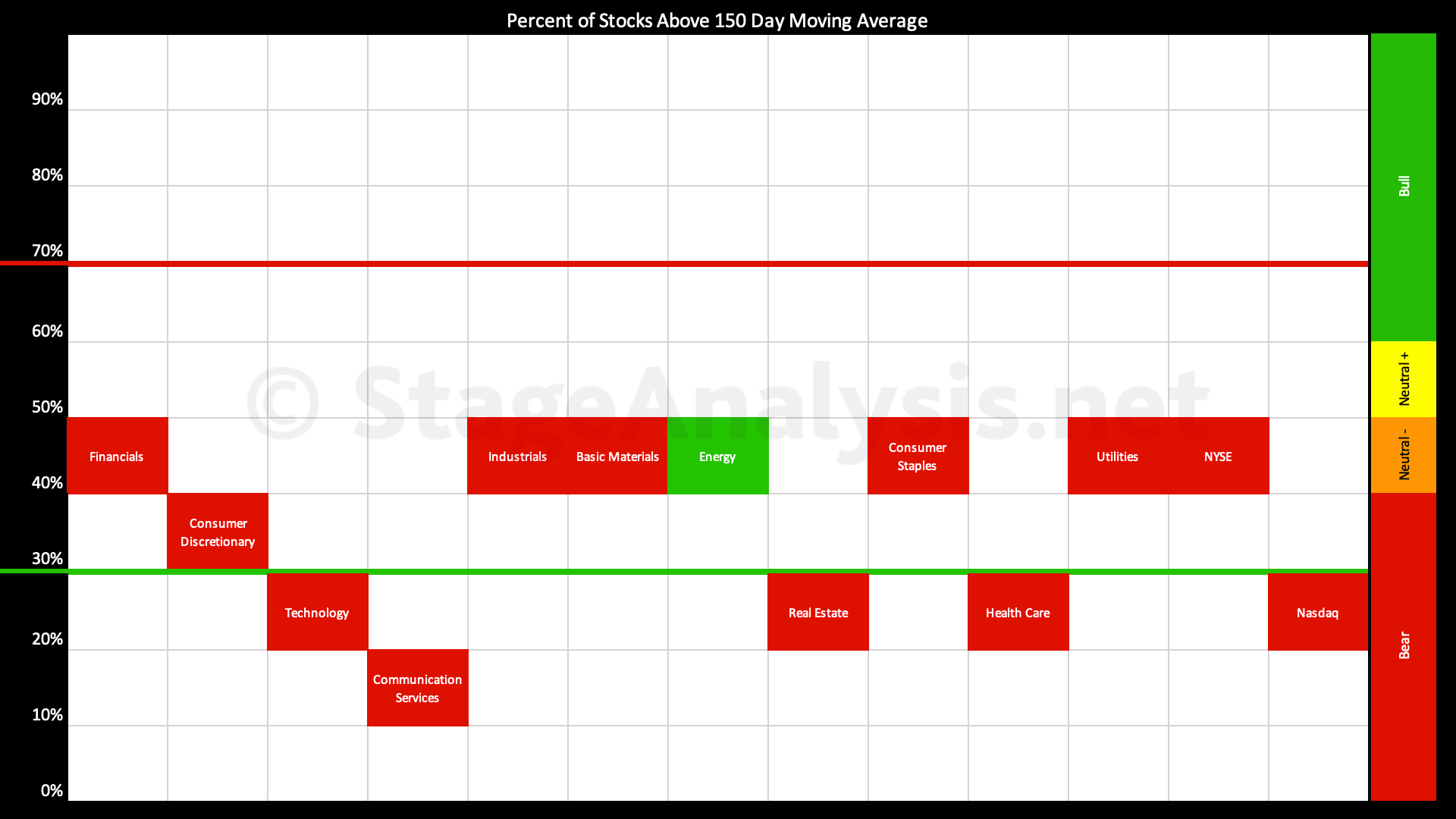

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has declined by -9.72% since the previous post on the 28th November, and so the overall average is now at 36.48% which is tipping it back into the Stage 4 zone once more, which it's spent the majority of 2022 in...

Read More

Blog

18 December, 2022

Stage Analysis Members Video – 18 December 2022 (1hr 23mins)

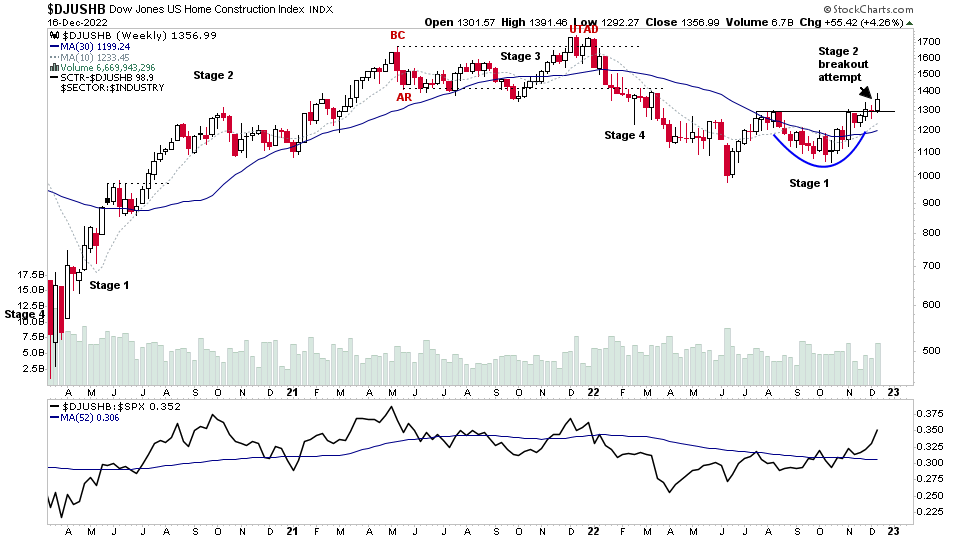

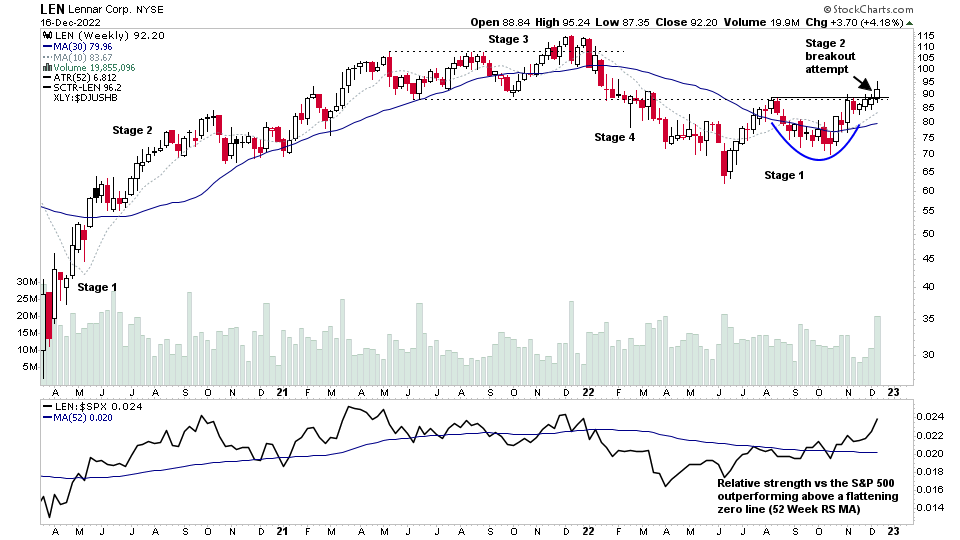

The Stage Analysis members weekend video begins this week with a special focus on the Home Construction Group stocks, of which multiple stocks within the group made a Stage 2 breakout attempt this week against the weak market action...

Read More

18 December, 2022

US Stocks Watchlist – 18 December 2022

For the watchlist from the weekend scans...

Read More

17 December, 2022

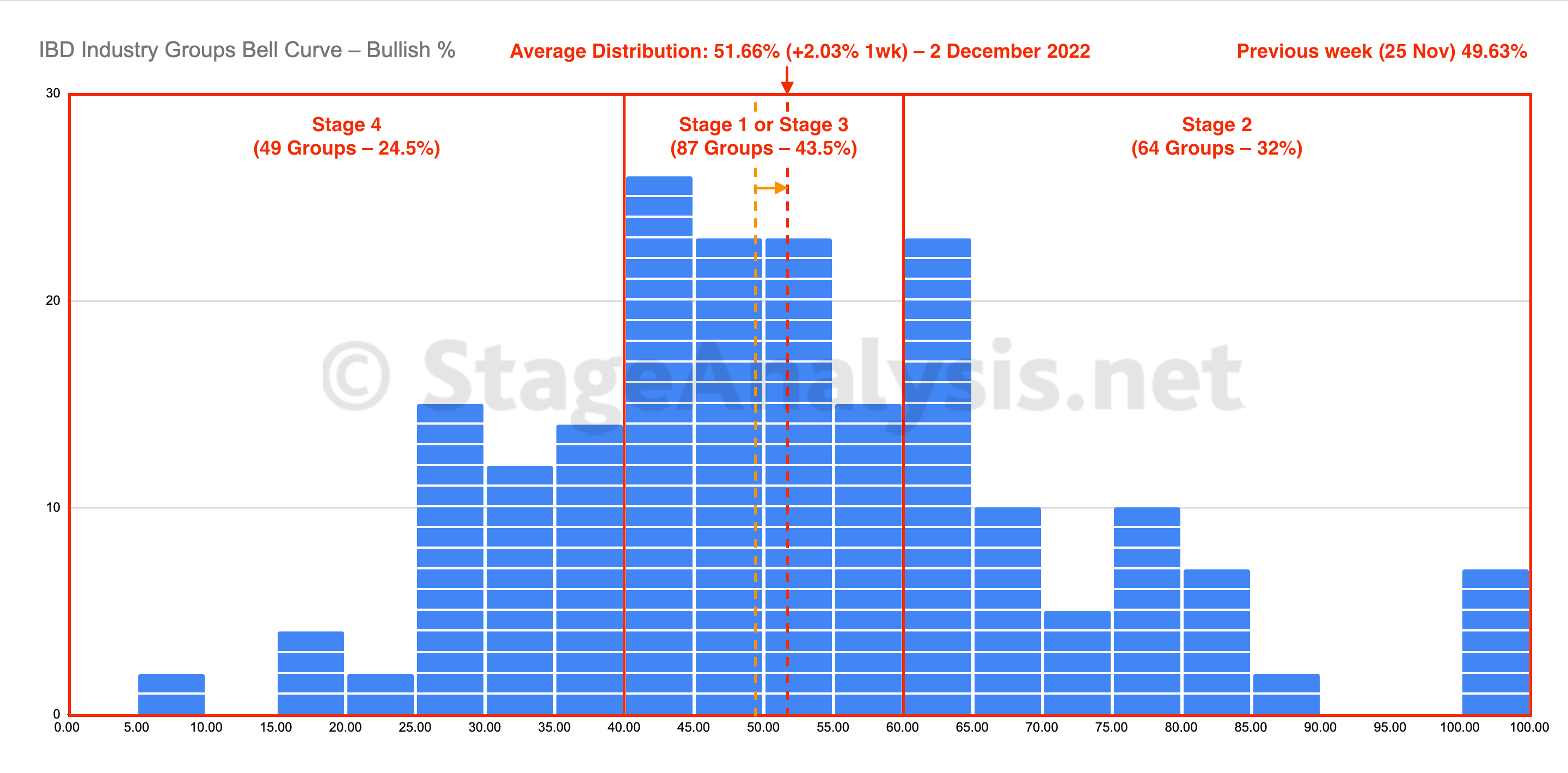

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve shows the distribution of the 200 IBD Narrow Industry Groups on a point and figure buy signal, plotted as a bell curve and includes the data tables of the 200 groups in relative strength order and the position changes over the last 1, 2 and 4 weeks.

Read More

17 December, 2022

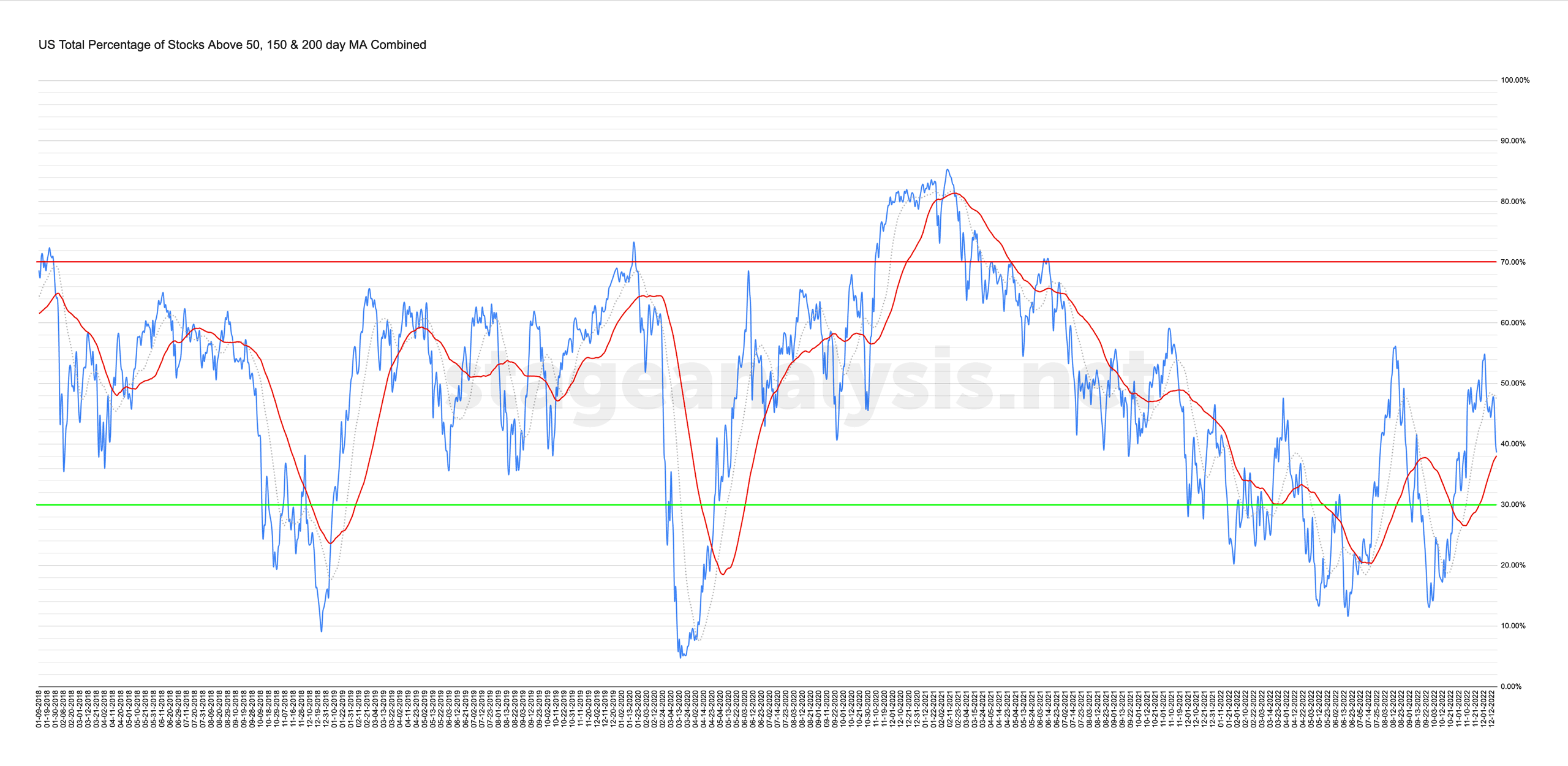

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

16 December, 2022

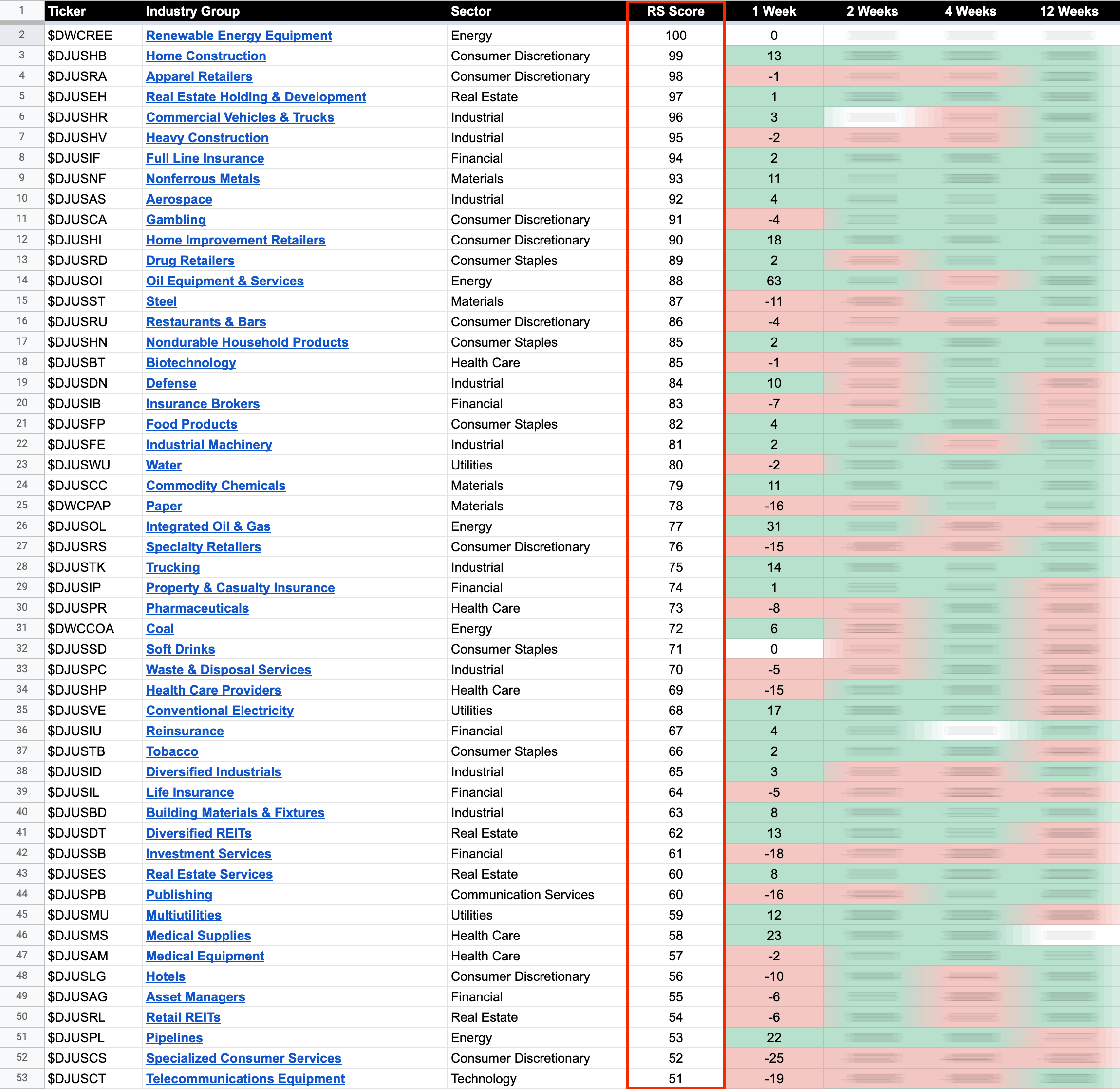

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

15 December, 2022

Most Vulnerable US Stocks & ETFs – 15 December 2022

This is the first post of a new weekly regular feature focusing on some of the most vulnerable issues in the US market, in order to get a broader picture of the overall market health and contribute valuable information to our Weight of Evidence – which is the key to successfully using Stan Weinstein's Stage Analysis method.

Read More

14 December, 2022

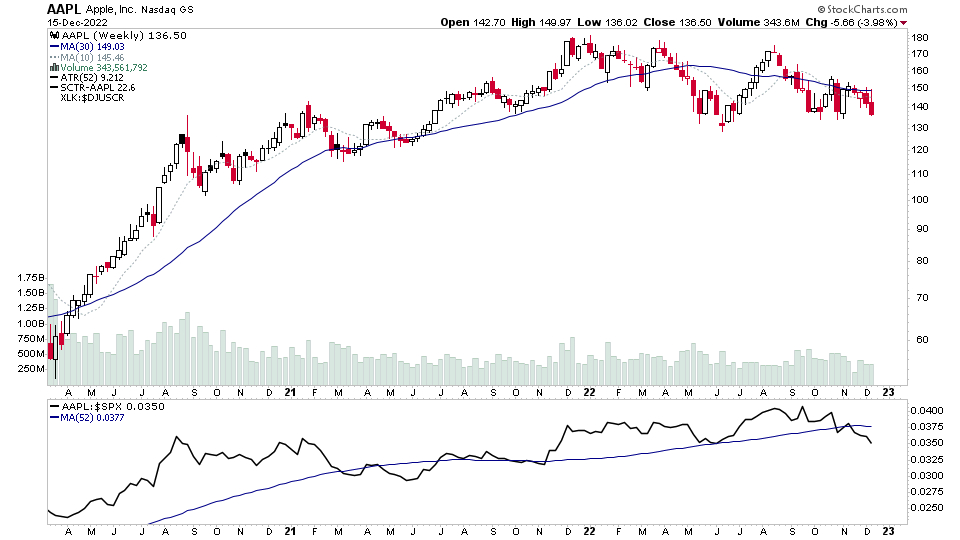

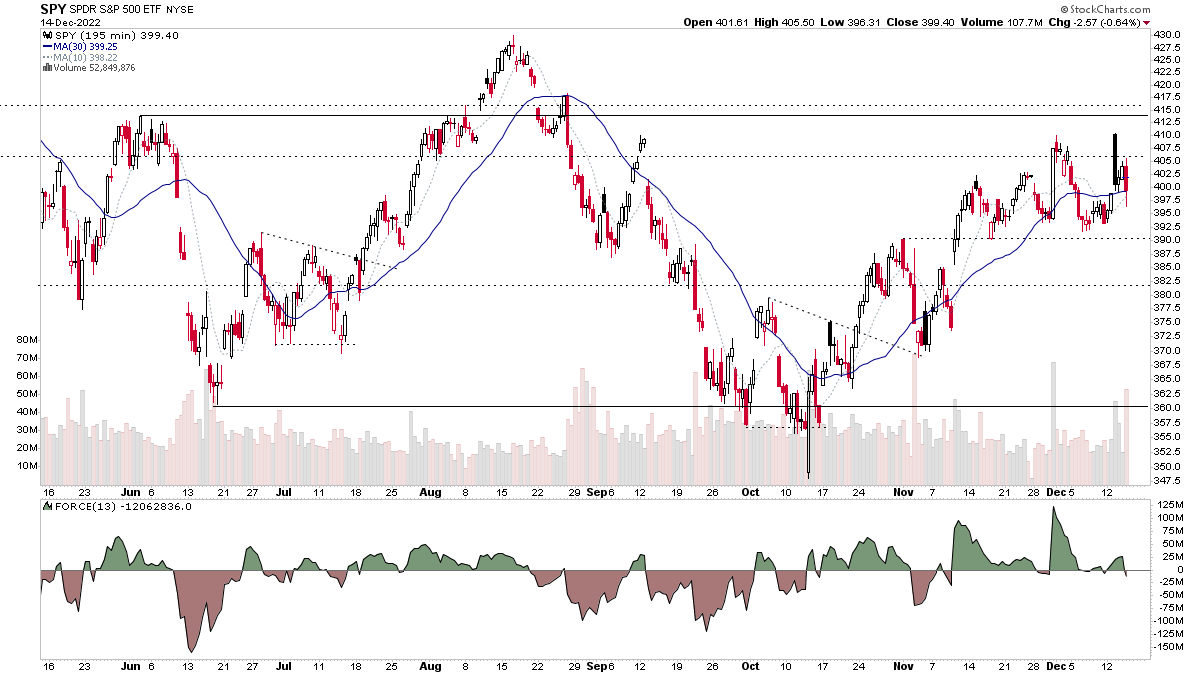

Stage Analysis Members Video – 14 December 2022 (1hr 2 mins)

The Stage Analysis members midweek video discussing the S&P 500, VIX and the Dollar Index, short-term market breadth indicators and the US watchlist stocks in more detail with live markups of the individual stocks and group themes.

Read More

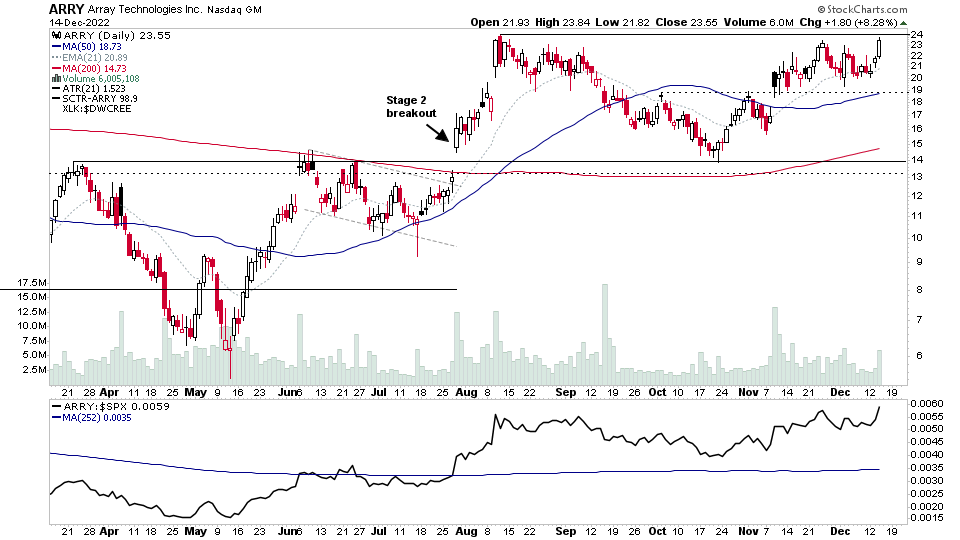

14 December, 2022

US Stocks Watchlist – 14 December 2022

I'll talk through the watchlist stocks and group themes from the last few days in detail on multiple timeframes during the Stage Analysis midweek video, which will be posted later today (Wednesday).

Read More

13 December, 2022

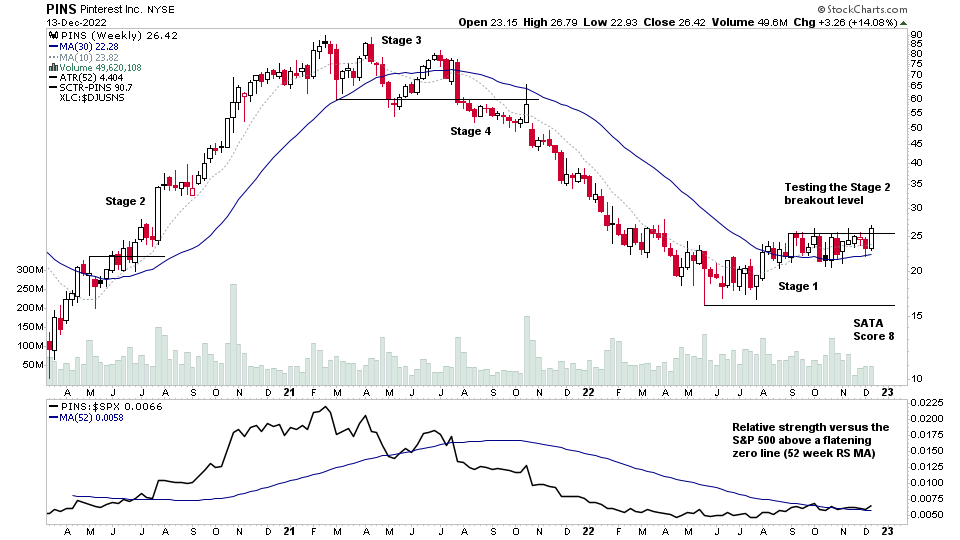

US Stocks Watchlist – 13 December 2022

Semiconductors continues to be the main group theme with more stocks in the group testing the Stage 2 breakout level today, but pulling back with the intraday market weakness.

Read More