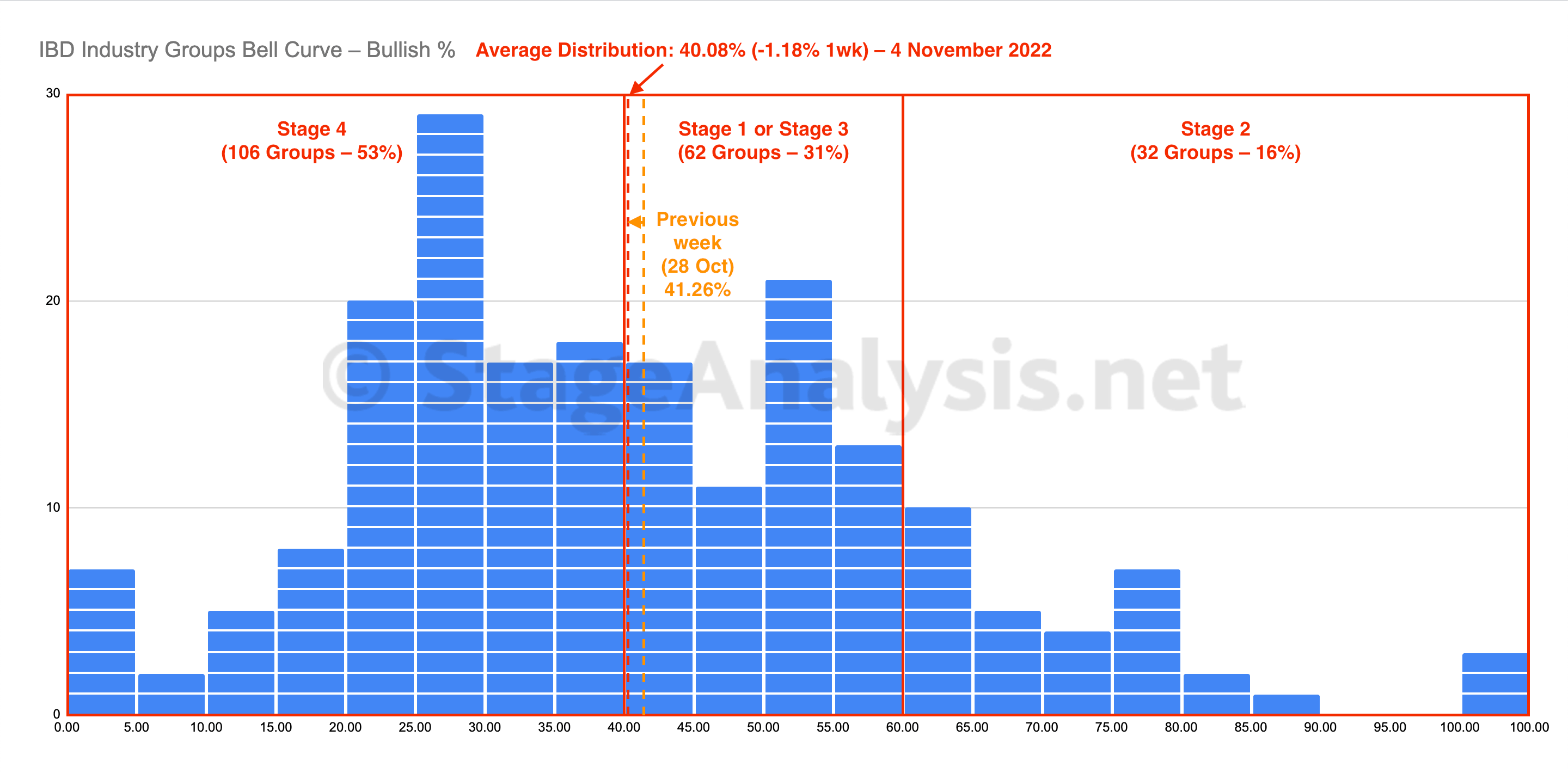

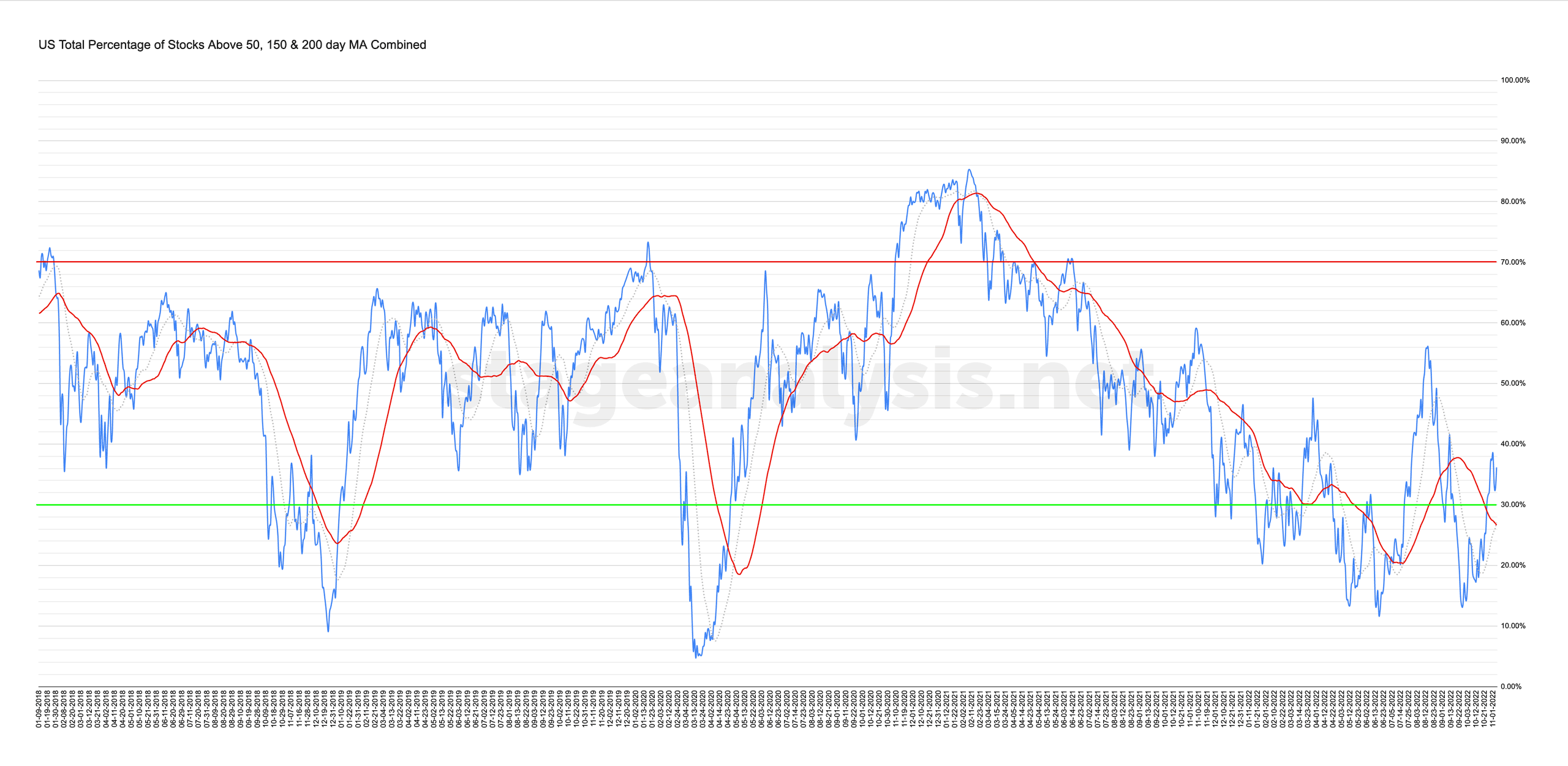

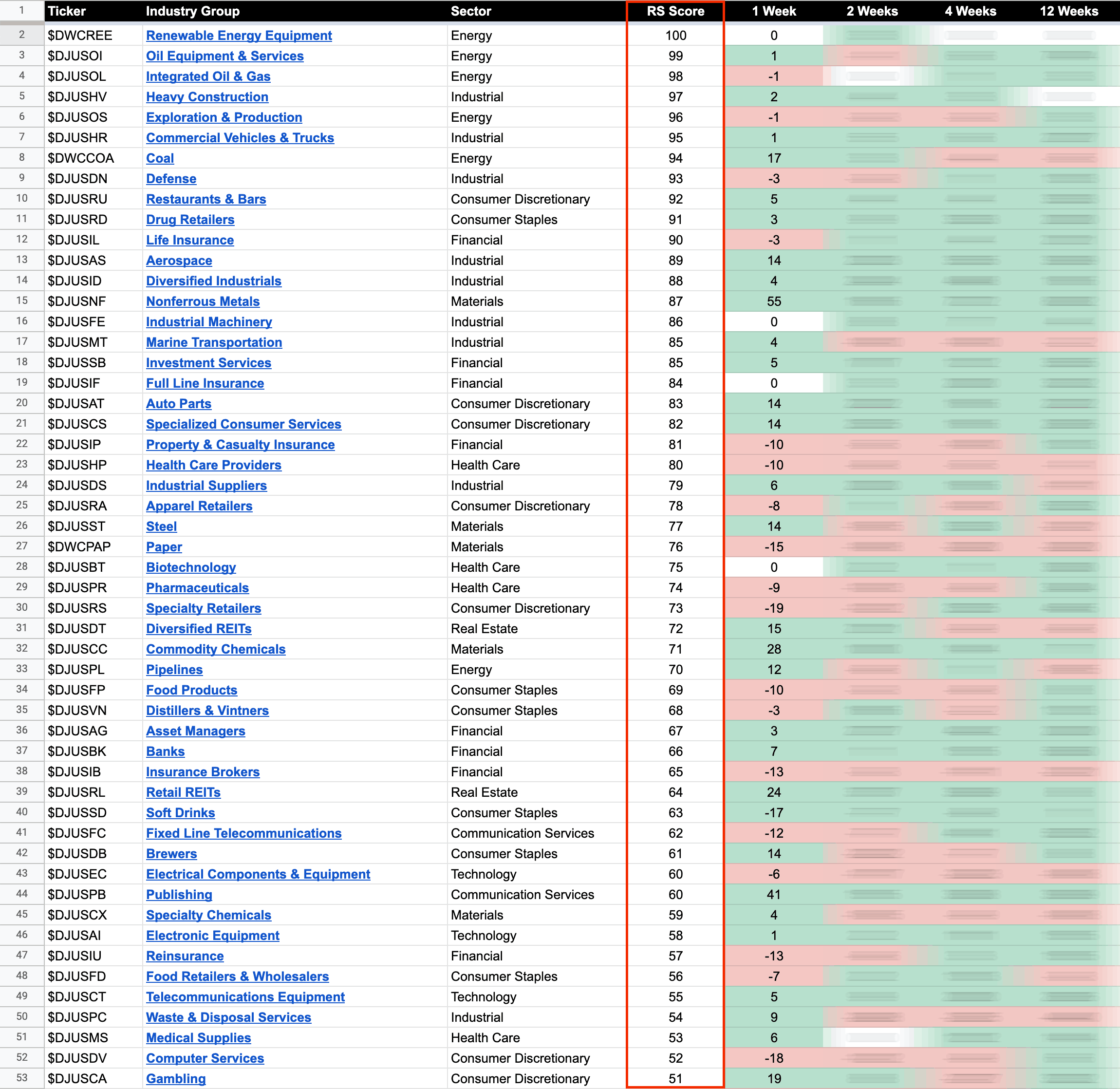

Part 1 of the regular members weekend video beginning with a special focus on Gold and Silver, and the Gold Miners group. Following that we discuss the Stage Analysis of the Major Indexes, and the Industry Groups Relative Strength Rankings, with a look in more depth of some of the groups making the strongest moves. Plus a look at the IBD Industry Groups Bell Curve – Bullish Percent and finally the Market Breadth Update to help to determine the current Weight of Evidence.

Read More

05 November, 2022

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent declined slightly over the last week by -1.18% to end the week at 40.08%. So the average distribution remains in the neutral Stage 1 zone in the left of middle of the bell curve...

Read More

05 November, 2022

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

04 November, 2022

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

03 November, 2022

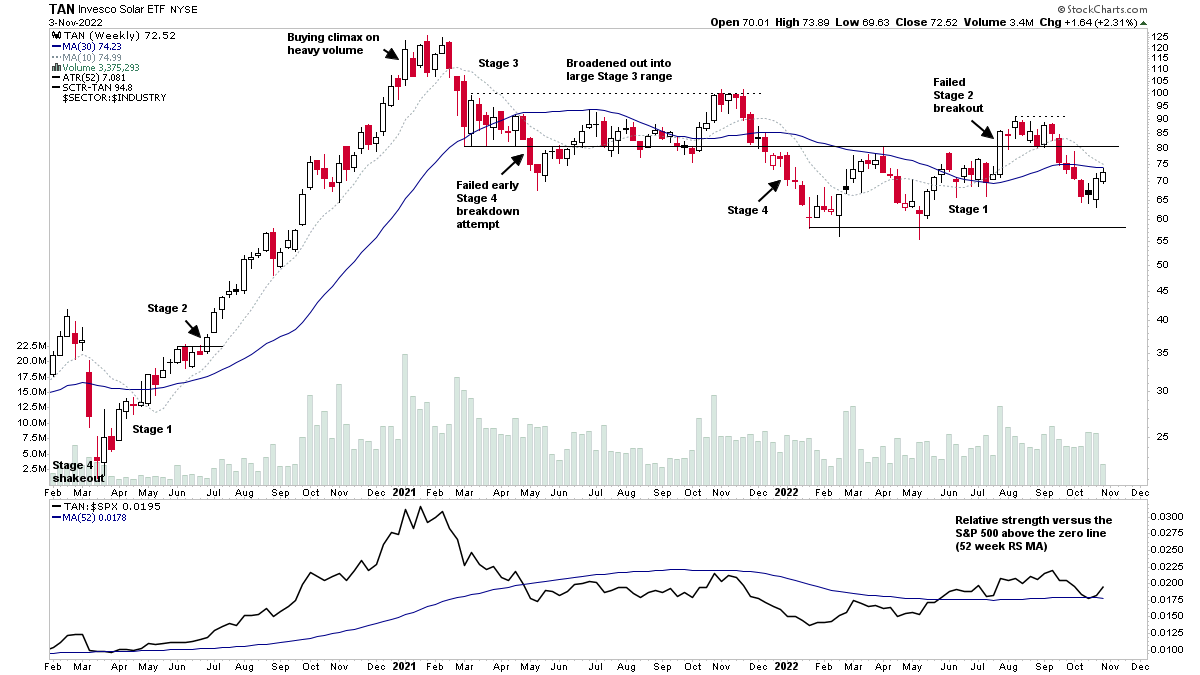

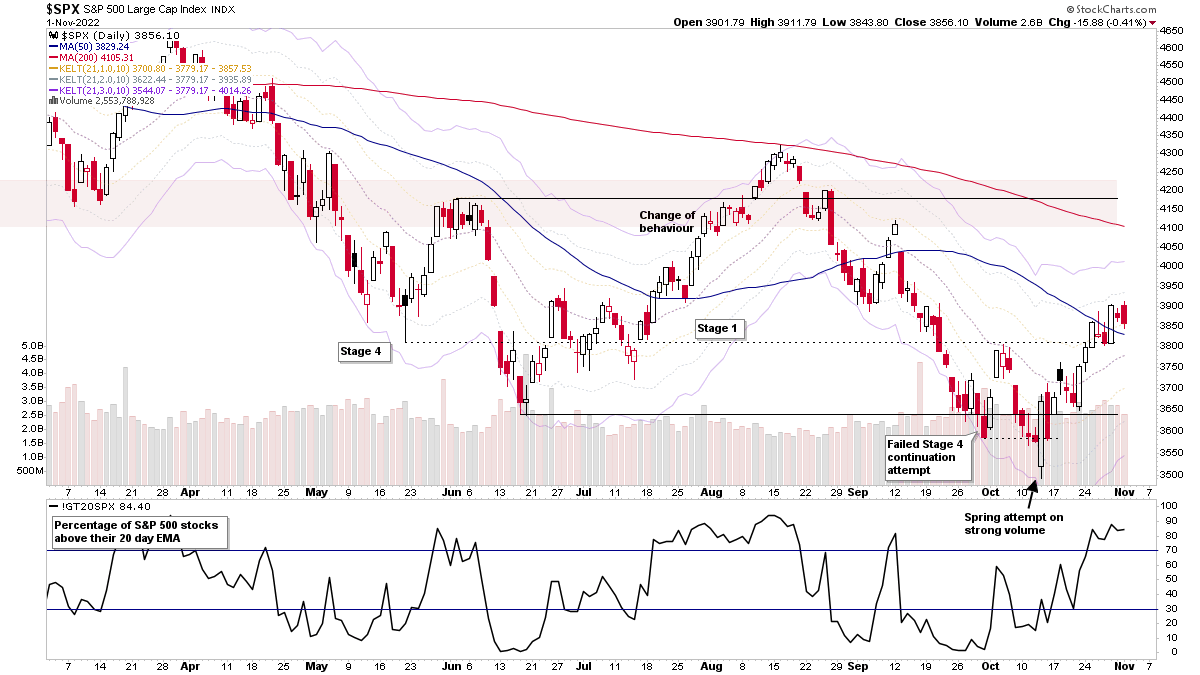

Stage Analysis Members Video – 03 November 2022 (1hr 2mins)

The members midweek video begins today with a group focus on the leading group Renewable Energy Equipment which made a Stage 2 continuation attempt today. Followed by analysis of the S&P 500 and VIX and the short-term Market Breadth charts...

Read More

01 November, 2022

S&P 500 Consolidates Above 50 Day MA Ahead of FOMC and the US Stocks Watchlist – 1 November 2022

Marine Transportation stocks featured heavily in todays scans with STNG leading the group and pushing to strongly to new highs with a further Stage 2 continuation breakout attempt on earnings results, which had a knock on effect in the other stocks in the groups...

Read More