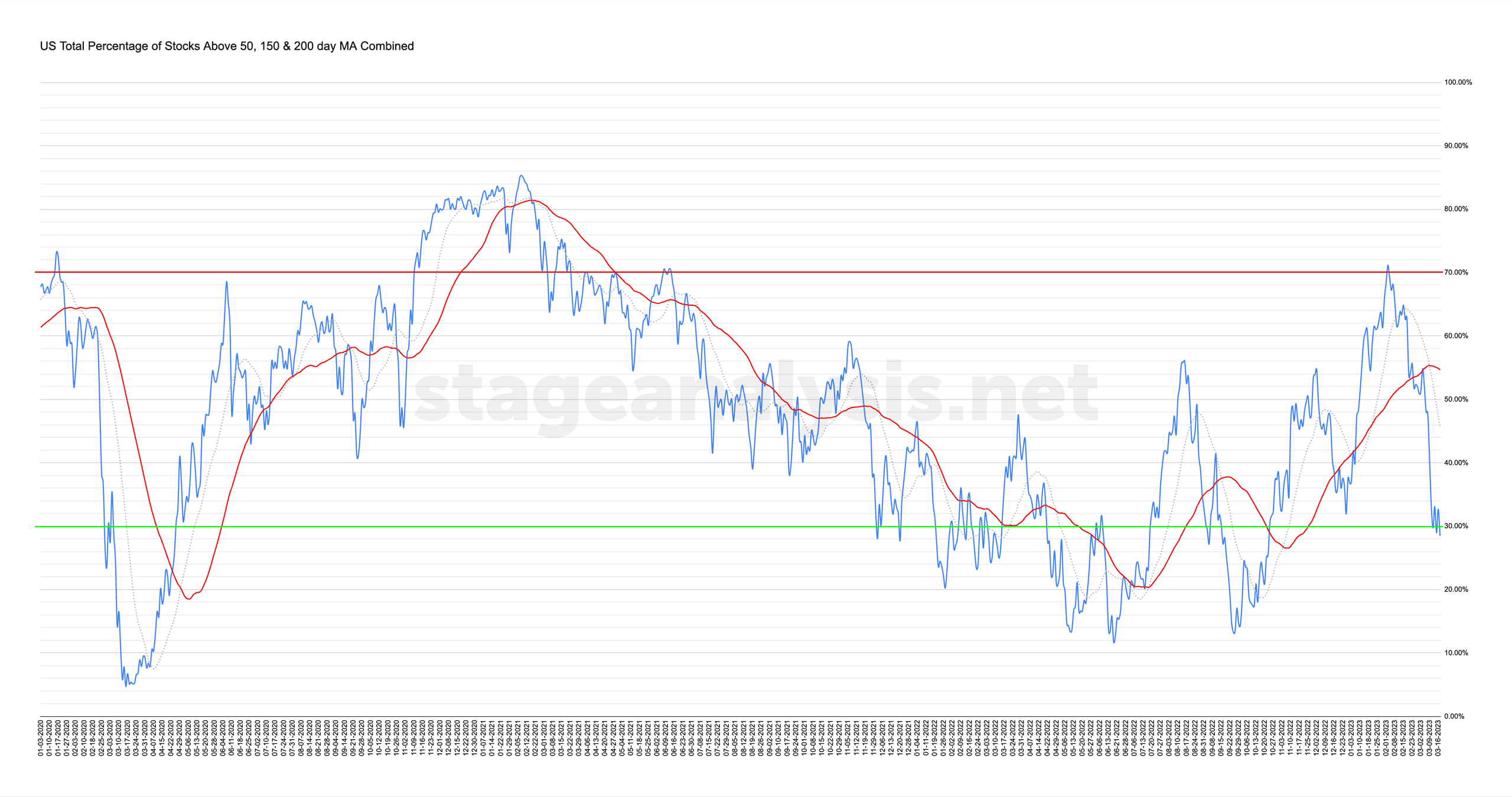

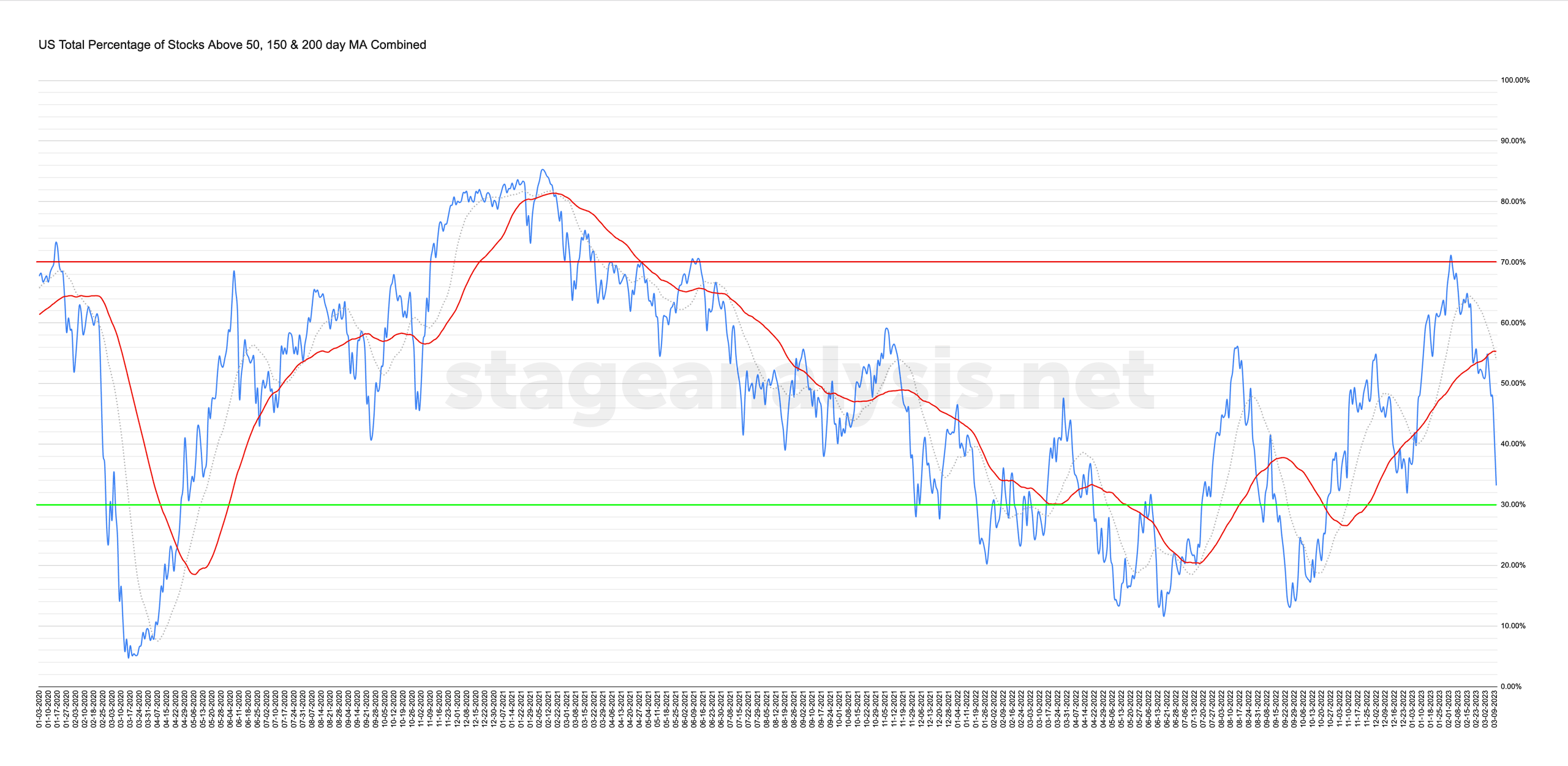

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

Blog

17 March, 2023

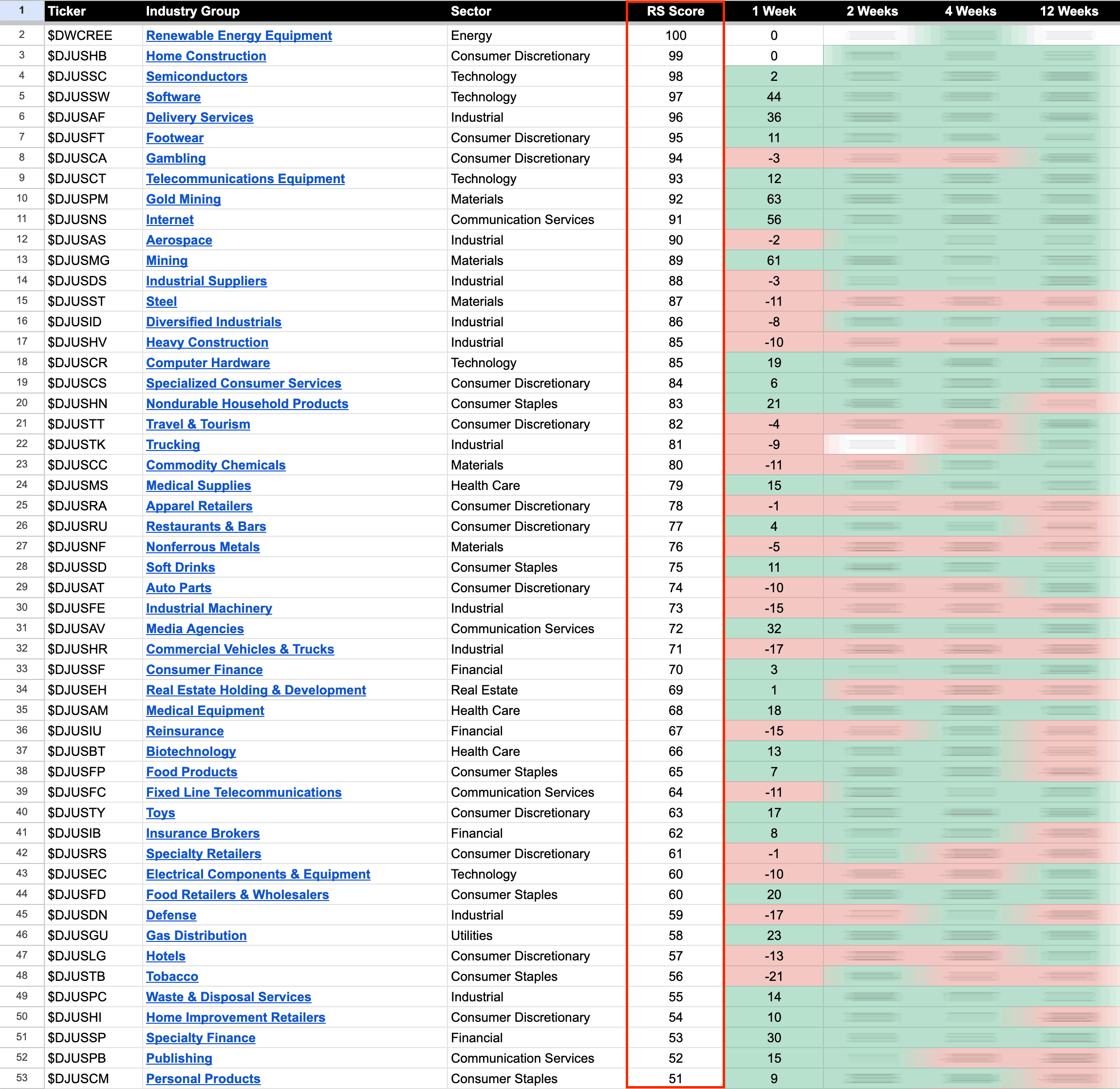

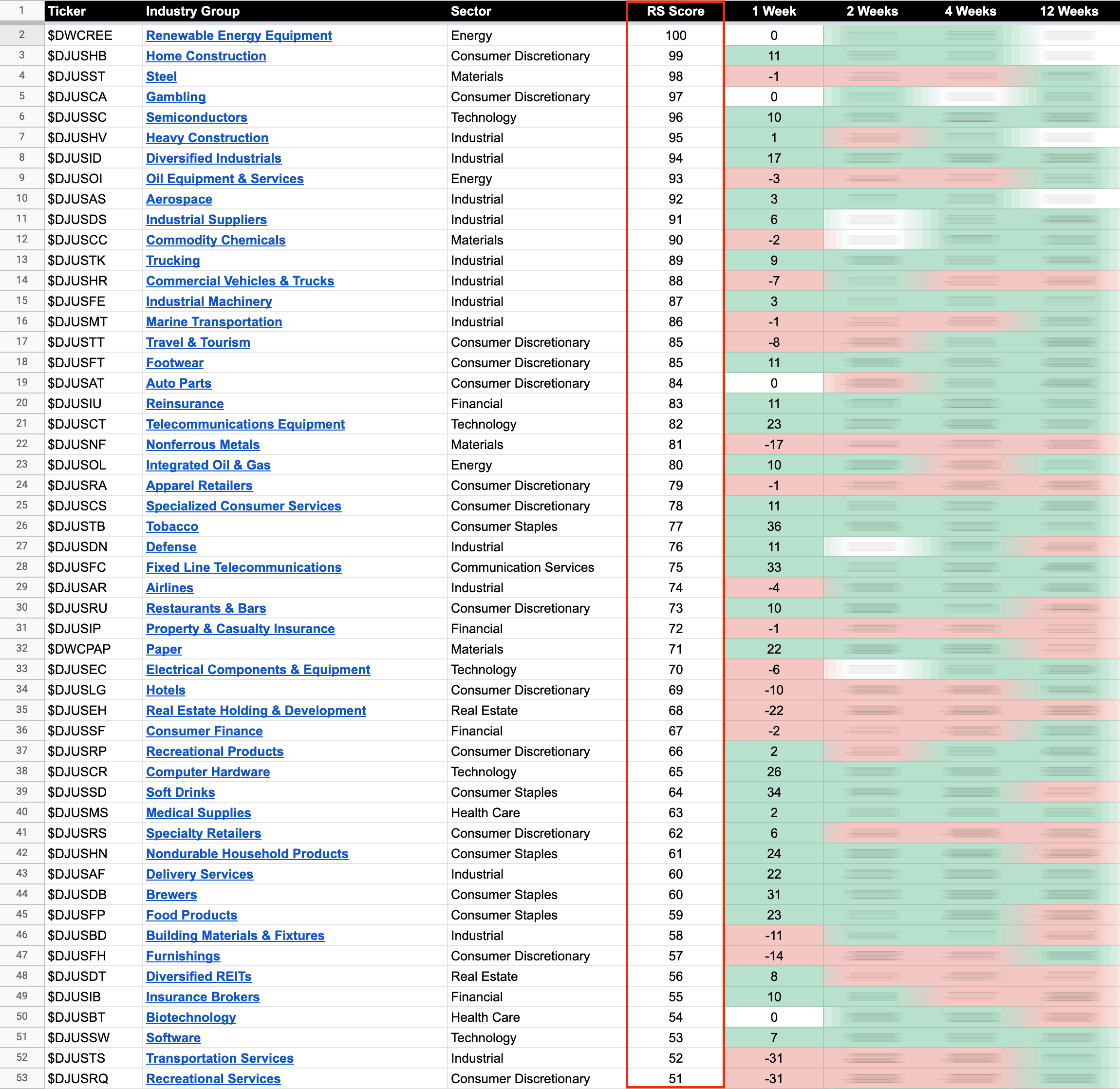

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

16 March, 2023

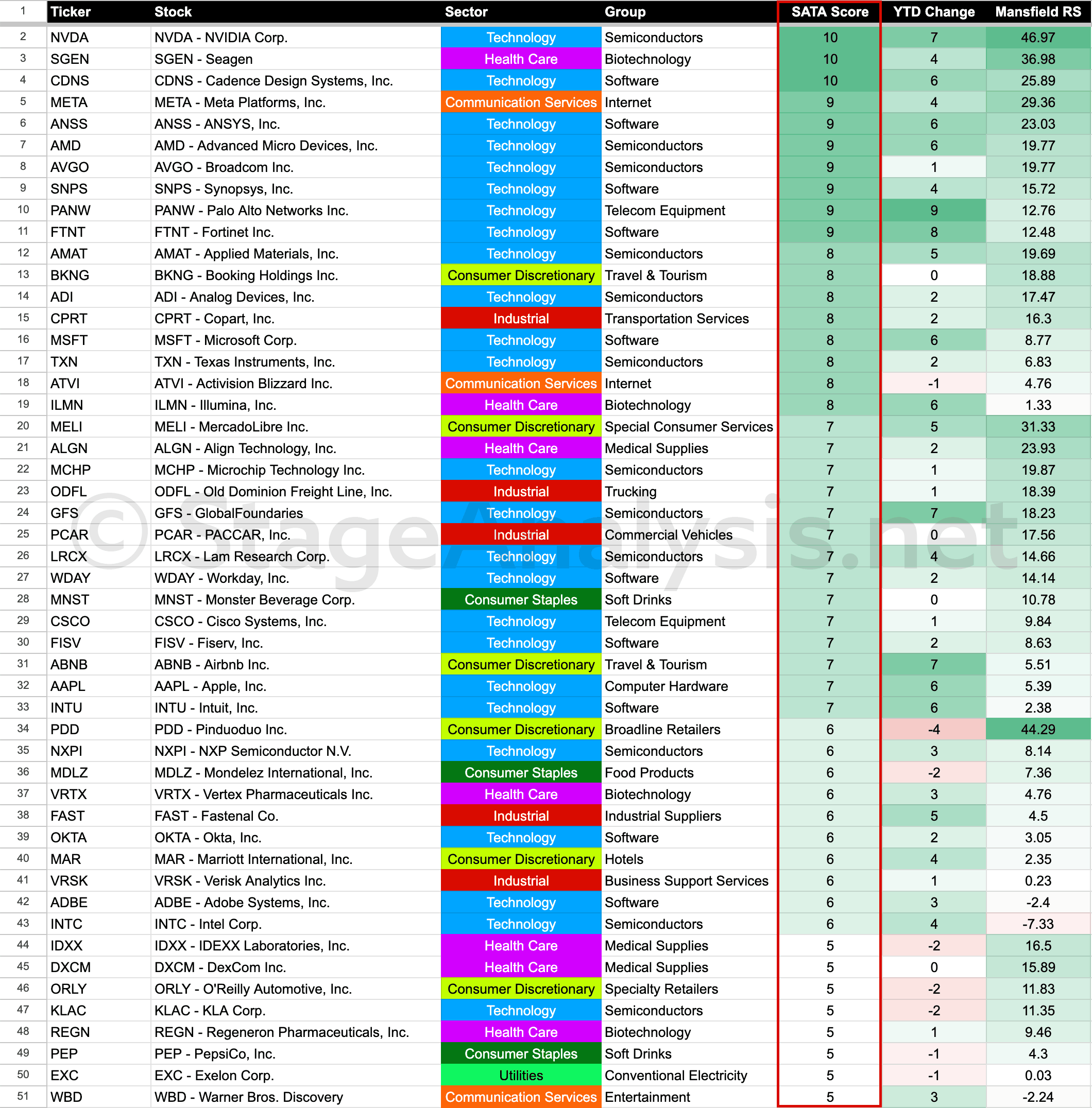

Stage Analysis Technical Attributes Scores – Nasdaq 100

The Stage Analysis Technical Attributes (SATA) score is our proprietary indicator that helps to identify the four stages from Stan Weinstein's Stage Analysis method, using a scoring system from 0 to 10 that rates ten of the key technical characteristics that we look for when analysing the weekly charts.

Read More

15 March, 2023

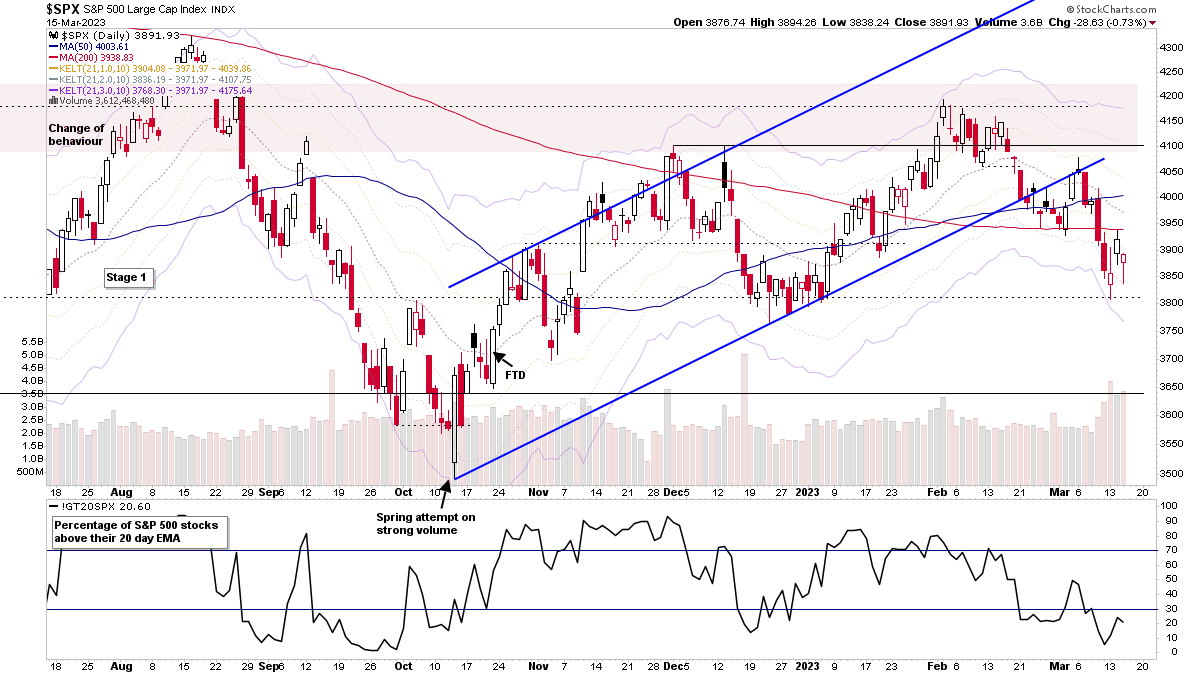

Stage Analysis Members Video – 15 March 2023 (58mins)

The Stage Analysis members midweek video discussing this weeks volatile price action in the S&P 500, Nasdaq Composite, Russell 2000 and the VIX, with a look at what the short-term market breadth indicators are suggesting. Plus a look at some of the this weeks major Stage 4 breakdown attempts. Followed by a detailed look at the US Watchlist Stocks from today scans and yesterdays post in more detail with live markups on multiple timeframes.

Read More

14 March, 2023

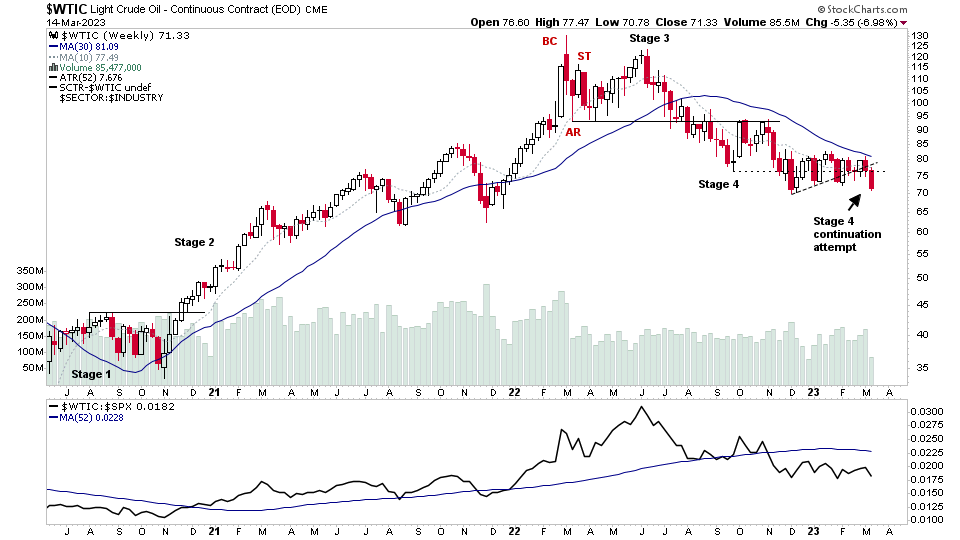

Crude Oil Attempting a Stage 4 Continuation Breakdown and the US Stocks Watchlist – 14 March 2023

Crude Oil has been weakening gradually since topping a year ago in early March 2022, where it had what's know in the Wyckoff method as a Buying Climax (BC) and Change of Behaviour as the Automatic Reaction (AR)....

Read More

13 March, 2023

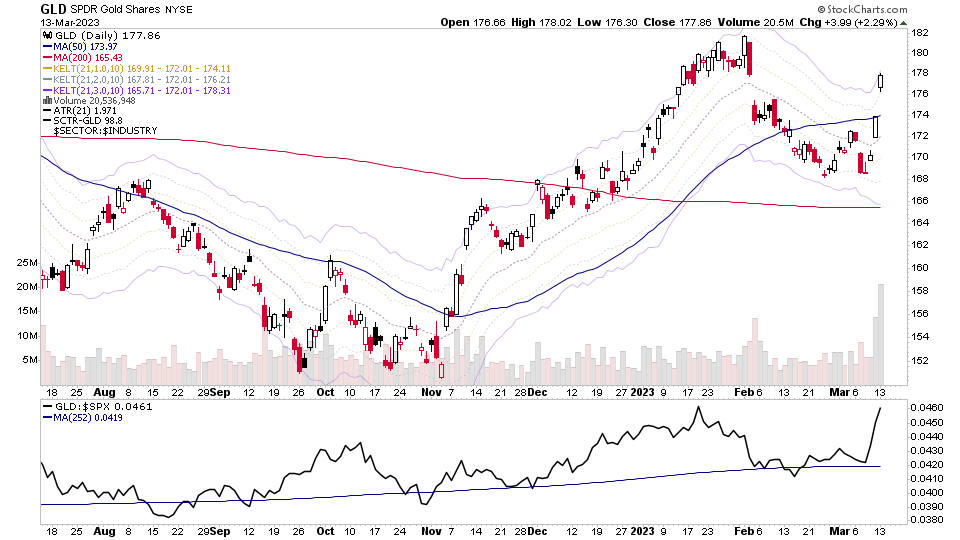

Group Focus: Gold, Silver and the Precious Metals Miners – 13 March 2023

Following on from yesterdays video where it was discussed that Gold might be in the Stage Analysis methods secondary entry zone. Today we saw a strong move in all of the precious metals futures – i.e. Gold (GC), Silver (SI), Platinum (PL) and Palladium (PA). The strength wasn't limited to the physical metals, as the precious metals mining stocks also caught a bid, so I though it would be useful to do a broader post covering some of the precious metals ETFs and stocks, so that you can further research the group in more detail...

Read More

12 March, 2023

Stage Analysis Members Video – 12 March 2023 (1hr 29mins)

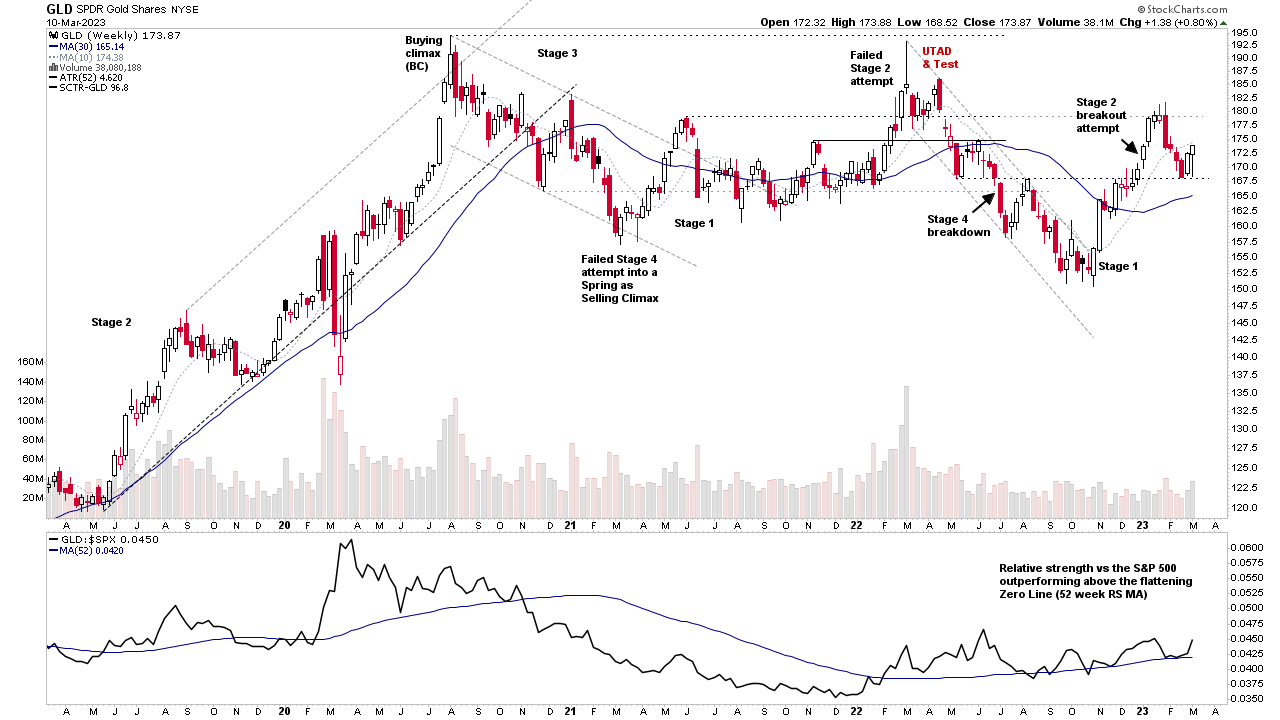

The Stage Analysis members weekend video this week begins with a discussion on Gold as it attempts to rebound around its prior Stage 2 breakout level in the turn with the US Dollar Index attempting to rollover at its Stage 4 breakdown level. Then a discussion of the Stage 4 breakdowns in the Bank indexes and different ETFs that cover them. Before the more regular weekly content of the Major Indexes Update, Futures and US Treasuries, IBD Industry Groups Bell Curve – Bullish Percent, US Stocks Industry Groups RS Rankings, Market Breadth Update – Weight of Evidence and some of the weeks Stage 2 Breakout attempts against the overall market action.

Read More

11 March, 2023

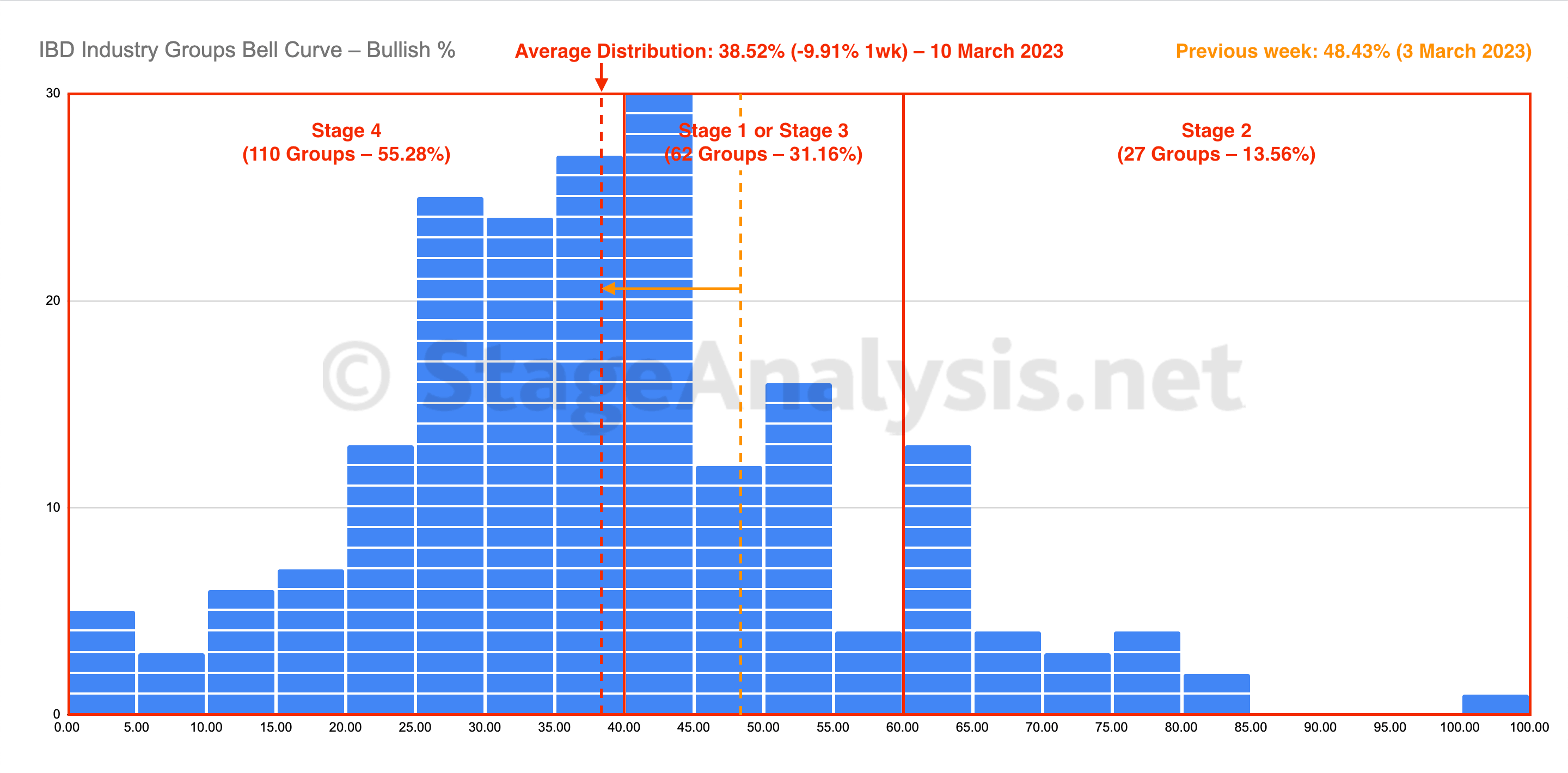

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve declined for a fifth week, losing -9.91% to finish at 38.52% overall. The amount of groups in Stage 4 increased by 52 (+26%), and the amount of groups in Stage 2 decreased by 27 (-13.6%), while the amount groups in Stage 1 or Stage 3 decreased by 25 (-12.6%)...

Read More

11 March, 2023

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

10 March, 2023

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More