There were 21 stocks highlighted from the US stocks watchlist scans today...

Read More

Blog

19 May, 2024

US Stocks Watchlist – 19 May 2024

18 May, 2024

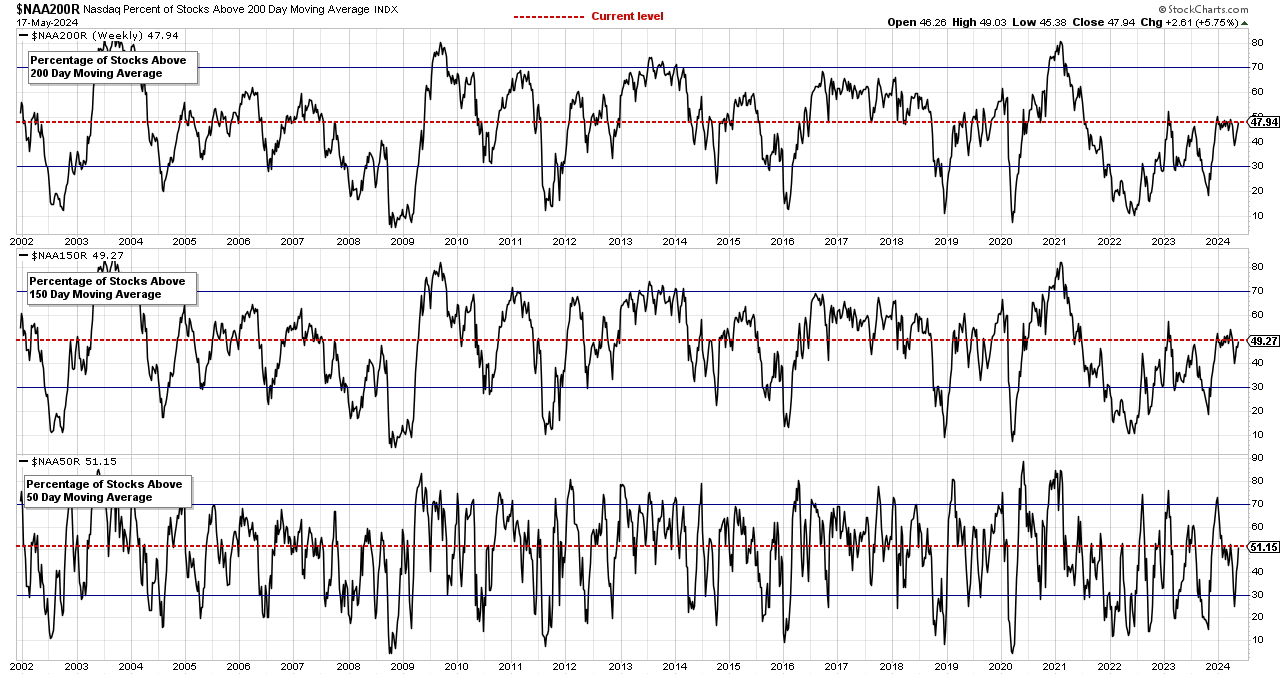

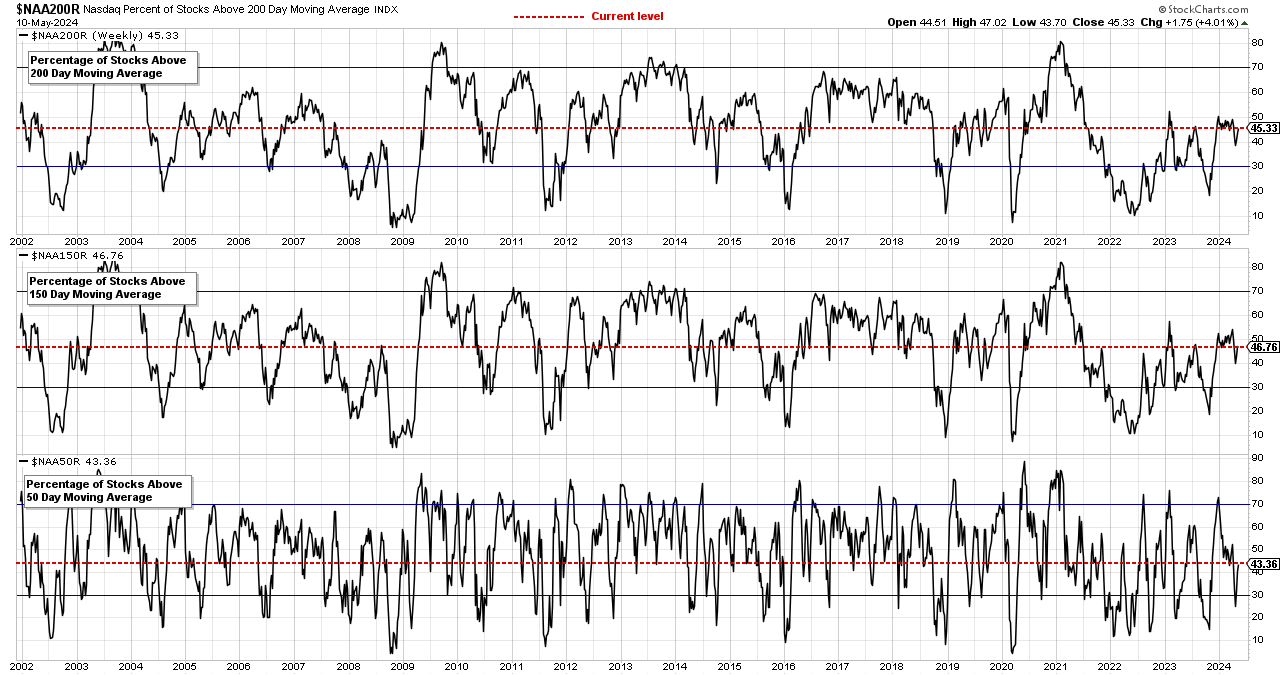

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom percentage of stocks above their 50 day, 150 day & 200 day moving averages combined market breadth charts for the overall US market, NYSE and Nasdaq for market timing and strategy...

Read More

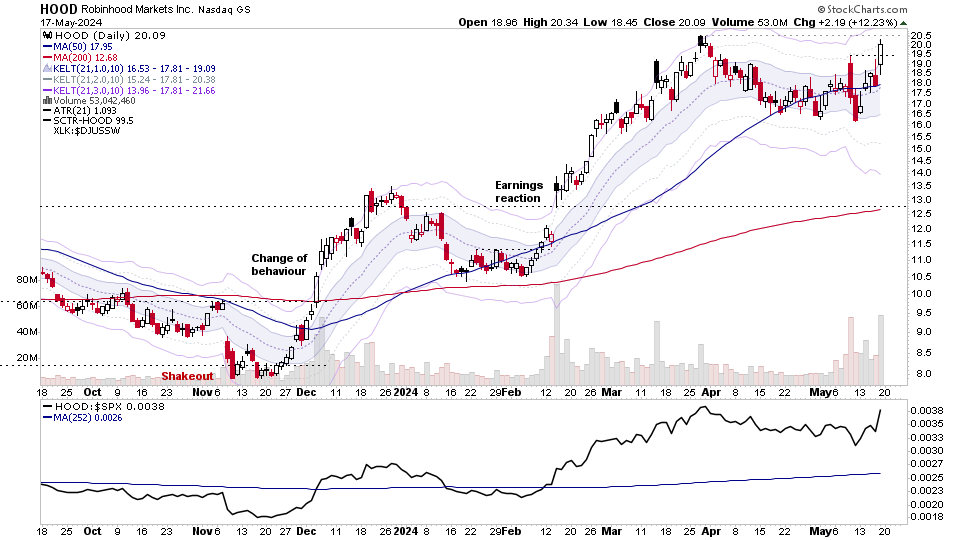

17 May, 2024

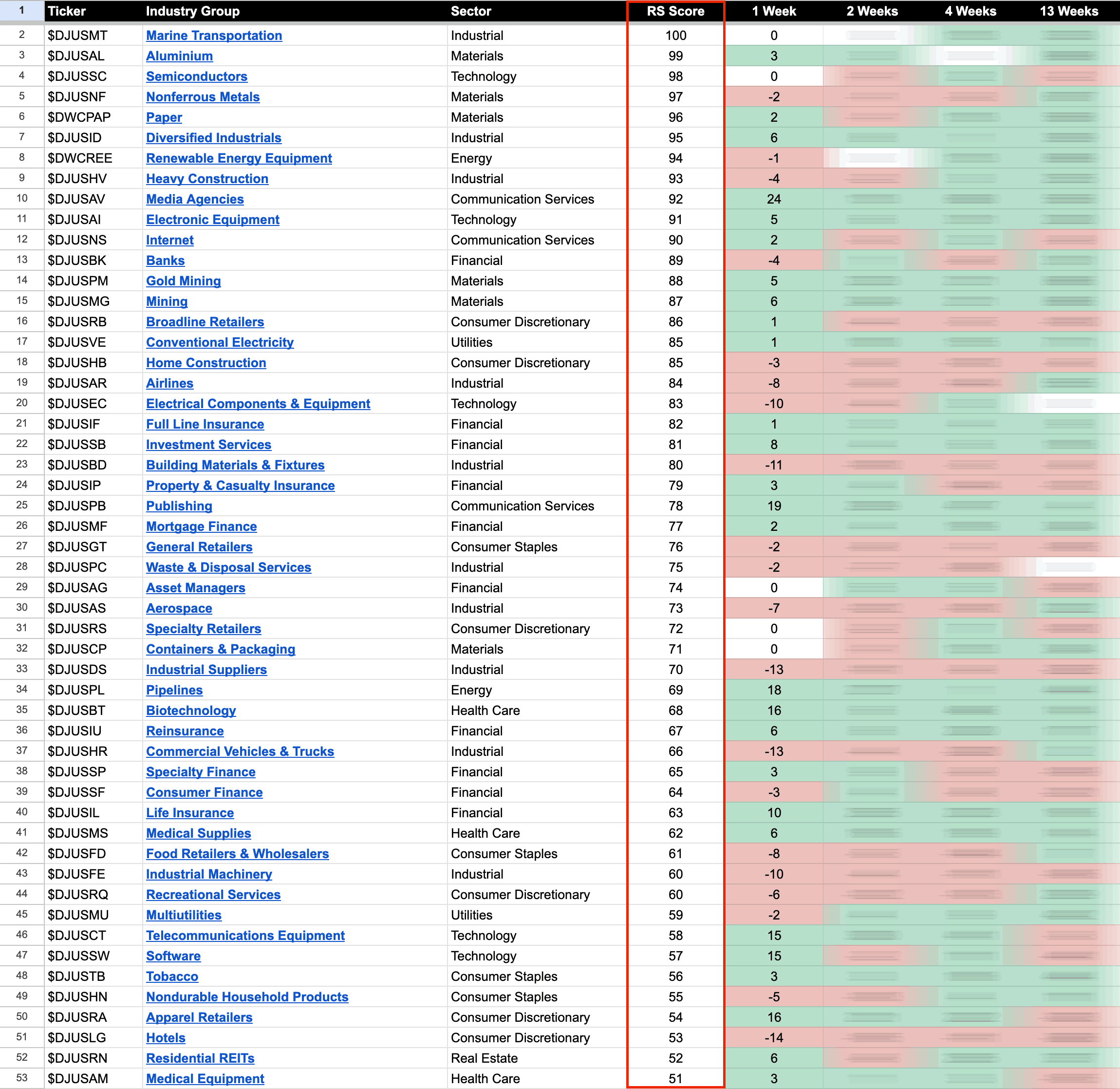

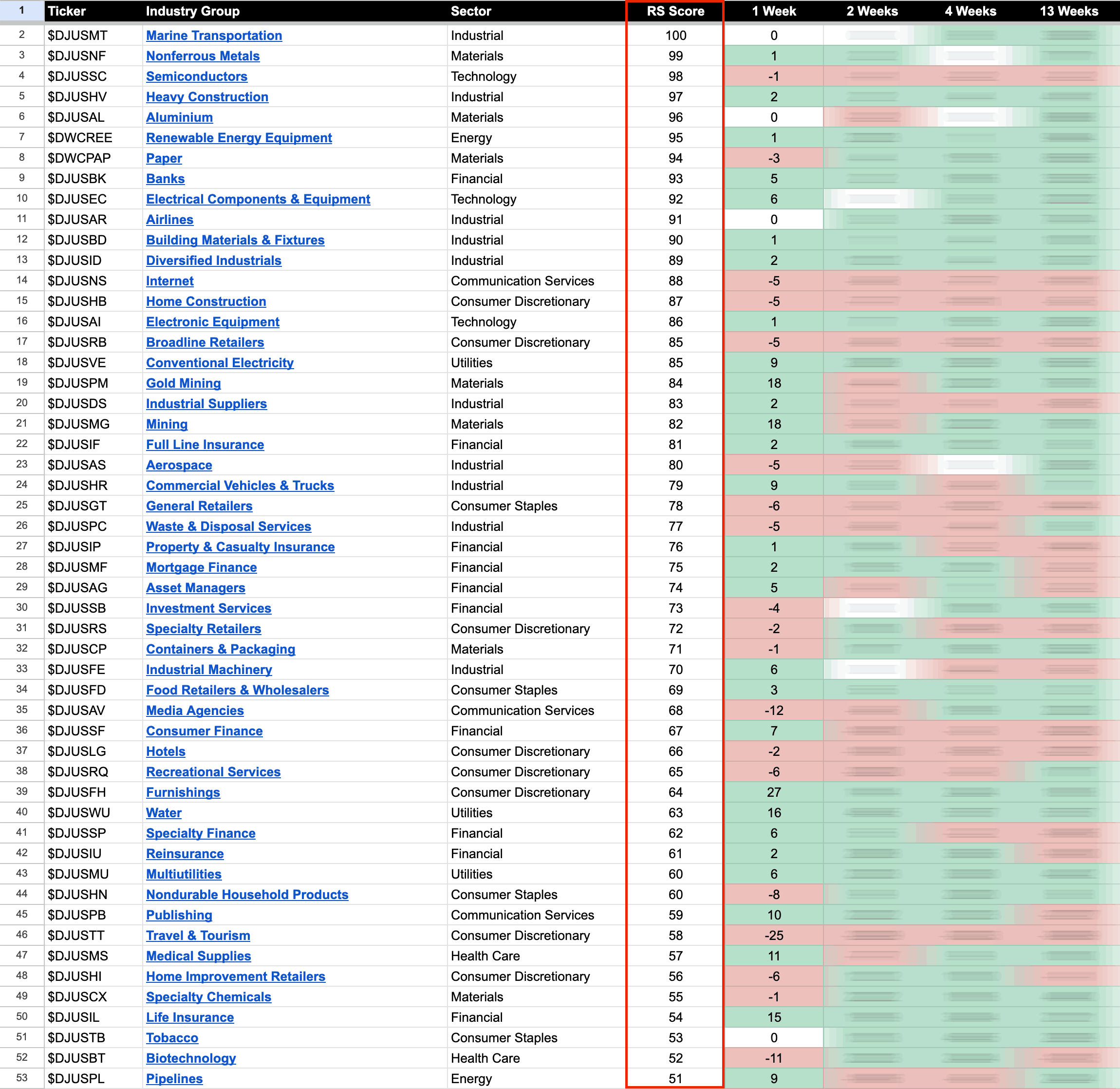

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

16 May, 2024

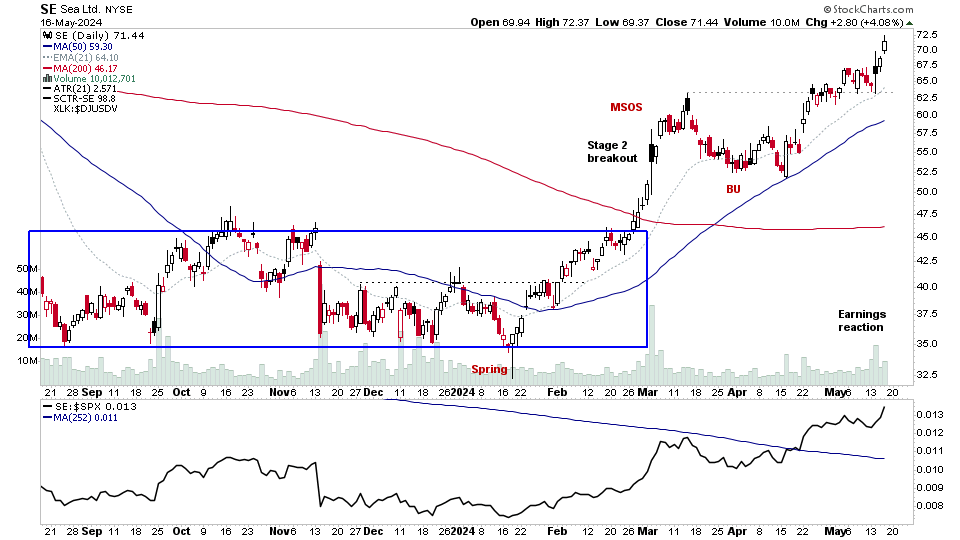

US Stocks Watchlist – 16 May 2024

There were 18 stocks highlighted from the US stocks watchlist scans today...

Read More

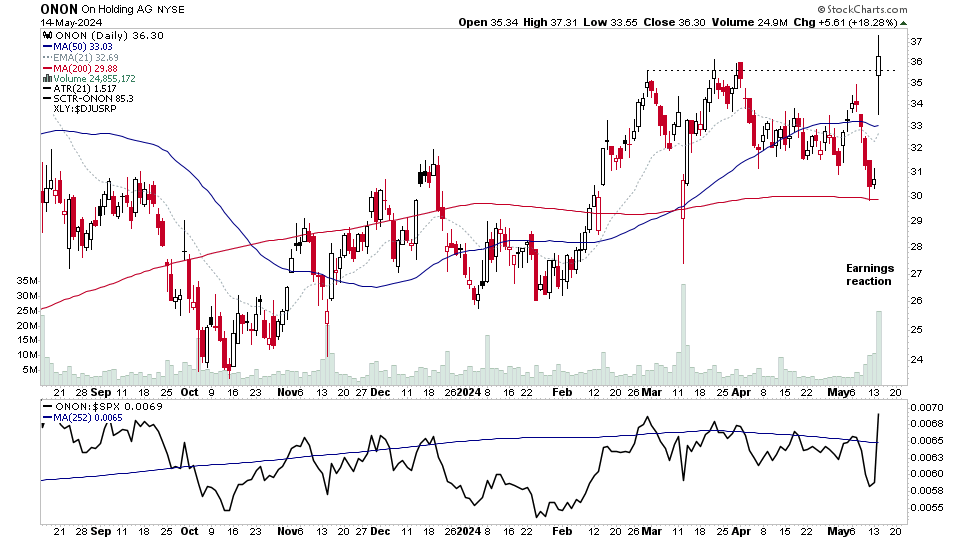

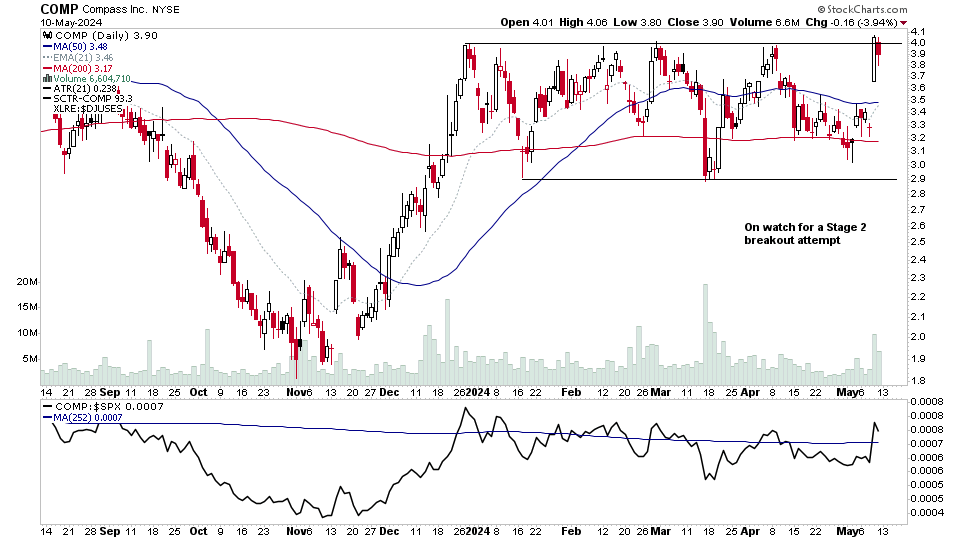

14 May, 2024

US Stocks Watchlist – 14 May 2024

There were 25 stocks highlighted from the US stocks watchlist scans today...

Read More

12 May, 2024

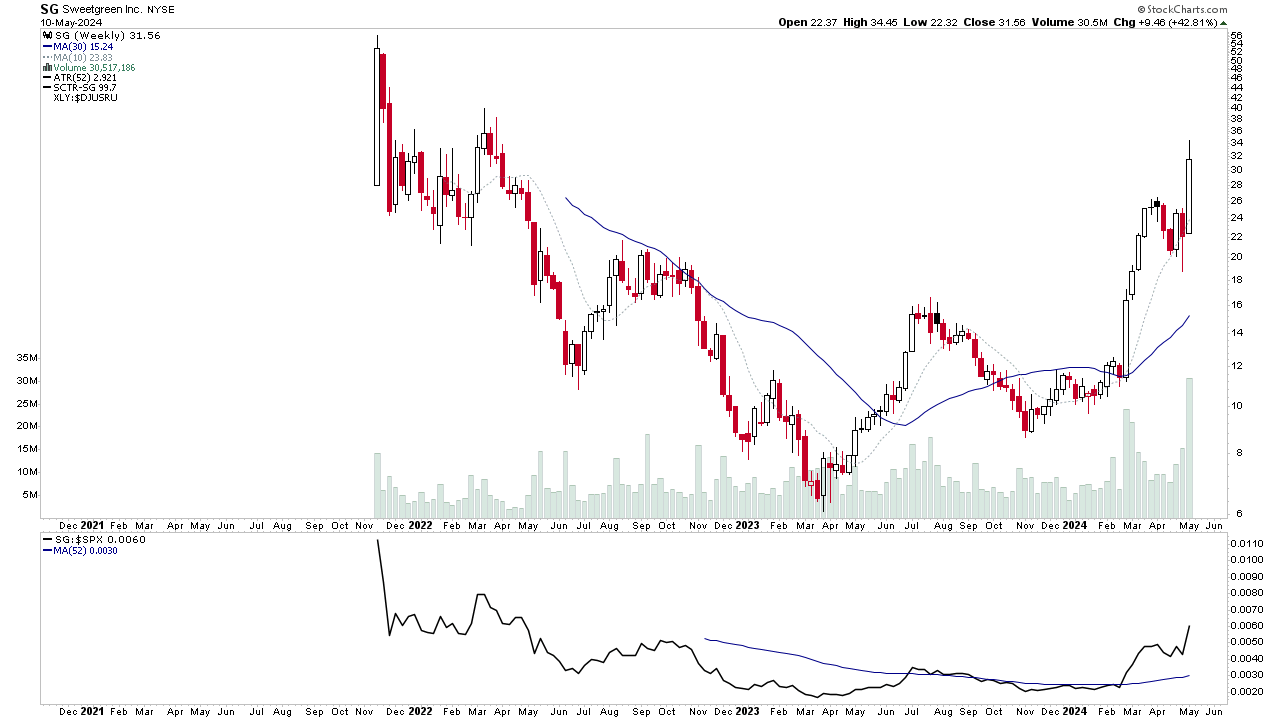

US Stocks Watchlist – 12 May 2024

There were 15 stocks highlighted from the US stocks watchlist scans today...

Read More

12 May, 2024

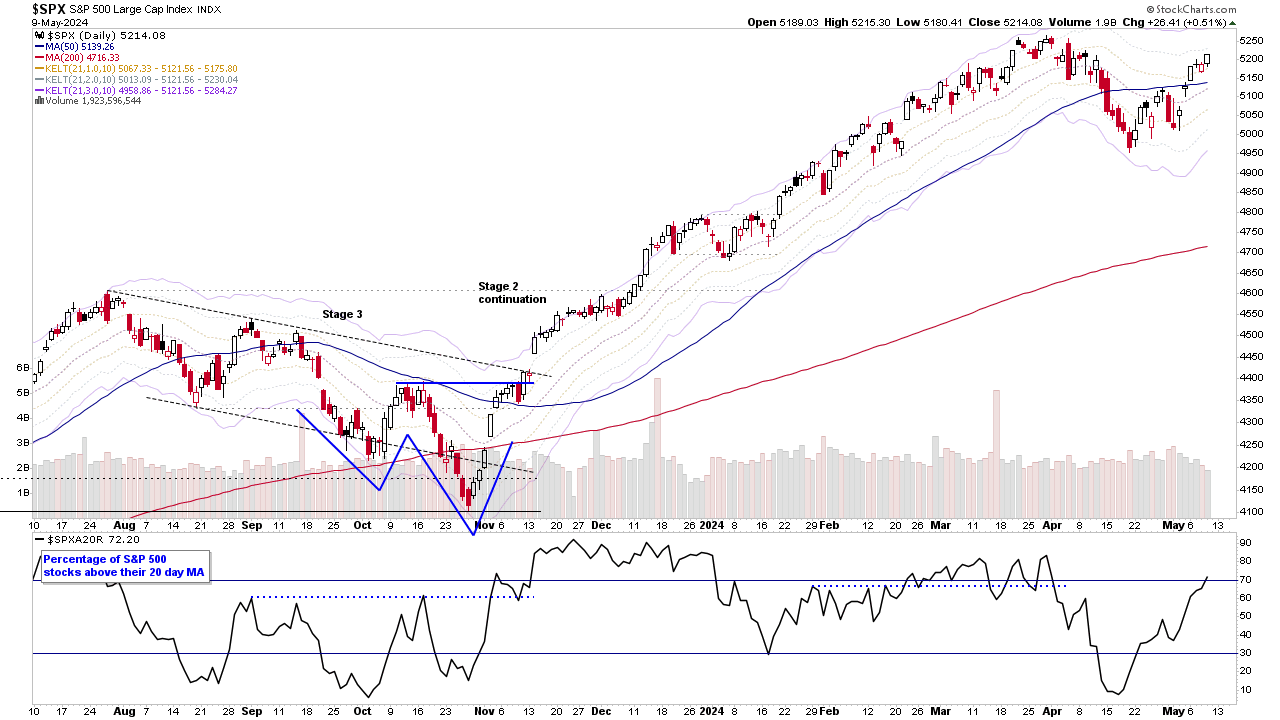

Stage Analysis Members Video – 12 May 2024 (1hr 3mins)

Stage Analysis members weekend video beginning with a look at some of this weeks Significant Bars, followed by the weekend US watchlist stocks, then the New Stage Analysis Screener options, the Industry Groups Relative Strength (RS) Rankings, the key Market Breadth Charts to determine the Weight of Evidence, and the Major US Stock Market Indexes.

Read More

11 May, 2024

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom percentage of stocks above their 50 day, 150 day & 200 day moving averages combined market breadth charts for the overall US market, NYSE and Nasdaq for market timing and strategy...

Read More

10 May, 2024

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

09 May, 2024

US Stocks Watchlist – 9 May 2024

There were 23 stocks highlighted from the US stocks watchlist scans today...

Read More