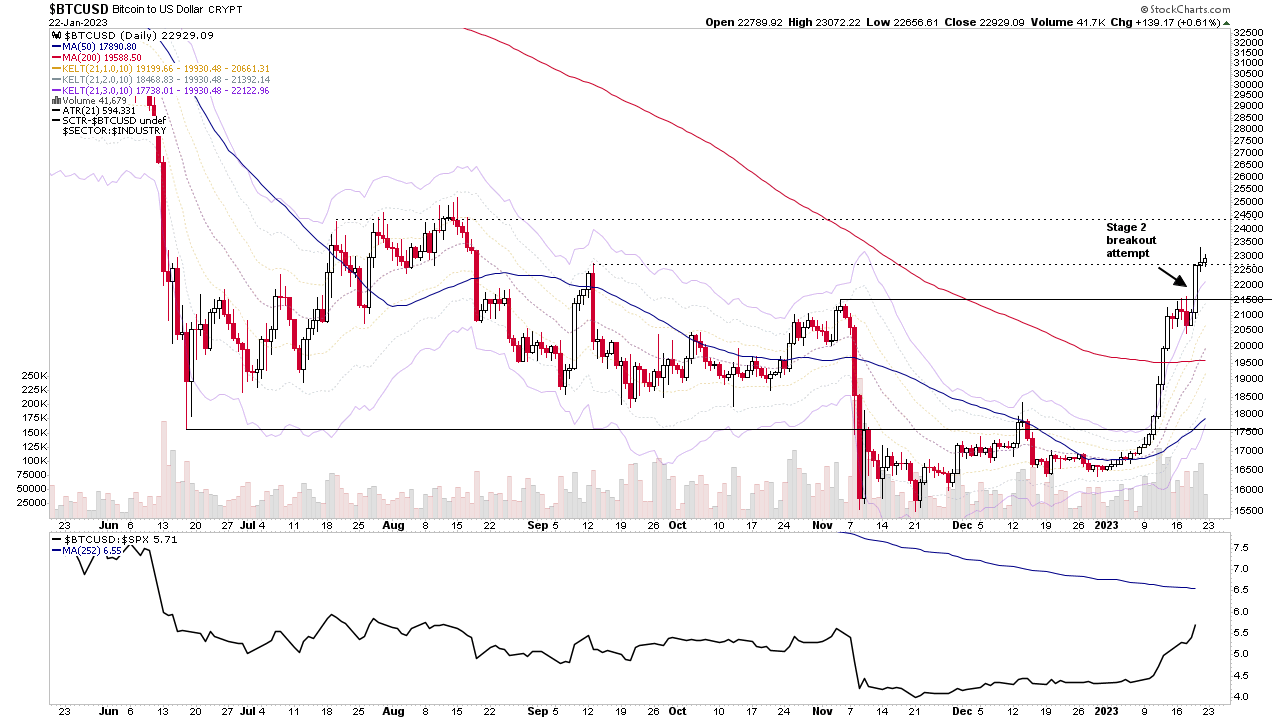

The Stage Analysis members weekend video featuring analysis of the early Stage breakout attempt in Bitcoin, and then the regular content with the major US Indexes, the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

Blog

22 January, 2023

Stage Analysis Members Video – 22 January 2023 (1hr 12mins)

22 January, 2023

US Stocks Watchlist – 22 January 2023

For the watchlist from the weekend scans...

Read More

21 January, 2023

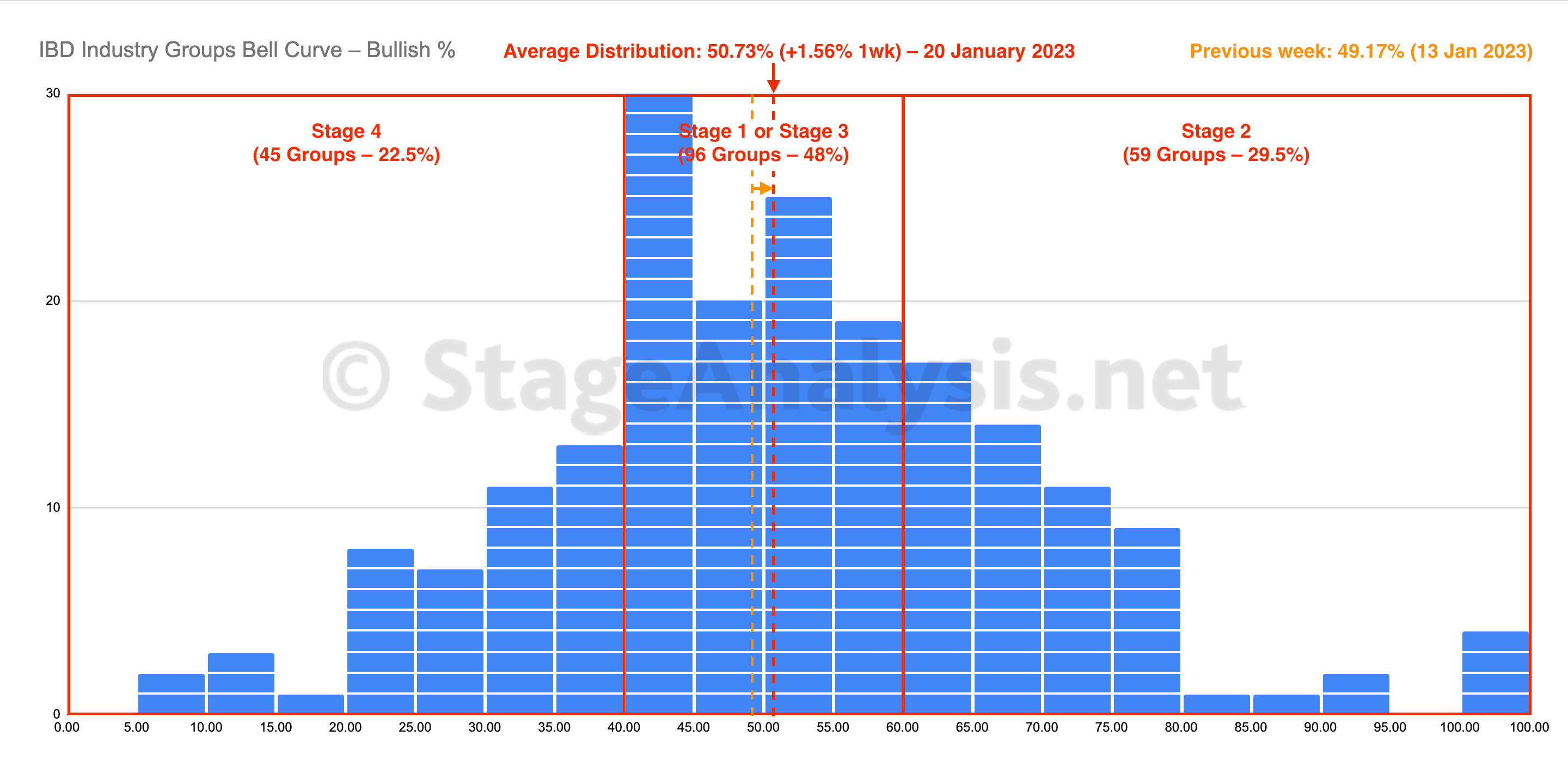

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve had a slight gain over the week of +1.56%. The amount of groups in Stage 4 decreased by -10 (-5%), and the amount of groups in Stage 2 increased by +9 (+4.5%), while the amount groups in Stage 1 or Stage 3 decreased by -1 (-0.5%).

Read More

21 January, 2023

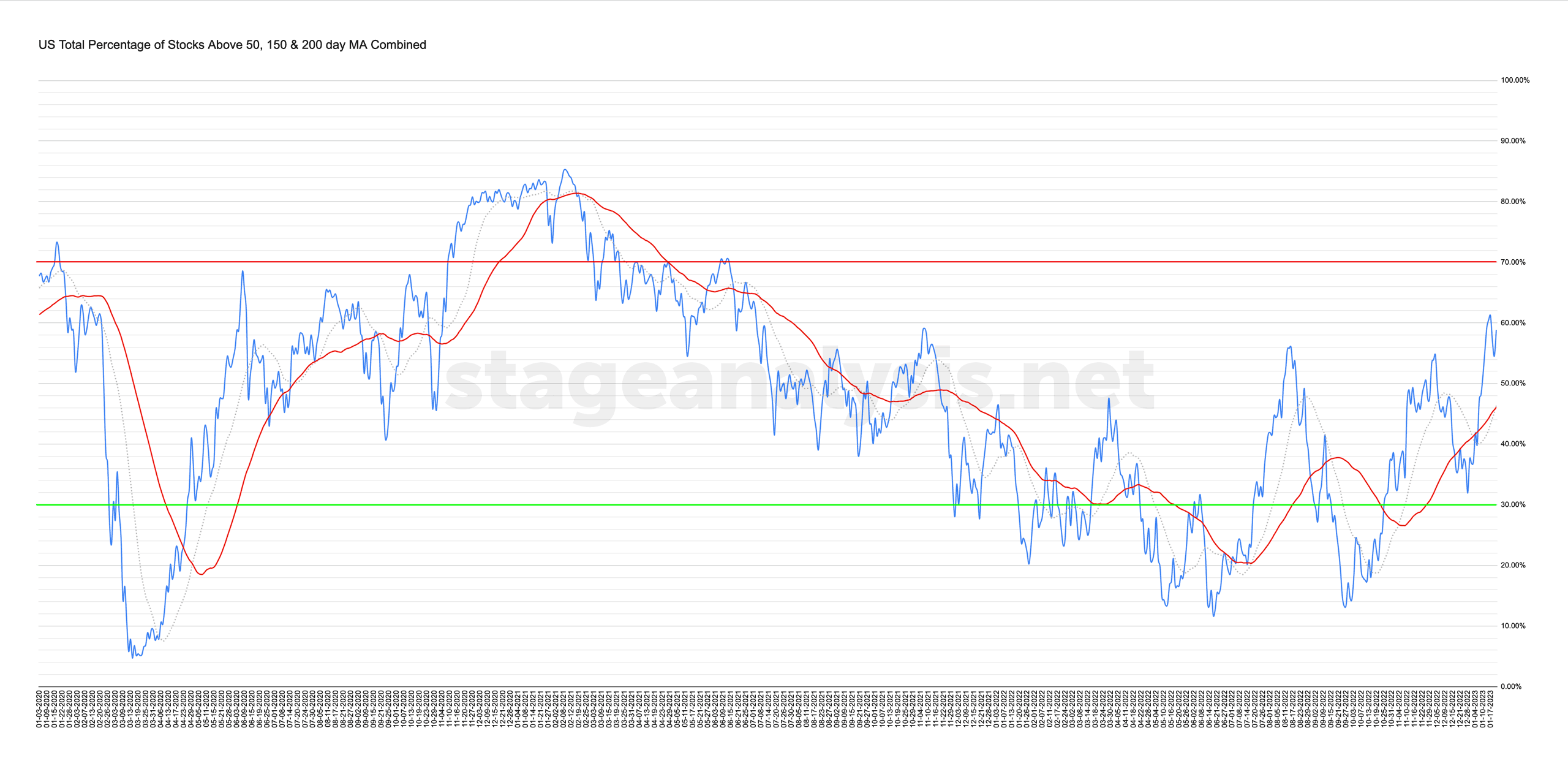

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

20 January, 2023

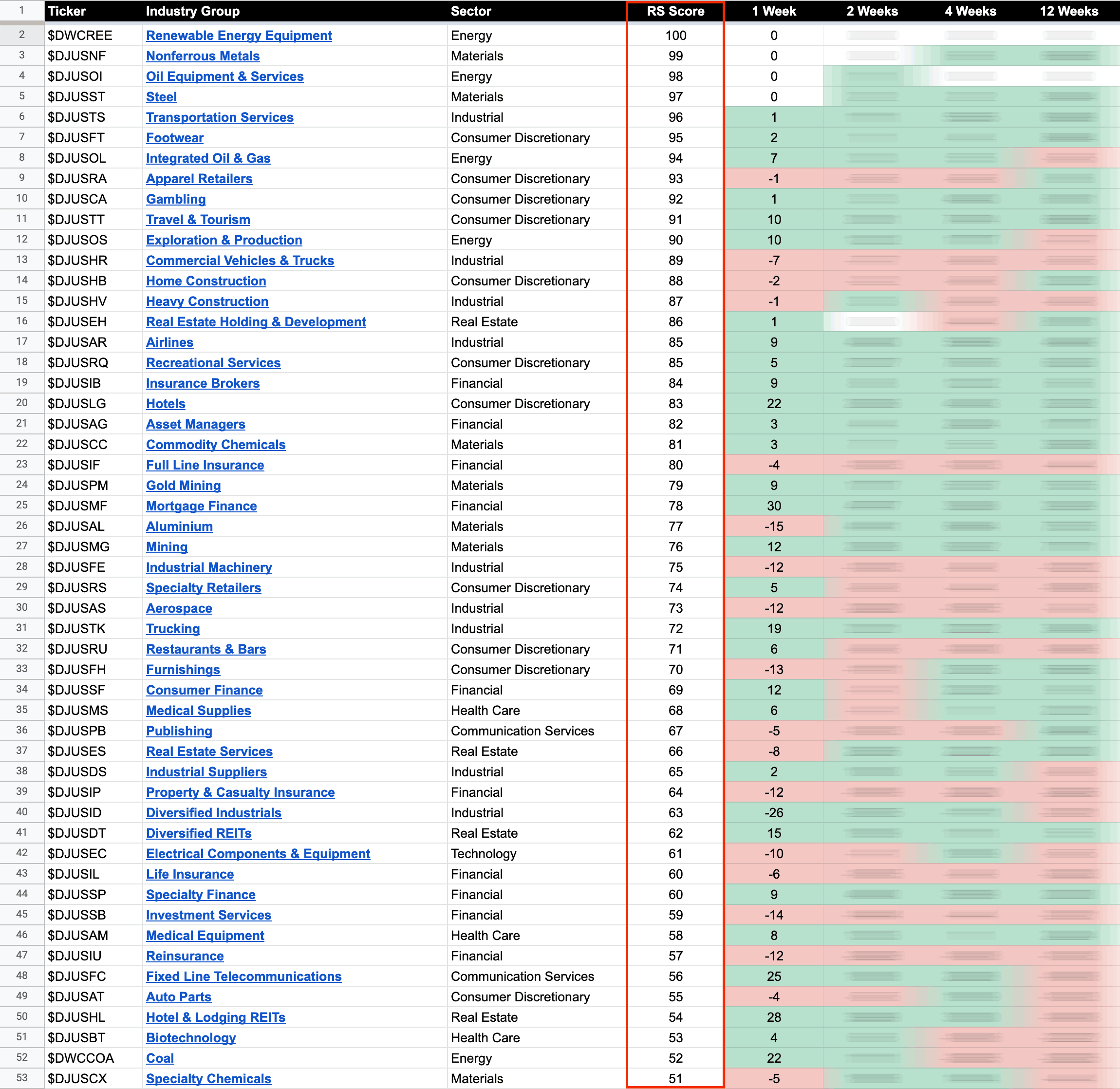

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

19 January, 2023

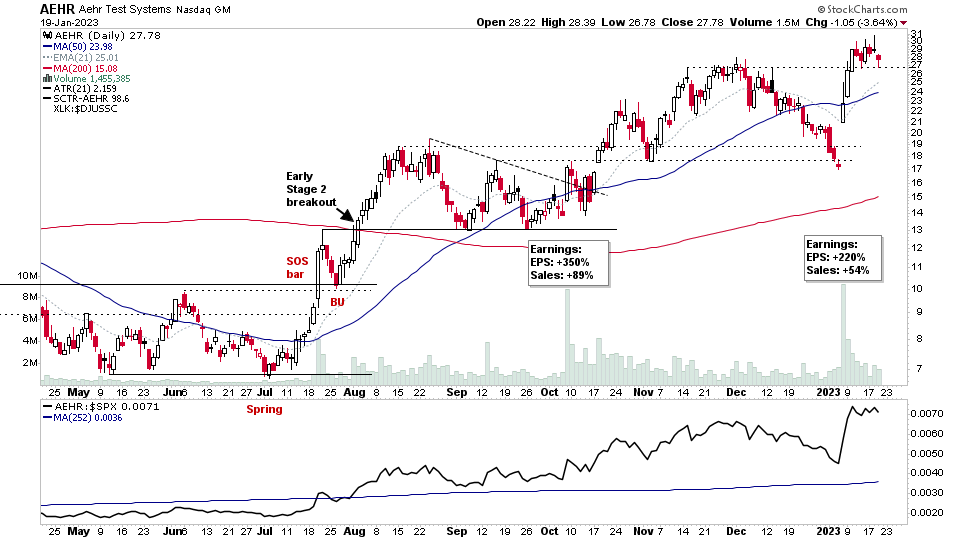

US Stocks Watchlist – 19 January 2023

There were 35 stocks highlighted from the US stocks watchlist scans today...

Read More

18 January, 2023

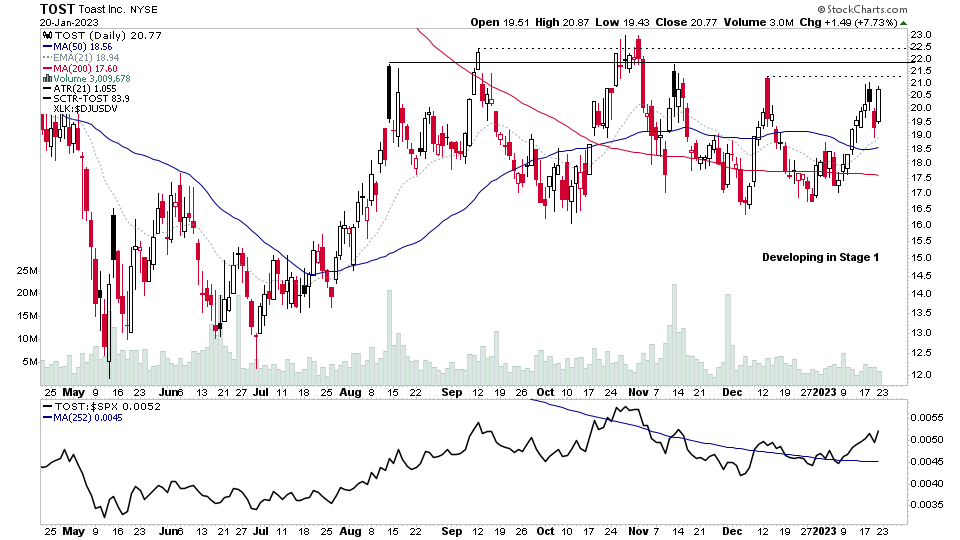

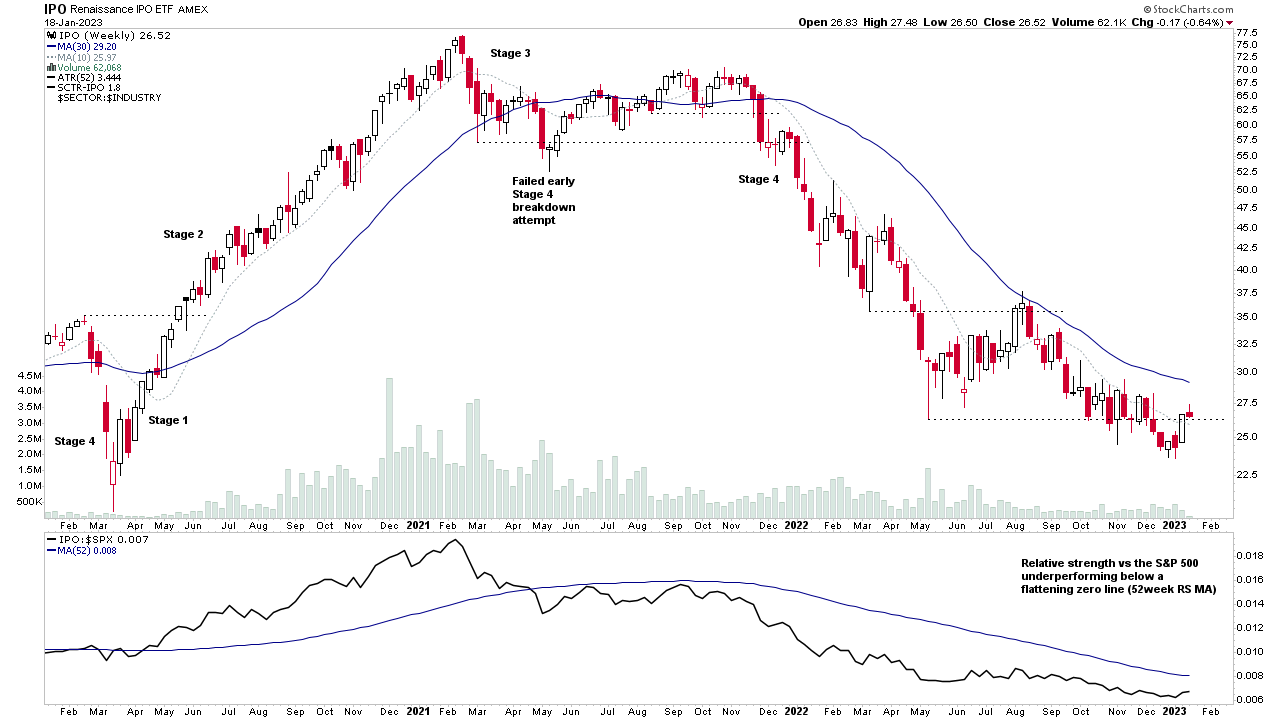

IPO Stocks Special: Developing Stage 1 and Stage 2 Stocks (53mins)

Special feature video, focusing mainly on IPO stocks from the last three years that are either developing in the Stage 1 basing phase or already early in the Stage 2 advancing phase. As if the US market manages to move into early Stage 2 in the coming weeks/months, then the more speculative areas of the market, such as the IPO stocks, would start to get some interest...

Read More

18 January, 2023

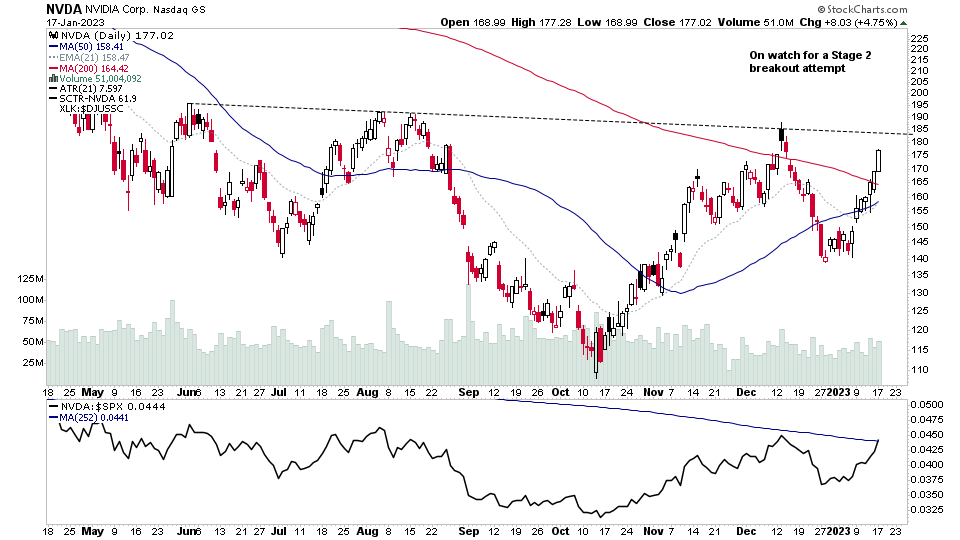

US Stocks Watchlist – 17 January 2023

Semiconductors was one of the main group themes from todays watchlist scans with a mix of late Stage 1 and early Stage 2 stocks highlighted. NVDA is the major large cap stock in the group and is moving above its 200 day MA...

Read More

15 January, 2023

Stage Analysis Members Video – 15 January 2023 (1hr 15mins)

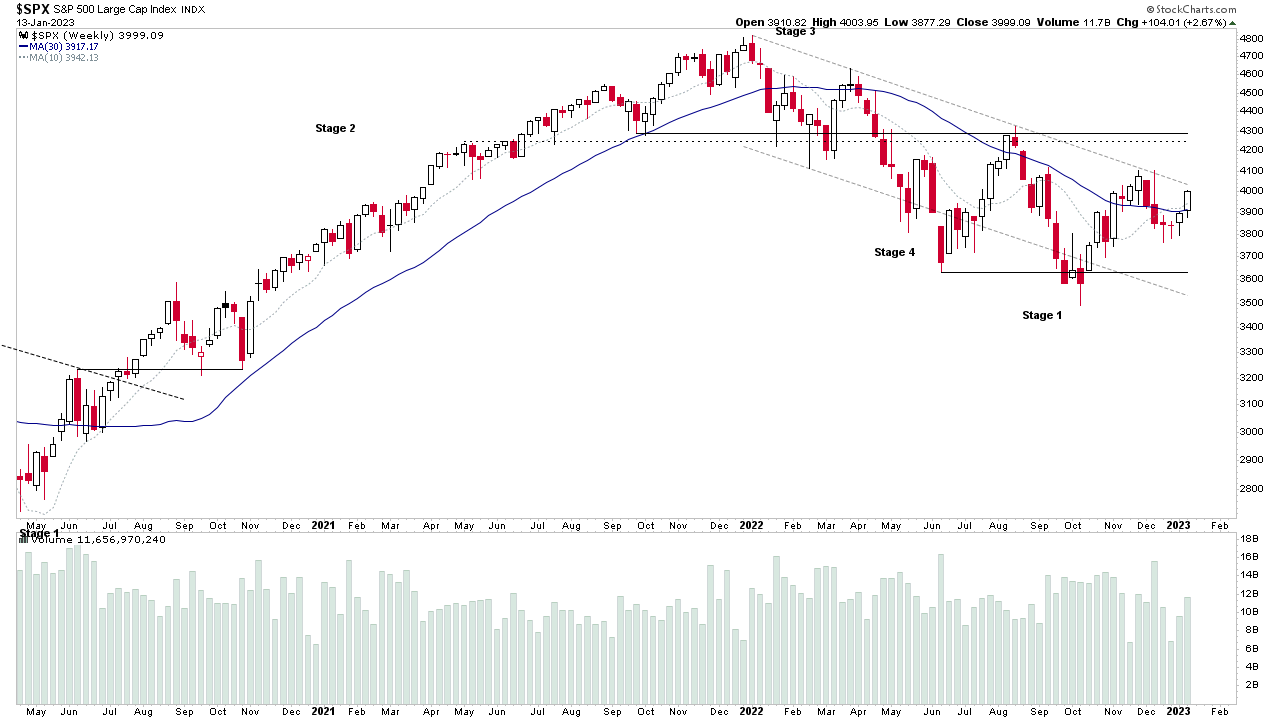

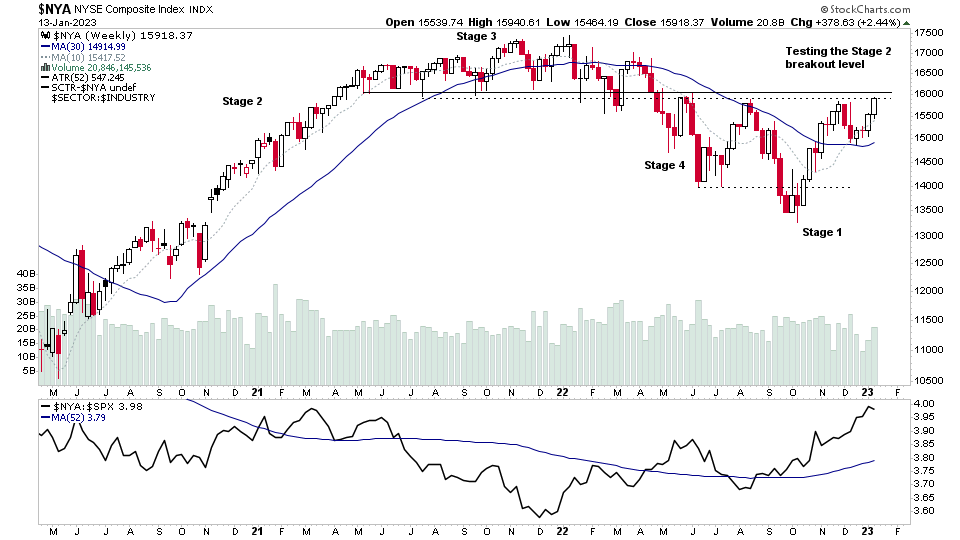

The Stage Analysis members weekend video featuring analysis of the major US Indexes as many approach their Stage 2 levels. Followed by a look at the futures charts, US Industry Groups RS Rankings, IBD Industry Groups Bell Curve - Bullish Percent, the Market Breadth Update to help to determine the Weight of Evidence and finishing with the US Stocks Watchlist in detail on multiple timeframes.

Read More

15 January, 2023

US Stocks Watchlist – 15 January 2023

There were 46 stocks highlighted from the US stocks watchlist scans today...

Read More