There were 25 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

06 July, 2023

US Stocks Watchlist – 6 July 2023

05 July, 2023

US Stocks Watchlist – 5 July 2023

There were 31 stocks highlighted from the US stocks watchlist scans today...

Read More

03 July, 2023

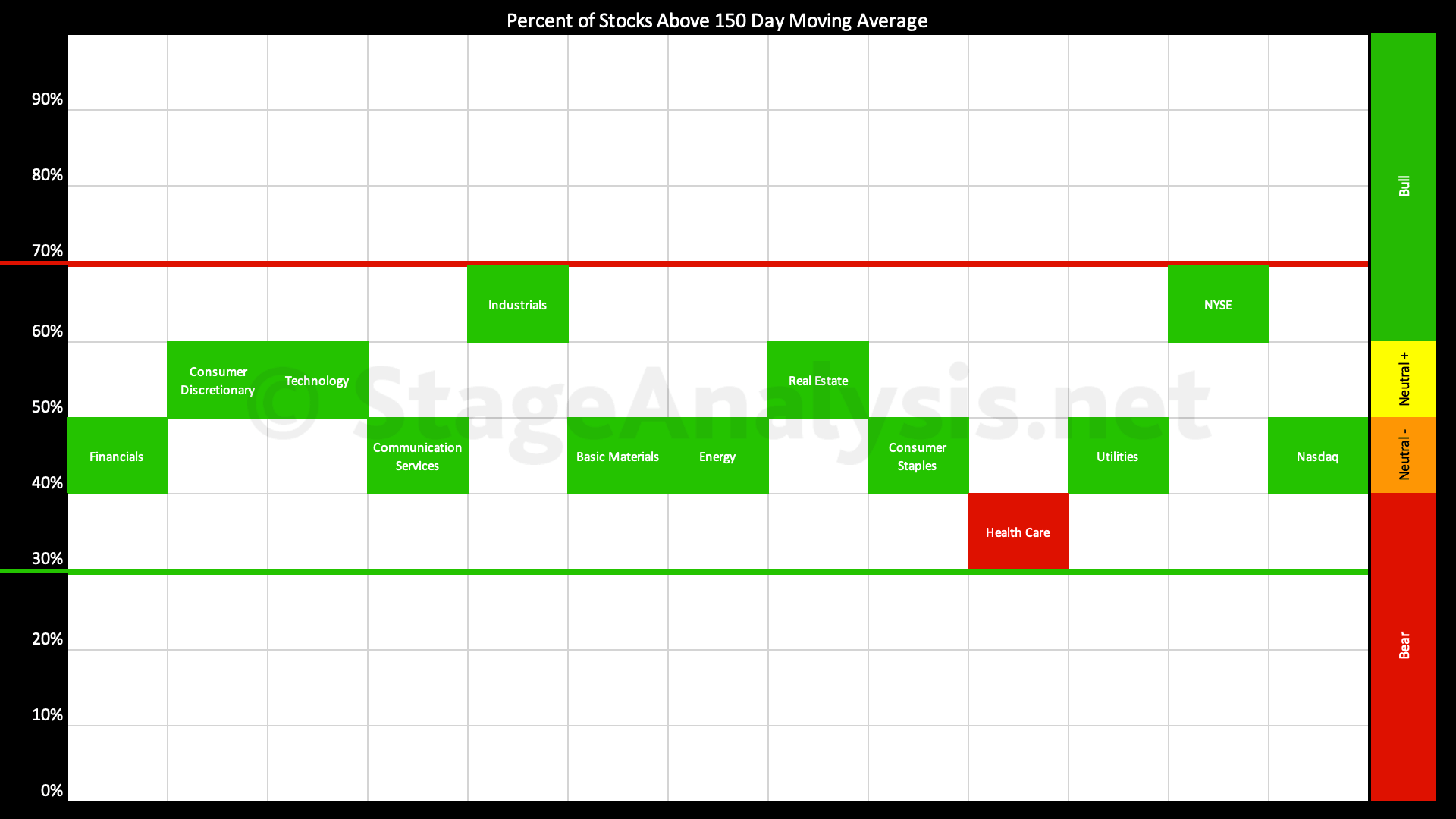

Sector Breadth: Percentage of US Stocks Above Their 150 day (30 Week) Moving Averages

The percentage of US stocks above their 150 day (30 week) moving averages in the 11 major sectors post provides a unique snapshot of the overall market health and is highlighted every few weeks in the Stage Analysis blog...

Read More

02 July, 2023

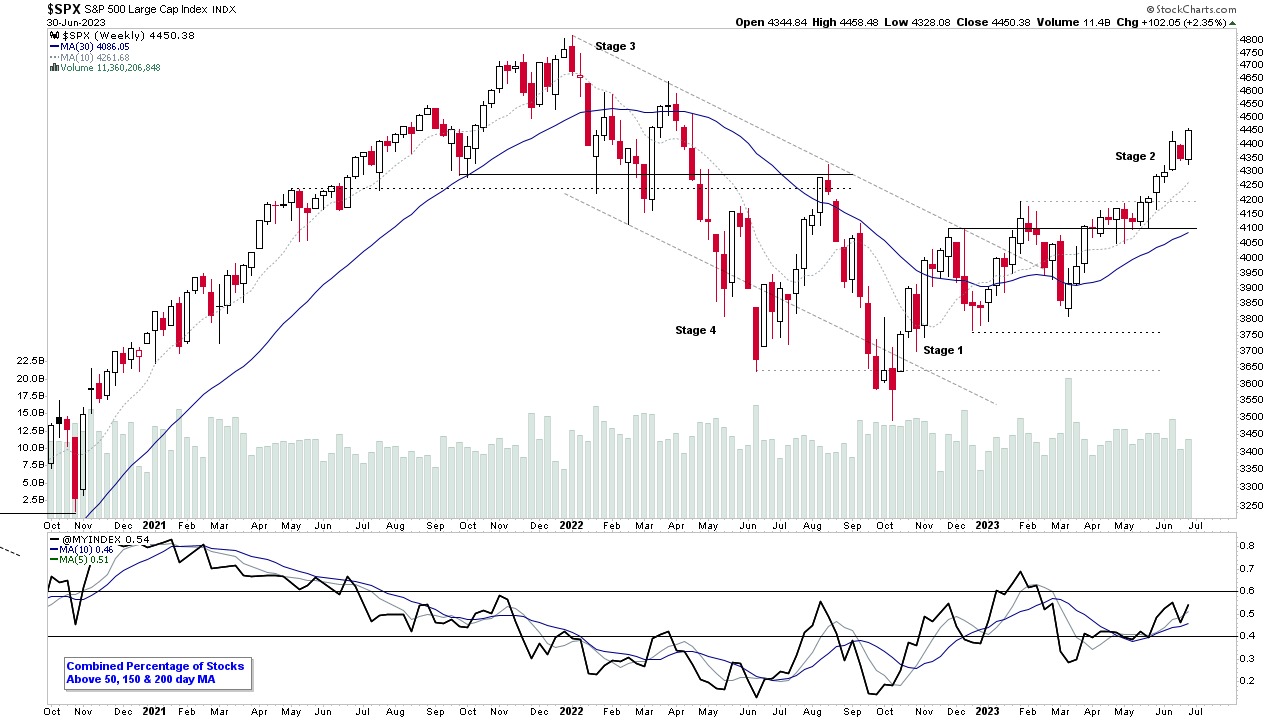

Stage Analysis Members Video – 2 July 2023 (1hr 35mins)

This weeks Stage Analysis members weekend video features discussion of the Major Indexes Update, Futures SATA Charts, Industry Groups RS Rankings, IBD Industry Group Bell Curve, Market Breadth Update to help to determine the weight of evidence, Stage 2 breakouts on volume, and finally the US Watchlist Stocks from the weekend scans in detail on multiple timeframes.

Read More

02 July, 2023

US Stocks Watchlist – 2 July 2023

There were 36 stocks highlighted from the US stocks watchlist scans today...

Read More

02 July, 2023

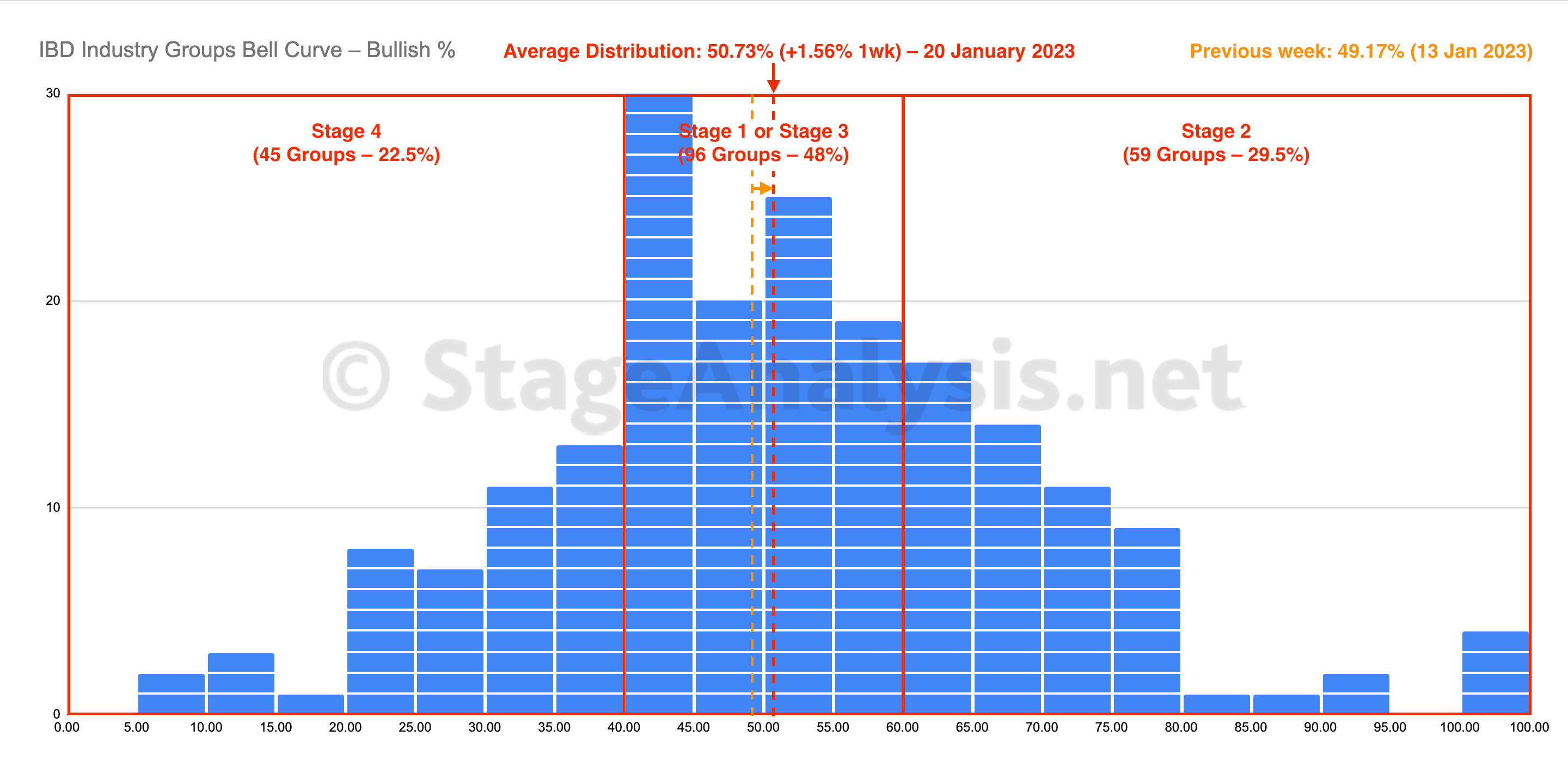

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent shows the few hundred industry groups plotted as a histogram chart and represents the percentage of stocks in each group that are on a point & figure (P&F) buy signal. This information provides a snapshot of the overall market health in a unique way, and is particularly useful for both market timing strategies and as a tool in aiding with the Stage Analysis methods "Forest to the Trees" approach, where we look for developing group themes...

Read More

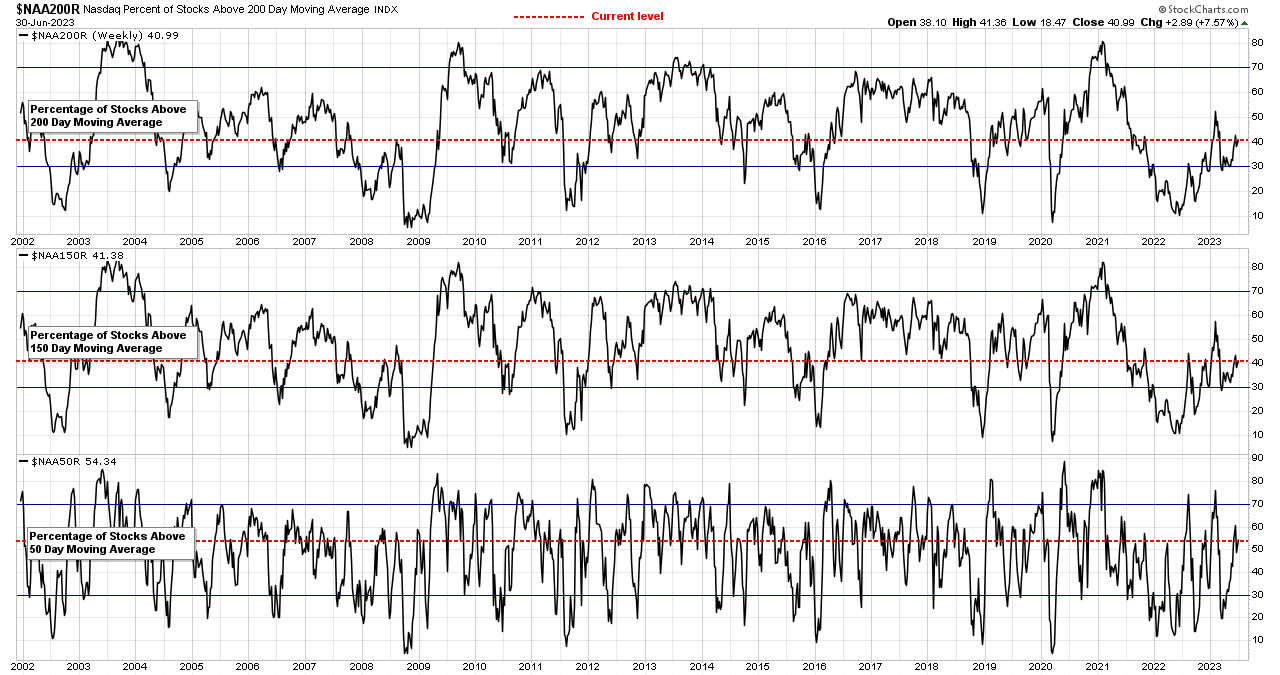

01 July, 2023

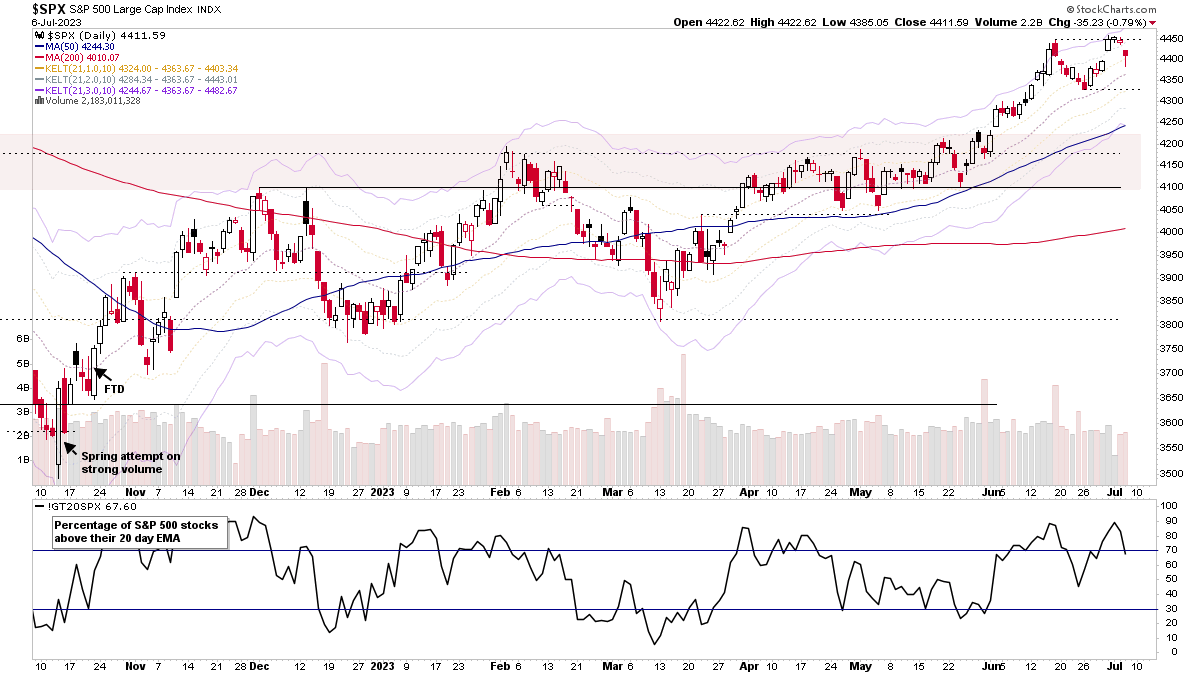

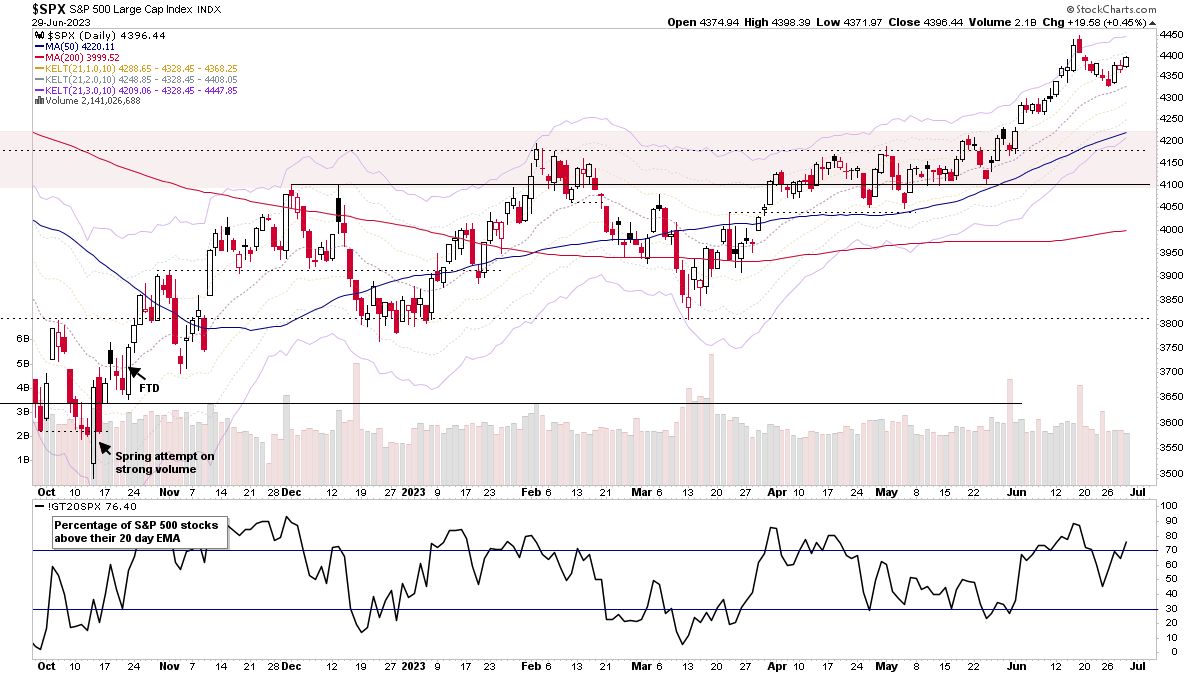

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

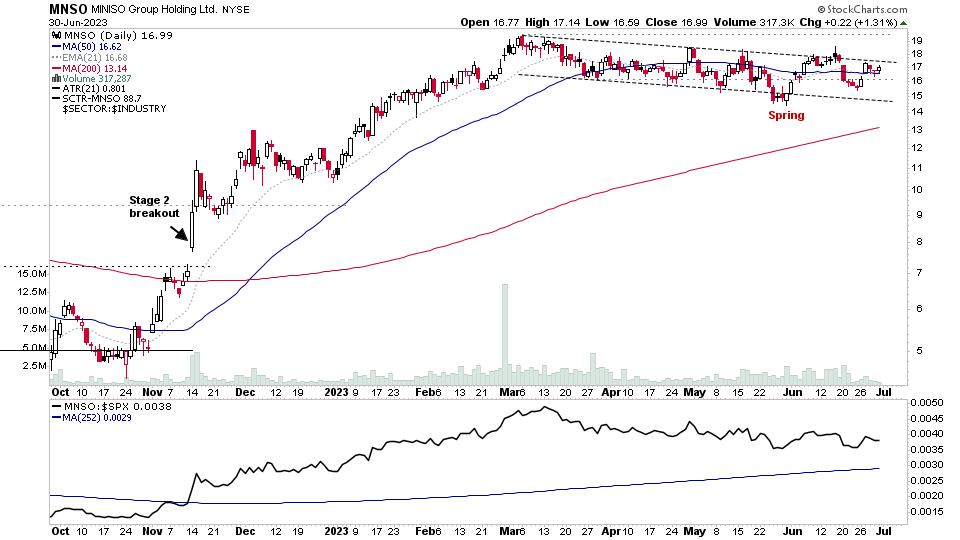

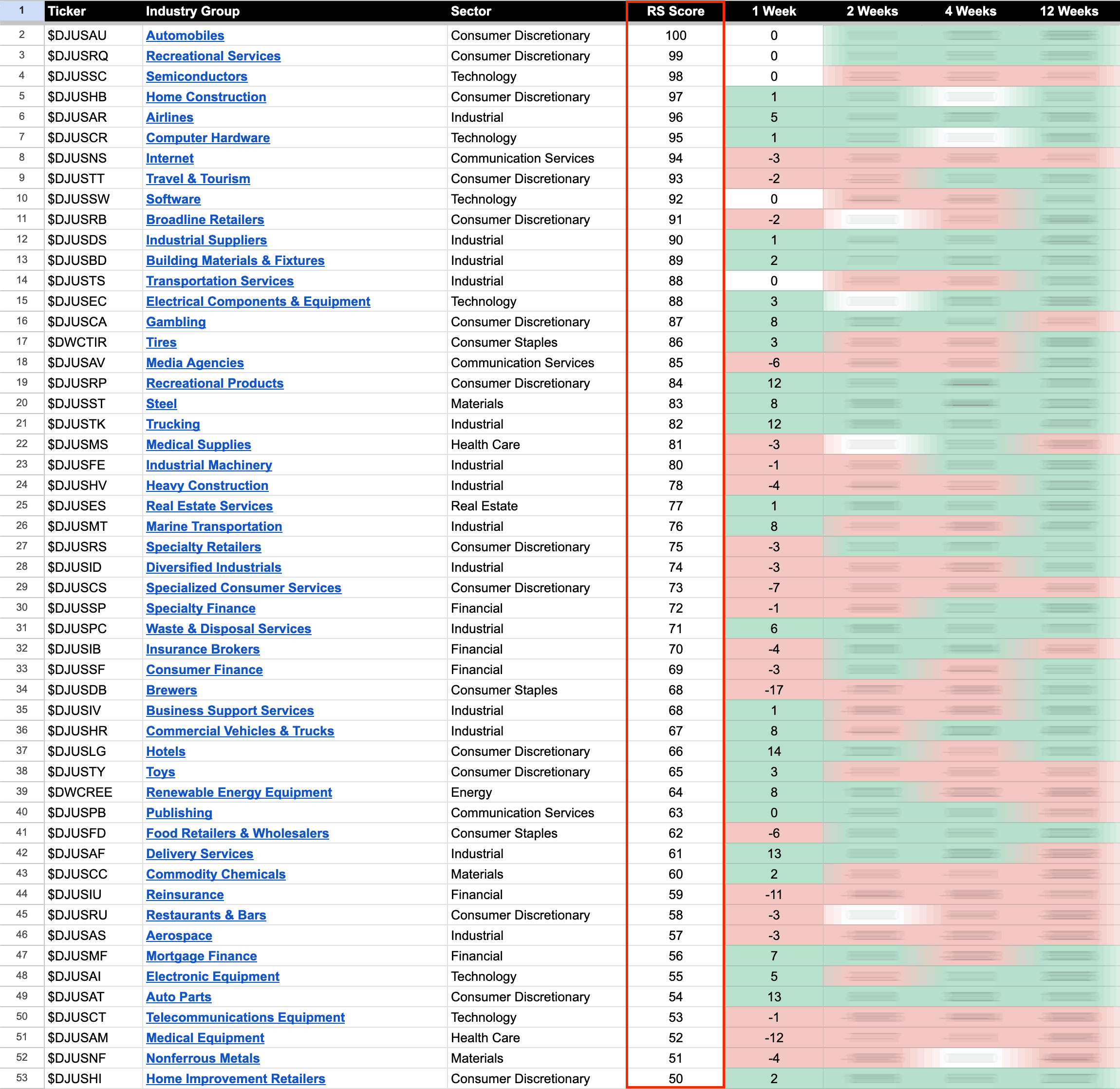

30 June, 2023

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

29 June, 2023

US Stocks Watchlist – 29 June 2023

There were 30 stocks highlighted from the US stocks watchlist scans today...

Read More

28 June, 2023

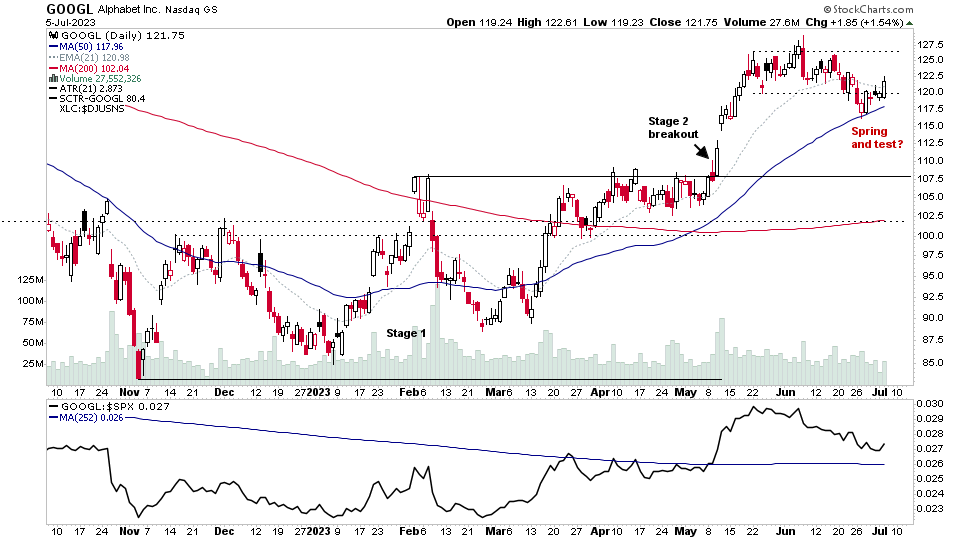

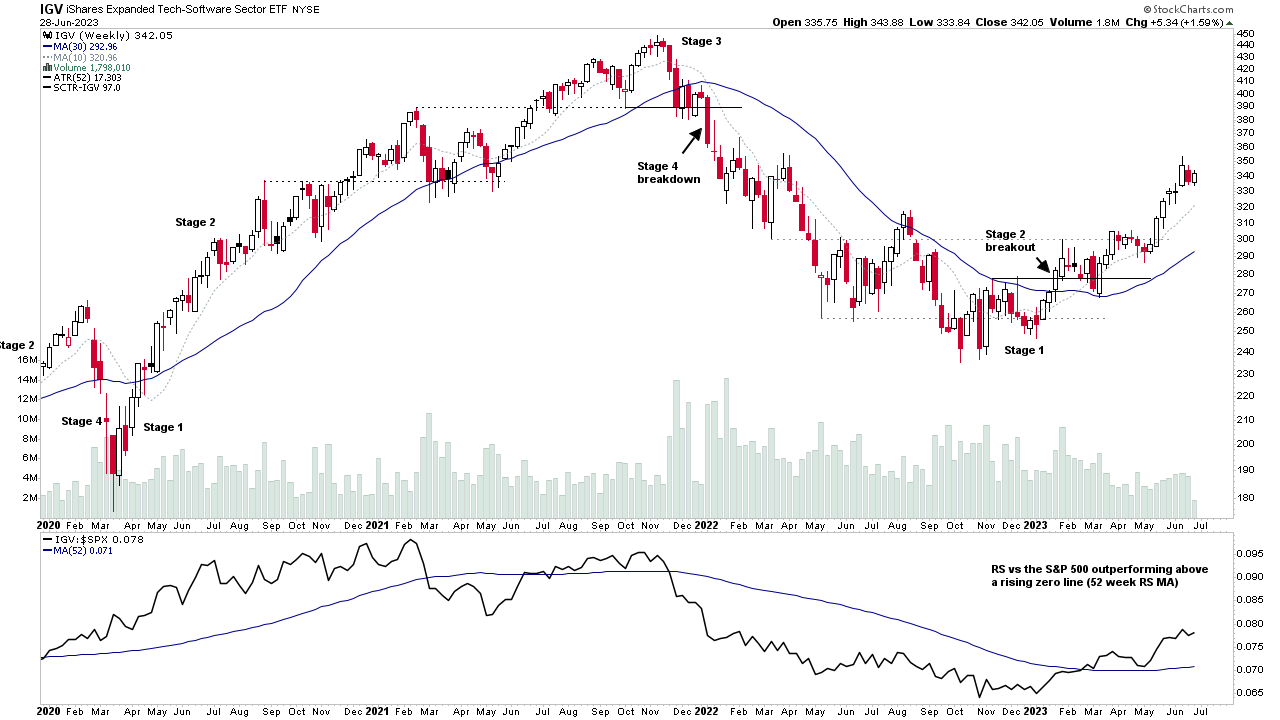

Software Group Focus Video – 28 June 2023 (50 mins)

Software group is back in focus again, as it remains one of the leading groups of 2023 with numerous stocks in strong Stage 2 advances and is host to a number of the leading sub themes, such the AI theme, which has been a huge driver of the broad market year to date.

Read More