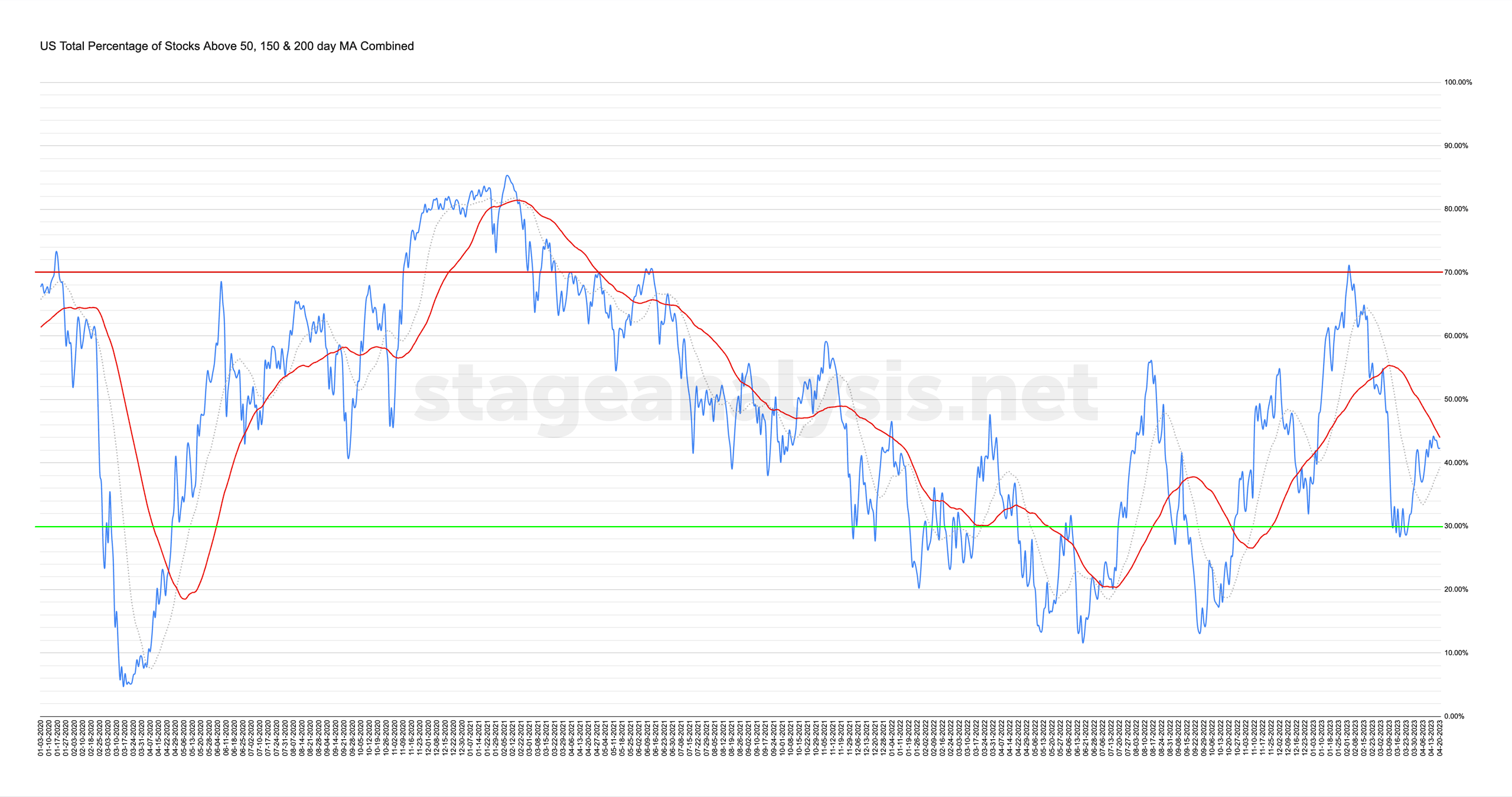

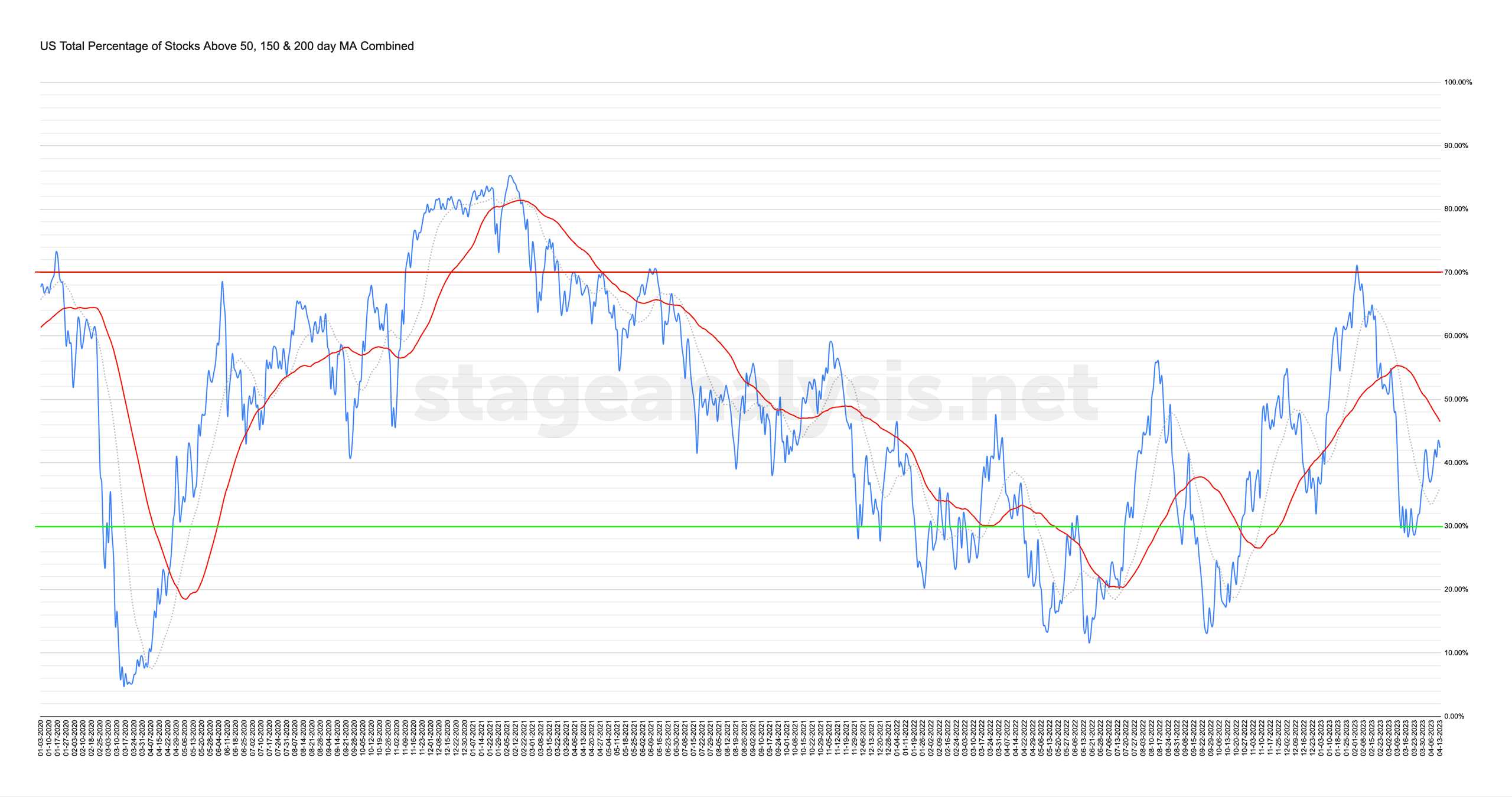

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

Blog

21 April, 2023

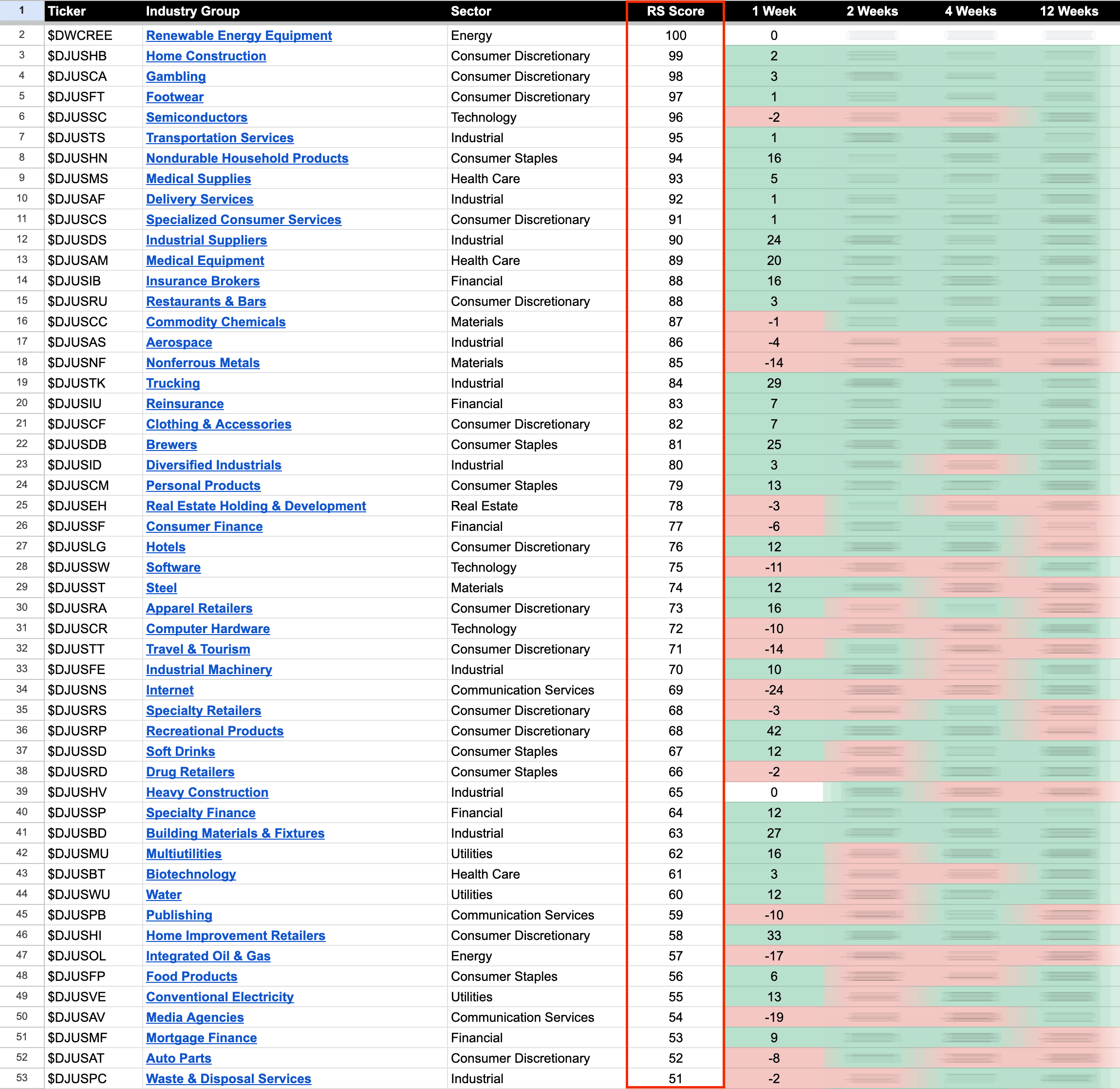

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

21 April, 2023

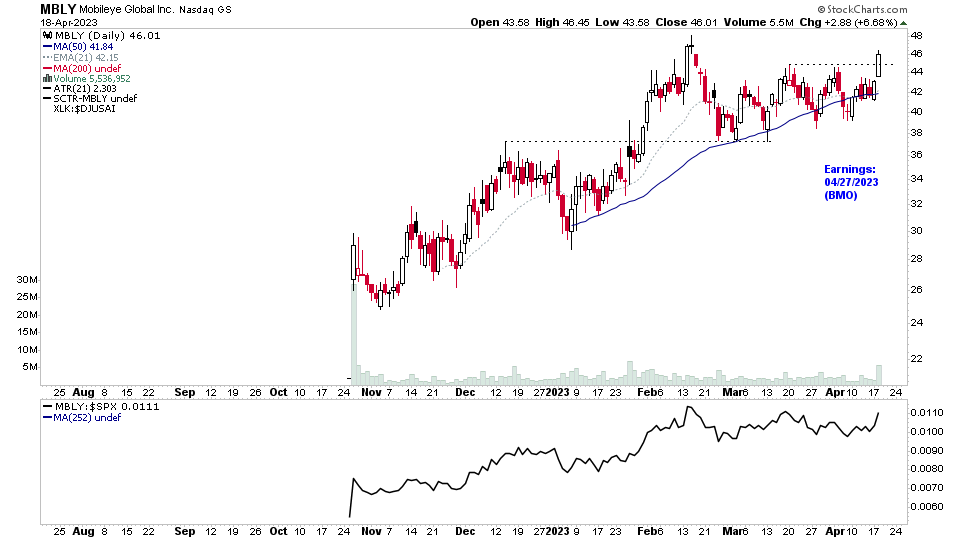

US Stocks Watchlist – 21 April 2023

There were 17 stocks highlighted from the US stocks watchlist scans today...

Read More

20 April, 2023

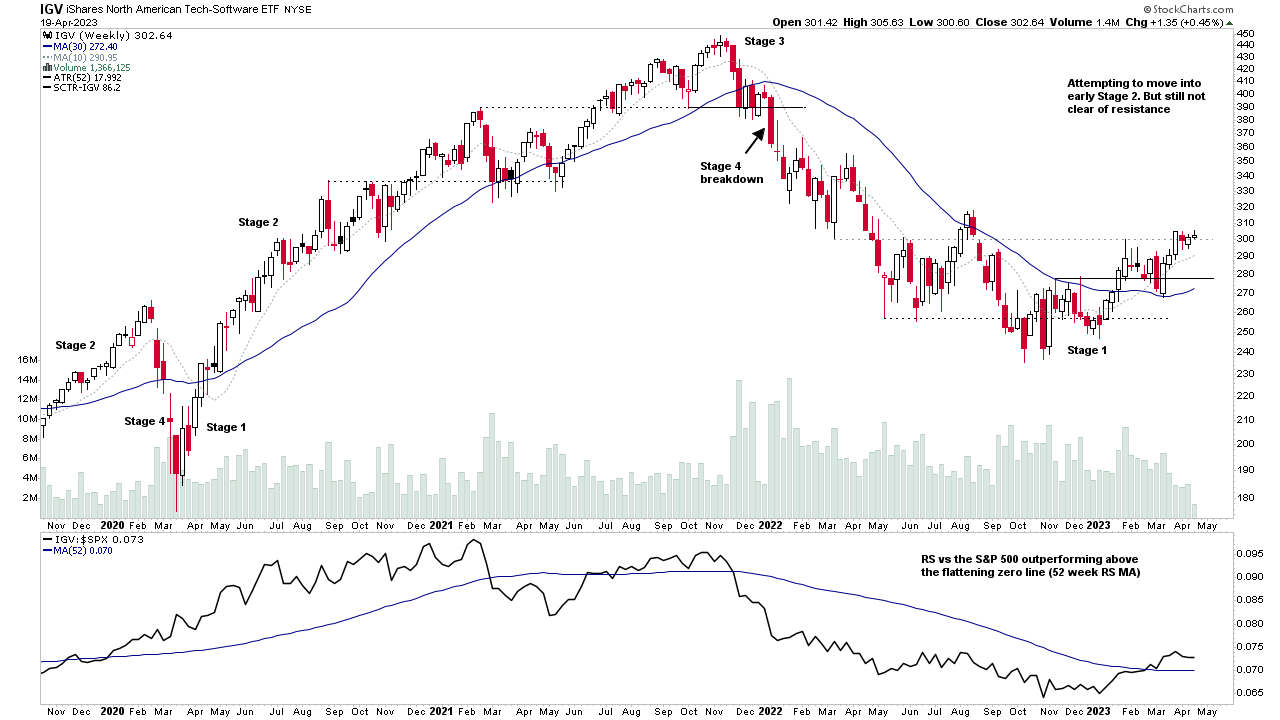

Software Group Focus Video – 19 April 2023 (36mins)

The Stage Analysis members midweek video is a special group focus on the Software group this week, looking at the top 10% of stocks within the group and how they are developing in Stage 2 and late Stage 1...

Read More

19 April, 2023

US Stocks Watchlist – 19 April 2023

There were 23 stocks highlighted from the US stocks watchlist scans today...

Read More

17 April, 2023

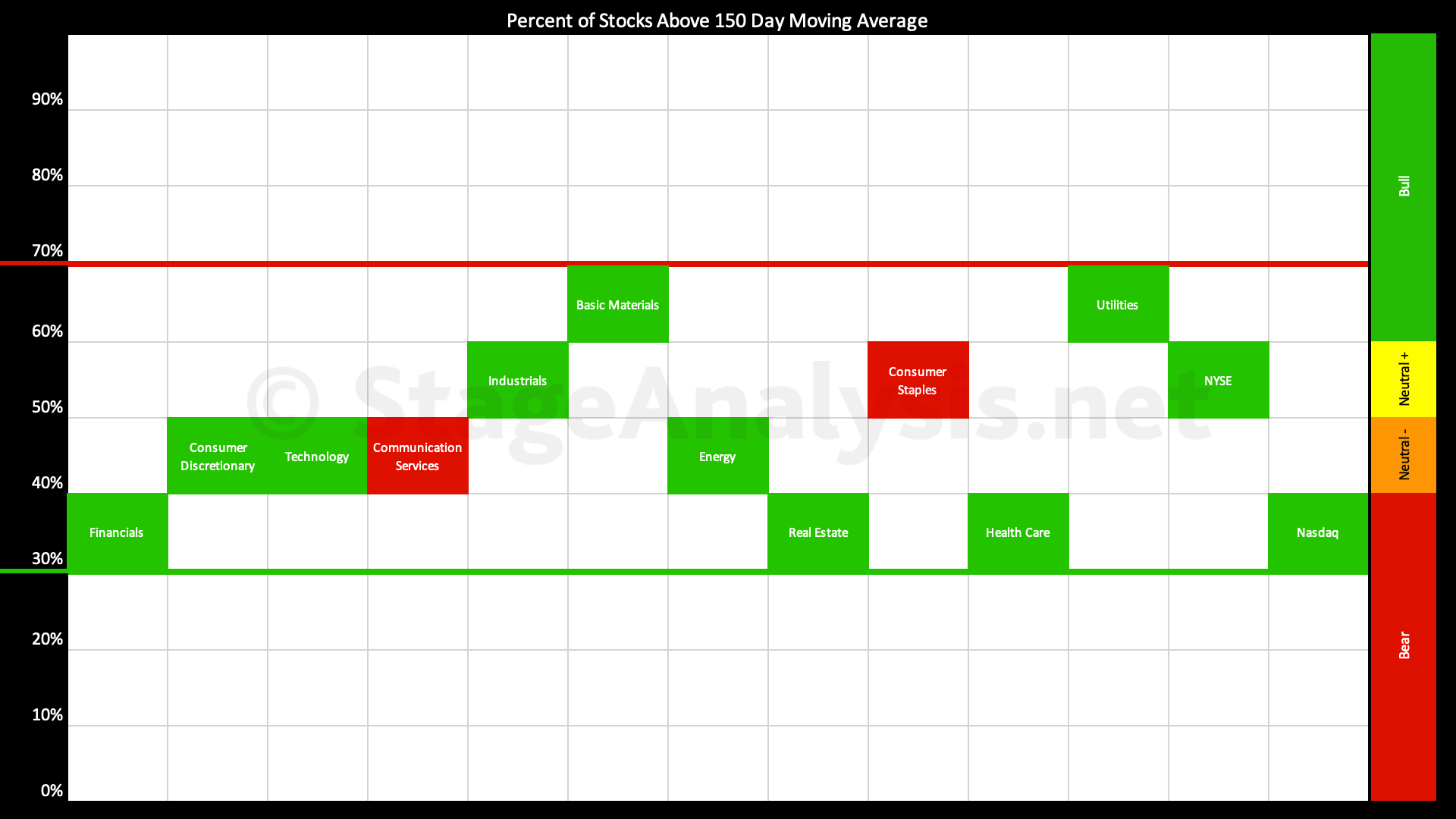

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors continues to edge to towards the middle of the range, with every sector clustered in the middle range, as can be see on the visual diagram...

Read More

16 April, 2023

Stage Analysis Members Video – 16 April 2023 (1hr 25mins)

Stage Analysis Members Weekend Video featuring Stage Analysis of the major US indexes on multiple timeframes, Futures (SATA) Stage Analysis Technical Attributes Charts, Industry Group RS Rankings and changes, IBD Industry Groups Bell Curve – Bullish Percent data. The Market Breadth Update to help to determine the Weight of Evidence, which is so crucial to Stan Weinstein's Stage Analysis method....

Read More

16 April, 2023

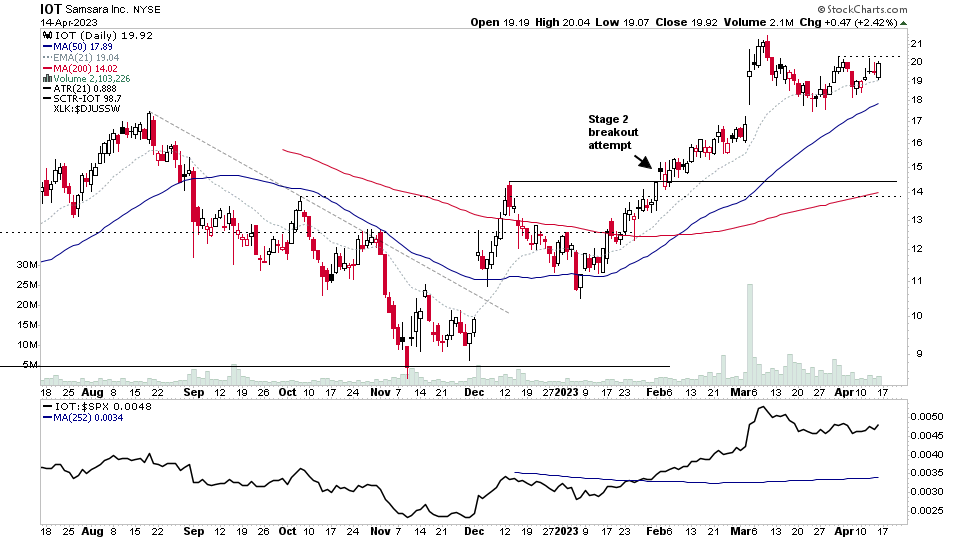

US Stocks Watchlist – 16 April 2023

There were 41 stocks highlighted from the US stocks watchlist scans today – IOT, TMHC, IGT, SKIN...

Read More

15 April, 2023

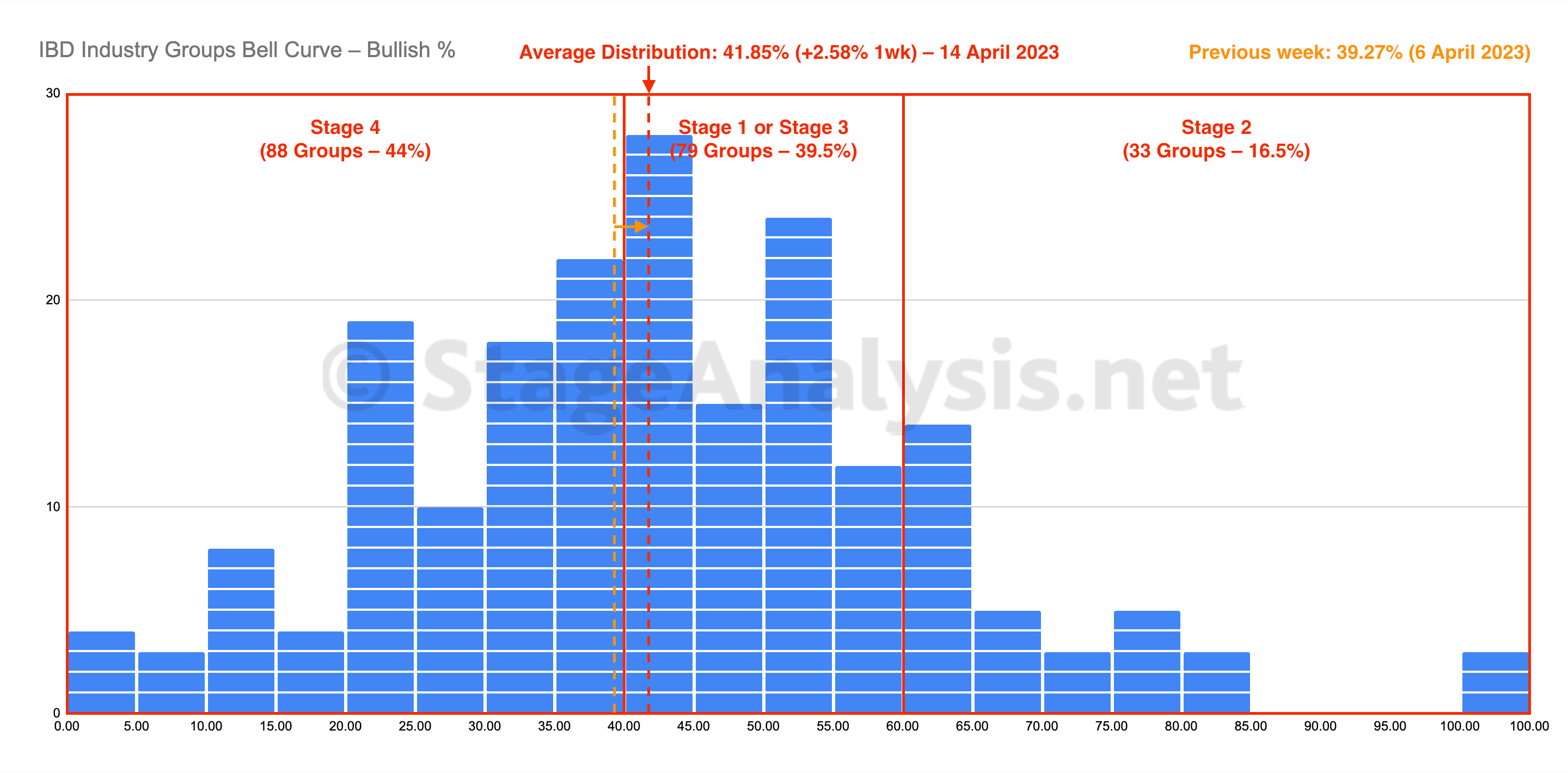

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve advanced slightly for a fourth week by +2.58% to finish the week at 41.85%. The amount of groups in Stage 4 decreased by 19 (-9.5%), and the amount of groups in Stage 2 increased by 9 (+4.5%), while the amount groups in Stage 1 or Stage 3 decreased by 10 (-5%).

Read More

15 April, 2023

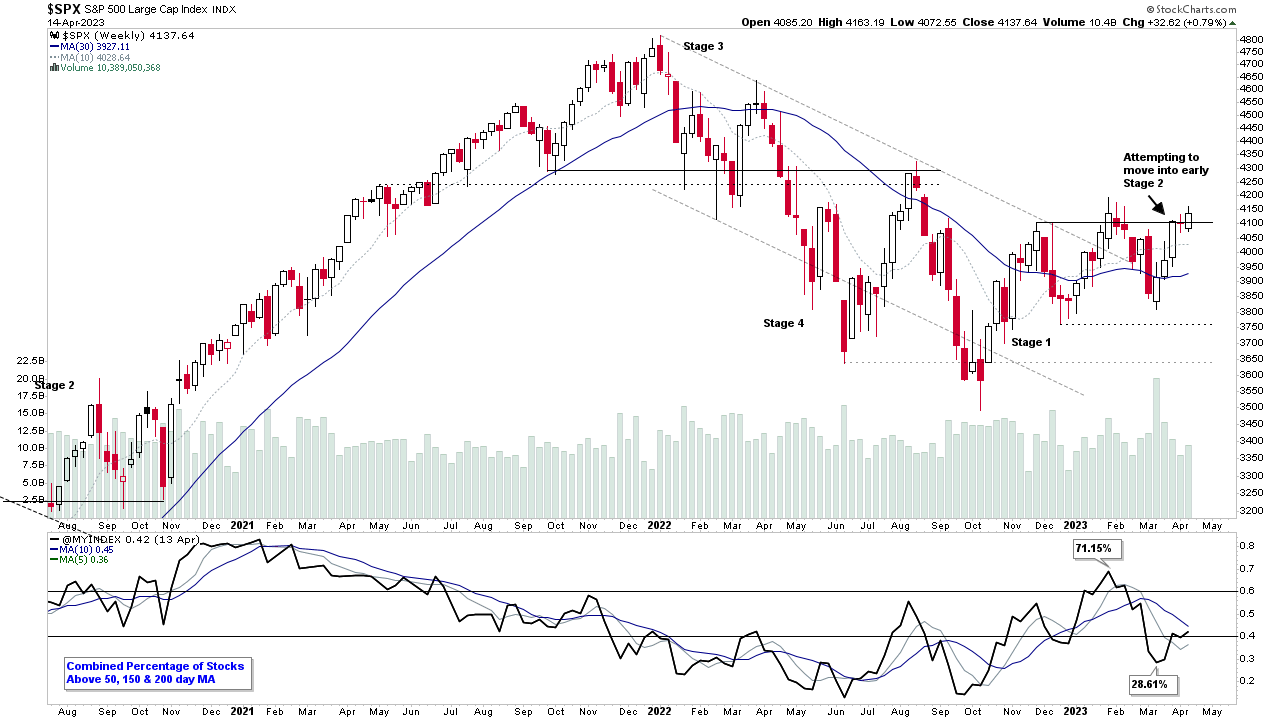

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More