There were 46 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

15 January, 2023

US Stocks Watchlist – 15 January 2023

14 January, 2023

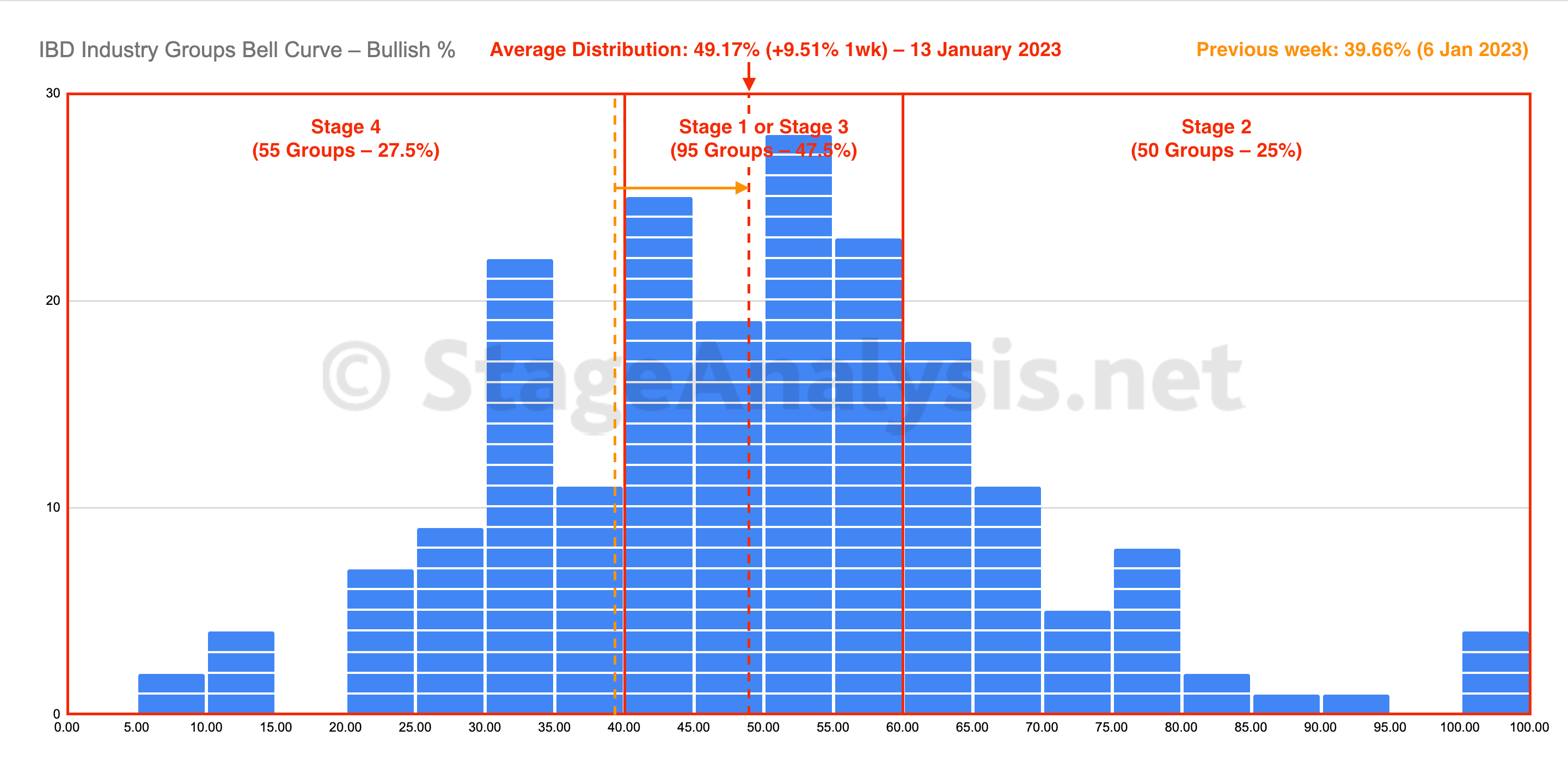

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve moved strongly higher this week with a +9.51% gain to close the week at 49.17%. The amount of groups in Stage 4 decreased by -48 (-24%), and the amount of groups in Stage 2 increased by +28 (+14%), while the amount groups in Stage 1 or Stage 3 decreased by -20 (-10%).

Read More

14 January, 2023

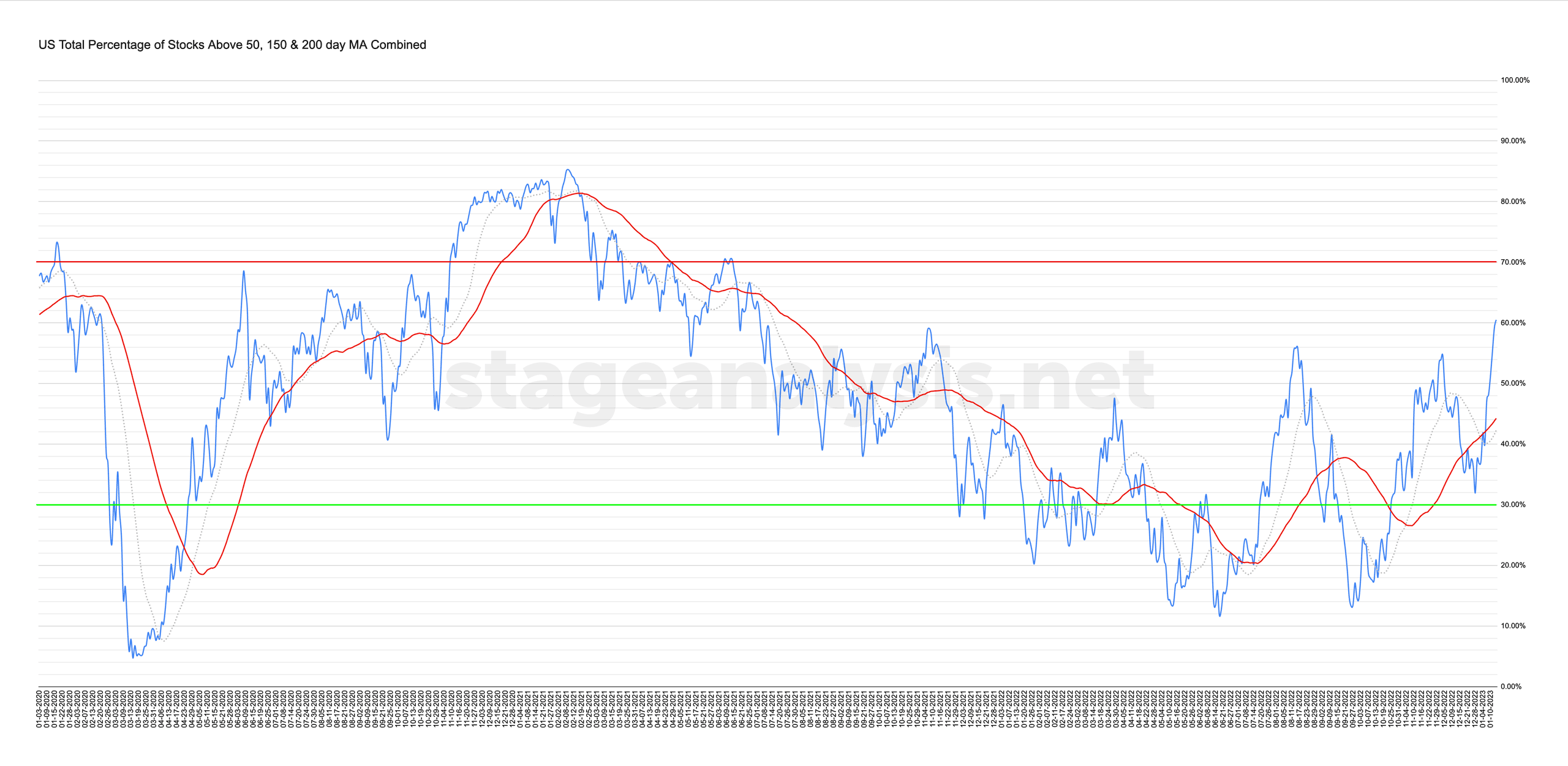

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

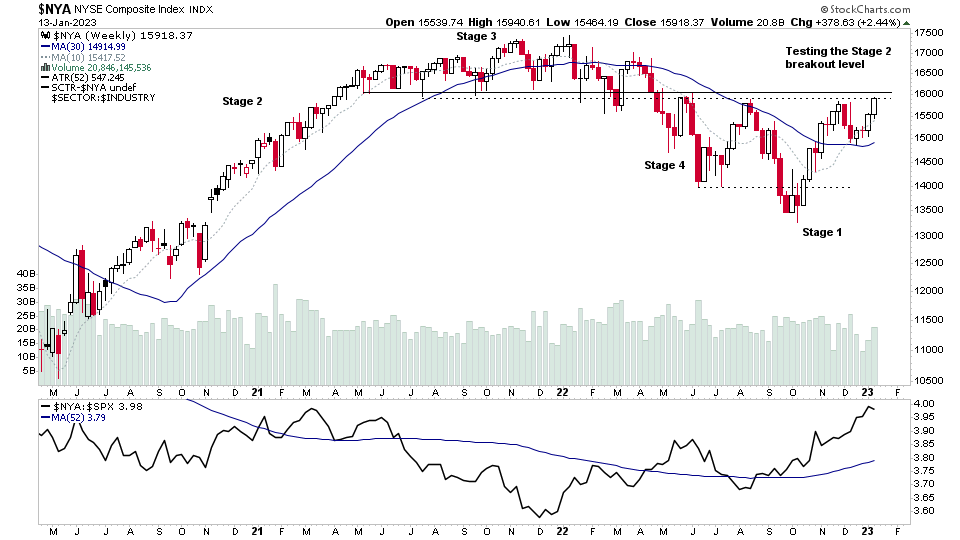

13 January, 2023

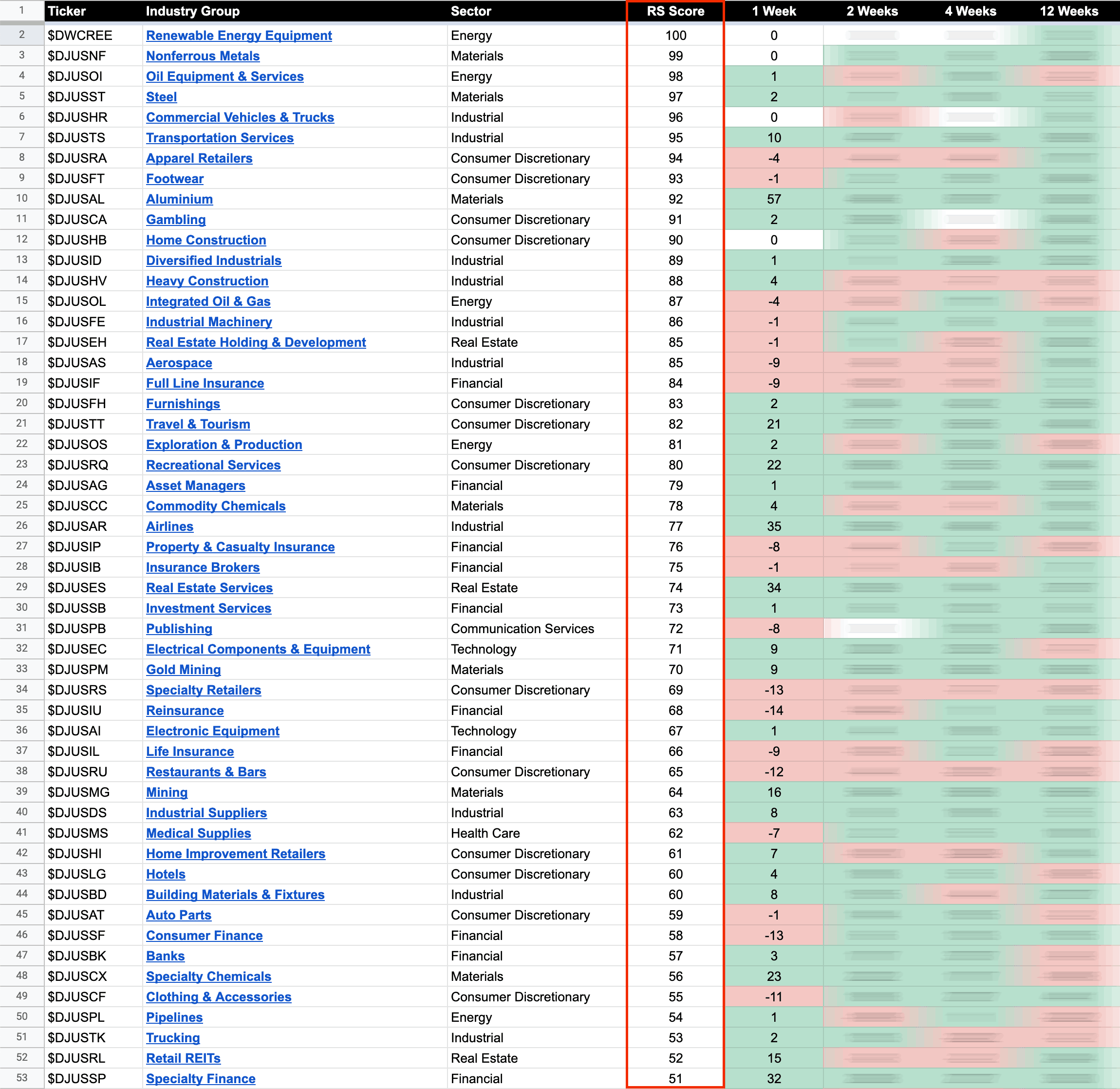

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

11 January, 2023

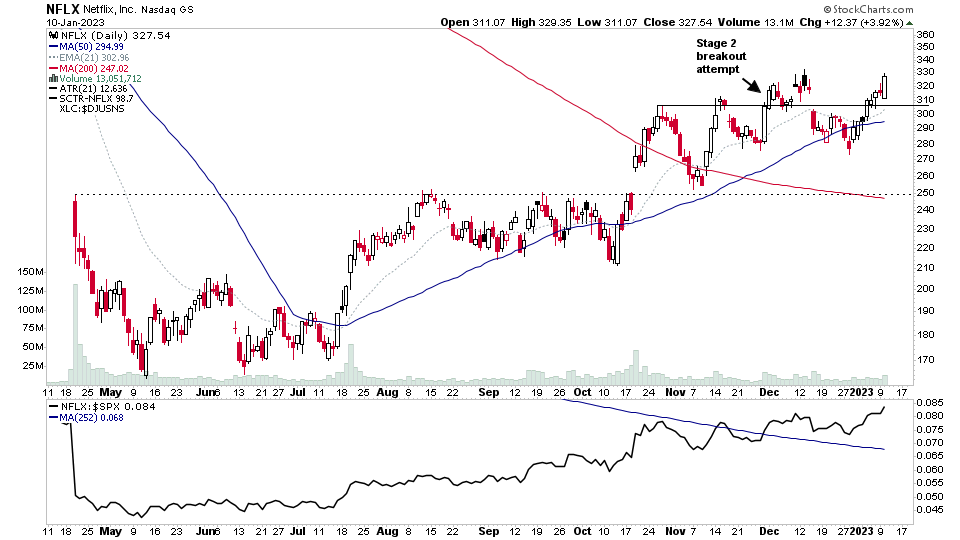

Early Stage 2 Groups & Stocks Special – 11 January 2023 (54 mins)

Stage Analysis Members midweek video with a special feature on the groups and stocks in early Stage 2, as more stocks continue to appear in the watchlist that are attempting to breakout or rebound in early Stage 2 or make continuation breakouts.

Read More

10 January, 2023

US Stocks Watchlist – 10 January 2023

There were 25 stocks highlighted from the US stocks watchlist scans today...

Read More

09 January, 2023

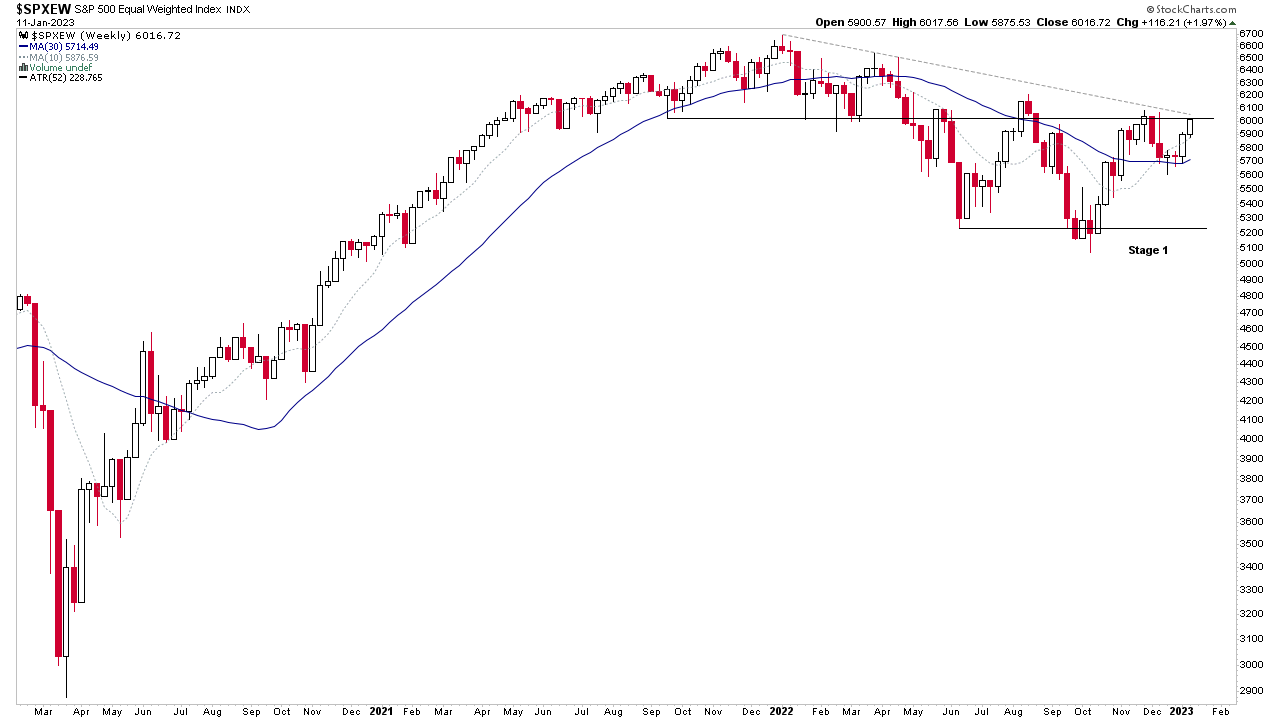

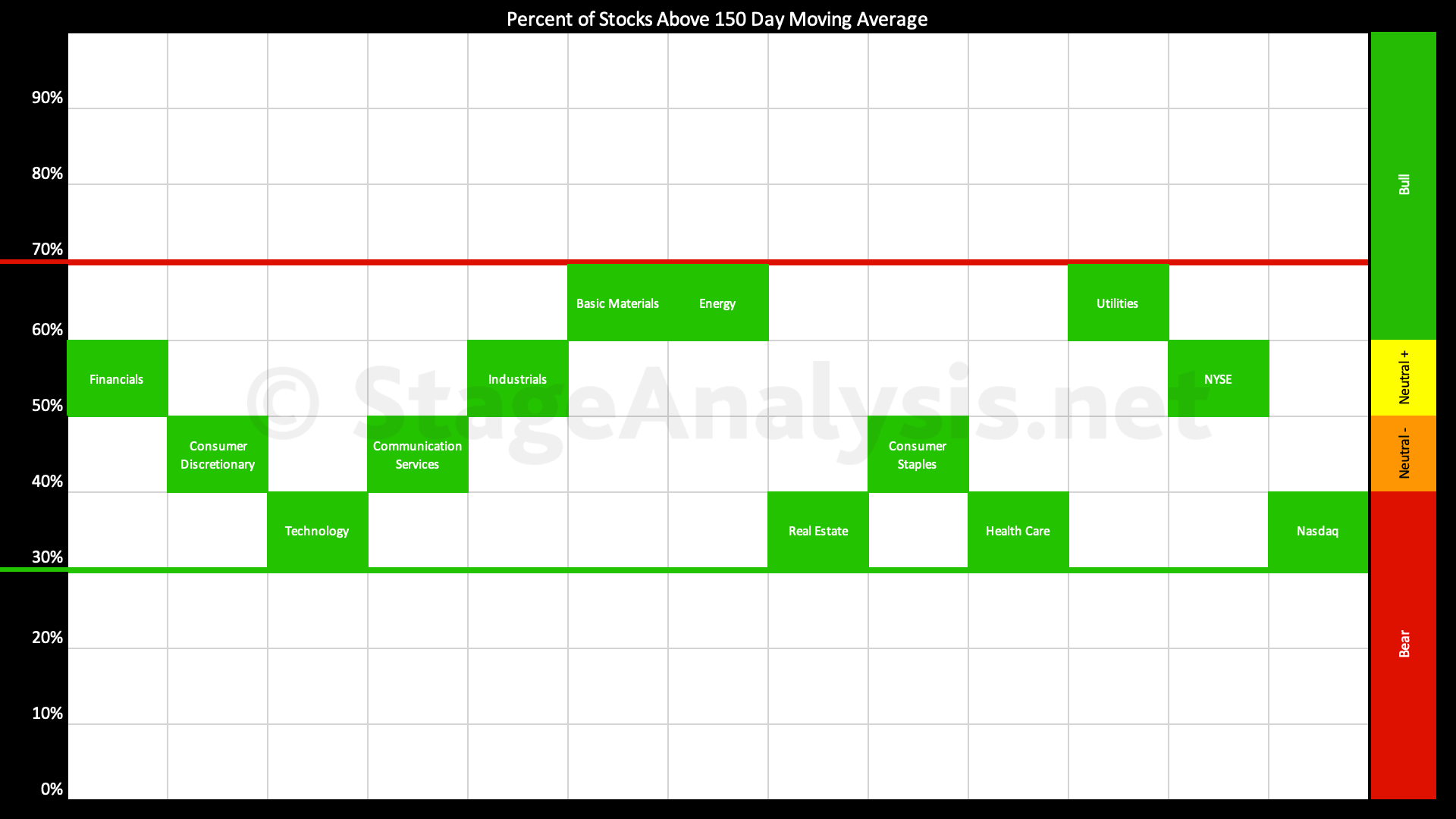

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors has moved higher by +12.92% over the last three weeks since the previous post of the 19th December, and so the overall average is now at 49.40%, which is firmly back in the Stage 1 zone in the middle of the range.

Read More

08 January, 2023

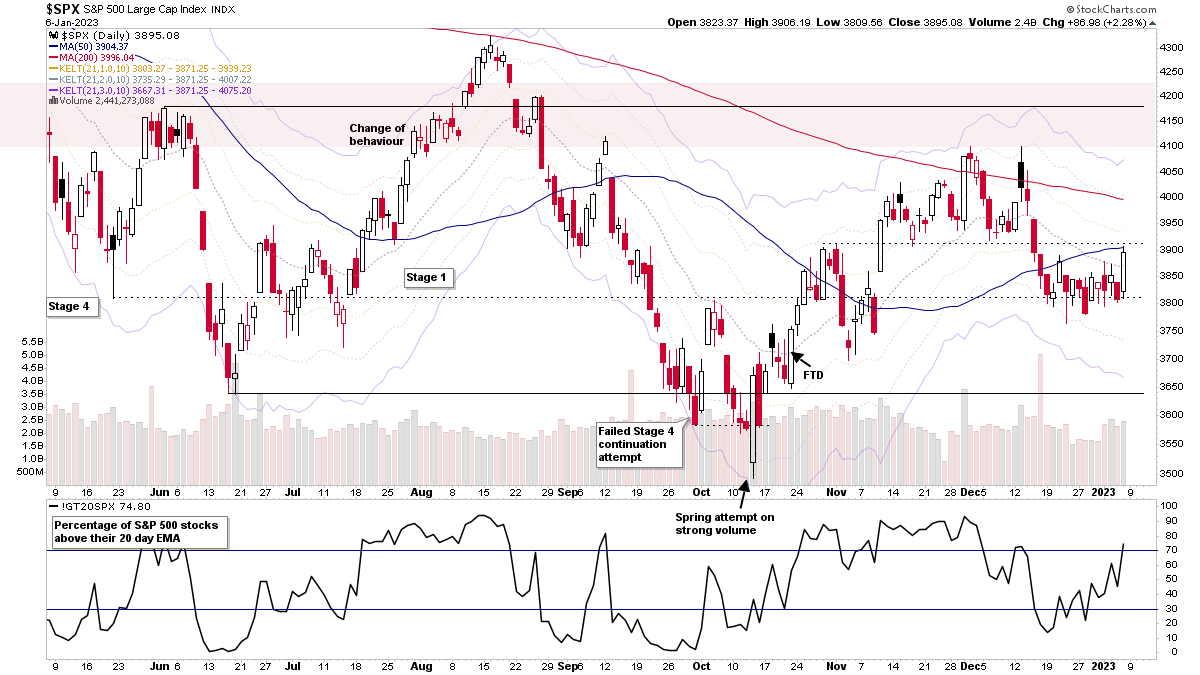

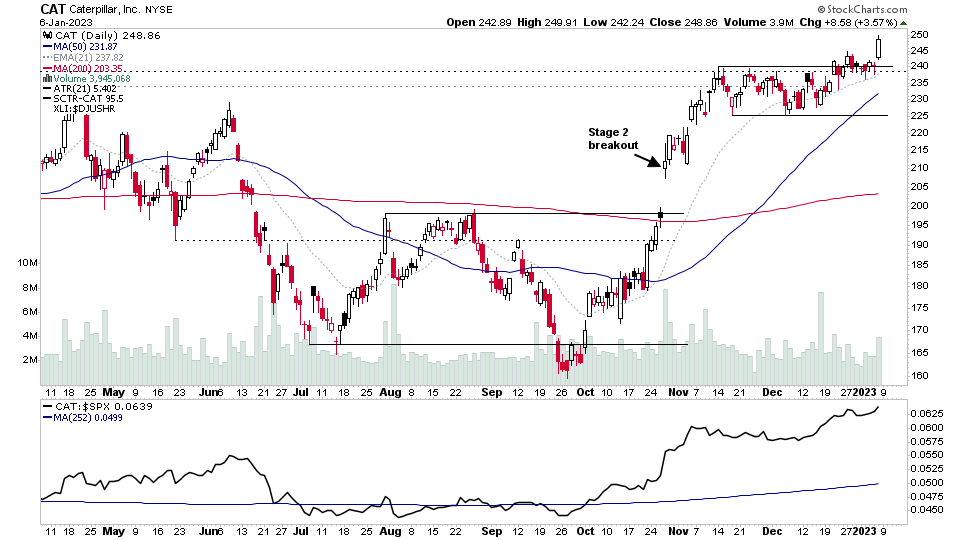

Stage Analysis Members Video – 8 January 2023 (1hr 22mins)

The Stage Analysis members weekend video featuring analysis of the US Sectors and major US Indexes. Followed by a look at the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, Nasdaq 100 SATA Scores, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

08 January, 2023

US Stocks Watchlist – 8 January 2023

For the watchlist from the weekend scans...

Read More

07 January, 2023

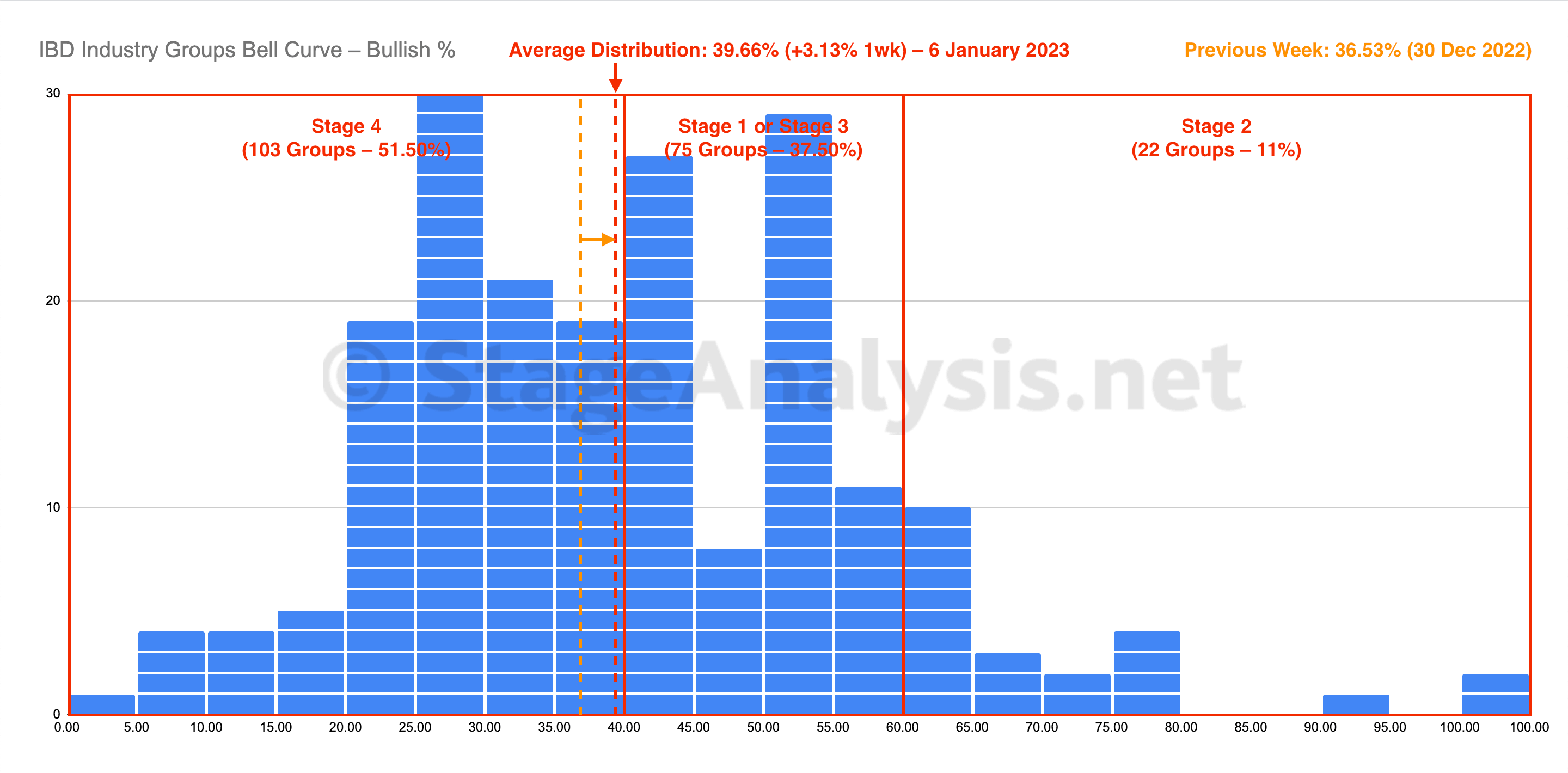

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve reversed slightly higher over the previous week with a +3.13% gain to close the week at 39.66%. The amount of groups in Stage 4 decreased by -19 (-9.5%), and the amount of groups in Stage 2 increased by +6 (+3%), while the amount groups in Stage 1 or Stage 3 increased by +13 (+6.5%).

Read More