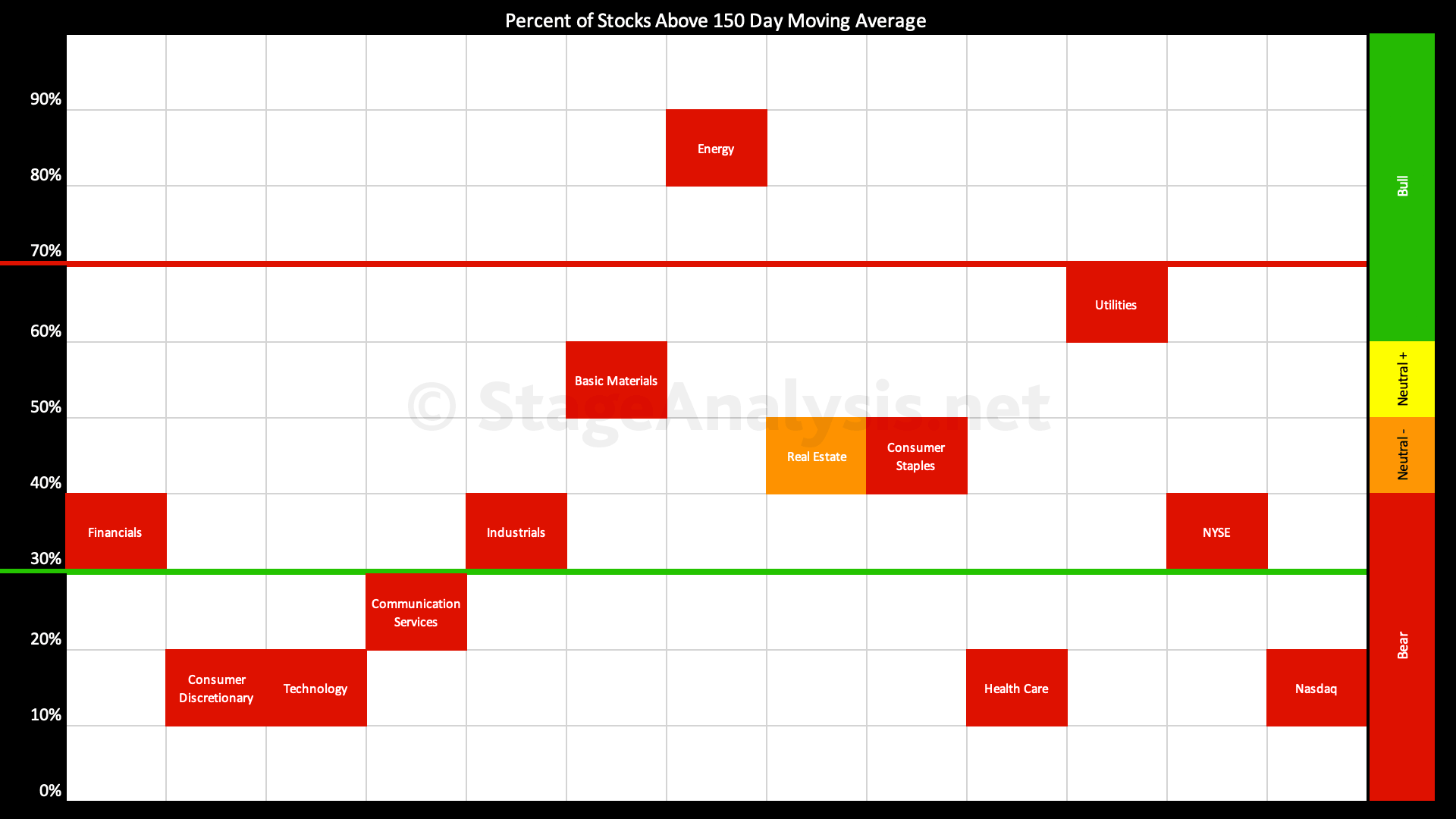

There were negative grid changes in 5 of the 11 sectors since the last update two weeks ago, with the overall average down to 40.53%. The biggest declines this week were in the Basic Materials and Utilities sectors – dropping the Basic Materials below the 60% level out of the Stage 2 zone and into the more neutral Stage 3 / Stage 1 zone...

Read More

Blog

23 April, 2022

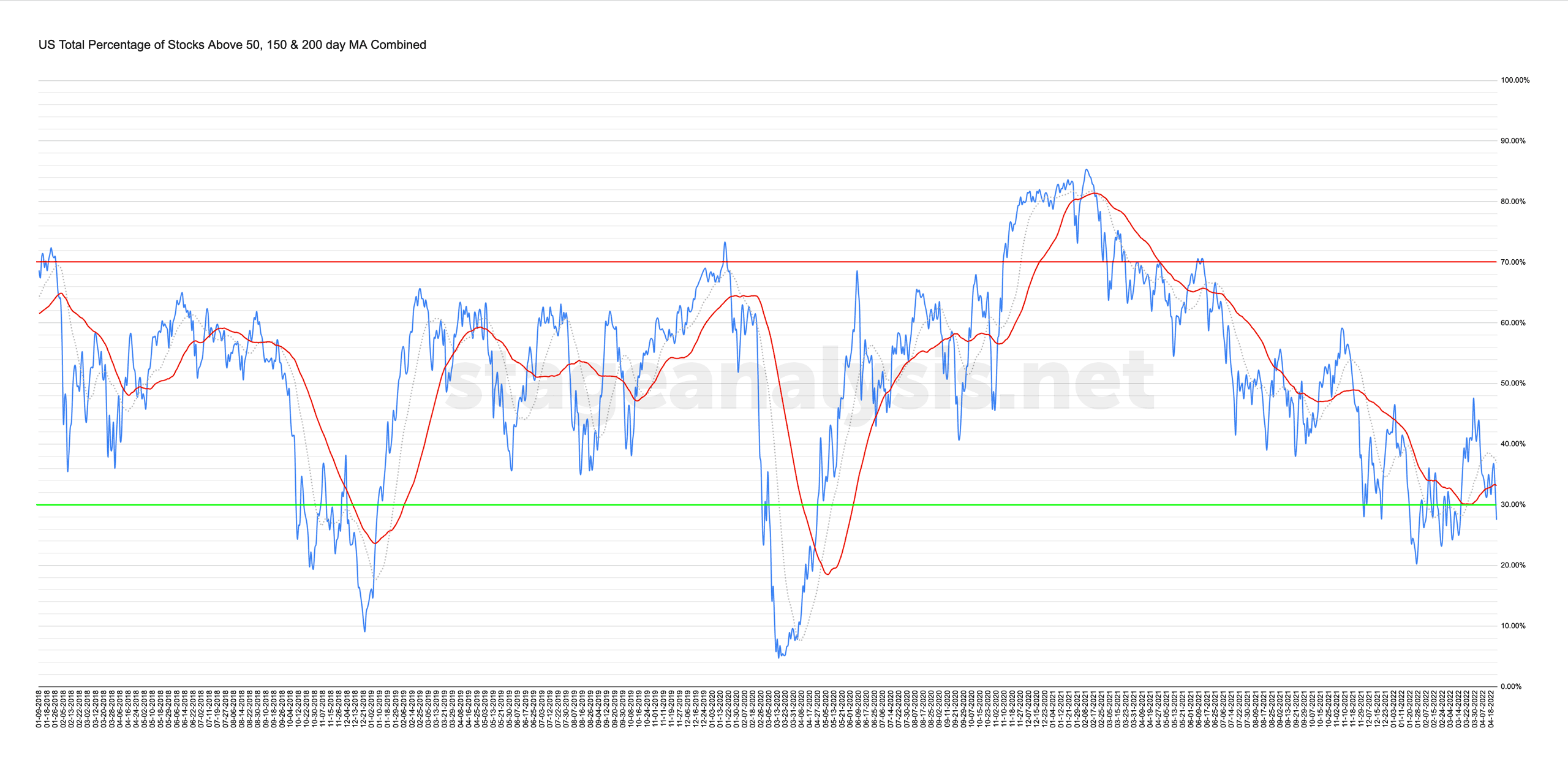

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

23 April, 2022

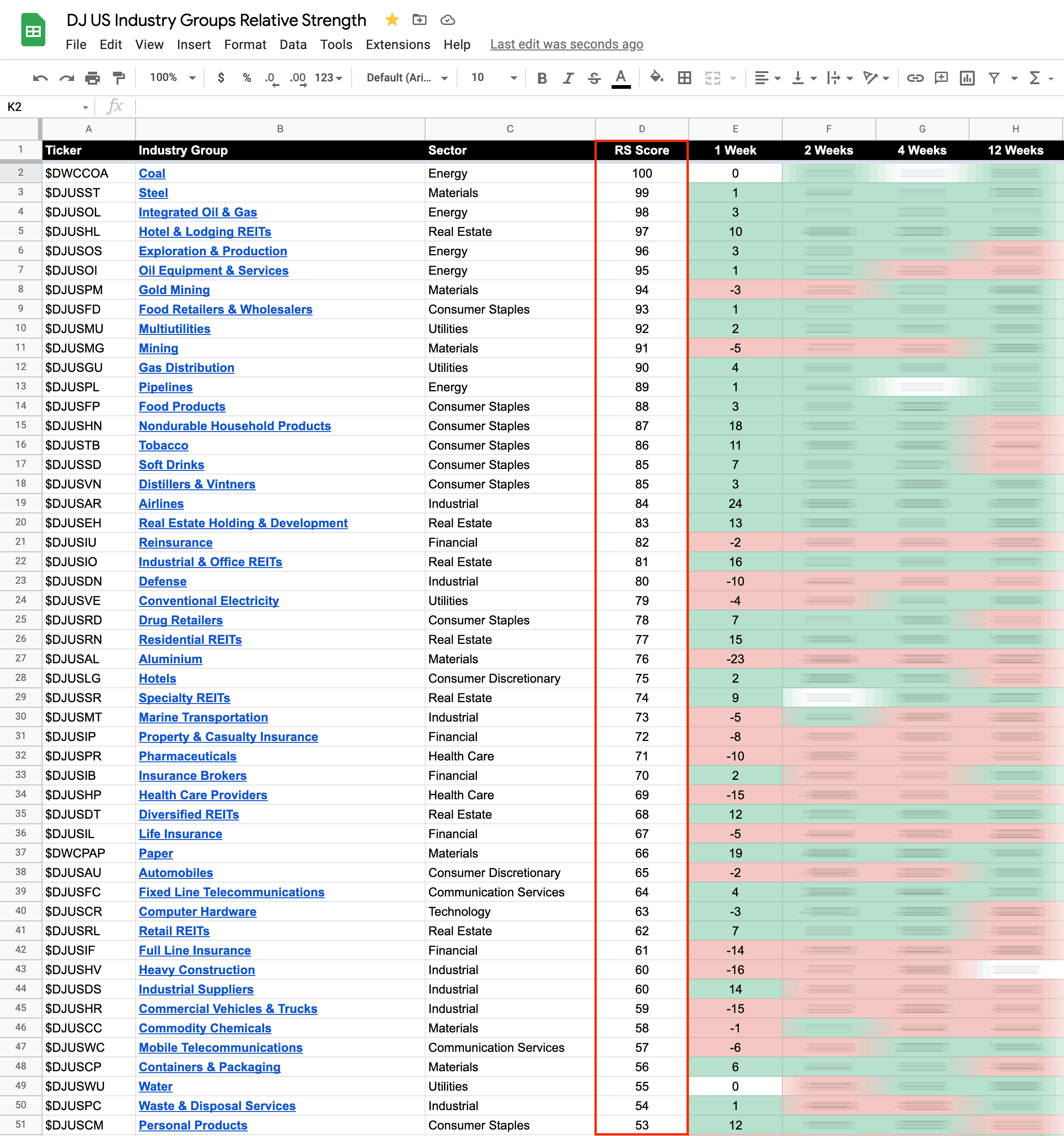

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

21 April, 2022

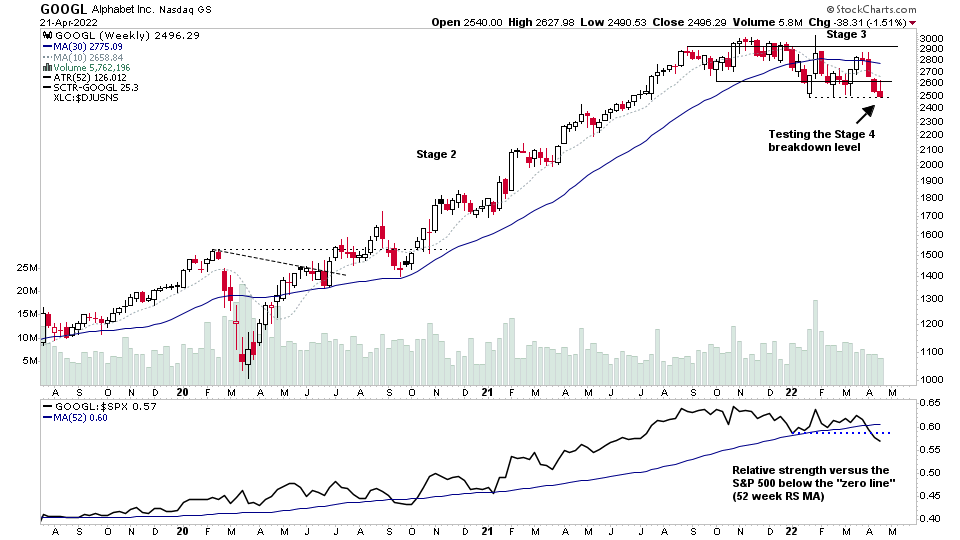

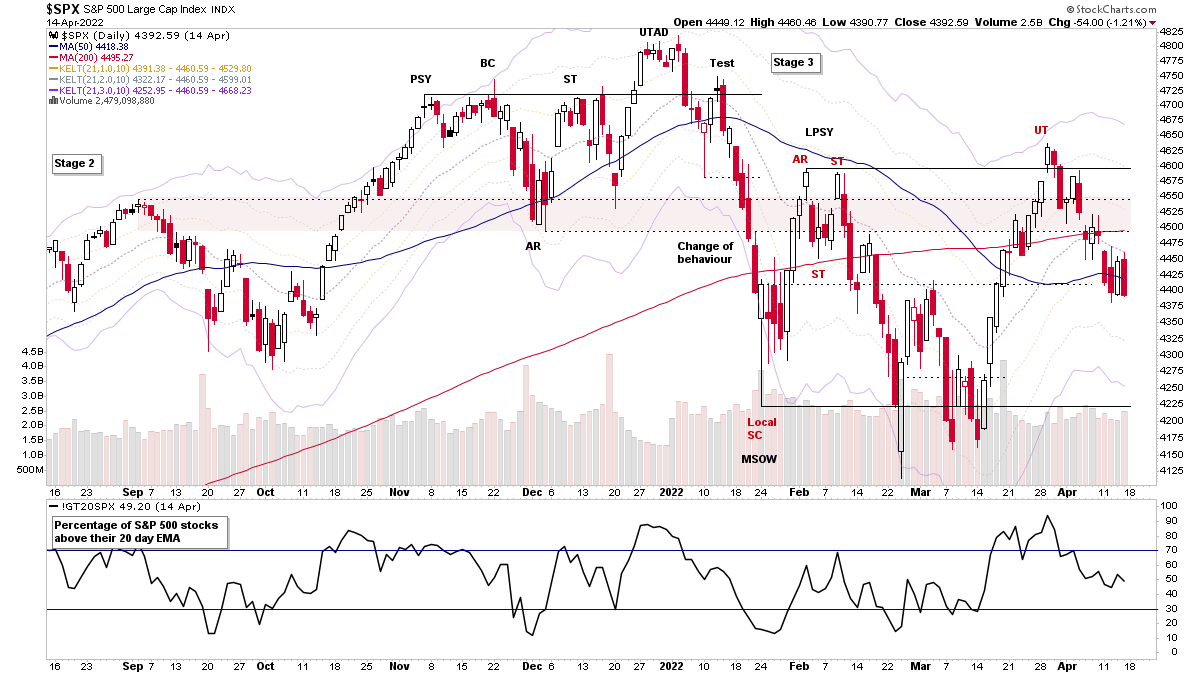

Change of Behaviour? Multiple Major Indexes Reject Key MAs

The S&P 500 strongly rejected the 200 day MA today following statements by Fed Chairman Jerome Powell of potential upcoming rate hikes to help tackle rampant inflation. Which gave the market the excuse it needed for a selloff at the key level of the 200 day MA in the S&P 500 and the Dow Industrials, while the Nasdaq Composite and Russell 2000 Small Caps rejected their 50 day MAs.

Read More

21 April, 2022

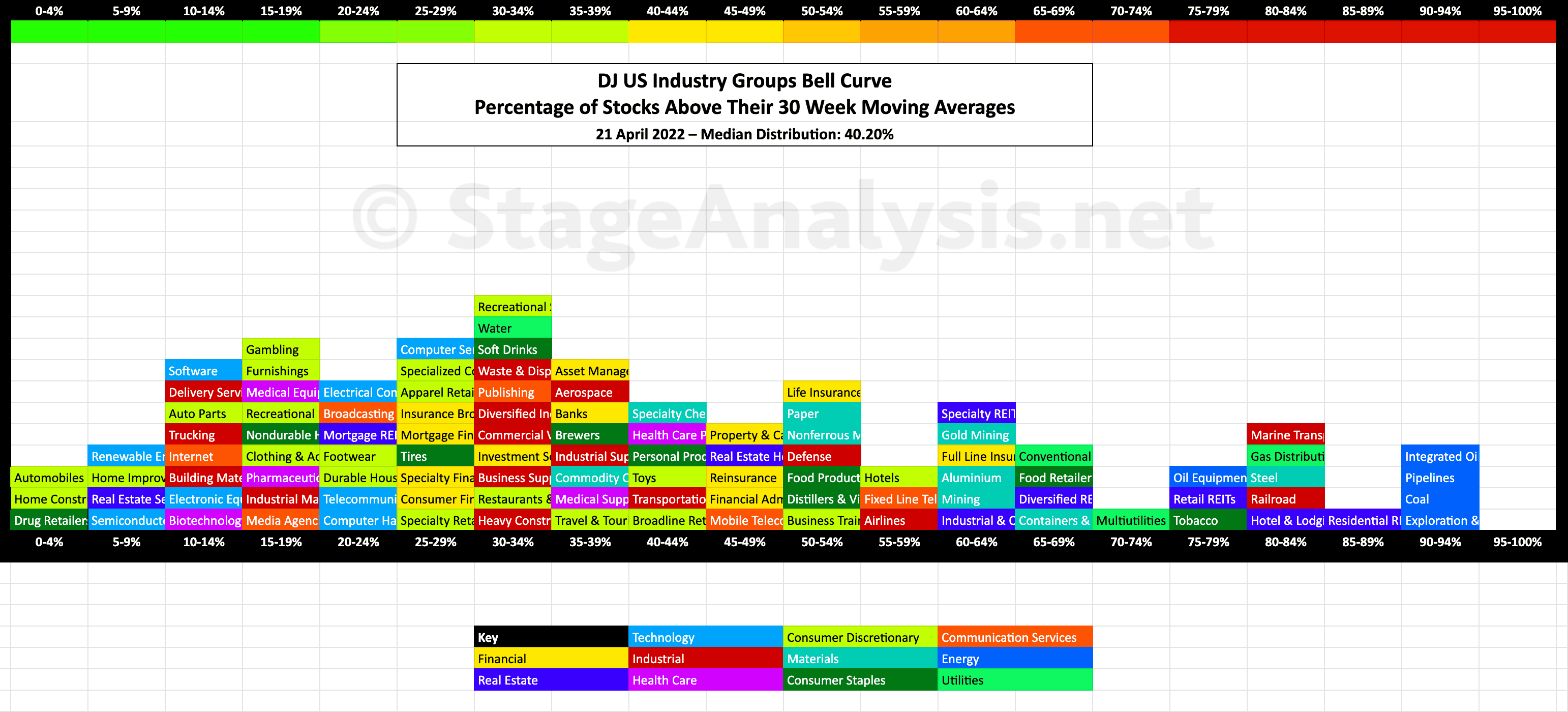

US Industry Groups Bell Curve – Exclusive to Stage Analysis

Exclusive graphic of the 104 Dow Jones Industry Groups showing the Percentage of Stocks Above 30 week MA in each group visualised as a Bell Curve chart – inspired by the Sector Bell Curve work by Tom Dorsey in his Point & Figure book....

Read More

21 April, 2022

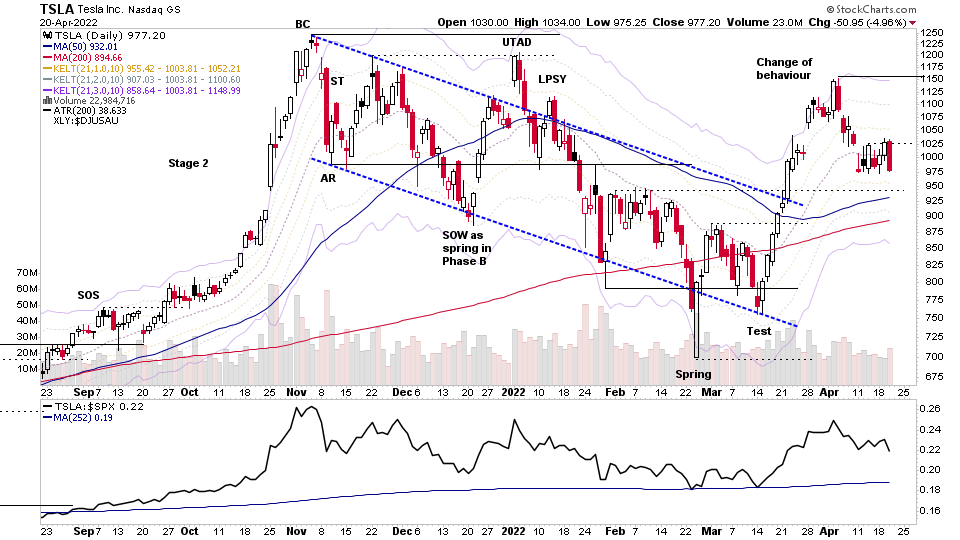

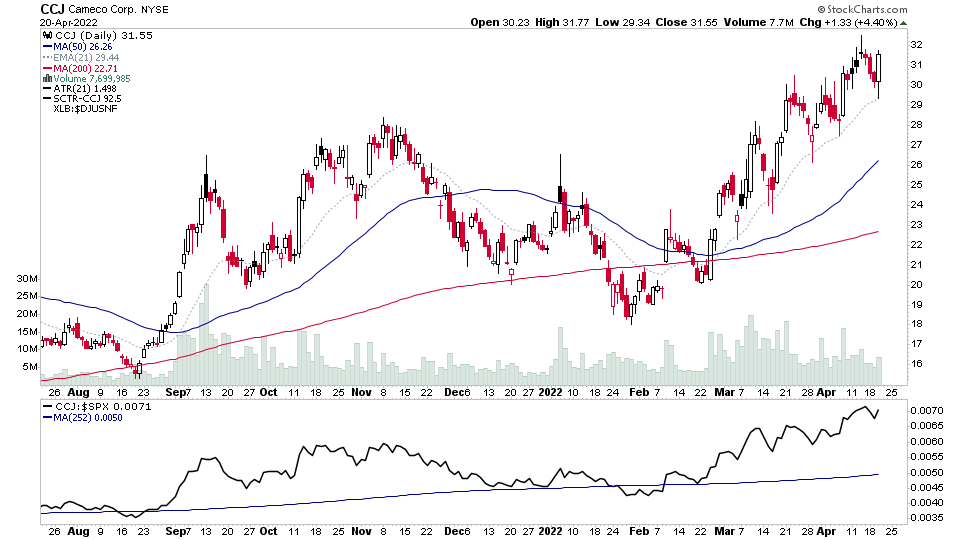

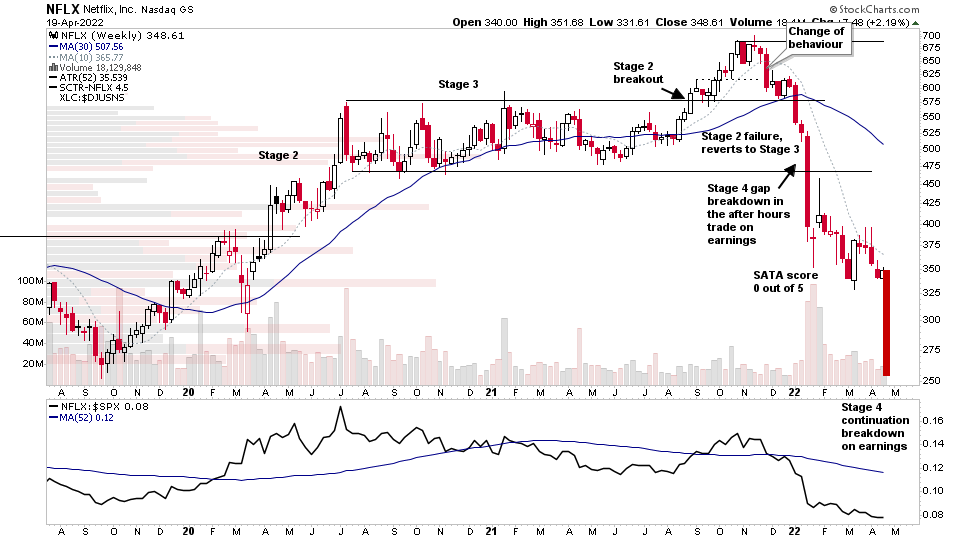

Stage Analysis Members Midweek Video - 20 April 2022 (56 mins)

Stage Analysis Members Midweek Video with a FREE preview covering the Stage 4 continuation breakdown in NFLX Netflix, and then members only content going through the Major Indexes, Short Term Market Breadth Charts, todays after hours moves from earnings in TSLA and UAL. The Uranium group attempt to rebound and the US Stocks Watchlist and Group Themes in more detail.

Read More

20 April, 2022

US Stocks Watchlist – 20 April 2022

For the watchlist from Wednesdays scans...

Read More

19 April, 2022

Netflix Stage 4 Continuation Breakdown on Earnings and the US Stocks Watchlist – 19 April 2022

NFLX (Netflix) reacted poorly to it earnings again and made its second large gap down of the year so far. The first of which was on the announcement of the previous earnings. And so it made a Stage 4 continuation breakdown with a massive gap of over -25% in the after hours trade and has now retraced the entire previous Stage 2 advance...

Read More

18 April, 2022

Stock Market Struggling to Find Direction and the US Stocks Watchlist – 18 April 2022

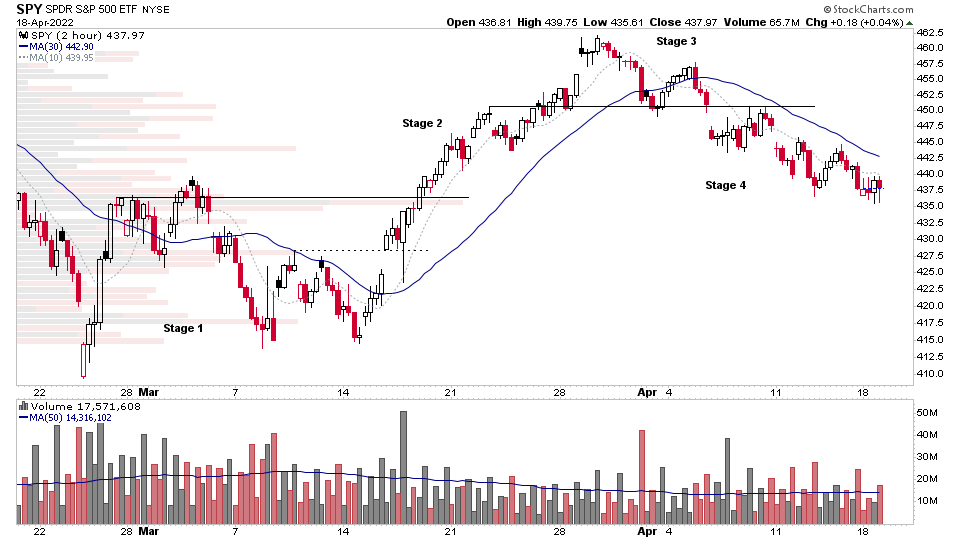

Stage Analysis can be used on multiple timeframes. So one of the best uses of that is to use it to help to determine the short term trend, which can be useful for swing trading purposes, or for fine tuning entry points, as well as general risk management uses...

Read More

17 April, 2022

Stage Analysis Members Weekend Video – 17 April 2022 (1hr 14mins)

This weekends Stage Analysis Members Video features analysis of the Major US Stock Market Indexes – S&P 500, Nasdaq Composite, Russell 2000 etc, plus a detailed run through of the key Market Breadth charts (with exclusive charts only on Stage Analysis) in order to determine the Weight of Evidence...

Read More