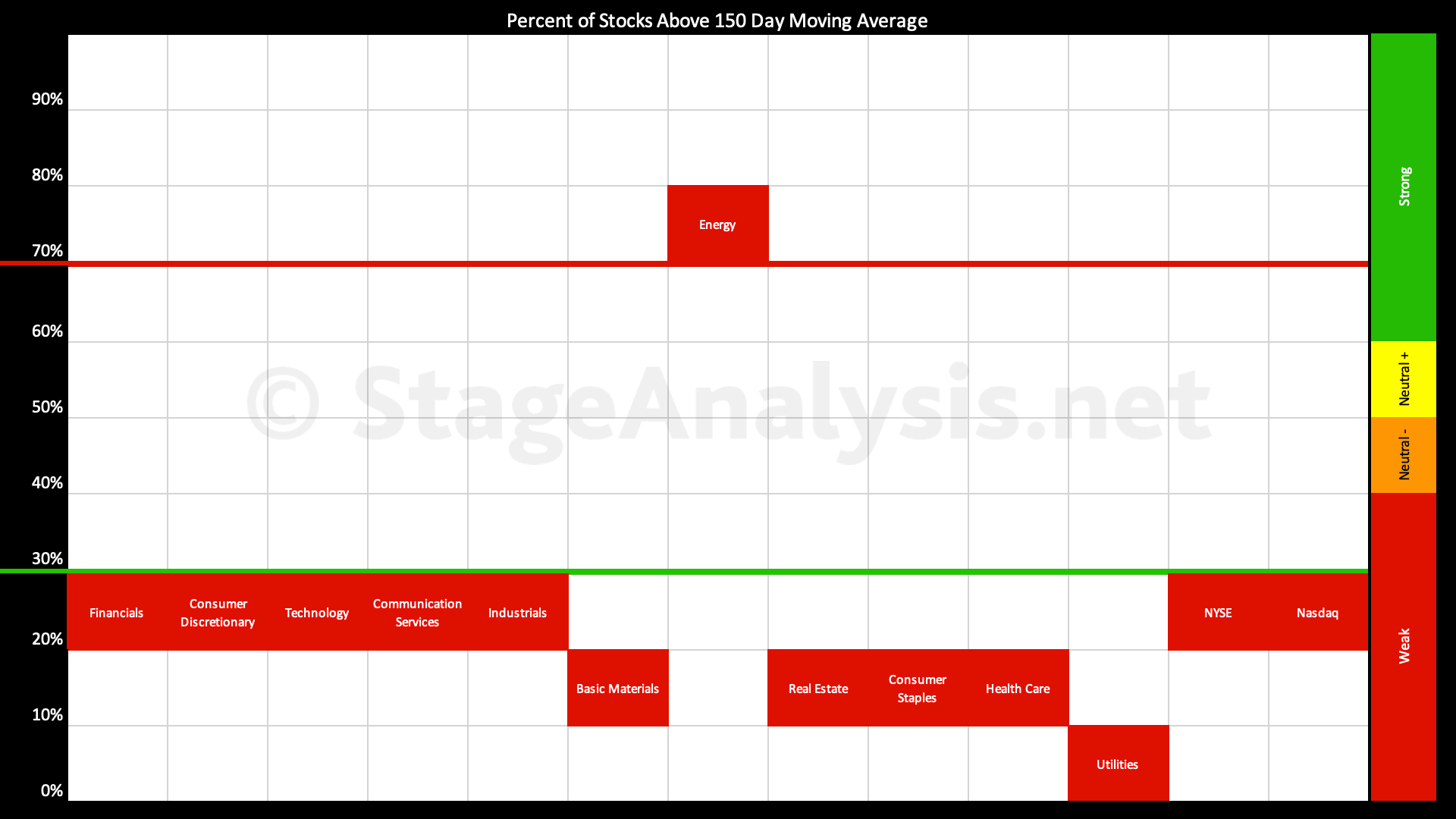

The Percentage of US Stocks Above Their 150 day Moving Averages in the 11 major sectors declined a further -7.93% since the previous post on the 9th October 2023, dropping the overall average down to 24.53%, and so it is now heavily weighted in the Weak zone in the lower third of the field.

Read More

Blog

22 October, 2023

Stage Analysis Members Video – 22 October 2023 (1hr 10mins)

Stage Analysis members weekend video discussing the Major US Indexes, the Futures Charts, Industry Groups Relative Strength (RS) Rankings, IBD Industry Group Bell Curve – Bullish Percent, Market Breadth Update to determine the Weight of Evidence. Bitcoin and Ethereum analysis, and then finally a discussion of the weekends watchlist stocks in detail on multiple timeframes.

Read More

22 October, 2023

US Stocks Watchlist – 22 October 2023

There were 16 stocks highlighted from the US stocks watchlist scans today...

Read More

21 October, 2023

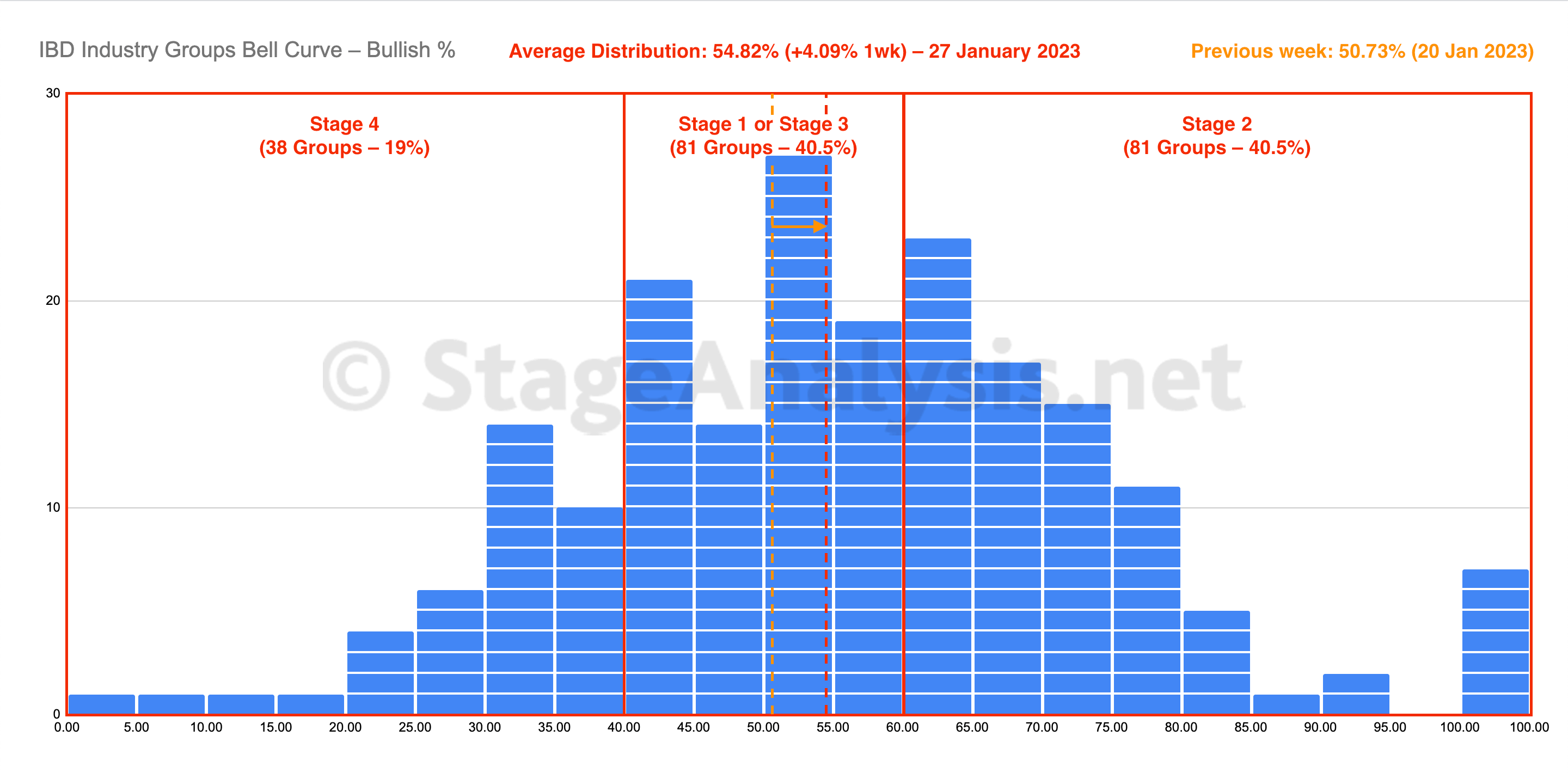

IBD Industry Groups Bell Curve – Bullish Percent

The IBD Industry Groups Bell Curve – Bullish Percent shows the few hundred industry groups plotted as a histogram chart and represents the percentage of stocks in each group that are on a point & figure (P&F) buy signal...

Read More

21 October, 2023

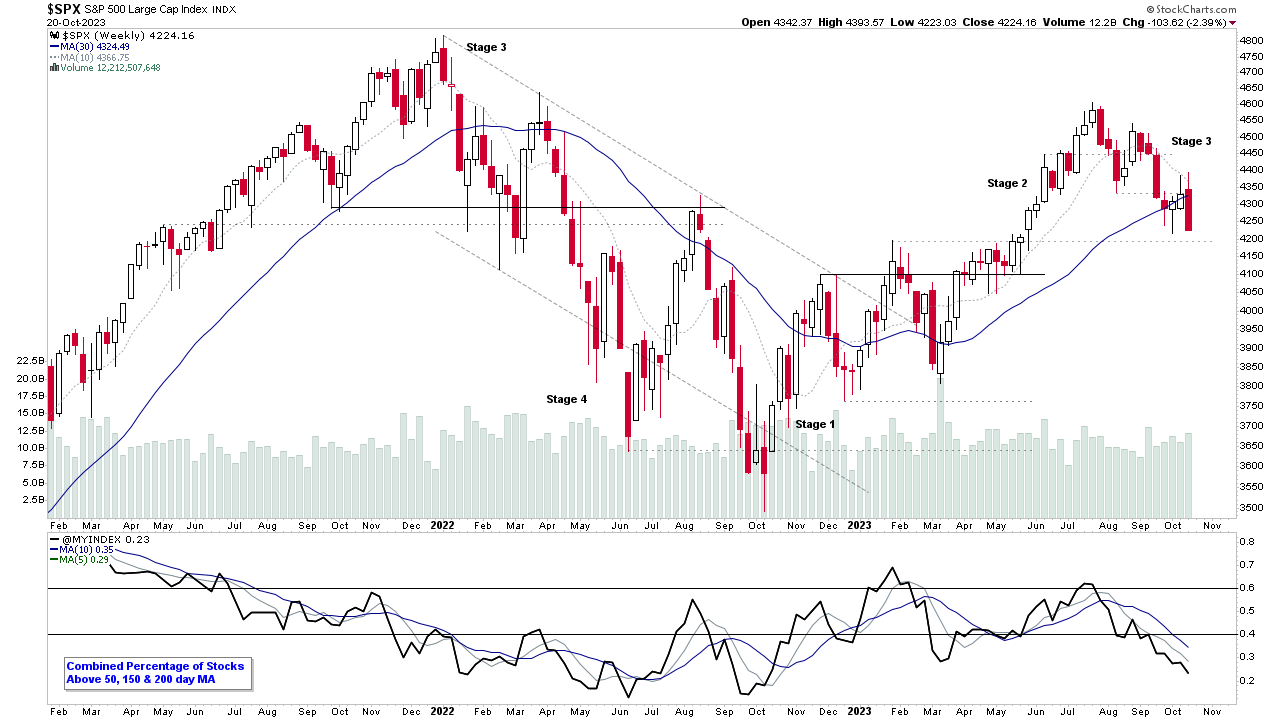

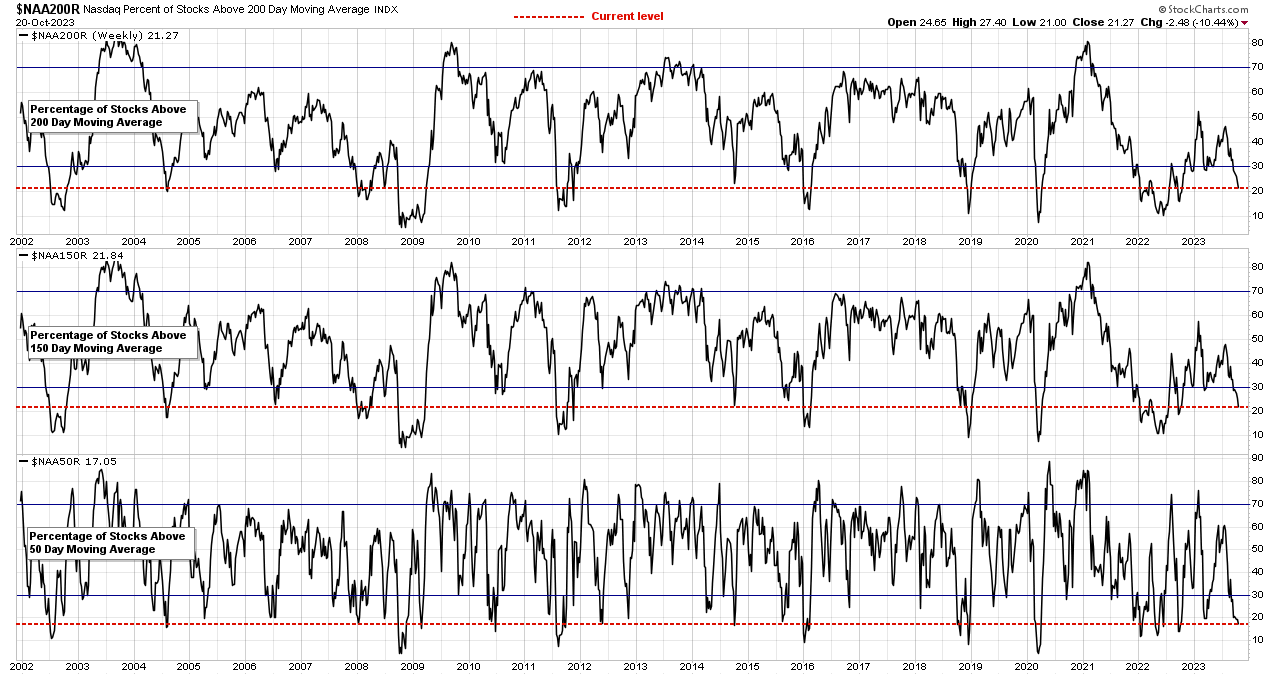

Market Breadth: Percentage of Stocks Above their 50 Day, 150 Day & 200 Day Moving Averages Combined

Custom Percentage of Stocks Above Their 50 Day, 150 Day & 200 Day Moving Averages Combined Market Breadth Charts for the Overall US Market, NYSE and Nasdaq for Market Timing and Strategy.

Read More

20 October, 2023

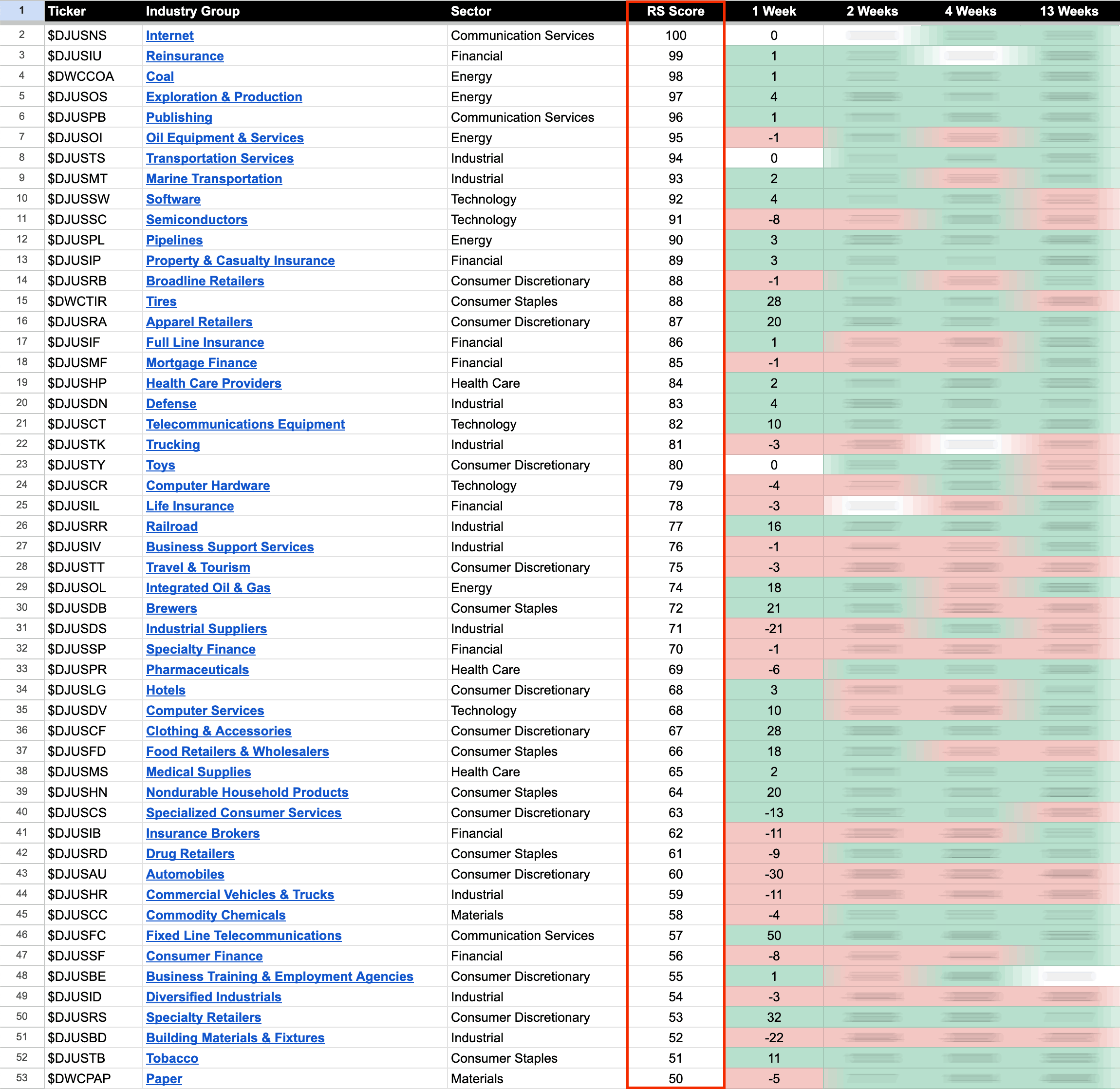

US Stocks Industry Groups Relative Strength Rankings

The purpose of the Relative Strength (RS) tables is to track the short, medium and long term RS changes of the individual groups to find the new leadership earlier than the crowd...

Read More

19 October, 2023

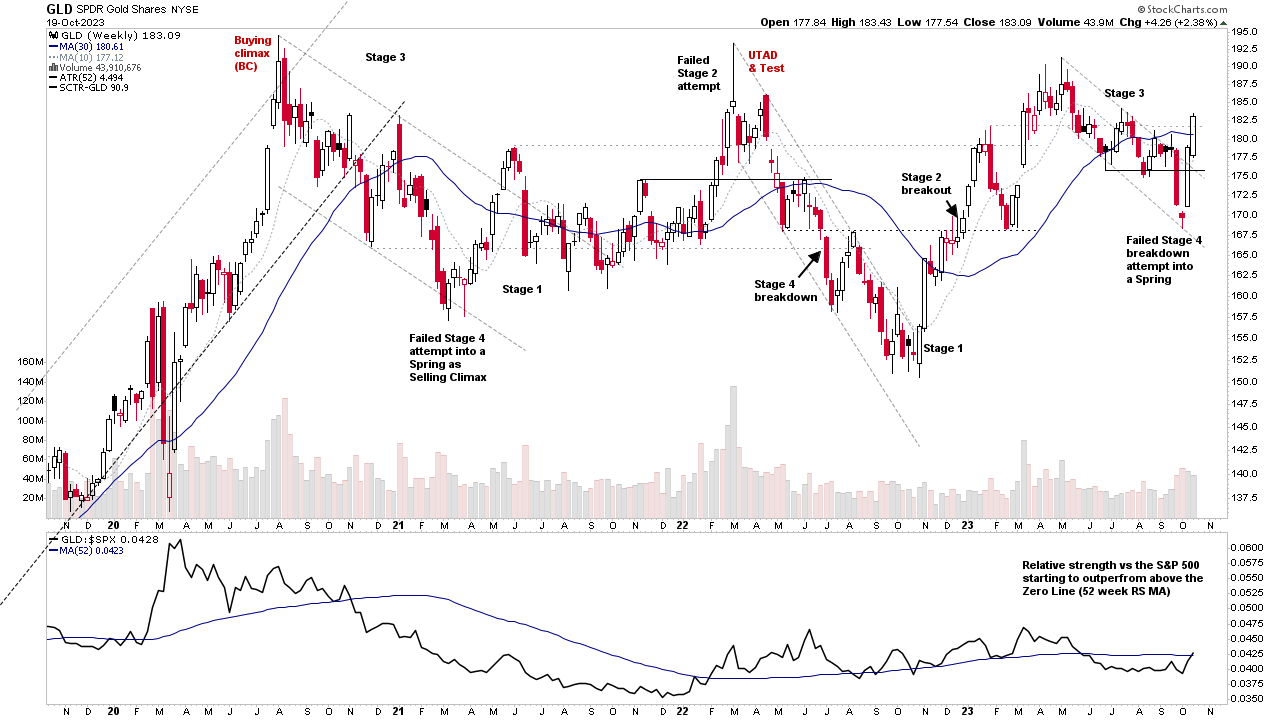

US Market Review – 19 October 2023

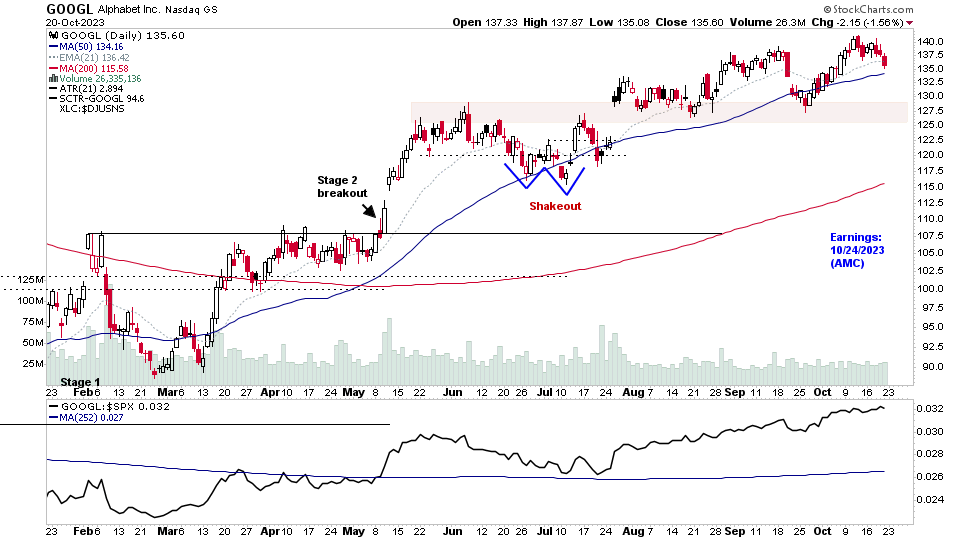

With the continued near-term correction in the major US stock market indexes, I thought it would be useful to do a broad review and Stage Analysis of some of the major charts in order to help to determine the current state of the market, beginning with the precious metals...

Read More

18 October, 2023

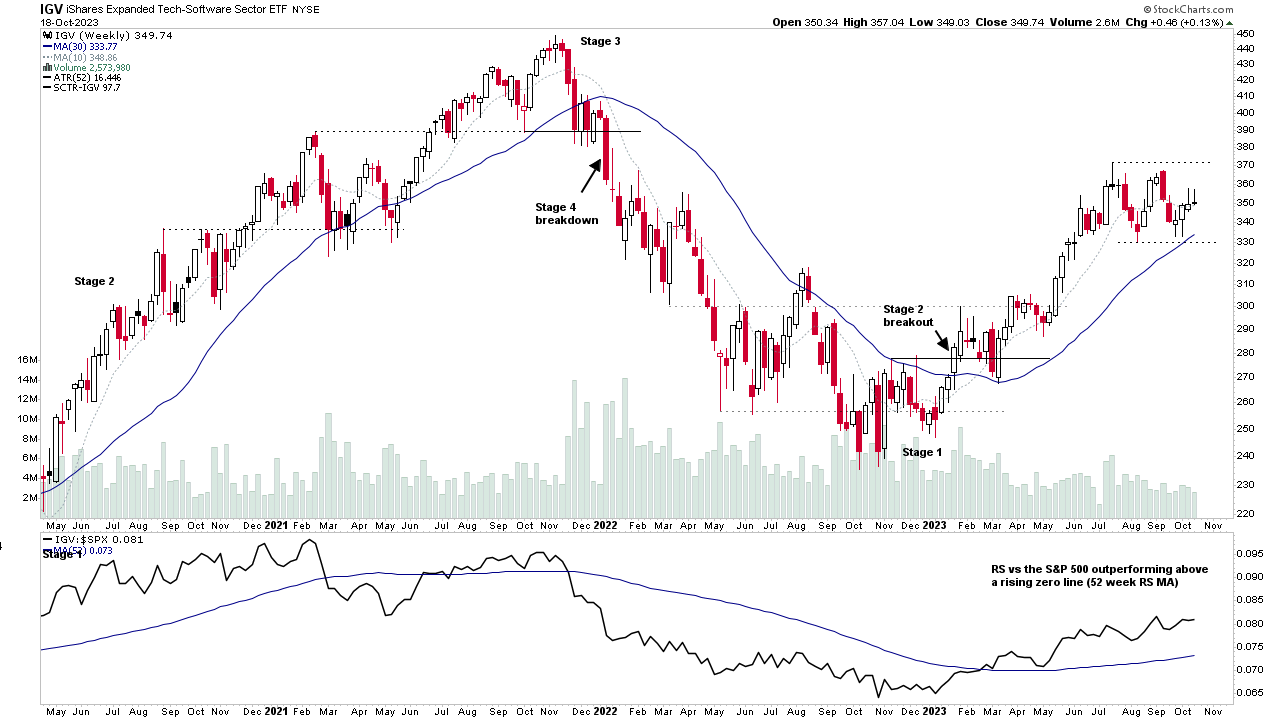

Software Group Focus Video – 18 October 2023 (55mins)

The Software group remains one of the leading industry groups year to date and has been consolidating / building a base structure in Stage 2 over the last quarter since the previous review as the broader market has also corrected. So with earnings approaching for the majority of the Software group in the coming weeks, it's an ideal time to do review the group again and how its current RS leaders are acting.

Read More

17 October, 2023

US Stocks Watchlist – 17 October 2023

There were 32 stocks highlighted from the US stocks watchlist scans today...

Read More

16 October, 2023

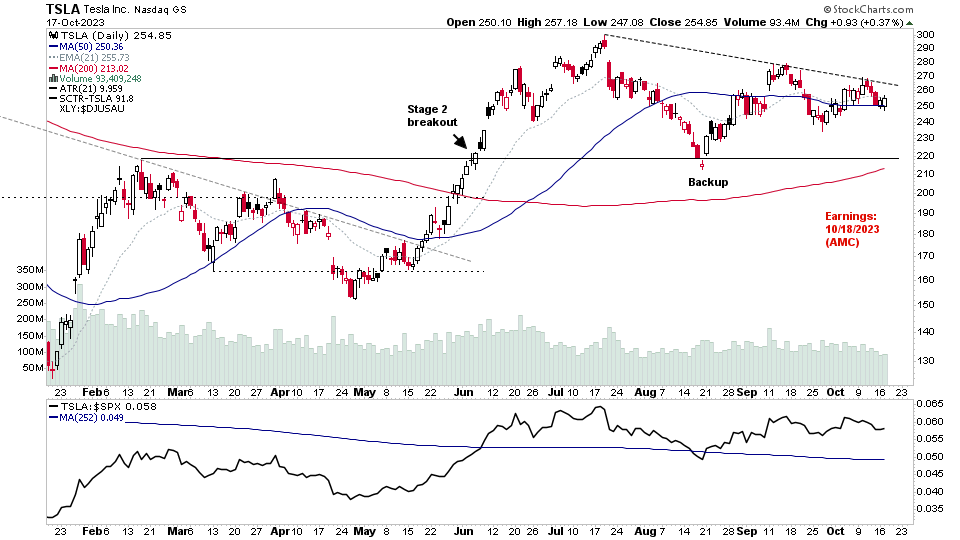

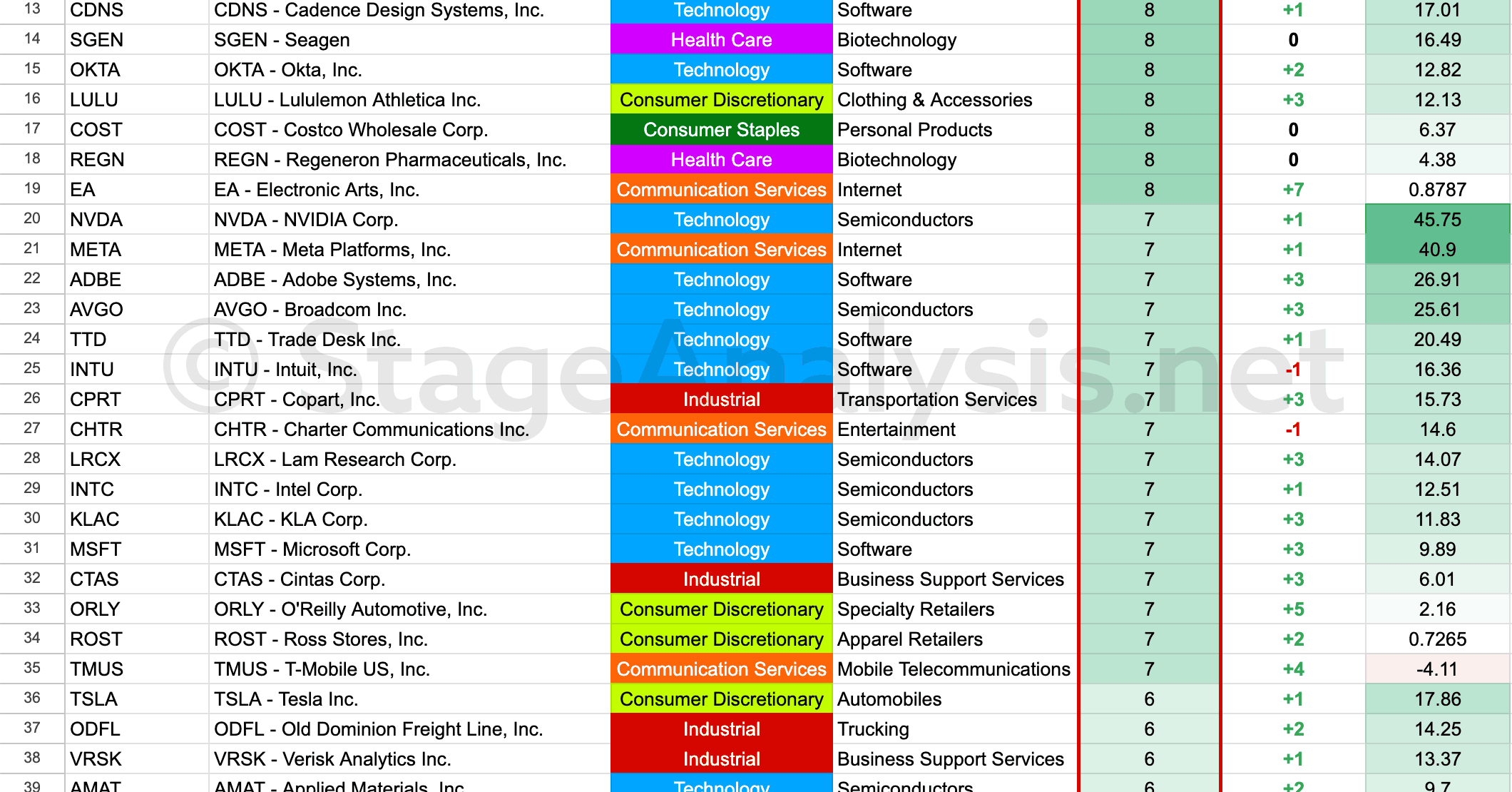

Stage Analysis Technical Attributes Scores – Nasdaq 100

The Stage Analysis Technical Attributes (SATA) score is our proprietary indicator that helps to identify the four stages from Stan Weinstein's Stage Analysis method, using a scoring system from 0 to 10 that rates ten of the key technical characteristics that we look for when analysing the weekly charts.

Read More